Key Insights

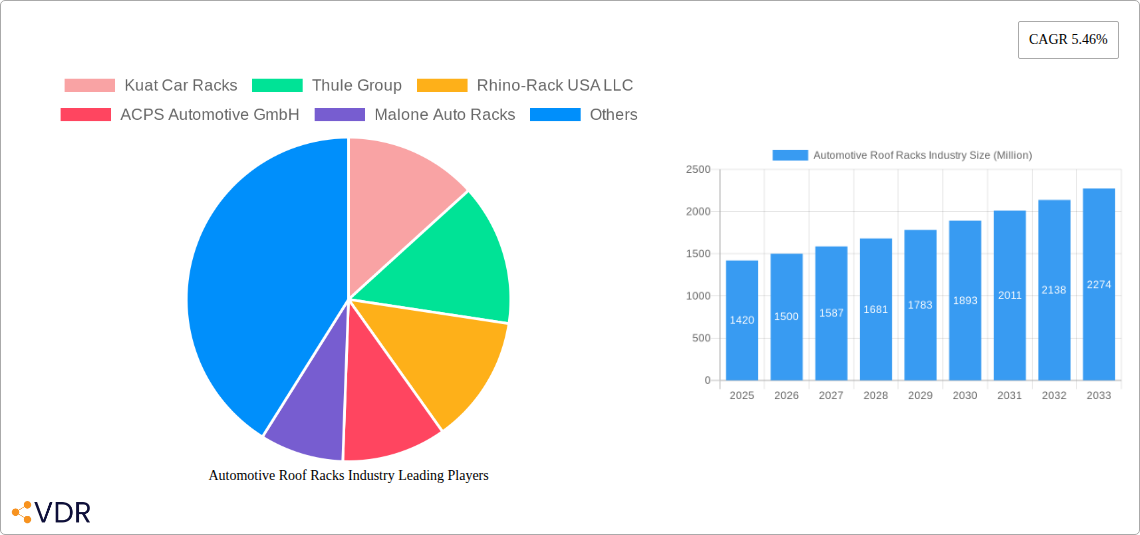

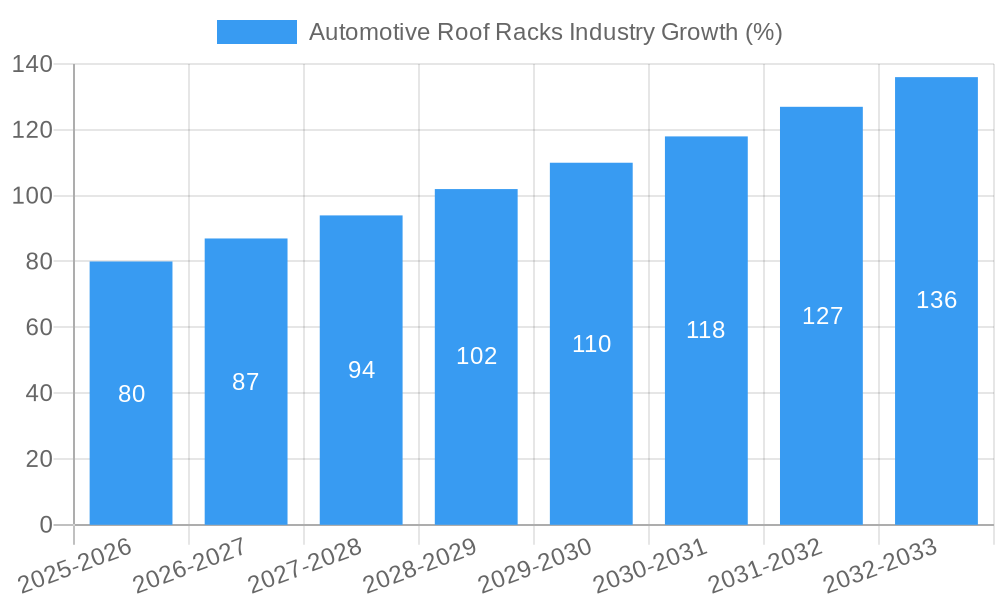

The global automotive roof rack market, valued at $1.42 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.46% from 2025 to 2033. This expansion is fueled by several key factors. The rising popularity of outdoor recreational activities like skiing, snowboarding, surfing, and cycling is significantly increasing demand for roof racks to transport sports equipment. Furthermore, the growing trend of road trips and adventure travel among millennials and Gen Z contributes to this market's upward trajectory. Increased vehicle ownership in developing economies, particularly in Asia-Pacific, further fuels market growth. Technological advancements, such as improved designs offering enhanced aerodynamics and load-carrying capacity, are also driving market expansion. The market is segmented by application type, encompassing roof racks, roof boxes, bike carriers, ski racks, and watersports carriers, with roof boxes and bike carriers anticipated to demonstrate strong growth due to their versatility and increasing consumer preference for carrying larger items. While increasing raw material costs and potential supply chain disruptions could pose challenges, the overall market outlook remains positive, driven by consistent consumer demand for safe and convenient ways to transport recreational gear.

Competitive dynamics within the automotive roof rack industry are characterized by a mix of established players and emerging companies. Key players such as Thule Group, Yakima Products Inc., and Rhino-Rack USA LLC hold significant market share due to their brand recognition, extensive distribution networks, and innovative product offerings. However, smaller, specialized companies are also emerging, focusing on niche segments or offering innovative designs and functionalities. The competitive landscape is characterized by intense competition in terms of pricing, product features, and brand building. Future market growth will likely depend on companies' ability to leverage technological advancements, cater to evolving consumer preferences, and maintain efficient supply chains to meet growing demand and maintain a competitive edge. Geographic expansion, particularly into rapidly developing markets, will also be crucial for companies aiming to maximize growth potential.

Automotive Roof Racks Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Automotive Roof Racks industry, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by application type: Roof Rack, Roof Box, Bike Car Rack, Ski Rack, and Watersport Carrier. This report projects a market size of xx Million units by 2033.

Automotive Roof Racks Industry Market Dynamics & Structure

The automotive roof rack market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, driven by increasing demand for aerodynamic designs and enhanced safety features, plays a crucial role in shaping the market landscape. Stringent regulatory frameworks concerning vehicle safety and emissions also impact industry practices. While direct substitutes are limited, alternative cargo solutions like trailers compete for market share. The end-user demographic comprises diverse segments including individual vehicle owners, commercial fleets, and outdoor enthusiasts. M&A activity in the sector has been moderate, with a focus on strategic acquisitions to expand product portfolios and geographic reach. The total M&A deal volume from 2019-2024 was xx.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on lightweight materials, aerodynamic designs, and integrated locking systems.

- Regulatory Framework: Compliance with safety standards (e.g., ISO standards) and emissions regulations.

- Competitive Substitutes: Trailers, cargo carriers, and interior storage solutions.

- End-User Demographics: Individual consumers, commercial fleets, and outdoor enthusiasts.

- M&A Trends: Moderate activity, driven by expansion strategies and technological advancements.

Automotive Roof Racks Industry Growth Trends & Insights

The automotive roof rack market has experienced steady growth over the past years, fueled by increasing vehicle ownership and rising popularity of outdoor recreational activities. The market is expected to continue its growth trajectory, driven by factors such as increasing disposable incomes, a rising trend of adventure travel and camping, and advancements in product design and functionality. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was xx%, and a CAGR of xx% is projected from 2025 to 2033. This growth is also influenced by technological disruptions, such as the introduction of smart features and integration with vehicle systems. Consumer behavior is shifting towards premium products offering enhanced safety, durability, and convenience. Market penetration is currently at xx% and is predicted to reach xx% by 2033.

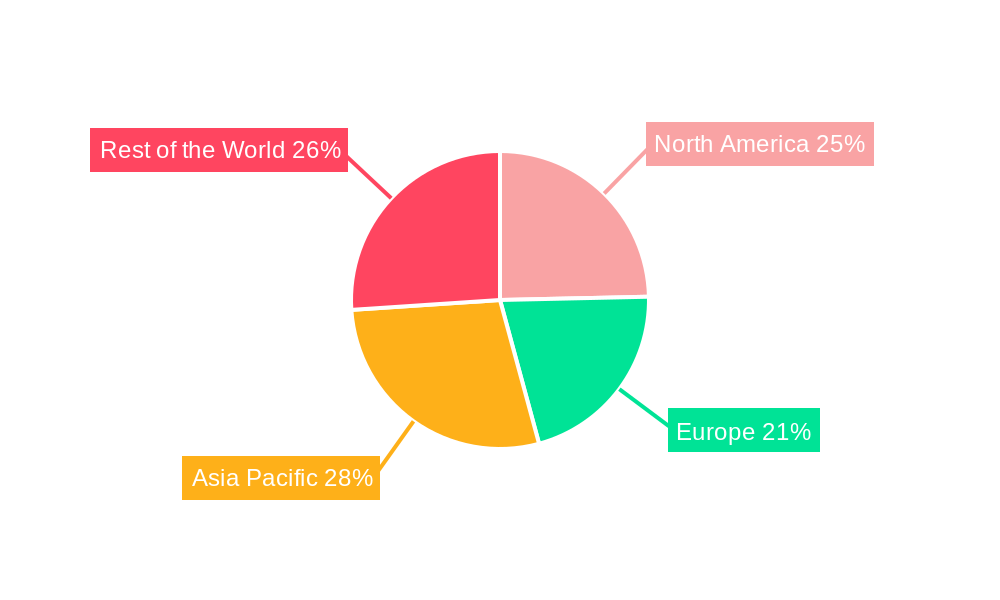

Dominant Regions, Countries, or Segments in Automotive Roof Racks Industry

North America and Europe currently dominate the automotive roof rack market, driven by high vehicle ownership rates, robust economies, and a strong preference for outdoor recreation. Within the application segments, roof racks hold the largest market share, followed by bike carriers and roof boxes. This dominance is attributed to factors like established infrastructure supporting outdoor activities, strong consumer demand, and a relatively high disposable income. However, developing regions in Asia-Pacific are exhibiting significant growth potential due to rising vehicle sales and increasing outdoor recreational activities.

- Key Drivers: Strong consumer demand, high vehicle ownership rates, established infrastructure for outdoor activities.

- Dominant Regions: North America and Europe.

- Fastest Growing Regions: Asia-Pacific.

- Leading Segment: Roof Racks (xx Million units in 2025).

Automotive Roof Racks Industry Product Landscape

The automotive roof rack market offers a diverse range of products catering to various needs and vehicle types. Innovation focuses on enhancing aerodynamics to reduce fuel consumption, improved safety features for secure cargo transport, and ease of installation. Many manufacturers offer specialized racks for bikes, skis, kayaks, and other outdoor gear. Unique selling propositions include features like integrated locking systems, lightweight materials, and customizable configurations to match individual needs. Technological advancements are centered around improving material strength, aerodynamic efficiency, and user-friendliness.

Key Drivers, Barriers & Challenges in Automotive Roof Racks Industry

Key Drivers:

- Rising disposable incomes and increased vehicle ownership globally.

- Growing popularity of outdoor recreational activities like camping, skiing, and water sports.

- Technological advancements leading to improved product features and functionality.

- Government initiatives supporting eco-friendly transportation solutions.

Challenges and Restraints:

- Fluctuations in raw material prices and supply chain disruptions.

- Stringent safety and emission regulations impacting production costs.

- Intense competition among established and emerging players, impacting market pricing.

- Economic downturns impacting consumer spending on non-essential items. This has a quantifiable impact, potentially reducing the market size by xx% in periods of recession.

Emerging Opportunities in Automotive Roof Racks Industry

- Untapped Markets: Expansion into developing economies with growing vehicle ownership and outdoor activity participation.

- Innovative Applications: Development of specialized racks for niche applications (e.g., e-bikes, camping equipment).

- Evolving Consumer Preferences: Focus on eco-friendly materials, smart features, and aesthetically pleasing designs.

Growth Accelerators in the Automotive Roof Racks Industry

Long-term growth in the automotive roof rack industry will be driven by technological breakthroughs in material science, leading to lighter, stronger, and more aerodynamic designs. Strategic partnerships with vehicle manufacturers for integrated solutions and expansion into new geographic markets will further accelerate growth. Effective marketing campaigns showcasing the convenience and versatility of roof racks will also play a significant role.

Key Players Shaping the Automotive Roof Racks Industry Market

- Kuat Car Racks

- Thule Group

- Rhino-Rack USA LLC

- ACPS Automotive GmbH

- Malone Auto Racks

- Cruzber SA

- Yakima Products Inc

- Allen Sports

- Saris

- Car Mate Mfg Co Ltd

Notable Milestones in Automotive Roof Racks Industry Sector

- September 2022: Cruzber launched the Cruz Pipe Carrier, expanding its product line for commercial vehicles.

- September 2022: Cruzber introduced several new products at Automechanika Frankfurt, including bike racks, towbar platforms, and ladder fitting systems, demonstrating a strong focus on innovation and product diversification.

- March 2022: Rhino-Rack US LLC launched Reconn-Deck truck bed systems, showcasing advancements in functionality and durability.

In-Depth Automotive Roof Racks Industry Market Outlook

The automotive roof rack industry is poised for continued growth, driven by expanding outdoor recreation trends and technological advancements. Opportunities exist in developing markets and through the development of innovative products tailored to evolving consumer needs. Strategic partnerships and investments in research and development will be key to long-term success in this dynamic market. The focus on sustainability and eco-friendly materials will also shape future product development and market dynamics.

Automotive Roof Racks Industry Segmentation

-

1. Application Type

- 1.1. Roof Rack

- 1.2. Roof Box

- 1.3. Bike Car Rack

- 1.4. Ski Rack

- 1.5. Watersport Carrier

Automotive Roof Racks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Automotive Roof Racks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. Recreational Vehicle Rental to Affect The Market Over the Long Term

- 3.4. Market Trends

- 3.4.1. Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Roof Rack

- 5.1.2. Roof Box

- 5.1.3. Bike Car Rack

- 5.1.4. Ski Rack

- 5.1.5. Watersport Carrier

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Roof Rack

- 6.1.2. Roof Box

- 6.1.3. Bike Car Rack

- 6.1.4. Ski Rack

- 6.1.5. Watersport Carrier

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Roof Rack

- 7.1.2. Roof Box

- 7.1.3. Bike Car Rack

- 7.1.4. Ski Rack

- 7.1.5. Watersport Carrier

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Roof Rack

- 8.1.2. Roof Box

- 8.1.3. Bike Car Rack

- 8.1.4. Ski Rack

- 8.1.5. Watersport Carrier

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Roof Rack

- 9.1.2. Roof Box

- 9.1.3. Bike Car Rack

- 9.1.4. Ski Rack

- 9.1.5. Watersport Carrier

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. North America Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World Automotive Roof Racks Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 South Africa

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Kuat Car Racks

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Thule Group

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Rhino-Rack USA LLC

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 ACPS Automotive GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Malone Auto Racks

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cruzber SA

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Yakima Products Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Allen Sports

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Saris*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Car Mate Mfg Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Kuat Car Racks

List of Figures

- Figure 1: Global Automotive Roof Racks Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 11: North America Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 12: North America Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 15: Europe Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 16: Europe Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 19: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 20: Asia Pacific Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Application Type 2024 & 2032

- Figure 23: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Application Type 2024 & 2032

- Figure 24: Rest of the World Automotive Roof Racks Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Automotive Roof Racks Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Roof Racks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 3: Global Automotive Roof Racks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of North America Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Africa Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Other Countries Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 24: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of North America Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 29: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Germany Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United Kingdom Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 36: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: China Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Japan Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Asia Pacific Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Automotive Roof Racks Industry Revenue Million Forecast, by Application Type 2019 & 2032

- Table 42: Global Automotive Roof Racks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Brazil Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Other Countries Automotive Roof Racks Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Roof Racks Industry?

The projected CAGR is approximately 5.46%.

2. Which companies are prominent players in the Automotive Roof Racks Industry?

Key companies in the market include Kuat Car Racks, Thule Group, Rhino-Rack USA LLC, ACPS Automotive GmbH, Malone Auto Racks, Cruzber SA, Yakima Products Inc, Allen Sports, Saris*List Not Exhaustive, Car Mate Mfg Co Ltd.

3. What are the main segments of the Automotive Roof Racks Industry?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period.

7. Are there any restraints impacting market growth?

Recreational Vehicle Rental to Affect The Market Over the Long Term.

8. Can you provide examples of recent developments in the market?

September, 2022: Cruz, the Spanish rack brand of Cruzber, launched Cruz Pipe Carrier. It is an accessory for transporting pipes safely on the roof of a light commercial vehicle.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Roof Racks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Roof Racks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Roof Racks Industry?

To stay informed about further developments, trends, and reports in the Automotive Roof Racks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence