Key Insights

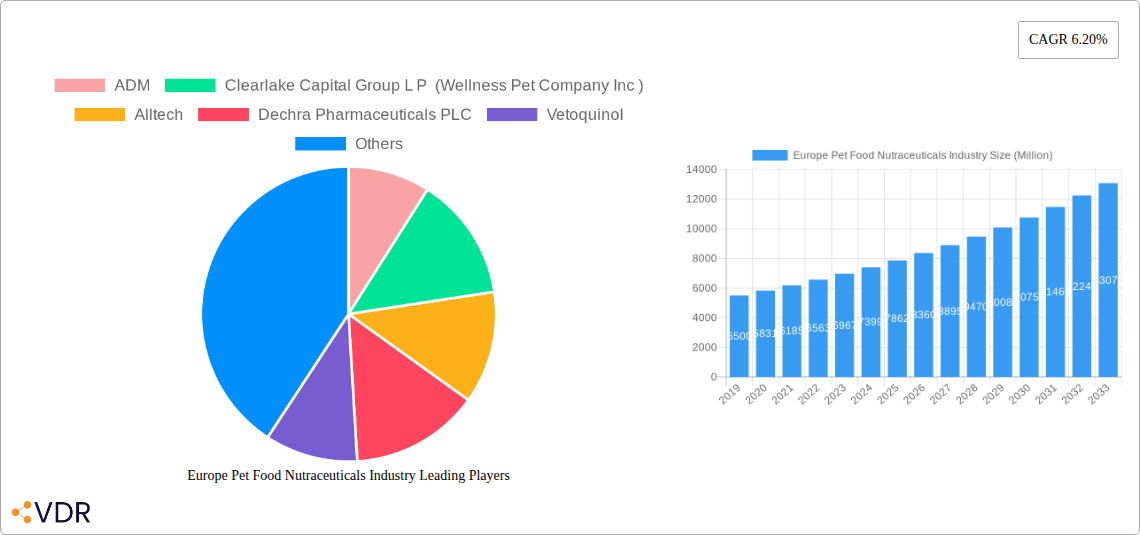

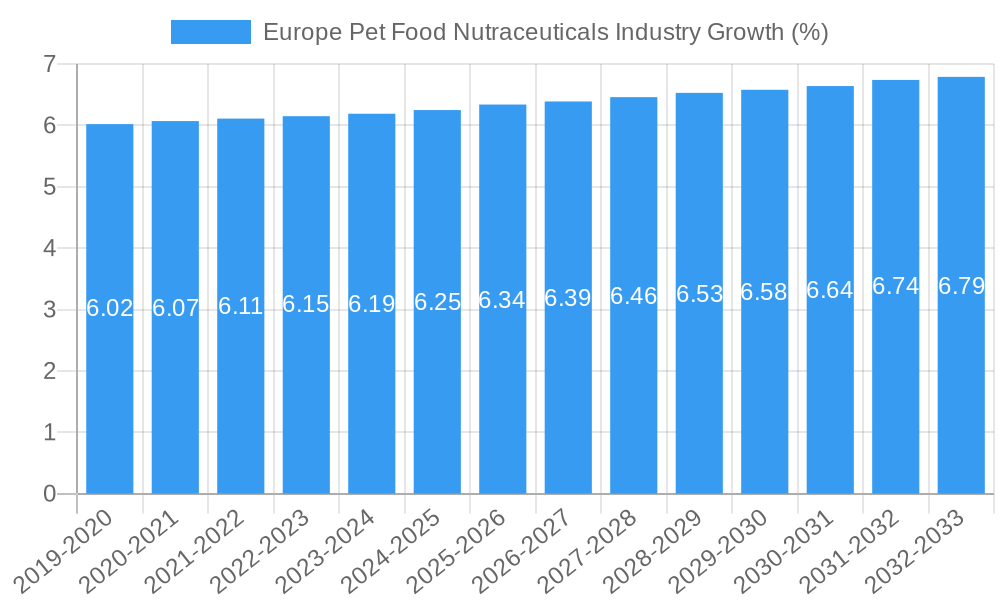

The Europe Pet Food Nutraceuticals Market is poised for robust growth, projected to reach an estimated XX million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.20% through 2033. This significant expansion is underpinned by a confluence of evolving pet owner priorities and advancements in pet healthcare. A primary driver is the escalating humanization of pets, leading owners to invest more in their companions' well-being, akin to human nutritional standards. This translates to a burgeoning demand for specialized pet food fortified with ingredients that promote digestive health, joint mobility, immune support, and cognitive function. Consequently, sub-segments like Probiotics, Omega-3 Fatty Acids, and Proteins and Peptides are witnessing substantial traction as owners actively seek preventative and therapeutic solutions for their pets. The increasing availability of these nutraceutical-enhanced foods across diverse distribution channels, from convenient online platforms to well-stocked supermarkets, further fuels market penetration and accessibility for European pet parents.

Further augmenting this market's trajectory are key trends such as the growing preference for natural and organic ingredients, the development of breed-specific and life-stage formulations, and the increasing focus on personalized nutrition for pets. While the market experiences strong tailwinds, certain restraints, such as the high cost of premium nutraceutical ingredients and the potential for consumer skepticism regarding efficacy, warrant strategic consideration by market players. Nonetheless, the proactive approach of major companies like Mars Incorporated (Purina), Nestle, and ADM in developing innovative product portfolios, coupled with a robust distribution network across key European nations like the UK, Germany, and France, positions the market for sustained and healthy expansion. The increasing adoption of advanced research and development, particularly in areas like gut health and immunity, will continue to shape product innovation and consumer adoption.

This in-depth report provides a strategic overview of the Europe Pet Food Nutraceuticals Industry, offering critical insights into market dynamics, growth trends, key players, and future opportunities. Covering the period from 2019 to 2033, with a base year of 2025, this analysis is essential for stakeholders seeking to understand and capitalize on the burgeoning demand for scientifically formulated, health-enhancing ingredients in pet food across Europe. We delve into both the parent market for pet food nutraceuticals and its crucial child markets, analyzing the granular impact of specific product types, pet demographics, and distribution channels.

Europe Pet Food Nutraceuticals Industry Market Dynamics & Structure

The Europe Pet Food Nutraceuticals Industry is characterized by a moderately concentrated market, with Mars Incorporated and Nestle (Purina) holding significant shares in the broader pet food segment, which heavily influences nutraceutical integration. Technological innovation is a primary driver, fueled by increasing consumer demand for science-backed health solutions for their pets. Regulatory frameworks, primarily driven by the European Food Safety Authority (EFSA), are becoming more stringent, influencing product development and claims. Competitive product substitutes, while present in basic pet nutrition, are less of a threat for specialized nutraceuticals designed for targeted health benefits. End-user demographics are shifting towards a more informed and health-conscious pet owner, viewing pets as family members, which directly impacts purchasing decisions for premium and functional pet food. Merger and acquisition (M&A) trends are notable, with companies like Virbac actively expanding their global footprint through strategic acquisitions, aiming to bolster their presence in key European markets. The estimated M&A deal volume in the past two years stands at approximately 5-7 significant transactions, indicating consolidation and strategic growth. Barriers to innovation include the high cost of clinical trials for efficacy claims and navigating diverse national regulations.

Europe Pet Food Nutraceuticals Industry Growth Trends & Insights

The Europe Pet Food Nutraceuticals Industry is poised for significant expansion, driven by a fundamental shift in pet owner perception from basic sustenance to holistic health and well-being. This evolution, supported by increasing disposable incomes and a growing trend of pet humanization, is propelling the adoption of premium and functional pet foods infused with scientifically validated nutraceuticals. The market size is projected to reach approximately €8,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This robust growth is underpinned by several key trends.

- Increasing Adoption Rates: The integration of nutraceuticals into mainstream pet food is accelerating. Pet owners are actively seeking products that offer tangible health benefits, such as improved joint health, enhanced immunity, better digestive function, and lustrous coats. This demand is further amplified by the growing awareness of preventive healthcare for pets, mirroring human health trends.

- Technological Disruptions: Advancements in encapsulation technologies, bioavailability enhancements, and the identification of novel bioactives are continuously improving the efficacy and appeal of pet food nutraceuticals. ADM, a key player, is at the forefront of developing advanced ingredients and sustainable sourcing methods, contributing significantly to product innovation.

- Consumer Behavior Shifts: The ‘pet parent’ phenomenon has led to a willingness among consumers to invest in higher-quality, health-focused pet food. This is evident in the rising popularity of specialty pet stores and online channels where detailed product information and expert recommendations are readily available. Consumers are increasingly scrutinizing ingredient lists, seeking transparency and efficacy.

- Market Penetration: While still evolving, the penetration of pet food nutraceuticals is steadily increasing. In major markets like Germany and the UK, an estimated 40-50% of premium pet food offerings now contain at least one type of nutraceutical ingredient. This penetration is expected to climb to over 65% by 2033. The overall market value in 2025 is estimated at €8,500 million, with historical data showing a consistent upward trajectory from €6,200 million in 2019.

Dominant Regions, Countries, or Segments in Europe Pet Food Nutraceuticals Industry

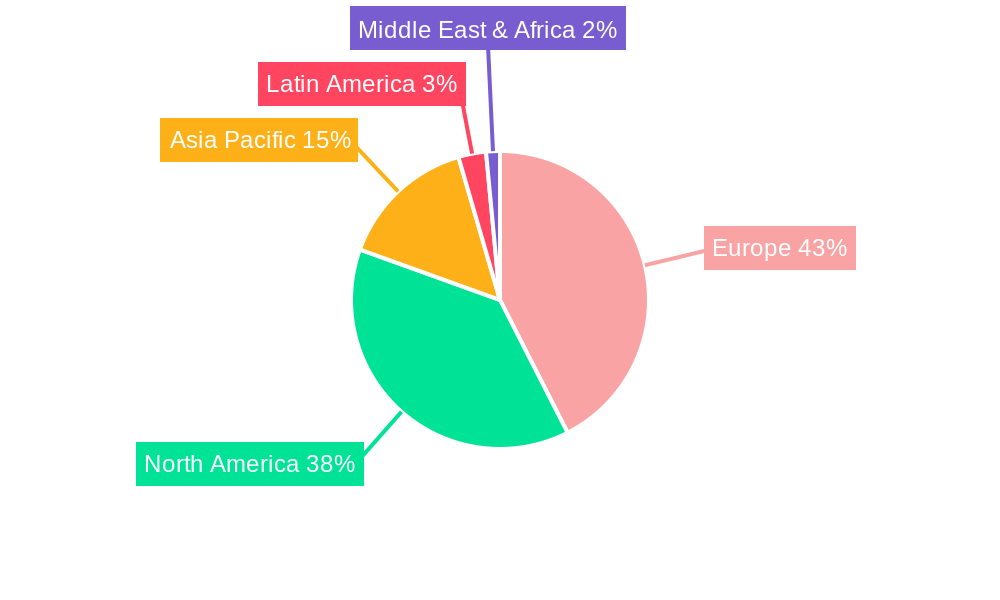

The Europe Pet Food Nutraceuticals Industry exhibits varied dominance across its regional, national, and segmental landscapes. Dogs consistently represent the largest pet segment, accounting for an estimated 70% of the total nutraceutical pet food market due to higher ownership rates and a broader range of health concerns addressed by functional ingredients.

- Leading Region: Western Europe, particularly Germany, the United Kingdom, and France, currently dominates the market. These regions boast high disposable incomes, a strong pet humanization culture, and a well-established premium pet food market. Germany alone is estimated to hold over 20% of the total European market share.

- Dominant Countries: Beyond the leading trio, Italy and Spain are emerging as significant growth markets, driven by increasing pet ownership and a rising awareness of pet health.

- Dominant Sub Product: Within the nutraceuticals segment, Omega-3 Fatty Acids and Probiotics are leading growth drivers, each capturing an estimated 25% and 22% of the market, respectively. Omega-3s are sought after for their benefits in skin and coat health, as well as joint and cognitive function, while probiotics are crucial for digestive health. Proteins and Peptides follow closely, driven by the need for muscle development and recovery, particularly in active dog breeds.

- Dominant Distribution Channel: The Specialty Stores and Online Channel segments are showing the most dynamic growth, with an estimated combined market share of 45% in 2025. Specialty stores offer a curated selection of premium and functional pet foods, often with knowledgeable staff, while the online channel provides convenience, a wide product selection, and easy access to detailed nutritional information. Supermarkets/Hypermarkets, while holding a larger overall volume share for general pet food, are experiencing slower growth in the specialized nutraceutical segment.

Europe Pet Food Nutraceuticals Industry Product Landscape

The Europe Pet Food Nutraceuticals Industry is witnessing a surge in product innovation focused on delivering targeted health benefits and enhanced palatability. Products are increasingly formulated with specific active ingredients like Milk Bioactives for immune support and digestive health, Omega-3 Fatty Acids derived from fish or algae for anti-inflammatory and cognitive benefits, Probiotics to foster gut microbiota balance, Proteins and Peptides for muscle synthesis and recovery, and Vitamins and Minerals to bridge nutritional gaps and support overall well-being. Manufacturers are emphasizing scientific formulation, often collaborating with veterinary nutritionists and research institutions. Unique selling propositions include evidence-based efficacy, natural ingredient sourcing, and tailored formulations for specific life stages or health conditions, such as joint support for senior dogs or digestive aid for sensitive cats. Technological advancements in ingredient processing and bioavailability are key differentiators, ensuring optimal nutrient absorption and efficacy.

Key Drivers, Barriers & Challenges in Europe Pet Food Nutraceuticals Industry

Key Drivers:

- Humanization of Pets: The perception of pets as family members drives demand for high-quality, health-promoting products.

- Growing Awareness of Preventive Healthcare: Owners are investing in nutraceuticals to maintain pet health and prevent future ailments.

- Scientific Advancements: Ongoing research and development yield more effective and targeted nutraceutical ingredients.

- Premiumization of Pet Food: A willingness to spend more on specialized, high-value pet food options.

Barriers & Challenges:

- Regulatory Hurdles: Navigating diverse national regulations regarding health claims and ingredient approvals across Europe can be complex and time-consuming.

- Consumer Education: The need to educate pet owners on the specific benefits and appropriate usage of various nutraceuticals.

- Cost of Ingredients and Production: High-quality, research-backed nutraceuticals can increase the overall cost of pet food, potentially limiting accessibility for some consumers.

- Supply Chain Volatility: Ensuring a consistent and sustainable supply of specialized ingredients can be challenging, impacting production volumes and pricing.

- Competition: The market is becoming increasingly competitive, necessitating strong differentiation and clear value propositions.

Emerging Opportunities in Europe Pet Food Nutraceuticals Industry

Emerging opportunities in the Europe Pet Food Nutraceuticals Industry lie in several key areas. The development of functional treats and toppers, designed for specific health benefits such as stress reduction or dental care, presents a significant avenue. Furthermore, untapped markets within Eastern Europe, driven by rapidly growing pet ownership and increasing disposable incomes, offer substantial potential. The demand for sustainably sourced and novel ingredients, such as insect-derived proteins with inherent nutritional benefits, is also a growing trend. Personalization of pet nutrition, leveraging data analytics and DNA testing, is an emerging frontier, allowing for tailor-made nutraceutical formulations.

Growth Accelerators in the Europe Pet Food Nutraceuticals Industry Industry

Catalysts driving long-term growth in the Europe Pet Food Nutraceuticals Industry are multifaceted. Technological breakthroughs in areas like gut microbiome research and the development of personalized nutrition platforms are pivotal. Strategic partnerships between ingredient manufacturers, pet food brands, and veterinary institutions are crucial for validating product efficacy and expanding market reach. The continuous expansion of e-commerce platforms and direct-to-consumer models provides new avenues for reaching a broader customer base and offering customized solutions. Moreover, the increasing focus on the environmental impact and sustainability of pet food ingredients will also drive innovation and market growth.

Key Players Shaping the Europe Pet Food Nutraceuticals Industry Market

- ADM

- Clearlake Capital Group L P (Wellness Pet Company Inc)

- Alltech

- Dechra Pharmaceuticals PLC

- Vetoquinol

- Mars Incorporated

- Nestle (Purina)

- Vafo Praha s r o

- Nutramax Laboratories Inc

- Virbac

Notable Milestones in Europe Pet Food Nutraceuticals Industry Sector

- May 2023: Virbac acquired its distributor (GS Partners) in the Czech Republic and Slovakia, which became Virbac's 35th subsidiary. This new subsidiary allows Virbac to expand its presence more in these countries.

- April 2023: Vafo Praha, s.r.o. partnered with the Swedish wholesaler of pet food products, Lupus Foder AB. Under this partnership, VAFO got the majority stake in Lupus Foder, thus expanding its position in Scandinavia.

- March 2023: Mars Incorporated launched new Pedigree Multivitamins, a trio of soft chews formulated to help pets with their immunity, digestion, and joints. It has been developed with the Waltham Petcare Science Institute team, vets, and pet nutritionists.

In-Depth Europe Pet Food Nutraceuticals Industry Market Outlook

- May 2023: Virbac acquired its distributor (GS Partners) in the Czech Republic and Slovakia, which became Virbac's 35th subsidiary. This new subsidiary allows Virbac to expand its presence more in these countries.

- April 2023: Vafo Praha, s.r.o. partnered with the Swedish wholesaler of pet food products, Lupus Foder AB. Under this partnership, VAFO got the majority stake in Lupus Foder, thus expanding its position in Scandinavia.

- March 2023: Mars Incorporated launched new Pedigree Multivitamins, a trio of soft chews formulated to help pets with their immunity, digestion, and joints. It has been developed with the Waltham Petcare Science Institute team, vets, and pet nutritionists.

In-Depth Europe Pet Food Nutraceuticals Industry Market Outlook

The Europe Pet Food Nutraceuticals Industry is set for sustained and dynamic growth, driven by an unyielding trend of pet humanization and an increasing consumer emphasis on proactive pet health management. The market's future potential is immense, fueled by continuous innovation in ingredient science, bioavailability enhancement, and personalized nutrition. Strategic opportunities abound for companies that can effectively communicate the scientific backing and tangible benefits of their nutraceutical offerings, alongside a commitment to sustainability and transparency. The forecast period 2025-2033 is anticipated to witness a significant increase in market value, estimated to reach over €15,000 million, as the integration of functional ingredients becomes standard practice in premium pet food formulations across all European markets.

Europe Pet Food Nutraceuticals Industry Segmentation

-

1. Sub Product

- 1.1. Milk Bioactives

- 1.2. Omega-3 Fatty Acids

- 1.3. Probiotics

- 1.4. Proteins and Peptides

- 1.5. Vitamins and Minerals

- 1.6. Other Nutraceuticals

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

Europe Pet Food Nutraceuticals Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pet Food Nutraceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Milk Bioactives

- 5.1.2. Omega-3 Fatty Acids

- 5.1.3. Probiotics

- 5.1.4. Proteins and Peptides

- 5.1.5. Vitamins and Minerals

- 5.1.6. Other Nutraceuticals

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. Germany Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Pet Food Nutraceuticals Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ADM

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Alltech

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Dechra Pharmaceuticals PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Vetoquinol

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mars Incorporated

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nestle (Purina)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vafo Praha s r o

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nutramax Laboratories Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Virba

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 ADM

List of Figures

- Figure 1: Europe Pet Food Nutraceuticals Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Pet Food Nutraceuticals Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 3: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Pets 2019 & 2032

- Table 4: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 15: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Pets 2019 & 2032

- Table 16: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Europe Pet Food Nutraceuticals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Pet Food Nutraceuticals Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pet Food Nutraceuticals Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Europe Pet Food Nutraceuticals Industry?

Key companies in the market include ADM, Clearlake Capital Group L P (Wellness Pet Company Inc ), Alltech, Dechra Pharmaceuticals PLC, Vetoquinol, Mars Incorporated, Nestle (Purina), Vafo Praha s r o, Nutramax Laboratories Inc, Virba.

3. What are the main segments of the Europe Pet Food Nutraceuticals Industry?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Virbac acquired its distributor (GS Partners) in the Czech Republic and Slovakia, which became Virbac's 35th subsidiary. This new subsidiary allows Virbac to expand its presence more in these countries.April 2023: Vafo Praha, s.r.o. partnered with the Swedish wholesaler of pet food products, Lupus Foder AB. Under this partnership, VAFO got the majority stake in Lupus Foder, thus expanding its position in Scandinavia.March 2023: Mars Incorporated launched new Pedigree Multivitamins, a trio of soft chews formulated to help pets with their immunity, digestion, and joints. It has been developed with the Waltham Petcare Science Institute team, vets, and pet nutritionists.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pet Food Nutraceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pet Food Nutraceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pet Food Nutraceuticals Industry?

To stay informed about further developments, trends, and reports in the Europe Pet Food Nutraceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence