Key Insights

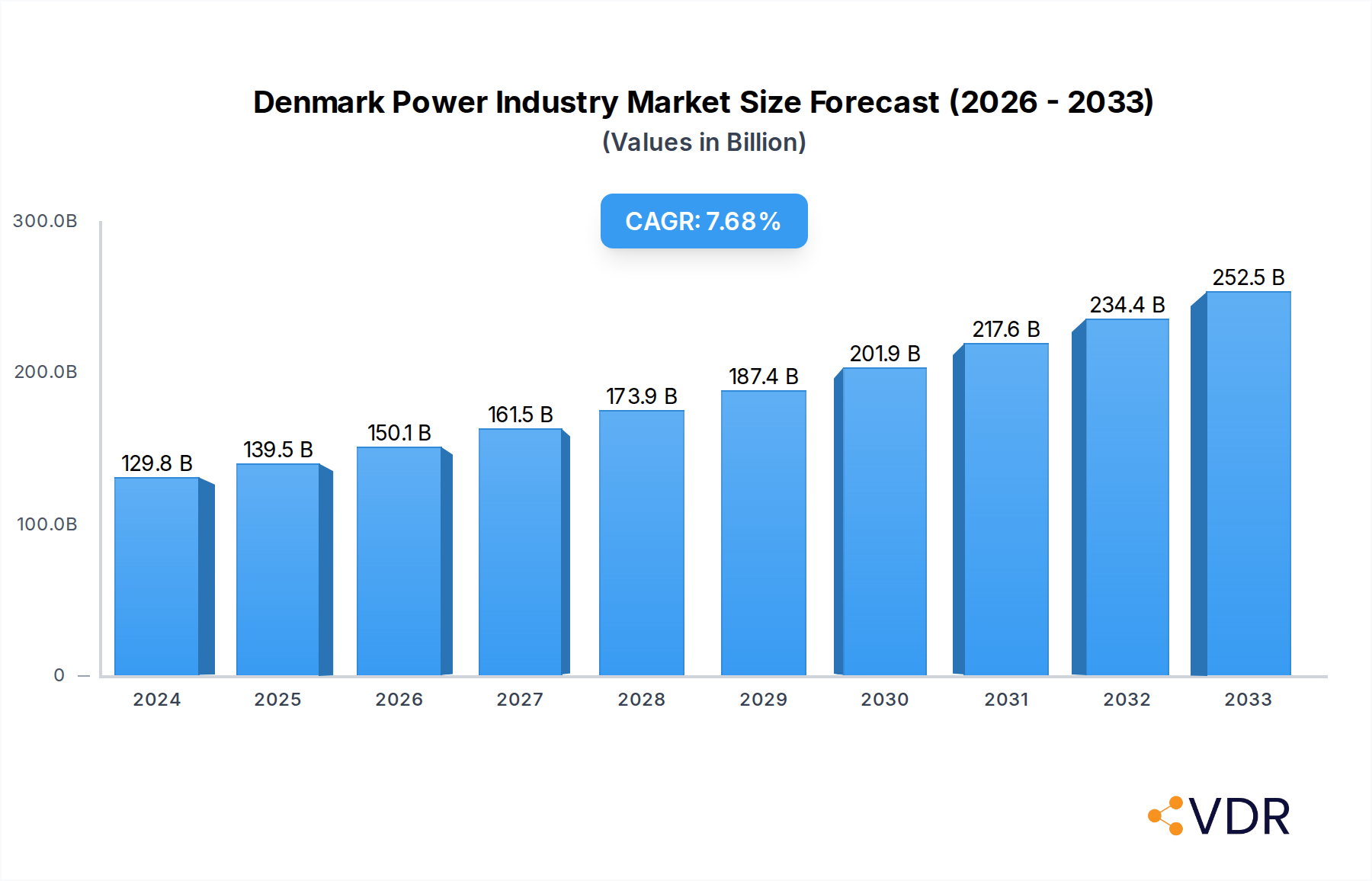

The Denmark Power Industry is poised for significant expansion, driven by a robust commitment to renewable energy sources and strategic investments in grid infrastructure. The market is projected to reach an impressive USD 139.5 billion by 2025, reflecting its current scale and anticipated growth. A compelling Compound Annual Growth Rate (CAGR) of 7.5% is expected over the forecast period of 2025-2033, underscoring a dynamic and forward-looking sector. This growth is primarily fueled by escalating investments in wind and solar power generation, aligning with Denmark's ambitious climate targets and its role as a leader in the green transition. The expansion of transmission and distribution networks is crucial for integrating these intermittent renewable sources effectively, ensuring grid stability and reliability. The market's trajectory indicates a strong emphasis on decarbonization and sustainable energy practices, creating substantial opportunities for both domestic and international players.

Denmark Power Industry Market Size (In Billion)

Key drivers propelling this growth include supportive government policies, advancements in renewable energy technologies, and increasing consumer demand for cleaner electricity. The ongoing development of offshore wind farms and the continuous improvement in solar panel efficiency are central to this expansion. While the industry benefits from these positive forces, it also navigates certain restraints, such as the need for substantial upfront capital investment and the challenges associated with grid modernization to accommodate a higher penetration of renewables. Nevertheless, the overarching trend points towards a cleaner, more resilient, and rapidly growing power sector in Denmark, with notable contributions from established companies like Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, and Ørsted A/S. The focus on innovation and sustainable practices will be paramount for continued success and leadership in the European energy landscape.

Denmark Power Industry Company Market Share

Denmark Power Industry Market Outlook: Renewable Energy Dominance and Strategic Expansion

This comprehensive report delves into the dynamic Denmark Power Industry, exploring its current landscape and forecasting its trajectory through 2033. With a sharp focus on renewable energy generation, particularly offshore wind power, Denmark is solidifying its position as a global leader in sustainable energy solutions. This report provides an in-depth analysis of market dynamics, growth trends, key players, and emerging opportunities within the Danish power sector, offering invaluable insights for stakeholders seeking to capitalize on this burgeoning market.

Denmark Power Industry Market Dynamics & Structure

The Denmark Power Industry is characterized by a strong emphasis on renewable energy, driven by ambitious climate goals and supportive government policies. Market concentration is evident, particularly within the wind power generation segment, where a few dominant players hold significant market share. Technological innovation is a primary driver, with continuous advancements in turbine efficiency and grid integration solutions. The regulatory framework is highly conducive to renewable energy deployment, incentivizing investments and facilitating project development. Competitive product substitutes are largely non-existent for core renewable energy sources, though energy storage solutions are emerging as complementary technologies. End-user demographics show a growing demand for clean energy, with both industrial and residential sectors actively seeking sustainable power options. Mergers and acquisitions (M&A) trends indicate a consolidation of players, particularly in the offshore wind sector, as companies seek to scale up operations and secure project pipelines.

- Market Concentration: Dominated by a few key players in offshore wind development and renewable energy generation.

- Technological Innovation Drivers: Focus on increasing wind turbine capacity, enhancing grid stability for intermittent renewables, and developing advanced energy storage.

- Regulatory Frameworks: Robust government support through feed-in tariffs, tax incentives, and ambitious renewable energy targets.

- Competitive Product Substitutes: Primarily energy storage solutions complementing renewable generation.

- End-User Demographics: Growing demand for green energy from businesses and households driven by environmental consciousness and cost-effectiveness.

- M&A Trends: Increasing M&A activity to consolidate market share and expand project portfolios in offshore wind.

Denmark Power Industry Growth Trends & Insights

The Denmark Power Industry is poised for substantial growth, driven by its unwavering commitment to a green transition and its strategic role in European energy security. The market size evolution is projected to be robust, propelled by significant investments in offshore wind power, which is set to dominate the generation mix. Adoption rates for renewable energy technologies are exceptionally high, supported by government mandates and decreasing technology costs. Technological disruptions are primarily focused on improving the efficiency and reliability of renewable energy sources, alongside advancements in smart grid technologies and energy storage solutions. Consumer behavior shifts are increasingly favoring sustainable energy consumption, with a growing preference for electricity sourced from wind and solar power. The CAGR (Compound Annual Growth Rate) is expected to be a strong xx% over the forecast period, reflecting the accelerated deployment of renewable energy infrastructure. Market penetration of renewable energy in the total energy mix is already high and will continue to climb significantly.

Dominant Regions, Countries, or Segments in Denmark Power Industry

The Wind power generation segment is unequivocally the dominant force driving the Denmark Power Industry. This dominance is underpinned by the nation's advantageous geographical location, boasting strong and consistent offshore wind resources. Government policies have been instrumental in fostering this segment's growth, with ambitious targets for offshore wind capacity expansion and substantial investment in port infrastructure to support large-scale projects. The economic policies are geared towards maximizing renewable energy production, making Denmark an attractive destination for international investors in the wind sector. Infrastructure development has been a key enabler, with the construction of specialized ports and transmission grids designed to handle the massive output of offshore wind farms. Market share within wind generation is substantial, with a significant portion of the nation's electricity already being supplied by wind turbines. The growth potential for offshore wind remains immense, as Denmark continues to explore new project sites and expand its offshore wind capacity to meet its decarbonization goals and serve as a green energy hub for Europe. The Transmission and Distribution segment is also crucial, evolving to accommodate the increasing and often decentralized nature of renewable energy generation, ensuring grid stability and efficient power delivery.

- Key Drivers for Wind Power Dominance:

- Abundant and consistent offshore wind resources.

- Favorable government policies and renewable energy targets.

- Significant investment in port infrastructure and grid upgrades.

- Technological advancements in offshore wind turbine technology.

- Denmark's strategic role in European energy transmission.

Denmark Power Industry Product Landscape

The product landscape in the Denmark Power Industry is increasingly dominated by innovations in renewable energy generation technologies. This includes highly efficient offshore wind turbines with larger rotor diameters and enhanced power output, exemplified by advancements from companies like Vestas Wind Systems A/S and Siemens Gamesa Renewable Energy SA. Solar photovoltaic (PV) solutions, while smaller in current market share compared to wind, are also seeing product innovations in terms of panel efficiency and integrated energy storage systems. The performance metrics of these technologies are constantly improving, leading to reduced levelized cost of energy (LCOE). Unique selling propositions revolve around sustainability, reliability, and contributing to national decarbonization efforts.

Key Drivers, Barriers & Challenges in Denmark Power Industry

Key Drivers:

- Ambitious National Climate Targets: Denmark's commitment to achieving carbon neutrality drives significant investment in renewable energy.

- Technological Advancements: Continuous innovation in wind turbine technology and grid management enhances efficiency and reduces costs.

- Supportive Government Policies: Favorable regulations, incentives, and long-term energy strategies accelerate renewable energy deployment.

- Energy Security and Independence: Reducing reliance on fossil fuel imports, especially from volatile regions.

- Cost Competitiveness of Renewables: Declining costs of wind and solar power make them economically attractive.

Barriers & Challenges:

- Grid Integration and Stability: Managing the intermittency of renewable sources and ensuring grid stability with high penetration.

- Supply Chain Constraints: Potential bottlenecks in the manufacturing and deployment of large-scale renewable energy components, especially for offshore wind.

- Permitting and Environmental Considerations: Lengthy and complex permitting processes, alongside ensuring minimal environmental impact from large-scale projects.

- Infrastructure Investment Needs: Significant ongoing investment required for grid upgrades and new transmission infrastructure to connect remote renewable energy sources.

- Public Acceptance and NIMBYism: Addressing local concerns regarding visual impact and land use for onshore renewable projects.

Emerging Opportunities in Denmark Power Industry

Emerging opportunities in the Denmark Power Industry lie in the expansion of green hydrogen production powered by abundant renewable energy, creating a new sector for energy export and industrial decarbonization. Furthermore, the development of advanced energy storage solutions, including large-scale battery storage and innovative pumped hydro systems, presents significant potential to enhance grid stability and optimize renewable energy utilization. The digitalization of the grid through smart meter technologies and AI-driven energy management systems offers opportunities for increased efficiency and decentralized energy trading. The circular economy principles are also gaining traction, with opportunities in the recycling and repurposing of renewable energy components.

Growth Accelerators in the Denmark Power Industry Industry

Several catalysts are accelerating the growth of the Denmark Power Industry. Technological breakthroughs in turbine design, materials science, and energy storage are continuously improving the efficiency and reducing the cost of renewable energy. Strategic partnerships between energy companies, technology providers, and investment funds are crucial for financing and executing large-scale offshore wind projects and innovative energy island concepts. Furthermore, market expansion strategies that focus on Denmark's role as a green energy exporter to neighboring European countries are creating new avenues for growth. The increasing global demand for sustainable energy solutions directly benefits Denmark's advanced renewable energy sector, positioning it for sustained leadership.

Key Players Shaping the Denmark Power Industry Market

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Oersted A/S

- BIGADAN A/S

- Vattenfall A / S

- Arcon-Sunmark A/S

- General Electric Company

Notable Milestones in Denmark Power Industry Sector

- October 2022: Orsted, a Danish energy company, announced its intentions to develop four new offshore wind farms, aiming to increase the country's wind power production twofold. This strategic move is part of Denmark's efforts to reduce its reliance on Russian gas and oil. Orsted partnered with investment fund Copenhagen Infrastructure Partners (CIP) to collaborate on developing approximately 5.2 GW of offshore wind capacity across four projects in Denmark.

- June 2022: Denmark and Germany agreed to jointly finalize the development of the anticipated Bornholm Energy Island. Once completed by 2030, this groundbreaking project will become the world's first of its kind and provide green electricity to approximately 3.3 - 4.5 million households in Denmark and Germany. Moreover, this agreement enabled Denmark to expand the original planned capacity of the energy island from 2 to 3 gigawatts (GW). It further emphasizes the significant role it will play in supporting renewable energy generation.

In-Depth Denmark Power Industry Market Outlook

The future outlook for the Denmark Power Industry is exceptionally bright, driven by a clear strategic vision centered on renewable energy dominance. The continued expansion of offshore wind capacity, coupled with advancements in energy storage and green hydrogen production, will solidify Denmark's position as a leader in the global energy transition. Strategic opportunities lie in further developing its role as a European energy hub, leveraging its advanced grid infrastructure and renewable generation capabilities to supply clean energy to neighboring nations. The commitment to innovation and sustainability ensures sustained growth and significant market potential for years to come.

Denmark Power Industry Segmentation

-

1. Generation

- 1.1. Wind

- 1.2. Solar

- 1.3. Coal

- 1.4. Others

- 2. Transmission and Distribution

Denmark Power Industry Segmentation By Geography

- 1. Denmark

Denmark Power Industry Regional Market Share

Geographic Coverage of Denmark Power Industry

Denmark Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Integration of Renewable Energy4.; Supportive government policies in Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land Availability

- 3.4. Market Trends

- 3.4.1. Wind Energy to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 5.1.1. Wind

- 5.1.2. Solar

- 5.1.3. Coal

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Gamesa Renewable Energy SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oersted A/S

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BIGADAN A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vattenfall A / S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arcon-Sunmark A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: Denmark Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Denmark Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Denmark Power Industry Revenue billion Forecast, by Generation 2020 & 2033

- Table 2: Denmark Power Industry Volume megawatt Forecast, by Generation 2020 & 2033

- Table 3: Denmark Power Industry Revenue billion Forecast, by Transmission and Distribution 2020 & 2033

- Table 4: Denmark Power Industry Volume megawatt Forecast, by Transmission and Distribution 2020 & 2033

- Table 5: Denmark Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Denmark Power Industry Volume megawatt Forecast, by Region 2020 & 2033

- Table 7: Denmark Power Industry Revenue billion Forecast, by Generation 2020 & 2033

- Table 8: Denmark Power Industry Volume megawatt Forecast, by Generation 2020 & 2033

- Table 9: Denmark Power Industry Revenue billion Forecast, by Transmission and Distribution 2020 & 2033

- Table 10: Denmark Power Industry Volume megawatt Forecast, by Transmission and Distribution 2020 & 2033

- Table 11: Denmark Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Denmark Power Industry Volume megawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Power Industry?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Denmark Power Industry?

Key companies in the market include Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, Oersted A/S, BIGADAN A/S, Vattenfall A / S, Arcon-Sunmark A/S, General Electric Company*List Not Exhaustive.

3. What are the main segments of the Denmark Power Industry?

The market segments include Generation, Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Integration of Renewable Energy4.; Supportive government policies in Power Plants.

6. What are the notable trends driving market growth?

Wind Energy to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Limited Land Availability.

8. Can you provide examples of recent developments in the market?

October 2022: Orsted, a Danish energy company, announced its intentions to develop four new offshore wind farms, aiming to increase the country's wind power production twofold. This strategic move is part of Denmark's efforts to reduce its reliance on Russian gas and oil. Orsted partnered with investment fund Copenhagen Infrastructure Partners (CIP) to collaborate on developing approximately 5.2 GW of offshore wind capacity across four projects in Denmark, as stated in their official statement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in megawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Power Industry?

To stay informed about further developments, trends, and reports in the Denmark Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence