Key Insights

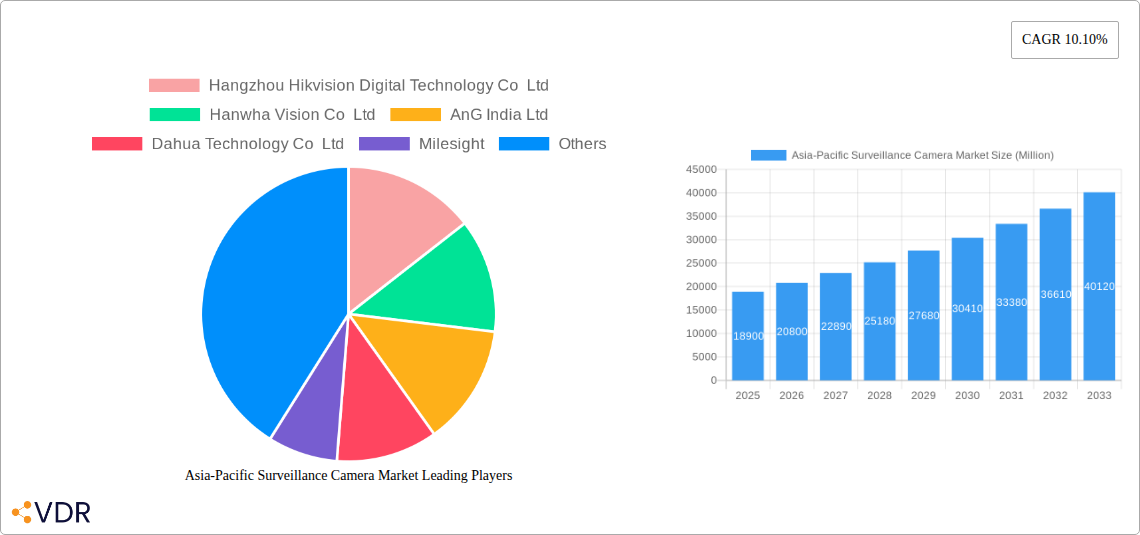

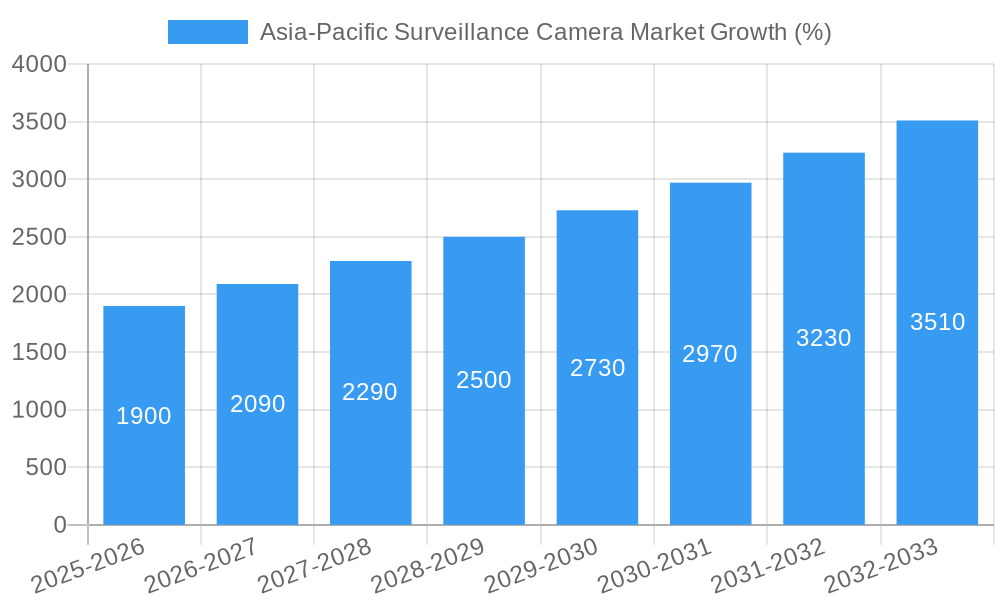

The Asia-Pacific surveillance camera market is experiencing robust growth, projected to reach \$18.90 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.10% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization across the region is fueling demand for enhanced security measures in public spaces and private properties. Furthermore, the rising adoption of smart city initiatives, focused on improving safety and efficiency, is a significant catalyst. Governments across the Asia-Pacific are investing heavily in advanced surveillance technologies to bolster national security and crime prevention. Technological advancements, such as the proliferation of high-resolution cameras with improved analytics capabilities, AI-powered video management systems, and the integration of IoT devices, further contribute to market growth. The growing adoption of cloud-based solutions for storage and remote monitoring also plays a crucial role. Competition is intense, with major players like Hikvision, Dahua, Hanwha Vision, and Axis Communications vying for market share. However, the market also accommodates several regional and niche players, fostering innovation and catering to specific market needs.

Despite the positive outlook, the market faces certain challenges. Concerns regarding data privacy and ethical implications of widespread surveillance are emerging as restraints. The high initial investment cost for advanced systems and the need for skilled personnel to manage and maintain these systems can also limit adoption, particularly among smaller businesses and municipalities. Nevertheless, the long-term potential remains substantial, driven by continuous technological innovation, increasing affordability of surveillance solutions, and the unwavering need for security in a rapidly evolving urban landscape. The market is segmented by product type (IP cameras, analog cameras, etc.), application (residential, commercial, government, etc.), and technology (AI, cloud, etc.), creating diverse opportunities for various stakeholders.

Asia-Pacific Surveillance Camera Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific surveillance camera market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The study delves into the parent market of security and surveillance equipment and the child market of network video recorders (NVRs) and digital video recorders (DVRs), providing granular insights for industry professionals and strategic decision-makers. The market size is presented in million units.

Asia-Pacific Surveillance Camera Market Dynamics & Structure

The Asia-Pacific surveillance camera market is characterized by a moderately concentrated landscape, with key players like Hangzhou Hikvision Digital Technology Co Ltd and Dahua Technology Co Ltd holding significant market share. Technological innovation, driven by the increasing adoption of Artificial Intelligence (AI), analytics, and cloud-based solutions, is a major driver. However, regulatory frameworks concerning data privacy and cybersecurity pose significant challenges. The market faces competition from alternative security solutions, such as access control systems. The end-user base spans diverse sectors including government, commercial, residential, and critical infrastructure. Mergers and acquisitions (M&A) activity remains relatively high, with xx deals recorded in the historical period (2019-2024), indicating a consolidating market.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: AI, analytics, and cloud solutions are key drivers, while cost and integration complexities pose barriers.

- Regulatory Landscape: Data privacy regulations (e.g., GDPR-like legislation in various APAC countries) influence market development.

- Competitive Substitutes: Access control systems, biometric security, and other security technologies are competing alternatives.

- End-User Demographics: Government, commercial establishments, residential spaces, and critical infrastructure segments are key end-users.

- M&A Activity: xx M&A deals in 2019-2024, indicating market consolidation.

Asia-Pacific Surveillance Camera Market Growth Trends & Insights

The Asia-Pacific surveillance camera market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to factors including increasing urbanization, rising crime rates, and the growing need for enhanced security in both public and private spaces. The adoption rate of IP-based cameras has been rapidly increasing, surpassing analog cameras in several regions. Technological advancements, such as improved image quality, wider field of view, and enhanced analytics capabilities, are driving market expansion. Consumer behavior shifts towards higher-quality video surveillance and smart home security solutions further fuel market demand. The market size is projected to reach xx million units by 2025, with a forecast CAGR of xx% from 2025 to 2033. Market penetration in key segments like smart cities is estimated at xx% in 2024, expected to grow to xx% by 2033.

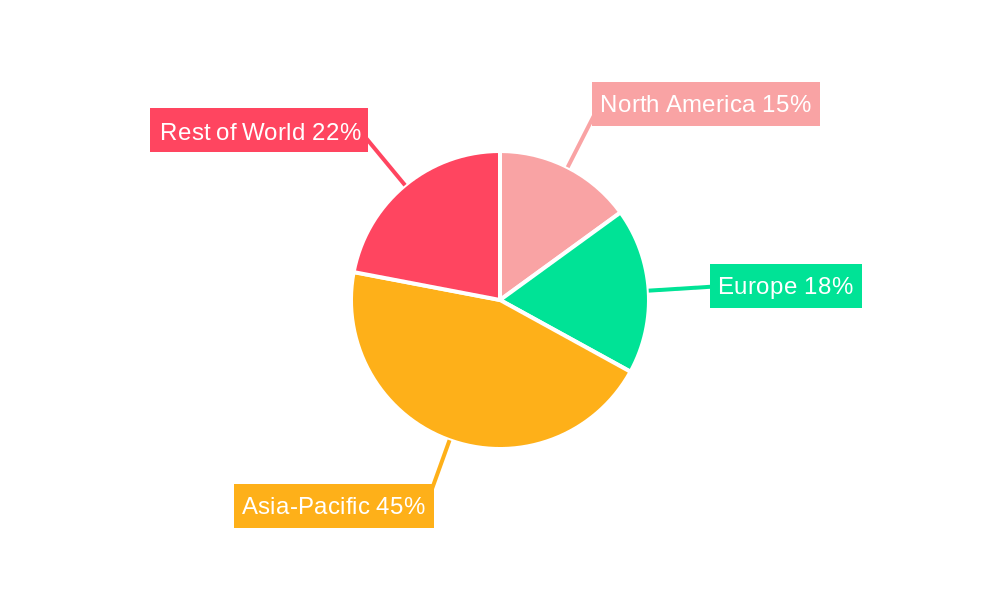

Dominant Regions, Countries, or Segments in Asia-Pacific Surveillance Camera Market

China and India are the leading countries driving the Asia-Pacific surveillance camera market's growth. China's robust government investment in smart city infrastructure and stringent security regulations has fueled significant demand. India's expanding commercial sector and increasing awareness of security needs also contribute significantly. Other regions such as South Korea, Japan, and Australia also show substantial growth, although at a slower pace than China and India. The market is further segmented based on camera type (IP, Analog), resolution (HD, 4K, etc.), application (residential, commercial, government, etc.), and technology (AI, analytics).

- Key Drivers in China: Government initiatives for smart city development and strong security regulations.

- Key Drivers in India: Expanding commercial sector, rising crime rates, and increased security consciousness.

- Other Notable Regions: South Korea, Japan, and Australia also show considerable but slower growth.

- Dominant Segments: IP cameras and high-resolution cameras are showing the fastest growth.

Asia-Pacific Surveillance Camera Market Product Landscape

The market offers a diverse range of surveillance cameras, including IP network cameras, analog CCTV cameras, PTZ (pan-tilt-zoom) cameras, dome cameras, bullet cameras, and body-worn cameras. Recent innovations focus on AI-powered features such as facial recognition, object detection, and license plate recognition. These advanced features enhance security and allow for proactive crime prevention. Many cameras now offer high-resolution video, wide field-of-view, and improved low-light performance. The integration of cloud-based platforms for remote monitoring and data storage is also a key trend.

Key Drivers, Barriers & Challenges in Asia-Pacific Surveillance Camera Market

Key Drivers:

- Increasing urbanization and rising crime rates drive demand for security solutions.

- Government initiatives promoting smart city development.

- Technological advancements leading to improved camera performance and features.

- Growing adoption of cloud-based solutions for centralized monitoring.

Key Challenges:

- High initial investment costs for advanced surveillance systems can be a barrier to adoption, particularly for smaller businesses and residential users. This impact is estimated to restrain the market by approximately xx% by 2033.

- Data privacy concerns and cybersecurity risks associated with storing and transmitting sensitive video data.

- Competition from alternative security technologies and solutions.

- Supply chain disruptions affecting the availability of components and finished goods.

Emerging Opportunities in Asia-Pacific Surveillance Camera Market

- Expansion into rural areas and underserved markets.

- Growing demand for AI-powered analytics and intelligent video surveillance.

- Increased adoption of thermal imaging cameras for enhanced security.

- Integration of surveillance cameras with other smart home and building automation systems.

Growth Accelerators in the Asia-Pacific Surveillance Camera Market Industry

Technological advancements, especially in AI and analytics, are driving long-term growth. Strategic partnerships between camera manufacturers, software developers, and cloud service providers are also creating new opportunities. Expansion into new applications, such as smart retail and logistics, is generating additional demand. Government investments in security infrastructure and smart city projects are further accelerating market expansion.

Key Players Shaping the Asia-Pacific Surveillance Camera Market Market

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision Co Ltd

- AnG India Ltd

- Dahua Technology Co Ltd

- Milesight

- Genetec Inc

- Anviz Global Inc

- Bosch Security Systems GmbH

- D-Link India Limited

- Secureye

- Teledyne FLIR LLC

- Milestone Systems

- Honeywell International Inc

- Axis Communications AB

- Eagle Eye Network

Notable Milestones in Asia-Pacific Surveillance Camera Market Sector

- August 2023: Hikvision launched the PanoVU, a 16 MP, 180-degree network camera designed for extreme weather conditions, featuring intelligent human density counting.

- May 2024: Hanwha Vision debuted its dual-lens barcode reader camera, integrating barcode recognition and video capture, enhancing logistics efficiency.

In-Depth Asia-Pacific Surveillance Camera Market Market Outlook

The Asia-Pacific surveillance camera market is poised for continued robust growth, driven by technological innovation, government support, and the increasing need for enhanced security across various sectors. Strategic partnerships and expansion into untapped markets present significant opportunities for market players. The focus on AI-powered features and cloud-based solutions will shape the future landscape, offering enhanced security and data analytics capabilities. This will lead to further market expansion and increased market penetration.

Asia-Pacific Surveillance Camera Market Segmentation

-

1. Type

- 1.1. Analog-based

- 1.2. IP-based

- 1.3. Hybrid

-

2. End-user Industry

- 2.1. Government

- 2.2. Banking

- 2.3. Healthcare

- 2.4. Transportation and Logistics

- 2.5. Industrial

- 2.6. Other En

Asia-Pacific Surveillance Camera Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Surveillance Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Advancements in Technology and Functionality

- 3.2.2 like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras

- 3.3. Market Restrains

- 3.3.1 Advancements in Technology and Functionality

- 3.3.2 like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras

- 3.4. Market Trends

- 3.4.1. IP-based Cameras are Gaining Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Surveillance Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog-based

- 5.1.2. IP-based

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government

- 5.2.2. Banking

- 5.2.3. Healthcare

- 5.2.4. Transportation and Logistics

- 5.2.5. Industrial

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hanwha Vision Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AnG India Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dahua Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Milesight

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetec Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Anviz Global Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch Security Systems GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 D-Link India Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Secureye

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Teledyne FLIR LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Milestone Systems

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Honeywell International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Axis Communications AB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Eagle Eye Network

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: Asia-Pacific Surveillance Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Surveillance Camera Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Asia-Pacific Surveillance Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Asia-Pacific Surveillance Camera Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: China Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: New Zealand Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: New Zealand Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Malaysia Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Singapore Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Thailand Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Thailand Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Vietnam Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Vietnam Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Philippines Asia-Pacific Surveillance Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Philippines Asia-Pacific Surveillance Camera Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Surveillance Camera Market?

The projected CAGR is approximately 10.10%.

2. Which companies are prominent players in the Asia-Pacific Surveillance Camera Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision Co Ltd, AnG India Ltd, Dahua Technology Co Ltd, Milesight, Genetec Inc, Anviz Global Inc, Bosch Security Systems GmbH, D-Link India Limited, Secureye, Teledyne FLIR LLC, Milestone Systems, Honeywell International Inc, Axis Communications AB, Eagle Eye Network.

3. What are the main segments of the Asia-Pacific Surveillance Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in Technology and Functionality. like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras.

6. What are the notable trends driving market growth?

IP-based Cameras are Gaining Momentum.

7. Are there any restraints impacting market growth?

Advancements in Technology and Functionality. like High-resolution Cameras; Increasing Demand for Cloud-based Storage; Strict Government Regulations for the Mandatory Installation of Surveillance Cameras.

8. Can you provide examples of recent developments in the market?

May 2024 - Hanwha Vision debuted the industry's inaugural dual-lens barcode reader (BCR) camera, merging barcode recognition and video capture into a singular, efficient device. This innovation equips logistics firms with a streamlined approach to cutting costs, curbing losses, and enhancing operational efficiency. The AI-powered BCR camera adeptly tracks and identifies parcel barcodes on swift conveyors, boasting a remarkable speed of 2 m/s. Its image sensors, tailored for both barcode recognition and video monitoring, deliver crisp 4K resolution and a broad field-of-view (FoV) courtesy of a 25 mm lens. The camera seamlessly integrates with Hanwha Vision's cutting-edge vision logistics tracking software (VLTS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Surveillance Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Surveillance Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Surveillance Camera Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Surveillance Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence