Key Insights

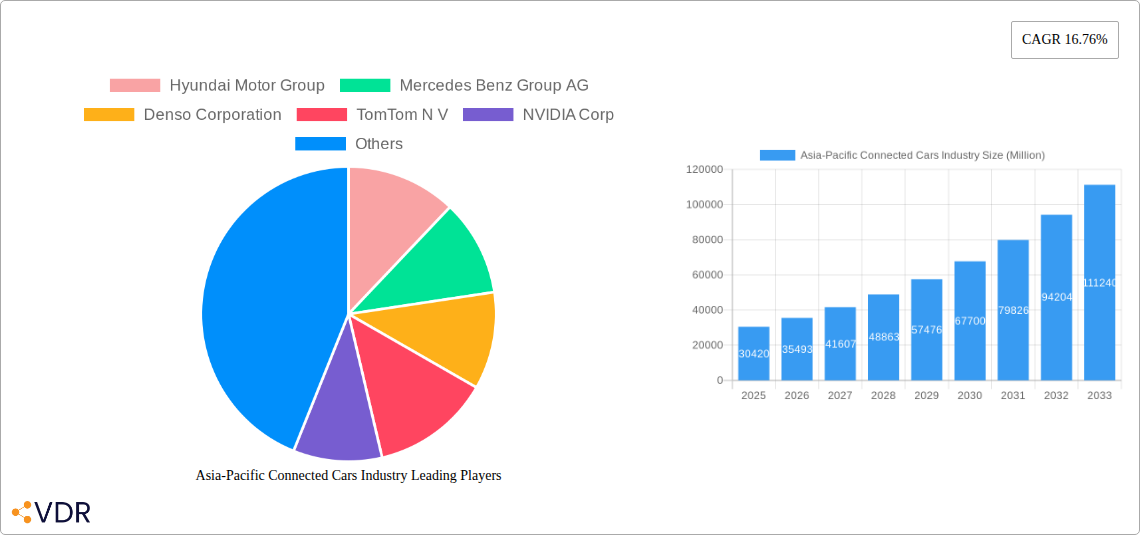

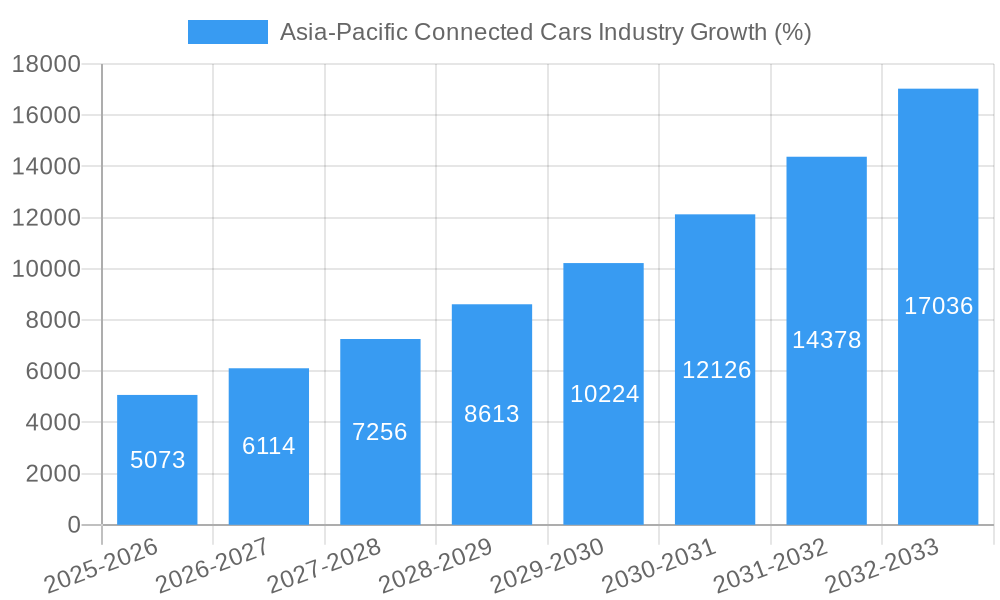

The Asia-Pacific connected cars market is experiencing robust growth, driven by increasing smartphone penetration, rising disposable incomes, and the escalating demand for advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems. The market, valued at $30.42 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 16.76% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the region's burgeoning automotive industry, particularly in countries like China and India, provides a vast and expanding market for connected car technologies. Secondly, government initiatives promoting smart city infrastructure and the adoption of V2X (Vehicle-to-Everything) communication are creating a favorable environment for connected car deployment. Furthermore, technological advancements leading to more sophisticated and affordable connectivity solutions are accelerating market penetration. The passenger car segment currently dominates the market, but the commercial vehicle segment is expected to witness significant growth driven by fleet management and logistics optimization needs. While Navigation and Entertainment systems are currently prevalent, Safety and Vehicle Management systems are poised for rapid adoption as consumers prioritize safety features and vehicle efficiency.

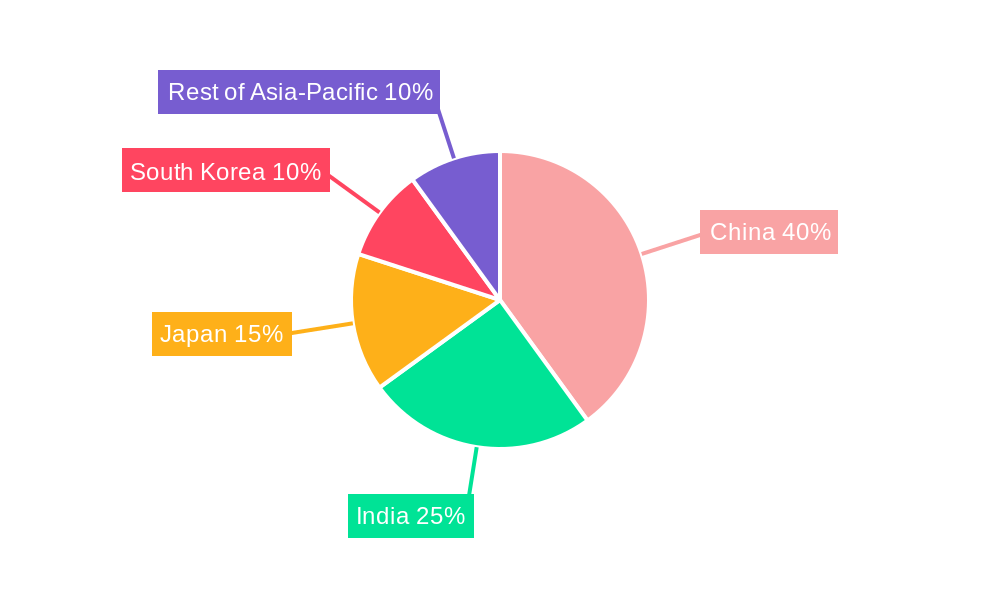

Significant regional variations exist within the Asia-Pacific market. China and India are leading the charge, owing to their large populations and expanding automotive sectors. Japan and South Korea, while having smaller markets compared to China and India, are characterized by a higher adoption rate of advanced technologies, contributing significantly to overall market value. The competitive landscape is highly fragmented, with a mix of global OEMs (Original Equipment Manufacturers) like Hyundai, Mercedes-Benz, and BMW, alongside major technology providers such as Denso, TomTom, and NVIDIA. The aftermarket/replacement segment is also gaining traction, indicating a growing preference for enhancing existing vehicles with connected car capabilities. This dynamic interplay of technological innovation, government support, and consumer demand suggests a bright future for the Asia-Pacific connected cars market, offering substantial opportunities for both established players and new entrants.

This comprehensive report provides an in-depth analysis of the Asia-Pacific connected cars industry, encompassing market dynamics, growth trends, dominant segments, and key players. With a focus on the period 2019-2033 (Study Period), base year 2025, and forecast period 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the market across various segments including Passenger Cars, Commercial Vehicles, Navigation, Entertainment, Safety, Vehicle Management, V2V, V2I, V2X, OEM, and Aftermarket, focusing on key countries such as India, China, Japan, South Korea, and the Rest of Asia-Pacific. The projected market size will be presented in Million units.

Asia-Pacific Connected Cars Industry Market Dynamics & Structure

The Asia-Pacific connected cars market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and intense competition. Market concentration is moderate, with several global and regional players vying for market share. Technological advancements, particularly in 5G and AI, are key drivers, while stringent data privacy regulations and cybersecurity concerns present challenges. The market exhibits a strong preference for passenger cars, driven by rising disposable incomes and increasing adoption of smart technologies.

Market Structure Highlights:

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Rapid advancements in AI, 5G, and IoT are driving innovation.

- Regulatory Framework: Varying regulations across countries impact market growth.

- Competitive Landscape: Intense competition among OEMs and Tier-1 suppliers.

- M&A Activity: xx M&A deals in the last 5 years, indicating consolidation trends.

- Innovation Barriers: High R&D costs, standardization challenges, and cybersecurity concerns.

- End-User Demographics: Predominantly urban, tech-savvy consumers with high disposable incomes.

Asia-Pacific Connected Cars Industry Growth Trends & Insights

The Asia-Pacific connected cars market is experiencing robust growth, fueled by increasing smartphone penetration, rising demand for infotainment features, and government initiatives promoting smart city infrastructure. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is driven by factors such as the increasing adoption of connected car technologies in new vehicles and the aftermarket retrofitting of existing vehicles. Technological disruptions, such as the advent of 5G and autonomous driving technologies, are further accelerating market expansion. Consumer behavior is shifting towards integrated digital experiences, demanding seamless connectivity and personalized services.

Key Growth Metrics:

- Market Size (2024): xx million units

- Market Size (2033): xx million units

- CAGR (2025-2033): xx%

- Market Penetration (2024): xx%

- Adoption Rate (2025-2033): xx% increase

Dominant Regions, Countries, or Segments in Asia-Pacific Connected Cars Industry

China and India are currently the dominant markets, driven by strong economic growth, large vehicle populations, and supportive government policies. The passenger car segment holds the largest market share, followed by commercial vehicles. Within technology types, navigation, entertainment, and safety features are currently driving market growth. The OEM segment dominates end-user type, while the aftermarket is witnessing significant growth. V2X technology, especially V2I, is experiencing increasing adoption due to smart city initiatives.

Key Market Drivers by Segment:

- China: Huge market size, supportive government policies, and advanced technological infrastructure.

- India: Rapid economic growth, increasing vehicle sales, and cost-effective solutions.

- Passenger Cars: High demand for infotainment and safety features.

- Navigation & Entertainment: Essential features driving initial adoption.

- OEM: Integration of connected car features in new vehicles.

- V2I: Smart city initiatives and traffic management systems.

Asia-Pacific Connected Cars Industry Product Landscape

The Asia-Pacific connected cars market features a diverse range of products, from basic navigation systems to advanced driver-assistance systems (ADAS) and fully integrated infotainment platforms. Product innovations focus on enhancing user experience, improving safety features, and integrating advanced technologies such as AI and machine learning. Unique selling propositions include seamless smartphone integration, personalized user interfaces, and advanced driver assistance capabilities. Technological advancements are primarily focused on improving data security, processing power, and reducing latency.

Key Drivers, Barriers & Challenges in Asia-Pacific Connected Cars Industry

Key Drivers:

- Government Initiatives: Supporting smart city development and promoting digitalization.

- Technological Advancements: 5G, AI, and IoT enable enhanced connectivity and functionalities.

- Rising Disposable Incomes: Increased purchasing power fuels demand for premium features.

Key Barriers and Challenges:

- High Initial Investment Costs: Hinders wider adoption, particularly in developing countries.

- Data Security and Privacy Concerns: Potential vulnerabilities and lack of robust regulations.

- Interoperability Issues: Lack of standardization creates integration challenges.

- Infrastructure Limitations: Inadequate network coverage in certain areas.

Emerging Opportunities in Asia-Pacific Connected Cars Industry

- Growth in the Aftermarket: Significant potential for retrofitting existing vehicles.

- Expansion into Rural Areas: Reaching untapped markets with cost-effective solutions.

- Development of Niche Applications: Focusing on specific industry needs (e.g., fleet management).

- Rise of Subscription-Based Services: Offering flexible and affordable access to features.

Growth Accelerators in the Asia-Pacific Connected Cars Industry Industry

Technological breakthroughs, particularly in 5G and AI, are key growth catalysts. Strategic partnerships between OEMs and technology providers are accelerating innovation and expanding market reach. Market expansion into less-penetrated regions, along with the development of cost-effective solutions, are also crucial for long-term growth.

Key Players Shaping the Asia-Pacific Connected Cars Industry Market

- Hyundai Motor Group

- Mercedes Benz Group AG

- Denso Corporation

- TomTom N V

- NVIDIA Corp

- ZF Friedrichshafen

- Aptiv PLC

- NXP Semiconductors

- Harman International

- Continental AG

- BMW AG

- Robert Bosch GmbH

- SAIC Motor Corporation

- Audi AG

- Volvo AB

- Airbiquity In

Notable Milestones in Asia-Pacific Connected Cars Industry Sector

- June 2023: Hyundai Motor Group reached 10 million connected car service subscribers, targeting 20 million by 2026.

- April 2023: MG Motor India launched the Comet EV with an integrated iSmart system featuring 55+ connected car features.

- September 2022: Hyundai Motor Group and KT Corporation formed a joint venture focusing on 6G autonomous driving and AAM communication.

In-Depth Asia-Pacific Connected Cars Industry Market Outlook

The Asia-Pacific connected cars market is poised for continued expansion, driven by technological advancements, supportive government policies, and increasing consumer demand. Strategic partnerships and investments in infrastructure will further accelerate growth. The focus will shift towards enhancing data security, personalized experiences, and the integration of autonomous driving technologies. The market presents significant opportunities for both established players and new entrants, particularly in developing markets and emerging application areas.

Asia-Pacific Connected Cars Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Technology Type

- 2.1. Navigation

- 2.2. Entertainment

- 2.3. Safety

- 2.4. Vehicle Management

- 2.5. Others (Multimedia Streaming etc.)

-

3. Vehicle Connectivity

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Infrastructure (V2I)

- 3.3. Vehicle-to-Everything (V2X)

-

4. End-User Type

- 4.1. Original Equipment Manufacturer (OEM)

- 4.2. Aftermarket/Replacement

Asia-Pacific Connected Cars Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Connected Cars Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vehicle Safety and User Convenience

- 3.3. Market Restrains

- 3.3.1. Vulnerability to Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Integrated Navigation System to gain significant Traction in the coming years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Navigation

- 5.2.2. Entertainment

- 5.2.3. Safety

- 5.2.4. Vehicle Management

- 5.2.5. Others (Multimedia Streaming etc.)

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Connectivity

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Infrastructure (V2I)

- 5.3.3. Vehicle-to-Everything (V2X)

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Original Equipment Manufacturer (OEM)

- 5.4.2. Aftermarket/Replacement

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Connected Cars Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hyundai Motor Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Mercedes Benz Group AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Denso Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 TomTom N V

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 NVIDIA Corp

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ZF Friedrichshafen

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Aptiv PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 NXP Semiconductors

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Harman International

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Continental AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 BMW AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Robert Bosch GmbH

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 SAIC Motor Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Audi AG

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Volvo AB

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Airbiquity In

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Hyundai Motor Group

List of Figures

- Figure 1: Asia-Pacific Connected Cars Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Connected Cars Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 4: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Connectivity 2019 & 2032

- Table 5: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 6: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 16: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 17: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Vehicle Connectivity 2019 & 2032

- Table 18: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by End-User Type 2019 & 2032

- Table 19: Asia-Pacific Connected Cars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: New Zealand Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Malaysia Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailand Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Vietnam Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Philippines Asia-Pacific Connected Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Connected Cars Industry?

The projected CAGR is approximately 16.76%.

2. Which companies are prominent players in the Asia-Pacific Connected Cars Industry?

Key companies in the market include Hyundai Motor Group, Mercedes Benz Group AG, Denso Corporation, TomTom N V, NVIDIA Corp, ZF Friedrichshafen, Aptiv PLC, NXP Semiconductors, Harman International, Continental AG, BMW AG, Robert Bosch GmbH, SAIC Motor Corporation, Audi AG, Volvo AB, Airbiquity In.

3. What are the main segments of the Asia-Pacific Connected Cars Industry?

The market segments include Vehicle Type, Technology Type, Vehicle Connectivity, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vehicle Safety and User Convenience.

6. What are the notable trends driving market growth?

Integrated Navigation System to gain significant Traction in the coming years.

7. Are there any restraints impacting market growth?

Vulnerability to Cyber Attacks.

8. Can you provide examples of recent developments in the market?

June 2023: Hyundai Motor Group, a multinational automotive manufacturer based out of South Korea, announced that its connected car services reached 10 million subscribers, owing to the growth in overseas subscribers using Bluelink, Kia Connect, and Genesis Connected Services. The company further stated that it expected that its connected car services would reach 20 million subscribers by the end of 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Connected Cars Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Connected Cars Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Connected Cars Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Connected Cars Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence