Key Insights

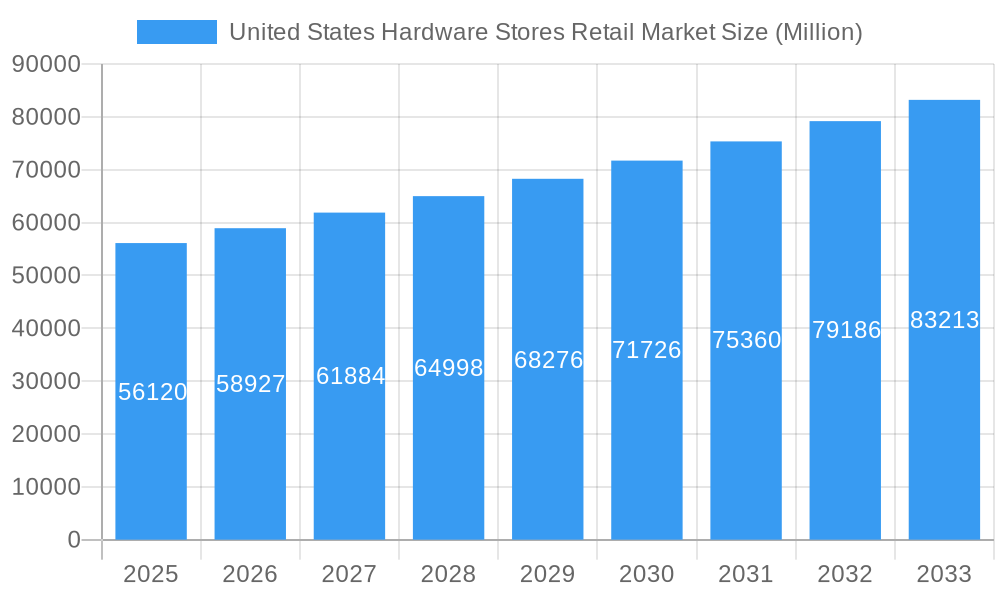

The United States hardware stores retail market, valued at $56.12 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing focus on home improvement and DIY projects, fueled by a rising homeowner population and a preference for personalized living spaces, significantly boosts demand. Furthermore, economic growth and rising disposable incomes contribute to increased spending on home maintenance and renovation. Technological advancements, such as online ordering and in-store digital tools, are enhancing the customer experience and driving sales. However, challenges exist, including rising material costs and supply chain disruptions which can impact profitability. Competition from large home improvement chains like Home Depot and Lowe's, alongside smaller independent stores and online retailers, creates a dynamic and competitive landscape. The market is segmented by store type (big-box, independent, online), product category (tools, lumber, paint, plumbing supplies), and geographic location, offering various opportunities for growth. Growth is expected to be consistent across regions, with higher rates in areas experiencing population growth and robust housing markets. The forecast period of 2025-2033 anticipates a compound annual growth rate (CAGR) of 4.89%, indicating a continuously expanding market.

United States Hardware Stores Retail Market Market Size (In Billion)

This growth trajectory is expected to continue throughout the forecast period (2025-2033), propelled by sustained consumer spending on home improvement and the increasing adoption of innovative technologies within the retail landscape. Key players like Home Depot, Lowe's, and Ace Hardware will continue to dominate the market, while smaller regional players will focus on niche markets and specialized service offerings to maintain their competitiveness. The market will likely see increased consolidation as larger players acquire smaller chains to gain market share and expand their geographical reach. Successful players will need to balance effective inventory management, competitive pricing strategies, and exceptional customer service to thrive in this increasingly competitive environment. Strategic partnerships and e-commerce expansion will also be critical success factors. Overall, the US hardware stores retail market presents a significant and growing opportunity for established players and emerging businesses alike.

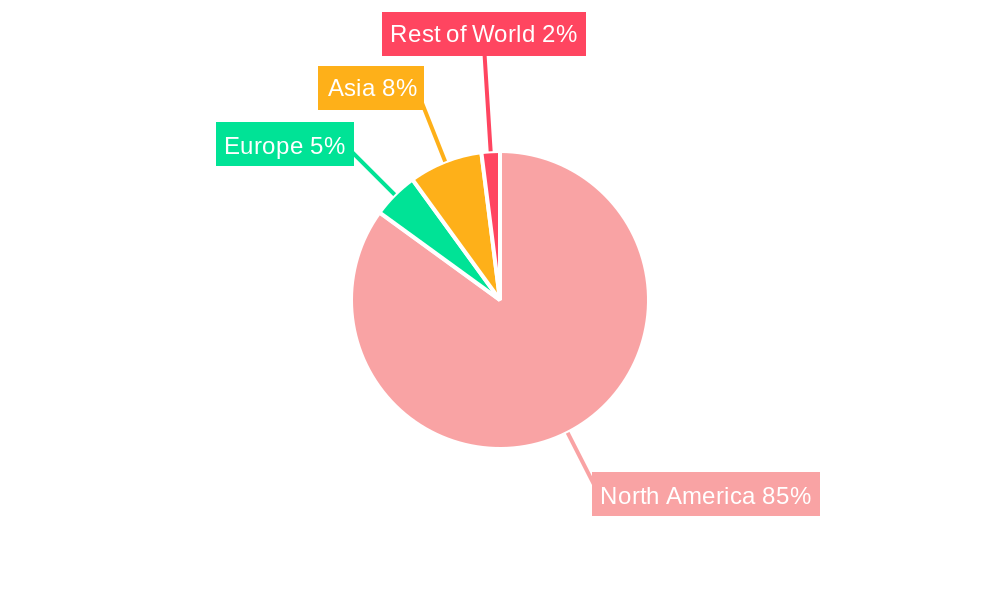

United States Hardware Stores Retail Market Company Market Share

United States Hardware Stores Retail Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Hardware Stores Retail Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The report segments the market into various categories, examining both the parent market (Home Improvement Retail) and child market (Hardware Stores). The total market size is projected to reach xx Million USD by 2033.

United States Hardware Stores Retail Market Dynamics & Structure

The US hardware stores retail market is characterized by a moderately concentrated structure, dominated by large national chains and complemented by a significant number of smaller independent stores. Market leader Home Depot Inc. holds a substantial market share, followed by Lowe’s Companies Inc. The market is experiencing significant technological innovation, particularly in areas such as e-commerce integration, inventory management systems, and customer relationship management (CRM). However, regulatory frameworks related to environmental regulations and product safety continue to evolve, impacting operational costs and product development. The market witnesses competitive pressures from various product substitutes, such as online marketplaces offering similar products, DIY video tutorials and increasing popularity of renting tools. End-user demographics are diverse, ranging from homeowners undertaking DIY projects to professional contractors.

- Market Concentration: Home Depot and Lowe’s account for approximately xx% of the market share combined in 2024, while the remaining share is distributed among regional and independent players.

- Technological Innovation: Adoption of omnichannel strategies, AI-powered inventory management, and personalized customer experiences are key drivers.

- Regulatory Framework: Compliance with building codes, environmental regulations, and product safety standards are major considerations.

- M&A Activity: The market has seen a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx major deals recorded between 2019 and 2024. This activity is expected to continue as larger players seek to expand their market share and product offerings.

- Competitive Substitutes: Online retailers and rental services are key competitive threats.

United States Hardware Stores Retail Market Growth Trends & Insights

The US hardware stores retail market experienced significant growth during the historical period (2019-2024), driven by robust housing construction activity, rising homeownership rates, and a growing interest in DIY home improvement projects. The market is expected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), although the rate may fluctuate based on economic conditions and consumer spending. Technological disruptions, such as the increased adoption of e-commerce and mobile applications, have significantly impacted consumer behavior. Customers are increasingly seeking convenience, personalized experiences, and broader product selection. Market penetration of online channels is steadily rising, but physical stores remain crucial for experiential purchases and immediate product access. The impact of inflation and economic fluctuations on consumer spending is likely to influence growth.

- Market Size Evolution: The market size is projected to grow from xx million USD in 2024 to xx million USD by 2033.

- Adoption Rates: E-commerce penetration is increasing steadily, with xx% of sales expected to be through online channels in 2033.

- Technological Disruptions: The integration of augmented reality (AR) and virtual reality (VR) tools for product visualization and online shopping is transforming the customer experience.

- Consumer Behavior Shifts: Increasing preference for sustainable and eco-friendly products is impacting procurement and supply chain choices.

Dominant Regions, Countries, or Segments in United States Hardware Stores Retail Market

The growth of the US hardware stores retail market is geographically diverse, with significant variations in growth rates across regions. The Southeast and Southwest regions are showing strong growth, fueled by robust housing construction and population growth. Urban areas generally have higher market concentration and sales volumes. However, rural areas demonstrate potential for expansion as the population increasingly opts for remote work arrangements.

- Key Drivers:

- Strong housing market in several regions.

- Increasing homeownership rates.

- Growing interest in DIY home improvement projects.

- Population shifts and increasing urbanization.

- Government initiatives supporting homeownership and infrastructure development.

- Dominance Factors:

- High population density.

- Strong economic conditions.

- Favorable demographic trends.

- Well-established retail infrastructure.

United States Hardware Stores Retail Market Product Landscape

The product landscape in the US hardware stores retail market is extensive, encompassing a wide range of products such as tools, building materials, home décor items, and outdoor living products. Continuous product innovation focuses on enhancing product functionality, durability, and user experience. Technological advancements are evident in smart home technology integration, advanced power tools with improved precision and efficiency, and sustainable building materials. Key differentiators include brand reputation, product quality, warranty offerings, and value-added services.

Key Drivers, Barriers & Challenges in United States Hardware Stores Retail Market

Key Drivers:

- Increased Home Improvement Activity: Rising homeownership rates and a renewed focus on home improvement projects are driving demand.

- Technological Advancements: Smart home technology and innovative tools are enhancing customer experience and creating new opportunities.

- Government Support: Initiatives promoting homeownership and infrastructure development stimulate market growth.

Challenges:

- Supply Chain Disruptions: Global supply chain challenges and increased material costs impact product availability and profitability (estimated xx% impact on profit margins in 2024).

- Competition: Intense competition from both large national chains and smaller independent stores increases price pressure and requires aggressive strategies to maintain market share.

- Economic Fluctuations: Economic downturns can significantly impact consumer spending on discretionary items like home improvement products.

Emerging Opportunities in United States Hardware Stores Retail Market

- Expansion into Rural Markets: Untapped potential exists in serving customers in underserved rural areas.

- Growth of E-commerce: Further development of online platforms and enhanced digital marketing capabilities is essential to capture more customers.

- Sustainable and Eco-Friendly Products: Increasing consumer demand for environmentally friendly products presents a significant opportunity.

- Specialized Product Niches: Focus on specific areas like smart home technology or sustainable building materials creates differentiation and higher profit margins.

Growth Accelerators in the United States Hardware Stores Retail Market Industry

Technological breakthroughs in materials science, automation in manufacturing and warehouse operations, and the development of sophisticated supply chain management systems are key drivers of long-term growth. Strategic partnerships with home builders, contractors, and interior designers offer increased market access and brand visibility. Expanding into new geographic markets and diversifying product offerings are also vital growth strategies.

Key Players Shaping the United States Hardware Stores Retail Market Market

- Home Depot Inc

- Lowe's Companies Inc

- Menard Inc

- Ace Hardware

- True Value Hardware

- 84 Lumber

- Handy Andy Home Improvement Centers Inc

- Hippo Hardware and Trading Company

- Orchard Supply Hardware

- Harbor Freight Tools

Notable Milestones in United States Hardware Stores Retail Market Sector

- September 2023: Lowe's extended its multi-year agreement with the NFL, launching a comprehensive marketing campaign to boost brand visibility and engagement.

- June 2023: Ace Hardware acquired 12 home services companies, expanding its service offerings and strengthening its position in the home improvement market.

In-Depth United States Hardware Stores Retail Market Market Outlook

The US hardware stores retail market holds significant future potential, driven by continued technological advancements, evolving consumer preferences, and consistent demand for home improvement products. Strategic investments in e-commerce, omnichannel strategies, and personalized customer experiences are crucial for achieving sustainable growth. Addressing supply chain challenges and adapting to economic fluctuations remains vital for success. The market is expected to witness further consolidation, with larger players acquiring smaller companies and expanding their product offerings and geographic reach.

United States Hardware Stores Retail Market Segmentation

-

1. Product Type

- 1.1. Door Hardware

- 1.2. Building Materials

- 1.3. Kitchen and Toilet Products

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Offline

- 2.2. Online

United States Hardware Stores Retail Market Segmentation By Geography

- 1. United States

United States Hardware Stores Retail Market Regional Market Share

Geographic Coverage of United States Hardware Stores Retail Market

United States Hardware Stores Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Home Improvement and Renovation Projects

- 3.3. Market Restrains

- 3.3.1. Rise in Home Improvement and Renovation Projects

- 3.4. Market Trends

- 3.4.1. Increased Focus on Home Improvement and Renovation Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Hardware Stores Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Door Hardware

- 5.1.2. Building Materials

- 5.1.3. Kitchen and Toilet Products

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Home Depot Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lowe's Companies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Menard Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ace Hardware

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 True Value Hardware

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 84 Lumber

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Handy Andy Home Improvement Centers Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hippo Hardware and Trading Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orchard Supply Hardware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Harbor Freight Tools

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Home Depot Inc

List of Figures

- Figure 1: United States Hardware Stores Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Hardware Stores Retail Market Share (%) by Company 2025

List of Tables

- Table 1: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: United States Hardware Stores Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Hardware Stores Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Hardware Stores Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: United States Hardware Stores Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: United States Hardware Stores Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United States Hardware Stores Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: United States Hardware Stores Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Hardware Stores Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Hardware Stores Retail Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the United States Hardware Stores Retail Market?

Key companies in the market include Home Depot Inc, Lowe's Companies Inc, Menard Inc, Ace Hardware, True Value Hardware, 84 Lumber, Handy Andy Home Improvement Centers Inc, Hippo Hardware and Trading Company, Orchard Supply Hardware, Harbor Freight Tools.

3. What are the main segments of the United States Hardware Stores Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Home Improvement and Renovation Projects.

6. What are the notable trends driving market growth?

Increased Focus on Home Improvement and Renovation Projects.

7. Are there any restraints impacting market growth?

Rise in Home Improvement and Renovation Projects.

8. Can you provide examples of recent developments in the market?

September 2023: Lowe declared the extension of its multi-year agreement with the NFL for the current year's season. The collaboration will commence with a comprehensive marketing campaign, including a national television commercial, an updated lineup of Lowe's Home Team players, and the introduction of a limited-edition DIY Wrist Coach accessory.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Hardware Stores Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Hardware Stores Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Hardware Stores Retail Market?

To stay informed about further developments, trends, and reports in the United States Hardware Stores Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence