Key Insights

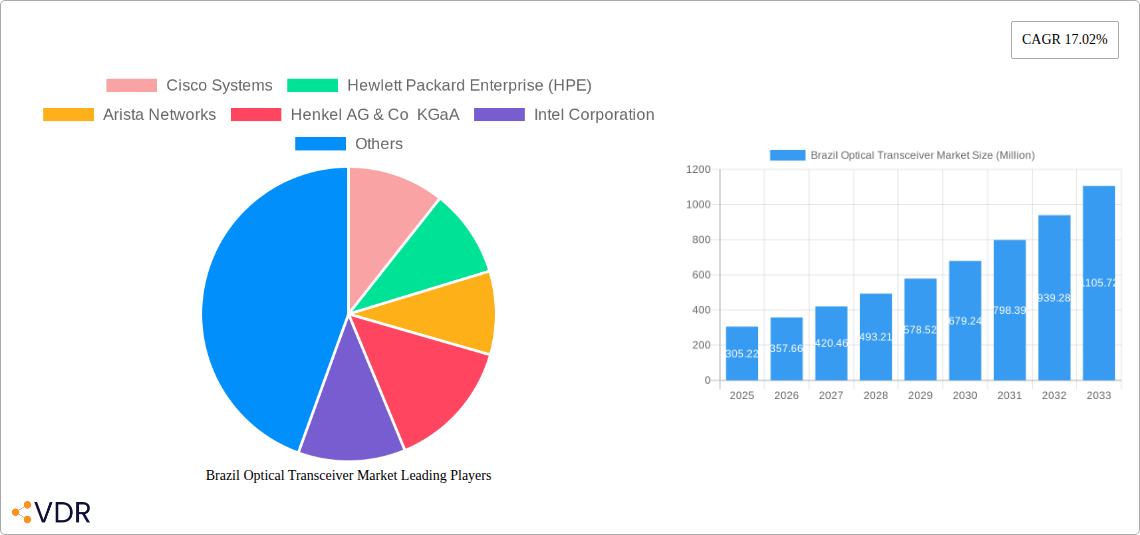

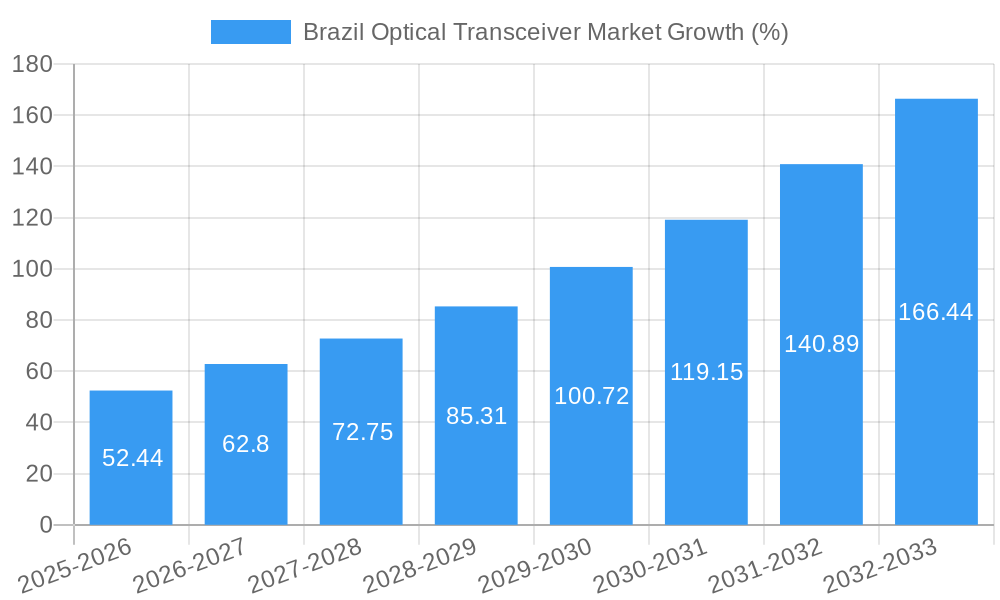

The Brazil optical transceiver market, valued at $305.22 million in 2025, is projected to experience robust growth, driven by the expanding telecommunications infrastructure and increasing adoption of high-speed data networks across the country. The market's Compound Annual Growth Rate (CAGR) of 17.02% from 2025 to 2033 indicates significant potential for expansion. This growth is fueled by several factors. The Brazilian government's investment in digital infrastructure initiatives, aiming to bridge the digital divide and enhance connectivity, is a key driver. Furthermore, the burgeoning demand for high-bandwidth applications, such as cloud computing, 5G deployment, and streaming services, is stimulating the adoption of high-performance optical transceivers. Increased adoption of data centers and enterprise networks within Brazil also contributes to market expansion. Competitive pricing strategies from major players, including Cisco, HPE, and Arista Networks, further fuel market growth. However, economic fluctuations within Brazil and the potential for supply chain disruptions could pose challenges to the market's sustained growth. The market is segmented by type (e.g., SFP, SFP+, QSFP), data rate, and application (e.g., telecom, data centers), allowing for nuanced analysis of specific growth opportunities.

The future of the Brazilian optical transceiver market looks promising, with continued expansion driven by the ongoing digital transformation. The high CAGR indicates significant investment opportunities. However, strategic players must actively monitor economic conditions and supply chain dynamics to mitigate potential risks. Focusing on high-growth segments like 5G infrastructure and data center deployments will be crucial for capturing a larger market share. Moreover, building robust partnerships with local telecommunication providers and system integrators will be vital for sustained market penetration. Market players are expected to increasingly focus on innovation in energy efficiency and cost-effectiveness of optical transceivers to remain competitive.

Brazil Optical Transceiver Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Brazil Optical Transceiver Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. This in-depth study is crucial for industry professionals, investors, and anyone seeking a deep understanding of this rapidly evolving market. The report analyzes the parent market of Optical Transceivers and delves into the child market specific to Brazil, providing granular insights for strategic decision-making. Market size is presented in million units.

Brazil Optical Transceiver Market Dynamics & Structure

The Brazilian optical transceiver market is characterized by a moderately concentrated landscape, with key players vying for market share. Technological innovation, particularly in high-speed data transmission and energy efficiency, is a significant driver. Government initiatives promoting digital infrastructure development influence market growth. The market faces competition from alternative technologies like wireless communication, though optical transceivers maintain a strong advantage in high-bandwidth applications. The end-user demographics are dominated by telecommunications companies, data centers, and enterprises increasingly adopting cloud services. M&A activity is moderate, with strategic acquisitions focused on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Focus on higher speeds (400G, 800G and beyond), improved power efficiency, and smaller form factors.

- Regulatory Framework: Government regulations supporting broadband infrastructure expansion positively impact market growth.

- Competitive Substitutes: Wireless technologies pose a competitive threat, but optical transceivers dominate in high-bandwidth applications.

- End-User Demographics: Telecommunication companies, data centers, and enterprises are major end-users.

- M&A Trends: Moderate activity, primarily driven by strategic acquisitions to expand product lines and market reach. xx M&A deals were recorded between 2019-2024.

Brazil Optical Transceiver Market Growth Trends & Insights

The Brazilian optical transceiver market experienced robust growth during the historical period (2019-2024), driven by expanding internet penetration, increasing data traffic, and investments in 5G infrastructure. The market size reached xx million units in 2024. The adoption rate of higher-speed optical transceivers is accelerating, particularly in data centers and enterprise networks. Technological disruptions, such as the introduction of coherent optical technology, are pushing the market towards higher capacities and longer transmission distances. Changing consumer behavior towards greater reliance on cloud services and streaming media further fuels market growth. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Market penetration is expected to increase significantly in underserved regions.

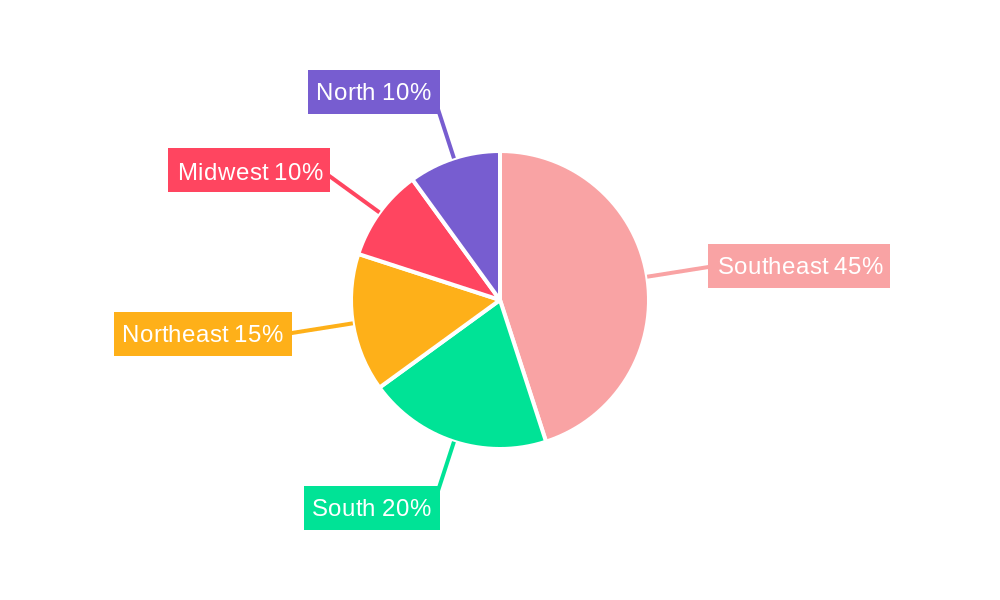

Dominant Regions, Countries, or Segments in Brazil Optical Transceiver Market

The Southeast region of Brazil is the dominant market segment, accounting for approximately xx% of the total market in 2024 due to a higher concentration of data centers, telecommunications infrastructure, and industrial activities. São Paulo, in particular, plays a crucial role due to its status as a major economic hub and technological center. The growth is primarily driven by investments in 5G network deployment, growing demand for high-speed internet access, and expanding cloud adoption within businesses and consumers.

- Key Drivers in Southeast Region:

- Extensive fiber optic network deployments.

- High concentration of data centers and telecommunications companies.

- Strong economic activity and investments in digital infrastructure.

- Government initiatives promoting digital inclusion and technological advancement.

The market dominance of Southeast Brazil stems from a combination of factors, including:

- Higher concentration of data centers and telecommunication infrastructure.

- Favorable regulatory environment encouraging technological advancements.

- Robust economic growth, leading to greater investment in high-bandwidth services.

Brazil Optical Transceiver Market Product Landscape

The Brazilian market offers a diverse range of optical transceivers, including SFP, SFP+, XFP, QSFP, and others, catering to various applications and data rates. Recent innovations have focused on higher speed transceivers (400G, 800G), enhanced power efficiency, and compact form factors. Unique selling propositions often include improved signal quality, longer transmission distances, and better compatibility with existing infrastructure. Technological advancements consistently push the boundaries of data transmission speed and reach.

Key Drivers, Barriers & Challenges in Brazil Optical Transceiver Market

Key Drivers:

- Growing demand for higher bandwidth fueled by increasing data traffic and cloud adoption.

- Government initiatives to expand digital infrastructure and enhance broadband connectivity.

- Increasing adoption of 5G networks driving demand for higher-speed optical transceivers.

Key Challenges:

- Economic fluctuations impacting investment in telecommunication infrastructure.

- Competition from alternative technologies (wireless communication).

- Supply chain disruptions impacting the availability and cost of components.

Emerging Opportunities in Brazil Optical Transceiver Market

- Expansion of fiber optic networks in underserved regions.

- Growing adoption of cloud-based services and data centers.

- Opportunities in specialized applications such as industrial automation and healthcare.

Growth Accelerators in the Brazil Optical Transceiver Market Industry

The long-term growth of the Brazilian optical transceiver market is fueled by technological breakthroughs in higher-speed and energy-efficient transceivers, strategic partnerships between technology providers and telecommunications operators, and expansion strategies targeting underserved regions.

Key Players Shaping the Brazil Optical Transceiver Market Market

- Cisco Systems

- Hewlett Packard Enterprise (HPE)

- Arista Networks

- Henkel AG & Co KGaA

- Intel Corporation

- NWS

- Coherent Corp

- D-Link International Pte Ltd

- Perle Systems

- Sumitomo Electric Industries Ltd

- Huawei Technologies Co Ltd

- Fujitsu Limited

Notable Milestones in Brazil Optical Transceiver Market Sector

- June 2024: Integra Optics launched the SFP+, 10/2.5 G BiDi, 20km, XGSPON OLT transceiver, enhancing XG/XGS-PON applications.

- May 2024: Samtec established its Optical Transceiver Center of Excellence (CoE), providing design tools and expertise for optical engineers.

In-Depth Brazil Optical Transceiver Market Outlook

The future of the Brazilian optical transceiver market appears bright, driven by continued investments in digital infrastructure, the expansion of 5G networks, and growing demand for high-speed data transmission. Strategic partnerships and technological innovations will play a crucial role in shaping the market landscape and unlocking new growth opportunities. The market is poised for significant expansion, presenting lucrative prospects for both established players and new entrants.

Brazil Optical Transceiver Market Segmentation

-

1. Protocol

- 1.1. Ethernet

- 1.2. Fiber Channels (including FTTx)

- 1.3. CWDM/DWDM

- 1.4. Other Protocols

-

2. Data Rate

- 2.1. Less than 10 Gbps

- 2.2. 10 Gbps to 40 Gbps

- 2.3. 41 Gbps to 100 Gbps

- 2.4. Greater than 100 Gbps (including 400 Gbps)

-

3. Application

- 3.1. Data Center

- 3.2. Telecommunication

- 3.3. Other Ap

Brazil Optical Transceiver Market Segmentation By Geography

- 1. Brazil

Brazil Optical Transceiver Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Digitalization Leading the Surge in Demand for High-speed Transmission Network; Widespread Implementation of 5G and Increase in Demand for Cloud-based Services; Data Center Expansions

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Digitalization Leading the Surge in Demand for High-speed Transmission Network; Widespread Implementation of 5G and Increase in Demand for Cloud-based Services; Data Center Expansions

- 3.4. Market Trends

- 3.4.1. Data Centers is the Fastest Growing Application for Optical Transceivers in Brazil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Optical Transceiver Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protocol

- 5.1.1. Ethernet

- 5.1.2. Fiber Channels (including FTTx)

- 5.1.3. CWDM/DWDM

- 5.1.4. Other Protocols

- 5.2. Market Analysis, Insights and Forecast - by Data Rate

- 5.2.1. Less than 10 Gbps

- 5.2.2. 10 Gbps to 40 Gbps

- 5.2.3. 41 Gbps to 100 Gbps

- 5.2.4. Greater than 100 Gbps (including 400 Gbps)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Data Center

- 5.3.2. Telecommunication

- 5.3.3. Other Ap

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Protocol

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cisco Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hewlett Packard Enterprise (HPE)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Henkel AG & Co KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Intel Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NWS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Coherent Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 D-Link International Pte Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Perle Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sumitomo Electric Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huawei Technologies Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Fujitsu Limite

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems

List of Figures

- Figure 1: Brazil Optical Transceiver Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Optical Transceiver Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Optical Transceiver Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Optical Transceiver Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil Optical Transceiver Market Revenue Million Forecast, by Protocol 2019 & 2032

- Table 4: Brazil Optical Transceiver Market Volume Million Forecast, by Protocol 2019 & 2032

- Table 5: Brazil Optical Transceiver Market Revenue Million Forecast, by Data Rate 2019 & 2032

- Table 6: Brazil Optical Transceiver Market Volume Million Forecast, by Data Rate 2019 & 2032

- Table 7: Brazil Optical Transceiver Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Brazil Optical Transceiver Market Volume Million Forecast, by Application 2019 & 2032

- Table 9: Brazil Optical Transceiver Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Optical Transceiver Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Brazil Optical Transceiver Market Revenue Million Forecast, by Protocol 2019 & 2032

- Table 12: Brazil Optical Transceiver Market Volume Million Forecast, by Protocol 2019 & 2032

- Table 13: Brazil Optical Transceiver Market Revenue Million Forecast, by Data Rate 2019 & 2032

- Table 14: Brazil Optical Transceiver Market Volume Million Forecast, by Data Rate 2019 & 2032

- Table 15: Brazil Optical Transceiver Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Brazil Optical Transceiver Market Volume Million Forecast, by Application 2019 & 2032

- Table 17: Brazil Optical Transceiver Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Optical Transceiver Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Optical Transceiver Market?

The projected CAGR is approximately 17.02%.

2. Which companies are prominent players in the Brazil Optical Transceiver Market?

Key companies in the market include Cisco Systems, Hewlett Packard Enterprise (HPE), Arista Networks, Henkel AG & Co KGaA, Intel Corporation, NWS, Coherent Corp, D-Link International Pte Ltd, Perle Systems, Sumitomo Electric Industries Ltd, Huawei Technologies Co Ltd, Fujitsu Limite.

3. What are the main segments of the Brazil Optical Transceiver Market?

The market segments include Protocol, Data Rate, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 305.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Digitalization Leading the Surge in Demand for High-speed Transmission Network; Widespread Implementation of 5G and Increase in Demand for Cloud-based Services; Data Center Expansions.

6. What are the notable trends driving market growth?

Data Centers is the Fastest Growing Application for Optical Transceivers in Brazil.

7. Are there any restraints impacting market growth?

Growing Adoption of Digitalization Leading the Surge in Demand for High-speed Transmission Network; Widespread Implementation of 5G and Increase in Demand for Cloud-based Services; Data Center Expansions.

8. Can you provide examples of recent developments in the market?

June 2024: Integra Optics unveiled its latest innovation, the SFP+, 10/2.5 G BiDi, 20km, XGSPON OLT transceiver. This state-of-the-art optical transceiver module is tailored for XG/XGS-PON 10/2.5 G applications, delivering exceptional performance over a single fiber strand and accommodating links extending up to 20 kilometers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Optical Transceiver Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Optical Transceiver Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Optical Transceiver Market?

To stay informed about further developments, trends, and reports in the Brazil Optical Transceiver Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence