Key Insights

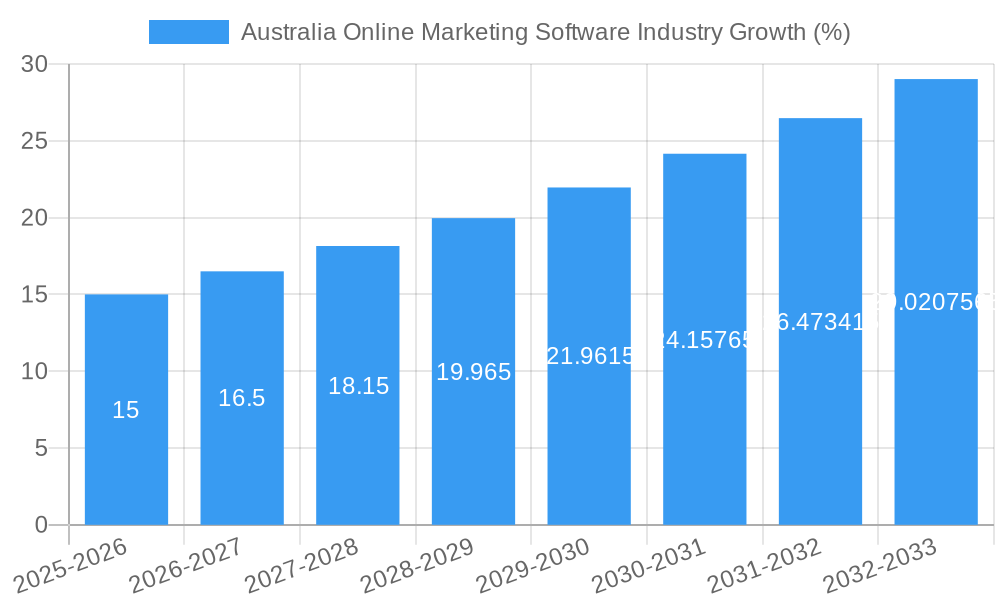

The Australian online marketing software market, valued at approximately $XX million in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of digital marketing strategies across diverse sectors like Information Technology, Telecommunications, BFSI (Banking, Financial Services, and Insurance), Media & Entertainment, and Retail is a significant contributor. Businesses are increasingly relying on sophisticated software solutions for email marketing, CRM (Customer Relationship Management), social CRM, web analytics, marketing automation, e-commerce management, and content management to enhance their online presence, target audiences effectively, and optimize marketing ROI. Further accelerating this growth are evolving trends such as the increasing preference for cloud-based deployments offering scalability and flexibility, the growing demand for data-driven marketing insights, and the rising adoption of AI-powered marketing tools for personalized campaigns.

However, the market's growth trajectory is not without challenges. Constraints such as the high initial investment required for implementing sophisticated software, the need for specialized technical expertise, and concerns surrounding data security and privacy could potentially impede market expansion. Despite these restraints, the market’s inherent dynamism and the continuous innovation within the online marketing software landscape are expected to drive substantial growth across various segments, including email marketing, CRM, and marketing automation, within the forecast period. The competitive landscape includes both established international players and local Australian companies, fostering innovation and choice for businesses seeking to enhance their online marketing capabilities. The dominance of cloud-based solutions is likely to continue, given their inherent advantages.

This comprehensive report provides an in-depth analysis of the Australia online marketing software industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report is crucial for businesses, investors, and industry professionals seeking to understand and navigate this dynamic market. The total market value in 2025 is estimated at $XX Million.

Australia Online Marketing Software Industry Market Dynamics & Structure

The Australian online marketing software market exhibits moderate concentration, with a few major players alongside numerous smaller, specialized firms. This dynamic landscape is significantly influenced by rapid technological advancements, particularly in AI, machine learning, and automation, driving efficiency and innovation. The regulatory environment, shaped by evolving data privacy laws (including considerations related to GDPR and local regulations), plays a crucial role in shaping market practices and influencing vendor strategies. Competitive pressures stem from both in-house developed solutions and the availability of free/open-source alternatives. The diverse end-user demographics reflect the widespread adoption of online marketing software across various sectors, from established enterprises to burgeoning startups.

Mergers and acquisitions (M&A) activity has shown a consistent trend, with an estimated XX deals annually between 2019 and 2024, representing a total value of approximately $XX million. These transactions largely focus on expanding capabilities, enhancing market reach, and securing access to cutting-edge technologies.

- Market Concentration: Moderately consolidated, with the top 5 players holding approximately XX% market share in 2025. This suggests opportunities for both established players to consolidate further and for innovative entrants to carve out niche markets.

- Technological Innovation: AI, machine learning, and automation are pivotal drivers, enabling predictive analytics, personalized marketing, and streamlined campaign management.

- Regulatory Framework: Data privacy regulations (e.g., impacts from GDPR, local data protection laws like the Privacy Act 1988) are paramount, necessitating robust compliance measures and secure data handling practices.

- Competitive Substitutes: The availability of in-house solutions and free/open-source options creates competitive pressure, particularly for smaller vendors who need to differentiate through superior features, support, or specialized functionalities.

- End-User Demographics: Highly diverse across numerous industries, reflecting the broad applicability of online marketing software across various business sizes and needs.

- M&A Activity: An average of XX deals annually (2019-2024) totaling approximately $XX million underscores strategic consolidation and growth within the sector.

Australia Online Marketing Software Industry Growth Trends & Insights

The Australian online marketing software market exhibits robust growth, driven by increasing digital adoption across industries. The market size witnessed a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024), reaching $XX Million in 2024. This growth is projected to continue at a CAGR of XX% during the forecast period (2025-2033), reaching an estimated $XX Million by 2033. Increased marketing budgets, the rise of e-commerce, and the need for data-driven decision-making contribute significantly. Technological disruptions, such as the rise of AI-powered marketing tools, are reshaping consumer behavior and driving adoption of new solutions. Market penetration in key sectors (e.g., Retail, BFSI) remains substantial but with ample scope for further growth, particularly in smaller businesses.

Dominant Regions, Countries, or Segments in Australia Online Marketing Software Industry

The Australian online marketing software market demonstrates a degree of geographical concentration, with New South Wales and Victoria holding prominent positions due to their robust business ecosystems and well-established technological infrastructure. This concentration, however, is gradually shifting as digital adoption expands across other regions.

By Type: The Marketing Automation and CRM software segments represent the largest market share, with Marketing Automation leading due to its proven ability to streamline campaigns and deliver significant ROI. E-commerce solutions are experiencing rapid growth, fueled by the thriving e-commerce sector in Australia and the increasing demand for integrated omnichannel strategies.

- By End-user Industry: The Information Technology, BFSI (Banking, Financial Services, and Insurance), and Retail sectors comprise the most significant market segments, driven by substantial digital marketing budgets and a strong emphasis on data-driven decision-making. Growth is also evident in other sectors rapidly adopting digital transformation strategies.

- By Deployment: Cloud-based solutions maintain dominance due to their inherent scalability, cost-effectiveness, and enhanced accessibility, catering to the varying needs of businesses of all sizes.

Australia Online Marketing Software Industry Product Landscape

The Australian online marketing software market features a diverse range of products, from basic email marketing tools to sophisticated marketing automation platforms and CRM solutions. Product innovation centers around enhancing user experience, integrating AI capabilities for better insights and automation, and improving data security. Key features include real-time analytics dashboards, seamless integrations with existing business systems, and personalized marketing capabilities.

Key Drivers, Barriers & Challenges in Australia Online Marketing Software Industry

Key Drivers: Increased digitalization across industries, rising e-commerce adoption, government initiatives promoting digital transformation, and the need for data-driven marketing strategies drive market growth. The growing use of AI and machine learning in marketing is a major driver.

Challenges: High initial investment costs, integration complexities with existing systems, data security and privacy concerns, competition from established international players, and a shortage of skilled professionals pose significant challenges.

Emerging Opportunities in Australia Online Marketing Software Industry

Untapped markets in smaller businesses and specific industry niches (e.g., agricultural technology) present significant growth opportunities. The increasing importance of personalization in marketing creates opportunities for software tailored to specific customer segments. Advances in AI and machine learning offer opportunities for more sophisticated predictive analytics and campaign optimization tools.

Growth Accelerators in the Australia Online Marketing Software Industry

Strategic partnerships between software providers and marketing agencies are accelerating market growth. Technological advancements, such as AI-powered marketing automation, further drive expansion. Government initiatives supporting digital transformation and e-commerce development also contribute significantly.

Key Players Shaping the Australia Online Marketing Software Market

- WebFX

- West Coast Infotech

- Cyber Infrastructure Inc

- Marketing Eye

- Swift Digital

- Lounge Lizard

- Andmine

Notable Milestones in Australia Online Marketing Software Industry Sector

- 2021: Heightened focus on data privacy compliance following the strengthening of existing regulations and a greater awareness of data protection.

- 2022: Substantial investments in AI-powered marketing solutions by major players, reflecting a shift towards more sophisticated, data-driven marketing strategies.

- 2023: The launch of several new cloud-based marketing platforms demonstrates ongoing innovation and competition within the market.

- 2024 (add if applicable): [Insert significant milestone for 2024]

In-Depth Australia Online Marketing Software Industry Market Outlook

The Australian online marketing software market is projected to experience sustained growth, propelled by ongoing digital transformation initiatives and the increasing adoption of advanced marketing technologies. Strategic investments in AI and machine learning will continue to shape the industry landscape, fostering innovation and enhancing market competitiveness. Maintaining a strong focus on data privacy and security will remain critical for all market participants. The market's healthy growth trajectory is expected to persist throughout the forecast period, with substantial potential for expansion in emerging market segments and within newly developing industries.

Australia Online Marketing Software Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. Type

- 2.1. Email

- 2.2. CRM

- 2.3. Social CRM

- 2.4. Web Analytics

- 2.5. Marketing Automation

- 2.6. E-commerce

- 2.7. Content Management

-

3. End-user Industry

- 3.1. Information Technology

- 3.2. Telecom

- 3.3. BFSI

- 3.4. Media & Entertainment

- 3.5. Retail

- 3.6. Manufacturing

- 3.7. Healthcare

- 3.8. Automotive

Australia Online Marketing Software Industry Segmentation By Geography

- 1. Australia

Australia Online Marketing Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Surge of Web and Expanded Digitization; Adoption of Cloud Technologies

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Professional in Marketing Solutions

- 3.4. Market Trends

- 3.4.1. Facebook Driving Social Media Marketing Platform

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Online Marketing Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Email

- 5.2.2. CRM

- 5.2.3. Social CRM

- 5.2.4. Web Analytics

- 5.2.5. Marketing Automation

- 5.2.6. E-commerce

- 5.2.7. Content Management

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Information Technology

- 5.3.2. Telecom

- 5.3.3. BFSI

- 5.3.4. Media & Entertainment

- 5.3.5. Retail

- 5.3.6. Manufacturing

- 5.3.7. Healthcare

- 5.3.8. Automotive

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 WebFX

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 West Coast Infotech*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cyber Infrastructure Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marketing Eye

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Swift Digital

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lounge Lizard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Andmine

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 WebFX

List of Figures

- Figure 1: Australia Online Marketing Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Online Marketing Software Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Online Marketing Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Online Marketing Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Australia Online Marketing Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia Online Marketing Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Australia Online Marketing Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australia Online Marketing Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Australia Online Marketing Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 8: Australia Online Marketing Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Australia Online Marketing Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Australia Online Marketing Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Online Marketing Software Industry?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Australia Online Marketing Software Industry?

Key companies in the market include WebFX, West Coast Infotech*List Not Exhaustive, Cyber Infrastructure Inc, Marketing Eye, Swift Digital, Lounge Lizard, Andmine.

3. What are the main segments of the Australia Online Marketing Software Industry?

The market segments include Deployment, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Surge of Web and Expanded Digitization; Adoption of Cloud Technologies.

6. What are the notable trends driving market growth?

Facebook Driving Social Media Marketing Platform.

7. Are there any restraints impacting market growth?

; Lack of Skilled Professional in Marketing Solutions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Online Marketing Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Online Marketing Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Online Marketing Software Industry?

To stay informed about further developments, trends, and reports in the Australia Online Marketing Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence