Key Insights

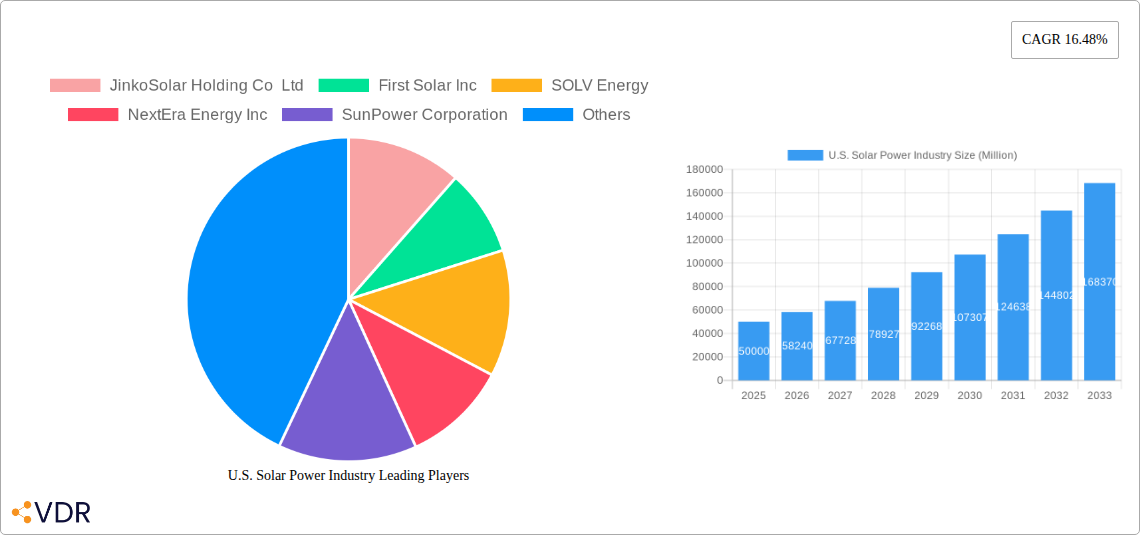

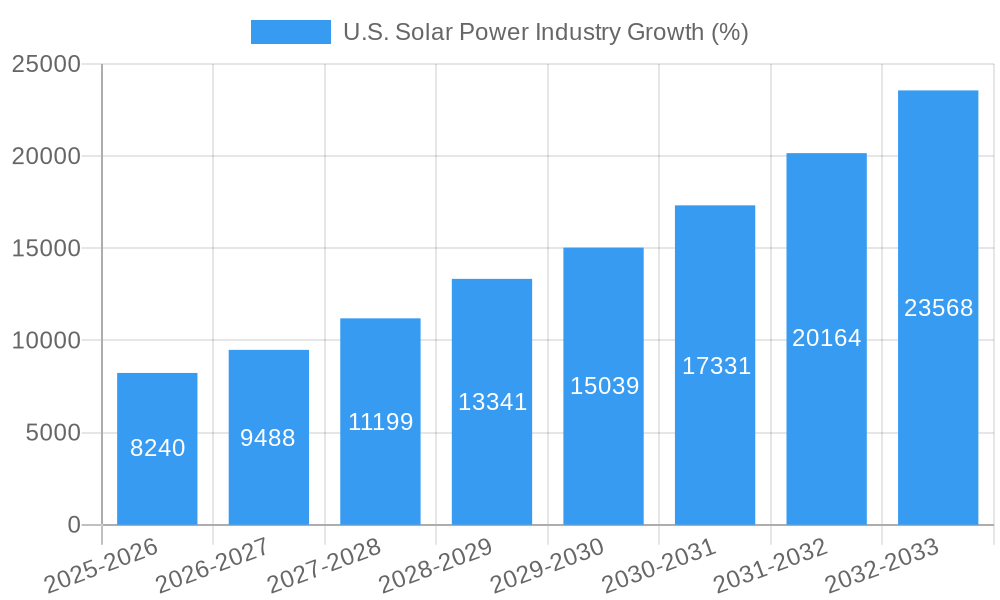

The U.S. solar power industry is experiencing robust growth, driven by increasing environmental concerns, supportive government policies like the Inflation Reduction Act, and decreasing solar panel costs. A CAGR of 16.48% from 2019-2033 indicates a significant expansion of the market, projected to reach substantial value by 2033 (the exact figure requires more data to calculate precisely but based on a 16.48% CAGR from a starting point in 2019, we can project substantial growth). Key market segments include Solar Photovoltaic (PV) and Concentrated Solar Power (CSP), with PV dominating the market share due to its cost-effectiveness and scalability. Regional variations exist, with states like California, Texas, and Florida leading in solar adoption due to favorable sunlight conditions and supportive regulatory environments. However, the Midwest and Northeast are also witnessing significant growth, driven by incentives and increasing demand for renewable energy sources. Major players like First Solar, SunPower, and JinkoSolar are actively shaping the market landscape through innovation in technology and expansion of projects. Challenges remain, including intermittent energy supply, land use constraints, and grid integration complexities; however, these are being addressed through technological advancements and strategic partnerships.

The industry's future trajectory is positive, bolstered by ongoing technological improvements enhancing efficiency and reducing costs. The increasing corporate and residential demand for clean energy, coupled with the growing awareness of climate change, is further fueling market expansion. Though grid infrastructure limitations can hinder growth, significant investments are being made to strengthen the grid's capacity to handle the influx of renewable energy. The diverse range of companies involved—from panel manufacturers to EPC (Engineering, Procurement, and Construction) firms—indicates a mature and dynamic market with numerous opportunities for growth and innovation across the entire value chain. Continued government support and technological advancements are expected to maintain the high growth trajectory of the U.S. solar power industry in the coming years.

This comprehensive report provides an in-depth analysis of the U.S. solar power industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for investors, industry professionals, and policymakers seeking a clear understanding of this rapidly evolving sector. The report analyzes both parent market (Renewable Energy) and child market (Solar Power) to provide a holistic view.

U.S. Solar Power Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competition, end-user demographics, and mergers and acquisitions (M&A) activity within the U.S. solar power industry. The market is characterized by a moderately high level of concentration, with several large players dominating the landscape. However, the presence of numerous smaller companies and startups indicates a dynamic and competitive environment.

- Market Concentration: The top 5 players control approximately xx% of the market. This concentration is expected to slightly decrease to xx% by 2033 due to increased participation of smaller players and entry of foreign companies.

- Technological Innovation: Continuous improvements in photovoltaic (PV) cell efficiency, battery storage technology, and smart grid integration drive market growth. Significant investments in R&D fuel innovation despite barriers such as high initial capital costs.

- Regulatory Framework: Federal and state-level incentives, including tax credits and renewable portfolio standards (RPS), significantly impact industry growth. However, regulatory uncertainty and permitting delays pose challenges.

- Competitive Substitutes: Other renewable energy sources, such as wind power and hydropower, compete with solar power. However, solar’s declining cost and versatility offer a competitive edge.

- End-User Demographics: Residential, commercial, and utility-scale sectors all contribute to solar power adoption. The residential segment has seen significant growth but the utility-scale is likely to continue leading in capacity.

- M&A Trends: The industry witnessed xx M&A deals in 2024 with a total value of $xx Million. This consolidation is expected to continue, driven by economies of scale and access to capital.

U.S. Solar Power Industry Growth Trends & Insights

The U.S. solar power industry has experienced substantial growth over the past five years, driven by declining costs, supportive government policies, and increasing environmental awareness. The market size, measured in installed capacity (MW), experienced a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024 and is projected to maintain a CAGR of xx% during 2025-2033. This growth is influenced by factors including decreasing module costs, innovative financing models, and a stronger emphasis on distributed generation. Technological advancements such as bifacial modules and advanced trackers are further contributing to increased efficiency and lower costs. Consumers' increasing preference for clean energy and corporate sustainability initiatives also drive adoption. Market penetration, measured as the percentage of total electricity generation from solar, is projected to increase from xx% in 2024 to xx% by 2033.

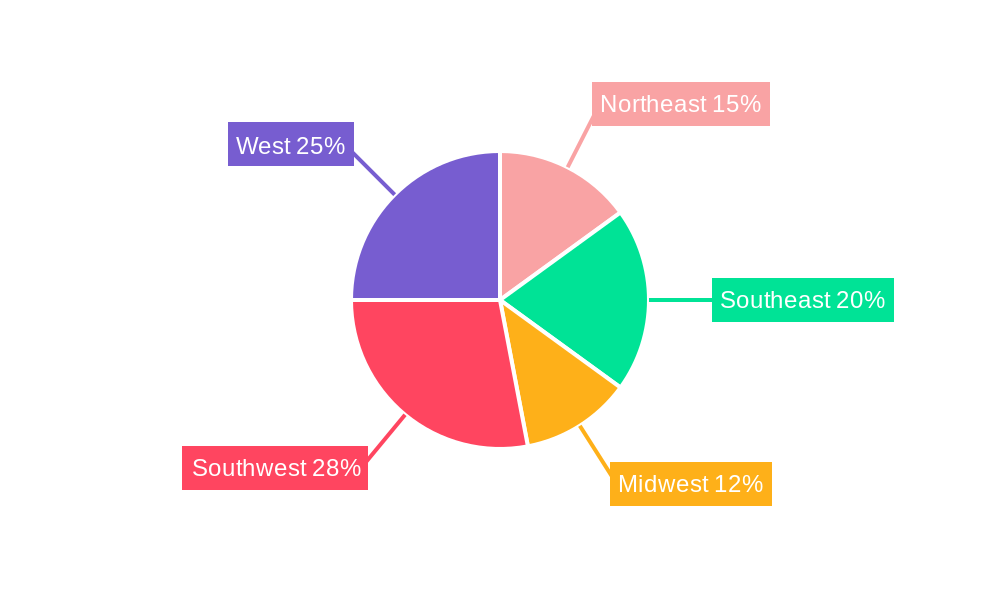

Dominant Regions, Countries, or Segments in U.S. Solar Power Industry

California, Texas, and Florida are the leading states in solar power adoption, driven by factors like abundant sunshine, supportive policies, and robust electricity demand. Within these states, utility-scale projects dominate the market, although residential installations are also growing steadily.

- California: High solar irradiation levels, strong state-level policies, and a significant population base make California a leader in PV segment.

- Texas: Low electricity costs and plentiful land for large-scale projects contribute to its dominance in the CSP segment.

- Florida: Strong population growth and increasing demand for renewable energy contribute to its growth.

- Solar Photovoltaic (PV): The PV segment is dominant within the U.S., accounting for xx% of total installed capacity in 2024. The continuous cost reductions make it particularly attractive.

- Concentrated Solar Power (CSP): Although smaller than PV, CSP has a significant potential in areas with high solar irradiance and land availability.

U.S. Solar Power Industry Product Landscape

The U.S. solar power product landscape is characterized by a wide range of PV modules, inverters, trackers, and balance-of-system (BOS) components. Technological advancements focus on higher efficiency, lower costs, improved durability, and enhanced aesthetics. Several companies offer unique selling propositions such as advanced tracking systems, improved energy storage solutions, and integrated software platforms for monitoring and optimization. Performance metrics like power conversion efficiency, module degradation rate, and energy yield are critical factors influencing product selection.

Key Drivers, Barriers & Challenges in U.S. Solar Power Industry

Key Drivers:

- Declining costs: The cost of solar PV modules has decreased significantly over the past decade, making solar energy increasingly competitive with fossil fuels.

- Government incentives: Federal and state-level tax credits, subsidies, and renewable portfolio standards (RPS) significantly stimulate demand.

- Environmental concerns: Growing public awareness of climate change and the need for clean energy is increasing demand for solar power.

Challenges:

- Intermittency: Solar power generation is intermittent, dependent on weather conditions. This requires efficient energy storage or grid management solutions.

- Land use: Large-scale solar projects require significant land areas, potentially impacting agricultural land or sensitive ecosystems. This issue is partially addressed by rooftop installations.

- Supply chain vulnerabilities: Reliance on imported PV modules increases vulnerability to global supply chain disruptions. Domestic manufacturing initiatives could mitigate this.

Emerging Opportunities in U.S. Solar Power Industry

- Floating solar farms: Utilizing water bodies for solar installations opens up new opportunities in land-constrained areas.

- Agrivoltaics: Combining agriculture and solar energy production on the same land increases land-use efficiency.

- Solar-plus-storage solutions: Integrating battery storage systems enhances grid stability and increases solar power's reliability.

Growth Accelerators in the U.S. Solar Power Industry Industry

Technological breakthroughs, such as perovskite solar cells, and the advancement of energy storage technologies are key growth accelerators. Strategic partnerships between solar developers, utilities, and technology providers facilitate project development and market expansion. Further government support, specifically targeted at overcoming supply chain issues, will accelerate growth. The continued reduction of PV module costs, driven by economies of scale and technological progress, remains a fundamental accelerator.

Key Players Shaping the U.S. Solar Power Industry Market

- JinkoSolar Holding Co Ltd

- First Solar Inc

- SOLV Energy

- NextEra Energy Inc

- SunPower Corporation

- Rosendin Electric Inc

- 8minute Solar Energy

- Canadian Solar Inc

- Renewable Energy Systems Ltd

- M A Mortenson Company

- Hanwha Corporation

Notable Milestones in U.S. Solar Power Industry Sector

- April 2023: Atlas Renewable Energy and Albras signed a PPA for the 902 MW Vista Alegre Photovoltaic Project in Brazil. This signals increasing international collaboration and the growing global reach of U.S. solar technology companies.

- April 2023: Masdar's acquisition of a 50% stake in the Big Beau solar and battery storage project showcases the growing interest in combined renewable energy and storage solutions.

- March 2023: Duke Energy's operation of the Pisgah Ridge Solar facility and its VPPA with Charles River Laboratories highlights the increasing role of corporate PPAs in driving solar development.

In-Depth U.S. Solar Power Industry Market Outlook

The U.S. solar power industry is poised for sustained growth over the next decade, driven by a confluence of factors including declining costs, strong policy support, and increasing consumer demand for clean energy. Strategic opportunities exist in expanding solar-plus-storage deployments, fostering domestic manufacturing capabilities, and exploring innovative applications such as agrivoltaics and floating solar. The market's future potential hinges on addressing supply chain challenges, promoting grid modernization, and ensuring regulatory stability.

U.S. Solar Power Industry Segmentation

-

1. Type

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

U.S. Solar Power Industry Segmentation By Geography

- 1. U.S.

U.S. Solar Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Solar Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Northeast U.S. Solar Power Industry Analysis, Insights and Forecast, 2019-2031

- 7. Southeast U.S. Solar Power Industry Analysis, Insights and Forecast, 2019-2031

- 8. Midwest U.S. Solar Power Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southwest U.S. Solar Power Industry Analysis, Insights and Forecast, 2019-2031

- 10. West U.S. Solar Power Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 JinkoSolar Holding Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 First Solar Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SOLV Energy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NextEra Energy Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SunPower Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rosendin Electric Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 8minute Solar Energy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Canadian Solar Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Renewable Energy Systems Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 M A Mortenson Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hanwha Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: U.S. Solar Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: U.S. Solar Power Industry Share (%) by Company 2024

List of Tables

- Table 1: U.S. Solar Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: U.S. Solar Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: U.S. Solar Power Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: U.S. Solar Power Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: U.S. Solar Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: U.S. Solar Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 7: U.S. Solar Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: U.S. Solar Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 9: Northeast U.S. Solar Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northeast U.S. Solar Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 11: Southeast U.S. Solar Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southeast U.S. Solar Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Midwest U.S. Solar Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Midwest U.S. Solar Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Southwest U.S. Solar Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Southwest U.S. Solar Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: West U.S. Solar Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West U.S. Solar Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: U.S. Solar Power Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: U.S. Solar Power Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 21: U.S. Solar Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: U.S. Solar Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Solar Power Industry?

The projected CAGR is approximately 16.48%.

2. Which companies are prominent players in the U.S. Solar Power Industry?

Key companies in the market include JinkoSolar Holding Co Ltd, First Solar Inc, SOLV Energy, NextEra Energy Inc, SunPower Corporation, Rosendin Electric Inc, 8minute Solar Energy, Canadian Solar Inc, Renewable Energy Systems Ltd, M A Mortenson Company, Hanwha Corporation.

3. What are the main segments of the U.S. Solar Power Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption.

8. Can you provide examples of recent developments in the market?

April 2023: Atlas Renewable Energy and Albras signed a solar power purchase agreement (PPA). Atlas will deliver solar-generated power to Albras for the next 21 years under the contract terms. The 902 MW Vista Alegre Photovoltaic Project will supply solar energy. The factory in Minas Gerais in Southeastern Brazil will begin operations in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Solar Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Solar Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Solar Power Industry?

To stay informed about further developments, trends, and reports in the U.S. Solar Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence