Key Insights

The North American Feed Phytogenics Market is projected for robust expansion, fueled by escalating consumer demand for natural and antibiotic-free animal products. Heightened awareness of feed safety and animal welfare is prompting livestock producers to adopt sustainable alternatives to conventional feed additives. Phytogenic feed additives, derived from plant sources, offer a viable solution due to their multifaceted benefits, including antimicrobial, antioxidant, and digestive enhancement properties. Regulatory mandates aimed at reducing antibiotic usage in animal agriculture are further accelerating market growth, presenting significant opportunities for phytogenic solutions. Advances in extraction and formulation technologies are also driving the development of more potent and stable phytogenic products, thereby improving their efficacy and adoption across diverse animal species.

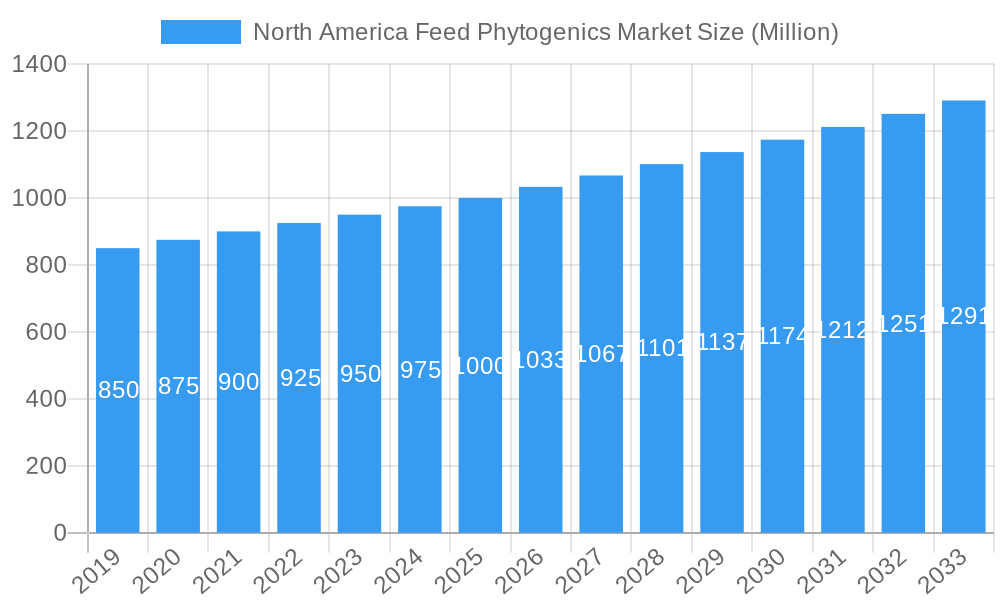

North America Feed Phytogenics Market Market Size (In Million)

The market is segmented by product type into Herbs, Species, Essential Oils, and Oleoresins. Essential Oils and Oleoresins are expected to command a substantial market share due to their concentrated bioactive compounds and extensive applications in animal feed. In terms of application, the Poultry and Ruminant segments are anticipated to lead, reflecting the high feed consumption volumes and the specific health and productivity advantages offered by phytogenics for these animal types. Geographically, the United States is the dominant market in North America, supported by advanced animal husbandry practices and a strong propensity for adopting novel feed technologies. Canada and Mexico are also exhibiting strong growth trajectories, driven by similar trends and increased investments in livestock production infrastructure. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 5.41%, reaching a market size of approximately $734.1 million in the base year 2025, and is expected to reach an estimated $1,200 million by the end of the forecast period in 2033.

North America Feed Phytogenics Market Company Market Share

North America Feed Phytogenics Market Report: Unlocking Sustainable Animal Nutrition

This comprehensive report offers an in-depth analysis of the North America Feed Phytogenics Market, a rapidly evolving sector driven by the demand for natural, effective, and sustainable animal feed additives. Explore critical market dynamics, growth trends, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive landscape, with all values presented in Million units.

North America Feed Phytogenics Market Dynamics & Structure

The North America Feed Phytogenics Market is characterized by a moderate market concentration, with a blend of established global players and emerging regional innovators. Technological innovation is a primary driver, with continuous research and development focused on identifying novel plant-derived compounds for enhanced animal health and performance. Regulatory frameworks are increasingly favoring natural alternatives, pushing the market away from synthetic additives. Competitive product substitutes, while present, are losing ground as the efficacy and sustainability of phytogenics become more evident. End-user demographics are shifting towards producers prioritizing animal welfare, food safety, and reduced antibiotic reliance. Mergers and acquisitions (M&A) are a notable trend, with XX M&A deals observed historically, indicating strategic consolidation and expansion by key stakeholders like Kemin and Danisco. Innovation barriers are primarily linked to the scientific validation of efficacy across diverse animal species and geographical regions, as well as ensuring consistent supply chains for raw botanical materials.

- Market Concentration: Moderate, with significant influence from key global players.

- Technological Innovation: Driven by R&D in botanical extraction, synergy of active compounds, and application-specific formulations.

- Regulatory Frameworks: Growing support for natural feed additives and stricter regulations on synthetic alternatives.

- Competitive Substitutes: Primarily synthetic antibiotics and other chemical growth promoters.

- End-User Demographics: Focus on sustainable farming, animal welfare, and antibiotic-free production.

- M&A Trends: Active consolidation for market share expansion and portfolio diversification.

- Innovation Barriers: Scientific validation, standardization of natural ingredients, and supply chain reliability.

North America Feed Phytogenics Market Growth Trends & Insights

The North America Feed Phytogenics Market is poised for substantial growth, projected to reach USD XX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by a significant increase in the adoption rates of phytogenic feed additives across various animal husbandry sectors. Technological disruptions, such as advanced extraction techniques and the development of synergistic blends of plant compounds, are enhancing the efficacy and broad-spectrum benefits of these natural solutions. Consumer behavior shifts towards ethically sourced and healthier animal products are indirectly driving demand for phytogenics as a means to reduce antibiotic usage and improve animal gut health. The market penetration of phytogenics is expected to rise dramatically as producers recognize their ability to improve feed conversion ratios, enhance immune responses, and mitigate the impact of common animal diseases. Historical data from 2019–2024 indicates a steady upward trajectory, with the market size growing from USD XX Million in 2019 to an estimated USD XX Million in 2024. The base year of 2025 is anticipated to witness a market size of USD XX Million, laying the foundation for accelerated growth in the subsequent years. This sustained demand reflects a global paradigm shift towards sustainable and natural approaches in animal nutrition.

Dominant Regions, Countries, or Segments in North America Feed Phytogenics Market

The United States emerges as the dominant force within the North America Feed Phytogenics Market, driven by its large-scale animal agriculture industry and a strong emphasis on technological adoption and regulatory compliance. This dominance is further bolstered by significant investments in research and development by leading companies.

Key Drivers for US Dominance:

- Expansive Livestock Population: The sheer size of the poultry, swine, and ruminant sectors in the US creates a substantial demand for feed additives.

- Advanced Animal Husbandry Practices: The US leads in adopting innovative farming techniques, including the integration of natural feed solutions for improved animal health and productivity.

- Supportive Regulatory Environment: While stringent, regulations in the US are increasingly aligning with the benefits of natural feed additives, encouraging their widespread use.

- High R&D Expenditure: Key players like Kemin and Danisco have a strong presence and invest heavily in developing and validating phytogenic solutions tailored to the US market.

Within the Type segment, Essential Oils are expected to command the largest market share, owing to their potent antimicrobial, antioxidant, and anti-inflammatory properties, offering a wide range of applications. Herbs and Species also hold significant sway due to their well-established historical use and proven efficacy in traditional animal husbandry.

In terms of Application, the Poultry segment is a major growth engine, driven by the global demand for poultry meat and the industry's proactive approach to enhancing feed efficiency and animal well-being. The Ruminant and Swine segments are also experiencing robust growth as producers seek alternatives to antibiotics and improved gut health solutions. The Aquaculture segment, while smaller, presents a considerable growth opportunity with increasing focus on sustainable fish farming practices.

The Canada and Mexico markets, while currently smaller in scale compared to the US, are demonstrating significant growth potential, influenced by increasing awareness of the benefits of phytogenics and the desire to align with North American sustainable farming trends. The “Rest of North America” segment, encompassing smaller agricultural economies, is also expected to contribute to the overall market expansion as knowledge and adoption of phytogenic solutions spread.

North America Feed Phytogenics Market Product Landscape

The North America Feed Phytogenics Market is characterized by continuous product innovation, with a focus on enhanced efficacy and tailored applications. Companies are developing sophisticated formulations that leverage the synergistic effects of various botanical extracts, essential oils, and oleoresins. These products offer unique selling propositions by addressing specific animal health challenges, improving nutrient digestibility, and reducing the need for synthetic additives. Technological advancements in extraction and encapsulation ensure greater stability, bioavailability, and targeted delivery of active compounds, leading to superior performance metrics in animal growth, immune function, and overall health.

Key Drivers, Barriers & Challenges in North America Feed Phytogenics Market

The North America Feed Phytogenics Market is propelled by several key drivers, primarily the growing demand for antibiotic-free animal products, driven by consumer health concerns and regulatory pressures. The increasing awareness of the health and performance benefits of natural feed additives, such as improved gut health and immune modulation, further fuels market expansion. Technological advancements in extraction and formulation techniques are enhancing the efficacy and cost-effectiveness of phytogenic solutions.

However, the market faces significant barriers and challenges. High research and development costs associated with validating the efficacy and safety of new phytogenic compounds can be substantial. Regulatory hurdles, including the need for extensive scientific data for product registration in different jurisdictions, can impede market entry. Supply chain complexities for sourcing consistent, high-quality botanical raw materials pose another challenge. Furthermore, competition from established synthetic feed additives and the need for producer education on the benefits of phytogenics require ongoing efforts.

Emerging Opportunities in North America Feed Phytogenics Market

Emerging opportunities in the North America Feed Phytogenics Market lie in the development of novel synergistic blends of plant-derived compounds that offer broad-spectrum efficacy against emerging pathogens. The untapped potential in the aquaculture sector presents a significant growth avenue as sustainable farming practices gain traction. Furthermore, there is an increasing demand for specialized phytogenic solutions tailored to specific life stages of animals and addressing unique health challenges. Evolving consumer preferences for traceable and natural food production will continue to drive innovation in this space.

Growth Accelerators in the North America Feed Phytogenics Market Industry

Growth in the North America Feed Phytogenics Market is being accelerated by significant technological breakthroughs in understanding the complex bioactive compounds in plants and their mechanisms of action in animal physiology. Strategic partnerships between feed manufacturers, ingredient suppliers, and research institutions are fostering innovation and market penetration. Furthermore, proactive market expansion strategies by key players, including geographical reach and product portfolio diversification, are contributing to sustained growth. The increasing emphasis on animal welfare and food safety by global regulatory bodies and consumers acts as a powerful catalyst for the adoption of these natural alternatives.

Key Players Shaping the North America Feed Phytogenics Market Market

- Nor-Feed Sud

- Natural Remedies

- Danisco

- Biomin

- PANCOSMA SA

- Delacon Biotechnik

- Bayir extract Pvt Ltd

- Phytosynthse

- Dostofarm

- Igusol

- Phytobiotics

- A&A Pharmachem Inc

- Kemin

Notable Milestones in North America Feed Phytogenics Market Sector

- 2020: Kemin launches a new range of phytogenic feed additives for poultry, enhancing gut health and reducing antibiotic reliance.

- 2021: Danisco invests in research to develop novel antimicrobial phytogenics for swine feed.

- 2022: Delacon Biotechnik expands its R&D facility in Europe, focusing on synergistic phytogenic formulations.

- 2022: Biomin announces strategic partnerships to expand its phytogenics portfolio in North America.

- 2023: Natural Remedies receives regulatory approval for a new phytogenic blend targeting ruminant health.

- 2024: Phytobiotics introduces an innovative encapsulation technology for improved essential oil delivery in animal feed.

- 2024: PANCOSMA SA acquires a smaller phytogenics producer to strengthen its market position.

In-Depth North America Feed Phytogenics Market Market Outlook

The future outlook for the North America Feed Phytogenics Market is exceptionally promising, driven by an unwavering commitment to sustainable animal agriculture. Growth accelerators such as continued innovation in bioactive compound discovery, the development of next-generation synergistic blends, and the increasing acceptance by major feed integrators will shape the market landscape. Strategic partnerships and acquisitions will further consolidate market power and expand reach. The market is well-positioned to capitalize on the global shift towards healthier and safer animal-derived food products, making phytogenics an indispensable component of modern animal nutrition strategies.

North America Feed Phytogenics Market Segmentation

-

1. Type

- 1.1. Herbs

- 1.2. Species

- 1.3. Essential Oils

- 1.4. Oleoresins

- 1.5. Others

-

2. Application

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Others

-

3. Geography

- 3.1. United States

- 3.2. Mexico

- 3.3. Canada

- 3.4. Rest of North America

North America Feed Phytogenics Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Canada

- 4. Rest of North America

North America Feed Phytogenics Market Regional Market Share

Geographic Coverage of North America Feed Phytogenics Market

North America Feed Phytogenics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Industrialized Livestock Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Herbs

- 5.1.2. Species

- 5.1.3. Essential Oils

- 5.1.4. Oleoresins

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Mexico

- 5.3.3. Canada

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Mexico

- 5.4.3. Canada

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Herbs

- 6.1.2. Species

- 6.1.3. Essential Oils

- 6.1.4. Oleoresins

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Mexico

- 6.3.3. Canada

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Mexico North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Herbs

- 7.1.2. Species

- 7.1.3. Essential Oils

- 7.1.4. Oleoresins

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Mexico

- 7.3.3. Canada

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Canada North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Herbs

- 8.1.2. Species

- 8.1.3. Essential Oils

- 8.1.4. Oleoresins

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Mexico

- 8.3.3. Canada

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Herbs

- 9.1.2. Species

- 9.1.3. Essential Oils

- 9.1.4. Oleoresins

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Mexico

- 9.3.3. Canada

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nor-Feed Sud

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Natural Remedies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Danisco

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Biomin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PANCOSMA SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Delacon Biotechnik

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bayir extract Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Phytosynthse

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Dostofarm

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Igusol

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Phytobiotics

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 A&A Pharmachem Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Kemin

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Nor-Feed Sud

List of Figures

- Figure 1: North America Feed Phytogenics Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Feed Phytogenics Market Share (%) by Company 2025

List of Tables

- Table 1: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Feed Phytogenics Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 15: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: North America Feed Phytogenics Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: North America Feed Phytogenics Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: North America Feed Phytogenics Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: North America Feed Phytogenics Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Feed Phytogenics Market?

The projected CAGR is approximately 5.41%.

2. Which companies are prominent players in the North America Feed Phytogenics Market?

Key companies in the market include Nor-Feed Sud, Natural Remedies, Danisco, Biomin, PANCOSMA SA, Delacon Biotechnik, Bayir extract Pvt Ltd, Phytosynthse, Dostofarm, Igusol, Phytobiotics, A&A Pharmachem Inc, Kemin.

3. What are the main segments of the North America Feed Phytogenics Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 734.1 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increase in Industrialized Livestock Production.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Feed Phytogenics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Feed Phytogenics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Feed Phytogenics Market?

To stay informed about further developments, trends, and reports in the North America Feed Phytogenics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence