Key Insights

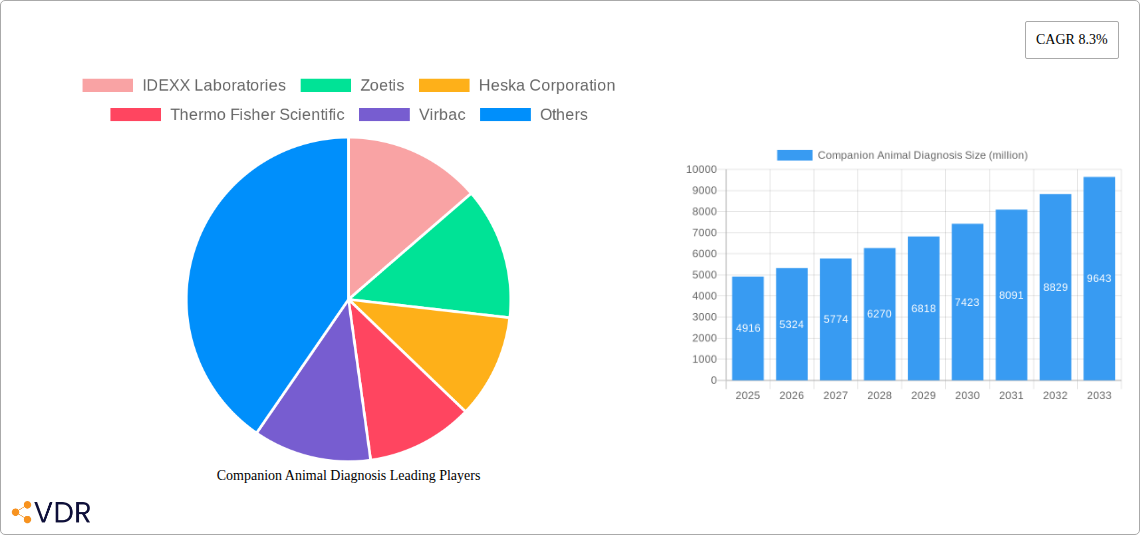

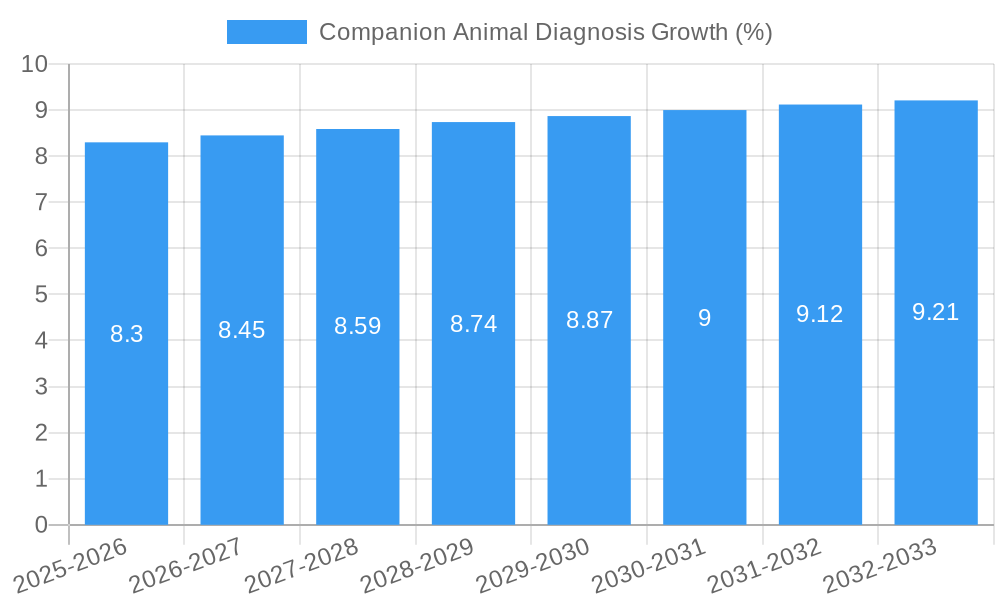

The global Companion Animal Diagnosis market is poised for robust expansion, projected to reach a substantial USD 4916 million by 2025, fueled by a compelling Compound Annual Growth Rate (CAGR) of 8.3%. This significant growth is primarily driven by the escalating humanization of pets, leading owners to invest more in advanced healthcare solutions. The increasing prevalence of chronic diseases and the growing demand for rapid and accurate diagnostic results at the point-of-care are further accelerating market adoption. Technological advancements, such as the development of sophisticated immunoassay and molecular diagnostic platforms, are enhancing the precision and efficiency of veterinary diagnostics, thereby boosting the market's trajectory. A rising awareness among pet owners regarding preventive healthcare and early disease detection also plays a crucial role in market penetration.

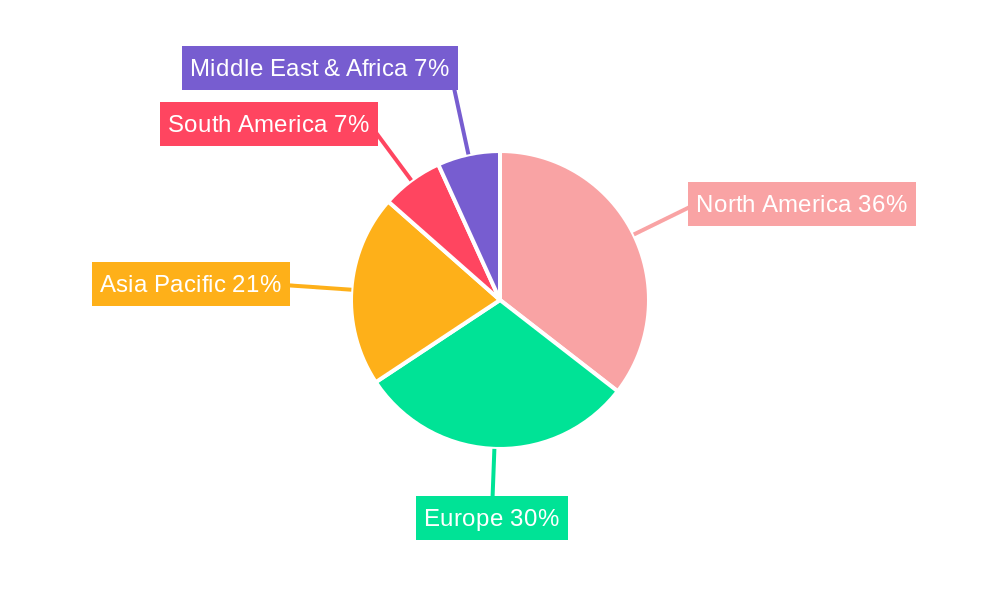

The market's segmentation reveals key areas of opportunity. Clinical Biochemistry, Immunodiagnostics, and Molecular Diagnostics are expected to be dominant segments, reflecting the trend towards more specialized and precise testing. Veterinary Reference Laboratories and Veterinary Hospitals and Clinics will continue to be major end-user segments, while Point-of-care/In-house Testing is anticipated to witness the fastest growth as accessibility and speed become paramount. Geographically, North America and Europe are projected to lead the market due to high pet ownership, advanced veterinary infrastructure, and significant healthcare expenditure. However, the Asia Pacific region, with its rapidly growing pet population and increasing disposable incomes, presents a substantial growth opportunity. While the market is largely optimistic, challenges such as the high cost of advanced diagnostic equipment and the need for skilled veterinary professionals in certain regions could pose moderate restraints.

Here is a compelling, SEO-optimized report description for Companion Animal Diagnosis, designed to maximize search engine visibility and engage industry professionals:

This comprehensive report delves into the dynamic companion animal diagnosis market, offering an in-depth analysis of its structure, growth trajectories, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this report provides actionable insights for stakeholders in the veterinary diagnostics, animal health, and pet care industries. We examine key market segments, including clinical biochemistry, immunodiagnostics, hematology, urinalysis, and molecular diagnostics, across various applications such as Veterinary Reference Laboratories, Veterinary Hospitals and Clinics, Point-of-care/In-house Testing, and Research Institutes and Universities.

Companion Animal Diagnosis Market Dynamics & Structure

The companion animal diagnosis market is characterized by a moderately concentrated structure, with key players like IDEXX Laboratories and Zoetis holding significant market shares. Technological innovation is a primary driver, fueled by advancements in molecular diagnostics, point-of-care testing platforms, and AI-driven analytical tools. Regulatory frameworks, such as those overseen by the FDA and EMA, play a crucial role in shaping product approvals and market access. Competitive product substitutes, while present, often lack the breadth of diagnostic capabilities offered by integrated platforms. End-user demographics are shifting towards a more proactive approach to pet health, driven by increasing pet humanization and a willingness to invest in advanced veterinary care. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and expansion, with an average of 5-7 significant deals annually over the historical period.

- Market Concentration: Dominated by a few large players with growing contributions from specialized niche providers.

- Technological Innovation: Driven by the demand for rapid, accurate, and less invasive diagnostic solutions.

- Regulatory Frameworks: Influence product development, market entry, and quality standards.

- Competitive Substitutes: Primarily consist of manual testing methods or less sophisticated diagnostic kits.

- End-User Demographics: Increasing disposable income allocated to pet healthcare, leading to demand for premium diagnostic services.

- M&A Trends: Focused on acquiring innovative technologies, expanding product portfolios, and gaining market share.

Companion Animal Diagnosis Growth Trends & Insights

The global companion animal diagnosis market is poised for robust expansion, projected to reach approximately $15.5 billion in 2025 and surge to an estimated $28.3 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period. This growth is underpinned by a confluence of factors including the escalating pet population worldwide, a marked increase in disposable income dedicated to pet healthcare, and a growing awareness among pet owners regarding the importance of early disease detection and preventative care. The adoption rate of advanced diagnostic technologies, particularly in point-of-care settings, is accelerating, driven by the demand for quicker results and improved patient outcomes. Technological disruptions, such as the integration of artificial intelligence in image analysis and the development of novel biomarkers for infectious diseases, are revolutionizing diagnostic capabilities. Consumer behavior shifts are evident, with pet owners increasingly viewing their animals as integral family members, leading to a greater willingness to invest in comprehensive health screenings and specialized veterinary treatments. The market penetration of in-house diagnostic equipment in veterinary clinics has seen a significant uptick, further contributing to market growth.

- Market Size Evolution: From an estimated $11.2 billion in 2019 to a projected $15.5 billion in 2025, with sustained growth anticipated through 2033.

- Adoption Rates: High and increasing for molecular diagnostics and rapid point-of-care tests.

- Technological Disruptions: AI in diagnostics, advanced immunoassay platforms, and novel biosensors are reshaping the market.

- Consumer Behavior Shifts: Humanization of pets, preventative care focus, and demand for advanced treatments.

- Market Penetration: Significant rise in in-house diagnostic utilization in veterinary practices.

Dominant Regions, Countries, or Segments in Companion Animal Diagnosis

North America currently dominates the companion animal diagnosis market, driven by its high pet ownership rates, advanced veterinary healthcare infrastructure, and significant disposable income allocated to pet care. The United States, in particular, is a powerhouse, accounting for approximately 45% of the regional market share. Key drivers include the presence of leading veterinary reference laboratories and a strong emphasis on technological adoption by veterinary hospitals and clinics. Europe follows closely, with countries like Germany, the UK, and France exhibiting substantial market presence due to similar trends in pet humanization and healthcare spending.

Within segments, Veterinary Hospitals and Clinics represent the largest application, contributing over 50% of the market revenue due to their direct access to pet owners and the prevalence of routine diagnostic testing. Point-of-care/In-house Testing is a rapidly expanding segment, driven by the desire for faster turnaround times and enhanced client satisfaction. In terms of diagnostic types, Immunodiagnostics and Clinical Biochemistry collectively hold the largest share, owing to their broad utility in detecting a wide range of diseases and metabolic conditions. However, Molecular Diagnostics is emerging as a significant growth engine, fueled by advancements in genetic testing and infectious disease detection.

- Dominant Region: North America, led by the United States, due to high pet ownership and healthcare expenditure.

- Leading Country: United States, with significant market influence and adoption of advanced technologies.

- Dominant Application: Veterinary Hospitals and Clinics, serving as the primary point of diagnostic service delivery.

- High-Growth Application: Point-of-care/In-house Testing, driven by efficiency and client convenience.

- Leading Diagnostic Type: Immunodiagnostics and Clinical Biochemistry, for their broad applicability.

- Fastest-Growing Diagnostic Type: Molecular Diagnostics, propelled by innovation in disease detection.

Companion Animal Diagnosis Product Landscape

The companion animal diagnosis product landscape is characterized by continuous innovation, with companies like IDEXX Laboratories offering comprehensive diagnostic platforms that integrate hematology, clinical chemistry, and infectious disease testing. Heska Corporation is notable for its advanced point-of-care diagnostic solutions, while Thermo Fisher Scientific provides a broad array of reagents and instruments. Product advancements focus on improving assay sensitivity, reducing turnaround times, and enhancing user-friendliness for veterinary professionals. Applications range from routine wellness screenings to the diagnosis of complex diseases like cancer and infectious agents. Key performance metrics such as diagnostic accuracy, precision, and cost-effectiveness are central to product development strategies.

Key Drivers, Barriers & Challenges in Companion Animal Diagnosis

The companion animal diagnosis market is propelled by the rising prevalence of zoonotic diseases, increasing pet ownership globally, and the growing trend of pet humanization, which drives demand for advanced veterinary care. Technological advancements in diagnostics, including AI-powered analysis and point-of-care devices, are also significant growth accelerators.

However, the market faces barriers such as the high cost of advanced diagnostic equipment and consumables, which can be a deterrent for smaller veterinary practices. Regulatory hurdles in obtaining approval for new diagnostic tests and devices also present challenges. Furthermore, the need for skilled personnel to operate and interpret complex diagnostic results can limit adoption in certain regions.

- Key Drivers:

- Increasing pet population and spending on pet healthcare.

- Advancements in diagnostic technologies (e.g., molecular, point-of-care).

- Growing awareness of preventative and proactive pet healthcare.

- Rising prevalence of chronic and infectious diseases in pets.

- Key Barriers & Challenges:

- High cost of diagnostic equipment and reagents.

- Stringent regulatory approval processes for new diagnostics.

- Shortage of skilled veterinary professionals for advanced diagnostics.

- Reimbursement challenges in some markets.

- Competition from established and emerging players.

Emerging Opportunities in Companion Animal Diagnosis

Emerging opportunities lie in the development of more accessible and affordable point-of-care diagnostic solutions, particularly for emerging infectious diseases and early detection of chronic conditions like kidney disease and diabetes. The expansion of telehealth services in veterinary medicine presents a significant opportunity for remote diagnostic monitoring and consultation. Furthermore, the growing demand for personalized medicine in companion animals, driven by advances in genomics and proteomics, offers a lucrative avenue for niche diagnostic developers. The integration of AI and machine learning for predictive diagnostics is also a key area of future growth.

- Point-of-care diagnostics: Focus on rapid, user-friendly tests for common conditions.

- Telemedicine integration: Remote diagnostic capabilities and data interpretation.

- Personalized medicine: Genetic and biomarker-based diagnostics.

- AI and machine learning: Predictive diagnostics and enhanced data analysis.

- Untapped markets: Developing economies with growing pet populations.

Growth Accelerators in the Companion Animal Diagnosis Industry

Technological breakthroughs in areas like CRISPR-based diagnostics, microfluidics for miniaturized testing, and advanced biosensor technology are poised to significantly accelerate the growth of the companion animal diagnosis industry. Strategic partnerships between diagnostic companies, pharmaceutical firms, and veterinary universities will foster innovation and accelerate product development cycles. Market expansion strategies, including targeting underserved regions and offering bundled diagnostic solutions, will further fuel growth. The increasing emphasis on companion animal well-being and the willingness of owners to invest in their pets' health represent a fundamental growth accelerator.

Key Players Shaping the Companion Animal Diagnosis Market

- IDEXX Laboratories

- Zoetis

- Heska Corporation

- Thermo Fisher Scientific

- Virbac

- Neogen Corporation

- bioMérieux

- INDICAL Bioscience GmbH

- IDvet

- Randox Laboratories

- Enalees

- agrolabo spa

- Biomerieux SA

- HyTest Ltd

Notable Milestones in Companion Animal Diagnosis Sector

- 2020: IDEXX Laboratories launches a new suite of in-house diagnostic tests for viral diseases, significantly reducing turnaround times.

- 2021: Zoetis acquires Bio-Techne's animal health business, bolstering its portfolio in molecular diagnostics.

- 2022: Heska Corporation receives FDA clearance for its advanced point-of-care diagnostic platform, enabling wider adoption in clinics.

- 2022: Thermo Fisher Scientific expands its animal health diagnostics offerings with innovative immunoassay solutions.

- 2023: Virbac introduces a novel diagnostic kit for early detection of feline infectious diseases.

- 2023: Neogen Corporation announces a strategic partnership to develop AI-powered diagnostic tools.

- 2024: bioMérieux launches a new rapid molecular diagnostic test for common canine bacterial infections.

In-Depth Companion Animal Diagnosis Market Outlook

The future of the companion animal diagnosis market is exceptionally promising, driven by a sustained increase in pet ownership, a growing humanization trend, and continuous technological innovation. The industry will witness a paradigm shift towards more integrated diagnostic platforms, predictive analytics, and personalized treatment approaches. Strategic investments in research and development, coupled with collaborations aimed at expanding market access and addressing unmet clinical needs, will be crucial for success. The market is expected to capitalize on the increasing demand for rapid, accurate, and cost-effective diagnostic solutions, solidifying its position as a vital component of modern veterinary healthcare.

Companion Animal Diagnosis Segmentation

-

1. Application

- 1.1. Veterinary Reference Laboratories

- 1.2. Veterinary Hospitals and Clinics

- 1.3. Point-of-care/In-house Testing

- 1.4. Research Institutes and Universities

-

2. Type

- 2.1. Clinical Biochemistry

- 2.2. Immunodiagnostics

- 2.3. Hematology

- 2.4. Urinalysis

- 2.5. Molecular Diagnostics

- 2.6. Other

Companion Animal Diagnosis Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Companion Animal Diagnosis REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Companion Animal Diagnosis Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Veterinary Reference Laboratories

- 5.1.2. Veterinary Hospitals and Clinics

- 5.1.3. Point-of-care/In-house Testing

- 5.1.4. Research Institutes and Universities

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Clinical Biochemistry

- 5.2.2. Immunodiagnostics

- 5.2.3. Hematology

- 5.2.4. Urinalysis

- 5.2.5. Molecular Diagnostics

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Companion Animal Diagnosis Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Veterinary Reference Laboratories

- 6.1.2. Veterinary Hospitals and Clinics

- 6.1.3. Point-of-care/In-house Testing

- 6.1.4. Research Institutes and Universities

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Clinical Biochemistry

- 6.2.2. Immunodiagnostics

- 6.2.3. Hematology

- 6.2.4. Urinalysis

- 6.2.5. Molecular Diagnostics

- 6.2.6. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Companion Animal Diagnosis Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Veterinary Reference Laboratories

- 7.1.2. Veterinary Hospitals and Clinics

- 7.1.3. Point-of-care/In-house Testing

- 7.1.4. Research Institutes and Universities

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Clinical Biochemistry

- 7.2.2. Immunodiagnostics

- 7.2.3. Hematology

- 7.2.4. Urinalysis

- 7.2.5. Molecular Diagnostics

- 7.2.6. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Companion Animal Diagnosis Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Veterinary Reference Laboratories

- 8.1.2. Veterinary Hospitals and Clinics

- 8.1.3. Point-of-care/In-house Testing

- 8.1.4. Research Institutes and Universities

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Clinical Biochemistry

- 8.2.2. Immunodiagnostics

- 8.2.3. Hematology

- 8.2.4. Urinalysis

- 8.2.5. Molecular Diagnostics

- 8.2.6. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Companion Animal Diagnosis Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Veterinary Reference Laboratories

- 9.1.2. Veterinary Hospitals and Clinics

- 9.1.3. Point-of-care/In-house Testing

- 9.1.4. Research Institutes and Universities

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Clinical Biochemistry

- 9.2.2. Immunodiagnostics

- 9.2.3. Hematology

- 9.2.4. Urinalysis

- 9.2.5. Molecular Diagnostics

- 9.2.6. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Companion Animal Diagnosis Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Veterinary Reference Laboratories

- 10.1.2. Veterinary Hospitals and Clinics

- 10.1.3. Point-of-care/In-house Testing

- 10.1.4. Research Institutes and Universities

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Clinical Biochemistry

- 10.2.2. Immunodiagnostics

- 10.2.3. Hematology

- 10.2.4. Urinalysis

- 10.2.5. Molecular Diagnostics

- 10.2.6. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IDEXX Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zoetis

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Heska Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Virbac

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Neogen Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 bioMérieux

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 INDICAL Bioscience GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IDvet

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Randox Laboratories

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Enalees

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 agrolabo spa

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Biomerieux SA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HyTest Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 IDEXX Laboratories

List of Figures

- Figure 1: Global Companion Animal Diagnosis Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Companion Animal Diagnosis Revenue (million), by Application 2024 & 2032

- Figure 3: North America Companion Animal Diagnosis Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Companion Animal Diagnosis Revenue (million), by Type 2024 & 2032

- Figure 5: North America Companion Animal Diagnosis Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Companion Animal Diagnosis Revenue (million), by Country 2024 & 2032

- Figure 7: North America Companion Animal Diagnosis Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Companion Animal Diagnosis Revenue (million), by Application 2024 & 2032

- Figure 9: South America Companion Animal Diagnosis Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Companion Animal Diagnosis Revenue (million), by Type 2024 & 2032

- Figure 11: South America Companion Animal Diagnosis Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Companion Animal Diagnosis Revenue (million), by Country 2024 & 2032

- Figure 13: South America Companion Animal Diagnosis Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Companion Animal Diagnosis Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Companion Animal Diagnosis Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Companion Animal Diagnosis Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Companion Animal Diagnosis Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Companion Animal Diagnosis Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Companion Animal Diagnosis Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Companion Animal Diagnosis Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Companion Animal Diagnosis Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Companion Animal Diagnosis Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Companion Animal Diagnosis Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Companion Animal Diagnosis Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Companion Animal Diagnosis Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Companion Animal Diagnosis Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Companion Animal Diagnosis Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Companion Animal Diagnosis Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Companion Animal Diagnosis Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Companion Animal Diagnosis Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Companion Animal Diagnosis Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Companion Animal Diagnosis Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Companion Animal Diagnosis Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Companion Animal Diagnosis Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Companion Animal Diagnosis Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Companion Animal Diagnosis Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Companion Animal Diagnosis Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Companion Animal Diagnosis Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Companion Animal Diagnosis Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Companion Animal Diagnosis Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Companion Animal Diagnosis Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Companion Animal Diagnosis Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Companion Animal Diagnosis Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Companion Animal Diagnosis Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Companion Animal Diagnosis Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Companion Animal Diagnosis Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Companion Animal Diagnosis Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Companion Animal Diagnosis Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Companion Animal Diagnosis Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Companion Animal Diagnosis Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Companion Animal Diagnosis Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Companion Animal Diagnosis?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Companion Animal Diagnosis?

Key companies in the market include IDEXX Laboratories, Zoetis, Heska Corporation, Thermo Fisher Scientific, Virbac, Neogen Corporation, bioMérieux, INDICAL Bioscience GmbH, IDvet, Randox Laboratories, Enalees, agrolabo spa, Biomerieux SA, HyTest Ltd.

3. What are the main segments of the Companion Animal Diagnosis?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4916 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Companion Animal Diagnosis," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Companion Animal Diagnosis report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Companion Animal Diagnosis?

To stay informed about further developments, trends, and reports in the Companion Animal Diagnosis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence