Key Insights

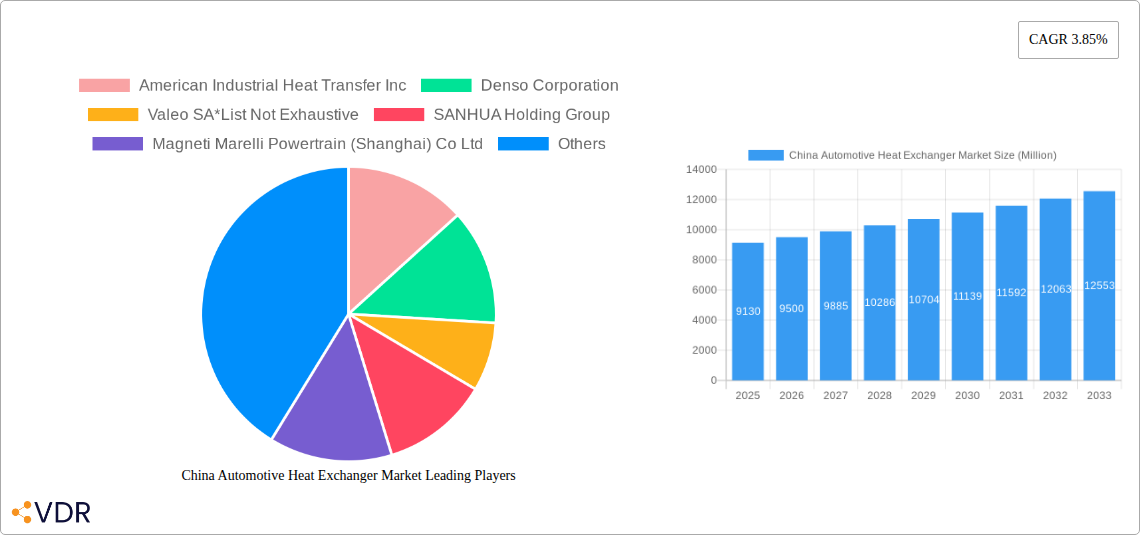

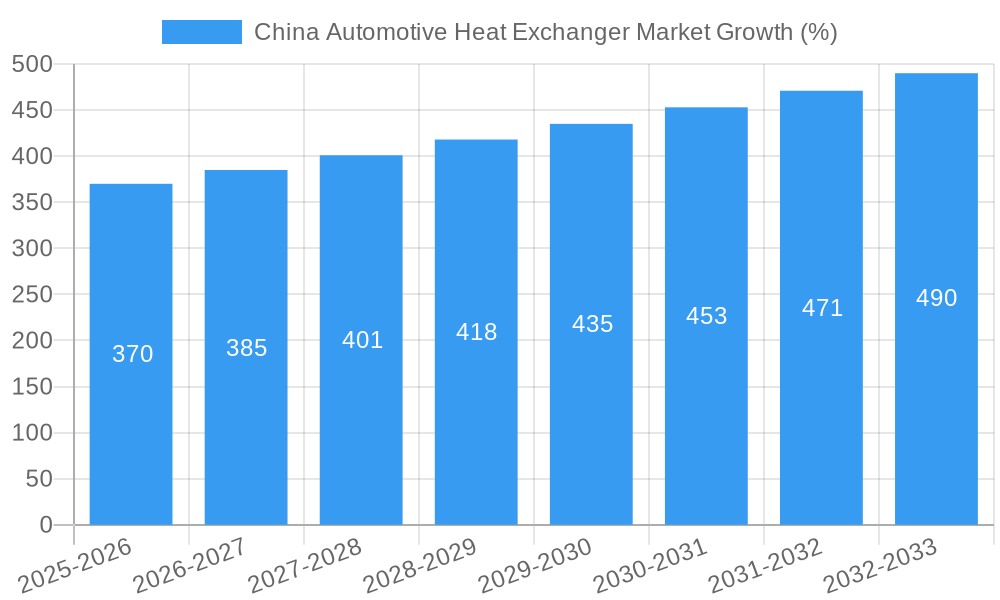

The China automotive heat exchanger market, valued at $9.13 billion in 2025, is projected to experience robust growth, driven by the burgeoning automotive industry and increasing demand for fuel-efficient and electric vehicles. A compound annual growth rate (CAGR) of 3.85% from 2025 to 2033 indicates a significant expansion in market size. Key growth drivers include stringent emission regulations pushing for advanced cooling technologies in both internal combustion engine (ICE) vehicles and electric vehicles (EVs). The rising adoption of EVs, particularly in China, further fuels demand for efficient battery thermal management systems, contributing significantly to market expansion. Segment-wise, passenger cars currently dominate the market, but the commercial vehicle segment is expected to witness considerable growth due to the increasing demand for heavy-duty vehicles and stricter emission standards in this sector. Technological advancements in heat exchanger designs, such as the adoption of more efficient materials and optimized fin designs (Tune-Fin and Plate-Bar), are further enhancing market prospects. However, fluctuating raw material prices and intense competition among established players and new entrants pose challenges to sustained growth.

Despite these challenges, the long-term outlook for the China automotive heat exchanger market remains positive. The increasing focus on lightweighting vehicles to improve fuel efficiency and the integration of advanced driver-assistance systems (ADAS) are contributing to the demand for sophisticated cooling solutions. Furthermore, government initiatives promoting electric vehicle adoption and investments in automotive manufacturing infrastructure are expected to stimulate significant market expansion in the coming years. Leading players in the market, including Denso, Valeo, MAHLE, and Hanon Systems, are actively investing in research and development to enhance their product offerings and strengthen their market position. This competitive landscape will further accelerate innovation and drive market growth, making the China automotive heat exchanger market an attractive investment destination.

China Automotive Heat Exchanger Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China automotive heat exchanger market, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for automotive manufacturers, component suppliers, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The report analyzes the parent market (Automotive Components) and the child market (Automotive Heat Exchangers) for a holistic view.

China Automotive Heat Exchanger Market Dynamics & Structure

The China automotive heat exchanger market is characterized by a moderately concentrated landscape with several dominant players and numerous smaller regional companies. Technological innovation, particularly in electric vehicle (EV) heat exchanger designs, is a key driver. Stringent emission regulations are pushing the adoption of advanced heat exchanger technologies. The market faces competition from alternative cooling solutions, but ongoing advancements offset this challenge.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Focus on lightweighting, improved efficiency, and integration with EVs is accelerating.

- Regulatory Framework: Emission standards are driving demand for efficient heat exchangers.

- Competitive Substitutes: Alternative cooling technologies pose a moderate threat.

- M&A Trends: The past five years saw xx M&A deals in the segment, indicating consolidation.

- End-User Demographics: Growth is primarily driven by increasing passenger car and commercial vehicle production.

The market exhibits a complex interplay of factors. Innovation barriers primarily relate to high R&D costs and the need for specialized materials for efficient heat transfer in EVs. The market is expected to consolidate further through mergers and acquisitions.

China Automotive Heat Exchanger Market Growth Trends & Insights

The China automotive heat exchanger market experienced robust growth during the historical period (2019-2024), driven by a surge in automobile production and government initiatives promoting vehicle electrification. This positive trajectory is expected to continue throughout the forecast period (2025-2033). The market size is estimated at xx million units in 2025 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx%. The adoption rate of advanced heat exchangers, especially in EVs, is rapidly increasing, fueled by technological advancements and supportive government policies.

Technological disruptions, such as the shift towards electric vehicles and the adoption of advanced materials, are significantly impacting market dynamics. Consumer behavior shifts towards fuel-efficient and environmentally friendly vehicles further contribute to the demand for sophisticated heat exchanger technologies. The market penetration of advanced heat exchangers (e.g., those utilizing innovative materials or designs) is steadily growing, reflecting increasing consumer awareness and demand for high-performance vehicles.

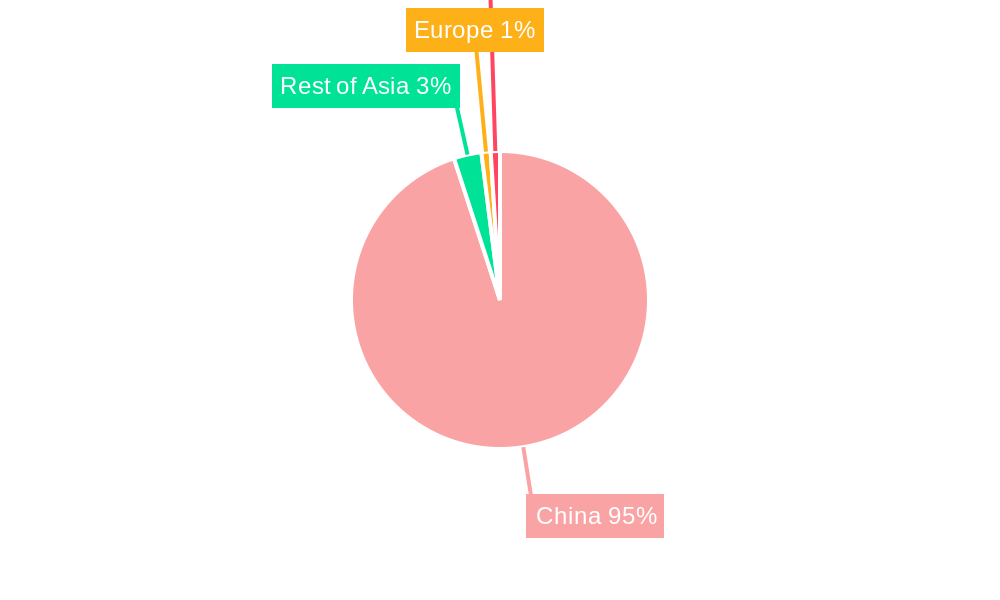

Dominant Regions, Countries, or Segments in China Automotive Heat Exchanger Market

The coastal regions of China, particularly those with established automotive manufacturing hubs, dominate the automotive heat exchanger market. Within applications, Radiators account for the largest segment, followed by Oil Coolers and Intercoolers. Passenger cars currently contribute the most significant portion of the market. However, the EV powertrain segment shows the highest growth potential.

- Leading Segment: Radiators (xx million units in 2025)

- Fastest Growing Segment: Electric Vehicle powertrains

- Key Regional Drivers: Strong automotive production in coastal provinces, government support for EV adoption.

The dominance of passenger cars reflects the high volume of passenger vehicle production in China. However, the fast growth in the commercial vehicle segment is expected to increase its market share in the coming years. Favorable economic policies, particularly government subsidies and tax incentives for EVs, significantly impact market growth in specific regions. Well-developed infrastructure and a strong supply chain within certain regions also play a crucial role.

China Automotive Heat Exchanger Market Product Landscape

The China automotive heat exchanger market displays a wide range of products, including radiators, oil coolers, intercoolers, air conditioning heat exchangers, and exhaust gas heat exchangers. Design types vary, encompassing tune-fin, plate-bar, and other specialized designs. Continuous innovation focuses on enhanced thermal efficiency, reduced weight, and improved durability. Unique selling propositions often include tailored designs for specific vehicle applications, integration with other vehicle systems, and the use of advanced materials. Technological advancements are constantly pushing the boundaries of heat transfer efficiency and reducing environmental impact.

Key Drivers, Barriers & Challenges in China Automotive Heat Exchanger Market

Key Drivers: The primary growth drivers include the booming automotive sector, increasing demand for fuel-efficient vehicles, stringent emission regulations, and the rapid growth of the electric vehicle market. Government incentives for EV adoption are also stimulating demand.

Challenges and Restraints: Supply chain disruptions, particularly regarding the sourcing of raw materials, and intense competition among manufacturers are major challenges. Regulatory hurdles related to emissions standards and product certifications can add complexity. Price competition and the need for continuous technological innovation pose significant challenges to companies operating in this market. These factors can impact profitability and growth.

Emerging Opportunities in China Automotive Heat Exchanger Market

Untapped markets include the growing demand for heat exchangers in hybrid electric vehicles (HEVs) and fuel-cell electric vehicles (FCEVs). Opportunities also exist in developing lightweight, high-efficiency heat exchangers using innovative materials and designs. The expanding adoption of advanced driver-assistance systems (ADAS) also creates opportunities for specialized heat exchanger solutions. The focus on improving vehicle thermal management is opening new avenues for growth.

Growth Accelerators in the China Automotive Heat Exchanger Market Industry

Technological advancements such as the development of high-performance materials and innovative designs will significantly boost market growth. Strategic collaborations between automakers and heat exchanger manufacturers can accelerate innovation and efficiency. Expanding into new markets, such as those for commercial vehicles and specialized automotive applications (e.g., buses and heavy-duty trucks), will fuel growth.

Key Players Shaping the China Automotive Heat Exchanger Market Market

- American Industrial Heat Transfer Inc

- Denso Corporation

- Valeo SA

- SANHUA Holding Group

- Magneti Marelli Powertrain (Shanghai) Co Ltd

- AKG Thermal Systems (Taicang) Co Ltd

- Zhejiang Lurun Group Co Ltd

- LU-VE Group

- Pierburg China Ltd Company

- MAHLE Group

- Conflux Technology

- Hanon Systems (Beijing) Co Ltd

- JIANGSU JIAHE THERMAL SYSTEN RADIATOR CO LTD

Notable Milestones in China Automotive Heat Exchanger Market Sector

- October 2022: Aiways launched the Aiways U6 SUV coupe featuring a new heat exchanger optimizing waste heat for cabin heating and battery conditioning.

- June 2023: LU-VE Group expanded its operations in China, focusing on automotive heat exchangers for HVAC and refrigeration applications.

- May 2023: Nippon Light Metal Holdings established a new subsidiary, integrating its auto parts business and accelerating EV product development.

In-Depth China Automotive Heat Exchanger Market Market Outlook

The future of the China automotive heat exchanger market is promising, driven by sustained growth in the automotive sector, the ongoing transition to electric vehicles, and the continuous advancement of heat exchanger technologies. Strategic opportunities lie in developing innovative solutions for efficient thermal management, lightweighting, and improved integration within vehicle systems. Companies that effectively leverage technological advancements and strategically navigate the evolving regulatory landscape are poised to benefit from the significant growth potential of this market.

China Automotive Heat Exchanger Market Segmentation

-

1. Application

- 1.1. Radiators

- 1.2. Oil Coolers

- 1.3. Intercoolers

- 1.4. Air Conditioning

- 1.5. Exhaust Gas

- 1.6. Other Applications

-

2. DesignType

- 2.1. Tune-Fin

- 2.2. Plate-Bar

- 2.3. Others

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Powertrain Type

- 4.1. IC Engine Vehicle

- 4.2. Electric Vehicles

China Automotive Heat Exchanger Market Segmentation By Geography

- 1. China

China Automotive Heat Exchanger Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Passenger Car Sales

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Used in Heat Exchangers

- 3.4. Market Trends

- 3.4.1. Increasing Electric Vehicle Sales in the Country Boosts the Market-

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Heat Exchanger Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Radiators

- 5.1.2. Oil Coolers

- 5.1.3. Intercoolers

- 5.1.4. Air Conditioning

- 5.1.5. Exhaust Gas

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by DesignType

- 5.2.1. Tune-Fin

- 5.2.2. Plate-Bar

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.4.1. IC Engine Vehicle

- 5.4.2. Electric Vehicles

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 American Industrial Heat Transfer Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Valeo SA*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SANHUA Holding Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Magneti Marelli Powertrain (Shanghai) Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AKG Thermal Systems (Taicang) Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Lurun Group Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LU-VE Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pierburg China Ltd Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MAHLE Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Conflux Technology

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hanon Systems (Beijing) Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JIANGSU JIAHE THERMAL SYSTEN RADIATOR CO LTD

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 American Industrial Heat Transfer Inc

List of Figures

- Figure 1: China Automotive Heat Exchanger Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Automotive Heat Exchanger Market Share (%) by Company 2024

List of Tables

- Table 1: China Automotive Heat Exchanger Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Automotive Heat Exchanger Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: China Automotive Heat Exchanger Market Revenue Million Forecast, by DesignType 2019 & 2032

- Table 4: China Automotive Heat Exchanger Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: China Automotive Heat Exchanger Market Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 6: China Automotive Heat Exchanger Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Automotive Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Automotive Heat Exchanger Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: China Automotive Heat Exchanger Market Revenue Million Forecast, by DesignType 2019 & 2032

- Table 10: China Automotive Heat Exchanger Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: China Automotive Heat Exchanger Market Revenue Million Forecast, by Powertrain Type 2019 & 2032

- Table 12: China Automotive Heat Exchanger Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Heat Exchanger Market?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the China Automotive Heat Exchanger Market?

Key companies in the market include American Industrial Heat Transfer Inc, Denso Corporation, Valeo SA*List Not Exhaustive, SANHUA Holding Group, Magneti Marelli Powertrain (Shanghai) Co Ltd, AKG Thermal Systems (Taicang) Co Ltd, Zhejiang Lurun Group Co Ltd, LU-VE Group, Pierburg China Ltd Company, MAHLE Group, Conflux Technology, Hanon Systems (Beijing) Co Ltd, JIANGSU JIAHE THERMAL SYSTEN RADIATOR CO LTD.

3. What are the main segments of the China Automotive Heat Exchanger Market?

The market segments include Application, DesignType, Vehicle Type, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Passenger Car Sales.

6. What are the notable trends driving market growth?

Increasing Electric Vehicle Sales in the Country Boosts the Market-.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Used in Heat Exchangers.

8. Can you provide examples of recent developments in the market?

May 2023: Nippon Light Metal Holdings Company Ltd. announced that it would integrate its Group's auto parts business and establish a new subsidiary. The new subsidiary, including the Nikkei Heat Exchanger Company, will aid in accelerating the development of products for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Heat Exchanger Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Heat Exchanger Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Heat Exchanger Market?

To stay informed about further developments, trends, and reports in the China Automotive Heat Exchanger Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence