Key Insights

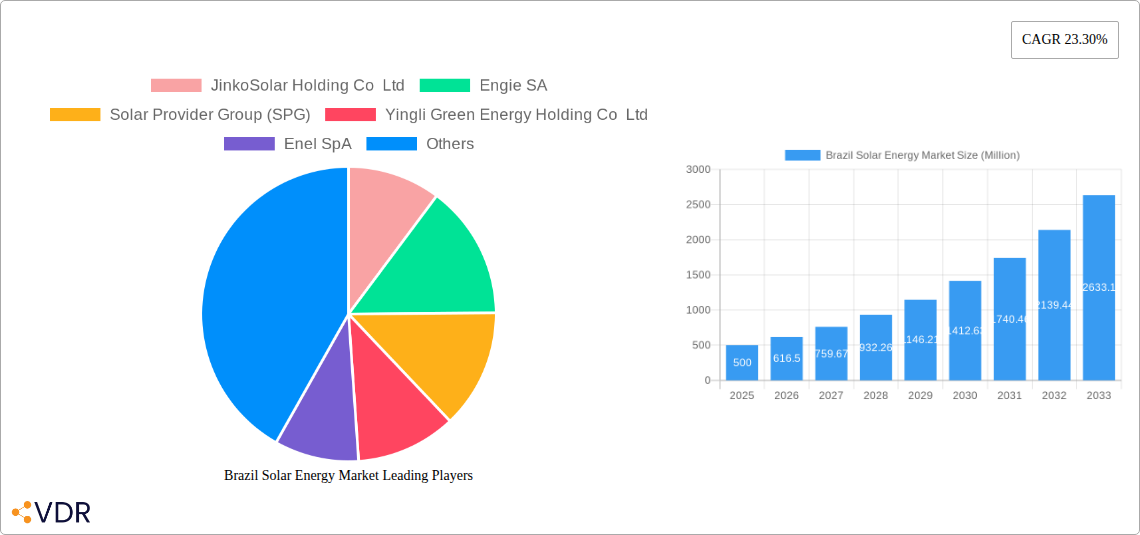

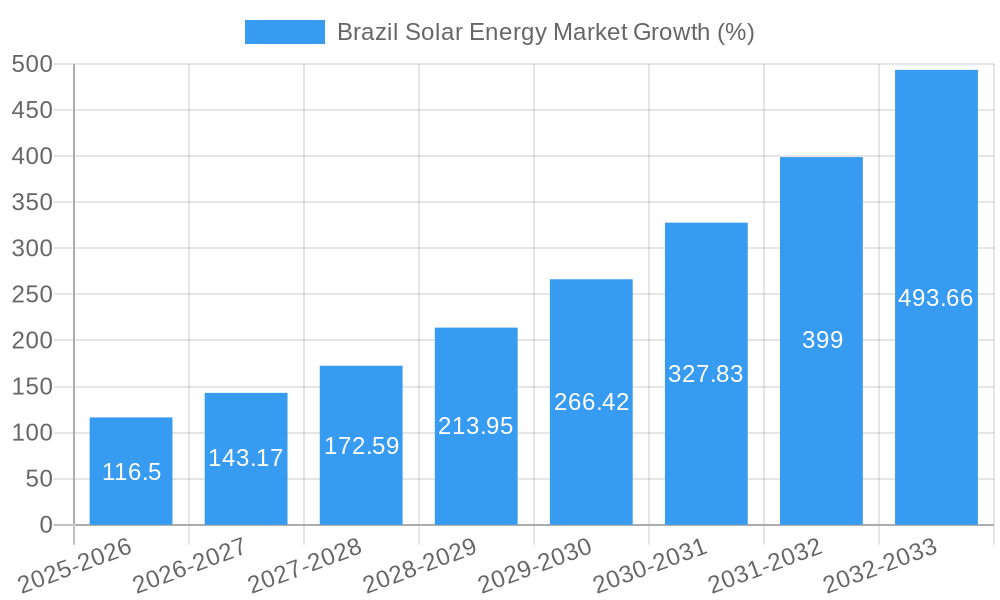

The Brazilian solar energy market is experiencing robust growth, fueled by increasing energy demand, government incentives promoting renewable energy adoption, and decreasing solar technology costs. With a Compound Annual Growth Rate (CAGR) of 23.30% from 2019 to 2033, the market presents significant investment opportunities. The market's segmentation into Solar Photovoltaic (PV) and Concentrated Solar Power (CSP) technologies reflects diverse applications, with PV likely dominating due to its lower initial investment and ease of implementation. Key players like JinkoSolar, Engie, and Canadian Solar are actively contributing to the market's expansion, leveraging their expertise in manufacturing, project development, and operations. While specific market size figures for 2019-2024 are unavailable, considering the 23.30% CAGR and a 2025 market size (let's assume a value of $500 million for illustrative purposes), we can project substantial growth in the forecast period (2025-2033). This growth is expected to be driven by large-scale solar farm projects, as well as increasing adoption of rooftop solar systems for residential and commercial consumers. Government policies supporting renewable energy integration within the national grid and initiatives to improve energy access in remote areas will further stimulate market expansion.

However, challenges remain. The relatively high initial capital expenditure for large-scale projects could deter some investors, and the intermittent nature of solar energy necessitates the development of efficient energy storage solutions for grid stability. Furthermore, land availability and regulatory hurdles related to permitting and grid connection can impact project timelines and overall market growth. Despite these constraints, the long-term outlook for the Brazilian solar energy market remains positive, driven by a strong commitment to sustainable energy development and increasing affordability of solar technology. The market is poised for significant expansion over the next decade, creating opportunities for both domestic and international players.

Brazil Solar Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Brazil solar energy market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (renewable energy) and child markets (Solar PV and Concentrated Solar Power), this report is an essential resource for industry professionals, investors, and policymakers seeking to understand and capitalize on this rapidly expanding sector. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Brazil Solar Energy Market Dynamics & Structure

The Brazilian solar energy market is experiencing robust growth, driven by a combination of factors including supportive government policies, increasing energy demand, and decreasing technology costs. Market concentration is currently moderate, with several large multinational players alongside a growing number of local companies. Technological innovation is primarily focused on improving efficiency and reducing the cost of solar PV systems. The regulatory framework, while generally supportive, faces ongoing evolution to accommodate the sector's rapid expansion. Concentrated Solar Power (CSP) technology adoption is currently lower than Solar PV, but it shows potential for future growth in specific regions. Competitive substitutes include hydropower and wind energy, though solar's cost competitiveness is becoming increasingly compelling.

- Market Concentration: Moderate, with a mix of large multinational and local players. xx% market share held by the top 5 players in 2025.

- Technological Innovation: Focus on efficiency improvements in PV cells and CSP technologies. Significant R&D investment observed in the last 5 years.

- Regulatory Framework: Supportive, but undergoing continuous refinement to streamline permitting and grid integration processes.

- Competitive Substitutes: Hydropower and wind energy. Solar's cost advantage is increasingly prominent.

- End-User Demographics: Residential, commercial, and industrial sectors. Growing adoption among SMEs and rural communities.

- M&A Trends: Significant increase in M&A activity in recent years, driven by consolidation and expansion strategies. xx number of deals in the last 5 years with a total value of xx Million USD.

Brazil Solar Energy Market Growth Trends & Insights

The Brazilian solar energy market exhibits a significant upward trajectory. The market size experienced substantial growth during the historical period (2019-2024), primarily fueled by decreasing costs, government incentives, and rising electricity prices. This growth is projected to continue throughout the forecast period (2025-2033), with a compound annual growth rate (CAGR) of xx% expected. Technological advancements, particularly in PV technology, are driving down installation costs and enhancing efficiency. Consumer behavior shifts towards environmentally friendly energy sources further bolster adoption rates. The increasing penetration of distributed generation, enabled by rooftop solar installations, signifies a notable trend. Market penetration is expected to reach xx% by 2033, up from xx% in 2025.

Dominant Regions, Countries, or Segments in Brazil Solar Energy Market

The Southeast region of Brazil is currently the leading market for solar energy, driven by high energy demand, favorable regulatory frameworks, and existing infrastructure. The states of Minas Gerais, São Paulo, and Rio de Janeiro are particularly significant. Within technology segments, Solar PV overwhelmingly dominates the market, accounting for xx% of total installed capacity in 2025. CSP technology adoption remains comparatively low but is anticipated to see growth in the future, especially in regions with high solar irradiance and suitable land availability.

- Key Drivers in Southeast Region: High energy demand, supportive state-level policies, established infrastructure, and favorable solar irradiance.

- Solar PV Dominance: Driven by lower cost, higher efficiency, and wider availability compared to CSP.

- CSP Potential: Growth expected in sunnier, less populated regions with suitable land availability for large-scale projects.

Brazil Solar Energy Market Product Landscape

The Brazilian solar energy market features a diverse product landscape, encompassing various PV module types (monocrystalline, polycrystalline, thin-film), inverters, racking systems, and balance-of-system (BOS) components. Technological advancements focus on improving efficiency, durability, and cost-effectiveness. The market shows a strong preference for high-efficiency PV modules with longer warranties. Innovative products, such as integrated solar roofing systems and energy storage solutions, are gaining traction.

Key Drivers, Barriers & Challenges in Brazil Solar Energy Market

Key Drivers:

- Decreasing solar PV technology costs.

- Supportive government policies and incentives.

- Growing awareness of environmental sustainability and climate change.

- Rising electricity prices.

Key Barriers and Challenges:

- Grid infrastructure limitations in certain regions.

- Financing challenges for large-scale projects.

- Intermittency of solar power and the need for energy storage solutions.

- Bureaucratic processes and permitting delays. These delays contribute to an estimated xx% increase in project costs.

Emerging Opportunities in Brazil Solar Energy Market

- Untapped potential in rural electrification and off-grid solutions.

- Increasing demand for energy storage systems for improved grid stability.

- Growing interest in agrivoltaics and floating solar projects.

- Opportunities for the development of specialized services such as Operations & Maintenance (O&M) and financing.

Growth Accelerators in the Brazil Solar Energy Market Industry

Long-term growth in the Brazilian solar energy market will be fueled by continued technological advancements leading to even lower costs and improved efficiencies. Strategic partnerships between energy companies, technology providers, and financial institutions are expected to play a crucial role in scaling up projects. Government initiatives to further streamline regulations and support grid infrastructure will significantly bolster market expansion.

Key Players Shaping the Brazil Solar Energy Market Market

- JinkoSolar Holding Co Ltd

- Engie SA

- Solar Provider Group (SPG)

- Yingli Green Energy Holding Co Ltd

- Enel SpA

- NextTracker Inc

- Canadian Solar Inc

- Scatec Solar ASA

- JA Solar Holdings Co Ltd

Notable Milestones in Brazil Solar Energy Market Sector

- June 2023: The European Investment Bank (EIB) provided a USD 213 million (EUR 200 million) loan to Sicredi for solar PV investments in homes, SMEs, and rural areas.

- August 2022: Exus Brasil Investimentos acquired Riacho da Serra Energia S.A., a portfolio of 20 solar parks with over 1GW installed capacity.

In-Depth Brazil Solar Energy Market Market Outlook

The Brazilian solar energy market is poised for continued, substantial growth over the next decade. The factors driving this growth—decreasing costs, supportive policies, and rising energy demand—are expected to persist. Strategic investment in grid infrastructure and energy storage will unlock even greater market potential. Opportunities abound for innovative solutions, such as integrated solar rooftops and smart energy management systems, further shaping the market landscape.

Brazil Solar Energy Market Segmentation

-

1. Technology

- 1.1. Solar PV

- 1.2. Concentrated Solar Power (CSP)

Brazil Solar Energy Market Segmentation By Geography

- 1. Brazil

Brazil Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Renewable Energy Generation4.; Rapidly Growing Demand for Net Metering of Bills

- 3.3. Market Restrains

- 3.3.1. 4.; Applicable Fee for Solar Systems with up to 5 MW by ANEEL

- 3.4. Market Trends

- 3.4.1. Rising Electricity Demand to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar PV

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JinkoSolar Holding Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Engie SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solar Provider Group (SPG)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yingli Green Energy Holding Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Enel SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NextTracker Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canadian Solar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Scatec Solar ASA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JA Solar Holdings Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Brazil Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Solar Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 3: Brazil Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Brazil Solar Energy Market Volume Gigawatte Forecast, by Technology 2019 & 2032

- Table 5: Brazil Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazil Solar Energy Market Volume Gigawatte Forecast, by Region 2019 & 2032

- Table 7: Brazil Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil Solar Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

- Table 9: Brazil Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 10: Brazil Solar Energy Market Volume Gigawatte Forecast, by Technology 2019 & 2032

- Table 11: Brazil Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Solar Energy Market Volume Gigawatte Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Solar Energy Market?

The projected CAGR is approximately 23.30%.

2. Which companies are prominent players in the Brazil Solar Energy Market?

Key companies in the market include JinkoSolar Holding Co Ltd, Engie SA, Solar Provider Group (SPG), Yingli Green Energy Holding Co Ltd, Enel SpA, NextTracker Inc, Canadian Solar Inc, Scatec Solar ASA, JA Solar Holdings Co Ltd.

3. What are the main segments of the Brazil Solar Energy Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Renewable Energy Generation4.; Rapidly Growing Demand for Net Metering of Bills.

6. What are the notable trends driving market growth?

Rising Electricity Demand to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Applicable Fee for Solar Systems with up to 5 MW by ANEEL.

8. Can you provide examples of recent developments in the market?

In June 2023, the European Investment Bank (EIB) has provided a loan of USD 213 million (EUR 200 million) loan to a cooperative financial institution in Brazil, Sicredi for investments in solar energy. Sicredi will use the funding to establish solar photovoltaic (PV) panels in individual homes, small and medium businesses, and rural properties in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatte.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Solar Energy Market?

To stay informed about further developments, trends, and reports in the Brazil Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence