Key Insights

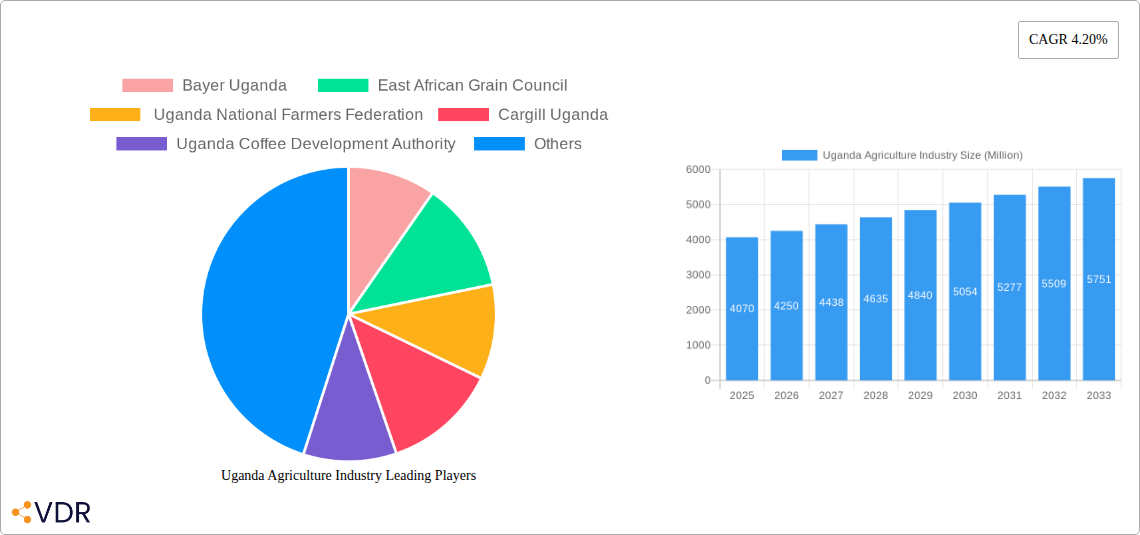

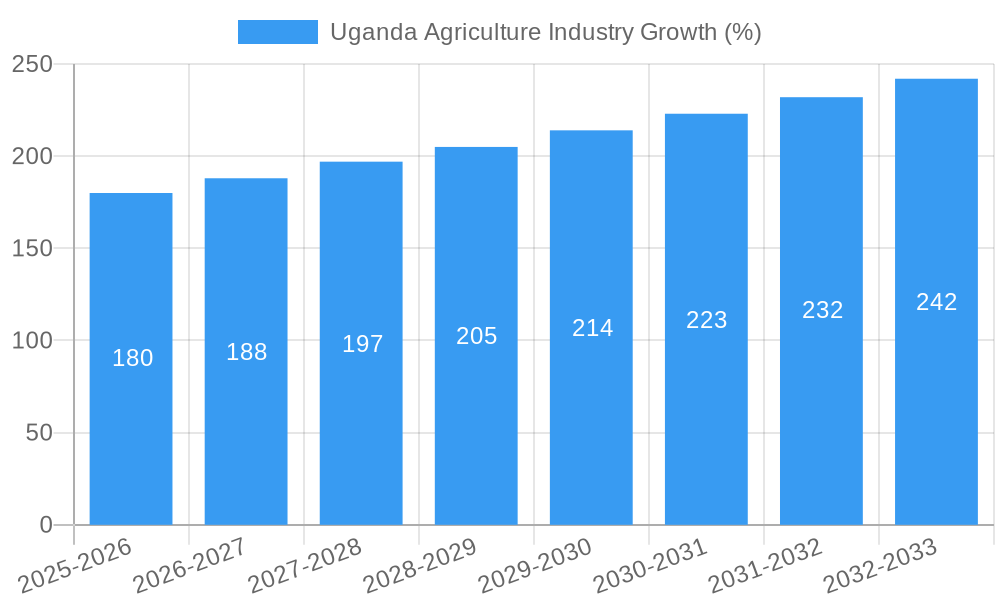

The Ugandan agriculture industry, valued at $4.07 billion in 2025, exhibits robust growth potential, projected at a 4.20% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This growth is driven by increasing domestic demand fueled by a rising population, government initiatives promoting agricultural diversification and value addition, and expanding export markets for key commodities like coffee and tea. Key segments include cereals and grains, oilseeds and pulses, and fruits and vegetables. While favorable climatic conditions contribute positively, challenges remain. These include limited access to finance and modern technology for many smallholder farmers, inadequate infrastructure for efficient post-harvest handling and transportation, and susceptibility to climate change impacts like unpredictable rainfall patterns. Strategic investments in agricultural research, improved farming practices, and infrastructure development are crucial to unlocking the sector's full potential. Companies like Bayer Uganda, Cargill Uganda, and the Uganda Coffee Development Authority play significant roles in shaping the industry landscape, contributing to both production and export activities. The industry's growth trajectory indicates substantial opportunities for investors and stakeholders focused on sustainable agricultural practices and value chain development.

The historical period (2019-2024) likely saw fluctuations influenced by global commodity prices and local weather patterns. However, the sustained projected CAGR points to a positive long-term outlook. Furthermore, the increasing focus on food security and the government's support for farmer cooperatives and agricultural extension services suggest a conducive environment for continued expansion. The dominance of smallholder farmers presents both opportunities and challenges; addressing their access to resources and capacity-building will be critical for realizing inclusive and equitable growth within the sector. Analysis of import and export data will reveal areas of strength and weakness, informing strategic decisions regarding product diversification and market penetration. The potential for growth in value-added agricultural products, such as processed fruits and vegetables, offers promising avenues for economic diversification and job creation.

Uganda Agriculture Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Ugandan agriculture industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic sector. The report meticulously analyzes key segments including Cereals and Grains, Oilseeds and Pulses, and Fruits and Vegetables, offering granular insights into production, consumption, import/export volumes and values, and price trends.

Keywords: Uganda Agriculture, Ugandan Agriculture Industry, Agriculture Uganda, Uganda Farming, Coffee Uganda, Cereals Uganda, Oilseeds Uganda, Pulses Uganda, Fruits Uganda, Vegetables Uganda, Bayer Uganda, Cargill Uganda, East African Grain Council, Uganda National Farmers Federation, Uganda Coffee Development Authority, Market Analysis, Market Research, Market Size, Market Forecast, Agriculture Market, Investment Opportunities.

Uganda Agriculture Industry Market Dynamics & Structure

The Ugandan agriculture industry is characterized by a diverse range of players, from smallholder farmers to large multinational corporations like Bayer Uganda and Cargill Uganda. Market concentration is relatively low, with numerous small-scale farmers dominating production in many segments. However, larger companies play significant roles in processing, export, and input supply. Technological innovation, while slowly increasing, remains a key challenge, constrained by factors such as limited access to finance and technology transfer. The regulatory framework, while improving, continues to evolve, impacting market access and trade. Competition exists not only between domestic producers but also from imports. M&A activity is limited, with a predicted xx million USD deal volume in 2025, but consolidation is anticipated as larger companies seek to enhance their market presence.

- Market Concentration: Low, dominated by smallholder farmers, with xx% market share held by top 5 companies in 2025.

- Technological Innovation: Limited adoption of advanced technologies due to financial constraints, resulting in lower productivity and efficiency compared to global standards.

- Regulatory Framework: Undergoing improvement but still presents some challenges to market access and trade for smaller producers.

- Competitive Substitutes: Imports compete with locally produced goods, particularly in processed food segments.

- End-User Demographics: Primarily rural population dependent on agriculture, with growing urban demand for processed and packaged foods.

- M&A Trends: Low level of activity, xx million USD predicted for 2025, expected to rise with increased industry consolidation.

Uganda Agriculture Industry Growth Trends & Insights

The Ugandan agriculture industry is expected to experience robust growth over the forecast period (2025-2033), driven by factors such as population growth, rising incomes, and increased government investment in the sector. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated value of xx million USD by 2033. Adoption rates of new technologies are slowly increasing, though still low, while consumer behavior shows a shift towards processed and packaged foods, especially in urban areas. Technological disruptions, such as precision agriculture and improved post-harvest handling, are slowly being adopted. Increased investment and infrastructural development promise to further accelerate growth.

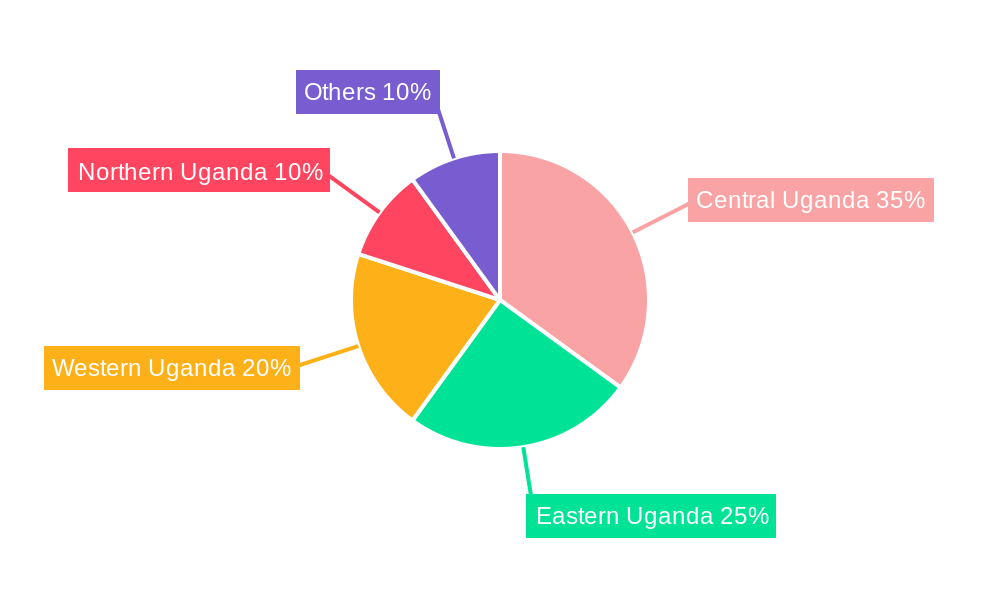

Dominant Regions, Countries, or Segments in Uganda Agriculture Industry

Within Uganda's diverse agricultural landscape, coffee production continues to be a significant contributor to the national economy. The Central region is a key production hub, exhibiting strong market dominance. This dominance is driven by factors including favorable climatic conditions, existing infrastructure, access to markets, and robust government support programs. High-value crops like fruits and vegetables also contribute significantly to growth.

- Key Drivers for Central Region Dominance: Favorable climate, existing infrastructure, proximity to markets, robust government support programs.

- Coffee Sector: Significant growth potential fueled by ambitious government plans to increase production and improve productivity; this is projected to contribute significantly to the industry’s growth over the forecast period.

- Fruits and Vegetables: Increasing consumer demand, supported by the formation of farmer cooperatives (such as Hortifresh), drives substantial growth.

Cereals and Grains: Production of maize, sorghum, beans and rice. Central and Eastern region are key production areas. Oilseeds and Pulses: Production of simsim, soya beans, groundnuts, and other pulses. Northern and Eastern regions dominate production of these commodities. Fruits and Vegetables: Production of bananas, potatoes, cassava, and various fruits. Central region is the dominant production area.

Uganda Agriculture Industry Product Landscape

The Ugandan agricultural product landscape encompasses a wide range of crops and livestock, with a growing focus on high-value products. Innovation is primarily focused on improving yields, quality, and post-harvest handling techniques. New product development is gradually increasing, driven by the need to meet the changing demands of consumers. Technology is influencing post-harvest management strategies, improving storage and processing capabilities.

Key Drivers, Barriers & Challenges in Uganda Agriculture Industry

Key Drivers:

- Increasing government investment in the sector.

- Growing domestic and regional demand.

- Rising incomes and urbanization.

- Favorable climatic conditions in certain regions.

Key Challenges and Restraints:

- Climate change-induced weather patterns impacting agricultural yields.

- Limited access to finance and credit for smallholder farmers impacting expansion plans.

- Poor infrastructure hindering efficient transportation and marketing of agricultural products. This results in approximately xx million USD in losses annually.

- Limited access to technology and improved farming techniques.

Emerging Opportunities in Uganda Agriculture Industry

- Value addition: Processing and packaging of agricultural products to enhance value and meet consumer demand.

- Organic farming: Growing consumer interest in organic produce creates significant opportunities.

- Export markets: Diversifying exports beyond traditional commodities such as coffee.

- Sustainable agriculture practices: adoption of climate-smart agriculture.

Growth Accelerators in the Uganda Agriculture Industry Industry

Long-term growth will be fueled by increased investment in research and development, improved infrastructure, and strategic partnerships between the government, private sector, and development partners. Technology transfer and capacity building initiatives will be critical for enhancing productivity and competitiveness. Government policies promoting value addition and export diversification will also be essential to accelerate growth.

Key Players Shaping the Uganda Agriculture Industry Market

- Bayer Uganda

- East African Grain Council

- Uganda National Farmers Federation

- Cargill Uganda

- Uganda Coffee Development Authority

Notable Milestones in Uganda Agriculture Industry Sector

- November 2022: Launch of biological control agents for the Mango mealybug, improving pest management and boosting mango production.

- August 2022: Government plan to increase coffee production to 1.2 million tons annually by 2025, significantly boosting the coffee sector.

- November 2021: Formation of Hortifresh, a farmer cooperative focused on improving the fruit and vegetable sector.

In-Depth Uganda Agriculture Industry Market Outlook

The Ugandan agriculture industry holds immense potential for growth and development. Continued government support, private sector investment, and technological advancements will be crucial for unlocking this potential. Strategic partnerships, focusing on value addition, export diversification, and sustainable agriculture practices, will be vital for driving long-term market expansion and creating significant opportunities for all stakeholders. The forecast for the next decade is positive, with a projected increase in both production and market value, positioning Uganda as a key player in the regional and global agricultural landscape.

Uganda Agriculture Industry Segmentation

-

1. Type (Pr

- 1.1. Cereals and Grains

- 1.2. Oilseeds and Pulses

- 1.3. Fruits and Vegetables

-

2. Type (Pr

- 2.1. Cereals and Grains

- 2.2. Oilseeds and Pulses

- 2.3. Fruits and Vegetables

Uganda Agriculture Industry Segmentation By Geography

- 1. Uganda

Uganda Agriculture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Agriculture Contributes Highly to Uganda’s GDP

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uganda Agriculture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 5.1.1. Cereals and Grains

- 5.1.2. Oilseeds and Pulses

- 5.1.3. Fruits and Vegetables

- 5.2. Market Analysis, Insights and Forecast - by Type (Pr

- 5.2.1. Cereals and Grains

- 5.2.2. Oilseeds and Pulses

- 5.2.3. Fruits and Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Uganda

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer Uganda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 East African Grain Council

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uganda National Farmers Federation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cargill Uganda

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Uganda Coffee Development Authority

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Bayer Uganda

List of Figures

- Figure 1: Uganda Agriculture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Uganda Agriculture Industry Share (%) by Company 2024

List of Tables

- Table 1: Uganda Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 3: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 4: Uganda Agriculture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Uganda Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 7: Uganda Agriculture Industry Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 8: Uganda Agriculture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uganda Agriculture Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Uganda Agriculture Industry?

Key companies in the market include Bayer Uganda , East African Grain Council , Uganda National Farmers Federation, Cargill Uganda, Uganda Coffee Development Authority .

3. What are the main segments of the Uganda Agriculture Industry?

The market segments include Type (Pr, Type (Pr.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Agriculture Contributes Highly to Uganda’s GDP.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

November 2022: The Government of Uganda, through the Ministry of Agriculture, Animal Industries, and Fisheries (MAAIF), together with development partners, launched and released biological control agents for the Mango mealybug (Rastococcus invaders).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uganda Agriculture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uganda Agriculture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uganda Agriculture Industry?

To stay informed about further developments, trends, and reports in the Uganda Agriculture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence