Key Insights

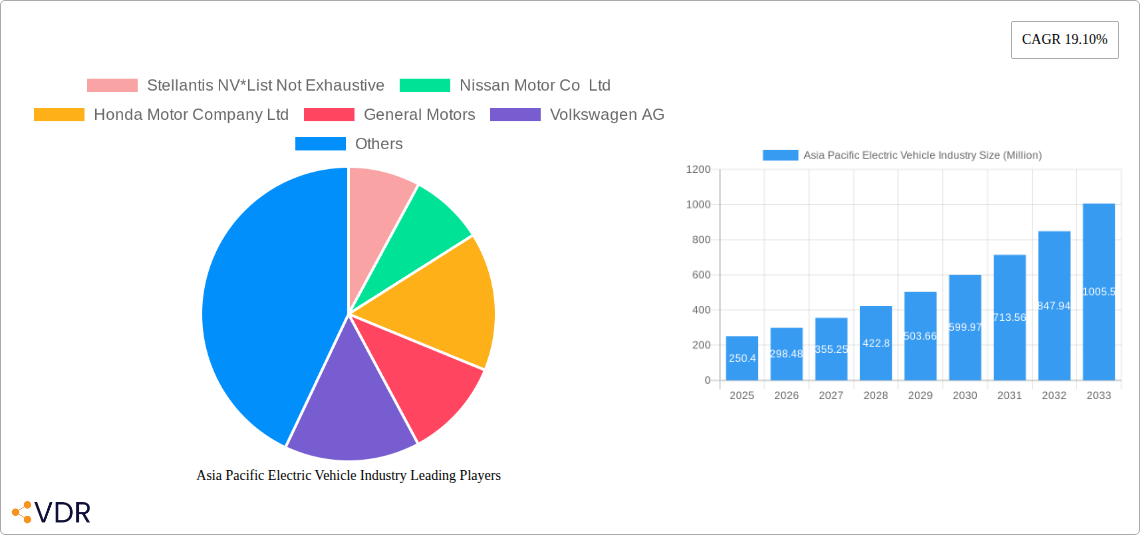

The Asia-Pacific electric vehicle (EV) market is experiencing explosive growth, projected to reach \$250.40 million in 2025 and maintain a robust Compound Annual Growth Rate (CAGR) of 19.10% from 2025 to 2033. This surge is driven by several key factors. Government incentives promoting EV adoption across nations like China, India, Japan, and South Korea are significantly boosting sales. Increasing environmental concerns and stricter emission regulations are further pushing consumers and businesses towards cleaner transportation solutions. Technological advancements resulting in longer battery life, faster charging times, and improved vehicle performance are also contributing to heightened consumer appeal. The market segmentation reveals strong growth across passenger cars and commercial vehicles, with fast charging infrastructure expanding rapidly to address range anxiety. Battery Electric Vehicles (BEVs) currently dominate the propulsion type segment, though Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) continue to hold significant market share, catering to varying consumer needs and preferences. China and India are projected to be the largest markets within the region, fuelled by their massive populations and burgeoning middle classes with increasing purchasing power. Leading automotive manufacturers like Tesla, BYD, Toyota, and others are investing heavily in R&D and production capacity to meet the escalating demand, further accelerating market expansion.

The competitive landscape is fiercely dynamic, with established automakers and emerging EV startups vying for market dominance. While challenges remain, including the need for further development of charging infrastructure, particularly in less developed regions, and the fluctuating price of raw materials for battery production, the overall market outlook remains highly positive. The continuous improvement in battery technology, cost reduction through economies of scale, and sustained government support are expected to mitigate these challenges and drive consistent growth throughout the forecast period. The Asia-Pacific EV market is poised to become a global leader in the transition to sustainable transportation, presenting significant opportunities for investors, manufacturers, and technology providers.

Asia Pacific Electric Vehicle Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific electric vehicle (EV) industry, encompassing market dynamics, growth trends, dominant segments, and key players. With a focus on the period 2019-2033 (base year 2025), this report offers invaluable insights for industry professionals, investors, and policymakers seeking to navigate this rapidly evolving landscape. The report analyzes parent markets (Electric Vehicles) and child markets (Passenger Cars, Commercial Vehicles, Charging Types, Propulsion Types, and Countries within the Asia-Pacific region) to provide a granular view of market segmentation and growth potential. The predicted market size in Million units for 2025 is xx.

Asia Pacific Electric Vehicle Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Asia-Pacific EV industry. We examine market concentration, analyzing market share percentages for key players, and evaluating the impact of mergers and acquisitions (M&A) activities. The report also delves into the influence of technological innovation, regulatory frameworks (including government incentives and emission standards), the presence of competitive product substitutes (e.g., hybrid vehicles), and evolving end-user demographics on market growth.

- Market Concentration: Analysis of market share held by top players (e.g., BYD, Tesla, Hyundai, etc.). The predicted market share for BYD in 2025 is xx%.

- Technological Innovation: Assessment of battery technology advancements, charging infrastructure development, and autonomous driving integration. Challenges related to battery range and charging times are also addressed.

- Regulatory Framework: Review of government policies, subsidies, and emission regulations across key Asia-Pacific countries.

- M&A Activity: Analysis of recent mergers, acquisitions, and joint ventures in the sector, including their impact on market consolidation and innovation. The number of M&A deals in 2024 is estimated at xx.

- Competitive Substitutes: Examination of the competition from internal combustion engine (ICE) vehicles and hybrid vehicles.

- End-User Demographics: Analysis of consumer preferences, purchasing power, and adoption rates across different demographics.

Asia Pacific Electric Vehicle Industry Growth Trends & Insights

This section provides a detailed analysis of the historical (2019-2024) and projected (2025-2033) growth of the Asia Pacific EV market. We utilize data-driven insights to determine the Compound Annual Growth Rate (CAGR) and market penetration rate, analyzing factors such as technological disruptions (e.g., advancements in battery technology), shifts in consumer behavior (e.g., increased environmental awareness), and evolving government regulations. This section leverages proprietary data and external sources to construct a robust and accurate view of market evolution. The predicted CAGR for the forecast period (2025-2033) is xx%.

Dominant Regions, Countries, or Segments in Asia Pacific Electric Vehicle Industry

This section identifies the leading regions, countries, and segments within the Asia-Pacific EV market based on market share and growth potential. It analyzes factors driving growth in each segment, including economic policies, infrastructure development, consumer preferences, and technological advancements.

- Leading Regions: China, India, Japan, and South Korea are analyzed for their market dominance and future growth prospects.

- Dominant Vehicle Types: Analysis of the growth trajectory of passenger cars versus commercial vehicles. The predicted market share for passenger cars in 2025 is xx%.

- Charging Infrastructure: Assessment of the growth of normal charging vs. fast charging infrastructure across the region.

- Propulsion Types: Market share and growth prospects of Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicles (FCEVs). The predicted market share for BEVs in 2025 is xx%.

Asia Pacific Electric Vehicle Industry Product Landscape

This section details the product innovations, applications, and performance metrics of electric vehicles in the Asia-Pacific region. We highlight unique selling propositions (USPs), technological advancements in battery technology, charging solutions, and autonomous driving features that are shaping the market. The focus is on the key features and technological differentiators of various EV models.

Key Drivers, Barriers & Challenges in Asia Pacific Electric Vehicle Industry

This section identifies the key factors driving growth in the Asia-Pacific EV market, including technological advancements, supportive government policies (e.g., tax incentives, emission standards), and rising consumer demand. It also analyzes significant challenges and restraints, such as supply chain disruptions, the high cost of EVs, and limited charging infrastructure in certain areas. Quantifiable impacts, where possible, are included.

Emerging Opportunities in Asia Pacific Electric Vehicle Industry

This section explores emerging opportunities within the Asia-Pacific EV industry, such as the expansion into untapped markets, the development of innovative applications for EVs (e.g., last-mile delivery), and the evolving consumer preferences toward sustainable transportation options.

Growth Accelerators in the Asia Pacific Electric Vehicle Industry Industry

This section discusses the key catalysts that will drive long-term growth in the Asia-Pacific EV industry, including technological breakthroughs in battery technology, strategic partnerships between automakers and technology companies, and the expansion of charging infrastructure.

Key Players Shaping the Asia Pacific Electric Vehicle Industry Market

- Stellantis NV

- Nissan Motor Co Ltd

- Honda Motor Company Ltd

- General Motors

- Volkswagen AG

- Hyundai Motor Company

- Tesla Inc

- Mercedes-Benz Group AG

- BYD Company Ltd

- Toyota Motor Corporation

Notable Milestones in Asia Pacific Electric Vehicle Industry Sector

- September 2023: Mercedes-Benz EQE SUV launched in India.

- November 2024: Kia launches EV5 electric SUV in China.

- December 2023: Kia Motors announces the launch of EV9 electric SUV in India for 2024.

In-Depth Asia Pacific Electric Vehicle Industry Market Outlook

This section summarizes the key growth drivers and strategic opportunities within the Asia-Pacific EV market, emphasizing the long-term potential for growth and the strategic implications for various stakeholders. The focus is on the future market landscape, highlighting key trends and predictions for the coming years.

Asia Pacific Electric Vehicle Industry Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric Vehicles

- 1.2. Hybrid Electric Vehicles

- 1.3. Fuel Cell Electric Vehicles

- 1.4. Plug-in Hybrid Electric Vehicles

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Charging Type

- 3.1. Normal Charging

- 3.2. Fast Charging

Asia Pacific Electric Vehicle Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Electric Vehicle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Passenger Car holds Highest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric Vehicles

- 5.1.2. Hybrid Electric Vehicles

- 5.1.3. Fuel Cell Electric Vehicles

- 5.1.4. Plug-in Hybrid Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Charging Type

- 5.3.1. Normal Charging

- 5.3.2. Fast Charging

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. China Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Stellantis NV*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nissan Motor Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Honda Motor Company Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 General Motors

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Volkswagen AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Hyundai Motor Company

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Tesla Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mercedes-Benz Group AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BYD Company Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Toyota Motor Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Stellantis NV*List Not Exhaustive

List of Figures

- Figure 1: Asia Pacific Electric Vehicle Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Electric Vehicle Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Charging Type 2019 & 2032

- Table 5: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 15: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 16: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Charging Type 2019 & 2032

- Table 17: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Electric Vehicle Industry?

The projected CAGR is approximately 19.10%.

2. Which companies are prominent players in the Asia Pacific Electric Vehicle Industry?

Key companies in the market include Stellantis NV*List Not Exhaustive, Nissan Motor Co Ltd, Honda Motor Company Ltd, General Motors, Volkswagen AG, Hyundai Motor Company, Tesla Inc, Mercedes-Benz Group AG, BYD Company Ltd, Toyota Motor Corporation.

3. What are the main segments of the Asia Pacific Electric Vehicle Industry?

The market segments include Propulsion Type, Vehicle Type, Charging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 250.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Passenger Car holds Highest Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

In September 2023, the Mercedes-Benz EQE SUV was launched in India, and it is available in one fully loaded variant and across nine color schemes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Electric Vehicle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Electric Vehicle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Electric Vehicle Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Electric Vehicle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence