Key Insights

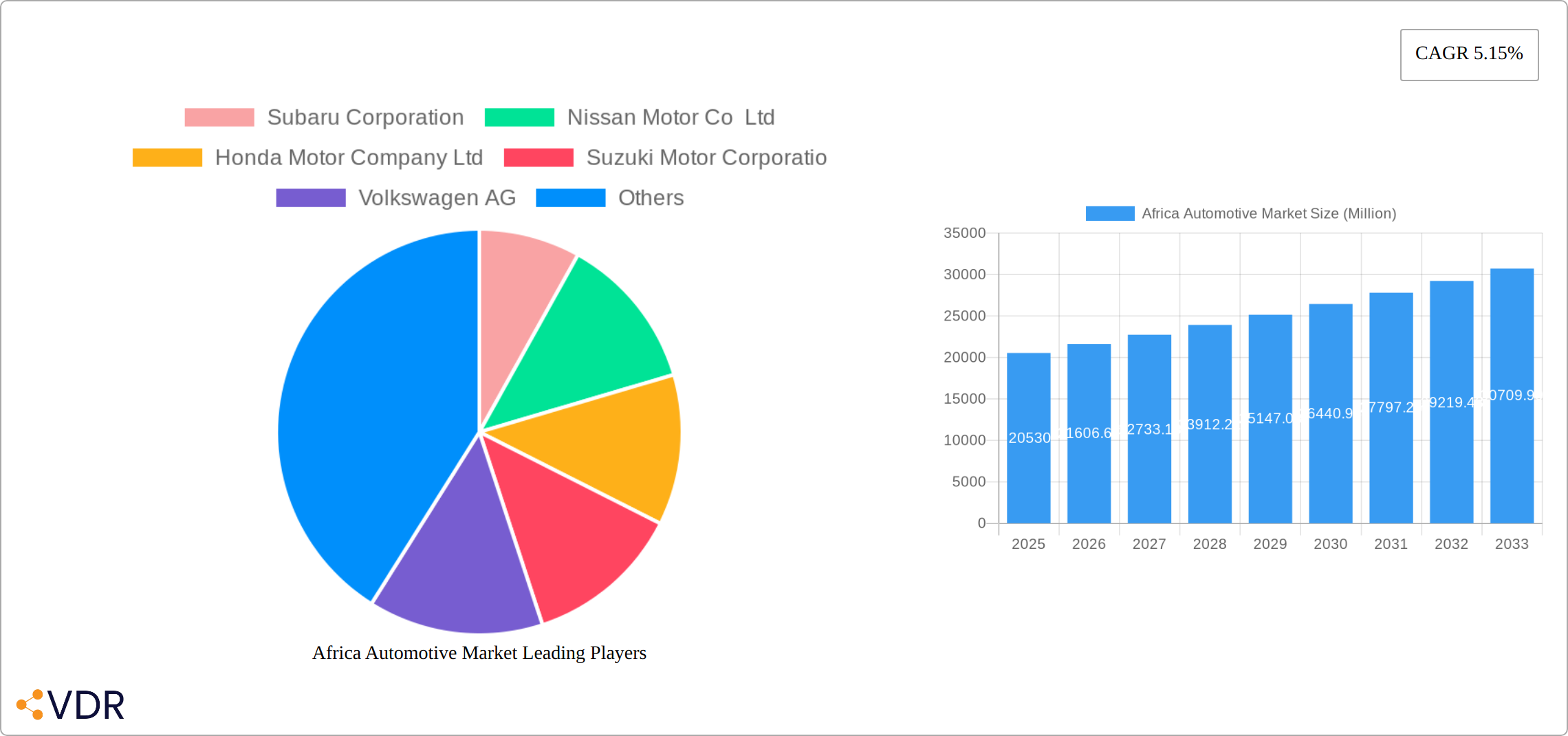

The African automotive market, valued at $20.53 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.15% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization across the continent fuels demand for personal transportation, particularly in rapidly growing cities like Lagos, Nairobi, and Accra. Furthermore, rising disposable incomes, coupled with government initiatives to improve infrastructure, are stimulating automotive sales. The burgeoning middle class is a significant driver, seeking improved mobility and status symbols associated with car ownership. While challenges remain, such as limited access to financing and inconsistent infrastructure in certain regions, the overall market outlook remains positive. The shift towards more fuel-efficient vehicles, driven by rising fuel prices and environmental concerns, is another notable trend. The market is segmented by body style (hatchbacks, sedans, SUVs dominating), vehicle type (passenger and commercial), fuel type (gasoline and diesel remaining prevalent, with slow adoption of alternative fuels), and country (South Africa, Nigeria, and Kenya leading the way). Major players like Toyota, Volkswagen, and Nissan are strategically positioning themselves to capitalize on this growth, investing in local manufacturing and distribution networks.

The forecast period (2025-2033) anticipates continued expansion, though the growth rate may fluctuate based on macroeconomic conditions and government policies. South Africa, with its established automotive industry, is expected to maintain its leading position. However, Nigeria and Kenya are poised for significant growth, fueled by their large and expanding populations. The diversification of the automotive landscape, with an increased presence of both established and emerging brands, will contribute to a dynamic and competitive market. The adoption of electric vehicles (EVs) is still nascent, but its potential is significant, dependent on supportive government regulations and infrastructure investments to overcome the present limitations. Overall, the African automotive market presents significant opportunities for manufacturers, dealers, and investors willing to navigate the unique challenges and capitalize on the continent's immense growth potential.

Africa Automotive Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa automotive market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. We analyze the market across various segments, including passenger cars and commercial vehicles, categorized by body style (hatchback, sedan, SUV, others), fuel type (gasoline, diesel, alternative fuels), and country (South Africa, Nigeria, Kenya, Ethiopia, Ghana, and other African countries). This report is essential for automotive manufacturers, suppliers, investors, and industry professionals seeking to understand and capitalize on opportunities within this rapidly evolving market. The total market size is projected to reach xx Million units by 2033.

Africa Automotive Market Dynamics & Structure

The African automotive market is characterized by a complex interplay of factors influencing its growth and structure. Market concentration is relatively low, with several international and local players competing for market share. Technological innovation, while gaining traction, faces barriers such as infrastructure limitations and affordability concerns. Regulatory frameworks vary across countries, impacting market access and investment decisions. The market sees competition from substitute modes of transportation, particularly two-wheelers and public transit. End-user demographics are shifting, with a growing middle class driving demand for personal vehicles. M&A activity remains moderate, with strategic partnerships and joint ventures playing a significant role.

- Market Concentration: Low to moderate, with no single dominant player.

- Technological Innovation: Driven by fuel efficiency and safety standards; hindered by infrastructure and affordability.

- Regulatory Framework: Varies significantly across countries, impacting market access and investment.

- Competitive Substitutes: Two-wheelers and public transport pose significant competition, especially in lower income segments.

- End-User Demographics: Growing middle class fuels demand for personal vehicles, particularly in urban areas.

- M&A Activity: Moderate, with a focus on strategic partnerships and joint ventures. xx M&A deals were recorded between 2019 and 2024.

Africa Automotive Market Growth Trends & Insights

The African automotive market has experienced remarkable growth in recent years, fueled by rapid urbanization, rising disposable incomes, and supportive government initiatives promoting local assembly and manufacturing. While precise figures for market size vary depending on the source and methodology, substantial expansion has been observed, with estimates showing a Compound Annual Growth Rate (CAGR) exceeding [Insert updated CAGR]% between [Insert Start Year] and [Insert End Year]. This growth trajectory is anticipated to continue, though potentially at a moderated pace, reaching an estimated [Insert Projected Market Size] units by [Insert Projected Year]. This projection incorporates a CAGR of approximately [Insert Updated CAGR]% for the forecast period ([Insert Start Year]–[Insert End Year]). The market's evolution is being significantly reshaped by technological advancements, including the rising adoption of electric vehicles (EVs), connected car technologies, and the increasing demand for advanced driver-assistance systems (ADAS). Furthermore, shifting consumer preferences, notably a growing preference for SUVs and hatchbacks, are impacting vehicle sales. Despite this progress, market penetration remains relatively low compared to global averages, presenting significant untapped potential for future growth. Challenges such as inadequate infrastructure in certain regions and fluctuating economic conditions need to be considered.

Dominant Regions, Countries, or Segments in Africa Automotive Market

South Africa remains the largest automotive market in Africa, accounting for a significant share of both passenger car and commercial vehicle sales. Nigeria is a rapidly growing market, driven by its large population and expanding economy. Kenya and Ethiopia also show considerable potential for growth, though infrastructure challenges remain. Within segments, SUVs are gaining popularity across the continent, fueled by their versatility and perceived status. Passenger cars continue to dominate overall sales, while the commercial vehicle segment exhibits strong growth potential linked to infrastructure development. Gasoline remains the dominant fuel type, though the adoption of diesel and alternative fuels is expected to increase gradually.

- Leading Region: Southern Africa (South Africa)

- Fastest-Growing Country: Nigeria

- Dominant Body Style: SUVs and Hatchbacks are seeing increasing popularity.

- Dominant Vehicle Type: Passenger Cars currently leads, but Commercial Vehicles show significant potential.

- Dominant Fuel Type: Gasoline

- Key Drivers: Economic growth, infrastructure development, urbanization, government policies.

Africa Automotive Market Product Landscape

The African automotive market showcases a diverse range of vehicles, catering to a wide spectrum of consumer needs and budgets. Manufacturers are increasingly focusing on enhancing fuel efficiency, bolstering safety features (including passive and active safety technologies), and integrating sophisticated infotainment systems. Key selling points often include robust vehicle designs capable of handling challenging terrains and competitive pricing strategies that address price-sensitive consumers. While the electric vehicle segment remains nascent, significant growth is projected in the coming years driven by government incentives and technological advancements in battery technology and charging infrastructure. The market also sees a strong presence of used imported vehicles, impacting the dynamics of the new vehicle market.

Key Drivers, Barriers & Challenges in Africa Automotive Market

Key Drivers:

- Rising disposable incomes and a growing middle class.

- Government initiatives to support local automotive assembly.

- Infrastructure development in major cities and transport corridors.

Challenges & Restraints:

- High import duties and taxes on vehicles.

- Limited access to financing and credit.

- Inadequate infrastructure in many regions hindering vehicle accessibility. This has a quantifiable impact on sales, reducing potential volume by an estimated xx million units annually.

Emerging Opportunities in Africa Automotive Market

- Growth in ride-hailing and shared mobility services.

- Expansion of electric vehicle infrastructure and adoption.

- Increasing demand for affordable and fuel-efficient vehicles.

Growth Accelerators in the Africa Automotive Market Industry

Several key factors are driving growth within the African automotive market. Technological innovation, particularly in electrification, connectivity, and autonomous driving technologies, is reshaping the industry landscape. Strategic partnerships between international automotive manufacturers and local businesses are crucial for knowledge transfer, local production, and market penetration. Expanding into underserved regions and targeting specific customer segments with tailored products and financing options will unlock new growth opportunities. Government policies promoting local content, investment in infrastructure development (including charging stations for EVs), and supportive regulations are essential for sustained market expansion.

Key Players Shaping the Africa Automotive Market Market

- Subaru Corporation

- Nissan Motor Co Ltd

- Honda Motor Company Ltd

- Suzuki Motor Corporation

- Volkswagen AG

- Hyundai Motor Company

- Groupe Renault

- Isuzu Motors Ltd

- Toyota Motor Corporation

- Ford Motor Company

Notable Milestones in Africa Automotive Market Sector

- May 2022: The 2022 Toyota Starlet launched in South Africa, priced at SAR 226,200.

In-Depth Africa Automotive Market Market Outlook

The African automotive market presents a compelling long-term growth story. Continued economic development, infrastructure improvements, and technological advancements will fuel market expansion. Strategic investments in local manufacturing and assembly will further enhance market accessibility and competitiveness. The focus on sustainable and affordable mobility solutions will be crucial in shaping the future of the industry in the region.

Africa Automotive Market Segmentation

-

1. Body Style Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sports Utility Vehicles

- 1.4. Others (Mini-vans, MPV, etc.)

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Other Alternative Fuels

Africa Automotive Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Automotive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus On Safety

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1. Rising Other Alternative Fuel to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Style Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicles

- 5.1.4. Others (Mini-vans, MPV, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Other Alternative Fuels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Body Style Type

- 6. South Africa Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Automotive Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Subaru Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nissan Motor Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Honda Motor Company Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Suzuki Motor Corporatio

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Volkswagen AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Hyundai Motor Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Groupe Renault

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Isuzu Motors Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Toyota Motor Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Ford Motor Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Subaru Corporation

List of Figures

- Figure 1: Africa Automotive Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Automotive Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Automotive Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Automotive Market Revenue Million Forecast, by Body Style Type 2019 & 2032

- Table 3: Africa Automotive Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Africa Automotive Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Africa Automotive Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Automotive Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Automotive Market Revenue Million Forecast, by Body Style Type 2019 & 2032

- Table 14: Africa Automotive Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Africa Automotive Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 16: Africa Automotive Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa Automotive Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Automotive Market?

The projected CAGR is approximately 5.15%.

2. Which companies are prominent players in the Africa Automotive Market?

Key companies in the market include Subaru Corporation, Nissan Motor Co Ltd, Honda Motor Company Ltd, Suzuki Motor Corporatio, Volkswagen AG, Hyundai Motor Company, Groupe Renault, Isuzu Motors Ltd, Toyota Motor Corporation, Ford Motor Company.

3. What are the main segments of the Africa Automotive Market?

The market segments include Body Style Type, Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus On Safety.

6. What are the notable trends driving market growth?

Rising Other Alternative Fuel to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

In May 2022, The 2022 Toyota Starlet arrived in South Africa, with a starting price of SAR 226,200. The premium hatchback, known as the Toyota Glanza in the U.S., is manufactured in India and exported under the Starlet brand. It was recently relaunched in India with significant changes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Automotive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Automotive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Automotive Market?

To stay informed about further developments, trends, and reports in the Africa Automotive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence