Key Insights

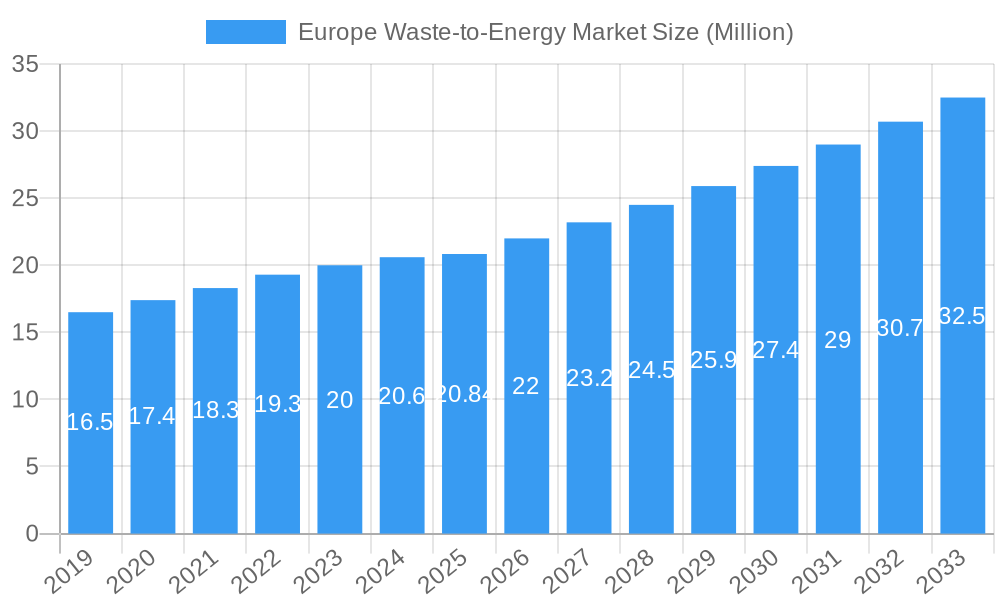

The Europe Waste-to-Energy (WtE) market is poised for significant expansion, projected to reach $20.84 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.54% anticipated from 2019 to 2033. Key drivers fueling this upward trajectory include increasingly stringent environmental regulations across European nations, a growing emphasis on renewable energy sources, and the persistent challenge of managing mounting municipal solid waste. As landfilling becomes less viable and economically burdensome, WtE facilities offer a sustainable solution for waste reduction while simultaneously generating valuable energy. The trend towards advanced WtE technologies, such as sophisticated incineration with enhanced energy recovery systems and anaerobic digestion, is further propelling market expansion. These advancements not only improve efficiency but also address environmental concerns, making WtE a more attractive and responsible waste management option.

Europe Waste-to-Energy Market Market Size (In Million)

Further analysis reveals that the market is segmented by source into Physical and Biological waste streams, each presenting unique opportunities and challenges. The physical segment, encompassing non-biological waste, is largely driven by the need for efficient volume reduction and energy generation. The biological segment, on the other hand, benefits from advancements in anaerobic digestion and biogas production, aligning with the growing bioeconomy. Prominent players like Suez SA, Veolia Environnement SA, and Mitsubishi Heavy Industries Ltd. are at the forefront of innovation, investing in R&D and expanding their operational capacities. However, the market also faces certain restraints, including high initial capital investment for WtE facilities and public perception challenges related to emissions and waste handling. Despite these hurdles, the strong push for circular economy principles and sustainable energy solutions in Europe solidifies the positive outlook for the WtE market. The European region, with countries like the United Kingdom, Germany, and France leading the charge, is expected to dominate this market due to supportive governmental policies and a well-established infrastructure for waste management and energy integration.

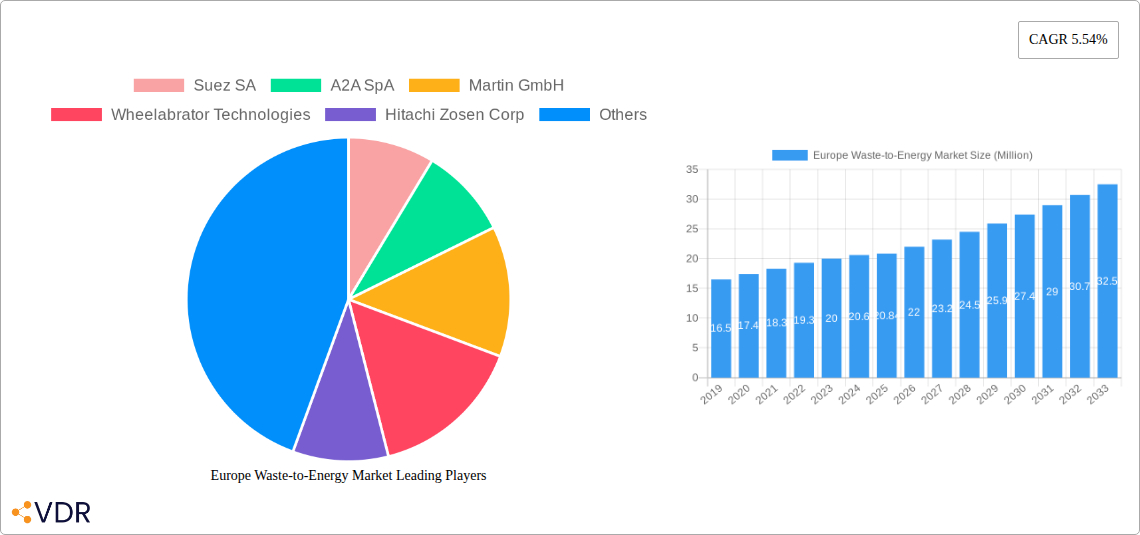

Europe Waste-to-Energy Market Company Market Share

Europe Waste-to-Energy Market: Comprehensive Report & Forecast (2019-2033)

Gain unparalleled insights into the Europe Waste-to-Energy (WtE) Market with our in-depth analysis, covering the study period of 2019 to 2033, with a base year of 2025. This report is meticulously crafted to provide industry professionals, investors, and stakeholders with a definitive understanding of market dynamics, growth trajectories, and strategic opportunities. We delve into the intricacies of the WtE sector, analyzing its evolution, key players, and the impact of technological advancements and regulatory landscapes. Explore the parent market of Waste Management and the child market of Waste-to-Energy to understand the broader ecosystem and specific market nuances. All quantitative data is presented in million units.

Europe Waste-to-Energy Market Market Dynamics & Structure

The Europe Waste-to-Energy market is characterized by a moderate to high market concentration, with established players like Suez SA, Veolia Environnement SA, and Mitsubishi Heavy Industries Ltd dominating significant portions of the market share. Technological innovation is a primary driver, spurred by increasing environmental regulations and the pursuit of sustainable energy solutions. Advanced combustion technologies, flue gas treatment systems, and the integration of energy recovery mechanisms are continuously being developed to enhance efficiency and reduce emissions. Regulatory frameworks, such as the EU's Circular Economy Package and national targets for waste reduction and recycling, significantly influence market development, pushing for higher energy recovery rates from non-recyclable waste. Competitive product substitutes, primarily landfilling and advanced recycling technologies, pose challenges, but the inherent advantages of WtE in terms of waste volume reduction and energy generation ensure its continued relevance. End-user demographics are increasingly focused on corporate social responsibility and sustainable resource management, driving demand for cleaner energy sources. Mergers and acquisitions (M&A) are a common strategy for market expansion and consolidation. In the historical period (2019-2024), we observed approximately 5-7 significant M&A deals annually, reflecting the dynamic competitive landscape. Innovation barriers include high initial capital investment, complex permitting processes, and public perception challenges, but these are being overcome through technological advancements and robust project development.

- Market Concentration: Moderate to High, with key players holding substantial market share.

- Technological Innovation Drivers: Stricter environmental regulations, drive for renewable energy, efficient waste management solutions.

- Regulatory Frameworks: EU Circular Economy Package, national waste reduction targets, emission standards.

- Competitive Product Substitutes: Landfilling, advanced mechanical recycling, anaerobic digestion.

- End-User Demographics: Increasing focus on sustainability, corporate ESG goals, demand for circular economy solutions.

- M&A Trends: Ongoing consolidation for market expansion and technological integration, with an average of 5-7 deals per year in the historical period.

- Innovation Barriers: High CAPEX, lengthy regulatory approvals, public acceptance.

Europe Waste-to-Energy Market Growth Trends & Insights

The Europe Waste-to-Energy market is projected to exhibit robust growth over the forecast period (2025–2033), driven by the increasing need for sustainable waste management solutions and the global push towards decarbonization. The market size is estimated to grow from approximately $15,000 million in 2025 to an anticipated $22,500 million by 2033, reflecting a compound annual growth rate (CAGR) of approximately 5.3%. Adoption rates for WtE technologies are steadily increasing as countries aim to divert waste from landfills and capitalize on the energy potential of residual waste. Technological disruptions, such as advancements in gasification and pyrolysis, are expanding the scope and efficiency of WtE processes, enabling the recovery of more valuable by-products and reducing the environmental footprint. Consumer behavior shifts are also playing a crucial role, with a growing public awareness and demand for environmentally responsible waste disposal and energy generation. The market penetration of WtE facilities is anticipated to rise across various European nations, particularly those with high population densities and limited landfill capacity. For instance, countries with advanced waste management policies are seeing higher WtE adoption rates. The integration of WtE with district heating and cooling networks further enhances its appeal by providing a consistent and localized source of renewable energy. This synergy between waste management, energy production, and environmental protection positions the Europe WtE market for sustained expansion. The trend towards waste-to-value (WtV) concepts, moving beyond mere waste-to-energy, is also gaining traction, emphasizing the recovery of materials and resources from waste streams.

Dominant Regions, Countries, or Segments in Europe Waste-to-Energy Market

The Thermal segment, specifically driven by Physical waste sources, currently dominates the Europe Waste-to-Energy Market. This dominance is primarily attributed to the well-established infrastructure and mature technologies associated with incineration. Countries like Germany, the UK, France, and Italy lead in the adoption and operation of thermal WtE plants, owing to stringent landfill bans, high waste generation rates, and supportive government policies. Germany, for example, has a long-standing commitment to WtE, with numerous facilities contributing significantly to its energy mix and waste management strategy. The market share for the Thermal segment is estimated to be around 85-90% of the total WtE market value.

Key drivers for the dominance of the Thermal segment include:

- Economic Policies: Government incentives, feed-in tariffs, and subsidies for renewable energy generated from WtE plants.

- Infrastructure: Extensive existing infrastructure for waste collection and transport, coupled with established industrial zones suitable for WtE plant development.

- Regulatory Frameworks: Strict regulations on landfilling, pushing waste towards alternative disposal and recovery methods.

- Technological Maturity: Proven and reliable thermal WtE technologies that offer high energy recovery rates and significant waste volume reduction.

- Energy Demand: Consistent demand for electricity and heat from urban centers and industrial facilities.

While Biological waste sources also contribute to the WtE market through processes like anaerobic digestion, their share is comparatively smaller, estimated at 10-15%. These processes are more suitable for organic waste streams and are often integrated into broader waste management strategies rather than being the primary WtE solution for mixed municipal solid waste. The growth potential for biological WtE remains significant, particularly with advancements in biogas upgrading and the production of biofuels. However, for the immediate future, thermal WtE, leveraging physical waste streams, will continue to be the cornerstone of the Europe Waste-to-Energy Market. The market share for Thermal: Physical is projected to remain dominant through 2033, supported by ongoing investments in modernizing existing facilities and developing new large-scale plants.

Europe Waste-to-Energy Market Product Landscape

The Europe Waste-to-Energy market product landscape is defined by advanced incineration technologies and sophisticated flue gas treatment systems designed for maximum energy recovery and minimal environmental impact. Modern WtE plants utilize advanced grate or fluidized bed combustion systems that ensure efficient burning of diverse waste streams, including municipal solid waste, industrial waste, and medical waste. Key product innovations focus on improving boiler efficiency, optimizing steam production for electricity generation and district heating, and enhancing the capture of pollutants like dioxins, furans, and heavy metals. Companies are also developing modular WtE solutions and smaller-scale plants for decentralized energy generation. The performance metrics of these products are continuously being refined to meet increasingly stringent emission standards and energy output targets, with many plants now achieving over 90% waste volume reduction and significant electricity generation capacities. The application of WtE technologies is expanding beyond traditional energy generation to include waste-to-chemicals and waste-to-fuels pathways, showcasing a shift towards a circular economy model.

Key Drivers, Barriers & Challenges in Europe Waste-to-Energy Market

Key Drivers:

- Stringent EU and National Waste Management Policies: Mandates to reduce landfilling and increase waste diversion for energy recovery.

- Growing Demand for Renewable Energy: WtE contributes to energy security and decarbonization goals, aligning with renewable energy targets.

- Waste Volume Reduction: Efficiently reduces the volume of waste requiring disposal, conserving landfill space.

- Technological Advancements: Improved efficiency, lower emissions, and greater energy recovery rates from WtE technologies.

- Circular Economy Initiatives: WtE plays a role in resource recovery and the transition towards a circular economy.

Barriers & Challenges:

- High Capital Investment: Significant upfront costs for constructing and maintaining WtE facilities.

- Public Perception and Opposition: Concerns regarding emissions, air quality, and potential health impacts, leading to "Not In My Backyard" (NIMBY) sentiments.

- Regulatory Complexity and Permitting: Lengthy and complex permitting processes can delay project development.

- Competition from Recycling and Other Waste Management Options: Increased focus on high-rate recycling can reduce the volume of waste available for WtE.

- Feedstock Availability and Quality: Ensuring a consistent and appropriate quality of waste feedstock can be a challenge, impacting operational efficiency and emission levels. Supply chain issues related to waste collection and transportation can also pose problems. The competitive pressure from alternative waste treatment methods, like advanced recycling and anaerobic digestion, is also a significant factor.

Emerging Opportunities in Europe Waste-to-Energy Market

Emerging opportunities in the Europe Waste-to-Energy market lie in the development of advanced WtE technologies that offer higher energy efficiency and reduced emissions. This includes exploring gasification and pyrolysis for the production of syngas and bio-oils, which can be further refined into fuels or chemicals. The integration of Carbon Capture, Utilization, and Storage (CCUS) technologies with WtE plants presents a significant opportunity to achieve negative emissions and contribute to climate change mitigation. Furthermore, decentralized WtE solutions for smaller communities or industrial clusters are gaining traction, offering tailored energy generation and waste management. The growing emphasis on the circular economy is also driving opportunities for WtE facilities to recover valuable materials and by-products, moving beyond simple energy generation towards waste-to-value concepts.

Growth Accelerators in the Europe Waste-to-Energy Market Industry

Several catalysts are accelerating the growth of the Europe Waste-to-Energy Market. Technological breakthroughs in plasma gasification and advanced thermal treatment are enhancing efficiency and broadening the applicability of WtE. Strategic partnerships between waste management companies, energy providers, and technology developers are crucial for project financing and implementation. Market expansion into regions with developing waste management infrastructure and increasing waste generation rates, such as Eastern European countries, presents significant growth potential. Moreover, the evolving regulatory landscape, with a continued push towards landfill diversion and renewable energy targets, acts as a powerful growth accelerator, incentivizing investment in WtE infrastructure. The increasing adoption of smart technologies for plant operation and waste stream analysis also contributes to optimized performance and cost-effectiveness.

Key Players Shaping the Europe Waste-to-Energy Market Market

- Suez SA

- A2A SpA

- Martin GmbH

- Wheelabrator Technologies

- Hitachi Zosen Corp

- Veolia Environnement SA

- STEAG Energy Services GmbH

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Europe Waste-to-Energy Market Sector

- September 2022: Fortum announced expanding its UK-based operations and is starting to develop a new WtE plant in Scotland. This market entry is a vital step forward in the company's ambition to transform the WtE sector with its novel Carbon2x concept, which already concluded the first round of pilot testing. The concept aimed to capture emissions from waste incineration and turn them into useful CO2-based, high-quality raw materials. Moreover, the Carbon2x will help reduce the dependence on fossil-based raw materials, improve Europe's self-sufficiency, and decarbonize waste incineration.

- July 2022: The mayor of Rome, to whom the government assigned regional waste management until 2026, announced the construction of an incinerator within the city for all unsorted waste, expected to account for 43% of all waste by 2026 without prior treatment dealing with such by burning it rather treating it as non-recoverable waste.

In-Depth Europe Waste-to-Energy Market Market Outlook

The future outlook for the Europe Waste-to-Energy Market is exceptionally promising, fueled by a confluence of environmental mandates, energy security concerns, and technological innovation. Growth accelerators such as the continued implementation of circular economy principles, advancements in CCUS technologies, and the expansion of WtE into emerging European markets will significantly shape the market. Strategic opportunities lie in developing integrated waste management solutions that incorporate WtE as a core component, alongside enhanced recycling and material recovery. The market's trajectory will also be influenced by policy shifts that favor sustainable energy sources and discourage landfilling. The transition towards a low-carbon economy inherently positions WtE as a crucial element in managing residual waste while generating valuable energy and potentially carbon-neutral products. The estimated market size for the Europe Waste-to-Energy Market in 2033 is projected to reach approximately $22,500 million, indicating a sustained and robust growth phase driven by these pivotal factors.

Europe Waste-to-Energy Market Segmentation

- 1. Thermal

-

2. Source:

- 2.1. Physical

- 2.2. Biological

Europe Waste-to-Energy Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

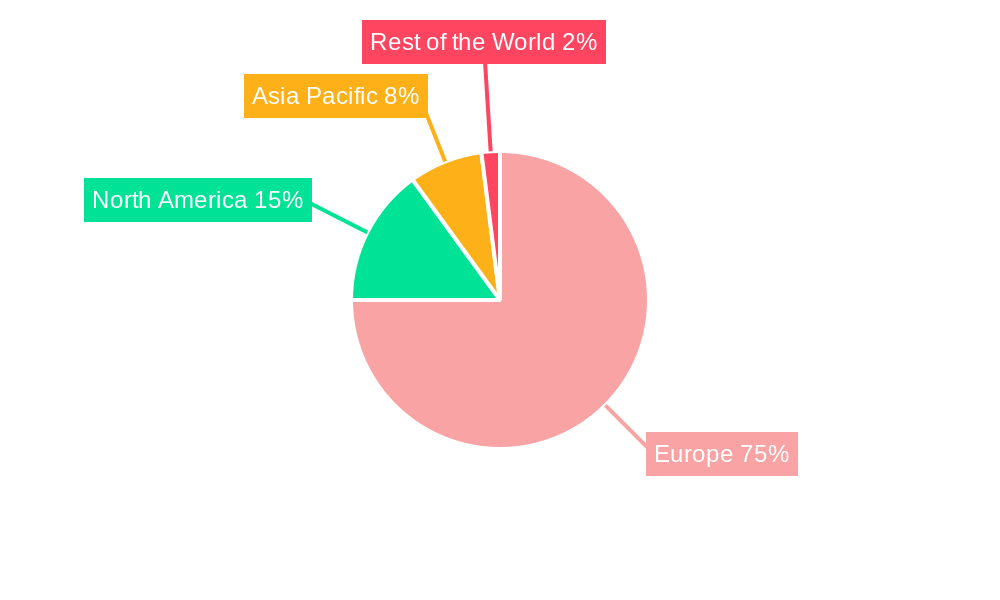

Europe Waste-to-Energy Market Regional Market Share

Geographic Coverage of Europe Waste-to-Energy Market

Europe Waste-to-Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Focus on Waste Management4.; Decline in Fossil-fuel based Electricity Generation

- 3.3. Market Restrains

- 3.3.1. 4.; High Price of Incinerators and Decline in Energy Price of Other Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Thermal-based Waste-to-Energy Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Waste-to-Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Thermal

- 5.2. Market Analysis, Insights and Forecast - by Source:

- 5.2.1. Physical

- 5.2.2. Biological

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Thermal

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Suez SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 A2A SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Martin GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wheelabrator Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Zosen Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veolia Environnement SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 STEAG Energy Services GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Heavy Industries Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Suez SA

List of Figures

- Figure 1: Europe Waste-to-Energy Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Waste-to-Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Waste-to-Energy Market Revenue Million Forecast, by Thermal 2020 & 2033

- Table 2: Europe Waste-to-Energy Market Volume Gigawatt Forecast, by Thermal 2020 & 2033

- Table 3: Europe Waste-to-Energy Market Revenue Million Forecast, by Source: 2020 & 2033

- Table 4: Europe Waste-to-Energy Market Volume Gigawatt Forecast, by Source: 2020 & 2033

- Table 5: Europe Waste-to-Energy Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Waste-to-Energy Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Europe Waste-to-Energy Market Revenue Million Forecast, by Thermal 2020 & 2033

- Table 8: Europe Waste-to-Energy Market Volume Gigawatt Forecast, by Thermal 2020 & 2033

- Table 9: Europe Waste-to-Energy Market Revenue Million Forecast, by Source: 2020 & 2033

- Table 10: Europe Waste-to-Energy Market Volume Gigawatt Forecast, by Source: 2020 & 2033

- Table 11: Europe Waste-to-Energy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Waste-to-Energy Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 17: France Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Waste-to-Energy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Waste-to-Energy Market Volume (Gigawatt) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Waste-to-Energy Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Europe Waste-to-Energy Market?

Key companies in the market include Suez SA, A2A SpA, Martin GmbH, Wheelabrator Technologies, Hitachi Zosen Corp, Veolia Environnement SA, STEAG Energy Services GmbH, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Europe Waste-to-Energy Market?

The market segments include Thermal, Source: .

4. Can you provide details about the market size?

The market size is estimated to be USD 20.84 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Focus on Waste Management4.; Decline in Fossil-fuel based Electricity Generation.

6. What are the notable trends driving market growth?

Thermal-based Waste-to-Energy Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Price of Incinerators and Decline in Energy Price of Other Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

September 2022: Fortum announced expanding its UK-based operations and is starting to develop a new WtE plant in Scotland. The market entry is a vital step forward in the company's ambition to transform the WtE sector with its novel Carbon2x concept, which already concluded the first round of pilot testing. The concept aimed to capture emissions from waste incineration and turn them into useful CO2-based, high-quality raw materials. Moreover, the Carbon2x will help reduce the dependence on fossil-based raw materials, improve Europe's self-sufficiency, and decarbonize waste incineration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Waste-to-Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Waste-to-Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Waste-to-Energy Market?

To stay informed about further developments, trends, and reports in the Europe Waste-to-Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence