Key Insights

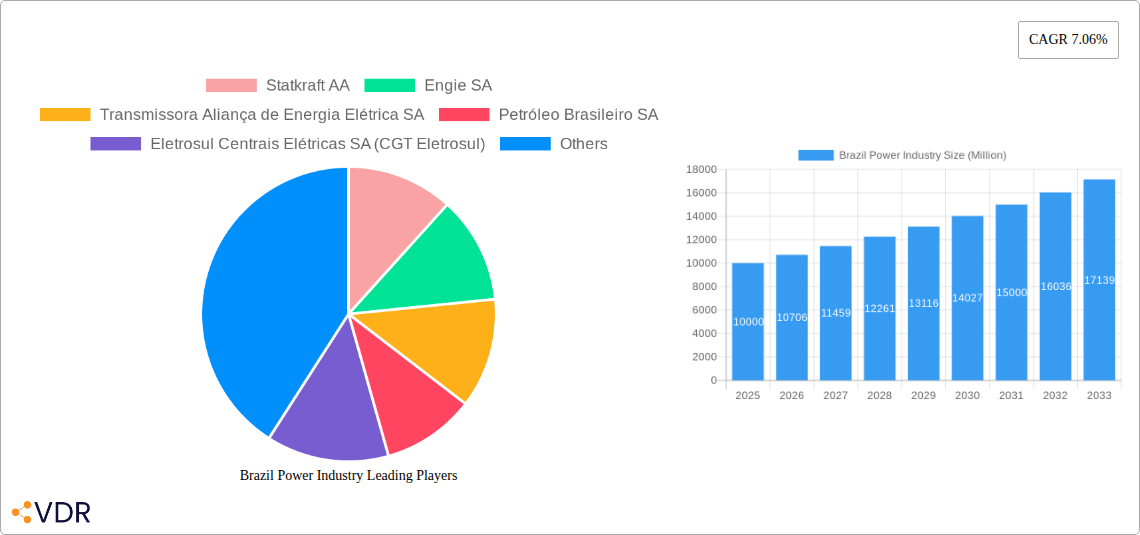

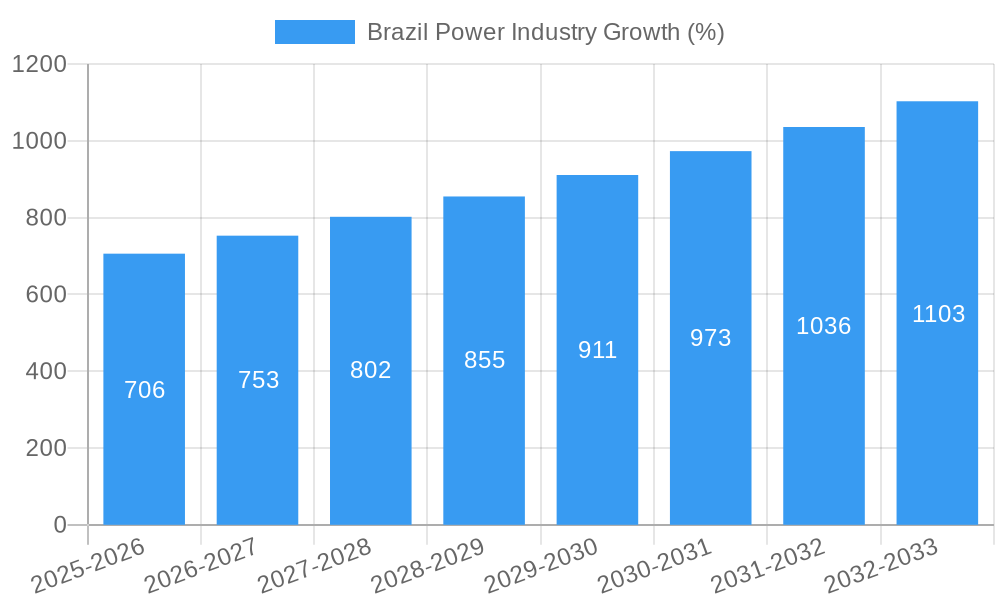

The Brazilian power industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 7.06% from 2025 to 2033. This expansion is fueled by several key drivers. Increased industrialization and urbanization are driving electricity demand, necessitating significant investments in power generation and transmission infrastructure. Furthermore, a growing emphasis on renewable energy sources, particularly hydropower and non-hydro renewables like solar and wind, is reshaping the industry landscape. Government initiatives promoting energy diversification and sustainability are also contributing to this positive outlook. However, the sector faces certain challenges. Fluctuations in water levels impacting hydropower generation, along with the need for continuous grid modernization and expansion to accommodate increased demand, represent potential constraints. The segment breakdown reveals a significant contribution from hydropower, reflecting Brazil's abundant water resources. Thermal power generation remains a substantial component, but its share is likely to decline gradually due to the growing adoption of renewables. Nuclear power contributes a smaller yet stable portion, while the non-hydro renewable segment is poised for significant expansion over the forecast period. Key players such as Statkraft, Engie, and Petróleo Brasileiro are actively shaping the market dynamics through investments, partnerships, and project developments.

Competition among these major players and the influx of new entrants are further stimulating innovation and efficiency improvements across the value chain. The regional focus on Brazil underscores the country's significant role in the South American energy market. The forecast period (2025-2033) offers ample opportunities for investments and expansion, especially in renewable energy infrastructure. The historical period (2019-2024) provides a valuable baseline for understanding the industry's trajectory and predicting future trends. Continuous monitoring of regulatory changes, technological advancements, and environmental concerns will be critical for companies operating within this dynamic and evolving market. The sustained growth trajectory signifies Brazil's commitment to meeting its energy demands while embracing cleaner and more sustainable power generation solutions.

Brazil Power Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Brazilian power industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on power generation segments (Thermal, Hydropower, Nuclear, Non-hydro Renewables), this report is essential for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Brazil Power Industry Market Dynamics & Structure

The Brazilian power industry is characterized by a complex interplay of market concentration, technological innovation, regulatory frameworks, and intense competition. Hydropower historically dominated, but a shift towards renewables and thermal sources is underway. The market exhibits moderate concentration, with a few large players holding significant market share, complemented by numerous smaller independent power producers (IPPs). Mergers and acquisitions (M&A) activity has been relatively consistent, driven by consolidation and expansion into renewable energy segments.

- Market Concentration: The top 5 players account for approximately xx% of the market in 2025 (estimated).

- Technological Innovation: Significant investments in renewable energy technologies, particularly wind and solar, are reshaping the industry landscape. However, regulatory hurdles and grid infrastructure limitations pose challenges to rapid adoption.

- Regulatory Framework: The regulatory environment is evolving, aiming to foster competition, attract investment in renewables, and ensure energy security. However, regulatory uncertainty can sometimes hinder investment decisions.

- Competitive Product Substitutes: The primary competitive pressure arises from the increasing affordability and accessibility of renewable energy sources, gradually replacing reliance on traditional thermal plants.

- End-User Demographics: The expanding Brazilian economy and increasing electrification rates across various sectors create significant demand for power, boosting the growth of the industry.

- M&A Trends: The past five years have witnessed an average of xx M&A deals annually (2019-2024), predominantly focused on renewable energy assets and infrastructure upgrades.

Brazil Power Industry Growth Trends & Insights

The Brazilian power industry is projected to experience robust growth over the forecast period (2025-2033). Driven by economic expansion, increasing energy demand, and government initiatives promoting renewable energy adoption, the market is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during this time. The adoption rate of renewable energy sources is accelerating, with significant investments in wind and solar projects transforming the energy mix. Consumer behavior is shifting towards greater awareness of environmental sustainability, pushing demand for clean energy solutions.

Dominant Regions, Countries, or Segments in Brazil Power Industry

Hydropower remains the dominant power generation segment in Brazil, accounting for xx% of the total installed capacity in 2025 (estimated). However, significant growth is projected for non-hydro renewables, particularly solar and wind, driven by favorable government policies and declining technology costs.

- Hydropower: The Southeast and South regions are the most significant contributors to hydropower generation due to their abundant water resources and established infrastructure.

- Thermal Power: Thermal power generation largely remains concentrated near major industrial centers and population hubs.

- Nuclear Power: Nuclear power capacity constitutes a smaller portion but is poised for potential expansion following the 2022 agreement to study new plant sites.

- Non-hydro Renewables: The Northeast and North regions are witnessing rapid development of wind and solar projects owing to their favorable geographical conditions.

- Key Drivers: Government incentives for renewables, expanding grid infrastructure, and decreasing technology costs are driving market expansion.

Brazil Power Industry Product Landscape

The Brazilian power industry features a diversified product landscape, encompassing a wide range of conventional and renewable energy generation technologies, transmission equipment, and distribution infrastructure. Recent innovations include advanced energy storage systems, smart grid technologies, and improved efficiency in renewable energy production. These technological advancements aim to enhance grid stability, reliability, and the integration of intermittent renewable sources.

Key Drivers, Barriers & Challenges in Brazil Power Industry

Key Drivers: Government initiatives promoting renewable energy integration, economic growth driving electricity demand, and advancements in renewable energy technologies are propelling market growth.

Key Challenges: Limited grid infrastructure in some regions, regulatory complexities, and the need to manage the intermittent nature of renewable energy sources pose significant challenges. Supply chain disruptions can also lead to cost increases and project delays, impacting overall market progress. Estimated losses from these challenges could range around xx Million annually.

Emerging Opportunities in Brazil Power Industry

The increasing demand for clean energy, coupled with the government's commitment to renewables, offers vast opportunities for investment in solar, wind, and other renewable energy projects. Furthermore, the development of smart grid technologies and energy storage solutions presents significant opportunities for companies to innovate and enhance grid efficiency and reliability. There's also a growing need for effective energy management solutions to address power imbalances and streamline energy consumption.

Growth Accelerators in the Brazil Power Industry Industry

Technological advancements, especially in battery storage technologies, are enabling greater integration of intermittent renewables into the grid. Strategic partnerships between international and domestic companies are accelerating the deployment of large-scale renewable energy projects. Government support and regulatory changes are further stimulating investments in the sector, fostering overall market growth.

Key Players Shaping the Brazil Power Industry Market

- Statkraft AA

- Engie SA

- Transmissora Aliança de Energia Elétrica SA

- Petróleo Brasileiro SA

- Eletrosul Centrais Elétricas SA (CGT Eletrosul)

- Enel Brasil

- Norte Energia SA

- Omega Energia SA

- Neoenergia SA

Notable Milestones in Brazil Power Industry Sector

- March 2023: Petrobras and Equinor's agreement to explore seven offshore wind projects with a potential capacity of up to 14.5 GW signifies a major step towards developing Brazil's offshore wind energy sector.

- March 2022: The government's cooperation agreement with the Electric Energy Research Center to identify new nuclear plant sites indicates a potential shift towards nuclear energy to enhance energy security and mitigate water crisis impacts on hydropower.

In-Depth Brazil Power Industry Market Outlook

The Brazilian power industry is poised for sustained growth, driven by robust economic growth, increasing energy demands, and a strong government push towards renewable energy sources. Strategic partnerships, technological breakthroughs, and infrastructure investments will be pivotal in shaping the future of the industry. The potential for growth in offshore wind, alongside the continuing development of solar and wind power, presents significant opportunities for investors and market participants. However, overcoming infrastructure challenges and ensuring grid stability will be critical to fully realizing this potential.

Brazil Power Industry Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Hydropower

- 1.3. Nuclear

- 1.4. Non-hydro Renewables

- 2. Power Transmission and Distribution (T&D)

Brazil Power Industry Segmentation By Geography

- 1. Brazil

Brazil Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Other Renewable Sources Such as Solar Energy

- 3.4. Market Trends

- 3.4.1. Hydropower to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Hydropower

- 5.1.3. Nuclear

- 5.1.4. Non-hydro Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Statkraft AA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Engie SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Transmissora Aliança de Energia Elétrica SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petróleo Brasileiro SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eletrosul Centrais Elétricas SA (CGT Eletrosul)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Enel Brasil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Norte Energia SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Omega Energia SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Neoenergia SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Statkraft AA

List of Figures

- Figure 1: Brazil Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Brazil Power Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 4: Brazil Power Industry Volume Gigawatt Forecast, by Power Generation 2019 & 2032

- Table 5: Brazil Power Industry Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 6: Brazil Power Industry Volume Gigawatt Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 7: Brazil Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Brazil Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Brazil Power Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 12: Brazil Power Industry Volume Gigawatt Forecast, by Power Generation 2019 & 2032

- Table 13: Brazil Power Industry Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 14: Brazil Power Industry Volume Gigawatt Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 15: Brazil Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Power Industry?

The projected CAGR is approximately 7.06%.

2. Which companies are prominent players in the Brazil Power Industry?

Key companies in the market include Statkraft AA, Engie SA, Transmissora Aliança de Energia Elétrica SA, Petróleo Brasileiro SA, Eletrosul Centrais Elétricas SA (CGT Eletrosul), Enel Brasil, Norte Energia SA, Omega Energia SA, Neoenergia SA.

3. What are the main segments of the Brazil Power Industry?

The market segments include Power Generation, Power Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources.

6. What are the notable trends driving market growth?

Hydropower to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Other Renewable Sources Such as Solar Energy.

8. Can you provide examples of recent developments in the market?

March 2023: Petrobras and Equinor entered an agreement aiming to expand cooperation between the companies to analyze the technical, economic, and environmental feasibility of seven offshore wind power generation projects. These projects are projected to have the potential to produce up to 14.5 GW. Initially, it will expand on the scope of two planned wind farms, namely, Aracatu I and II, located on the coast between Rio de Janeiro and Espírito Santo. The new agreement also considers a feasibility study of wind farms in Mangara (on the coast of Piaui); Ibitucatu (on the coast of Ceara); Colibri (on the coast between Rio Grande do Norte and Ceara), as well as Atoba and Ibituassu both on the coast of Rio Grande do Sul. In total, there are seven projects set to run until 2028.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Power Industry?

To stay informed about further developments, trends, and reports in the Brazil Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence