Key Insights

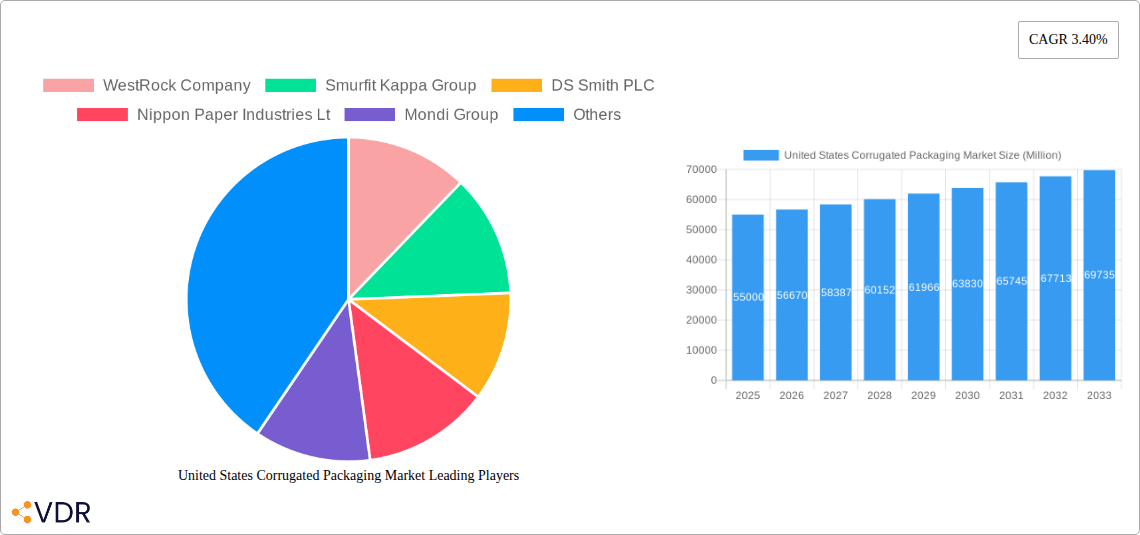

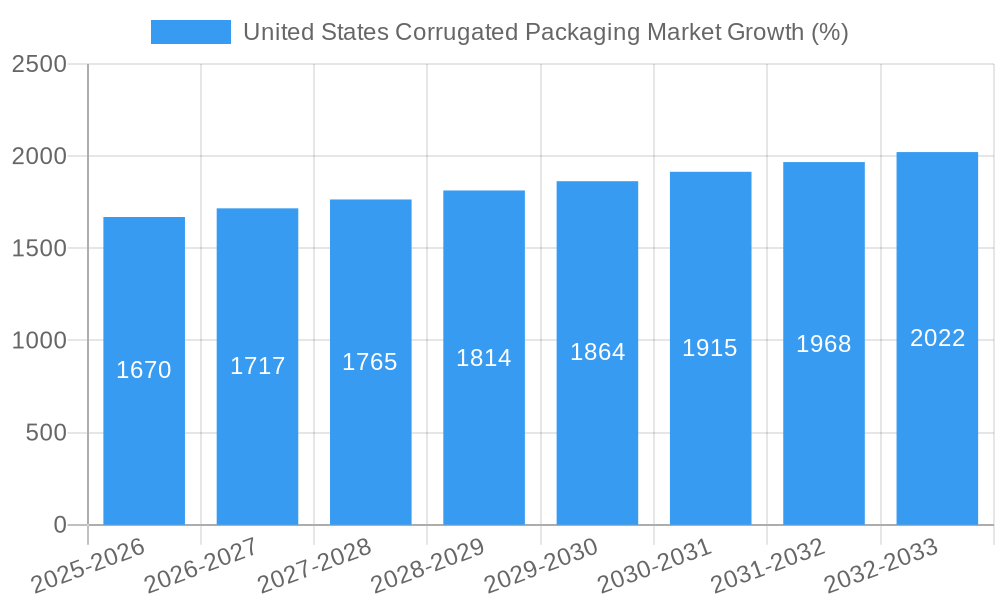

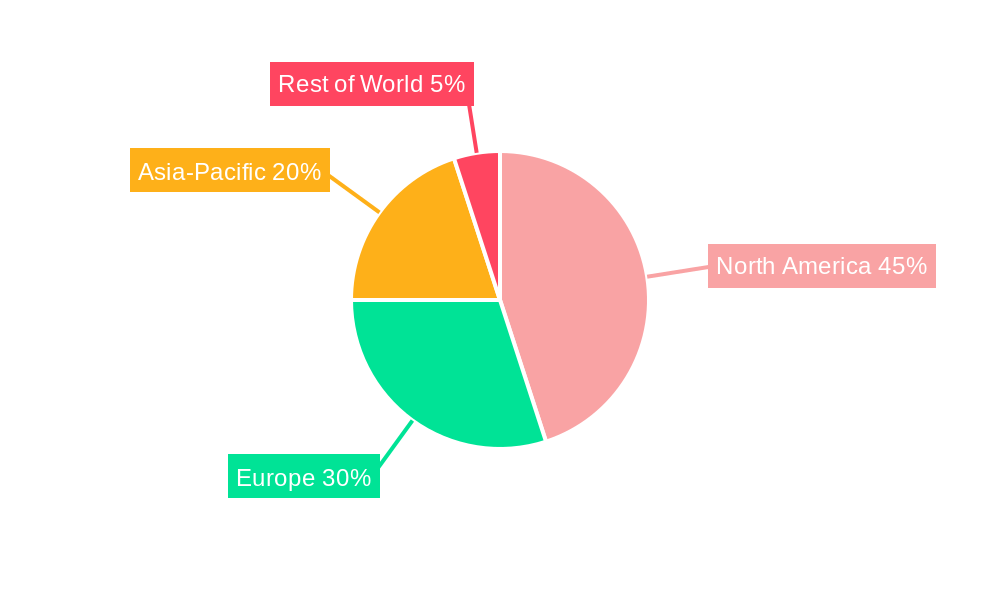

The United States corrugated packaging market, while lacking precise figures in the provided data, exhibits robust growth potential fueled by several key factors. The global CAGR of 3.40% suggests a similarly positive outlook for the US market, though likely influenced by regional variations. Considering the significant consumption of packaged goods in the US across diverse sectors like processed foods, beverages, and e-commerce, a conservative estimate for the 2025 US market size could be placed between $50 and $60 billion. This is based on the understanding that the US represents a substantial portion of the global market. Key drivers include the burgeoning e-commerce sector demanding increased packaging solutions, and a growing emphasis on sustainable packaging options. Trends show a shift towards lightweight, recyclable, and customizable corrugated packaging to meet both environmental concerns and brand-specific needs. However, restraints exist, primarily related to fluctuating raw material prices (primarily virgin fiber and recycled content), and potential supply chain disruptions that impact production and delivery times. The segmentation by end-user industry highlights the significant contributions of processed foods, fresh food and produce, and beverages. Major players like WestRock, Smurfit Kappa, and International Paper are likely dominating the market through their extensive production capabilities and established distribution networks. The market's future hinges on the ongoing balance between meeting the demand for efficient and sustainable packaging while managing cost pressures and supply chain complexities.

Looking forward to 2033, the US corrugated packaging market is projected to experience steady growth, although the exact CAGR will depend on macroeconomic factors and industry-specific developments. The continued expansion of e-commerce, alongside increased consumer focus on sustainable packaging solutions, will continue driving demand. However, manufacturers need to adapt to changing regulations and consumer preferences, which necessitates investments in innovative materials and manufacturing processes. Further market penetration in the less saturated segments within the end-user industries could unlock additional growth opportunities. Effective supply chain management and diversification of sourcing strategies will be crucial for mitigating risks associated with raw material price volatility and supply chain disruptions. This will be critical for maintaining profitability and securing market share in the increasingly competitive landscape.

United States Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States corrugated packaging market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report segments the market by end-user industry, offering granular insights for informed strategic decision-making. This report is essential for industry professionals, investors, and anyone seeking a complete understanding of this dynamic market valued at XX million units in 2025.

United States Corrugated Packaging Market Dynamics & Structure

The US corrugated packaging market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in sustainable and automated packaging solutions, is a major driver. Stringent environmental regulations are influencing material choices and manufacturing processes. Competition from alternative packaging materials, such as plastic, presents a challenge, but the market's resilience is supported by the continued growth of e-commerce and consumer goods. Mergers and acquisitions (M&A) activity is relatively high, with companies focusing on expanding their production capacity and geographic reach.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Focus on automation, sustainable materials (recycled content, biodegradable options), and improved printing technologies.

- Regulatory Framework: Increasing emphasis on sustainability and recyclability is impacting material sourcing and production methods.

- Competitive Substitutes: Plastic and other packaging materials pose a competitive threat, but corrugated board's cost-effectiveness and recyclability provide advantages.

- End-User Demographics: Growth is driven by shifts in consumer purchasing habits, particularly the rise of e-commerce and online grocery delivery.

- M&A Trends: A high volume of M&A activity is observed, with xx deals recorded between 2019 and 2024, indicating consolidation and expansion strategies.

United States Corrugated Packaging Market Growth Trends & Insights

The US corrugated packaging market experienced significant growth during the historical period (2019-2024), driven primarily by the expansion of the e-commerce sector and increased demand for consumer packaged goods. The market size expanded from XX million units in 2019 to XX million units in 2024, registering a Compound Annual Growth Rate (CAGR) of xx%. This growth trend is expected to continue throughout the forecast period (2025-2033), with a projected CAGR of xx%, reaching an estimated XX million units by 2033. Technological disruptions, such as the adoption of advanced automation and digital printing technologies, are further accelerating market growth. Changing consumer preferences towards sustainable packaging are also influencing market dynamics, driving demand for eco-friendly options. Market penetration of corrugated packaging in various end-use sectors remains high, indicating substantial market maturity with continuous growth potential.

Dominant Regions, Countries, or Segments in United States Corrugated Packaging Market

The growth of the US corrugated packaging market is distributed across various regions and end-user segments. However, specific regions such as the South and West Coast experienced comparatively higher growth rates due to significant e-commerce hubs and robust consumer goods sectors. Among the end-user industries, the Processed Foods segment dominated in 2024 with xx% market share, followed by Fresh Food and Produce and Beverages. This dominance stems from the high demand for packaging solutions in these sectors, driven by the need for efficient and safe transportation and storage of perishable goods.

- Key Drivers (Processed Foods Segment): High volume production, stringent safety and hygiene requirements, and increasing demand for ready-to-eat meals.

- Dominance Factors (Processed Foods Segment): Established supply chains, high demand for efficient and protective packaging, and wide acceptance of corrugated boxes.

- Growth Potential (Fresh Food & Produce and Beverages): Increasing consumer awareness of food safety, growing demand for convenient packaging, and rise of online grocery and beverage delivery services.

United States Corrugated Packaging Market Product Landscape

Product innovation in the US corrugated packaging market focuses on enhancing functionality and sustainability. This includes the development of lighter-weight, yet highly durable boxes, improved printing techniques for enhanced branding, and the incorporation of recycled and sustainable materials. Key innovations include the use of water-based inks, biodegradable coatings, and customized designs to meet specific customer needs. These advancements offer unique selling propositions, such as reduced environmental impact and improved product protection, which translate to enhanced customer value.

Key Drivers, Barriers & Challenges in United States Corrugated Packaging Market

Key Drivers: The primary drivers of market growth include the robust growth of e-commerce and related direct-to-consumer delivery models, the rising demand for consumer packaged goods, and the increasing need for sustainable packaging solutions. Government regulations promoting environmentally friendly packaging further accelerate market growth.

Challenges & Restraints: Fluctuations in raw material prices (e.g., pulp and paper), supply chain disruptions, and intense competition among existing players are key challenges. Furthermore, the increasing adoption of alternative packaging materials represents a significant restraint. These factors can negatively impact profitability and hinder market expansion, leading to fluctuations in growth projections.

Emerging Opportunities in United States Corrugated Packaging Market

Emerging opportunities include the growing demand for customized packaging solutions for personalized products and niche markets. There is also increasing focus on the use of smart packaging, which incorporates sensors and technology to monitor product condition and enhance the supply chain. Expansion into untapped markets, particularly in rural areas and developing regions, presents further potential for market growth. Additionally, developing innovative solutions for reducing packaging waste and promoting recycling is a major area for opportunity.

Growth Accelerators in the United States Corrugated Packaging Market Industry

Technological advancements such as automation and digital printing are key growth accelerators. Strategic partnerships between packaging manufacturers and retailers are facilitating improved supply chain efficiency and product innovation. Expansion into new geographical markets and diversification into high-growth segments like e-commerce packaging drive market expansion. Moreover, a focus on sustainability and circular economy principles, such as using recycled materials and optimizing packaging design for reduced waste, is further accelerating market growth.

Key Players Shaping the United States Corrugated Packaging Market Market

- WestRock Company

- Smurfit Kappa Group

- DS Smith PLC

- Nippon Paper Industries Lt

- Mondi Group

- Georgia-Pacific LLC

- Oji Holdings Corporation

- International Paper Company

- Packaging Corporation of America

- Cascades Inc

Notable Milestones in United States Corrugated Packaging Market Sector

- February 2022: McKinley Packaging announces a new DFW plant in Lancaster, Texas, driven by e-commerce demand.

- February 2022: CBRE announces a 500,000-square-foot McKinley Packaging cardboard box factory in Lancaster, Texas, to meet soaring e-commerce demand.

- February 2022: Menasha Packaging acquires Color-Box from Georgia-Pacific, expanding its capacity in high-graphic corrugated boxes for e-commerce.

In-Depth United States Corrugated Packaging Market Market Outlook

The future of the US corrugated packaging market looks promising, driven by continued growth in e-commerce, a focus on sustainable solutions, and ongoing technological advancements. Strategic opportunities exist for companies that can effectively leverage these trends. This includes investing in automation and sustainable materials, developing innovative packaging solutions for emerging markets, and fostering strategic partnerships to optimize supply chains and enhance product offerings. The market's long-term growth trajectory remains positive, with significant potential for expansion across various segments and regions.

United States Corrugated Packaging Market Segmentation

-

1. End-user Industry

- 1.1. Processed Foods

- 1.2. Fresh Food and Produce

- 1.3. Beverages

- 1.4. Paper Products

- 1.5. Electrical Products

- 1.6. Other End-user Industries

United States Corrugated Packaging Market Segmentation By Geography

- 1. United States

United States Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials & Scope for Printing Innovations Propelling Growth In Electronics & Personal Care Segment

- 3.3. Market Restrains

- 3.3.1. Strict Environmental Regulation Regarding Deforestation

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Processed Foods

- 5.1.2. Fresh Food and Produce

- 5.1.3. Beverages

- 5.1.4. Paper Products

- 5.1.5. Electrical Products

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Eastern Europe United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Poland

- 6.1.2 Russia

- 6.1.3 Rest of Eastern Europe

- 7. Western Europe United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Germany

- 7.1.3 France

- 7.1.4 Spain

- 7.1.5 Italy

- 7.1.6 Belgium and Switzerland

- 7.1.7 Rest of Western Europe

- 8. Middle East and Africa United States Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Turkey

- 8.1.2 South Africa

- 8.1.3 Gulf Cooperation Council

- 8.1.4 Rest of Africa

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 WestRock Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Smurfit Kappa Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DS Smith PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Nippon Paper Industries Lt

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Mondi Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Georgia-Pacific LLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Oji Holdings Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Paper Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Packaging Corporation of America

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Cascades Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 WestRock Company

List of Figures

- Figure 1: United States Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Corrugated Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: United States Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: United States Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Poland United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Russia United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Rest of Eastern Europe United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Belgium and Switzerland United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Western Europe United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Turkey United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Gulf Cooperation Council United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Africa United States Corrugated Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: United States Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: United States Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Corrugated Packaging Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the United States Corrugated Packaging Market?

Key companies in the market include WestRock Company, Smurfit Kappa Group, DS Smith PLC, Nippon Paper Industries Lt, Mondi Group, Georgia-Pacific LLC, Oji Holdings Corporation, International Paper Company, Packaging Corporation of America, Cascades Inc.

3. What are the main segments of the United States Corrugated Packaging Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials & Scope for Printing Innovations Propelling Growth In Electronics & Personal Care Segment.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

Strict Environmental Regulation Regarding Deforestation.

8. Can you provide examples of recent developments in the market?

February 2022: McKinley Packaging announced that it would build a new DFW plant in Lancaster as e-commerce fuels the demand for corrugated boxes in the region. McKinley Packaging selected the location in southern Dallas after looking at locations in Louisiana and Oklahoma.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the United States Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence