Key Insights

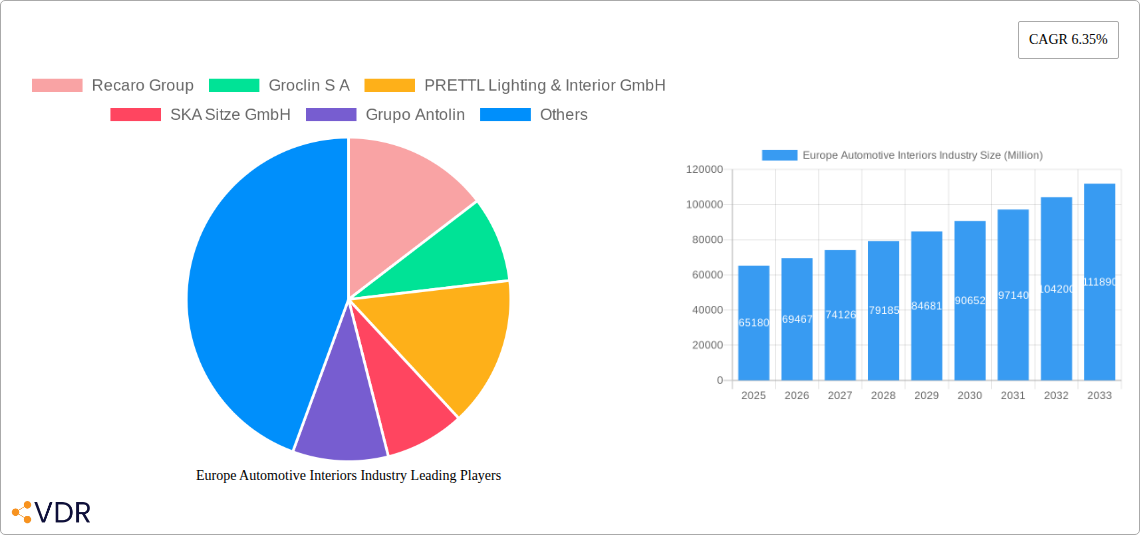

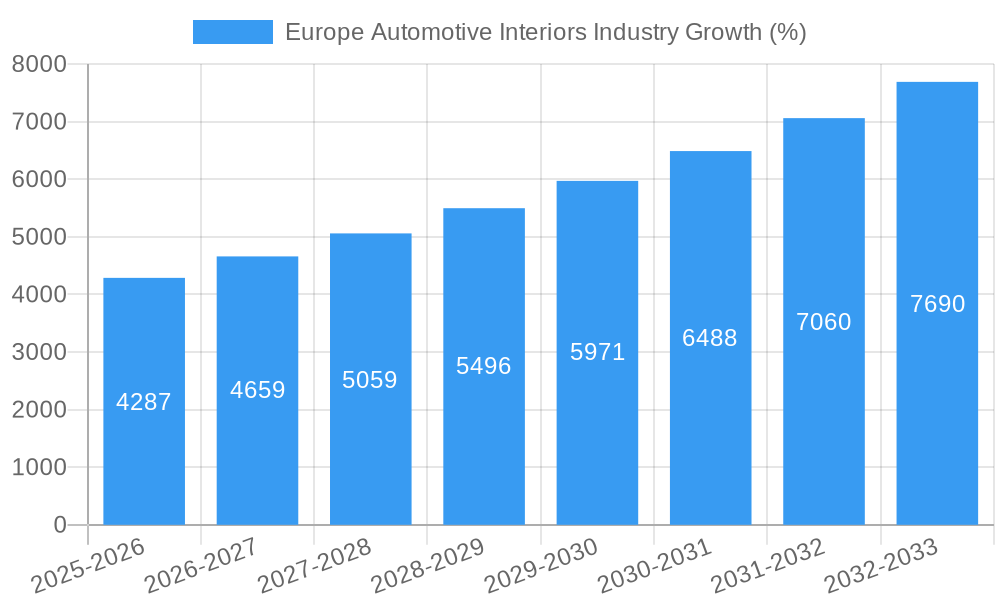

The European automotive interiors market, valued at €65.18 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.35% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for enhanced comfort and luxury features in vehicles, particularly within the passenger car segment, is a significant driver. Consumers are increasingly willing to pay a premium for sophisticated infotainment systems, premium materials, and advanced lighting solutions. Secondly, the ongoing trend toward vehicle electrification and autonomous driving technologies is creating new opportunities for innovation within automotive interiors. Electric vehicles (EVs) often feature minimalist dashboards and redesigned interior layouts, necessitating the development of innovative and functional interior components. Furthermore, advancements in lightweight materials are being adopted to improve fuel efficiency and reduce vehicle weight, further stimulating market growth. Finally, stringent safety regulations within the European Union are pushing manufacturers to integrate advanced safety features, including improved seat designs and enhanced lighting systems, thereby bolstering demand.

However, the market faces certain challenges. Fluctuations in raw material prices, particularly for plastics and leather, can impact production costs and profitability. Furthermore, the ongoing global chip shortage continues to affect the automotive industry as a whole, potentially causing production delays and impacting market growth. Despite these restraints, the long-term outlook for the European automotive interiors market remains positive, with continued growth expected across all major segments, including infotainment systems, instrument panels, and interior lighting. Germany, the United Kingdom, and France are expected to remain the leading national markets due to their established automotive manufacturing bases and high consumer spending on automobiles. The market segmentation by vehicle type reveals strong growth potential within passenger cars, but the commercial vehicle segment is also projected to exhibit steady expansion driven by the increasing demand for comfortable and technologically advanced commercial vehicles.

Europe Automotive Interiors Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe automotive interiors industry, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report utilizes data from 2019-2024 (historical period), with the base year being 2025 and the forecast period spanning 2025-2033. The study period encompasses the years 2019-2033. The report uses Million units as the unit of measure for all values.

Europe Automotive Interiors Industry Market Dynamics & Structure

The European automotive interiors market is a highly competitive landscape characterized by a mix of established multinational corporations and specialized component suppliers. Market concentration is moderate, with a few major players holding significant market share, but a substantial number of smaller firms specializing in niche components or regional markets. Technological innovation, driven by advancements in lightweight materials, sustainable manufacturing processes, and enhanced infotainment systems, is a key driver. Stringent regulatory frameworks concerning safety, emissions, and material sustainability significantly influence the industry. The increasing popularity of electric vehicles (EVs) and the shift towards autonomous driving are shaping product development and material choices. Competitive product substitutes, such as recycled materials and alternative manufacturing techniques, are gaining traction, presenting both opportunities and challenges. End-user demographics, particularly the growing demand for comfort and personalized features within vehicles, are fueling growth. Mergers and acquisitions (M&A) activity is frequent, with larger companies consolidating their market position and broadening their product portfolios. The number of M&A deals in the last 5 years averages xx per year, representing xx% of the total market value.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on lightweighting, sustainability, and advanced infotainment.

- Regulatory Framework: Stringent safety and environmental standards influence material choices and manufacturing processes.

- Competitive Substitutes: Recycled materials and innovative manufacturing methods pose both threats and opportunities.

- End-User Demographics: Growing demand for comfort and personalized interiors in both passenger and commercial vehicles.

- M&A Trends: Consolidation among major players to expand market reach and product offerings.

Europe Automotive Interiors Industry Growth Trends & Insights

The European automotive interiors market is experiencing robust growth, driven by the increasing demand for vehicles and the continuous integration of advanced technologies. Market size has shown a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to reach xx Million units by 2025. The CAGR for the forecast period (2025-2033) is estimated at xx%. This growth is fueled by factors like technological advancements leading to enhanced comfort, safety, and connectivity features, coupled with rising disposable incomes and changing consumer preferences. Adoption rates of advanced features such as customized infotainment systems and ambient lighting are increasing significantly, surpassing xx% penetration in 2025. Disruptive technologies, like the integration of artificial intelligence (AI) and augmented reality (AR) into vehicle interiors, are shaping the market. Consumer behavior is shifting towards sustainability concerns, creating demand for eco-friendly materials and manufacturing practices. Market penetration of sustainable materials is expected to reach xx% by 2033.

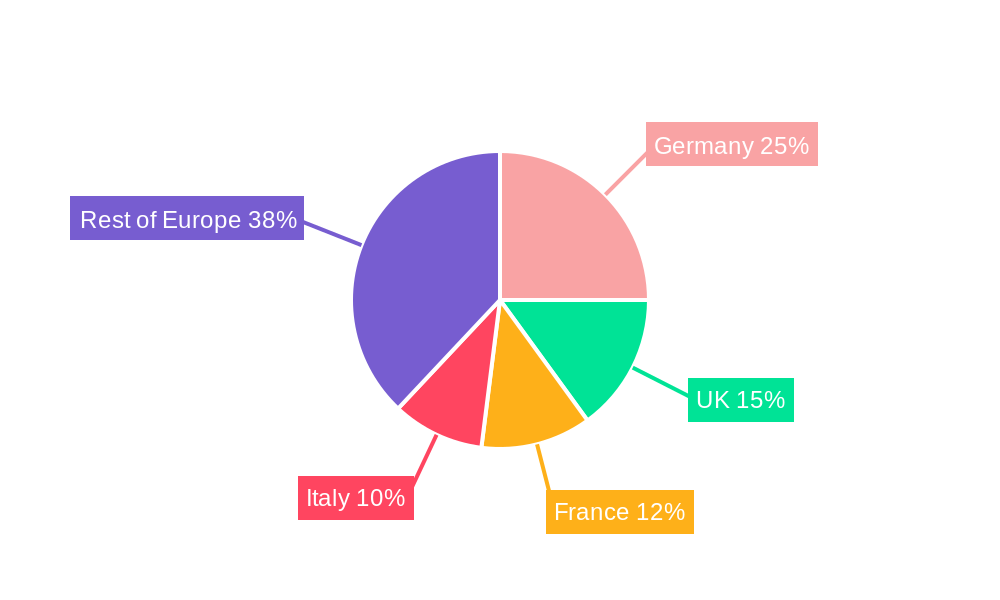

Dominant Regions, Countries, or Segments in Europe Automotive Interiors Industry

Germany holds the largest market share in the European automotive interiors industry, driven by a strong automotive manufacturing base and a concentration of major automotive companies. The UK, France, and Italy follow, exhibiting significant market size and growth potential. The passenger car segment dominates the market, with a significantly larger share than the commercial vehicle segment. Among component types, infotainment systems, and instrument panels are the leading segments, exhibiting high demand and growth due to increasing technological advancements.

- By Country: Germany (xx Million units in 2025), UK (xx Million units in 2025), France (xx Million units in 2025), Italy (xx Million units in 2025).

- By Component Type: Infotainment Systems (xx Million units in 2025), Instrument Panels (xx Million units in 2025).

- By Vehicle Type: Passenger Cars (xx Million units in 2025)

Key Drivers:

- Strong automotive manufacturing base in Germany and other major European countries.

- High demand for advanced features and enhanced comfort levels in vehicles.

- Growing adoption of electric vehicles and autonomous driving technologies.

Dominance Factors:

- Established automotive manufacturing hubs in Germany and surrounding regions.

- High levels of R&D and technological innovation in the region.

- Favorable government policies and economic conditions supporting the automotive sector.

Europe Automotive Interiors Industry Product Landscape

The product landscape is characterized by increasing sophistication in infotainment systems, advanced driver-assistance systems (ADAS) integration, and the adoption of sustainable materials. Products are evolving towards greater personalization, enhanced connectivity, and improved ergonomics. Unique selling propositions include superior comfort, intuitive interfaces, and advanced safety features. Technological advancements include the use of augmented reality (AR) displays, voice-activated controls, and haptic feedback systems.

Key Drivers, Barriers & Challenges in Europe Automotive Interiors Industry

Key Drivers:

- Rising demand for vehicles in Europe is a primary driver.

- Technological advancements such as advanced infotainment systems and personalized features.

- Stringent safety and environmental regulations are driving innovation.

Key Challenges and Restraints:

- Supply chain disruptions are impacting the availability of raw materials.

- Fluctuating raw material prices increase production costs. The impact on margins is estimated at xx% in 2025.

- Intense competition from both domestic and international players.

Emerging Opportunities in Europe Automotive Interiors Industry

- Growing demand for sustainable and eco-friendly materials in vehicle interiors.

- Increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies.

- Expansion of the electric vehicle market driving opportunities for lightweight and energy-efficient components.

Growth Accelerators in the Europe Automotive Interiors Industry Industry

The long-term growth of the European automotive interiors market is fueled by technological advancements, particularly in electrification and autonomous driving. Strategic partnerships between automotive manufacturers and interior component suppliers are fostering innovation. Market expansion into emerging markets within Europe and the integration of new materials and manufacturing processes are further contributing to growth.

Key Players Shaping the Europe Automotive Interiors Industry Market

- Recaro Group

- Groclin S A

- PRETTL Lighting & Interior GmbH

- SKA Sitze GmbH

- Grupo Antolin

- GUMOTEX Automotive B?eclav sro

- EFI Automotive Group

- Faurecia

- Adient PLC

- Grammer AG

Notable Milestones in Europe Automotive Interiors Industry Sector

- October 2022: Lear Corporation opened a new manufacturing facility in Meknes, Morocco, creating over 2,000 jobs.

- November 2022: Daewon Precision Ind. Co., Ltd. completed a new plant for Hyundai Genesis car seats, including EV components.

- January 2023: Panasonic Automotive updated its SkipGen in-vehicle infotainment system with Siri and Alexa wakeword access.

- April 2023: Marelli showcased its full active electromechanics technology at Auto Shanghai 2023.

- April 2023: Schaeffler introduced its "VibSense" technology for vibration and noise reduction.

In-Depth Europe Automotive Interiors Industry Market Outlook

The future of the European automotive interiors market is bright, driven by continued technological advancements, increasing vehicle production, and a growing focus on sustainability. Strategic partnerships and investments in innovative technologies will be crucial for companies to maintain their competitive edge. The market is poised for significant growth, driven by the adoption of innovative materials, advanced technologies, and a growing focus on customer experience. The market is expected to witness substantial growth in the coming years, presenting lucrative opportunities for players across the value chain.

Europe Automotive Interiors Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Component Type

- 2.1. Infotainment Systems

- 2.2. Instrument Panels

- 2.3. Interior Lighting

- 2.4. Body Panels

- 2.5. Other Component Types

Europe Automotive Interiors Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Interiors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity for Aftermarket Vehicle Modification May Drive the Market

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Against Modifications

- 3.4. Market Trends

- 3.4.1. Interior Lighting is Anticipated to Register Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Infotainment Systems

- 5.2.2. Instrument Panels

- 5.2.3. Interior Lighting

- 5.2.4. Body Panels

- 5.2.5. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Automotive Interiors Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Recaro Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Groclin S A

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PRETTL Lighting & Interior GmbH

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SKA Sitze GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Grupo Antolin

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GUMOTEX Automotive B?eclav sro*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 EFI Automotive Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Faurecia

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Adient PLC

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Grammer AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Recaro Group

List of Figures

- Figure 1: Europe Automotive Interiors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Automotive Interiors Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Automotive Interiors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Automotive Interiors Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Automotive Interiors Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 4: Europe Automotive Interiors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Automotive Interiors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Automotive Interiors Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Europe Automotive Interiors Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 15: Europe Automotive Interiors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Automotive Interiors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Interiors Industry?

The projected CAGR is approximately 6.35%.

2. Which companies are prominent players in the Europe Automotive Interiors Industry?

Key companies in the market include Recaro Group, Groclin S A, PRETTL Lighting & Interior GmbH, SKA Sitze GmbH, Grupo Antolin, GUMOTEX Automotive B?eclav sro*List Not Exhaustive, EFI Automotive Group, Faurecia, Adient PLC, Grammer AG.

3. What are the main segments of the Europe Automotive Interiors Industry?

The market segments include Vehicle Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity for Aftermarket Vehicle Modification May Drive the Market.

6. What are the notable trends driving market growth?

Interior Lighting is Anticipated to Register Highest Growth.

7. Are there any restraints impacting market growth?

Stringent Regulations Against Modifications.

8. Can you provide examples of recent developments in the market?

April 2023: Marelli demonstrated its latest innovations at Auto Shanghai 2023, focusing on co-creating the future of mobility. Their electromechanical actuator, known as full active electromechanics technology, minimizes roll, pitch, yaw, and vibration through the self-generated reactive force and provides sound damping inside the vehicle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Interiors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Interiors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Interiors Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Interiors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence