Key Insights

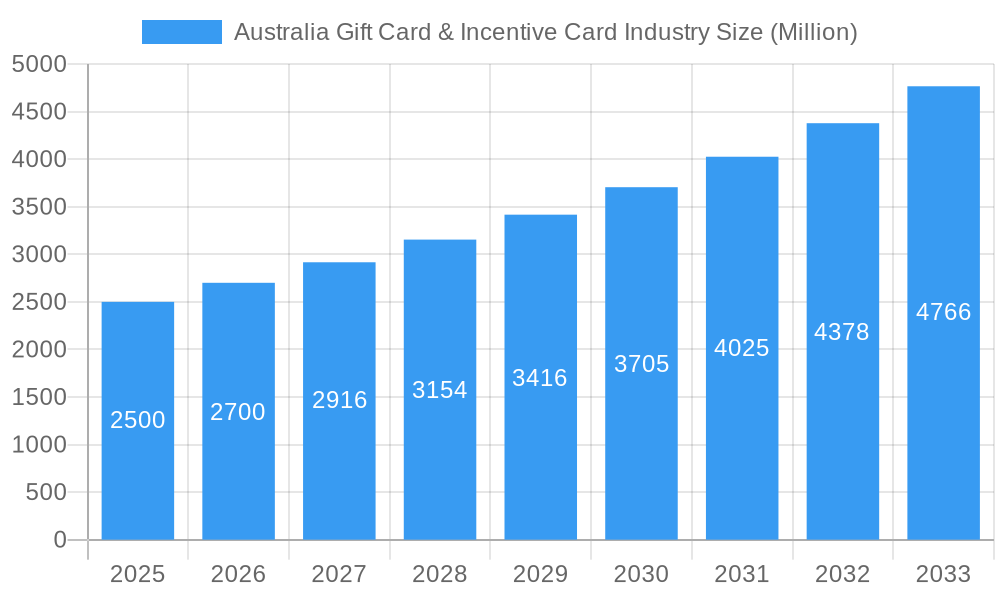

The Australian gift card and incentive card market is poised for substantial growth, projected to reach $8.22 billion by 2025. With a Compound Annual Growth Rate (CAGR) of 9.6%, the market is expected to witness sustained expansion through 2033. This upward trajectory is primarily fueled by increasing consumer spending during key shopping periods and special occasions, alongside the expanding reach of e-commerce and digital gift card platforms, which enhance convenience and accessibility. Major retailers like Wesfarmers, Woolworths, and Coles are dominant players, leveraging their extensive retail presence. However, new entrants, including digital platforms and specialized incentive providers, are actively innovating and capturing market segments. The demand for corporate incentives and employee reward programs further bolsters market growth. While economic fluctuations present potential challenges, the overall outlook for the Australian gift card and incentive card market remains positive.

Australia Gift Card & Incentive Card Industry Market Size (In Billion)

Despite a favorable market outlook, the Australian gift card and incentive card sector faces significant competition from both established retailers and emerging digital providers. Key to sustained growth will be maintaining consumer trust by addressing concerns such as card expiration dates and managing unused balances. Industry players must remain adaptable to evolving consumer preferences and potential regulatory changes. Strategic partnerships, targeted marketing campaigns, and loyalty programs are essential for continued expansion. The market's diverse segments, including physical gift cards, e-gift cards, and various incentive programs, offer opportunities for specialized companies to establish strong positions. Future growth will be driven by ongoing innovation in digital delivery, personalized offerings, and enhanced security features. The forecast period of 2025-2033 anticipates continued, albeit potentially moderated, growth as the market matures.

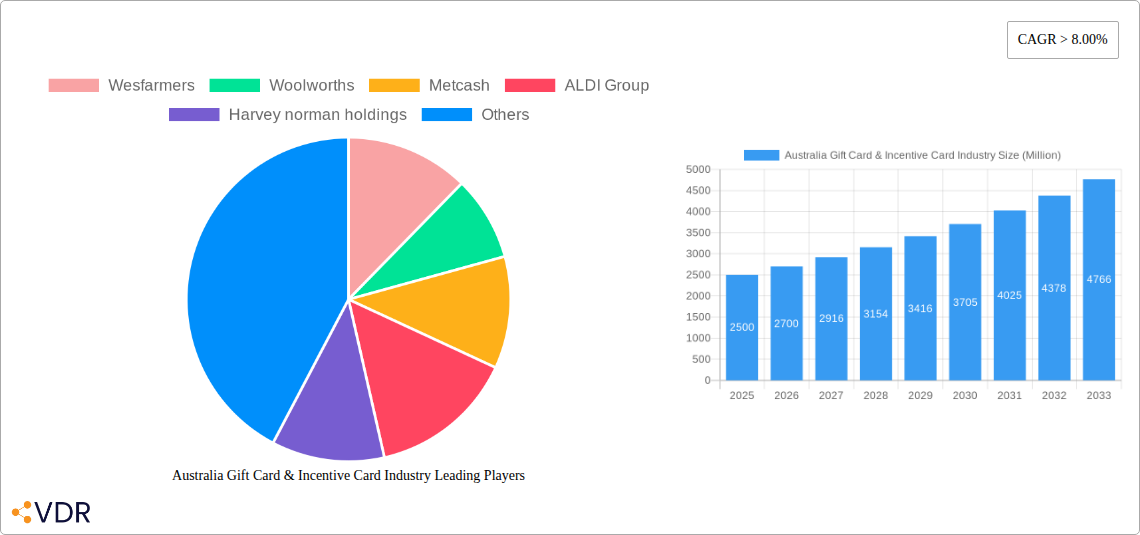

Australia Gift Card & Incentive Card Industry Company Market Share

Australia Gift Card & Incentive Card Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Australian gift card and incentive card industry, encompassing market dynamics, growth trends, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report leverages extensive primary and secondary research to provide quantitative and qualitative insights, enabling informed decision-making.

High-traffic keywords: Australia gift card market, incentive card industry Australia, gift card market size Australia, gift card sales Australia, Australian incentive programs, prepaid card market Australia, gift card trends Australia, retail gift card market

Australia Gift Card & Incentive Card Industry Market Dynamics & Structure

The Australian gift card and incentive card market is characterized by a moderately concentrated structure with key players like Wesfarmers, Woolworths, Coles, and Metcash holding significant market share (xx%). Technological innovation, particularly in digital gift card platforms and mobile wallets, is a major driver, alongside evolving consumer preferences and regulatory frameworks governing prepaid financial products. The industry faces competition from alternative reward systems and experiences, necessitating continuous innovation. Mergers and acquisitions (M&A) activity, while not exceptionally high (xx deals in the last 5 years), is a significant factor in market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Technological Innovation: Digital platforms, mobile wallets, and personalized gift card options are key drivers.

- Regulatory Framework: Compliance with financial regulations governing prepaid instruments is crucial.

- Competitive Substitutes: Experiences, subscription services, and alternative reward systems present competition.

- End-User Demographics: Gift cards cater to a broad demographic, with varying preferences based on age and spending habits.

- M&A Trends: Consolidation through M&A is expected to continue, albeit at a moderate pace.

Australia Gift Card & Incentive Card Industry Growth Trends & Insights

The Australian gift card and incentive card market exhibited robust growth during the historical period (2019-2024), reaching a market size of $xx million in 2024. This growth is driven by rising consumer spending, increased adoption of digital gift cards, and their utilization in employee incentive programs. The market is projected to maintain a strong CAGR of xx% during the forecast period (2025-2033), reaching $xx million by 2033. Factors driving this growth include expanding e-commerce penetration, the growing popularity of digital gift cards, and the increasing adoption of incentive programs by businesses across various sectors. Consumer behaviour is shifting towards more personalized and experiential gifts and seamless digital redemption options.

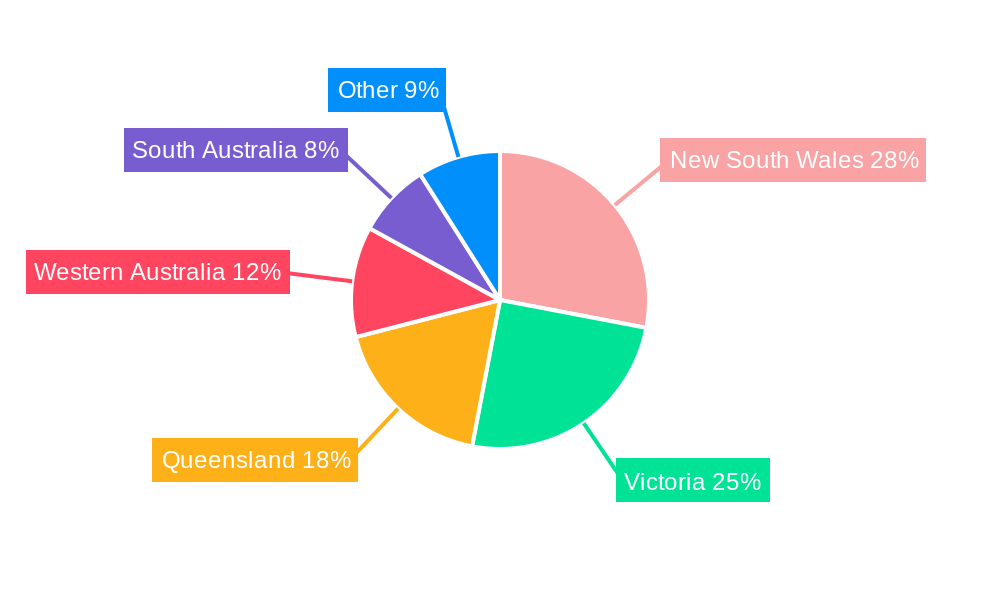

Dominant Regions, Countries, or Segments in Australia Gift Card & Incentive Card Industry

The major metropolitan areas of Sydney, Melbourne, and Brisbane drive the majority of market growth in the Australian gift card industry, representing xx% of the total market in 2024. This dominance stems from higher disposable incomes, greater e-commerce penetration, and a high concentration of businesses leveraging gift cards as marketing tools. The retail segment, particularly grocery and department stores, holds the largest market share, boosted by the increasing adoption of co-branded cards and loyalty programs, while the corporate incentive and reward market segment is gaining traction, contributing xx million in 2024.

- Key Drivers: High population density, strong disposable incomes, high e-commerce penetration.

- Dominance Factors: High consumer spending, strong retail presence, increasing corporate adoption.

- Growth Potential: Continued urbanization, rising disposable incomes, and increased focus on employee engagement present further opportunities.

Australia Gift Card & Incentive Card Industry Product Landscape

The Australian gift card market offers diverse product options, ranging from traditional physical gift cards to digital e-gift cards and mobile wallet integrations. Recent innovations focus on enhancing the user experience through personalized designs, customizable amounts, and seamless integration with popular e-commerce platforms. Companies are increasingly incorporating loyalty programs into gift card offerings, building stronger customer relationships and increasing repeat purchases. Performance metrics are tracked closely, focusing on redemption rates, customer satisfaction, and overall ROI for both issuers and recipients.

Key Drivers, Barriers & Challenges in Australia Gift Card & Incentive Card Industry

Key Drivers:

- Increasing consumer spending and disposable incomes.

- Growing popularity of e-commerce and digital gift card options.

- Rise of corporate incentive programs using gift cards.

- Expansion of digital payment methods and mobile wallets.

Key Barriers & Challenges:

- Intense competition among issuers and retailers.

- Regulatory compliance related to prepaid instruments.

- Fraud and security concerns associated with digital gift cards.

- Potential for chargebacks and disputes.

Emerging Opportunities in Australia Gift Card & Incentive Card Industry

The market presents opportunities in personalized gift card experiences, the integration of loyalty programs, and expansion into niche markets. The growing adoption of BNPL (Buy Now, Pay Later) solutions suggests potential integration with gift card platforms. Furthermore, exploring experiential gift cards, offering unique experiences instead of just monetary value, could be a major growth area.

Growth Accelerators in the Australia Gift Card & Incentive Card Industry

Technological advancements in digital platforms, mobile wallets and blockchain-based security features will significantly enhance the user experience and security of gift cards, accelerating market growth. Strategic partnerships between retailers, financial institutions, and technology providers create opportunities for innovation and wider market reach. Expansion into new market segments, such as corporate gifting, employee rewards, and loyalty programs within different industry sectors, provides further growth opportunities.

Key Players Shaping the Australia Gift Card & Incentive Card Industry Market

- Wesfarmers

- Woolworths

- Metcash

- ALDI Group

- Harvey Norman Holdings

- JB Hi-Fi

- Apple

- Giftpay

- The Good Guys

- Coles

- Australia Post

- Blackhawk Network

- iChoose

- Karta

Notable Milestones in Australia Gift Card & Incentive Card Industry Sector

- December 2022: Wesfarmers OneDigital and The Walt Disney Company launched a bundled subscription combining Disney+ and OnePass, boosting OnePass adoption and driving sales across Wesfarmers retail brands.

- June 2022: Metcash Limited signed a long-term lease for a new distribution center, enhancing its supply chain efficiency and potentially impacting its gift card offerings.

In-Depth Australia Gift Card & Incentive Card Industry Market Outlook

The Australian gift card and incentive card market is poised for continued expansion, driven by technological innovation, strategic partnerships, and increasing consumer adoption. The ongoing shift towards digital gift cards and the integration of loyalty programs will further fuel market growth. Companies focusing on personalized experiences and enhanced security will be best positioned to capitalize on the market's potential, leading to significant long-term growth and strategic opportunities.

Australia Gift Card & Incentive Card Industry Segmentation

-

1. Consumer

- 1.1. Individual

-

1.2. Corporate

- 1.2.1. Small scale

- 1.2.2. Mid-tier

- 1.2.3. Large enterprise

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Product

- 3.1. E-gift card

- 3.2. Physical card

Australia Gift Card & Incentive Card Industry Segmentation By Geography

- 1. Australia

Australia Gift Card & Incentive Card Industry Regional Market Share

Geographic Coverage of Australia Gift Card & Incentive Card Industry

Australia Gift Card & Incentive Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Digital Wallet Adoption in Australia is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Gift Card & Incentive Card Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 5.1.1. Individual

- 5.1.2. Corporate

- 5.1.2.1. Small scale

- 5.1.2.2. Mid-tier

- 5.1.2.3. Large enterprise

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. E-gift card

- 5.3.2. Physical card

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Consumer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wesfarmers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Woolworths

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Metcash

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALDI Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harvey norman holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jb Hi-Fi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Apple

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gift pay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The good guys

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coles

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Australia post

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Blackhawk network

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ichoose

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Karta**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Wesfarmers

List of Figures

- Figure 1: Australia Gift Card & Incentive Card Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Gift Card & Incentive Card Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 2: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Consumer 2020 & 2033

- Table 6: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Australia Gift Card & Incentive Card Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Gift Card & Incentive Card Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Australia Gift Card & Incentive Card Industry?

Key companies in the market include Wesfarmers, Woolworths, Metcash, ALDI Group, Harvey norman holdings, Jb Hi-Fi, Apple, Gift pay, The good guys, Coles, Australia post, Blackhawk network, ichoose, Karta**List Not Exhaustive.

3. What are the main segments of the Australia Gift Card & Incentive Card Industry?

The market segments include Consumer, Distribution Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.22 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Digital Wallet Adoption in Australia is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Wesfarmers OneDigital and The Walt Disney Company announced an exclusive new subscription bundle combining Disney+ and OnePass for $14.99 a month.OnePass provides benefits across Wesfarmers retail brands, including free delivery on eligible purchases from Kmart, Target, Catch, and Bunnings Warehouse, as well as exclusive deals and in-store savings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Gift Card & Incentive Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Gift Card & Incentive Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Gift Card & Incentive Card Industry?

To stay informed about further developments, trends, and reports in the Australia Gift Card & Incentive Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence