Key Insights

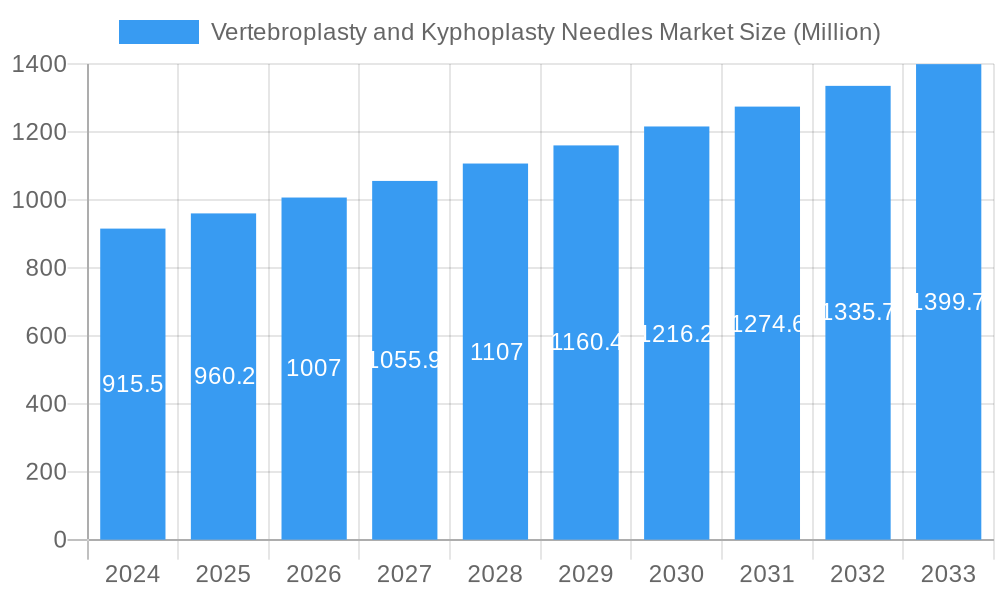

The global Vertebroplasty and Kyphoplasty Needles Market is experiencing robust growth, estimated at $915.5 million in 2024, with a projected CAGR of 4.9% from 2025 to 2033. This expansion is primarily fueled by the increasing prevalence of vertebral compression fractures (VCFs), often associated with osteoporosis, spinal injuries, and certain cancers. Minimally invasive procedures like vertebroplasty and kyphoplasty offer significant advantages over traditional open surgery, including reduced recovery times, lower complication rates, and improved patient outcomes, thereby driving demand for specialized needles. The aging global population is a significant demographic driver, as older individuals are more susceptible to osteoporosis-related VCFs. Furthermore, advancements in needle technology, such as the development of enhanced imaging guidance capabilities and ergonomic designs, are contributing to procedural efficiency and patient safety, further stimulating market growth. The growing awareness among healthcare professionals and patients regarding the benefits of these less invasive techniques is also a crucial factor propelling the market forward.

Vertebroplasty and Kyphoplasty Needles Market Market Size (In Million)

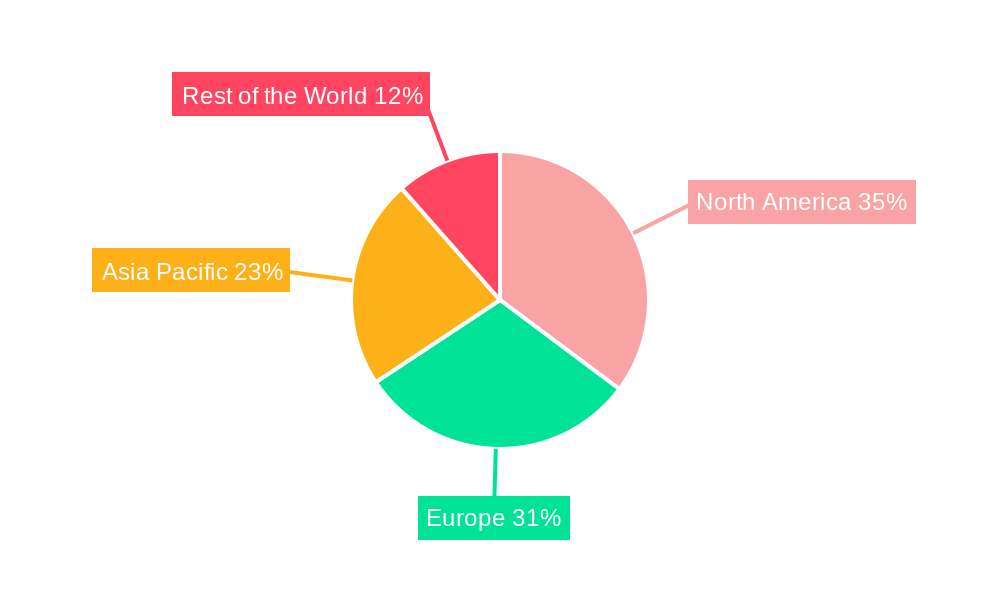

Key trends shaping the Vertebroplasty and Kyphoplasty Needles Market include a continuous push towards innovation in device design, focusing on precision, ease of use, and compatibility with advanced imaging modalities like fluoroscopy and CT scans. The market is also witnessing a rising demand for specialized kits that streamline the procedural workflow, encompassing all necessary components for successful intervention. Geographically, North America and Europe are leading markets due to high healthcare expenditure, advanced medical infrastructure, and a well-established adoption rate of minimally invasive techniques. However, the Asia Pacific region presents substantial growth opportunities, driven by an increasing aging population, a rising incidence of spinal disorders, and improving healthcare access. While the market demonstrates strong upward momentum, potential restraints include the high cost associated with advanced needle systems, the need for specialized training for healthcare providers, and reimbursement challenges in certain healthcare systems. Despite these factors, the overall outlook for the Vertebroplasty and Kyphoplasty Needles Market remains highly positive, supported by ongoing technological advancements and a growing need for effective VCF treatment.

Vertebroplasty and Kyphoplasty Needles Market Company Market Share

Vertebroplasty and Kyphoplasty Needles Market: Unveiling Growth Drivers and Competitive Dynamics (2019-2033)

This comprehensive report offers an in-depth analysis of the global Vertebroplasty and Kyphoplasty Needles Market, a critical segment within minimally invasive spinal procedures. Spanning a study period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, opportunities, and the competitive landscape. We provide crucial insights for industry professionals, investors, and stakeholders seeking to navigate this evolving market. The report meticulously analyzes both the parent market (Vertebroplasty and Kyphoplasty Needles Market) and its child markets (Vertebroplasty Devices Market and Kyphoplasty Devices Market), offering a granular view of the entire value chain. All market size and growth values are presented in million units.

Vertebroplasty and Kyphoplasty Needles Market Market Dynamics & Structure

The Vertebroplasty and Kyphoplasty Needles Market is characterized by a moderately concentrated structure, with a few leading global players dominating the landscape. Technological innovation remains a primary driver, with continuous advancements in needle design, material science, and delivery systems aimed at improving procedural efficiency, patient outcomes, and safety. Regulatory frameworks, particularly FDA approvals and CE marking, play a significant role in market access and product commercialization, influencing market entry barriers and the pace of innovation. Competitive product substitutes, while not directly replacing the core function of specialized needles, can influence market dynamics through alternative treatment modalities or adjunctive technologies. End-user demographics, including the aging global population and the increasing prevalence of osteoporosis and vertebral compression fractures (VCFs), are powerful drivers of demand. Mergers and acquisitions (M&A) activity, though not consistently high, can lead to market consolidation and shifts in competitive positioning.

- Market Concentration: Dominated by key manufacturers with a strong emphasis on R&D and established distribution networks.

- Technological Innovation Drivers: Miniaturization, improved imaging guidance compatibility, enhanced cement delivery systems, and bio-compatible materials.

- Regulatory Frameworks: Stringent FDA and EMA approval processes, impacting product launches and market penetration.

- Competitive Product Substitutes: While direct substitutes for specialized needles are limited, advancements in conservative management or alternative surgical techniques can indirectly influence demand.

- End-User Demographics: Rising incidence of osteoporosis, age-related spinal degeneration, and VCFs, particularly in aging populations.

- M&A Trends: Strategic acquisitions for portfolio expansion, technology integration, and market share enhancement.

Vertebroplasty and Kyphoplasty Needles Market Growth Trends & Insights

The Vertebroplasty and Kyphoplasty Needles Market is poised for robust growth, driven by an escalating global burden of osteoporosis and vertebral compression fractures (VCFs), coupled with an increasing preference for minimally invasive surgical procedures. The aging global population, particularly in developed economies, directly correlates with a higher incidence of conditions necessitating these interventions, thereby fueling market expansion. Technological advancements in needle design and delivery systems are continuously enhancing procedure safety, efficacy, and patient recovery times, further accelerating adoption rates. The market size for vertebroplasty and kyphoplasty needles is projected to grow from approximately $XXX million in 2019 to an estimated $XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period (2025–2033). This growth is underpinned by increasing healthcare expenditure, improved diagnostic capabilities leading to earlier detection of VCFs, and a growing awareness among both healthcare professionals and patients regarding the benefits of these minimally invasive techniques.

The adoption of vertebroplasty and kyphoplasty procedures is steadily rising, moving from specialized centers to broader healthcare settings. This trend is supported by favorable reimbursement policies in many regions and the demonstrated cost-effectiveness of these procedures in reducing pain and improving quality of life, thus lowering long-term healthcare burdens. Technological disruptions, such as the development of advanced imaging guidance software and robotic-assisted surgery, are enhancing the precision and predictability of these procedures, making them more attractive for a wider range of patients. Consumer behavior shifts are also playing a role, with patients increasingly seeking less invasive options that offer quicker recovery and reduced hospital stays. The market penetration of these devices is expected to deepen as healthcare systems globally prioritize efficient and effective treatments for spinal pathologies. Furthermore, the development of innovative biomaterials and drug-eluting needles for enhanced bone healing and pain management presents significant future growth opportunities, pushing the market towards more sophisticated and value-added solutions.

Dominant Regions, Countries, or Segments in Vertebroplasty and Kyphoplasty Needles Market

The Vertebroplasty Devices segment is a dominant force within the Vertebroplasty and Kyphoplasty Needles Market, consistently driving significant market share and growth potential. This dominance is attributable to several factors, including the widespread prevalence of osteoporosis, a primary condition necessitating vertebroplasty, and the established track record and relative simplicity of vertebroplasty procedures compared to kyphoplasty in certain patient populations. North America, particularly the United States, stands as the leading region, boasting a robust healthcare infrastructure, high healthcare spending, advanced technological adoption, and a well-established reimbursement system that favors minimally invasive spinal interventions. The sheer volume of VCFs diagnosed annually in the US, coupled with an aging demographic, creates a substantial and consistent demand for vertebroplasty devices and their associated needles.

Key drivers contributing to North America's dominance include:

- High Incidence of Osteoporosis: A significant portion of the population suffers from osteoporosis, leading to a greater need for VCF treatment.

- Advanced Healthcare Infrastructure: Well-equipped hospitals and clinics with specialized spinal intervention centers.

- Favorable Reimbursement Policies: Strong insurance coverage for minimally invasive spinal procedures.

- Technological Adoption: Early and widespread adoption of new medical technologies and devices.

- Awareness and Education: High levels of awareness among healthcare professionals and patients regarding VCFs and their treatment options.

Beyond North America, Europe represents another substantial market, driven by similar factors such as an aging population and a growing understanding of the benefits of vertebroplasty and kyphoplasty. Countries like Germany, the UK, and France exhibit strong market presence due to their developed healthcare systems and significant patient volumes. The Asia-Pacific region is emerging as a rapidly growing market, fueled by increasing healthcare expenditure, improving access to advanced medical treatments, and a rising prevalence of osteoporosis, particularly in countries like China and Japan. The growth in these regions is further propelled by increasing government initiatives to improve healthcare access and the introduction of innovative, cost-effective treatment solutions. The Vertebroplasty Devices segment's continued growth is intrinsically linked to the development of more precise, safer, and user-friendly needle systems that can be readily integrated into existing clinical workflows.

Vertebroplasty and Kyphoplasty Needles Market Product Landscape

The product landscape of the Vertebroplasty and Kyphoplasty Needles Market is defined by ongoing innovation focused on enhancing procedural precision, patient safety, and operator convenience. Manufacturers are developing specialized needles with features such as advanced tip designs for controlled bone cement injection, integrated imaging markers for improved fluoroscopic or CT guidance, and ergonomic handle designs for better control during insertion. Applications span the treatment of painful osteoporotic vertebral compression fractures, traumatic VCFs, and spinal metastases. Performance metrics are evaluated based on ease of insertion, cement delivery accuracy, minimized leakage, and reduced procedure time. Unique selling propositions often revolve around proprietary needle configurations, novel material compositions that enhance lubricity or rigidity, and compatibility with various bone cement formulations. Technological advancements are also extending to integrated systems that combine needles with delivery tools and balloons for kyphoplasty, aiming for seamless procedural execution.

Key Drivers, Barriers & Challenges in Vertebroplasty and Kyphoplasty Needles Market

The Vertebroplasty and Kyphoplasty Needles Market is propelled by several key drivers. The escalating global prevalence of osteoporosis and resulting vertebral compression fractures (VCFs) is a primary growth catalyst. An aging population worldwide further exacerbates this trend, creating a consistent and growing patient pool. The increasing preference for minimally invasive surgical procedures, due to faster recovery times and reduced patient trauma, directly favors vertebroplasty and kyphoplasty. Furthermore, technological advancements in needle design, imaging compatibility, and cement delivery systems enhance procedural efficacy and safety, driving adoption. Improved diagnostic capabilities and greater physician awareness also contribute significantly.

Conversely, the market faces several barriers and challenges. High costs associated with advanced needle systems and the overall procedure can be a significant restraint, particularly in price-sensitive healthcare markets. Stringent regulatory approval processes in various countries can delay market entry for new products and necessitate substantial investment in clinical validation. Competition from alternative treatment modalities, such as conservative management or other surgical techniques, can also pose a challenge, though often these are not direct substitutes for the specific benefits offered by vertebroplasty and kyphoplasty. Supply chain disruptions, as observed globally, can impact the availability and cost of raw materials and finished products. Furthermore, the need for specialized training for surgeons to perform these procedures effectively can be a barrier to widespread adoption in less specialized healthcare settings.

Emerging Opportunities in Vertebroplasty and Kyphoplasty Needles Market

Emerging opportunities within the Vertebroplasty and Kyphoplasty Needles Market lie in the development of smart needles with integrated sensors for real-time feedback on bone density and cement flow. Untapped markets in developing economies, with growing healthcare expenditure and a rising aging population, present significant expansion potential. Innovative applications, such as the use of these needles in conjunction with novel bone cement formulations or biologics for enhanced bone regeneration and pain relief, offer promising avenues for growth. Evolving consumer preferences towards personalized medicine and patient-centric care will also drive demand for tailored needle solutions that optimize individual treatment outcomes. The integration of AI and advanced imaging techniques for improved procedural planning and execution presents another fertile ground for innovation.

Growth Accelerators in the Vertebroplasty and Kyphoplasty Needles Market Industry

Long-term growth in the Vertebroplasty and Kyphoplasty Needles Market will be significantly accelerated by continued technological breakthroughs in areas like biomaterials, allowing for improved biocompatibility and integration with bone. Strategic partnerships between needle manufacturers and cement suppliers, or with imaging technology providers, will foster integrated solutions that enhance procedural efficiency and market reach. Market expansion strategies targeting underserved regions with increasing VCF prevalence and improving healthcare infrastructure will unlock new revenue streams. The ongoing development of more cost-effective and user-friendly needle systems will also be crucial in driving widespread adoption globally. Furthermore, demonstrating the long-term efficacy and economic benefits of these procedures through robust clinical research will solidify their position in the spinal intervention landscape.

Key Players Shaping the Vertebroplasty and Kyphoplasty Needles Market Market

- Joimax GmbH

- Cardinal Health

- Medtronic

- Medaid Inc

- Johnson & Johnson (Depuy Synthes)

- Biopsybell

- IZI Medical Products

- Stryker

- Lindare Medical

- Globus Medical

- Merit Medical Systems

- Teknimed

- Intraosseous

Notable Milestones in Vertebroplasty and Kyphoplasty Needles Market Sector

- April 2022: Nanox.AI received FDA 510(k) approval for the HealthOST device, an AI software that provides qualitative and quantitative analysis for monitoring vertebral compression fractures and low bone density, potentially associated with osteoporosis. This development signifies a growing trend towards AI-powered diagnostic and monitoring tools in spinal care.

- February 2022: Enlife Solutions represented Tecres, an Italian company, in Romania. This representation includes Tecres' spinal and cranial portfolio, notably the Mendec spine vertebroplasty kit, designed for osteoporosis management. This expansion highlights the increasing availability of specialized kits in emerging markets.

In-Depth Vertebroplasty and Kyphoplasty Needles Market Market Outlook

The future outlook for the Vertebroplasty and Kyphoplasty Needles Market is highly promising, fueled by sustained demand stemming from the global aging population and the persistent challenge of osteoporosis. Growth accelerators include the continuous pursuit of technological advancements, such as smarter needle designs with enhanced precision and integrated functionalities, promising to elevate procedural safety and patient outcomes. Strategic collaborations between key industry players, including manufacturers, cement providers, and imaging technology developers, are expected to foster comprehensive solutions that streamline procedures and broaden market appeal. Market expansion into emerging economies, where the incidence of VCFs is rising alongside improving healthcare infrastructures, presents significant untapped potential. The development of more affordable and user-friendly needle systems will be paramount in democratizing access to these vital minimally invasive treatments. Robust clinical evidence supporting the long-term efficacy and cost-effectiveness of vertebroplasty and kyphoplasty will further solidify their position as standard-of-care interventions, paving the way for substantial market growth and innovation.

Vertebroplasty and Kyphoplasty Needles Market Segmentation

-

1. Product Type

- 1.1. Vertebroplasty Devices

- 1.2. Kyphoplasty Devices

Vertebroplasty and Kyphoplasty Needles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Vertebroplasty and Kyphoplasty Needles Market Regional Market Share

Geographic Coverage of Vertebroplasty and Kyphoplasty Needles Market

Vertebroplasty and Kyphoplasty Needles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Population of Osteoporosis; Rising Geriatric Population; Technological Advancements in the Products

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Kyphoplasty Devices are Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vertebroplasty and Kyphoplasty Needles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vertebroplasty Devices

- 5.1.2. Kyphoplasty Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Vertebroplasty and Kyphoplasty Needles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vertebroplasty Devices

- 6.1.2. Kyphoplasty Devices

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Vertebroplasty and Kyphoplasty Needles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vertebroplasty Devices

- 7.1.2. Kyphoplasty Devices

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vertebroplasty Devices

- 8.1.2. Kyphoplasty Devices

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Vertebroplasty and Kyphoplasty Needles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vertebroplasty Devices

- 9.1.2. Kyphoplasty Devices

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Joimax GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cardinal health

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Medtronic

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Medaid Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Johnson & Johnson (Depuy Synthes)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Biopsybell

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 IZI Medical Products

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Stryker

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Lindare Medical

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Globus Medical

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Merit Medical Systems

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Teknimed

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Joimax GmbH

List of Figures

- Figure 1: Global Vertebroplasty and Kyphoplasty Needles Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Vertebroplasty and Kyphoplasty Needles Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 12: Europe Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 13: Europe Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Product Type 2025 & 2033

- Figure 15: Europe Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: Europe Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Vertebroplasty and Kyphoplasty Needles Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 7: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United States Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 17: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: France Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Italy Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Spain Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Spain Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 32: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 33: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: China Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: China Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Japan Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Japan Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: India Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Australia Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Australia Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: South Korea Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Vertebroplasty and Kyphoplasty Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 48: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 49: Global Vertebroplasty and Kyphoplasty Needles Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Vertebroplasty and Kyphoplasty Needles Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vertebroplasty and Kyphoplasty Needles Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Vertebroplasty and Kyphoplasty Needles Market?

Key companies in the market include Joimax GmbH, Cardinal health, Medtronic, Medaid Inc, Johnson & Johnson (Depuy Synthes), Biopsybell, IZI Medical Products, Stryker, Lindare Medical, Globus Medical, Merit Medical Systems , Teknimed.

3. What are the main segments of the Vertebroplasty and Kyphoplasty Needles Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Population of Osteoporosis; Rising Geriatric Population; Technological Advancements in the Products.

6. What are the notable trends driving market growth?

Kyphoplasty Devices are Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In April 2022, Nanox.AI received FDA 510(k) approval for the HealthOST device, an AI software that provides qualitative and quantitative analysis that monitors vertebral compression fractures and low bone density, which may be associated with osteoporosis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vertebroplasty and Kyphoplasty Needles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vertebroplasty and Kyphoplasty Needles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vertebroplasty and Kyphoplasty Needles Market?

To stay informed about further developments, trends, and reports in the Vertebroplasty and Kyphoplasty Needles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence