Key Insights

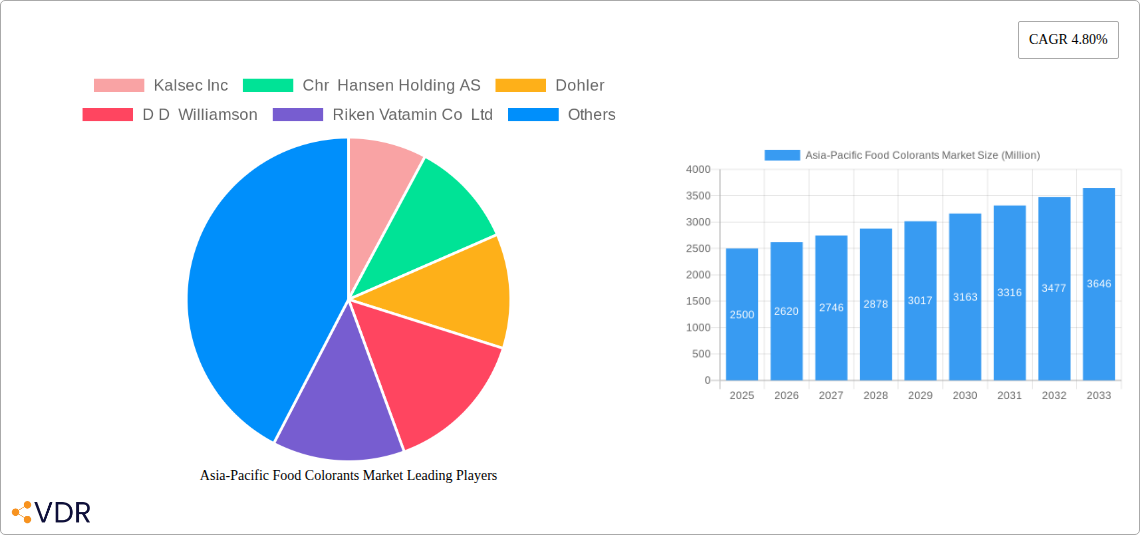

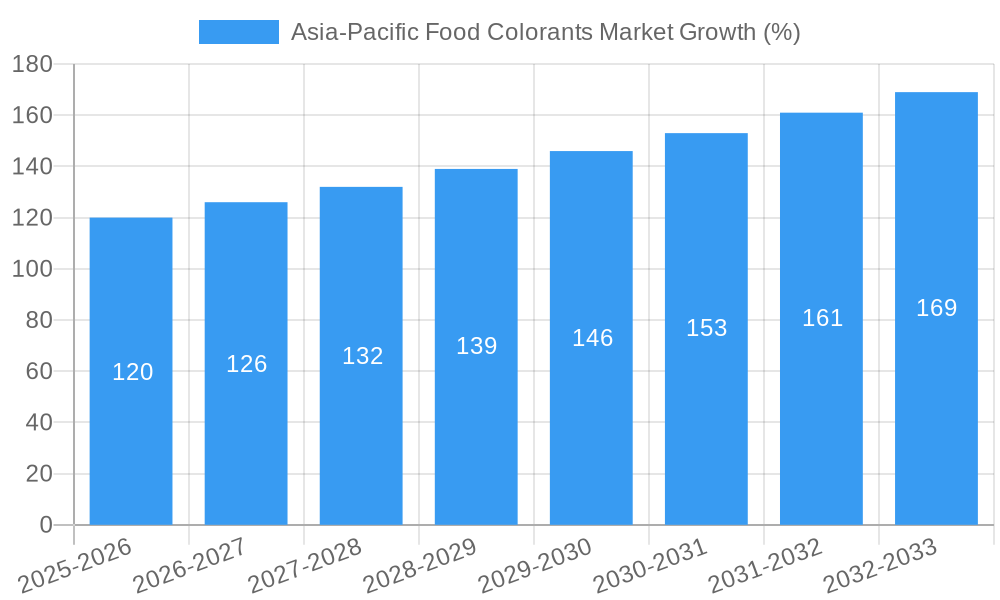

The Asia-Pacific food colorants market, valued at approximately $2.5 billion in 2025, is projected to experience robust growth, driven by increasing demand for processed foods and beverages, particularly in rapidly developing economies like India and China. The market's Compound Annual Growth Rate (CAGR) of 4.80% from 2025 to 2033 reflects a consistent upward trajectory fueled by several key factors. Consumers' growing preference for visually appealing food products, coupled with the expanding food processing industry within the region, significantly contributes to this growth. The rising disposable incomes and changing dietary habits across the Asia-Pacific region, particularly a shift towards convenient and ready-to-eat meals, further bolster market expansion. Natural food colorants are gaining traction due to increasing health consciousness among consumers, although synthetic colorants still maintain a significant market share owing to their cost-effectiveness and consistent color delivery. The market segmentation by application reveals strong demand from the beverages, confectionery, and dairy sectors, while the bakery and savory snacks segments are also exhibiting steady growth. While regulatory changes concerning food additives pose a potential restraint, innovative product development and strategic partnerships within the industry are likely to mitigate these challenges and maintain market momentum.

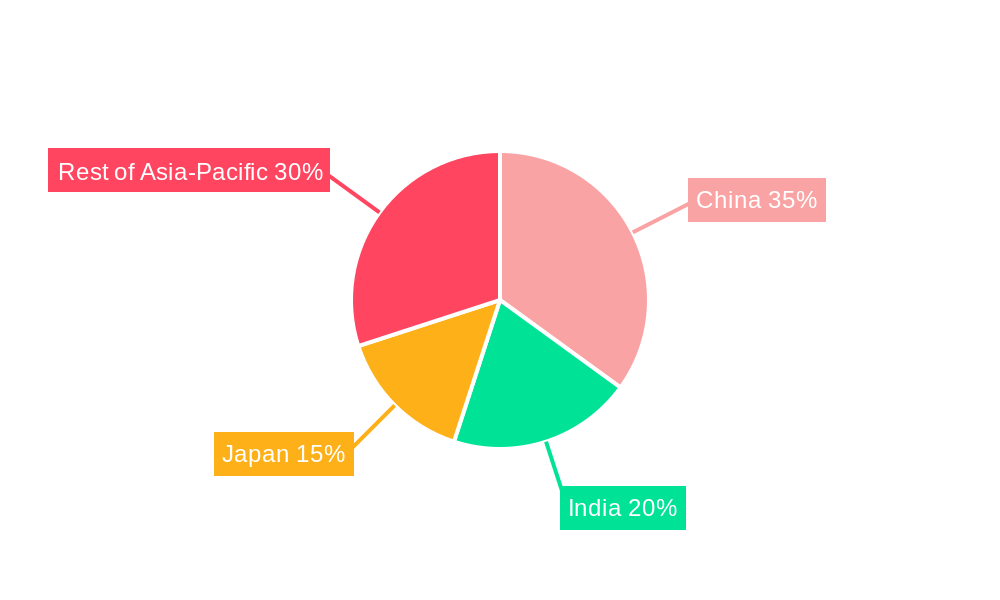

Within the Asia-Pacific region, China and India represent the largest market segments, exhibiting high growth potential due to their vast populations and burgeoning food and beverage industries. Japan, with its sophisticated food processing sector and high consumer demand for premium food products, also contributes significantly to the overall market value. Other countries within the region, such as Australia and South Korea, show promising growth prospects, driven by increasing consumer awareness and rising disposable incomes. Key players in the market, including Kalsec Inc., Chr. Hansen Holding AS, and Döhler, leverage their extensive product portfolios and strong distribution networks to maintain market leadership. The competitive landscape is characterized by ongoing innovation in colorant technology, expansion into new market segments, and strategic mergers and acquisitions, ensuring continuous market evolution and growth.

Asia-Pacific Food Colorants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific food colorants market, encompassing market dynamics, growth trends, dominant segments, and key players. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The market is segmented by product type (natural and synthetic colors), application (beverages, dairy products, bakery products, savory snacks, confectionery, and other applications), and country (China, Japan, India, Australia, and the Rest of Asia-Pacific). The total market size is projected to reach xx Million by 2033.

Asia-Pacific Food Colorants Market Dynamics & Structure

The Asia-Pacific food colorants market is characterized by a moderately concentrated landscape, with key players like Kalsec Inc, Chr. Hansen Holding AS, Dohler, D D Williamson, Riken Vitamin Co Ltd, KANCOR, BASF SE, and Sensient Technologies Corporation holding significant market share. Technological innovation, particularly in natural colorants, is a key driver, alongside evolving consumer preferences towards cleaner labels and healthier food options. Stringent regulatory frameworks concerning food safety and the increasing demand for natural food colorants are shaping market dynamics. The market witnesses consistent M&A activity, with xx deals recorded between 2019 and 2024, indicating a trend toward consolidation. Competition from synthetic colorants remains strong, driven by their cost-effectiveness.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on natural colorants, sustainable sourcing, and improved color stability.

- Regulatory Framework: Stringent regulations impacting product approvals and labeling requirements.

- Competitive Substitutes: Synthetic colorants offer cost advantages but face increasing pressure from consumer demand for natural alternatives.

- End-User Demographics: Growing middle class and changing consumer preferences towards convenience foods drive demand.

- M&A Trends: xx M&A deals between 2019 and 2024, indicating consolidation and expansion strategies.

Asia-Pacific Food Colorants Market Growth Trends & Insights

The Asia-Pacific food colorants market experienced significant growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, changing dietary habits, and increased demand for processed and packaged foods. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Market penetration of natural colorants is increasing steadily, driven by health consciousness and clean label trends. Technological advancements, such as the development of new extraction and production methods for natural colorants, are further fueling market growth. Consumer preference shifts towards healthier, more naturally colored food products are also contributing to the overall market expansion. The increasing demand for convenience foods in rapidly urbanizing regions is a significant factor. Furthermore, the growing popularity of functional foods and beverages, which often incorporate natural colorants, is contributing to market expansion.

Dominant Regions, Countries, or Segments in Asia-Pacific Food Colorants Market

China dominates the Asia-Pacific food colorants market, accounting for approximately xx% of the total market value in 2024, followed by Japan and India. This dominance is attributed to the large population, booming food processing industry, and rising demand for processed foods. The natural color segment is experiencing faster growth compared to synthetic colorants, driven by consumer preference for natural ingredients. Within applications, beverages and confectionery products are the largest segments, due to the extensive use of colorants to enhance visual appeal.

- Key Drivers in China: Large and growing population, robust food processing sector, increasing disposable incomes.

- Key Drivers in Japan: High demand for premium and natural food products.

- Key Drivers in India: Expanding food processing industry, rising demand for processed and packaged foods.

- Segment Dominance: Natural colorants are experiencing faster growth than synthetic colorants due to consumer preference shifts.

- Application Dominance: Beverages and confectionery are the largest application segments.

Asia-Pacific Food Colorants Market Product Landscape

The Asia-Pacific food colorants market offers a wide array of products, including natural colorants derived from plants, fruits, vegetables, and insects, as well as synthetic colorants. Innovation focuses on developing more stable, versatile, and cost-effective colorants that cater to the diverse needs of various food applications. Manufacturers are investing heavily in research and development to improve the performance characteristics of both natural and synthetic colorants, including color intensity, stability, and compatibility with various food matrices. Unique selling propositions include enhanced color stability, natural sourcing, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Asia-Pacific Food Colorants Market

Key Drivers: Growing demand for processed food, increasing health consciousness (leading to demand for natural colors), rising disposable incomes in developing economies, and stringent food safety regulations driving the adoption of high-quality colorants.

Key Challenges: Fluctuations in raw material prices, stringent regulations and approvals, competition from synthetic colorants, and maintaining consistent color quality across different production batches. Supply chain disruptions due to geopolitical events can lead to price volatility and shortages. The regulatory environment differs across countries, increasing compliance costs.

Emerging Opportunities in Asia-Pacific Food Colorants Market

Emerging opportunities lie in the growing demand for clean-label products, the development of novel natural colorants from unconventional sources, and the increasing adoption of personalized nutrition. Untapped markets in Southeast Asia and the expansion into functional food applications present significant growth potential. The use of natural colorants in meat alternatives and plant-based products is also a rapidly expanding market segment.

Growth Accelerators in the Asia-Pacific Food Colorants Market Industry

Technological breakthroughs in extraction and production methods for natural colorants, strategic collaborations between colorant manufacturers and food companies, and expansion into emerging markets are driving long-term growth. Sustainable sourcing initiatives and improvements in color stability are also key growth catalysts.

Key Players Shaping the Asia-Pacific Food Colorants Market Market

- Kalsec Inc

- Chr. Hansen Holding AS

- Dohler

- D D Williamson

- Riken Vitamin Co Ltd

- KANCOR

- BASF SE

- Sensient Technologies Corporation

Notable Milestones in Asia-Pacific Food Colorants Market Sector

- 2021: Kalsec Inc. launched a new line of natural colorants derived from fruit and vegetable extracts.

- 2022: Chr. Hansen Holding AS acquired a smaller natural colorants company to expand its portfolio.

- 2023: BASF SE invested heavily in R&D for improved natural colorant stability.

- 2024: New regulations regarding synthetic colorants implemented in several countries within the region.

In-Depth Asia-Pacific Food Colorants Market Outlook

The Asia-Pacific food colorants market is poised for robust growth in the coming years, driven by the factors mentioned above. Strategic partnerships, focus on sustainability, and innovation in natural colorants will continue to shape market dynamics. The expansion into emerging markets and the growing demand for clean label products represent key opportunities for market participants. The market is expected to show significant potential for long-term sustainable growth with a positive outlook for the next decade.

Asia-Pacific Food Colorants Market Segmentation

-

1. Product Type

- 1.1. Natural Color

- 1.2. Synthetic Color

-

2. Application

- 2.1. Beverages

- 2.2. Dairy Products

- 2.3. Bakery Products

- 2.4. Savory Snacks

- 2.5. Confectionery

- 2.6. Other Applications

Asia-Pacific Food Colorants Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Food Colorants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean-label Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Natural Color

- 5.1.2. Synthetic Color

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy Products

- 5.2.3. Bakery Products

- 5.2.4. Savory Snacks

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Food Colorants Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Kalsec Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Chr Hansen Holding AS

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Dohler

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 D D Williamson

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Riken Vatamin Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KANCOR*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BASF SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sensient Technologies Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Kalsec Inc

List of Figures

- Figure 1: Asia-Pacific Food Colorants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Food Colorants Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Asia-Pacific Food Colorants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Food Colorants Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Food Colorants Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Asia-Pacific Food Colorants Market?

Key companies in the market include Kalsec Inc, Chr Hansen Holding AS, Dohler, D D Williamson, Riken Vatamin Co Ltd, KANCOR*List Not Exhaustive, BASF SE, Sensient Technologies Corporation.

3. What are the main segments of the Asia-Pacific Food Colorants Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Increasing Demand for Clean-label Products.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Food Colorants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Food Colorants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Food Colorants Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Food Colorants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence