Key Insights

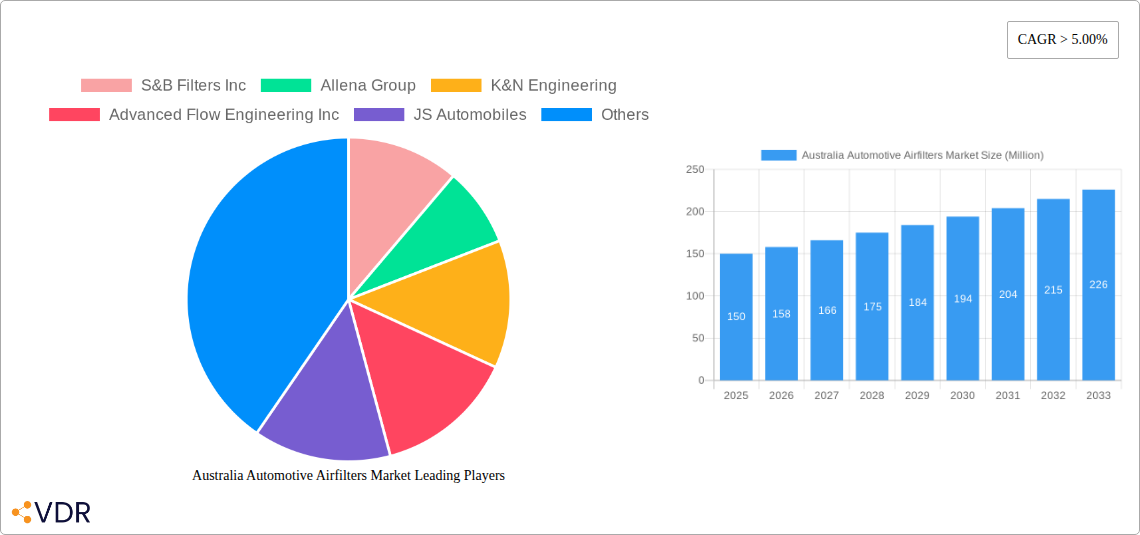

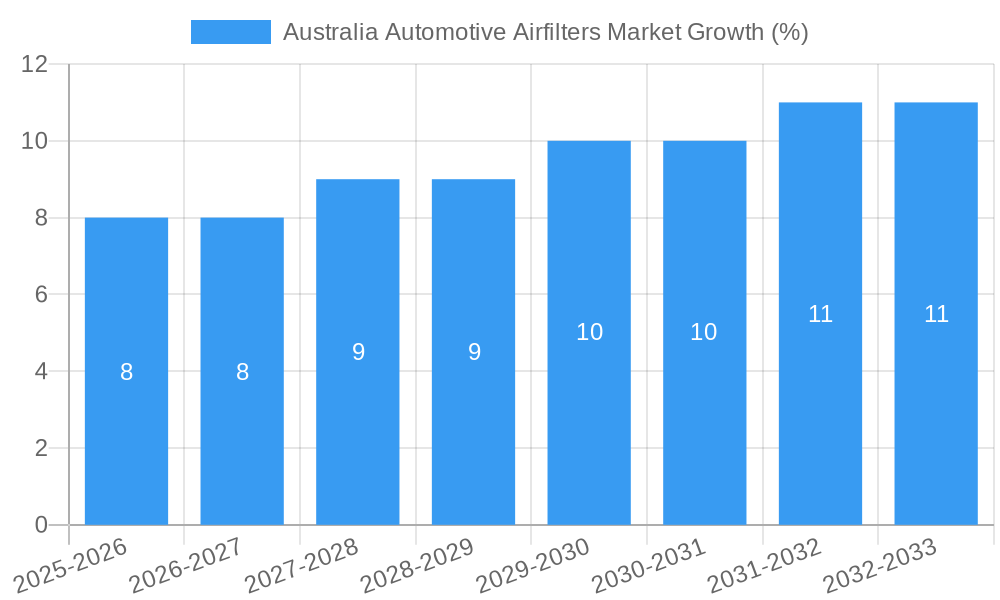

The Australian automotive air filter market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 5% compound annual growth rate (CAGR) through 2033. This expansion is fueled by several key factors. Firstly, the increasing age of the vehicle fleet in Australia necessitates more frequent air filter replacements, driving demand in the aftermarket segment. Secondly, stringent emission regulations and growing environmental awareness are pushing for higher-quality air filters, particularly in passenger cars, creating opportunities for premium filter manufacturers like K&N Engineering and Mann+Hummel. The dominance of passenger cars in the vehicle type segment further contributes to market growth. Technological advancements, such as the development of more efficient and durable filter materials like synthetic materials beyond paper, gauze, and foam, represent a significant trend shaping the market landscape. However, economic fluctuations impacting consumer spending and the potential for material cost increases pose challenges to sustained market growth. The market is segmented by sales channel (OEMs and aftermarket), material type (paper, gauze, foam, and others), type (intake and cabin filters), and vehicle type (passenger cars and commercial vehicles). Key players like S&B Filters Inc., Allena Group, and Purolator Filters LLC are leveraging their established distribution networks and brand recognition to maintain a competitive edge. The aftermarket segment is anticipated to witness faster growth due to increased vehicle maintenance needs and the availability of a wider range of filter choices.

The forecast period of 2025-2033 reveals a positive trajectory for the Australian automotive air filter market. The continued growth in the passenger car segment is expected to fuel demand, particularly for intake filters due to their crucial role in engine performance and longevity. The gradual shift towards higher-quality, longer-lasting filters, alongside the expansion of e-commerce channels within the aftermarket segment, further contributes to optimistic growth predictions. The competitive landscape remains dynamic, with both established international players and local manufacturers vying for market share through product innovation, strategic partnerships, and targeted marketing campaigns. Ongoing efforts to enhance the efficiency and lifespan of air filters, combined with increasing government support for environmental protection measures, present opportunities for considerable market expansion in the coming years. However, maintaining price competitiveness amidst fluctuating raw material costs will be critical for sustained success within this segment.

Australia Automotive Air Filters Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australia automotive air filters market, encompassing market dynamics, growth trends, regional analysis, competitive landscape, and future outlook. The report covers the period 2019-2033, with 2025 as the base year and forecast period extending to 2033. This crucial data is presented in Million units, offering invaluable insights for industry professionals, investors, and strategic decision-makers.

Australia Automotive Airfilters Market Market Dynamics & Structure

The Australian automotive air filter market, valued at xx Million units in 2025, is characterized by a moderately concentrated landscape with key players including S&B Filters Inc, Allena Group, K&N Engineering, Advanced Flow Engineering Inc, JS Automobiles, Purolator Filters LLC, Wsmridhi Manufacturing Co Pvt Ltd, Mann+Hummel, AL Filters, and AIRAID. The market structure is influenced by several factors, including technological advancements in filter materials and designs, stringent emission regulations, and the growing preference for higher-quality, longer-lasting filters.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. Consolidation through mergers and acquisitions (M&A) is anticipated to increase in the coming years.

- Technological Innovation: The adoption of advanced filter materials like nanofiber and synthetic media is driving innovation, enhancing filtration efficiency and extending filter lifespan. However, the high initial investment required for new technologies acts as a barrier to entry for smaller players.

- Regulatory Framework: Stringent emission regulations imposed by the Australian government are pushing manufacturers to develop filters with improved particulate matter filtration capabilities. Compliance costs pose a challenge, but the drive for environmental protection creates opportunities for innovation.

- Competitive Product Substitutes: While no direct substitutes exist, the increasing availability of aftermarket filters with varying price points and performance levels creates intense competition.

- End-User Demographics: The market is primarily driven by passenger car owners, but the increasing fleet size of commercial vehicles offers substantial growth potential. The rising disposable income of Australian consumers fuels the demand for premium air filters.

- M&A Trends: The past five years witnessed xx M&A deals, primarily focused on expanding product portfolios and geographical reach. This trend is expected to continue.

Australia Automotive Airfilters Market Growth Trends & Insights

The Australian automotive air filters market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as the increasing vehicle parc, rising awareness regarding air quality, and the growing demand for high-performance filters. Market penetration for advanced filter technologies like nanofiber filters is gradually increasing, although the higher cost remains a restraint. Consumer behavior is shifting toward purchasing longer-lasting, high-efficiency filters, reflecting a preference for improved vehicle performance and reduced maintenance costs. Market size evolution exhibits a steady upward trend, reflecting the strong automotive industry growth and improved vehicle maintenance practices. The adoption rate for higher-quality filters is significantly increasing among consumers. Technological disruptions in filter materials and design are driving innovation, enhancing filtration efficiency and lifespan.

Dominant Regions, Countries, or Segments in Australia Automotive Airfilters Market

The Australian automotive air filter market is geographically dispersed across various states and territories, with New South Wales and Victoria emerging as dominant regions. The aftermarket segment holds a significant market share, driven by the high volume of independent vehicle maintenance and repair shops. Within the material types, paper air filters maintain a larger market share due to its cost-effectiveness.

- Sales Channel: The aftermarket channel is currently the dominant segment and is expected to maintain its lead due to the large number of independent workshops and consumers undertaking DIY maintenance. OEMs contribute a substantial share with a xx Million units market in 2025.

- Material Type: Paper air filters dominate the market (xx Million units in 2025) due to their affordability and sufficient performance for most applications. Gauze and foam air filters cater to specific vehicle segments, contributing xx and xx Million units respectively in 2025.

- Type: Intake filters hold a dominant position (xx Million units in 2025) owing to their essential role in protecting the engine. Cabin filters are gaining traction (xx Million units in 2025) as consumer awareness about cabin air quality increases.

- Vehicle Type: The passenger car segment dominates the market (xx Million units in 2025), reflecting the large passenger vehicle fleet. However, the commercial vehicle segment is poised for significant growth driven by fleet expansion and stricter emission norms.

Australia Automotive Airfilters Market Product Landscape

The Australian automotive air filter market offers a range of products with varying performance metrics, including filtration efficiency, airflow restriction, and lifespan. Innovations primarily focus on enhancing filtration efficiency through advanced materials and designs, improving airflow dynamics, and increasing filter durability. The development of synthetic media filters offers a higher-performance alternative to conventional paper filters. Unique selling propositions hinge on superior filtration efficiency, longer service life, and improved airflow, catering to diverse consumer requirements.

Key Drivers, Barriers & Challenges in Australia Automotive Airfilters Market

Key Drivers: Rising vehicle ownership, increasing consumer awareness about air quality, stringent emission regulations, and technological advancements in filter design and materials propel market growth. Government initiatives promoting vehicle maintenance also contribute positively.

Challenges: Intense competition from aftermarket brands, fluctuating raw material prices, and the need for continuous product innovation pose challenges. Supply chain disruptions and economic uncertainties create instability, and the complexity of complying with environmental standards represents a significant hurdle.

Emerging Opportunities in Australia Automotive Airfilters Market

Emerging opportunities lie in the growing demand for high-efficiency particulate air (HEPA) filters, the rise of electric vehicles (potentially requiring specialized filters), and the expansion into the niche market of performance-enhancing air filters for enthusiast car owners. Untapped market segments include specialized filters for off-road vehicles and agricultural machinery.

Growth Accelerators in the Australia Automotive Airfilters Market Industry

Long-term growth is fueled by the continued adoption of advanced filter technologies, strategic partnerships between filter manufacturers and vehicle OEMs, and expansion into new vehicle segments like electric vehicles. Technological breakthroughs in filter media and design enhance filtration performance and lifespan, while strategic partnerships streamline supply chains and enhance market reach.

Key Players Shaping the Australia Automotive Airfilters Market Market

- S&B Filters Inc

- Allena Group

- K&N Engineering

- Advanced Flow Engineering Inc

- JS Automobiles

- Purolator Filters LLC

- Wsmridhi Manufacturing Co Pvt Ltd

- Mann+Hummel

- AL Filters

- AIRAID

Notable Milestones in Australia Automotive Airfilters Market Sector

- 2021: Mann+Hummel launched a new line of high-efficiency cabin air filters.

- 2022: Purolator Filters LLC announced a strategic partnership with a major Australian auto parts distributor.

- 2023: New emission standards came into effect, impacting filter design requirements. (Further milestones to be added as data becomes available)

In-Depth Australia Automotive Airfilters Market Market Outlook

The Australian automotive air filter market presents a promising outlook for the forecast period, driven by continuous innovation in filter technologies, expansion of the vehicle parc, and the growing emphasis on vehicle maintenance. Strategic opportunities exist in catering to the expanding commercial vehicle segment, developing specialized filters for electric vehicles, and penetrating the performance-oriented aftermarket. The market's positive trajectory hinges on maintaining technological leadership, fostering strategic alliances, and adapting to evolving consumer preferences.

Australia Automotive Airfilters Market Segmentation

-

1. Material Type

- 1.1. Paper Airfilter

- 1.2. Gauze Airfilter

- 1.3. Foam Airfilter

- 1.4. Others

-

2. Type

- 2.1. Intake Filters

- 2.2. Cabin Filters

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Sales Channel

- 4.1. OEMs

- 4.2. Aftermarket

Australia Automotive Airfilters Market Segmentation By Geography

- 1. Australia

Australia Automotive Airfilters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Vehicle Sales Anticipated to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Acting as Barrier for the Market

- 3.4. Market Trends

- 3.4.1. Commercial Vehicle Segment Captures Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Automotive Airfilters Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper Airfilter

- 5.1.2. Gauze Airfilter

- 5.1.3. Foam Airfilter

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Intake Filters

- 5.2.2. Cabin Filters

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEMs

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 S&B Filters Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Allena Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 K&N Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advanced Flow Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JS Automobiles

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Purolator Filters LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wsmridhi Manufacturing Co Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mann+Hummel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AL Filters

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AIRAID

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 S&B Filters Inc

List of Figures

- Figure 1: Australia Automotive Airfilters Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Automotive Airfilters Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Automotive Airfilters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Automotive Airfilters Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Australia Automotive Airfilters Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia Automotive Airfilters Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Australia Automotive Airfilters Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Australia Automotive Airfilters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Australia Automotive Airfilters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Australia Automotive Airfilters Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 9: Australia Automotive Airfilters Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Australia Automotive Airfilters Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Australia Automotive Airfilters Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: Australia Automotive Airfilters Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Automotive Airfilters Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Australia Automotive Airfilters Market?

Key companies in the market include S&B Filters Inc, Allena Group, K&N Engineering, Advanced Flow Engineering Inc, JS Automobiles, Purolator Filters LLC, Wsmridhi Manufacturing Co Pvt Ltd, Mann+Hummel, AL Filters, AIRAID.

3. What are the main segments of the Australia Automotive Airfilters Market?

The market segments include Material Type, Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Vehicle Sales Anticipated to Drive the Market.

6. What are the notable trends driving market growth?

Commercial Vehicle Segment Captures Market.

7. Are there any restraints impacting market growth?

High Initial Cost Acting as Barrier for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Automotive Airfilters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Automotive Airfilters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Automotive Airfilters Market?

To stay informed about further developments, trends, and reports in the Australia Automotive Airfilters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence