Key Insights

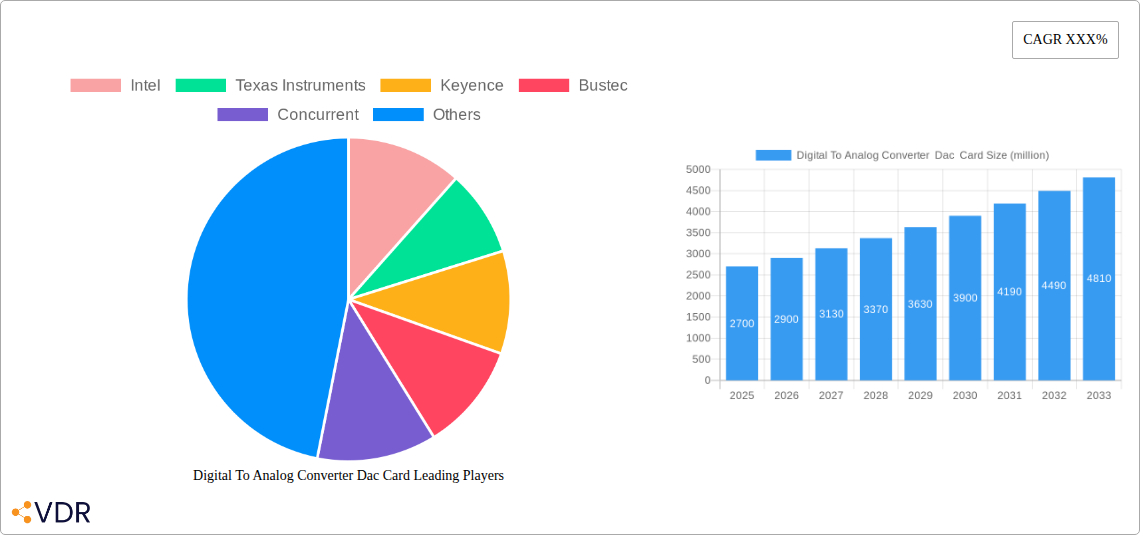

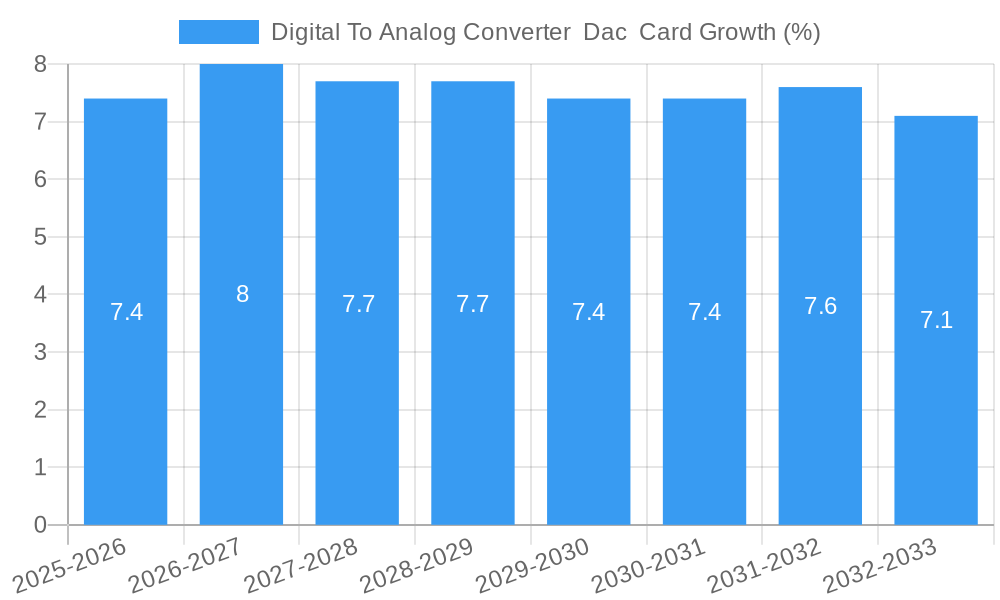

The global Digital-to-Analog Converter (DAC) Card market is poised for significant expansion, projected to reach approximately $4,500 million by 2033, growing at a Compound Annual Growth Rate (CAGR) of around 7.5% from its estimated 2025 valuation. This robust growth is primarily fueled by the increasing demand from the electronics industry, driven by advancements in consumer electronics, telecommunications, and the burgeoning Internet of Things (IoT) ecosystem. The industrial sector also presents a substantial growth avenue, with DAC cards being integral to automation, control systems, and advanced manufacturing processes. The proliferation of high-resolution audio and video equipment, coupled with the need for precise signal generation in scientific instrumentation and medical devices, further propels market adoption. The introduction of higher passage count DAC cards, such as 32-passage variants, caters to specialized applications requiring enhanced performance and multiple channel outputs.

However, the market is not without its challenges. The high cost associated with advanced DAC technologies and stringent quality control requirements can act as a restraint. Furthermore, the increasing integration of DAC functionalities directly onto SoCs (Systems on a Chip) for cost-sensitive applications might limit the growth of standalone DAC card solutions in certain segments. Despite these factors, the ongoing innovation in semiconductor technology, leading to more efficient, powerful, and compact DAC solutions, alongside the expanding applications in emerging technologies like artificial intelligence and virtual reality, are expected to drive sustained market momentum. Key players like Intel and Texas Instruments are heavily investing in research and development, introducing cutting-edge DAC technologies to capture a larger market share.

Here is a comprehensive, SEO-optimized report description for the Digital To Analog Converter DAC Card market, designed for maximum visibility and engagement:

Digital To Analog Converter Dac Card Market Dynamics & Structure

The Digital to Analog Converter (DAC) Card market is characterized by a moderate concentration of key players, with a significant competitive landscape. Technological innovation is a primary driver, fueled by the increasing demand for high-fidelity audio, precise signal processing in industrial automation, and advanced sensor integration within the electronics industry. Companies like Texas Instruments and Intel are at the forefront, developing sophisticated DAC chips that enable next-generation product development. Regulatory frameworks, particularly concerning electromagnetic compatibility (EMC) and environmental standards, play a crucial role in shaping product design and market entry. Competitive product substitutes, such as integrated audio codecs and software-defined solutions, pose a challenge, necessitating continuous innovation in DAC card performance and cost-effectiveness. End-user demographics span from audiophiles and professional content creators to industrial control engineers and medical device manufacturers, each with distinct performance and feature requirements. Mergers and acquisitions (M&A) activity is present, with larger entities acquiring niche technology providers to expand their portfolios and market reach.

- Market Concentration: Moderately concentrated with a few dominant players and a significant number of smaller, specialized manufacturers.

- Technological Innovation Drivers: Demand for higher resolution, lower latency, improved signal-to-noise ratio, and increased channel density.

- Regulatory Frameworks: Stringent regulations in EMC, safety, and environmental compliance (e.g., RoHS, REACH) influence product development.

- Competitive Product Substitutes: Integrated chip solutions, software-based DACs, and alternative signal conversion technologies.

- End-User Demographics: Diverse, including consumer electronics, professional audio, industrial automation, medical devices, and automotive sectors.

- M&A Trends: Strategic acquisitions to gain access to specialized technologies, expand product portfolios, and enter new market segments.

Digital To Analog Converter Dac Card Growth Trends & Insights

The Digital to Analog Converter (DAC) Card market is poised for robust growth, driven by the relentless advancement and widespread adoption of digital technologies across various industries. This market is experiencing a substantial expansion, with an estimated market size expected to reach $1,850.6 million by 2025. The compound annual growth rate (CAGR) projected for the forecast period of 2025–2033 is a healthy 6.2%, indicating sustained upward momentum. This growth is intrinsically linked to the escalating demand for high-fidelity audio in consumer electronics, professional sound systems, and the burgeoning gaming industry. Simultaneously, the industrial sector is witnessing a significant uptake of DAC cards for precise control in automation systems, robotics, and instrumentation, where accuracy and real-time signal processing are paramount.

Technological disruptions are continuously reshaping the DAC card landscape. The development of higher resolution DACs (e.g., 32-bit and beyond) with lower total harmonic distortion (THD) and improved dynamic range is a key trend, catering to the discerning requirements of professional audio engineers and high-end consumer applications. Furthermore, the integration of advanced features such as low latency, digital noise shaping, and enhanced connectivity options (USB, PCIe) are becoming standard, making DAC cards more versatile and powerful.

Consumer behavior shifts are also playing a pivotal role. There's a growing consumer preference for immersive audio experiences, driving demand for premium DAC solutions in home entertainment systems and personal audio devices. In the industrial realm, the push towards Industry 4.0 and smart manufacturing necessitates sophisticated data acquisition and control systems, where accurate analog signal generation through DAC cards is indispensable. The increasing adoption of IoT devices, medical equipment, and advanced automotive infotainment systems further amplifies the market's reach. The parent market, encompassing all digital signal processing components, provides a strong foundation, while the niche child market of specialized DAC cards exhibits accelerated growth due to its critical role in converting digital commands into actionable analog outputs. The market penetration of DAC cards is steadily increasing as their benefits in terms of performance, flexibility, and precision become more widely recognized and integrated into an ever-expanding array of electronic products and systems.

Dominant Regions, Countries, or Segments in Digital To Analog Converter Dac Card

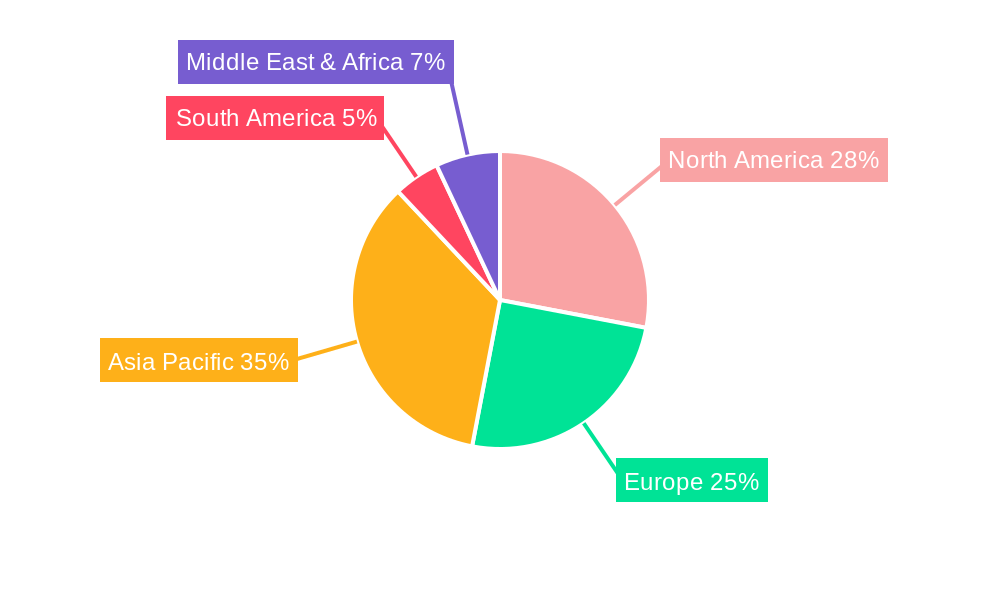

The Digital to Analog Converter (DAC) Card market is experiencing significant growth and dominance across various geographical regions and application segments, driven by a confluence of technological advancements, industrial expansion, and robust economic policies.

Dominant Region: North America

North America, particularly the United States, stands out as a dominant region in the DAC card market. This leadership is attributed to several key factors:

- Technological Hubs and R&D Investment: The region boasts a high concentration of technology companies, research institutions, and venture capital funding, fostering rapid innovation in digital signal processing and analog-to-digital conversion technologies.

- Strong Consumer Electronics and Pro-Audio Demand: The presence of a sophisticated consumer base with a high disposable income fuels demand for premium audio equipment, home theater systems, and advanced personal audio devices, all of which rely on high-performance DAC cards.

- Advanced Industrial Automation: The robust industrial sector, encompassing manufacturing, aerospace, and automotive industries, heavily invests in automation and control systems that require precise analog signal generation.

- Government Initiatives and Infrastructure: Supportive government policies promoting technological development and significant investments in digital infrastructure further bolster the market.

- Market Share: North America is estimated to hold approximately 35% of the global DAC card market share in 2025.

Dominant Segment: Electronics Industry (Application)

Within the application segments, the Electronics Industry emerges as the most dominant driver of growth for DAC cards.

- Ubiquitous Integration: DAC cards are integral components in a vast array of electronic devices, including smartphones, tablets, computers, audio interfaces, gaming consoles, and smart home devices.

- High-Volume Production: The sheer scale of production within the consumer electronics sector translates into substantial demand for DAC cards.

- Performance Enhancement: Manufacturers continually seek to enhance the audio and signal processing capabilities of their products, driving the adoption of more advanced DAC solutions.

- Market Share: The Electronics Industry segment is projected to account for over 40% of the total DAC card market revenue by 2025.

Dominant Segment: 16-Passage (Type)

Among the different passage types, the 16-Passage DAC cards are experiencing significant traction due to their balanced performance and cost-effectiveness for a wide range of applications.

- Versatility: 16-passage DAC cards offer a suitable balance between channel density and complexity, making them ideal for multi-channel audio systems, industrial control panels with moderate channel requirements, and various test and measurement equipment.

- Cost-Effectiveness: Compared to higher passage count cards, 16-passage options often provide a more economical solution without significant compromise on essential performance metrics.

- Broad Adoption: This segment caters to a large swathe of the parent market's needs, bridging the gap between simpler 8-passage devices and more specialized higher-passage solutions.

- Market Share: The 16-Passage segment is expected to capture approximately 30% of the DAC card market by volume in 2025.

These dominant regions and segments highlight the critical role of DAC cards in both the advancement of consumer technology and the backbone of modern industrial operations. The synergy between these areas ensures continued growth and innovation within the DAC card market.

Digital To Analog Converter Dac Card Product Landscape

The Digital to Analog Converter (DAC) Card product landscape is characterized by increasing sophistication and specialization. Innovations are focused on achieving higher resolution (e.g., 32-bit audio DACs), lower distortion, and improved signal-to-noise ratios for pristine audio reproduction. In industrial applications, ruggedized designs, extended temperature ranges, and enhanced isolation are paramount for reliability in harsh environments. Key advancements include the integration of advanced digital filtering, low-latency architectures, and diverse interface options such as PCIe and USB 3.0 for seamless connectivity. Product differentiation often lies in the specific chipsets employed, such as those from Texas Instruments or custom solutions from specialized manufacturers, offering unique performance benchmarks and application-specific features.

Key Drivers, Barriers & Challenges in Digital To Analog Converter Dac Card

Key Drivers:

- Explosive Growth in Consumer Electronics: The insatiable demand for high-fidelity audio in smartphones, home theaters, gaming consoles, and personal audio devices is a primary growth engine.

- Industry 4.0 and Industrial Automation: The increasing adoption of sophisticated control systems, robotics, and IoT devices in manufacturing and industrial sectors necessitates precise analog signal generation.

- Advancements in Digital Signal Processing (DSP): Ongoing improvements in DSP technology enable the development of more powerful and efficient DAC cards with superior performance.

- Rise of Pro-Audio and Content Creation: The growing content creation industry, including music production, podcasting, and video editing, requires high-quality audio interfaces with robust DAC capabilities.

Key Barriers & Challenges:

- Component Shortages and Supply Chain Disruptions: The global semiconductor shortage continues to impact the availability and cost of critical components, leading to production delays and increased prices.

- Intensifying Competition: The market is competitive, with numerous players offering a wide range of products, leading to price pressures and a constant need for differentiation.

- Rapid Technological Obsolescence: The fast pace of technological advancement can lead to quicker product lifecycles, requiring continuous R&D investment to stay competitive.

- High Development Costs: The research, development, and stringent testing required for high-performance DAC cards can be substantial, particularly for niche or specialized applications.

- Regulatory Compliance: Meeting diverse international standards for safety, emissions, and environmental impact adds complexity and cost to product development and market entry.

Emerging Opportunities in Digital To Analog Converter Dac Card

Emerging opportunities for Digital to Analog Converter (DAC) Cards lie in the expanding fields of virtual and augmented reality (VR/AR), where high-quality, low-latency audio is crucial for immersive experiences. The burgeoning market for advanced medical devices, particularly in diagnostics and therapeutic systems requiring precise analog signal control, presents another significant avenue. Furthermore, the increasing integration of AI and machine learning in industrial processes creates demand for DAC cards capable of handling complex data streams and generating nuanced analog outputs for sophisticated control loops. The development of highly integrated System-on-Chip (SoC) solutions incorporating DAC functionality also presents an opportunity for market expansion and diversification.

Growth Accelerators in the Digital To Analog Converter Dac Card Industry

Several catalysts are accelerating growth within the Digital to Analog Converter (DAC) Card industry. The ongoing miniaturization and increased processing power of microcontrollers are enabling the development of smaller, more efficient DAC cards suitable for a wider range of portable and embedded applications. Strategic partnerships between DAC card manufacturers and original equipment manufacturers (OEMs) are crucial for co-developing integrated solutions tailored to specific industry needs, such as advanced automotive infotainment systems or next-generation industrial robotics. The global push towards smart cities and connected infrastructure also fuels demand for reliable analog signal generation in sensor networks, traffic management, and smart grid technologies.

Key Players Shaping the Digital To Analog Converter Dac Card Market

- Intel

- Texas Instruments

- Keyence

- Bustec

- Concurrent

- TEKBOX

- ASHLY

Notable Milestones in Digital To Analog Converter Dac Card Sector

- 2019: Introduction of 32-bit audio DAC chips offering unprecedented dynamic range and THD+N figures by leading semiconductor manufacturers.

- 2020: Increased demand for professional audio interfaces with multi-channel DAC capabilities driven by the surge in remote work and home studio setups.

- 2021: Focus on ultra-low latency DAC solutions for real-time industrial control and gaming applications gains momentum.

- 2022: Growing adoption of high-resolution DACs in automotive infotainment systems to enhance in-car audio experiences.

- 2023: Expansion of the "Others" application segment driven by emerging use cases in medical diagnostics and IoT devices.

- 2024: Significant advancements in power efficiency for DAC cards, crucial for battery-powered and portable electronic devices.

In-Depth Digital To Analog Converter Dac Card Market Outlook

The Digital to Analog Converter (DAC) Card market is projected for sustained and significant growth, driven by an insatiable demand from both the consumer electronics and industrial sectors. Future market potential is anchored in the continuous pursuit of higher fidelity audio, increased precision in industrial control systems, and the integration of DAC technology into emerging fields like AI-driven robotics and advanced medical imaging. Strategic opportunities lie in developing highly specialized DAC cards for niche applications, focusing on ultra-low latency, exceptional noise immunity, and robust power management. The ongoing evolution towards smarter, more connected devices across all industries will continue to propel the adoption of advanced DAC solutions, solidifying their indispensable role in the digital transformation landscape.

Digital To Analog Converter Dac Card Segmentation

-

1. Application

- 1.1. Electronics Industry

- 1.2. Industrial

- 1.3. Others

-

2. Type

- 2.1. 8 Passage

- 2.2. 16 Passage

- 2.3. 24 Passage

- 2.4. 32 Passage

Digital To Analog Converter Dac Card Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital To Analog Converter Dac Card REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital To Analog Converter Dac Card Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electronics Industry

- 5.1.2. Industrial

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 8 Passage

- 5.2.2. 16 Passage

- 5.2.3. 24 Passage

- 5.2.4. 32 Passage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital To Analog Converter Dac Card Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electronics Industry

- 6.1.2. Industrial

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 8 Passage

- 6.2.2. 16 Passage

- 6.2.3. 24 Passage

- 6.2.4. 32 Passage

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital To Analog Converter Dac Card Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electronics Industry

- 7.1.2. Industrial

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 8 Passage

- 7.2.2. 16 Passage

- 7.2.3. 24 Passage

- 7.2.4. 32 Passage

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital To Analog Converter Dac Card Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electronics Industry

- 8.1.2. Industrial

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 8 Passage

- 8.2.2. 16 Passage

- 8.2.3. 24 Passage

- 8.2.4. 32 Passage

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital To Analog Converter Dac Card Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electronics Industry

- 9.1.2. Industrial

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 8 Passage

- 9.2.2. 16 Passage

- 9.2.3. 24 Passage

- 9.2.4. 32 Passage

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital To Analog Converter Dac Card Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electronics Industry

- 10.1.2. Industrial

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 8 Passage

- 10.2.2. 16 Passage

- 10.2.3. 24 Passage

- 10.2.4. 32 Passage

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Texas Instruments

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Keyence

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bustec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Concurrent

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TEKBOX

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ASHLY

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Intel

List of Figures

- Figure 1: Global Digital To Analog Converter Dac Card Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital To Analog Converter Dac Card Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital To Analog Converter Dac Card Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital To Analog Converter Dac Card Revenue (million), by Type 2024 & 2032

- Figure 5: North America Digital To Analog Converter Dac Card Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Digital To Analog Converter Dac Card Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital To Analog Converter Dac Card Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital To Analog Converter Dac Card Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital To Analog Converter Dac Card Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital To Analog Converter Dac Card Revenue (million), by Type 2024 & 2032

- Figure 11: South America Digital To Analog Converter Dac Card Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Digital To Analog Converter Dac Card Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital To Analog Converter Dac Card Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital To Analog Converter Dac Card Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital To Analog Converter Dac Card Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital To Analog Converter Dac Card Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Digital To Analog Converter Dac Card Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Digital To Analog Converter Dac Card Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital To Analog Converter Dac Card Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital To Analog Converter Dac Card Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital To Analog Converter Dac Card Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital To Analog Converter Dac Card Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Digital To Analog Converter Dac Card Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Digital To Analog Converter Dac Card Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital To Analog Converter Dac Card Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital To Analog Converter Dac Card Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital To Analog Converter Dac Card Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital To Analog Converter Dac Card Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Digital To Analog Converter Dac Card Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Digital To Analog Converter Dac Card Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital To Analog Converter Dac Card Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Digital To Analog Converter Dac Card Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital To Analog Converter Dac Card Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital To Analog Converter Dac Card?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Digital To Analog Converter Dac Card?

Key companies in the market include Intel, Texas Instruments, Keyence, Bustec, Concurrent, TEKBOX, ASHLY.

3. What are the main segments of the Digital To Analog Converter Dac Card?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital To Analog Converter Dac Card," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital To Analog Converter Dac Card report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital To Analog Converter Dac Card?

To stay informed about further developments, trends, and reports in the Digital To Analog Converter Dac Card, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence