Key Insights

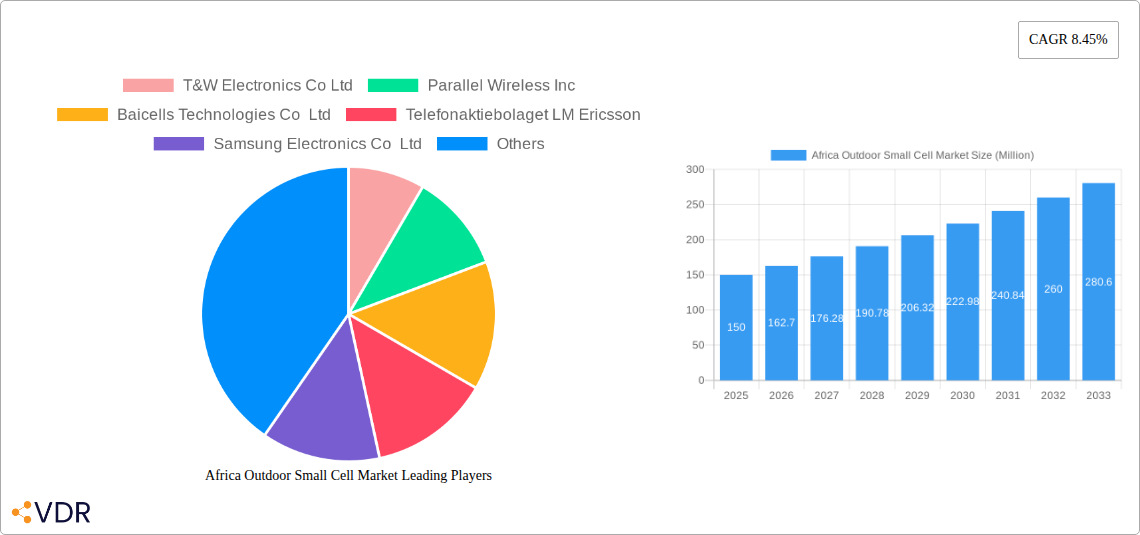

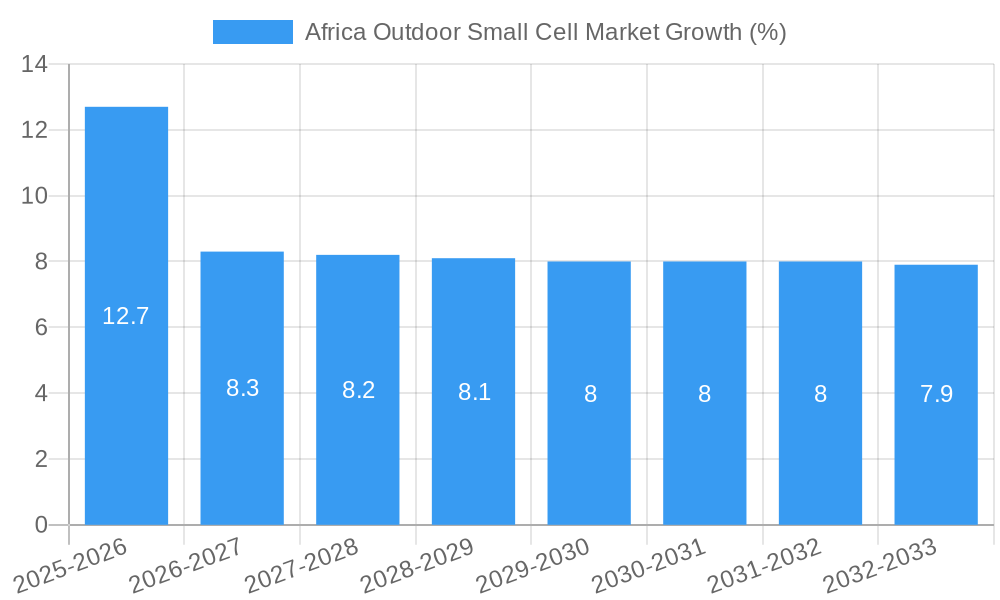

The African outdoor small cell market is experiencing robust growth, driven by the increasing demand for enhanced mobile broadband coverage and capacity, particularly in underserved rural areas. A CAGR of 8.45% from 2019 to 2025 suggests a significant market expansion, fueled by rising smartphone penetration, data consumption, and the burgeoning adoption of 5G technology across the continent. Key drivers include the need for improved network infrastructure to support mobile money transactions, e-commerce, and the expanding digital economy. Government initiatives aimed at bridging the digital divide and fostering digital inclusion further contribute to this growth. While challenges remain, such as limited infrastructure investment in certain regions and regulatory hurdles, the long-term outlook for the African outdoor small cell market remains positive. The market segmentation reveals strong performance in both South Africa and the broader region, indicating opportunities for both large-scale deployments and localized solutions tailored to specific regional needs. Major players like Ericsson, Huawei, and Nokia are actively participating in this market, showcasing the increasing investor confidence and strategic importance of Africa in the global telecommunications landscape. The segment breakdown between indoor and outdoor applications suggests a preference for outdoor deployments to maximize coverage in expansive regions, emphasizing the critical role of these small cells in expanding network reach.

The market's growth trajectory projects continued expansion through 2033. The diverse geographic landscape of Africa necessitates customized solutions, with small cell deployments crucial for addressing the unique challenges of varying terrains and population densities. Competition among established players and emerging local companies is expected to intensify, leading to innovation in cost-effective and energy-efficient small cell technologies. The focus on expanding 4G and 5G network coverage will be a key driver of investment in outdoor small cells, creating significant opportunities for technology providers and infrastructure developers. Furthermore, partnerships between telecommunications companies and local governments will be vital in navigating regulatory hurdles and securing successful deployments across the continent. Successfully navigating these complexities will be key for companies seeking to capitalize on the substantial growth potential of this dynamic market.

Africa Outdoor Small Cell Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Outdoor Small Cell Market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period analyzed is 2019-2024. The report segments the market by application (Outdoor, Indoor) and region (North & West Africa, South Africa, Rest of Africa). This analysis is crucial for understanding the evolving landscape of the parent market (African Telecom Infrastructure) and its child market (Outdoor Small Cell Deployment). The market is valued at xx Million units in 2025 and is projected to reach xx Million units by 2033.

Africa Outdoor Small Cell Market Market Dynamics & Structure

The African outdoor small cell market is characterized by moderate concentration, with key players like Huawei, Ericsson, and Nokia holding significant shares, although a fragmented landscape exists due to regional variations. Technological innovation is a major driver, particularly the adoption of 5G and the deployment of private networks. Regulatory frameworks vary across African nations, impacting market entry and expansion strategies. Competitive substitutes include traditional macrocell sites, but small cells offer advantages in terms of capacity and coverage, particularly in densely populated areas and challenging terrains. The end-user demographic is diverse, encompassing both mobile network operators (MNOs) and enterprise customers. M&A activity has been relatively limited, but strategic partnerships are increasingly common as companies seek to expand their reach and capabilities.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Technological Drivers: 5G rollout, private network deployment, and advancements in virtualization.

- Regulatory Landscape: Varied across regions, creating both opportunities and challenges.

- Competitive Substitutes: Traditional macrocells, but small cells offer superior capacity and coverage in specific scenarios.

- End-User Demographics: MNOs, enterprises, and government entities.

- M&A Activity: Relatively low volume, but strategic alliances are rising.

Africa Outdoor Small Cell Market Growth Trends & Insights

The African outdoor small cell market is experiencing robust growth, fueled by increasing mobile data consumption, expanding network coverage requirements, and the need for improved network capacity. The market size is expanding significantly, driven by rising smartphone penetration, growing urbanization, and the increasing adoption of mobile financial services. Technological disruptions, particularly 5G deployment, are accelerating market expansion. Consumer behavior shifts towards higher data consumption and increased reliance on mobile devices are further propelling demand. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is estimated at xx%, resulting in significant market penetration within the forecast period. By 2033, market penetration is expected to reach xx%. This growth is also influenced by government initiatives to bridge the digital divide and initiatives like the Universal Communications Service Access Fund (UCSAF) in East Africa.

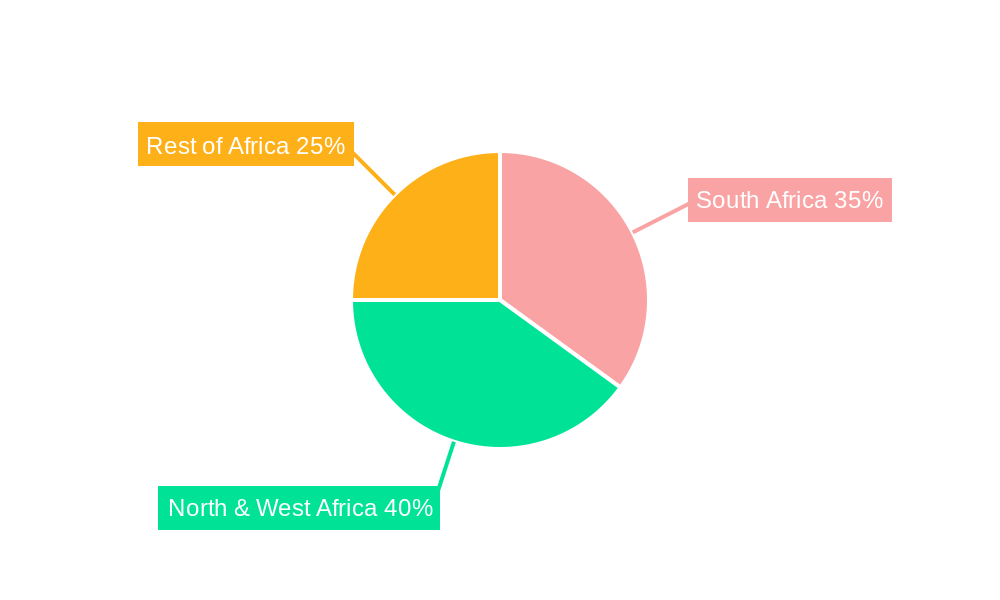

Dominant Regions, Countries, or Segments in Africa Outdoor Small Cell Market

South Africa currently dominates the African outdoor small cell market due to its advanced telecommunications infrastructure, robust economy, and high mobile penetration rates. However, significant growth potential exists in North & West Africa and the Rest of Africa, driven by rapid urbanization, increasing mobile subscriptions, and government investments in infrastructure development. The outdoor segment is the larger segment by application due to the higher demand for broader network coverage.

- South Africa: Strong existing infrastructure, high mobile penetration, and economic stability.

- North & West Africa: Rapid urbanization, rising mobile subscriptions, and expanding digital infrastructure initiatives.

- Rest of Africa: Untapped potential in rural areas, fueled by government investment and connectivity initiatives.

- Outdoor Segment: Dominant due to extensive network coverage needs.

Africa Outdoor Small Cell Market Product Landscape

The outdoor small cell market is characterized by a wide range of products, encompassing various form factors, technologies, and functionalities. Small cells are designed to provide high capacity and seamless connectivity, and are often deployed in a variety of locations, such as streetlights, buildings, and utility poles. Key product innovations include advanced antenna technologies, integrated network management, and enhanced security features. Technological advancements in 5G and other wireless technologies continuously shape the product landscape. Unique selling propositions include ease of deployment, scalability, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Africa Outdoor Small Cell Market

Key Drivers:

- Rising mobile data consumption.

- Increasing demand for improved network coverage.

- Government initiatives to bridge the digital divide.

- Technological advancements such as 5G.

Challenges & Restraints:

- High initial investment costs.

- Limited power infrastructure in certain regions.

- Regulatory hurdles and spectrum licensing complexities.

- Supply chain disruptions impacting component availability.

- xx% of planned deployments are hampered by permitting delays (estimated).

Emerging Opportunities in Africa Outdoor Small Cell Market

Emerging opportunities include the deployment of private networks for enterprise customers, the expansion of 5G networks, and the increasing use of small cells in rural areas to enhance connectivity. Further opportunities lie in the development of innovative applications for small cells, and in catering to growing consumer demand for high-speed mobile data. The untapped potential in rural areas presents significant growth opportunities.

Growth Accelerators in the Africa Outdoor Small Cell Market Industry

The long-term growth of the African outdoor small cell market will be driven by strategic partnerships between MNOs and small cell vendors, technological breakthroughs in 5G and related technologies, and expansion into underserved areas. Government initiatives to promote digital inclusion and investment in infrastructure will also accelerate growth. This will lead to improved connectivity for enterprises, individuals, and governments, further driving market expansion and digital transformation across the continent.

Key Players Shaping the Africa Outdoor Small Cell Market Market

- T&W Electronics Co Ltd

- Parallel Wireless Inc

- Baicells Technologies Co Ltd

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co Ltd

- Nokia Corporation

- NEC Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Airspan Networks Inc

Notable Milestones in Africa Outdoor Small Cell Market Sector

- November 2023: Parallel Wireless announces deployment of 2G and 4G networks in East Africa under the UCSAF initiative, focusing on rural and suburban areas. This signifies a significant step towards bridging the digital divide.

- September 2023: InfiniG introduces its Neutral Host Service (NHaaS), leveraging shared spectrum for improved in-building mobile coverage. This highlights advancements in shared infrastructure and cloud-based network management.

In-Depth Africa Outdoor Small Cell Market Market Outlook

The future of the African outdoor small cell market is bright, with significant growth potential driven by ongoing technological advancements, increased mobile data consumption, and expansion into previously underserved areas. Strategic partnerships, government initiatives, and investments in infrastructure will play a vital role in shaping the market's future. The market is poised for continued expansion, offering lucrative opportunities for both established players and new entrants.

Africa Outdoor Small Cell Market Segmentation

-

1. Application

- 1.1. Outdoor

- 1.2. Indoor

Africa Outdoor Small Cell Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Outdoor Small Cell Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents

- 3.3. Market Restrains

- 3.3.1. Various Regulations and Policies Coupled with Storage Issues

- 3.4. Market Trends

- 3.4.1. Outdoor to Have Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Outdoor

- 5.1.2. Indoor

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Outdoor Small Cell Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 T&W Electronics Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Parallel Wireless Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Baicells Technologies Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Telefonaktiebolaget LM Ericsson

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Samsung Electronics Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nokia Corporation*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 NEC Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Huawei Technologies Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ZTE Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Airspan Networks Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 T&W Electronics Co Ltd

List of Figures

- Figure 1: Africa Outdoor Small Cell Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Outdoor Small Cell Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Outdoor Small Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 3: Africa Outdoor Small Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2019 & 2032

- Table 5: Africa Outdoor Small Cell Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Region 2019 & 2032

- Table 7: Africa Outdoor Small Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 9: South Africa Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 11: Sudan Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sudan Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 13: Uganda Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Uganda Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 15: Tanzania Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 17: Kenya Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 19: Rest of Africa Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 21: Africa Outdoor Small Cell Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Application 2019 & 2032

- Table 23: Africa Outdoor Small Cell Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Outdoor Small Cell Market Volume Thousand Forecast, by Country 2019 & 2032

- Table 25: Nigeria Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Nigeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 27: South Africa Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 29: Egypt Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Egypt Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 31: Kenya Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Kenya Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 33: Ethiopia Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ethiopia Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 35: Morocco Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Morocco Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 37: Ghana Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ghana Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 39: Algeria Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Algeria Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 41: Tanzania Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Tanzania Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

- Table 43: Ivory Coast Africa Outdoor Small Cell Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Ivory Coast Africa Outdoor Small Cell Market Volume (Thousand) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Outdoor Small Cell Market?

The projected CAGR is approximately 8.45%.

2. Which companies are prominent players in the Africa Outdoor Small Cell Market?

Key companies in the market include T&W Electronics Co Ltd, Parallel Wireless Inc, Baicells Technologies Co Ltd, Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd, Nokia Corporation*List Not Exhaustive, NEC Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Airspan Networks Inc.

3. What are the main segments of the Africa Outdoor Small Cell Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Increase in Mobile Data Traffic in the Region; Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers; Steady Growth in Installations by Market Incumbents.

6. What are the notable trends driving market growth?

Outdoor to Have Significant Share.

7. Are there any restraints impacting market growth?

Various Regulations and Policies Coupled with Storage Issues.

8. Can you provide examples of recent developments in the market?

November 2023 - Parallel Wireless has announced that it will be deploying 2G and 4G networks for a for a large national operator, Where It will focus on rural and suburban areas, deploying and delivering cellular connectivity under the Universal Communications Service Access Fund (UCSAF) in East Africa which is a government initiative aimed to deliver greater coverage to all residents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Outdoor Small Cell Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Outdoor Small Cell Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Outdoor Small Cell Market?

To stay informed about further developments, trends, and reports in the Africa Outdoor Small Cell Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence