Key Insights

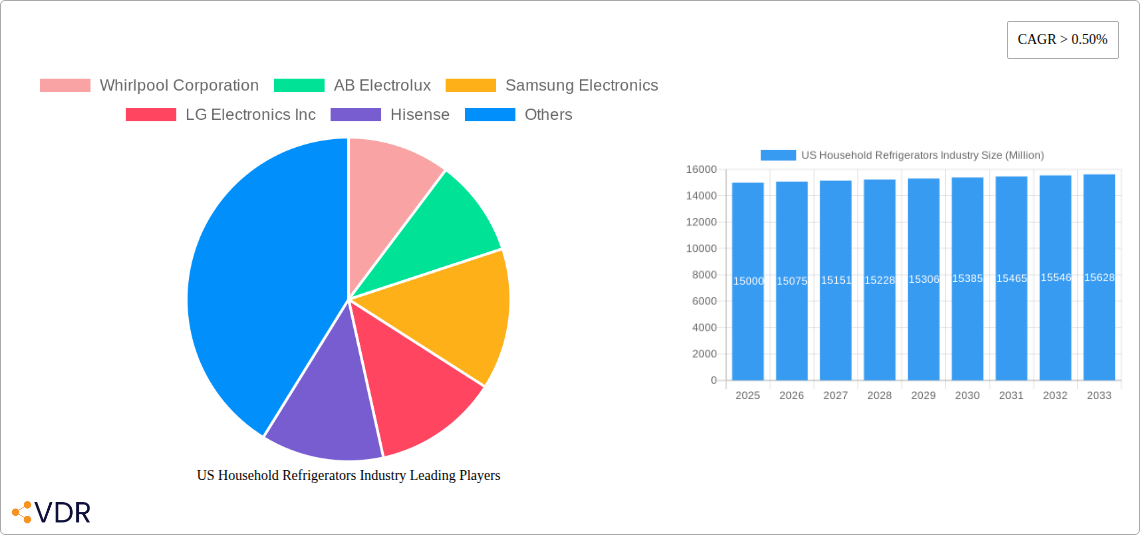

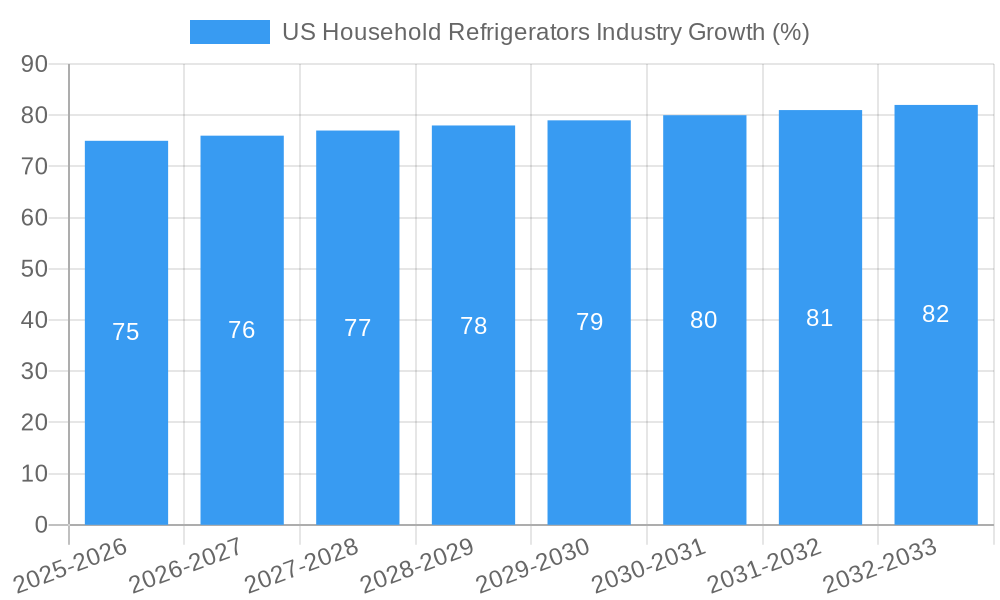

The US household refrigerator market, a significant segment of the broader appliance industry, exhibits robust growth potential. The market, valued at approximately $15 billion in 2025 (estimated based on available data and market trends), is projected to experience a compound annual growth rate (CAGR) exceeding 0.50% from 2025 to 2033. This growth is driven by several key factors. Rising disposable incomes, particularly among millennial and Gen Z households, fuel demand for energy-efficient and technologically advanced models. The increasing prevalence of dual-income households necessitates convenient and space-efficient refrigeration solutions. Furthermore, the growing popularity of frozen foods contributes to the demand for larger capacity refrigerators, particularly those with advanced features like French door and side-by-side configurations. The market's segmentation reveals noteworthy trends. While specialty stores maintain a significant presence, the online distribution channel is experiencing rapid expansion, fueled by e-commerce growth and convenient home delivery options. In terms of refrigerator types, side-by-side and French door models command considerable market share, reflecting consumer preferences for style, functionality, and increased storage capacity. However, the market faces certain restraints, such as fluctuating raw material costs and economic uncertainties that can impact consumer spending on durable goods. Key players, including Whirlpool, Samsung, LG, and others, are continuously innovating to meet consumer demand and maintain their market positions through technological advancements, brand building, and strategic partnerships.

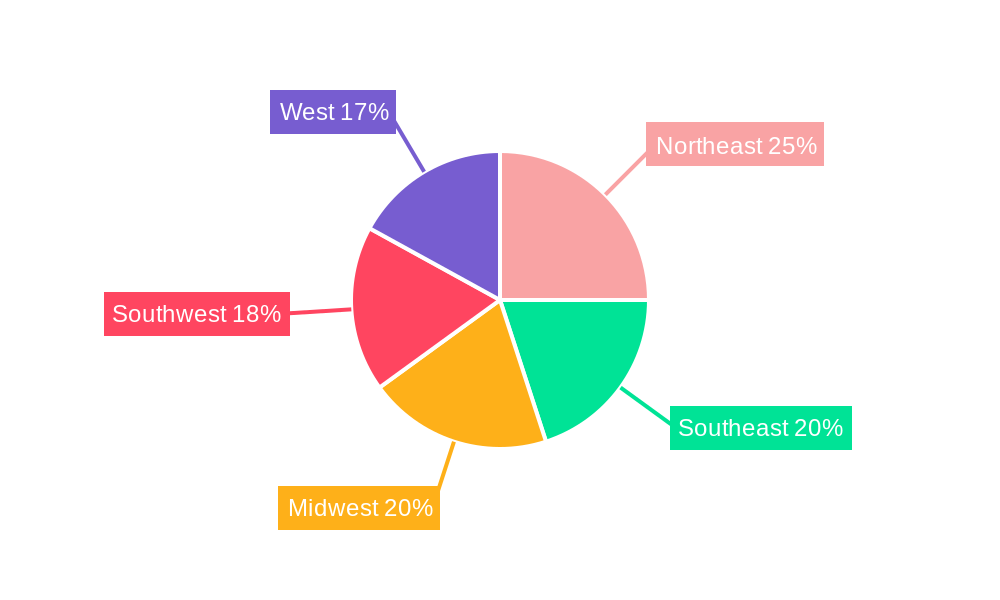

The regional distribution of the US market demonstrates variation in growth patterns. The Northeast and West Coast regions, characterized by higher disposable incomes and a larger population density, tend to show faster adoption rates for premium refrigerator models. The Midwest and South, meanwhile, often exhibit a more price-sensitive market, with demand for more budget-friendly options. This necessitates a nuanced approach by manufacturers, tailoring product offerings and marketing strategies to specific regional preferences. The forecast period, 2025-2033, promises continued expansion driven by ongoing technological advancements, evolving consumer preferences, and the enduring need for efficient food storage in US households. Competitive intensity will remain high, with companies constantly vying for market share through product differentiation and strategic expansion.

US Household Refrigerators Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US household refrigerators industry, covering market dynamics, growth trends, dominant segments, product landscape, challenges, opportunities, and key players. The report utilizes data from 2019-2024 (Historical Period), with a base year of 2025 (Estimated Year) and forecasts extending to 2033 (Forecast Period). The study period encompasses 2019-2033. Market values are presented in million units.

Note: Where specific data was unavailable, estimated or predicted values (denoted as "xx") are provided.

US Household Refrigerators Industry Market Dynamics & Structure

The US household refrigerator market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Whirlpool Corporation, AB Electrolux, Samsung Electronics, and LG Electronics Inc. are key players, alongside others such as Hisense, Haier Group Corporation, and Panasonic Corporation. Market concentration is further analyzed considering various factors mentioned below. Technological innovation, driven by energy efficiency standards and consumer demand for smart features, is a major driver. Regulatory frameworks, particularly those concerning energy consumption, significantly influence product design and manufacturing. Competitive substitutes, such as smaller, energy-efficient cooling appliances, pose a challenge, particularly to traditional models. The end-user demographic is evolving towards smaller households, impacting the demand for different refrigerator types. Finally, mergers and acquisitions (M&A) activity has played a role in shaping the market structure.

- Market Concentration: xx% held by top 5 players in 2024.

- Technological Innovation: Focus on energy efficiency (e.g., inverter compressors), smart connectivity, and improved food preservation.

- Regulatory Framework: Compliance with Department of Energy (DOE) efficiency standards.

- M&A Activity: xx major deals in the last 5 years.

- Competitive Substitutes: Growth of mini-fridges and beverage coolers impacting sales of larger models.

- Innovation Barriers: High R&D costs and complexities in achieving significant efficiency improvements.

US Household Refrigerators Industry Growth Trends & Insights

The US household refrigerator market experienced steady growth during the historical period (2019-2024), driven by factors including rising disposable incomes, increasing urbanization, and changing consumer lifestyles. However, growth rate exhibited fluctuations over this period. The market size is projected to reach xx million units in 2025 (Estimated Year), with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of smart refrigerators with internet connectivity and advanced features like inventory management, are impacting adoption rates and consumer behavior. Consumer preferences are shifting towards larger capacity, energy-efficient models with advanced features.

- Market Size in 2024: xx Million Units

- Projected Market Size in 2033: xx Million Units

- CAGR (2025-2033): xx%

- Market Penetration of Smart Refrigerators in 2024: xx%

- Market Penetration of Smart Refrigerators in 2033: xx%

Dominant Regions, Countries, or Segments in US Household Refrigerators Industry

The US household refrigerator market is geographically diverse, with varying levels of penetration across different regions. However, no single region overwhelmingly dominates the market. In terms of distribution channels, supermarkets/hypermarkets account for the largest share, followed by specialty stores and online channels. Among refrigerator types, side-by-side and French door models are popular, indicating consumer preferences for larger capacity and stylish designs. Application-wise, the market is primarily driven by demand for storing frozen vegetables, fruits, and meat.

- Distribution Channel: Supermarkets/Hypermarkets (xx million units in 2024), Specialty Stores (xx million units in 2024), Online (xx million units in 2024).

- Refrigerator Type: Side-by-side freezers (xx million units in 2024), French Door Refrigerators (xx million units in 2024)

- Application: Frozen Vegetables and Fruit (xx million units in 2024), Frozen Meat (xx million units in 2024).

US Household Refrigerators Industry Product Landscape

The US household refrigerator market showcases a wide range of products, catering to diverse consumer needs and preferences. Innovations focus on enhancing energy efficiency, improving food preservation through advanced technologies like adjustable temperature zones, and integrating smart features such as remote monitoring and inventory management. Manufacturers are also emphasizing aesthetics and design to enhance the appeal of their products. Unique selling propositions include features like built-in water dispensers, ice makers, and adjustable shelving.

Key Drivers, Barriers & Challenges in US Household Refrigerators Industry

Key Drivers: Rising disposable incomes, increasing urbanization, growing preference for convenience, and technological advancements driving innovation in energy efficiency and smart features.

Key Challenges: Fluctuations in raw material prices, stringent energy efficiency regulations, intense competition among established and emerging players, and supply chain disruptions.

Emerging Opportunities in US Household Refrigerators Industry

Emerging opportunities lie in the growing demand for energy-efficient and smart refrigerators, particularly in newly constructed homes and apartments. There is also potential in developing niche products catering to specific consumer segments, like compact models for smaller households or premium features in luxury models. Further, expanding e-commerce channels for refrigerator sales offer significant growth potential.

Growth Accelerators in the US Household Refrigerators Industry

Long-term growth will be driven by technological innovations in energy efficiency, smart features, and improved food preservation technologies. Strategic partnerships between manufacturers and retailers to enhance distribution and marketing capabilities will also be vital. Expansion into underserved markets and development of tailored products for specific consumer segments will also contribute to market growth.

Key Players Shaping the US Household Refrigerators Industry Market

- Whirlpool Corporation

- AB Electrolux

- Samsung Electronics

- LG Electronics Inc

- Hisense

- Haier Group Corporation

- Dover Corporation

- Robert Bosch GmbH

- Philips Electronics

- Siemens Group

- Panasonic Corporation

Notable Milestones in US Household Refrigerators Industry Sector

- 2020: Introduction of several energy-star rated refrigerators from major manufacturers.

- 2021: Increased adoption of smart refrigerators in new construction projects.

- 2022: Launch of new models focusing on sustainability and food waste reduction features.

- 2023: xx major M&A activity in the market.

- 2024: Launch of first fully integrated smart refrigerators that include AI-based features

In-Depth US Household Refrigerators Industry Market Outlook

The US household refrigerator market is poised for continued growth in the coming years, driven by technological advancements, rising consumer demand, and evolving lifestyle preferences. Strategic opportunities exist for manufacturers to focus on energy efficiency, smart features, and premium product differentiation. Companies that can effectively adapt to changing consumer preferences and navigate the evolving regulatory landscape will be well-positioned for success in this dynamic market.

US Household Refrigerators Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

US Household Refrigerators Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Household Refrigerators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Smart Home is boosting the Market

- 3.3. Market Restrains

- 3.3.1. Flactuting Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Increase in Number of Smart Homes in United States is Driving the Market for Smart Refrigerators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Northeast US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 15. West US Household Refrigerators Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Whirlpool Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 AB Electrolux

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Samsung Electronics

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 LG Electronics Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hisense

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Haier Group Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Dover Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Robert Bosch GmbH

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Philips Electronics

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Siemens Group*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Panasonic Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global US Household Refrigerators Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Household Refrigerators Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Household Refrigerators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Household Refrigerators Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 5: North America US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 6: North America US Household Refrigerators Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 7: North America US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 8: North America US Household Refrigerators Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 9: North America US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 10: North America US Household Refrigerators Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 11: North America US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 12: North America US Household Refrigerators Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 13: North America US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 14: North America US Household Refrigerators Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America US Household Refrigerators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America US Household Refrigerators Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 17: South America US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 18: South America US Household Refrigerators Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 19: South America US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 20: South America US Household Refrigerators Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 21: South America US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 22: South America US Household Refrigerators Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 23: South America US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 24: South America US Household Refrigerators Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 25: South America US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 26: South America US Household Refrigerators Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America US Household Refrigerators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe US Household Refrigerators Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 29: Europe US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 30: Europe US Household Refrigerators Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 31: Europe US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 32: Europe US Household Refrigerators Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 33: Europe US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 34: Europe US Household Refrigerators Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 35: Europe US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 36: Europe US Household Refrigerators Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 37: Europe US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 38: Europe US Household Refrigerators Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Europe US Household Refrigerators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: Middle East & Africa US Household Refrigerators Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 41: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 42: Middle East & Africa US Household Refrigerators Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 43: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 44: Middle East & Africa US Household Refrigerators Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 45: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 46: Middle East & Africa US Household Refrigerators Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 47: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 48: Middle East & Africa US Household Refrigerators Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 49: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 50: Middle East & Africa US Household Refrigerators Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Asia Pacific US Household Refrigerators Industry Revenue (Million), by Production Analysis 2024 & 2032

- Figure 53: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 54: Asia Pacific US Household Refrigerators Industry Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 55: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 56: Asia Pacific US Household Refrigerators Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 57: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 58: Asia Pacific US Household Refrigerators Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 59: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 60: Asia Pacific US Household Refrigerators Industry Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 61: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 62: Asia Pacific US Household Refrigerators Industry Revenue (Million), by Country 2024 & 2032

- Figure 63: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Household Refrigerators Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Household Refrigerators Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global US Household Refrigerators Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global US Household Refrigerators Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global US Household Refrigerators Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global US Household Refrigerators Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global US Household Refrigerators Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global US Household Refrigerators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Northeast US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southeast US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Midwest US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southwest US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: West US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global US Household Refrigerators Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 15: Global US Household Refrigerators Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 16: Global US Household Refrigerators Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 17: Global US Household Refrigerators Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Global US Household Refrigerators Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 19: Global US Household Refrigerators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Household Refrigerators Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 24: Global US Household Refrigerators Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 25: Global US Household Refrigerators Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 26: Global US Household Refrigerators Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 27: Global US Household Refrigerators Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 28: Global US Household Refrigerators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global US Household Refrigerators Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 33: Global US Household Refrigerators Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Global US Household Refrigerators Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 35: Global US Household Refrigerators Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Global US Household Refrigerators Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 37: Global US Household Refrigerators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Kingdom US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Germany US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Russia US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Benelux US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Nordics US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global US Household Refrigerators Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 48: Global US Household Refrigerators Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 49: Global US Household Refrigerators Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 50: Global US Household Refrigerators Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 51: Global US Household Refrigerators Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 52: Global US Household Refrigerators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Turkey US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Israel US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: GCC US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: North Africa US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Africa US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East & Africa US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global US Household Refrigerators Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 60: Global US Household Refrigerators Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 61: Global US Household Refrigerators Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 62: Global US Household Refrigerators Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 63: Global US Household Refrigerators Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 64: Global US Household Refrigerators Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: China US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: India US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Japan US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Korea US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: ASEAN US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Oceania US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Asia Pacific US Household Refrigerators Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Household Refrigerators Industry?

The projected CAGR is approximately > 0.50%.

2. Which companies are prominent players in the US Household Refrigerators Industry?

Key companies in the market include Whirlpool Corporation, AB Electrolux, Samsung Electronics, LG Electronics Inc, Hisense, Haier Group Corporation, Dover Corporation, Robert Bosch GmbH, Philips Electronics, Siemens Group*List Not Exhaustive, Panasonic Corporation.

3. What are the main segments of the US Household Refrigerators Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Smart Home is boosting the Market.

6. What are the notable trends driving market growth?

Increase in Number of Smart Homes in United States is Driving the Market for Smart Refrigerators.

7. Are there any restraints impacting market growth?

Flactuting Raw Material Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Household Refrigerators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Household Refrigerators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Household Refrigerators Industry?

To stay informed about further developments, trends, and reports in the US Household Refrigerators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence