Key Insights

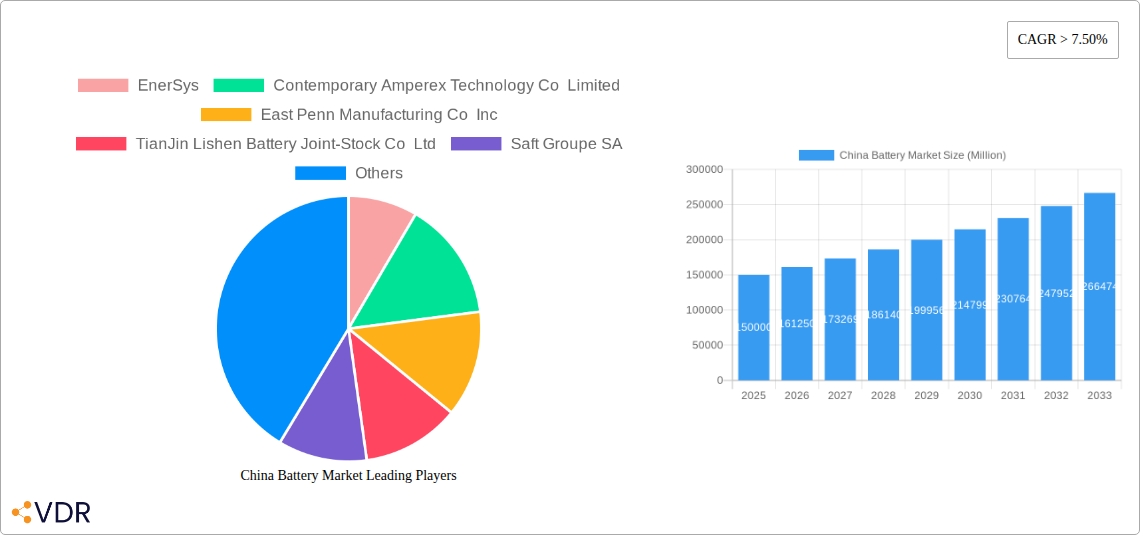

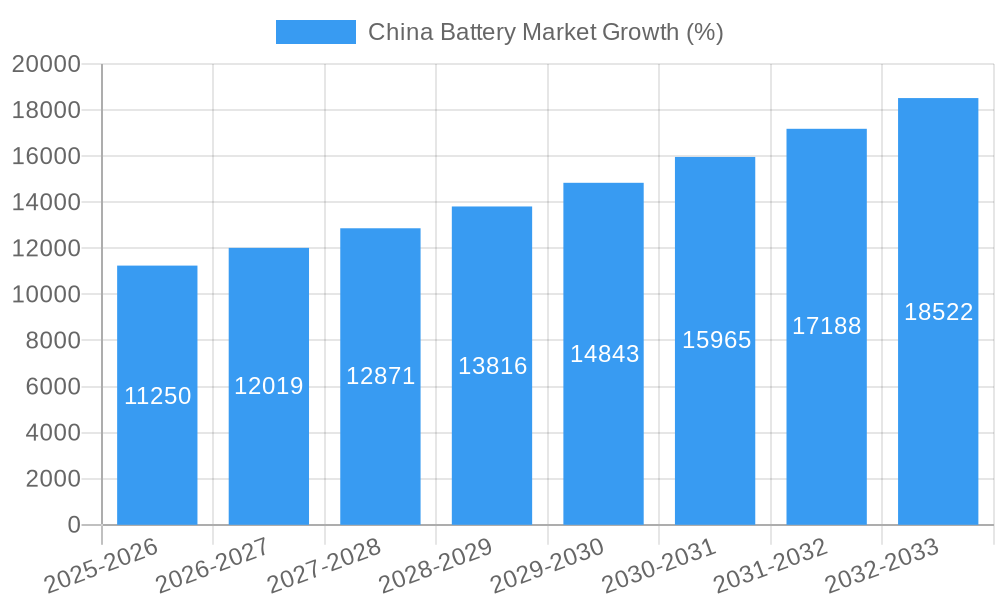

The China battery market, a significant player in the global landscape, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7.50% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning electric vehicle (EV) sector in China is a primary catalyst, demanding vast quantities of lithium-ion batteries for powering automobiles. Furthermore, the increasing adoption of renewable energy sources, such as solar and wind power, necessitates advanced energy storage solutions, further boosting demand for stationary batteries in industrial and utility applications. Government initiatives promoting clean energy and technological advancements in battery technology, particularly in improving energy density and lifespan, are also contributing significantly to market growth. While the market faces challenges like fluctuating raw material prices and environmental concerns related to battery production and disposal, the overall positive outlook persists. The market segmentation reveals a strong dominance of lithium-ion batteries, driven by their superior performance compared to lead-acid batteries. The automotive sector remains the largest application segment, followed by industrial batteries and portable electronics. Key players like Contemporary Amperex Technology Co Limited (CATL), BYD, and several international companies are fiercely competing, driving innovation and price competitiveness within the market.

The forecast period (2025-2033) anticipates continued market expansion, with lithium-ion battery technology expected to maintain its leading position due to ongoing advancements and government support. However, the market's future success hinges on addressing the environmental concerns associated with battery production and waste management, ensuring sustainable practices throughout the battery lifecycle. The continuous development of more efficient and cost-effective manufacturing processes will be crucial in sustaining the high CAGR. Diversification into new applications, such as grid-scale energy storage and smart grids, will also open new avenues for market growth, further solidifying China's role as a global battery powerhouse. The competitive landscape will likely remain highly dynamic, with companies focusing on technological innovation and strategic partnerships to maintain a competitive edge.

China Battery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China battery market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is invaluable for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly evolving market. The report includes detailed analysis of both parent market (China Battery Market) and child markets (Primary & Secondary Batteries, Lead-acid, Lithium-ion, Automotive, Industrial, Portable Batteries etc.). Market values are presented in million units.

China Battery Market Market Dynamics & Structure

The China battery market is characterized by intense competition, rapid technological innovation, and a complex regulatory landscape. Market concentration is moderate, with several dominant players alongside numerous smaller participants. Technological advancements, particularly in lithium-ion battery technology, are key growth drivers. Stringent environmental regulations are pushing the adoption of cleaner energy storage solutions. The market witnesses significant M&A activity, reflecting consolidation and expansion strategies. Competitive substitutes include fuel cells and other energy storage technologies, although lithium-ion currently dominates. End-user demographics are diverse, spanning automotive, industrial, and consumer electronics sectors.

- Market Concentration: Moderate, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on improving energy density, lifespan, and safety of lithium-ion batteries; emerging interest in sodium-ion technology.

- Regulatory Framework: Government policies promoting electric vehicles and renewable energy are boosting market demand.

- Competitive Substitutes: Fuel cells and other energy storage technologies pose a limited threat.

- End-User Demographics: Automotive, industrial, and portable electronics sectors are major consumers.

- M&A Trends: xx M&A deals were recorded in the past five years, reflecting industry consolidation.

China Battery Market Growth Trends & Insights

The China battery market experienced significant growth during the historical period (2019-2024), driven by increasing demand from the burgeoning electric vehicle (EV) sector and the expansion of renewable energy infrastructure. The market size is projected to reach xx million units by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, particularly the advancements in lithium-ion battery technology and the emergence of sodium-ion batteries, are reshaping the market landscape. Consumer behavior shifts towards eco-friendly products and the increasing adoption of EVs are further accelerating market growth. Market penetration of lithium-ion batteries is expected to reach xx% by 2033.

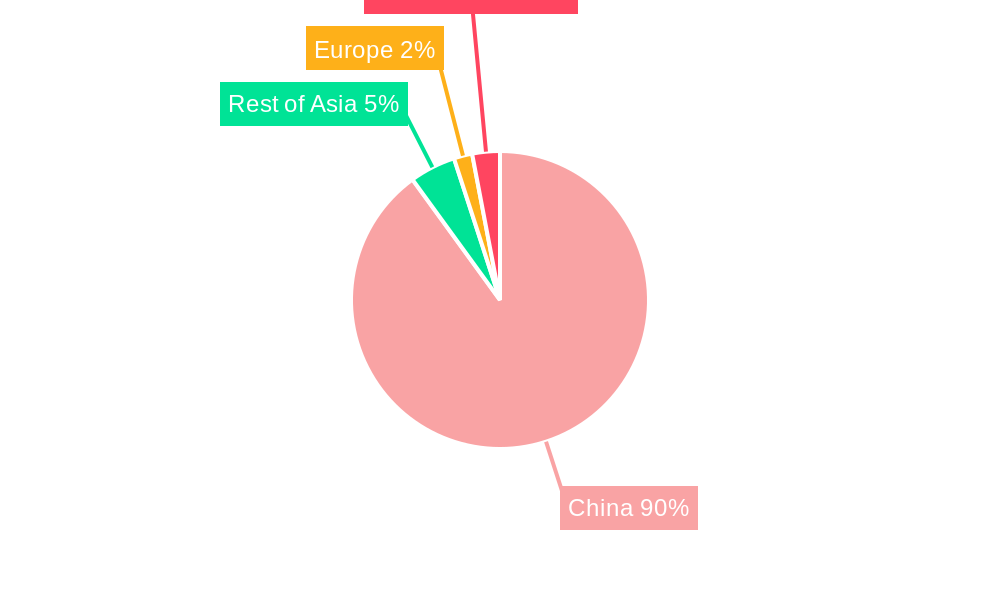

Dominant Regions, Countries, or Segments in China Battery Market

The eastern coastal regions of China, particularly Guangdong, Jiangsu, and Zhejiang provinces, are currently the dominant regions for battery production and consumption. This is largely driven by the concentration of manufacturing facilities and a robust automotive and electronics industry. Within the battery types, secondary batteries (particularly Lithium-ion) dominate the market, accounting for xx% of total market value in 2024. The automotive segment is the largest application area, followed by the industrial and portable battery sectors.

- Key Drivers: Government incentives for electric vehicles and renewable energy; strong industrial base; increasing consumer demand for portable electronics.

- Dominance Factors: High concentration of manufacturing facilities; established supply chain; strong domestic demand.

- Growth Potential: Continued investment in renewable energy; increasing EV adoption; expansion into emerging applications.

China Battery Market Product Landscape

The China battery market showcases a diverse product landscape, encompassing primary and secondary batteries with varying technologies, including lead-acid, lithium-ion, and emerging alternatives like solid-state batteries. Lithium-ion batteries dominate due to their high energy density and performance characteristics. Product innovation focuses on enhancing energy density, cycle life, safety, and cost-effectiveness. Key selling propositions include improved performance, longer lifespan, and enhanced safety features. Advancements in battery management systems (BMS) and thermal management technologies are also key aspects of innovation.

Key Drivers, Barriers & Challenges in China Battery Market

Key Drivers:

- Government support for electric vehicles and renewable energy.

- Growing demand for portable electronics.

- Technological advancements in battery technology (e.g., sodium-ion).

Key Challenges:

- Raw material price volatility (lithium, cobalt).

- Environmental concerns related to battery manufacturing and disposal.

- Intense competition and potential for overcapacity. Supply chain disruptions impacting xx% of production in 2022.

Emerging Opportunities in China Battery Market

Emerging opportunities lie in the increasing demand for energy storage solutions for renewable energy integration (solar, wind), the development of grid-scale energy storage systems, and the exploration of niche applications such as drones and electric aviation. The development of safer and more sustainable battery chemistries will also create significant opportunities. The growth of the electric two and three-wheeler segment presents an untapped market.

Growth Accelerators in the China Battery Market Industry

Long-term growth will be driven by technological breakthroughs in battery technology, particularly solid-state batteries and advanced lithium-ion chemistries. Strategic partnerships between battery manufacturers and automakers will accelerate EV adoption, further fueling market demand. Government initiatives to promote the development of domestic battery supply chains and the expansion of charging infrastructure will also play a crucial role.

Key Players Shaping the China Battery Market Market

- EnerSys

- Contemporary Amperex Technology Co Limited

- East Penn Manufacturing Co Inc

- Tianjin Lishen Battery Joint-Stock Co Ltd

- Saft Groupe SA

- GS Yuasa International Ltd

- C&D Technologies Inc

- FIAMM Energy Technology SpA

- Tesla Inc

- LG Chem Ltd

- Panasonic Corporation

Notable Milestones in China Battery Market Sector

- July 2021: Contemporary Amperex Technology Co. Limited (CATL) unveils its first-generation sodium-ion battery and AB battery pack solution, signifying a significant technological advancement.

In-Depth China Battery Market Market Outlook

The China battery market is poised for sustained growth in the coming years, driven by the continued expansion of the EV market, the growing adoption of renewable energy, and advancements in battery technology. Strategic partnerships, investments in R&D, and government support will further accelerate market expansion. The focus on enhancing battery safety, lifespan, and sustainability will be crucial for future success in this dynamic market. The potential for significant market expansion presents attractive opportunities for both established players and new entrants.

China Battery Market Segmentation

-

1. Type

- 1.1. Primary Battery

- 1.2. Secondary Battery

-

2. Technology

- 2.1. Lead-acid Battery

- 2.2. Lithium-ion Battery

- 2.3. Other Technologies

-

3. Application

- 3.1. Automotive

- 3.2. Industrial Batteries

- 3.3. Portable Batteries

- 3.4. Other Applications

China Battery Market Segmentation By Geography

- 1. China

China Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. The Automotive Batteries Segment is Expected to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Battery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Battery

- 5.1.2. Secondary Battery

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Lead-acid Battery

- 5.2.2. Lithium-ion Battery

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive

- 5.3.2. Industrial Batteries

- 5.3.3. Portable Batteries

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EnerSys

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Contemporary Amperex Technology Co Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 East Penn Manufacturing Co Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TianJin Lishen Battery Joint-Stock Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saft Groupe SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GS Yuasa International Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 C&D Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FIAMM Energy Technology SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tesla Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Chem Ltd*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 EnerSys

List of Figures

- Figure 1: China Battery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Battery Market Share (%) by Company 2024

List of Tables

- Table 1: China Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Battery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: China Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China Battery Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: China Battery Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: China Battery Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 7: China Battery Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: China Battery Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 9: China Battery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: China Battery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: China Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Battery Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: China Battery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: China Battery Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 15: China Battery Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: China Battery Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 17: China Battery Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: China Battery Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 19: China Battery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Battery Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Battery Market?

The projected CAGR is approximately > 7.50%.

2. Which companies are prominent players in the China Battery Market?

Key companies in the market include EnerSys, Contemporary Amperex Technology Co Limited, East Penn Manufacturing Co Inc, TianJin Lishen Battery Joint-Stock Co Ltd, Saft Groupe SA, GS Yuasa International Ltd, C&D Technologies Inc, FIAMM Energy Technology SpA, Tesla Inc, LG Chem Ltd*List Not Exhaustive, Panasonic Corporation.

3. What are the main segments of the China Battery Market?

The market segments include Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

The Automotive Batteries Segment is Expected to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In July 2021, Contemporary Amperex Technology Co. Limited (CATL) unveiled the company's first-generation sodium-ion battery, together with its AB battery pack solution, which can integrate sodium-ion cells and lithium-ion cells into one pack. The company stated that sodium-ion batteries will provide a new solution for the use of clean energy and transportation electrification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Battery Market?

To stay informed about further developments, trends, and reports in the China Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence