Key Insights

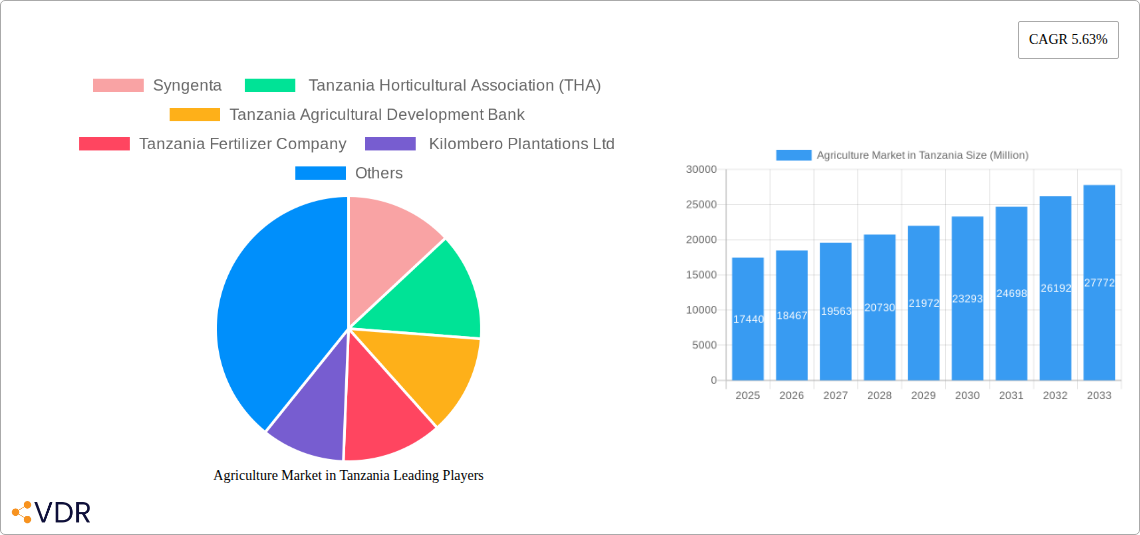

The Tanzanian agricultural market, valued at $17.44 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.63% from 2025 to 2033. This growth is driven by several factors. Increasing domestic demand fueled by a growing population and rising incomes is a key driver. Furthermore, government initiatives aimed at improving agricultural infrastructure, promoting sustainable farming practices, and enhancing access to finance are bolstering the sector. The rising adoption of improved crop varieties and advanced agricultural technologies, such as precision farming techniques, contributes significantly to increased productivity and yield. While challenges such as climate change, limited access to irrigation, and inadequate storage facilities persist, the overall outlook remains positive. The market is segmented into food crops (cereals, fruits, vegetables), each exhibiting unique growth trajectories. Key players like Syngenta, Rijk Zwaan, and local organizations like the Tanzania Horticultural Association (THA) and Tanzania Seed Trade Association (TASTA) are actively shaping the market landscape through investments in research and development, distribution networks, and farmer outreach programs. The substantial contribution of agriculture to Tanzania's GDP underscores its strategic importance to the national economy.

Agriculture Market in Tanzania Market Size (In Billion)

The forecast period (2025-2033) is expected to see continued growth, although the pace might fluctuate based on external factors like global commodity prices and weather patterns. The diversification of crops and the development of value-added agricultural products present significant opportunities for growth. Further investments in irrigation systems, improved storage facilities, and market linkages will be crucial to unlock the sector’s full potential. The increasing adoption of sustainable agricultural practices is a key trend, driven by both environmental concerns and the growing awareness of the benefits of environmentally friendly farming methods. This shift towards sustainability presents both opportunities and challenges for market participants, necessitating strategic adaptation and innovation. Strong collaboration between the government, private sector, and farmer communities will be key to ensuring sustainable and inclusive growth within the Tanzanian agricultural sector.

Agriculture Market in Tanzania Company Market Share

Agriculture Market in Tanzania: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Tanzanian agriculture market, covering market dynamics, growth trends, key players, and future outlook. With a focus on crop types like food crops/cereals, fruits, and vegetables, this report is an essential resource for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic sector. The report analyzes market data from the historical period (2019-2024), base year (2025), and forecasts the market until 2033. All values are presented in Million units.

Agriculture Market in Tanzania Market Dynamics & Structure

The Tanzanian agriculture market exhibits a complex interplay of factors shaping its structure and dynamics. Market concentration is moderate, with a few large players like Syngenta and Kilombero Plantations Ltd alongside numerous smaller, often family-run farms. Technological innovation, while growing, faces barriers including limited access to finance and infrastructure. The regulatory framework is evolving, with recent policy shifts impacting genetically modified (GM) crops. Competitive substitutes are limited, especially for staple food crops. The end-user demographic is predominantly rural, with a significant proportion of smallholder farmers. M&A activity has been moderate, with xx deals recorded between 2019 and 2024, primarily focused on consolidation within the input supply sector.

- Market Concentration: Moderate, with a mix of large multinational corporations and smaller local firms.

- Technological Innovation: Growing but hampered by access to finance and infrastructure.

- Regulatory Framework: Evolving, with recent policy changes impacting GM crop research.

- Competitive Substitutes: Limited for staple crops; more prevalent in higher-value segments like fruits and vegetables.

- End-User Demographics: Predominantly rural, smallholder farmers.

- M&A Activity: Moderate, with xx deals (2019-2024), focused on input supply consolidation.

Agriculture Market in Tanzania Growth Trends & Insights

The Tanzanian agriculture market experienced significant growth during the historical period (2019-2024), driven by increasing domestic demand and favorable government policies. The market size reached xx Million units in 2024, exhibiting a CAGR of xx% during the period. Adoption rates of improved agricultural technologies remain low but are gradually increasing due to government initiatives and private sector investments. Technological disruptions, such as precision agriculture and mobile-based information services, are slowly gaining traction. Consumer behavior is changing, with a growing preference for higher-value crops and processed food products. The forecast period (2025-2033) projects continued growth, albeit at a slightly moderated pace, reaching xx Million units by 2033, with a projected CAGR of xx%. This moderation is due to factors like climate change and global economic uncertainties. Market penetration of improved seeds and fertilizers remains below xx%, indicating substantial untapped potential for growth.

Dominant Regions, Countries, or Segments in Agriculture Market in Tanzania

The northern regions of Tanzania, including Kilimanjaro and Arusha, show dominance in the high-value horticulture sector, particularly in flower and fruit production. The central and southern regions are key production areas for staple food crops like maize and rice. Within crop types, food crops/cereals constitute the largest segment by volume, followed by vegetables and then fruits. This dominance is driven by high domestic demand and relatively lower production costs. High-value crops like fruits and vegetables display higher growth potential due to increasing export demand and higher profit margins. Key growth drivers include government support programs, improvements in irrigation infrastructure, and increasing adoption of improved seeds and fertilizers.

- Key Drivers (Northern Regions): Favorable climate, established infrastructure, proximity to markets.

- Key Drivers (Central & Southern Regions): Large arable land, government investment in irrigation.

- Dominant Segment: Food crops/cereals (by volume), fruits (by value).

- High Growth Potential: Fruits and vegetables, driven by export demand and higher profit margins.

Agriculture Market in Tanzania Product Landscape

The product landscape is characterized by a mix of traditional and improved crop varieties. Improved seeds with higher yields and disease resistance are gradually gaining traction, although adoption remains relatively low. There is increasing demand for fertilizers tailored to specific crop needs. Technological advancements, such as precision farming techniques and mobile-based agricultural advisory services, are playing a key role in improving agricultural productivity and efficiency. Companies like Rijk Zwaan are introducing high-yielding, disease-resistant vegetable varieties. Unique selling propositions increasingly focus on enhanced yields, improved quality, and reduced input costs.

Key Drivers, Barriers & Challenges in Agriculture Market in Tanzania

Key Drivers: Increasing domestic demand, government support programs, investments in irrigation, growing export markets, improved seed varieties, and increased access to credit through initiatives like the Tanzania Agricultural Development Bank.

Challenges: Climate change impacts, including droughts and floods, reducing yields and impacting food security. Limited access to finance and credit for smallholder farmers remains a major barrier, as does inadequate infrastructure for storage, processing, and transportation, leading to post-harvest losses of up to xx%. The high cost of agricultural inputs also limits profitability for many farmers. Competition from imported agricultural products also presents a challenge.

Emerging Opportunities in Agriculture Market in Tanzania

Emerging opportunities include growth in the high-value crop sector, particularly fruits and vegetables for export markets. Contract farming arrangements are gaining traction, improving supply chain efficiency and farmer incomes. The increasing adoption of technology, such as precision agriculture and mobile-based agricultural advisory services, presents opportunities for technology providers. The development of value-added agricultural products and processing industries also offers substantial growth potential. Untapped opportunities exist in organic farming and agritourism.

Growth Accelerators in the Agriculture Market in Tanzania Industry

Significant long-term growth will be propelled by continued government investment in agricultural infrastructure, technology transfer initiatives, and strengthening of agricultural value chains. Strategic partnerships between public and private sector actors, including companies like Kilimanjaro Agro Inputs Ltd and the Tanzania Seed Trade Association (TASTA), are key for accelerating growth. Increased access to finance for smallholder farmers, coupled with improved market access and export promotion strategies, will be crucial for unlocking the market's full potential.

Key Players Shaping the Agriculture Market in Tanzania Market

- Syngenta

- Tanzania Horticultural Association (THA)

- Tanzania Agricultural Development Bank

- Tanzania Fertilizer Company

- Kilombero Plantations Ltd

- Rijk Zwaan

- Monsanto

- Tanzania Breweries Limited

- Kilimanjaro Agro Inputs Ltd

- Tanzania Seed Trade Association (TASTA)

Notable Milestones in Agriculture Market in Tanzania Sector

- September 2022: Tanzania's Ministry of Agriculture directed TARI to find a location for genetically engineered (GE) crop trials, potentially overturning a 2021 ban. This signifies a shift towards embracing biotechnology in agriculture.

- July 2022: The African Development Bank Group approved USD 73.5 million to increase food production by a million tonnes over three years. This injection of funding represents a major boost to agricultural development.

- February 2022: AgriFI and ElectrFI hosted a signing ceremony and launch event, highlighting growing collaboration between the EU and Tanzania in agricultural financing and electrification. This demonstrates a commitment to sustainable agricultural development.

In-Depth Agriculture Market in Tanzania Market Outlook

The Tanzanian agriculture market presents significant long-term growth potential, driven by a rising population, increasing demand for food, and growing export opportunities. Strategic investments in infrastructure, technology, and farmer capacity building will be critical to realizing this potential. Further liberalization of the agricultural sector and supportive policy frameworks will also be instrumental in attracting private sector investment and driving innovation. The market is poised for substantial growth, especially in high-value crops and value-added agricultural products.

Agriculture Market in Tanzania Segmentation

-

1. Crop Typ

- 1.1. Food Crops/Cereals

- 1.2. Fruits

- 1.3. Vegetables

-

2. Crop Typ

- 2.1. Food Crops/Cereals

- 2.2. Fruits

- 2.3. Vegetables

Agriculture Market in Tanzania Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agriculture Market in Tanzania Regional Market Share

Geographic Coverage of Agriculture Market in Tanzania

Agriculture Market in Tanzania REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Favorable Government Policies Supporting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture Market in Tanzania Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 5.1.1. Food Crops/Cereals

- 5.1.2. Fruits

- 5.1.3. Vegetables

- 5.2. Market Analysis, Insights and Forecast - by Crop Typ

- 5.2.1. Food Crops/Cereals

- 5.2.2. Fruits

- 5.2.3. Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Crop Typ

- 6. North America Agriculture Market in Tanzania Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Crop Typ

- 6.1.1. Food Crops/Cereals

- 6.1.2. Fruits

- 6.1.3. Vegetables

- 6.2. Market Analysis, Insights and Forecast - by Crop Typ

- 6.2.1. Food Crops/Cereals

- 6.2.2. Fruits

- 6.2.3. Vegetables

- 6.1. Market Analysis, Insights and Forecast - by Crop Typ

- 7. South America Agriculture Market in Tanzania Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Crop Typ

- 7.1.1. Food Crops/Cereals

- 7.1.2. Fruits

- 7.1.3. Vegetables

- 7.2. Market Analysis, Insights and Forecast - by Crop Typ

- 7.2.1. Food Crops/Cereals

- 7.2.2. Fruits

- 7.2.3. Vegetables

- 7.1. Market Analysis, Insights and Forecast - by Crop Typ

- 8. Europe Agriculture Market in Tanzania Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Crop Typ

- 8.1.1. Food Crops/Cereals

- 8.1.2. Fruits

- 8.1.3. Vegetables

- 8.2. Market Analysis, Insights and Forecast - by Crop Typ

- 8.2.1. Food Crops/Cereals

- 8.2.2. Fruits

- 8.2.3. Vegetables

- 8.1. Market Analysis, Insights and Forecast - by Crop Typ

- 9. Middle East & Africa Agriculture Market in Tanzania Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Crop Typ

- 9.1.1. Food Crops/Cereals

- 9.1.2. Fruits

- 9.1.3. Vegetables

- 9.2. Market Analysis, Insights and Forecast - by Crop Typ

- 9.2.1. Food Crops/Cereals

- 9.2.2. Fruits

- 9.2.3. Vegetables

- 9.1. Market Analysis, Insights and Forecast - by Crop Typ

- 10. Asia Pacific Agriculture Market in Tanzania Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Crop Typ

- 10.1.1. Food Crops/Cereals

- 10.1.2. Fruits

- 10.1.3. Vegetables

- 10.2. Market Analysis, Insights and Forecast - by Crop Typ

- 10.2.1. Food Crops/Cereals

- 10.2.2. Fruits

- 10.2.3. Vegetables

- 10.1. Market Analysis, Insights and Forecast - by Crop Typ

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Syngenta

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tanzania Horticultural Association (THA)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tanzania Agricultural Development Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tanzania Fertilizer Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kilombero Plantations Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rijk Zwaan

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Monsanto

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tanzania Breweries Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kilimanjaro Agro Inputs Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tanzania Seed Trade Association (TASTA)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Syngenta

List of Figures

- Figure 1: Global Agriculture Market in Tanzania Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 3: North America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 4: North America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 5: North America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 6: North America Agriculture Market in Tanzania Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Agriculture Market in Tanzania Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 9: South America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 10: South America Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 11: South America Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 12: South America Agriculture Market in Tanzania Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Agriculture Market in Tanzania Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 15: Europe Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 16: Europe Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 17: Europe Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 18: Europe Agriculture Market in Tanzania Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Agriculture Market in Tanzania Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 21: Middle East & Africa Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 22: Middle East & Africa Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 23: Middle East & Africa Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 24: Middle East & Africa Agriculture Market in Tanzania Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Agriculture Market in Tanzania Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 27: Asia Pacific Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 28: Asia Pacific Agriculture Market in Tanzania Revenue (Million), by Crop Typ 2025 & 2033

- Figure 29: Asia Pacific Agriculture Market in Tanzania Revenue Share (%), by Crop Typ 2025 & 2033

- Figure 30: Asia Pacific Agriculture Market in Tanzania Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Agriculture Market in Tanzania Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 2: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 3: Global Agriculture Market in Tanzania Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 5: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 6: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 11: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 12: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 17: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 18: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 29: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 30: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 38: Global Agriculture Market in Tanzania Revenue Million Forecast, by Crop Typ 2020 & 2033

- Table 39: Global Agriculture Market in Tanzania Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Agriculture Market in Tanzania Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Market in Tanzania?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Agriculture Market in Tanzania?

Key companies in the market include Syngenta , Tanzania Horticultural Association (THA) , Tanzania Agricultural Development Bank , Tanzania Fertilizer Company , Kilombero Plantations Ltd , Rijk Zwaan , Monsanto , Tanzania Breweries Limited , Kilimanjaro Agro Inputs Ltd , Tanzania Seed Trade Association (TASTA).

3. What are the main segments of the Agriculture Market in Tanzania?

The market segments include Crop Typ, Crop Typ.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Favorable Government Policies Supporting the Market Growth.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

September 2022: Tanzania's Ministry of Agriculture directed the Tanzania Agriculture Research Institute (TARI) to find a location for genetically engineered (GE) crop trials. This decision appeared to overturn the Tanzanian government's (GoT) 2021 ban on all GE crop research trials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture Market in Tanzania," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture Market in Tanzania report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture Market in Tanzania?

To stay informed about further developments, trends, and reports in the Agriculture Market in Tanzania, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence