Key Insights

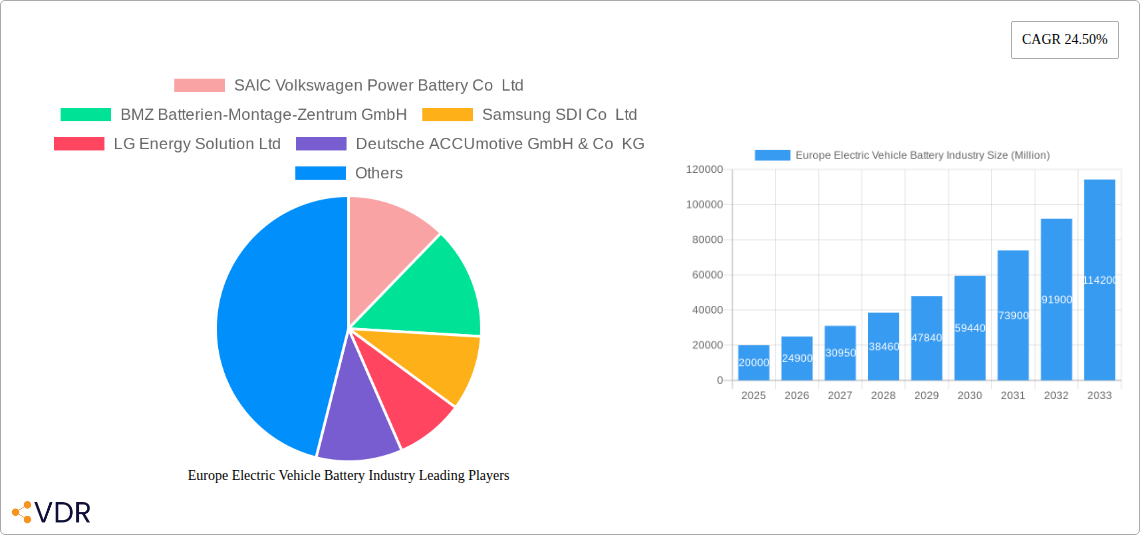

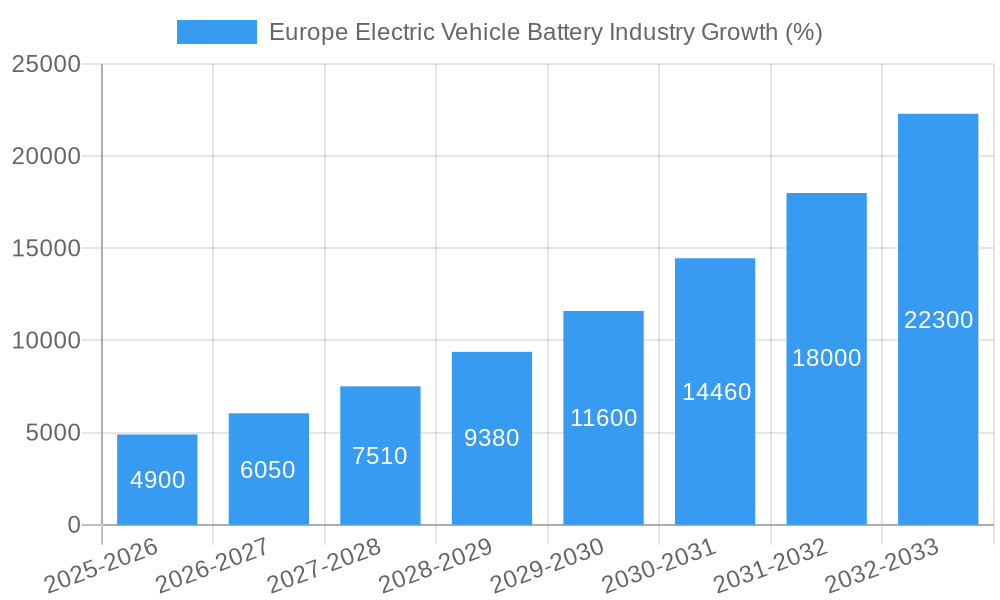

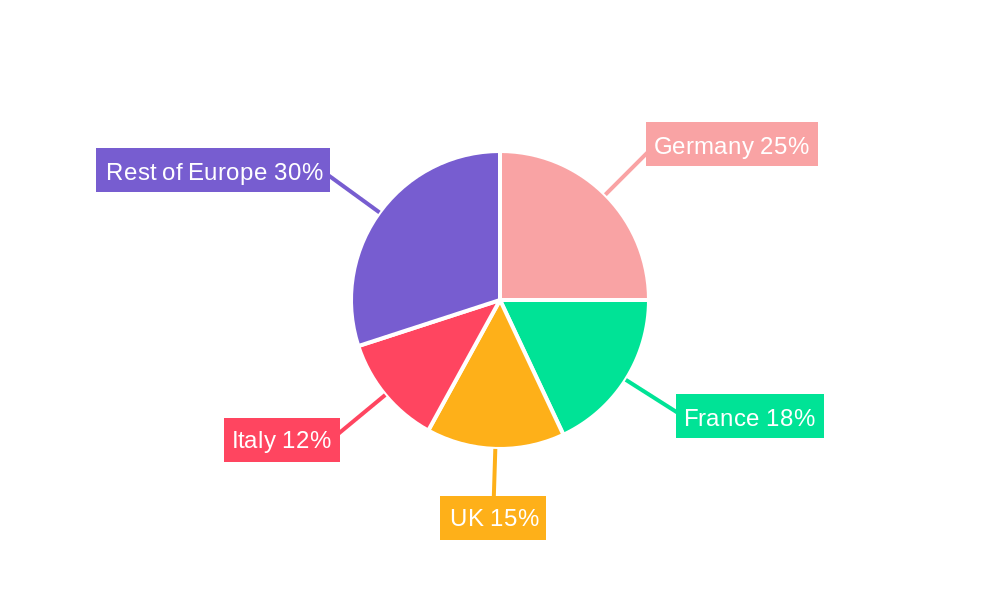

The European electric vehicle (EV) battery market is experiencing robust growth, driven by stringent emission regulations, increasing EV adoption, and supportive government policies promoting sustainable transportation. The market, valued at approximately €XX million in 2025 (assuming a logical estimation based on the provided CAGR of 24.50% and a 2019-2024 historical period), is projected to witness a Compound Annual Growth Rate (CAGR) of 24.50% from 2025 to 2033. This expansion is fueled by several factors. Firstly, the transition to electric mobility is accelerating across Europe, with governments incentivizing EV purchases and investing heavily in charging infrastructure. Secondly, advancements in battery technology, particularly in energy density and lifespan, are making EVs more appealing to consumers. The market is segmented by various factors, including battery chemistry (NMC, NCA, LFP are dominant), battery form factor (prismatic and pouch cells leading), material composition (nickel, cobalt, lithium being key components), vehicle type (passenger cars currently leading, with significant growth in buses and LCVs anticipated), and manufacturing methods. Germany, France, and the UK are currently the largest markets within Europe, but other countries like Sweden and Poland are emerging as significant players, contributing to the overall growth trajectory.

The competitive landscape is intensely dynamic, with a mix of established players like LG Energy Solution, CATL, and Samsung SDI alongside newer entrants focusing on innovation and localized production. The presence of major automotive manufacturers like Volkswagen and Renault investing significantly in battery technology and production facilities indicates long-term commitment to the EV ecosystem. However, challenges remain, including securing raw material supplies (particularly lithium and cobalt), managing the environmental impact of battery production and recycling, and ensuring a robust and reliable supply chain. Overcoming these restraints will be crucial for sustaining the market's impressive growth trajectory and fortifying Europe's position as a global leader in the EV battery sector. Further growth will be influenced by advancements in battery technology, cost reductions, and the development of effective battery recycling infrastructure.

Europe Electric Vehicle Battery Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European electric vehicle (EV) battery industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market across various parameters, offering granular insights into the parent and child markets. This crucial data helps businesses make strategic decisions, understand market trends, and identify new opportunities within this rapidly evolving sector. The report is designed for industry professionals, investors, and strategic decision-makers.

Europe Electric Vehicle Battery Industry Market Dynamics & Structure

The European EV battery market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderately high, with a few dominant players controlling significant market share. However, the emergence of new entrants and technological disruptions is continuously reshaping the competitive dynamics. The market is driven by stringent emission regulations, increasing EV adoption rates, and government incentives promoting the transition to electric mobility. The industry witnesses significant mergers and acquisitions (M&A) activity, reflecting the consolidation efforts and expansion strategies of key players.

- Market Concentration: xx% controlled by top 5 players in 2024.

- Technological Innovation: Focus on high energy density, fast charging, and improved safety features.

- Regulatory Framework: Stringent environmental regulations and incentives driving market growth.

- Competitive Substitutes: Alternative energy storage solutions pose a moderate competitive threat.

- End-User Demographics: Increasing demand from passenger car, LCV and bus segments.

- M&A Trends: xx major M&A deals in the last 5 years, valued at approximately xx Million. This includes strategic partnerships and joint ventures to secure supply chains and enhance technological capabilities. Innovation barriers include high R&D costs and complex supply chain management.

Europe Electric Vehicle Battery Industry Growth Trends & Insights

The European EV battery market is experiencing robust growth, driven by the increasing adoption of electric vehicles across various segments. The market size witnessed a significant expansion in the historical period (2019-2024), exhibiting a CAGR of xx%. This positive trend is projected to continue throughout the forecast period (2025-2033), with an anticipated CAGR of xx%. Technological advancements, including improved battery chemistries and enhanced energy density, are accelerating market growth. Consumer preference shifts towards electric mobility further fuel the demand. The market penetration rate of EVs in Europe is projected to reach xx% by 2033, significantly contributing to the expansion of the EV battery market. The transition to electric mobility is also spurred by government policies and incentives that promote EV adoption and battery production within Europe.

Dominant Regions, Countries, or Segments in Europe Electric Vehicle Battery Industry

Germany and France lead the European EV battery market, driven by robust automotive manufacturing sectors and supportive government policies. The passenger car segment dominates the market due to increasing EV sales. Within material types, Lithium and Nickel are the dominant materials due to their high energy density.

- Leading Regions: Germany and France dominate due to established automotive industries and supportive government initiatives.

- Leading Countries: Germany, followed by France, UK, and Sweden. Poland and Hungary are emerging as key manufacturing hubs.

- Dominant Segments: Passenger car (xx Million units), followed by LCV (xx Million units) segment. NMC and NCA battery chemistries hold the largest market share. Lithium and Nickel dominate the materials market.

- Key Drivers: Stringent emission regulations, government incentives, and increasing consumer demand for EVs.

- Growth Potential: Eastern European countries present significant growth opportunities due to expanding manufacturing capacities and supportive government policies.

Europe Electric Vehicle Battery Industry Product Landscape

The EV battery market showcases continuous innovation in battery chemistry, form factor, and manufacturing processes. Key innovations include higher energy density batteries, faster charging technologies, improved thermal management systems, and the development of solid-state batteries. These advancements aim to enhance battery performance, lifespan, safety, and cost-effectiveness. Battery form factors are evolving towards prismatic and pouch cells to optimize packaging efficiency and vehicle design. Manufacturers focus on achieving superior energy density and faster charging capabilities as unique selling propositions.

Key Drivers, Barriers & Challenges in Europe Electric Vehicle Battery Industry

Key Drivers:

- Increasing demand for electric vehicles.

- Stringent government regulations on emissions.

- Growth of renewable energy sources and the need for energy storage solutions.

- Technological advancements in battery technology.

Key Challenges:

- High raw material costs and supply chain disruptions, impacting production costs and potentially slowing expansion plans.

- The need for substantial infrastructure investments in charging networks.

- The need to address environmental concerns related to battery production and disposal.

- Intense competition from established and emerging players.

Emerging Opportunities in Europe Electric Vehicle Battery Industry

- Growth in the commercial vehicle segment (buses, trucks).

- Demand for second-life battery applications in stationary energy storage.

- Expansion into new battery chemistries and technologies (solid-state, lithium-sulfur).

- Development of innovative battery management systems (BMS) for improved efficiency and safety.

Growth Accelerators in the Europe Electric Vehicle Battery Industry Industry

Technological breakthroughs in battery chemistry, such as advancements in solid-state battery technology, and improvements in battery management systems (BMS), are key growth accelerators. Strategic partnerships between battery manufacturers, automotive companies, and raw material suppliers ensure efficient supply chains and promote economies of scale. Government support through grants, tax credits, and infrastructure development further stimulates market expansion.

Key Players Shaping the Europe Electric Vehicle Battery Industry Market

- SAIC Volkswagen Power Battery Co Ltd

- BMZ Batterien-Montage-Zentrum GmbH

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Deutsche ACCUmotive GmbH & Co KG

- TOSHIBA Corp

- Contemporary Amperex Technology Co Ltd (CATL)

- BYD Company Ltd

- Groupe Renault

- SK Innovation Co Ltd

- Ningbo Tuopu Group Co Ltd

- Panasonic Holdings Corporation

- NorthVolt AB

- SVOLT Energy Technology Co Ltd (SVOLT)

Notable Milestones in Europe Electric Vehicle Battery Industry Sector

- June 2023: IMCO invests USD 400 million in Northvolt AB, supporting its expansion and sustainable supply chain.

- June 2023: CATL launches Qiji Energy, a battery swap solution for heavy-duty trucks using 3rd-generation LFP battery chemistry.

- February 2023: SK nexilis agrees to supply copper foils to Northvolt for five years, with expected sales of KRW 1.4 trillion.

In-Depth Europe Electric Vehicle Battery Industry Market Outlook

The European EV battery market is poised for significant growth, driven by accelerating EV adoption, technological innovations, and supportive government policies. Strategic partnerships and investments in sustainable supply chains will play a crucial role in shaping the future of the industry. The focus on improving battery performance, reducing costs, and addressing environmental concerns will continue to drive innovation and expansion within the market. Opportunities abound in new battery chemistries, second-life applications, and the development of integrated energy storage solutions.

Europe Electric Vehicle Battery Industry Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCA

- 3.3. NCM

- 3.4. NMC

- 3.5. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

Europe Electric Vehicle Battery Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Vehicle Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCA

- 5.3.3. NCM

- 5.3.4. NMC

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Germany Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Vehicle Battery Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SAIC Volkswagen Power Battery Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 BMZ Batterien-Montage-Zentrum GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Samsung SDI Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LG Energy Solution Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Deutsche ACCUmotive GmbH & Co KG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 TOSHIBA Corp

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Contemporary Amperex Technology Co Ltd (CATL)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BYD Company Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Groupe Renault

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 SK Innovation Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ningbo Tuopu Group Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Panasonic Holdings Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 NorthVolt AB

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 SVOLT Energy Technology Co Ltd (SVOLT)

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 SAIC Volkswagen Power Battery Co Ltd

List of Figures

- Figure 1: Europe Electric Vehicle Battery Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Vehicle Battery Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 5: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Capacity 2019 & 2032

- Table 6: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 7: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 8: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 10: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 11: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherlands Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Sweden Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Body Type 2019 & 2032

- Table 20: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 21: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 22: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Capacity 2019 & 2032

- Table 23: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 24: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 25: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 26: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 27: Europe Electric Vehicle Battery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Netherlands Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Belgium Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Sweden Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Norway Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Poland Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Denmark Europe Electric Vehicle Battery Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Vehicle Battery Industry?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the Europe Electric Vehicle Battery Industry?

Key companies in the market include SAIC Volkswagen Power Battery Co Ltd, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, LG Energy Solution Ltd, Deutsche ACCUmotive GmbH & Co KG, TOSHIBA Corp, Contemporary Amperex Technology Co Ltd (CATL), BYD Company Ltd, Groupe Renault, SK Innovation Co Ltd, Ningbo Tuopu Group Co Ltd, Panasonic Holdings Corporation, NorthVolt AB, SVOLT Energy Technology Co Ltd (SVOLT).

3. What are the main segments of the Europe Electric Vehicle Battery Industry?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

June 2023: The Investment Management Corporation of Ontario (IMCO) announced that it is investing USD 400 million in Northvolt AB. The funds will enable Northvolt's planned expansion, aligned with IMCO and the company's commitment to a deeply sustainable battery supply chain.June 2023: CATL announced that it launched Qiji Energy, a battery swap solution for heavy-duty trucks. The solution consists of Qiji Swapping Electric Blocks, Qiji Battery Swap Station, and Qiji Cloud Platform. Based on the CATL’s 3rd-generation LFP battery chemistry, Qiji Swapping Electric Blocks adopt the innovative NP (Non Propagation) technology and CTP (cell-to-pack) technology, striking a balance between safety and usage costs. Qiji Battery Swap Station enables one-stop swapping for different truck models and brands.February 2023: SK nexilis to supply copper foils to Northvolt. The deal is valid for five years from 2024, and the sales under the contract are expected to reach KRW 1.4 trillion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Vehicle Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Vehicle Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Vehicle Battery Industry?

To stay informed about further developments, trends, and reports in the Europe Electric Vehicle Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence