Key Insights

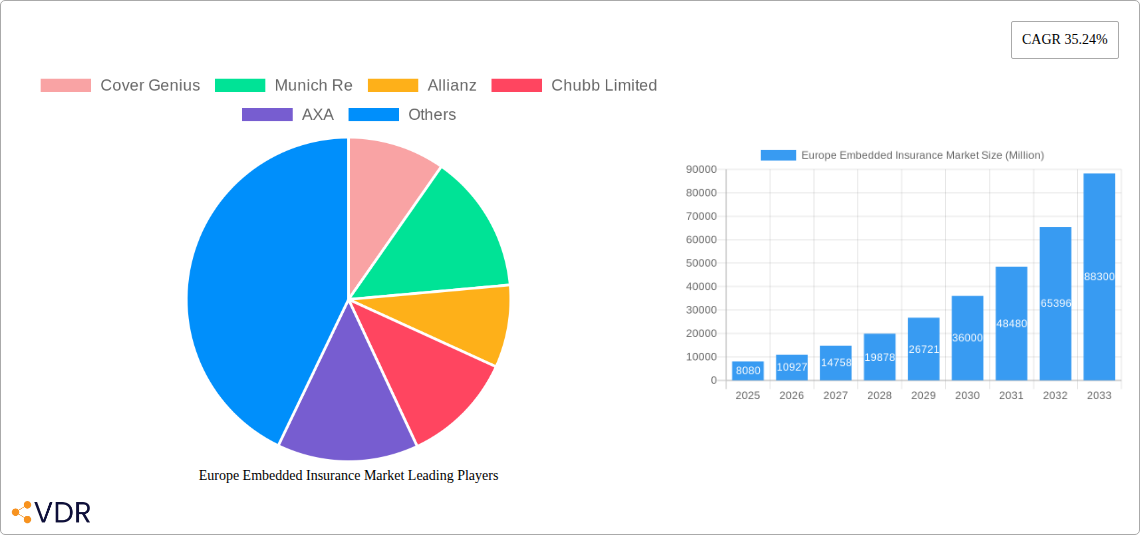

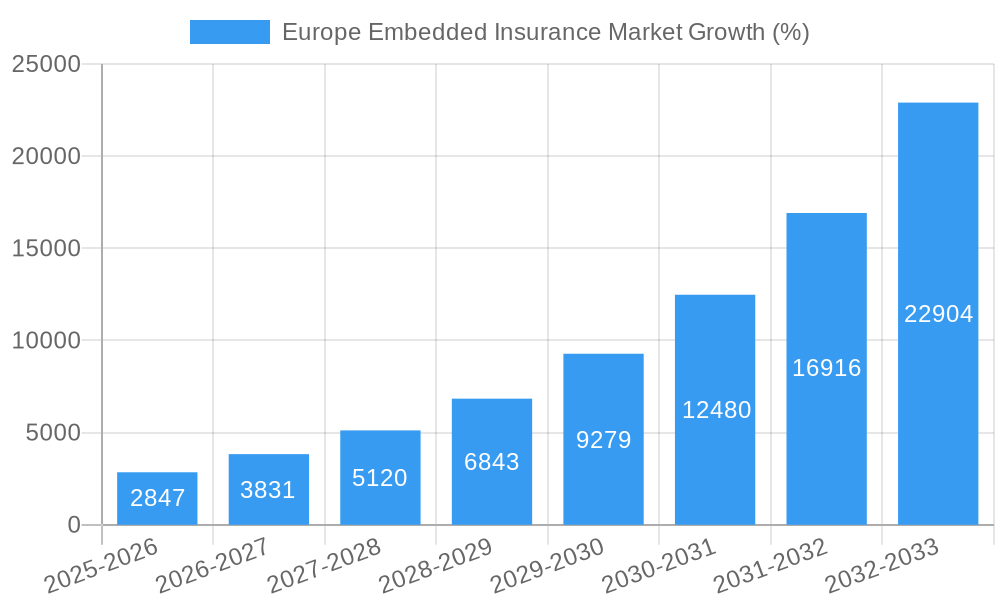

The European embedded insurance market is experiencing explosive growth, projected to reach €8.08 billion in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 35.24% from 2025 to 2033. This surge is driven by several key factors. Firstly, the increasing adoption of digital technologies across various sectors facilitates seamless integration of insurance products into existing customer journeys. E-commerce platforms, fintech applications, and subscription services are prime examples, leveraging embedded insurance to offer bundled protection, enhancing customer experience and driving revenue streams. Secondly, evolving consumer preferences favor convenience and personalized experiences. Embedded insurance precisely addresses these desires by offering tailored policies within the context of a purchase or subscription, eliminating the need for separate insurance purchases. Regulatory changes promoting digitalization and open banking are also instrumental in accelerating market expansion. While data privacy concerns and the need for robust technological infrastructure could pose some challenges, the overall market outlook remains overwhelmingly positive.

The leading players in this dynamic market – including Cover Genius, Munich Re, Allianz, Chubb Limited, AXA, Assicurazioni Generali, Companjon, Qover, Swiss Re, and Zurich – are strategically investing in innovative solutions and partnerships to capitalize on this significant growth opportunity. Market segmentation, though not explicitly detailed, likely includes various insurance types (e.g., travel, warranty, pet, etc.) integrated within different platforms and across various sectors (e.g., e-commerce, fintech, subscription services). Regional variations within Europe will undoubtedly reflect differences in digital adoption rates, regulatory landscapes, and consumer behavior. Future growth will depend on continued technological advancements, successful navigation of regulatory changes, and effective marketing strategies to reach and educate consumers about the benefits of embedded insurance. The market's trajectory suggests substantial opportunities for both established insurers and agile fintech startups.

Europe Embedded Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Embedded Insurance Market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory through 2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This in-depth analysis will be invaluable for industry professionals, investors, and strategists seeking to navigate this rapidly evolving landscape.

Europe Embedded Insurance Market Market Dynamics & Structure

The European embedded insurance market is characterized by a dynamic interplay of factors, influencing its structure and growth trajectory. Market concentration is currently moderate, with a few large players like Allianz, AXA, and Munich Re holding significant shares, alongside emerging insurtechs such as Cover Genius and Qover. Technological innovation is a key driver, enabling seamless integration of insurance products within various platforms and enhancing customer experience. Regulatory frameworks, varying across European countries, present both opportunities and challenges, impacting market penetration and product offerings. Competitive product substitutes, primarily traditional insurance models, still hold market share, but the increasing convenience and personalization of embedded solutions are eroding this advantage. End-user demographics are shifting, with younger generations increasingly receptive to digital insurance solutions. Finally, M&A activity is witnessing moderate growth, with larger players acquiring smaller insurtechs to expand their capabilities and market reach.

- Market Concentration: Moderate, with a mix of established insurers and emerging insurtechs. Top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: AI-driven personalization, API integrations, and blockchain technology are key drivers. Innovation barriers include legacy systems and data integration challenges.

- Regulatory Frameworks: Varying regulations across EU countries create complexity but also niche opportunities for specialized solutions.

- Competitive Product Substitutes: Traditional insurance models face increasing competition from embedded solutions focusing on user experience and convenience.

- End-User Demographics: Growing adoption among younger, digitally-savvy consumers fuels market expansion.

- M&A Trends: Moderate activity, with larger players strategically acquiring smaller insurtechs to enhance their technological capabilities. xx M&A deals projected for 2025-2028.

Europe Embedded Insurance Market Growth Trends & Insights

The European embedded insurance market is experiencing robust growth, fueled by increasing digitalization, the rising popularity of embedded finance, and a growing preference for convenient and personalized insurance solutions. Market size has demonstrated consistent expansion during the historical period (2019-2024), with accelerated growth expected throughout the forecast period (2025-2033). Adoption rates are increasing rapidly, particularly in sectors such as travel, e-commerce, and fintech. Technological disruptions, including the implementation of AI and machine learning, are enhancing product offerings, optimizing pricing, and improving customer experience. Consumer behavior is shifting towards digital-first interactions, favoring seamless insurance integration within existing platforms and services. This shift, coupled with the increasing adoption of embedded insurance models across various sectors, drives significant market expansion.

(Note: Specific metrics such as CAGR and market penetration will be detailed within the full report. This section requires access to data sources (XXX) not currently provided.)

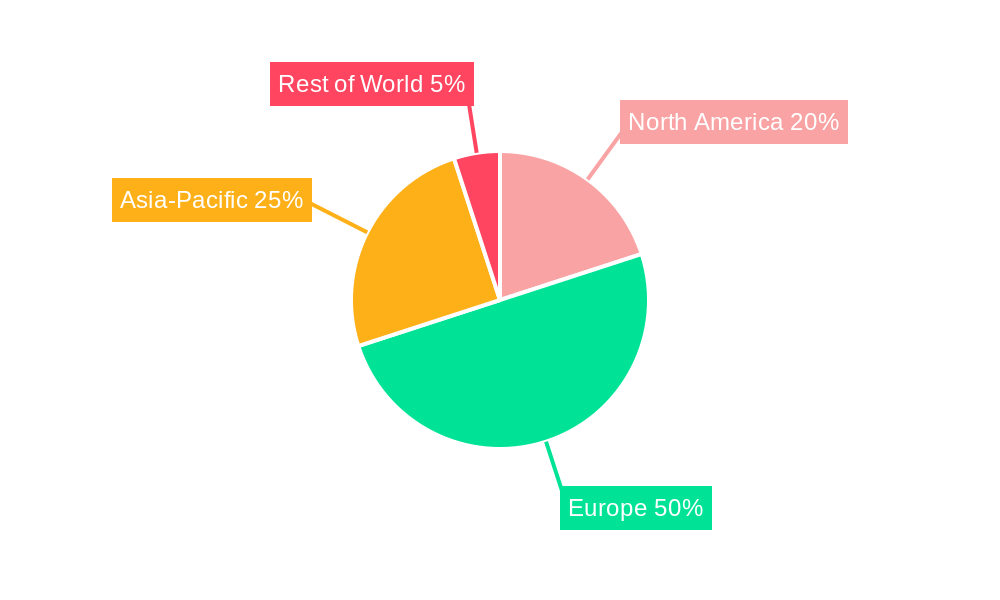

Dominant Regions, Countries, or Segments in Europe Embedded Insurance Market

The UK, Germany, and France represent the largest national markets within the European embedded insurance sector in 2025, accounting for approximately xx% of the total market value. This dominance is attributed to several factors: robust digital infrastructure, high internet penetration, and a comparatively developed fintech sector. Other significant growth areas include the Nordics, driven by high technological adoption and innovative insurance models.

- UK: Strong digital infrastructure, significant fintech presence, and high consumer adoption drive market leadership.

- Germany: Large economy and established insurance market create a fertile ground for embedded insurance solutions.

- France: Growing fintech sector and increasing digitalization contribute to significant market growth.

- Nordics: High technological adoption and early adoption of innovative insurance models fuel strong growth.

(Note: Detailed regional and country-level market share and growth projections will be presented in the full report.)

Europe Embedded Insurance Market Product Landscape

The product landscape is characterized by a diverse range of embedded insurance offerings tailored to various sectors. These products leverage technological advancements like AI-powered risk assessment, personalized pricing, and seamless integration with existing platforms. Unique selling propositions frequently emphasize ease of access, convenience, and personalized customer experiences. Key technological advancements include AI-driven risk assessment and personalized pricing, API integrations for seamless platform integrations, and blockchain technology for secure and transparent transaction processing.

Key Drivers, Barriers & Challenges in Europe Embedded Insurance Market

Key Drivers:

- Increasing digitalization and the rise of embedded finance.

- Growing demand for personalized and convenient insurance solutions.

- Technological advancements enabling seamless integration and improved customer experiences.

Key Barriers & Challenges:

- Regulatory complexities and varying regulations across European countries.

- Data security and privacy concerns.

- Integration challenges with legacy systems and established insurance platforms.

- Competition from established insurance providers. This competition limits market share gains for newer entrants in the short term.

Emerging Opportunities in Europe Embedded Insurance Market

- Untapped market potential in emerging European economies.

- Growing demand for embedded insurance in new sectors such as the sharing economy and the Internet of Things (IoT).

- Opportunities for innovative product development focused on customer personalization and convenience.

Growth Accelerators in the Europe Embedded Insurance Market Industry

Technological breakthroughs, particularly in AI and machine learning, continue to propel the market. Strategic partnerships between insurers, technology providers, and platform operators are key to market expansion. The ongoing expansion of the embedded finance ecosystem, alongside a shift towards digital-first customer experiences, creates significant growth opportunities.

Key Players Shaping the Europe Embedded Insurance Market Market

- Cover Genius

- Munich Re

- Allianz

- Chubb Limited

- AXA

- Assicurazioni Generali

- Companjon

- Qover

- Swiss Re

- Zurich

- (List Not Exhaustive)

Notable Milestones in Europe Embedded Insurance Market Sector

- November 2023: Cover Genius partners with SAS Scandinavian Airlines, launching a travel protection program across 25+ European countries and the US.

- January 2024: Cover Genius and Vueling airline partner to protect over 30 million travelers.

- March 2024: Chubb Limited launches a global platform for transactional risk liability insurance.

In-Depth Europe Embedded Insurance Market Market Outlook

The future of the European embedded insurance market is exceptionally promising. Continued technological innovation, strategic partnerships, and increasing consumer adoption will drive substantial growth. Opportunities abound for companies that can effectively leverage technological advancements, navigate regulatory complexities, and meet the evolving needs of a digitally savvy customer base. The market's expansion is expected to continue at a robust pace, driven by the increasing integration of insurance solutions within various platforms and services.

Europe Embedded Insurance Market Segmentation

-

1. Insurance Line

- 1.1. Electronics

- 1.2. Furniture

- 1.3. Sports Equipment

- 1.4. Travel Insurance

- 1.5. Other Insurance Lines

-

2. Channel

- 2.1. Online

- 2.2. Offline

Europe Embedded Insurance Market Segmentation By Geography

- 1. UK

- 2. France

- 3. Germany

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Embedded Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 35.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market

- 3.4. Market Trends

- 3.4.1. Digitalization and High-speed Internet to Propel the European Embedded Insurance Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Line

- 5.1.1. Electronics

- 5.1.2. Furniture

- 5.1.3. Sports Equipment

- 5.1.4. Travel Insurance

- 5.1.5. Other Insurance Lines

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UK

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Line

- 6. UK Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Line

- 6.1.1. Electronics

- 6.1.2. Furniture

- 6.1.3. Sports Equipment

- 6.1.4. Travel Insurance

- 6.1.5. Other Insurance Lines

- 6.2. Market Analysis, Insights and Forecast - by Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Insurance Line

- 7. France Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Line

- 7.1.1. Electronics

- 7.1.2. Furniture

- 7.1.3. Sports Equipment

- 7.1.4. Travel Insurance

- 7.1.5. Other Insurance Lines

- 7.2. Market Analysis, Insights and Forecast - by Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Insurance Line

- 8. Germany Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Line

- 8.1.1. Electronics

- 8.1.2. Furniture

- 8.1.3. Sports Equipment

- 8.1.4. Travel Insurance

- 8.1.5. Other Insurance Lines

- 8.2. Market Analysis, Insights and Forecast - by Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Insurance Line

- 9. Italy Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Line

- 9.1.1. Electronics

- 9.1.2. Furniture

- 9.1.3. Sports Equipment

- 9.1.4. Travel Insurance

- 9.1.5. Other Insurance Lines

- 9.2. Market Analysis, Insights and Forecast - by Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Insurance Line

- 10. Spain Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Line

- 10.1.1. Electronics

- 10.1.2. Furniture

- 10.1.3. Sports Equipment

- 10.1.4. Travel Insurance

- 10.1.5. Other Insurance Lines

- 10.2. Market Analysis, Insights and Forecast - by Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Insurance Line

- 11. Rest of Europe Europe Embedded Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Insurance Line

- 11.1.1. Electronics

- 11.1.2. Furniture

- 11.1.3. Sports Equipment

- 11.1.4. Travel Insurance

- 11.1.5. Other Insurance Lines

- 11.2. Market Analysis, Insights and Forecast - by Channel

- 11.2.1. Online

- 11.2.2. Offline

- 11.1. Market Analysis, Insights and Forecast - by Insurance Line

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cover Genius

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Munich Re

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Allianz

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Chubb Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Assicurazioni Generali

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Companjon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Qover

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Swiss Re

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Zurich**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cover Genius

List of Figures

- Figure 1: Global Europe Embedded Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Europe Embedded Insurance Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: UK Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 4: UK Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 5: UK Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 6: UK Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 7: UK Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 8: UK Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 9: UK Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 10: UK Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 11: UK Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 12: UK Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 13: UK Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: UK Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 15: France Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 16: France Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 17: France Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 18: France Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 19: France Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 20: France Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 21: France Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 22: France Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 23: France Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 24: France Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 25: France Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: France Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Germany Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 28: Germany Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 29: Germany Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 30: Germany Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 31: Germany Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 32: Germany Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 33: Germany Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 34: Germany Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 35: Germany Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Germany Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Germany Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Germany Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Italy Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 40: Italy Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 41: Italy Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 42: Italy Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 43: Italy Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 44: Italy Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 45: Italy Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 46: Italy Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 47: Italy Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Italy Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Italy Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Italy Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Spain Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 52: Spain Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 53: Spain Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 54: Spain Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 55: Spain Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 56: Spain Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 57: Spain Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 58: Spain Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 59: Spain Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Spain Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Spain Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Spain Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Insurance Line 2024 & 2032

- Figure 64: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Insurance Line 2024 & 2032

- Figure 65: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Insurance Line 2024 & 2032

- Figure 66: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Insurance Line 2024 & 2032

- Figure 67: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Channel 2024 & 2032

- Figure 68: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Channel 2024 & 2032

- Figure 69: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Channel 2024 & 2032

- Figure 70: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Channel 2024 & 2032

- Figure 71: Rest of Europe Europe Embedded Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Rest of Europe Europe Embedded Insurance Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Rest of Europe Europe Embedded Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Rest of Europe Europe Embedded Insurance Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Europe Embedded Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Europe Embedded Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 4: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 5: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 6: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 7: Global Europe Embedded Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Europe Embedded Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 10: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 11: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 12: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 13: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 16: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 17: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 18: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 19: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 22: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 23: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 24: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 25: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 28: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 29: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 30: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 31: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 34: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 35: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 36: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 37: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Europe Embedded Insurance Market Revenue Million Forecast, by Insurance Line 2019 & 2032

- Table 40: Global Europe Embedded Insurance Market Volume Billion Forecast, by Insurance Line 2019 & 2032

- Table 41: Global Europe Embedded Insurance Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 42: Global Europe Embedded Insurance Market Volume Billion Forecast, by Channel 2019 & 2032

- Table 43: Global Europe Embedded Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Europe Embedded Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Embedded Insurance Market?

The projected CAGR is approximately 35.24%.

2. Which companies are prominent players in the Europe Embedded Insurance Market?

Key companies in the market include Cover Genius, Munich Re, Allianz, Chubb Limited, AXA, Assicurazioni Generali, Companjon, Qover, Swiss Re, Zurich**List Not Exhaustive.

3. What are the main segments of the Europe Embedded Insurance Market?

The market segments include Insurance Line, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market.

6. What are the notable trends driving market growth?

Digitalization and High-speed Internet to Propel the European Embedded Insurance Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Cashless Transactions will Boost the Market; Growth in E-Commerce is Driving the Market.

8. Can you provide examples of recent developments in the market?

March 2024: Chubb Limited recently unveiled a global platform aimed at offering transactional risk liability insurance products in international markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Embedded Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Embedded Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Embedded Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Embedded Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence