Key Insights

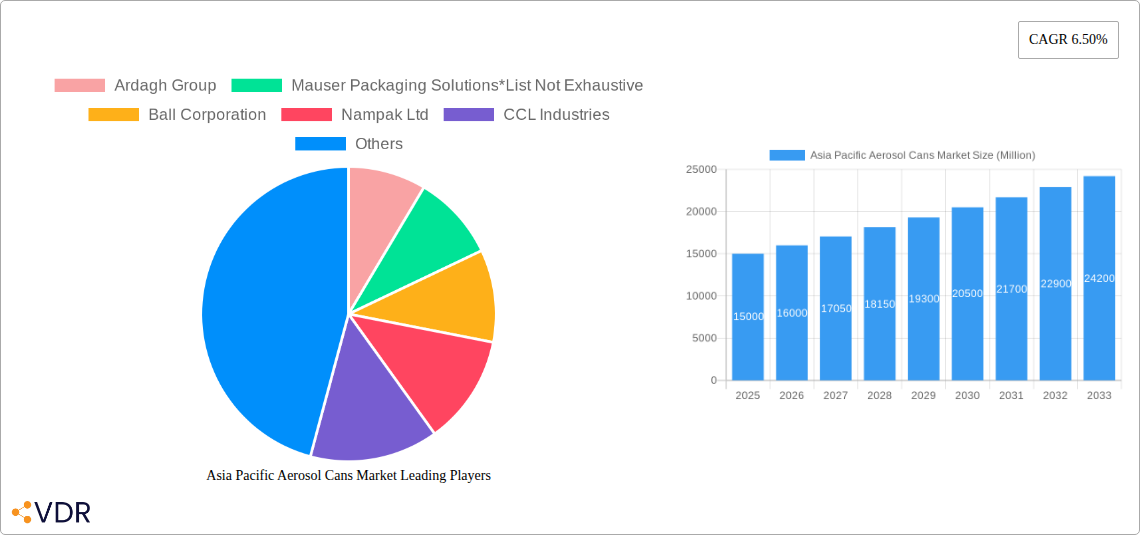

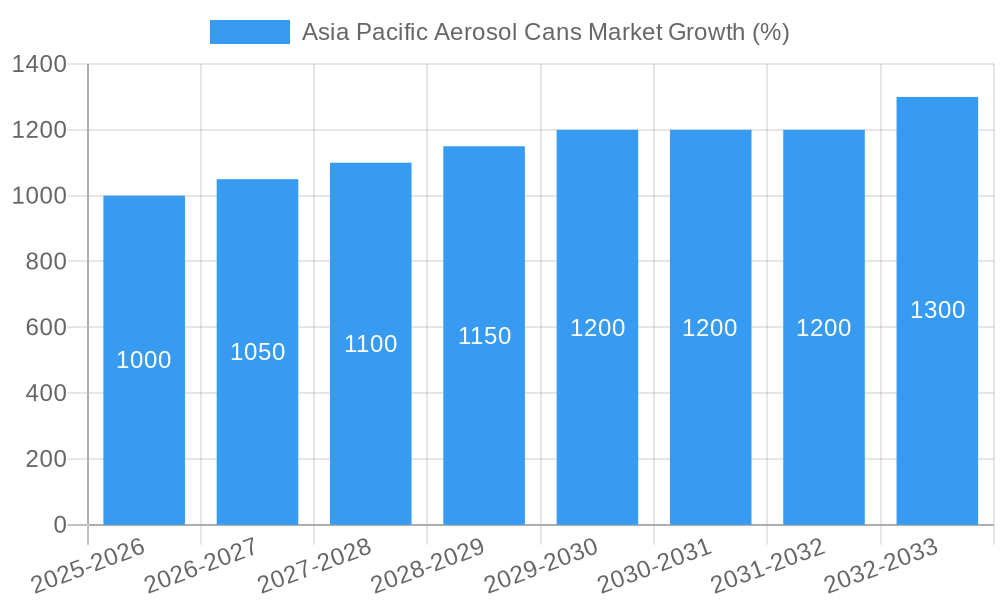

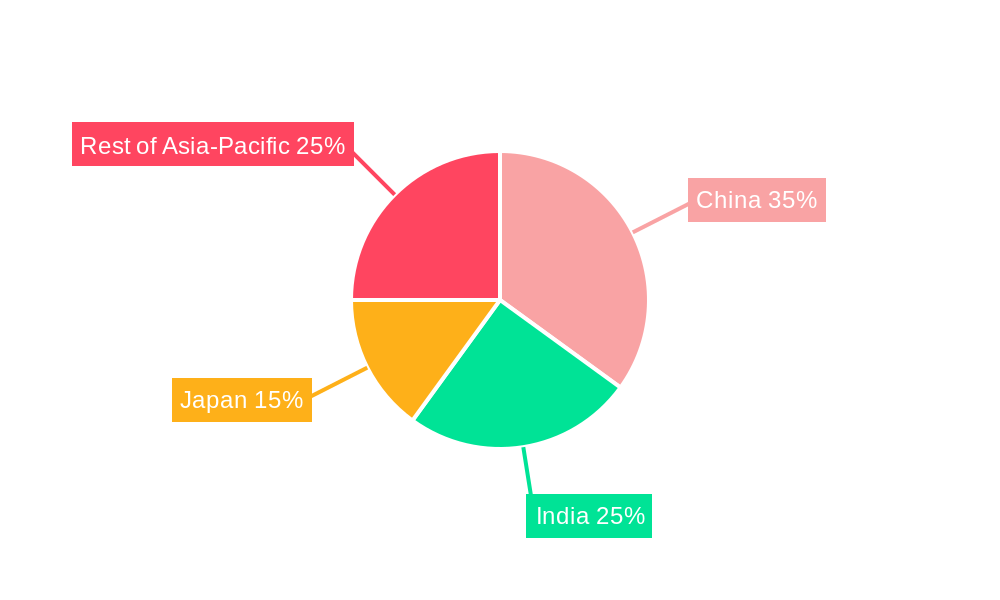

The Asia Pacific aerosol can market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for convenience and ease of use in personal care, household, and industrial applications fuels the consumption of aerosol products across the region. Secondly, the rising disposable incomes in emerging economies like India and China are boosting consumer spending on products packaged in aerosol cans. Thirdly, the continuous innovation in aerosol can materials, focusing on lighter, more sustainable options like aluminum, contributes to market growth. However, environmental concerns surrounding the release of propellants and the disposal of aerosol cans pose a significant restraint, pushing manufacturers to adopt eco-friendly alternatives and sustainable packaging practices. Market segmentation reveals that the cosmetic and personal care sector (deodorants, hairsprays, etc.) dominates the end-user industry, followed by household and pharmaceutical/veterinary applications. China, India, and Japan represent the largest national markets within the Asia Pacific region, reflecting their significant populations and expanding consumer bases. Major players like Ardagh Group, Mauser Packaging Solutions, Ball Corporation, and Crown Holdings Inc. are actively shaping the market landscape through strategic investments and technological advancements. The market's future trajectory will depend on regulatory changes related to propellant emissions, consumer preferences towards sustainable packaging, and the continuous innovation within the aerosol can manufacturing sector.

The forecast for the Asia Pacific aerosol can market indicates substantial growth throughout the projected period (2025-2033). Regional variations will exist, with the fastest growth potentially observed in countries with rapidly expanding middle classes and increasing consumption of aerosol-based products. Competition among leading manufacturers will remain intense, emphasizing the need for strategic partnerships, technological upgrades, and cost-optimization initiatives. The success of individual companies will hinge on their ability to adapt to evolving consumer preferences, meet stricter environmental regulations, and innovate in sustainable packaging solutions. The market is expected to witness a shift towards lighter, more recyclable materials and the adoption of eco-friendly propellants, driving sustainable growth within the aerosol can industry. Further analysis of specific segments (material type, end-user industry, and country-specific trends) will provide a more granular understanding of the market dynamics and opportunities.

Asia Pacific Aerosol Cans Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific aerosol cans market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by material (aluminum, steel-tinplate, other materials), end-user industry (cosmetic & personal care, household, pharmaceutical/veterinary, paints & varnishes, automotive/industrial, others), and country (China, India, Japan, Rest of Asia-Pacific). The market size is presented in million units.

Asia Pacific Aerosol Cans Market Dynamics & Structure

The Asia Pacific aerosol cans market exhibits a moderately concentrated structure, with several major players holding significant market share. Technological innovations, particularly in sustainable materials and can design, are key drivers. Stringent regulatory frameworks concerning environmental impact and material safety influence market dynamics. Competitive product substitutes, such as pump sprays and pouches, pose a challenge, while increasing consumer demand for convenient packaging fuels market growth. M&A activity within the packaging industry, though currently at xx deals annually (2024), is expected to increase over the forecast period. Market concentration is estimated at xx% in 2025, with top 5 players holding xx% of total market share.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2025).

- Technological Innovation: Focus on lightweighting, sustainable materials (recycled aluminum), and improved dispensing mechanisms.

- Regulatory Landscape: Increasingly stringent environmental regulations driving adoption of eco-friendly materials.

- Competitive Substitutes: Pump sprays and pouches pose a competitive threat, but consumer preference for convenience often favors aerosol cans.

- End-User Demographics: Growing middle class and rising disposable incomes in many Asia-Pacific countries fuel demand.

- M&A Trends: xx M&A deals per year currently (2024); potential for increase driven by consolidation and expansion strategies.

Asia Pacific Aerosol Cans Market Growth Trends & Insights

The Asia Pacific aerosol cans market witnessed significant growth during the historical period (2019-2024), driven by robust demand across various end-user industries. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. This growth trajectory is expected to continue throughout the forecast period (2025-2033), albeit at a slightly moderated pace, reaching xx million units by 2033 with a projected CAGR of xx%. Technological advancements, such as the development of more sustainable packaging materials and improved dispensing mechanisms, are driving adoption rates, along with changing consumer preferences towards convenient and user-friendly products. Market penetration remains highest in the cosmetic and personal care sector in developed markets within Asia Pacific, however, penetration is increasing in developing markets across all segments.

Dominant Regions, Countries, or Segments in Asia Pacific Aerosol Cans Market

China and India represent the largest markets within the Asia Pacific region, driven by substantial population sizes, rapid economic growth, and expanding end-user industries. The cosmetic and personal care segment consistently displays the highest demand, owing to the increasing popularity of aerosol-based products like deodorants, hairsprays, and hair mousse. Aluminum remains the dominant material, favored for its recyclability and lightweight properties.

- Leading Region: China, followed by India.

- Leading Country: China, driven by its large population and significant manufacturing base.

- Leading Segment (By Material): Aluminum, due to its lightweight properties and recyclability.

- Leading Segment (By End-user Industry): Cosmetic and Personal Care, primarily driven by the burgeoning demand for personal care products.

- Key Growth Drivers: Rapid economic growth, increasing disposable incomes, rising urbanization, and expanding middle class.

Asia Pacific Aerosol Cans Market Product Landscape

The Asia Pacific aerosol cans market features a diverse range of products, catering to various end-user needs. Innovation focuses on enhancing sustainability through lightweight designs and the use of recycled materials. Advanced dispensing mechanisms, such as those offering controlled spray patterns or reduced propellant usage, are gaining traction. Unique selling propositions often revolve around environmental friendliness, convenience, and superior performance. Technological advancements emphasize improved sustainability and reduced environmental impact.

Key Drivers, Barriers & Challenges in Asia Pacific Aerosol Cans Market

Key Drivers:

- Rising disposable incomes and expanding middle class across many Asian countries.

- Growing demand for convenient and user-friendly packaging solutions.

- Increasing popularity of aerosol-based products across various end-user industries.

- Technological advancements resulting in lighter weight, more sustainable options.

Key Challenges & Restraints:

- Fluctuations in raw material prices, particularly for aluminum and steel-tinplate, affecting profitability.

- Stringent environmental regulations impacting material selection and manufacturing processes. These regulations create additional compliance costs, potentially slowing down adoption of less-sustainable options.

- Intense competition among established and emerging players in the market. This leads to price pressure and necessitates strong innovation to maintain market share.

- Supply chain disruptions related to raw material sourcing and logistics. The impact is estimated to cause price increases of xx% in the next 2 years.

Emerging Opportunities in Asia Pacific Aerosol Cans Market

- Expansion into untapped rural markets in developing Asian countries.

- Development of innovative aerosol cans with improved sustainability features, such as biodegradable materials.

- Focus on customized aerosol solutions tailored to specific end-user industries.

- Leveraging e-commerce channels to improve reach and market penetration.

Growth Accelerators in the Asia Pacific Aerosol Cans Market Industry

Strategic partnerships among manufacturers, material suppliers, and end-user companies are expected to drive significant growth. Further technological advancements in sustainable and recyclable materials will create opportunities. The expansion into new and niche markets, combined with innovative product design, presents significant opportunities for growth. These factors together will contribute to a substantial market expansion over the forecast period.

Key Players Shaping the Asia Pacific Aerosol Cans Market Market

- Ardagh Group

- Mauser Packaging Solutions

- Ball Corporation

- Nampak Ltd

- CCL Industries

- Toyo Seikan Group Holdings

- SKS Bottle & Packaging Inc

- Crown Holdings Inc

- Can-Pack SA

Notable Milestones in Asia Pacific Aerosol Cans Market Sector

- September 2022: Crown Holdings Inc. announced a weight reduction of its beverage cans, minimizing its environmental footprint.

- July 2022: Chemill Pharma Ltd launched VirX, a nitric oxide nasal spray, expanding the pharmaceutical application of aerosol cans.

In-Depth Asia Pacific Aerosol Cans Market Market Outlook

The Asia Pacific aerosol cans market is poised for sustained growth, driven by the factors mentioned above. Strategic investments in research and development, along with focused marketing efforts targeting expanding consumer segments, are key to capitalizing on emerging opportunities. The market's future hinges on the continued adoption of sustainable materials, innovations in dispensing technology, and the ability of key players to adapt to evolving regulatory landscapes. The long-term outlook remains positive, projecting strong growth through 2033.

Asia Pacific Aerosol Cans Market Segmentation

-

1. Material

- 1.1. Aluminum

- 1.2. Steel-tinplate

- 1.3. Other Materials

-

2. End-user Industry

- 2.1. Cosmetic

- 2.2. Household

- 2.3. Pharmaceutical/Veterinary

- 2.4. Paints and Varnishes

- 2.5. Automotive/Industrial

- 2.6. Other End-user Industries

Asia Pacific Aerosol Cans Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Aerosol Cans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Cosmetic Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Competition from Substitute Packaging

- 3.4. Market Trends

- 3.4.1. Household is Expected to Account for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Aluminum

- 5.1.2. Steel-tinplate

- 5.1.3. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Cosmetic

- 5.2.2. Household

- 5.2.3. Pharmaceutical/Veterinary

- 5.2.4. Paints and Varnishes

- 5.2.5. Automotive/Industrial

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. China Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Aerosol Cans Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Ardagh Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Mauser Packaging Solutions*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ball Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Nampak Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 CCL Industries

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Toyo Seikan Group Holdings

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 SKS Bottle & Packaging Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Crown Holdings Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Can-Pack SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Ardagh Group

List of Figures

- Figure 1: Asia Pacific Aerosol Cans Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Aerosol Cans Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by Material 2019 & 2032

- Table 14: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Pacific Aerosol Cans Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Aerosol Cans Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Aerosol Cans Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Asia Pacific Aerosol Cans Market?

Key companies in the market include Ardagh Group, Mauser Packaging Solutions*List Not Exhaustive, Ball Corporation, Nampak Ltd, CCL Industries, Toyo Seikan Group Holdings, SKS Bottle & Packaging Inc, Crown Holdings Inc, Can-Pack SA.

3. What are the main segments of the Asia Pacific Aerosol Cans Market?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Cosmetic Industry.

6. What are the notable trends driving market growth?

Household is Expected to Account for Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Competition from Substitute Packaging.

8. Can you provide examples of recent developments in the market?

September 2022 - Crown Holdings Inc. announced the weight reduction of beverage can, as part of its Twentyby30 sustainability strategy, by reducing the use of packaging material and making aluminum cans 10% lighter in weight to minimize the footprint of products and manufacturing processes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Aerosol Cans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Aerosol Cans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Aerosol Cans Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Aerosol Cans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence