Key Insights

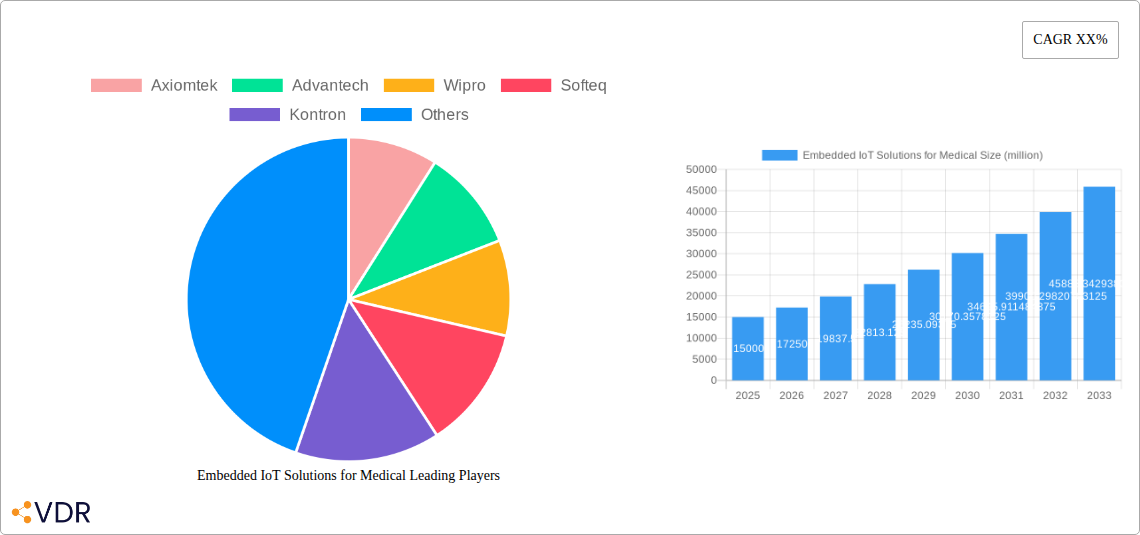

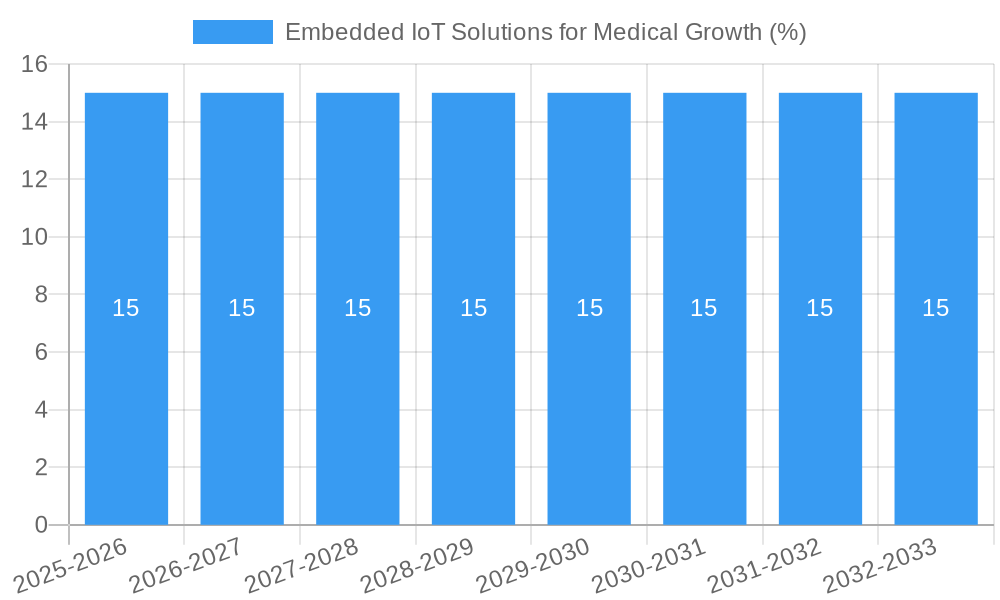

The global market for Embedded IoT Solutions for Medical is poised for significant expansion, projected to reach approximately USD 15,000 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 15% through 2033. This robust growth is underpinned by critical drivers such as the increasing adoption of connected healthcare devices, the demand for real-time patient monitoring, and the burgeoning need for efficient data management in healthcare facilities. The market is segmented into hardware and software, with both experiencing substantial demand. The hardware segment benefits from the proliferation of sensors, wearables, and specialized embedded systems for medical devices, while the software segment thrives on the development of advanced analytics, cloud platforms, and secure communication protocols essential for medical IoT. Hospitals are leading the adoption of these solutions, followed by clinics and laboratories, as they seek to enhance patient care, improve operational efficiency, and reduce healthcare costs.

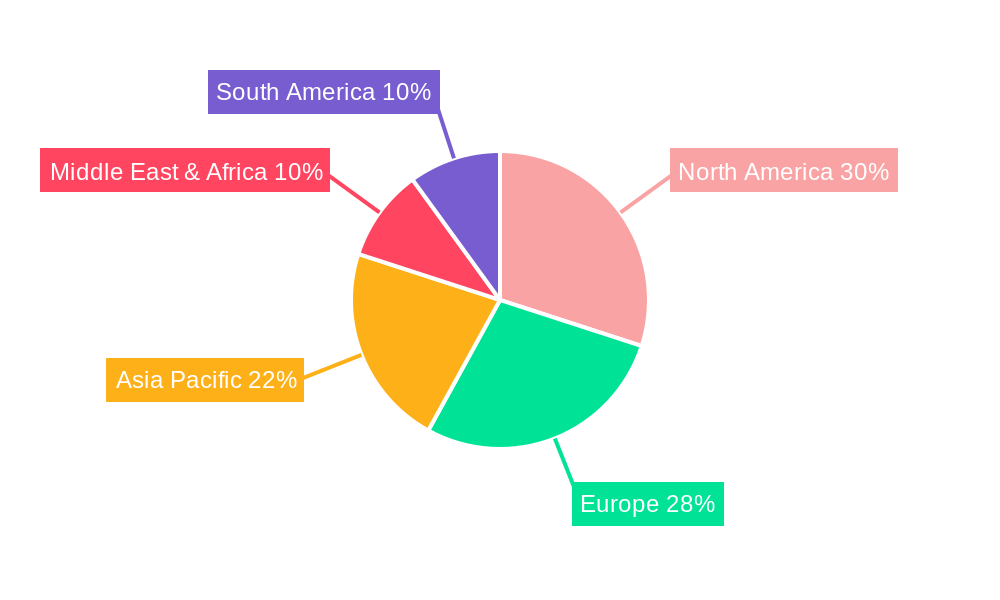

The future trajectory of the Embedded IoT Solutions for Medical market is shaped by emerging trends like the integration of artificial intelligence (AI) and machine learning (ML) for predictive diagnostics and personalized treatment, the expansion of remote patient monitoring to cater to aging populations and chronic disease management, and the increasing focus on data security and regulatory compliance. While the market presents immense opportunities, certain restraints, such as the high cost of implementation for advanced IoT infrastructure, concerns surrounding data privacy and cybersecurity, and the need for skilled professionals to manage and operate these complex systems, need to be addressed. Geographically, North America and Europe currently dominate the market due to established healthcare infrastructure and significant investments in digital health technologies. However, the Asia Pacific region is expected to witness the fastest growth, driven by increasing healthcare expenditure, a growing patient pool, and supportive government initiatives promoting digital transformation in healthcare. Key players such as Siemens, Advantech, and Axiomtek are actively investing in research and development to introduce innovative solutions and expand their market reach.

This comprehensive report delves into the dynamic landscape of Embedded IoT Solutions for the Medical sector, offering an in-depth analysis of market trends, growth drivers, and future potential. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report provides invaluable insights for industry stakeholders.

Embedded IoT Solutions for Medical Market Dynamics & Structure

The Embedded IoT Solutions for Medical market is characterized by a moderately concentrated structure, with key players like Axiomtek, Advantech, Wipro, and Siemens holding significant sway. Technological innovation is the primary driver, fueled by advancements in sensor technology, miniaturization, and edge computing capabilities. Robust regulatory frameworks, including FDA and CE certifications, play a crucial role in market entry and product development, ensuring patient safety and data integrity. Competitive product substitutes, such as standalone medical devices without IoT integration, are gradually being phased out as the benefits of connectivity, remote monitoring, and data analytics become more apparent. End-user demographics are shifting towards a greater adoption of home healthcare solutions and proactive patient management, driving demand for user-friendly and accessible embedded IoT devices. Mergers and acquisitions (M&A) are moderately active, with larger technology firms acquiring specialized medical IoT startups to expand their portfolios and market reach. For instance, the market witnessed approximately 5-10 significant M&A deals annually during the historical period (2019-2024), focusing on companies with unique software platforms or specialized hardware components. Innovation barriers include the high cost of R&D, stringent regulatory compliance, and the need for secure, interoperable systems.

Embedded IoT Solutions for Medical Growth Trends & Insights

The Embedded IoT Solutions for Medical market is poised for substantial expansion, driven by an escalating demand for remote patient monitoring, telehealth services, and personalized medicine. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-18% during the forecast period (2025-2033), reaching an estimated value of USD 25,000 million by 2033. Adoption rates for connected medical devices are accelerating across hospitals, clinics, and laboratories, propelled by the need for improved diagnostic accuracy, reduced healthcare costs, and enhanced patient outcomes. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive diagnostics and the growing use of blockchain for secure data management, are reshaping the market. Consumer behavior is shifting towards a preference for continuous health monitoring and preventative care, leading to increased demand for wearable medical devices and smart home healthcare solutions. The market penetration of embedded IoT in critical care devices is expected to reach over 70% by 2030. Furthermore, the increasing prevalence of chronic diseases globally necessitates advanced monitoring and management systems, which embedded IoT solutions are well-positioned to provide. The integration of 5G technology promises to further revolutionize real-time data transmission, enabling faster and more efficient remote diagnostics and interventions.

Dominant Regions, Countries, or Segments in Embedded IoT Solutions for Medical

North America currently dominates the Embedded IoT Solutions for Medical market, driven by its advanced healthcare infrastructure, high disposable incomes, and a strong emphasis on technological adoption in healthcare. The United States, in particular, accounts for a significant market share of approximately 40% within North America due to substantial investments in digital health and a favorable regulatory environment for medical device innovation. Within the Application segment, the Hospital segment is the largest contributor, accounting for an estimated 55% of the market share in 2025. This dominance is attributed to the extensive use of IoT-enabled devices for patient monitoring, asset tracking, and operational efficiency within hospital settings.

- Key Drivers in Hospitals:

- Remote Patient Monitoring: Enabling continuous tracking of vital signs for improved patient care and reduced readmission rates.

- Asset Management: Real-time tracking of expensive medical equipment to optimize utilization and reduce loss.

- Operational Efficiency: Streamlining workflows through connected devices and data analytics, leading to cost savings.

- Data-Driven Decision Making: Providing clinicians with actionable insights from patient data for better treatment plans.

In terms of Types, the Hardware segment currently holds a dominant position, representing approximately 65% of the market share in 2025, owing to the fundamental need for connected medical devices and sensors. However, the Software segment is experiencing a higher growth rate, driven by the increasing demand for sophisticated data analytics platforms, AI-powered diagnostic tools, and secure cloud-based management systems. Countries like Germany and the UK are significant contributors to the European market, fueled by government initiatives promoting digital healthcare and an aging population. Asia Pacific is emerging as a high-growth region, propelled by increasing healthcare expenditure, a growing middle class, and government investments in smart city initiatives that include connected healthcare.

Embedded IoT Solutions for Medical Product Landscape

The product landscape for Embedded IoT Solutions in Medical is diverse and rapidly evolving. Innovations focus on miniaturized, low-power sensors for continuous patient monitoring, such as implantable glucose monitors and wearable ECG trackers. Advanced hardware components from companies like Axiomtek and Advantech are enabling the development of robust and reliable medical devices. Software platforms developed by Wipro, Softeq, and ITRex Group are facilitating seamless data integration, analysis, and secure transmission. Unique selling propositions often lie in enhanced connectivity features, advanced AI algorithms for predictive analytics, and stringent adherence to medical-grade security protocols. For example, remote patient monitoring platforms are offering real-time alerts for critical events, while smart diagnostic devices are providing enhanced accuracy and speed in laboratory settings.

Key Drivers, Barriers & Challenges in Embedded IoT Solutions for Medical

Key Drivers:

- Growing Demand for Remote Patient Monitoring: To manage chronic diseases and elderly care effectively.

- Technological Advancements: Miniaturization of sensors, AI integration, and improved connectivity (5G).

- Cost Reduction in Healthcare: IoT solutions aim to optimize resource utilization and reduce hospital stays.

- Increasing Government Initiatives: Promoting digital health and smart healthcare infrastructure.

- Rising Chronic Disease Prevalence: Necessitating continuous monitoring and proactive management.

Barriers & Challenges:

- Data Security and Privacy Concerns: Protecting sensitive patient information from cyber threats.

- Regulatory Hurdles: Complex and lengthy approval processes for medical devices (e.g., FDA, CE).

- Interoperability Issues: Ensuring seamless communication between diverse devices and systems.

- High Initial Investment Costs: For both manufacturers and healthcare providers.

- Limited Technical Expertise: Among healthcare professionals for managing IoT systems.

- Supply Chain Disruptions: Affecting the availability of critical components, as seen in recent global events.

Emerging Opportunities in Embedded IoT Solutions for Medical

Emerging opportunities lie in the development of personalized treatment plans through advanced data analytics, predictive maintenance for medical equipment, and the expansion of telehealth services to remote and underserved regions. The integration of AI for early disease detection and personalized drug delivery systems presents significant potential. Furthermore, the growth of the "Internet of Medical Things" (IoMT) is creating avenues for smart hospitals, connected ambulances, and at-home diagnostic kits. The increasing focus on preventative healthcare is also driving demand for consumer-grade yet medically accurate wearable devices. The potential for integration with emerging technologies like virtual reality (VR) and augmented reality (AR) for surgical training and remote consultations is also noteworthy.

Growth Accelerators in the Embedded IoT Solutions for Medical Industry

Key growth accelerators include strategic partnerships between technology providers and healthcare institutions, fostering collaborative innovation and ensuring market relevance. The increasing adoption of cloud computing and edge AI capabilities is enabling more sophisticated data processing and real-time decision-making. Government incentives and favorable policies aimed at digitalizing healthcare infrastructure are further propelling market growth. The continuous evolution of cybersecurity protocols and data encryption technologies is building greater trust and confidence in connected medical solutions, mitigating a major barrier. Strategic market expansion initiatives by key players into developing economies with burgeoning healthcare needs also act as significant growth catalysts.

Key Players Shaping the Embedded IoT Solutions for Medical Market

Axiomtek Advantech Wipro Softeq Kontron Witekio Robustel ITRex Group Orthogone FirstNet SAS Solwit Azure EmbedTek Penguin Solutions Siemens ClearBlade Sierra Wireless MOKOSmart Tessolve CimpleO Telit

Notable Milestones in Embedded IoT Solutions for Medical Sector

- 2019: Launch of FDA-cleared AI-powered diagnostic imaging software by SAS.

- 2020: Wipro expands its healthcare IoT offerings with a focus on remote patient monitoring.

- 2021: Advantech introduces new rugged embedded platforms designed for medical device manufacturers.

- 2022: Siemens launches an integrated cloud platform for healthcare data management.

- 2023: Sierra Wireless announces enhanced connectivity solutions for medical wearables.

- 2024: Softeq develops advanced software for remote surgical assistance using IoT.

- 2024: Azure announces enhanced security features for healthcare IoT solutions.

In-Depth Embedded IoT Solutions for Medical Market Outlook

The future outlook for Embedded IoT Solutions in the Medical sector is exceptionally promising, with continued robust growth anticipated. Key growth accelerators will involve the deeper integration of AI and ML for predictive analytics and personalized medicine, alongside the expansion of edge computing to enable real-time processing closer to the patient. Strategic partnerships and collaborative efforts between technology giants and specialized medical device manufacturers will drive further innovation and market penetration. The increasing focus on preventative healthcare and home-based patient care will create substantial opportunities for consumer-friendly yet clinically accurate connected devices. The continued evolution of cybersecurity measures will instill greater confidence, paving the way for wider adoption across all healthcare segments. The market is expected to witness significant advancements in areas like connected drug delivery systems and advanced remote diagnostic tools, ultimately contributing to improved patient outcomes and a more efficient global healthcare ecosystem.

Embedded IoT Solutions for Medical Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Laboratory

-

2. Types

- 2.1. Software

- 2.2. Hardware

Embedded IoT Solutions for Medical Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Embedded IoT Solutions for Medical REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Embedded IoT Solutions for Medical Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Laboratory

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Software

- 5.2.2. Hardware

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Embedded IoT Solutions for Medical Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Laboratory

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Software

- 6.2.2. Hardware

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Embedded IoT Solutions for Medical Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Laboratory

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Software

- 7.2.2. Hardware

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Embedded IoT Solutions for Medical Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Laboratory

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Software

- 8.2.2. Hardware

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Embedded IoT Solutions for Medical Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Laboratory

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Software

- 9.2.2. Hardware

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Embedded IoT Solutions for Medical Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Laboratory

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Software

- 10.2.2. Hardware

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Axiomtek

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Advantech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wipro

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Softeq

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kontron

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Witekio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robustel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ITRex Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Orthogone

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FirstNet

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Solwit

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Azure

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 EmbedTek

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Penguin Solutions

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Siemens

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ClearBlade

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Sierra Wireless

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 MOKOSmart

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Tessolve

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 CimpleO

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Telit

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Axiomtek

List of Figures

- Figure 1: Global Embedded IoT Solutions for Medical Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Embedded IoT Solutions for Medical Revenue (million), by Application 2024 & 2032

- Figure 3: North America Embedded IoT Solutions for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Embedded IoT Solutions for Medical Revenue (million), by Types 2024 & 2032

- Figure 5: North America Embedded IoT Solutions for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Embedded IoT Solutions for Medical Revenue (million), by Country 2024 & 2032

- Figure 7: North America Embedded IoT Solutions for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Embedded IoT Solutions for Medical Revenue (million), by Application 2024 & 2032

- Figure 9: South America Embedded IoT Solutions for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Embedded IoT Solutions for Medical Revenue (million), by Types 2024 & 2032

- Figure 11: South America Embedded IoT Solutions for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Embedded IoT Solutions for Medical Revenue (million), by Country 2024 & 2032

- Figure 13: South America Embedded IoT Solutions for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Embedded IoT Solutions for Medical Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Embedded IoT Solutions for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Embedded IoT Solutions for Medical Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Embedded IoT Solutions for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Embedded IoT Solutions for Medical Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Embedded IoT Solutions for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Embedded IoT Solutions for Medical Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Embedded IoT Solutions for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Embedded IoT Solutions for Medical Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Embedded IoT Solutions for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Embedded IoT Solutions for Medical Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Embedded IoT Solutions for Medical Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Embedded IoT Solutions for Medical Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Embedded IoT Solutions for Medical Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Embedded IoT Solutions for Medical Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Embedded IoT Solutions for Medical Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Embedded IoT Solutions for Medical Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Embedded IoT Solutions for Medical Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Embedded IoT Solutions for Medical Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Embedded IoT Solutions for Medical Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Embedded IoT Solutions for Medical?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Embedded IoT Solutions for Medical?

Key companies in the market include Axiomtek, Advantech, Wipro, Softeq, Kontron, Witekio, Robustel, ITRex Group, Orthogone, FirstNet, SAS, Solwit, Azure, EmbedTek, Penguin Solutions, Siemens, ClearBlade, Sierra Wireless, MOKOSmart, Tessolve, CimpleO, Telit.

3. What are the main segments of the Embedded IoT Solutions for Medical?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Embedded IoT Solutions for Medical," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Embedded IoT Solutions for Medical report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Embedded IoT Solutions for Medical?

To stay informed about further developments, trends, and reports in the Embedded IoT Solutions for Medical, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence