Key Insights

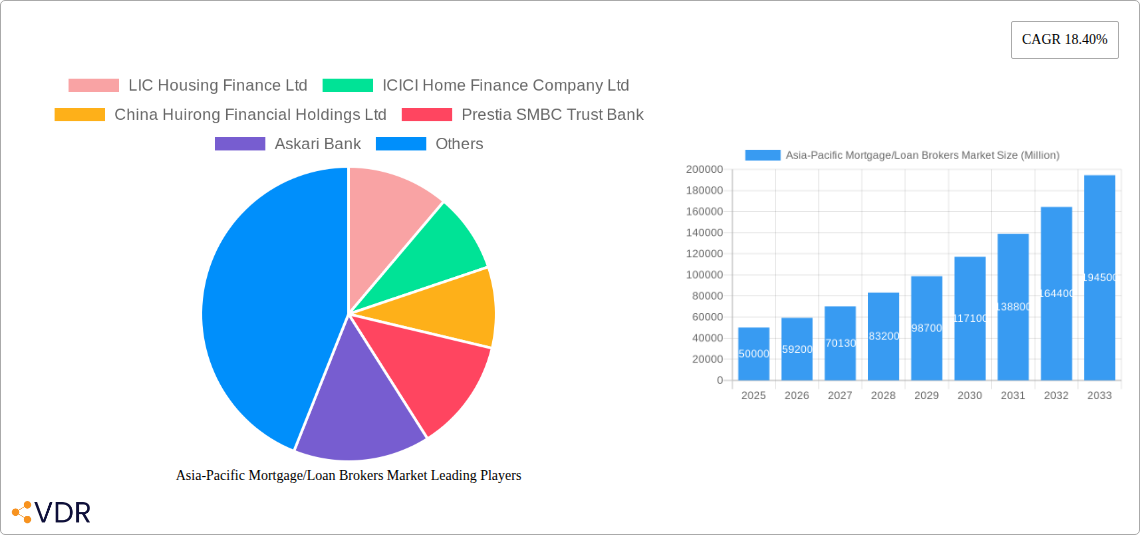

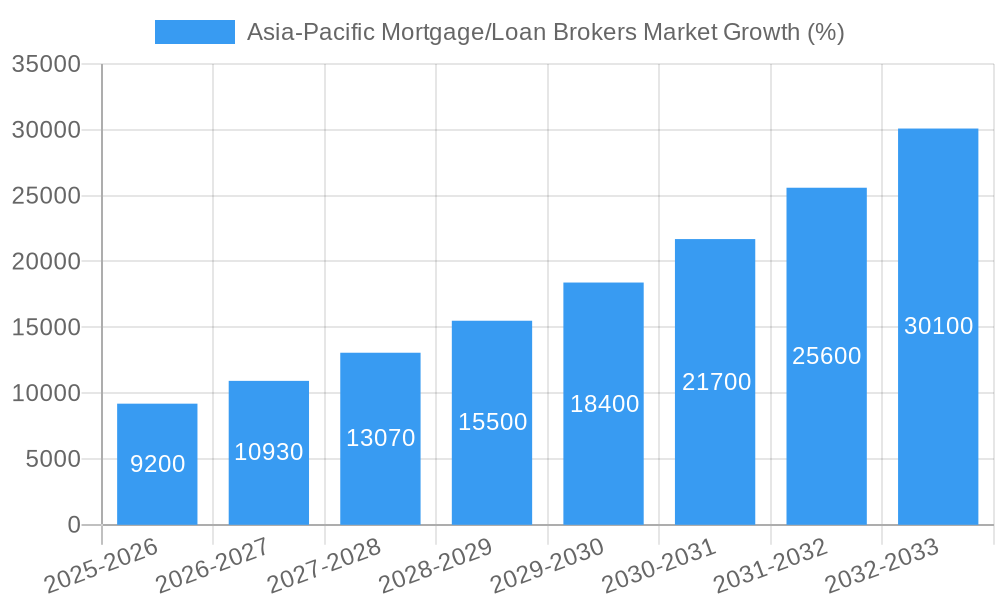

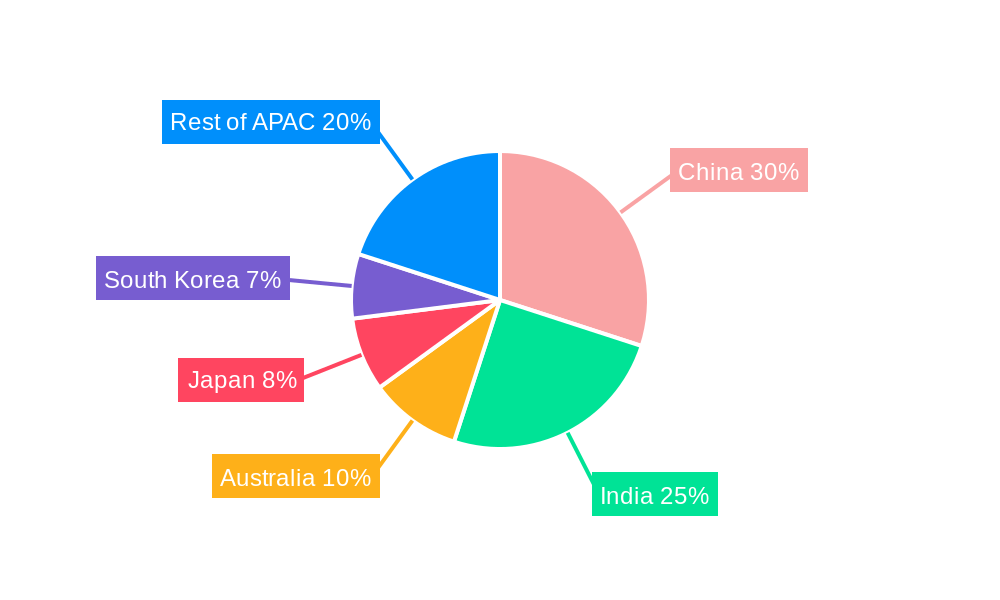

The Asia-Pacific mortgage/loan broker market is experiencing robust growth, fueled by a burgeoning middle class, increasing urbanization, and supportive government policies aimed at boosting homeownership. The market's Compound Annual Growth Rate (CAGR) of 18.40% from 2019 to 2024 indicates a significant expansion, projected to continue throughout the forecast period (2025-2033). While precise market sizing data is unavailable, considering a conservative estimate, assuming a 2025 market size of $50 billion (based on global market trends and the provided CAGR), the market is likely to exceed $150 billion by 2033. Key drivers include rising disposable incomes, favorable interest rates (although subject to fluctuation), and the increasing availability of digital mortgage platforms streamlining the application process. Furthermore, the expanding use of fintech solutions is enhancing efficiency and transparency within the mortgage brokerage industry. However, challenges remain, including stringent regulatory compliance requirements and the potential for economic downturns that could impact consumer demand. The market is segmented geographically, with significant contributions from countries like India, China, and Australia, where rapid economic growth and expanding housing markets drive demand for mortgage broker services. Competition is intense, with both established players like LIC Housing Finance and ICICI Home Finance, and newer fintech entrants vying for market share.

The competitive landscape showcases a blend of established financial institutions and emerging fintech companies. Established players leverage their extensive networks and brand recognition, while fintech disruptors provide innovative technology-driven solutions. This competitive dynamic fosters innovation and contributes to improved customer experiences. Regional variations in market growth are expected, influenced by factors like economic development, government regulations, and cultural preferences. Further growth will likely be driven by increased financial literacy among consumers, leading to greater awareness of mortgage broker services and their benefits. The market's success hinges on adapting to evolving consumer needs and technological advancements. Continued innovation, regulatory clarity, and sustained economic growth will be crucial factors in determining the market's trajectory in the coming years. A diversified product portfolio, targeting various income levels and property types, is key for securing a dominant market position.

Asia-Pacific Mortgage/Loan Brokers Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Mortgage/Loan Brokers Market, encompassing market dynamics, growth trends, regional performance, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The report utilizes both quantitative and qualitative data to deliver actionable insights for industry professionals, investors, and stakeholders. The report analyzes the parent market of Financial Services and the child market of Mortgage and Loan Brokerage to offer a complete overview of this dynamic sector.

Asia-Pacific Mortgage/Loan Brokers Market Dynamics & Structure

This section analyzes the competitive landscape of the Asia-Pacific mortgage/loan brokers market, examining market concentration, technological innovation, regulatory frameworks, and market dynamics. We delve into the interplay of factors influencing market growth and stability.

- Market Concentration: The market exhibits a [xx]% concentration ratio with the top 5 players holding [xx]% market share in 2024. This indicates a [competitive/consolidated] market structure.

- Technological Innovation: The increasing adoption of fintech solutions, including AI-powered lending platforms and digital mortgage applications, is a major driver. However, data security concerns and legacy system integration pose challenges.

- Regulatory Frameworks: Varying regulatory landscapes across Asia-Pacific countries create both opportunities and obstacles. Compliance costs and differing lending criteria impact market dynamics.

- Competitive Product Substitutes: Direct lenders and peer-to-peer lending platforms pose significant competition. The rise of digital lenders is eroding traditional brokers’ market share by [xx]% annually.

- End-User Demographics: The growing middle class and increasing urbanization in key Asian markets fuel demand for mortgages and loans. First-time homebuyers are a significant segment, with [xx] million new mortgages expected by 2033.

- M&A Trends: The past five years have seen [xx] M&A deals in the Asia-Pacific mortgage brokerage sector, with an average deal value of [xx] million. Consolidation is expected to continue driven by [mention specific reasons, e.g., economies of scale, technological integration].

Asia-Pacific Mortgage/Loan Brokers Market Growth Trends & Insights

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Using robust data analysis, we project a CAGR of [xx]% for the forecast period (2025-2033).

[Insert 600-word analysis here focusing on market size evolution, adoption rates of digital platforms, technological disruptions like AI and blockchain, and shifting consumer behavior towards online services and personalized financial solutions. Include specific metrics such as CAGR, market penetration rates in different countries, and the impact of macroeconomic factors like interest rates and GDP growth.]

Dominant Regions, Countries, or Segments in Asia-Pacific Mortgage/Loan Brokers Market

This section identifies the leading regions, countries, and segments driving market growth within the Asia-Pacific region.

[Insert 600-word analysis here. Identify the leading region (e.g., China, India, Australia) and explain the dominance factors based on market size, growth rate, and economic factors. Use bullet points to highlight key drivers:

- Strong economic growth

- Favorable government policies (e.g., tax incentives for homebuyers)

- Growing middle class

- Rapid urbanization

- Development of robust infrastructure. Analyze market share and growth potential of each dominant region and segment. Quantify the market size and growth projections for each region.]

Asia-Pacific Mortgage/Loan Brokers Market Product Landscape

The Asia-Pacific mortgage/loan brokers market offers a diverse range of products and services tailored to specific customer needs. These include traditional brokerage services, alongside innovative fintech solutions offering online mortgage applications, AI-driven credit scoring, and personalized financial advice. The increasing integration of technology enhances efficiency and customer experience, leading to the adoption of bundled services and value-added offerings. This evolution is reflected in higher customer satisfaction and increased market penetration.

Key Drivers, Barriers & Challenges in Asia-Pacific Mortgage/Loan Brokers Market

Key Drivers: The Asia-Pacific mortgage/loan brokers market is propelled by several factors: increasing disposable incomes, favorable government policies supporting homeownership, and the expansion of the middle class. Technological advancements such as AI-driven credit scoring and digital mortgage platforms further accelerate growth.

Key Barriers and Challenges: Regulatory hurdles, intense competition from direct lenders, and cybersecurity risks are significant challenges. Supply chain disruptions and economic downturns can also impact market performance. For example, the [xx]% increase in interest rates in [year] led to a [xx]% decrease in mortgage applications.

Emerging Opportunities in Asia-Pacific Mortgage/Loan Brokers Market

Untapped markets in less-developed regions present significant growth potential. The increasing adoption of digital technologies and the growing demand for personalized financial services create opportunities for innovative product development and targeted marketing strategies. Expansion into niche markets, such as green mortgages and sustainable finance, offer further avenues for growth.

Growth Accelerators in the Asia-Pacific Mortgage/Loan Brokers Market Industry

Technological innovations, strategic partnerships with fintech companies, and government initiatives promoting affordable housing are key catalysts for long-term growth. Expanding into underserved markets and offering customized financial solutions cater to evolving consumer needs.

Key Players Shaping the Asia-Pacific Mortgage/Loan Brokers Market Market

- LIC Housing Finance Ltd

- ICICI Home Finance Company Ltd

- China Huirong Financial Holdings Ltd

- Prestia SMBC Trust Bank

- Askari Bank

- CNFinance Holdings Limited

- Shinsei Bank

- Tokyo Star Bank

- PNB Housing Finance Ltd

- Can Fin Homes Ltd (List Not Exhaustive)

Notable Milestones in Asia-Pacific Mortgage/Loan Brokers Market Sector

- March 2023: All Fleet Mortgages reduced rates on two- and five-year fixed-rate packages by 20 basis points across various loan types. This reflects the competitive pressure and potential impact on market pricing.

- February 2023: The State Bank of India raised USD 1 billion in syndicated social funds, the largest ESG loan in Asia Pacific history, demonstrating growing interest in sustainable finance and its potential impact on the mortgage market.

In-Depth Asia-Pacific Mortgage/Loan Brokers Market Market Outlook

The Asia-Pacific mortgage/loan brokers market is poised for significant growth driven by technological advancements, increasing urbanization, and supportive government policies. Strategic partnerships, expansion into untapped markets, and the development of innovative financial products will play a crucial role in shaping the future landscape. The market is expected to reach [xx] million by 2033, presenting substantial opportunities for both established and emerging players.

Asia-Pacific Mortgage/Loan Brokers Market Segmentation

-

1. Enterprise

- 1.1. Large

- 1.2. Small

- 1.3. Mid-sized

-

2. Applications

- 2.1. Home Loans

- 2.2. Commercial and Industrial Loans

- 2.3. Vehicle Loans

- 2.4. Loans to Governments

- 2.5. Others

-

3. End- User

- 3.1. Businesses

- 3.2. Individuals

Asia-Pacific Mortgage/Loan Brokers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth in Demand for Personalized Financial Guidance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Mid-sized

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Home Loans

- 5.2.2. Commercial and Industrial Loans

- 5.2.3. Vehicle Loans

- 5.2.4. Loans to Governments

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Businesses

- 5.3.2. Individuals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 LIC Housing Finance Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ICICI Home Finance Company Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Huirong Financial Holdings Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Prestia SMBC Trust Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Askari Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CNFinance Holdings Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shinsei Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokyo Star Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PNB Housing Finance Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Can Fin Homes Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LIC Housing Finance Ltd

List of Figures

- Figure 1: Asia-Pacific Mortgage/Loan Brokers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Mortgage/Loan Brokers Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 3: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 4: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by End- User 2019 & 2032

- Table 5: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by Enterprise 2019 & 2032

- Table 7: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by Applications 2019 & 2032

- Table 8: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by End- User 2019 & 2032

- Table 9: Asia-Pacific Mortgage/Loan Brokers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: New Zealand Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Indonesia Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Malaysia Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Singapore Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Thailand Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Vietnam Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Philippines Asia-Pacific Mortgage/Loan Brokers Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Mortgage/Loan Brokers Market?

The projected CAGR is approximately 18.40%.

2. Which companies are prominent players in the Asia-Pacific Mortgage/Loan Brokers Market?

Key companies in the market include LIC Housing Finance Ltd, ICICI Home Finance Company Ltd, China Huirong Financial Holdings Ltd, Prestia SMBC Trust Bank, Askari Bank, CNFinance Holdings Limited, Shinsei Bank, Tokyo Star Bank, PNB Housing Finance Ltd, Can Fin Homes Ltd **List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Mortgage/Loan Brokers Market?

The market segments include Enterprise, Applications, End- User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth in Demand for Personalized Financial Guidance.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: All Fleet Mortgages' two- and five-year fixed-rate packages had their rates reduced. The buy-to-let lender claims a 20 basis point reduction in its standard, limited company, residences in multiple occupations, and multi-unit freehold block loans in these term ranges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence