Key Insights

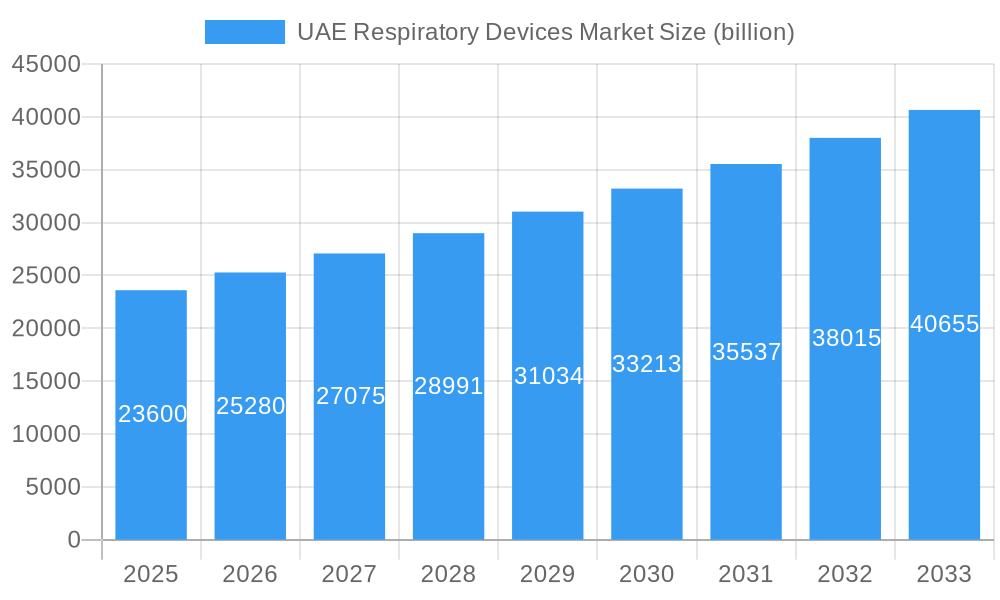

The UAE Respiratory Devices Market is poised for significant expansion, projected to reach a market size of $23.6 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.3% during the forecast period of 2025-2033. This robust growth is primarily fueled by a confluence of factors, including the increasing prevalence of respiratory diseases such as asthma, COPD, and sleep apnea, driven by lifestyle changes, rising pollution levels, and an aging population. The growing awareness and adoption of advanced diagnostic and monitoring devices like spirometers and pulse oximeters are crucial in early detection and effective management of these conditions. Furthermore, the demand for therapeutic devices, including CPAP machines for sleep apnea and ventilators for critical care, is on an upward trajectory, supported by improving healthcare infrastructure and increased access to advanced medical technologies in the UAE. The government's focus on enhancing healthcare services and promoting preventive care also acts as a significant catalyst for market growth, encouraging greater investment in respiratory care solutions.

UAE Respiratory Devices Market Market Size (In Billion)

The market's trajectory is further shaped by evolving trends such as the integration of smart technologies and IoT in respiratory devices for remote patient monitoring and improved adherence to treatment. The development of more portable, user-friendly, and cost-effective devices is also a key trend, catering to a wider patient demographic and facilitating home-based care. While the market exhibits strong growth potential, certain restraints, such as the high cost of advanced respiratory equipment and potential reimbursement challenges, could pose hurdles. However, the continuous innovation by leading market players, including Medtronic, ResMed, and GE Healthcare, in developing next-generation respiratory solutions, coupled with strategic partnerships and expanding distribution networks, is expected to mitigate these challenges. The increasing focus on personalized medicine and the rising demand for homecare respiratory solutions will likely unlock new avenues for market expansion in the coming years.

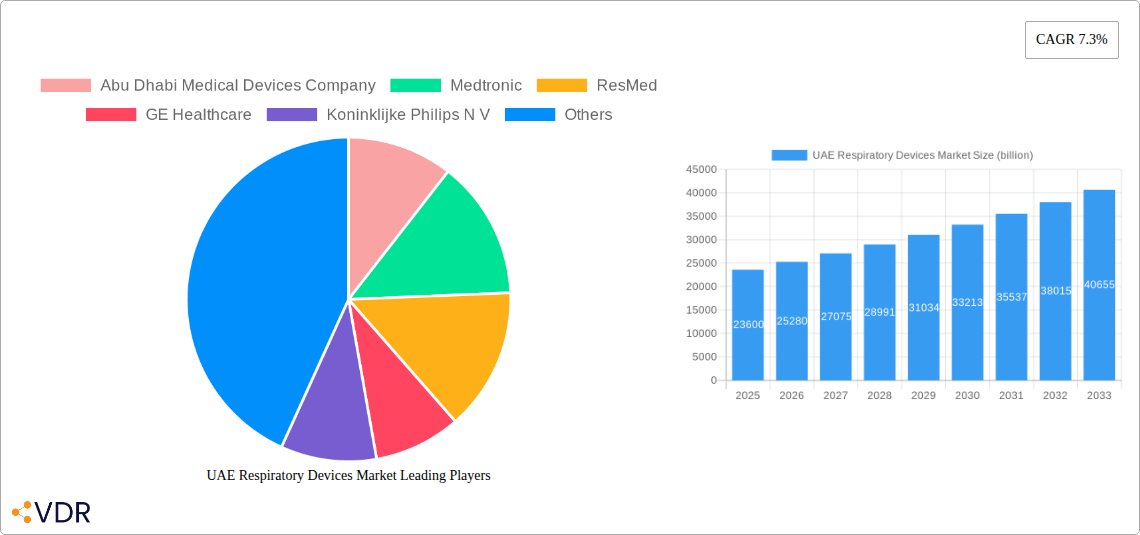

UAE Respiratory Devices Market Company Market Share

This in-depth report offers a definitive analysis of the UAE Respiratory Devices Market, providing a detailed examination of market dynamics, growth trends, and future opportunities from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study is indispensable for stakeholders seeking to understand the burgeoning demand for respiratory health solutions in the United Arab Emirates. The report delves into key market segments, including diagnostic and monitoring devices (spirometers, sleep test devices, peak flow meters, pulse oximeters) and therapeutic devices (CPAP devices, BiPAP devices, humidifiers, nebulizers, ventilators, oxygen concentrators, inhalers), as well as respiratory disposables such as masks and breathing circuits. We meticulously analyze the impact of industry developments, key players, and emerging technologies on the GCC respiratory care market.

UAE Respiratory Devices Market Market Dynamics & Structure

The UAE Respiratory Devices Market exhibits a moderately concentrated structure, driven by a blend of established global players and emerging regional entities. Technological innovation serves as a primary catalyst, with advancements in wearable respiratory monitoring, AI-powered diagnostics, and minimally invasive ventilation systems shaping the competitive landscape. Stringent regulatory frameworks, overseen by authorities like the UAE Ministry of Health and Prevention, ensure product safety and efficacy, influencing product development and market entry strategies. The availability of competitive product substitutes, ranging from basic medical equipment to sophisticated integrated health solutions, necessitates continuous innovation and cost-effectiveness. End-user demographics, characterized by an aging population and a rising prevalence of chronic respiratory diseases such as asthma and COPD, are significantly influencing market demand. Mergers and acquisitions (M&A) trends, though not extensively documented in terms of volume, are evident as larger companies strategically acquire smaller innovators to expand their product portfolios and market reach. For instance, the integration of telehealth solutions into respiratory device ecosystems presents a significant innovation driver.

- Market Concentration: Moderate, with key global manufacturers holding significant share.

- Technological Innovation Drivers: Wearable sensors, AI diagnostics, advanced ventilation, and telehealth integration.

- Regulatory Frameworks: Strict adherence to MoHAP guidelines, impacting product approvals and market access.

- Competitive Product Substitutes: Wide range, from basic to advanced integrated respiratory care systems.

- End-User Demographics: Growing elderly population and increasing incidence of chronic respiratory conditions (asthma, COPD).

- M&A Trends: Strategic acquisitions by larger players to enhance product offerings and market penetration.

UAE Respiratory Devices Market Growth Trends & Insights

The UAE Respiratory Devices Market is poised for robust growth, driven by an escalating demand for advanced pulmonary function testing and ventilator solutions. The market size is projected to expand significantly, fueled by increasing healthcare expenditure, a growing awareness of respiratory health, and the rising incidence of respiratory ailments. Adoption rates for home-use respiratory devices, particularly CPAP and BiPAP machines for sleep apnea, are witnessing a steady incline, supported by favourable reimbursement policies and a growing preference for comfortable, at-home treatment options. Technological disruptions, including the integration of smart features and connectivity in devices, are transforming patient care. The demand for oxygen concentrators and nebulizers is consistently high, addressing immediate respiratory distress. Consumer behavior shifts towards proactive health management and the adoption of digital health tools are further accelerating market penetration. The global respiratory devices market trends are strongly reflected in the UAE, with a focus on portable, efficient, and user-friendly devices. The CAGR is estimated to be around 7.5% during the forecast period, reaching an estimated market value of $1.5 billion by 2033.

- Market Size Evolution: Consistent upward trajectory, driven by increasing healthcare investments and disease prevalence.

- Adoption Rates: High for home-care devices (CPAP, BiPAP) and essential therapeutic devices (oxygen concentrators, nebulizers).

- Technological Disruptions: Smart features, IoT connectivity, AI-driven diagnostics, and advanced materials.

- Consumer Behavior Shifts: Increased focus on preventative care, self-management, and digital health integration.

- Market Penetration: Expanding, particularly in urban centers and among patient populations with chronic conditions.

Dominant Regions, Countries, or Segments in UAE Respiratory Devices Market

Within the UAE Respiratory Devices Market, the Therapeutic Devices segment is the dominant force, primarily driven by the extensive adoption of CPAP devices, BiPAP devices, ventilators, and oxygen concentrators. This dominance is attributed to the rising prevalence of chronic respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and sleep apnea, which necessitate continuous therapeutic intervention. Furthermore, the increasing number of critical care units in hospitals across the UAE fuels the demand for advanced ventilators. Dubai and Abu Dhabi, being major economic and healthcare hubs, lead in the adoption of these therapeutic devices, supported by robust healthcare infrastructure and higher disposable incomes. The diagnostic and monitoring devices segment, especially pulse oximeters and spirometers, also contributes significantly, driven by routine check-ups and disease management protocols. The disposables segment, comprising masks and breathing circuits, exhibits consistent growth, directly correlating with the usage of therapeutic and diagnostic devices. Key drivers include government initiatives focused on improving public health, substantial private sector investment in healthcare facilities, and the growing expatriate population with diverse healthcare needs. The market share of therapeutic devices is estimated to be around 60% of the total UAE respiratory devices market in 2025.

- Dominant Segment: Therapeutic Devices, including CPAP, BiPAP, Ventilators, and Oxygen Concentrators.

- Key Drivers: High prevalence of chronic respiratory diseases (COPD, asthma, sleep apnea), expanding critical care infrastructure, and increasing healthcare expenditure.

- Leading Regions/Cities: Dubai and Abu Dhabi due to advanced healthcare infrastructure and higher adoption rates.

- Contributing Segments: Diagnostic and Monitoring Devices (Pulse Oximeters, Spirometers) and Disposables (Masks, Breathing Circuits).

- Market Share (Therapeutic Devices): Approximately 60% in 2025.

UAE Respiratory Devices Market Product Landscape

The UAE Respiratory Devices Market product landscape is characterized by continuous innovation focused on enhancing patient comfort, portability, and efficacy. Key product advancements include the development of smart CPAP machines with integrated data tracking for remote monitoring, lightweight and portable oxygen concentrators for home use, and user-friendly nebulizers with improved drug delivery mechanisms. The integration of AI in diagnostic devices like spirometers is enabling more accurate and early detection of respiratory conditions. Furthermore, advancements in materials science are leading to the creation of more comfortable and hypoallergenic respiratory masks. The peak flow meters are evolving to include digital connectivity for better asthma management. The overall performance metrics of these devices are improving, offering greater accuracy, efficiency, and patient compliance.

Key Drivers, Barriers & Challenges in UAE Respiratory Devices Market

Key Drivers: The UAE Respiratory Devices Market is propelled by a confluence of factors including a growing prevalence of respiratory diseases like asthma and COPD, increasing healthcare expenditure, and a strong emphasis on improving public health infrastructure. Technological advancements in home healthcare devices and the adoption of digital health solutions further fuel market growth. Government initiatives promoting medical tourism and establishing advanced healthcare facilities also act as significant accelerators.

Barriers & Challenges: Despite robust growth, the market faces challenges such as the high cost of advanced respiratory equipment, which can be a barrier for some patient segments. Stringent regulatory approval processes, while ensuring quality, can sometimes delay market entry for new products. Intense competition from both global and local manufacturers, coupled with potential supply chain disruptions, also poses challenges. The need for skilled healthcare professionals to operate and maintain sophisticated ventilator and diagnostic equipment is another consideration.

Emerging Opportunities in UAE Respiratory Devices Market

Emerging opportunities within the UAE Respiratory Devices Market lie in the expansion of telehealth solutions for remote patient monitoring and management of chronic respiratory conditions. The increasing focus on preventative healthcare presents opportunities for advanced diagnostic devices and early detection tools. Untapped markets in smaller Emirates and a growing demand for portable and user-friendly devices for elderly care and home-use applications are also significant. Furthermore, the development of customized respiratory therapies and the integration of IoT in devices for seamless data flow are poised to reshape the market.

Growth Accelerators in the UAE Respiratory Devices Market Industry

Growth accelerators in the UAE Respiratory Devices Market industry include significant government investments in healthcare infrastructure and a proactive approach to adopting cutting-edge medical technologies. Strategic partnerships between international manufacturers and local distributors are expanding market reach and accessibility of advanced pulmonary function testing equipment and therapeutic respiratory devices. The UAE's status as a hub for medical tourism also drives demand for high-quality respiratory care solutions. Furthermore, increasing health awareness campaigns and the continuous drive towards digitalization in healthcare are critical growth catalysts.

Key Players Shaping the UAE Respiratory Devices Market Market

- Abu Dhabi Medical Devices Company

- Medtronic

- ResMed

- GE Healthcare

- Koninklijke Philips N V

- Ceumed

- Hamilton Medical

- Som Healthcare

- ICU Medical (Smith Medical)

- Fisher & Paykel Healthcare Ltd

Notable Milestones in UAE Respiratory Devices Market Sector

- January 2022: Smart Respiratory is set to showcase its new integrated 'smart' peak flow meter, which allows patients to conveniently manage their asthma, at Arab Health 2022.

- January 2022: The UAE Emirates Health Services (EHS) will debut the Masimo W1, a wrist-worn wearable health device, at Arab Health 2022 in collaboration with Masimo (NASDAQ: MASI). W1 monitors various parameters continuously, including oxygen saturation (SpO2), pulse rate, and respiration rate (RR), as well as fall detection and electrocardiogram (ECG) (with a fibrillation detection).

In-Depth UAE Respiratory Devices Market Market Outlook

The UAE Respiratory Devices Market is on an upward trajectory, driven by demographic shifts, increasing chronic disease burdens, and a strong commitment to healthcare innovation. Growth accelerators like government-backed healthcare expansion, strategic corporate alliances, and the pervasive adoption of digital health technologies will continue to propel the market forward. The increasing demand for personalized and home-based respiratory care solutions presents significant strategic opportunities for both established and emerging players. The market is expected to witness sustained growth in segments like ventilators, CPAP machines, and oxygen concentrators, reflecting the evolving healthcare needs of the UAE population.

UAE Respiratory Devices Market Segmentation

-

1. Type

-

1.1. By Diagnostic and Monitoring Devices

- 1.1.1. Spirometers

- 1.1.2. Sleep Test Devices

- 1.1.3. Peak Flow Meters

- 1.1.4. Pulse Oximeters

- 1.1.5. Others

-

1.2. By Therapeutic Devices

- 1.2.1. CPAP Devices

- 1.2.2. BiPAP Devices

- 1.2.3. Humidifiers

- 1.2.4. Nebulizers

- 1.2.5. Ventilators

- 1.2.6. Oxygen Concentrators

- 1.2.7. Inhalers

-

1.3. By Disposables

- 1.3.1. Masks

- 1.3.2. Breathing Circuits

-

1.1. By Diagnostic and Monitoring Devices

UAE Respiratory Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

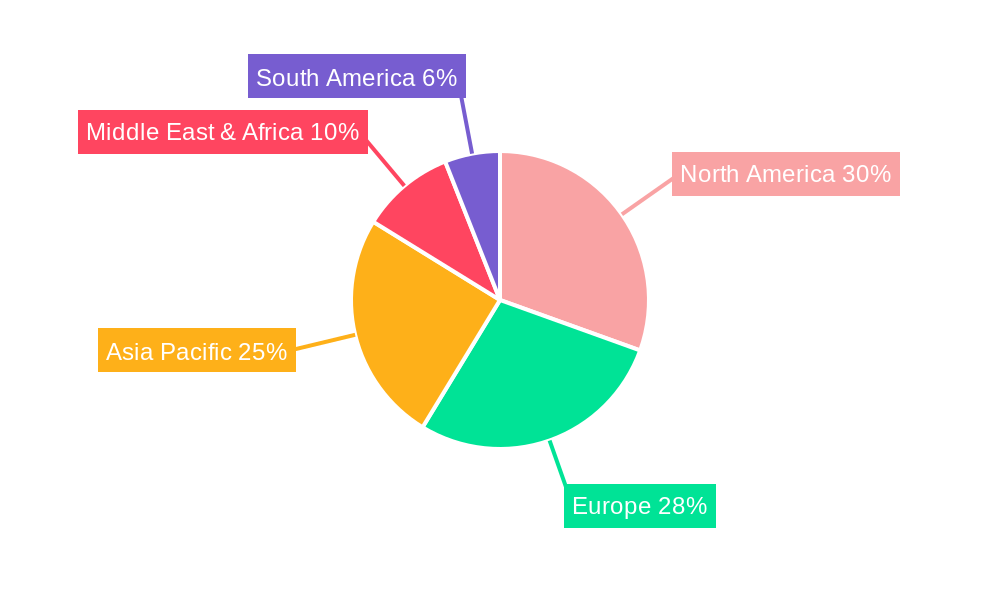

UAE Respiratory Devices Market Regional Market Share

Geographic Coverage of UAE Respiratory Devices Market

UAE Respiratory Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in Respiratory Devices; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Nebulizer by Therapeutics Devices Segment is Estimated to Witness a Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Respiratory Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. By Diagnostic and Monitoring Devices

- 5.1.1.1. Spirometers

- 5.1.1.2. Sleep Test Devices

- 5.1.1.3. Peak Flow Meters

- 5.1.1.4. Pulse Oximeters

- 5.1.1.5. Others

- 5.1.2. By Therapeutic Devices

- 5.1.2.1. CPAP Devices

- 5.1.2.2. BiPAP Devices

- 5.1.2.3. Humidifiers

- 5.1.2.4. Nebulizers

- 5.1.2.5. Ventilators

- 5.1.2.6. Oxygen Concentrators

- 5.1.2.7. Inhalers

- 5.1.3. By Disposables

- 5.1.3.1. Masks

- 5.1.3.2. Breathing Circuits

- 5.1.1. By Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Respiratory Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. By Diagnostic and Monitoring Devices

- 6.1.1.1. Spirometers

- 6.1.1.2. Sleep Test Devices

- 6.1.1.3. Peak Flow Meters

- 6.1.1.4. Pulse Oximeters

- 6.1.1.5. Others

- 6.1.2. By Therapeutic Devices

- 6.1.2.1. CPAP Devices

- 6.1.2.2. BiPAP Devices

- 6.1.2.3. Humidifiers

- 6.1.2.4. Nebulizers

- 6.1.2.5. Ventilators

- 6.1.2.6. Oxygen Concentrators

- 6.1.2.7. Inhalers

- 6.1.3. By Disposables

- 6.1.3.1. Masks

- 6.1.3.2. Breathing Circuits

- 6.1.1. By Diagnostic and Monitoring Devices

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Respiratory Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. By Diagnostic and Monitoring Devices

- 7.1.1.1. Spirometers

- 7.1.1.2. Sleep Test Devices

- 7.1.1.3. Peak Flow Meters

- 7.1.1.4. Pulse Oximeters

- 7.1.1.5. Others

- 7.1.2. By Therapeutic Devices

- 7.1.2.1. CPAP Devices

- 7.1.2.2. BiPAP Devices

- 7.1.2.3. Humidifiers

- 7.1.2.4. Nebulizers

- 7.1.2.5. Ventilators

- 7.1.2.6. Oxygen Concentrators

- 7.1.2.7. Inhalers

- 7.1.3. By Disposables

- 7.1.3.1. Masks

- 7.1.3.2. Breathing Circuits

- 7.1.1. By Diagnostic and Monitoring Devices

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Respiratory Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. By Diagnostic and Monitoring Devices

- 8.1.1.1. Spirometers

- 8.1.1.2. Sleep Test Devices

- 8.1.1.3. Peak Flow Meters

- 8.1.1.4. Pulse Oximeters

- 8.1.1.5. Others

- 8.1.2. By Therapeutic Devices

- 8.1.2.1. CPAP Devices

- 8.1.2.2. BiPAP Devices

- 8.1.2.3. Humidifiers

- 8.1.2.4. Nebulizers

- 8.1.2.5. Ventilators

- 8.1.2.6. Oxygen Concentrators

- 8.1.2.7. Inhalers

- 8.1.3. By Disposables

- 8.1.3.1. Masks

- 8.1.3.2. Breathing Circuits

- 8.1.1. By Diagnostic and Monitoring Devices

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Respiratory Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. By Diagnostic and Monitoring Devices

- 9.1.1.1. Spirometers

- 9.1.1.2. Sleep Test Devices

- 9.1.1.3. Peak Flow Meters

- 9.1.1.4. Pulse Oximeters

- 9.1.1.5. Others

- 9.1.2. By Therapeutic Devices

- 9.1.2.1. CPAP Devices

- 9.1.2.2. BiPAP Devices

- 9.1.2.3. Humidifiers

- 9.1.2.4. Nebulizers

- 9.1.2.5. Ventilators

- 9.1.2.6. Oxygen Concentrators

- 9.1.2.7. Inhalers

- 9.1.3. By Disposables

- 9.1.3.1. Masks

- 9.1.3.2. Breathing Circuits

- 9.1.1. By Diagnostic and Monitoring Devices

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Respiratory Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. By Diagnostic and Monitoring Devices

- 10.1.1.1. Spirometers

- 10.1.1.2. Sleep Test Devices

- 10.1.1.3. Peak Flow Meters

- 10.1.1.4. Pulse Oximeters

- 10.1.1.5. Others

- 10.1.2. By Therapeutic Devices

- 10.1.2.1. CPAP Devices

- 10.1.2.2. BiPAP Devices

- 10.1.2.3. Humidifiers

- 10.1.2.4. Nebulizers

- 10.1.2.5. Ventilators

- 10.1.2.6. Oxygen Concentrators

- 10.1.2.7. Inhalers

- 10.1.3. By Disposables

- 10.1.3.1. Masks

- 10.1.3.2. Breathing Circuits

- 10.1.1. By Diagnostic and Monitoring Devices

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Abu Dhabi Medical Devices Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ResMed

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koninklijke Philips N V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ceumed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hamilton Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Som Healthcare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ICU Medical (Smith Medical)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fisher & Paykel Healthcare Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Abu Dhabi Medical Devices Company

List of Figures

- Figure 1: Global UAE Respiratory Devices Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global UAE Respiratory Devices Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America UAE Respiratory Devices Market Revenue (billion), by Type 2025 & 2033

- Figure 4: North America UAE Respiratory Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America UAE Respiratory Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UAE Respiratory Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America UAE Respiratory Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America UAE Respiratory Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America UAE Respiratory Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America UAE Respiratory Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America UAE Respiratory Devices Market Revenue (billion), by Type 2025 & 2033

- Figure 12: South America UAE Respiratory Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 13: South America UAE Respiratory Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America UAE Respiratory Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 15: South America UAE Respiratory Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 16: South America UAE Respiratory Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: South America UAE Respiratory Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America UAE Respiratory Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe UAE Respiratory Devices Market Revenue (billion), by Type 2025 & 2033

- Figure 20: Europe UAE Respiratory Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe UAE Respiratory Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe UAE Respiratory Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe UAE Respiratory Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe UAE Respiratory Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe UAE Respiratory Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UAE Respiratory Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa UAE Respiratory Devices Market Revenue (billion), by Type 2025 & 2033

- Figure 28: Middle East & Africa UAE Respiratory Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Middle East & Africa UAE Respiratory Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa UAE Respiratory Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Middle East & Africa UAE Respiratory Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Middle East & Africa UAE Respiratory Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Respiratory Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa UAE Respiratory Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific UAE Respiratory Devices Market Revenue (billion), by Type 2025 & 2033

- Figure 36: Asia Pacific UAE Respiratory Devices Market Volume (K Unit), by Type 2025 & 2033

- Figure 37: Asia Pacific UAE Respiratory Devices Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific UAE Respiratory Devices Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific UAE Respiratory Devices Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Asia Pacific UAE Respiratory Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Respiratory Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UAE Respiratory Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Respiratory Devices Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global UAE Respiratory Devices Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global UAE Respiratory Devices Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Global UAE Respiratory Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global UAE Respiratory Devices Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 17: Global UAE Respiratory Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Brazil UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Brazil UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Argentina UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Argentina UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global UAE Respiratory Devices Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global UAE Respiratory Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Spain UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Spain UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Russia UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Benelux UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Benelux UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Nordics UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Nordics UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global UAE Respiratory Devices Market Revenue billion Forecast, by Type 2020 & 2033

- Table 48: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 49: Global UAE Respiratory Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Turkey UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Turkey UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Israel UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Israel UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: GCC UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: GCC UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: North Africa UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: North Africa UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global UAE Respiratory Devices Market Revenue billion Forecast, by Type 2020 & 2033

- Table 64: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 65: Global UAE Respiratory Devices Market Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global UAE Respiratory Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: China UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: China UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: India UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: India UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Japan UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Korea UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Korea UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: ASEAN UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: ASEAN UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Oceania UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Oceania UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific UAE Respiratory Devices Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific UAE Respiratory Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Respiratory Devices Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the UAE Respiratory Devices Market?

Key companies in the market include Abu Dhabi Medical Devices Company, Medtronic, ResMed, GE Healthcare, Koninklijke Philips N V, Ceumed, Hamilton Medical, Som Healthcare, ICU Medical (Smith Medical), Fisher & Paykel Healthcare Ltd.

3. What are the main segments of the UAE Respiratory Devices Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in Respiratory Devices; Technological Advancements.

6. What are the notable trends driving market growth?

Nebulizer by Therapeutics Devices Segment is Estimated to Witness a Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

January 2022: Smart Respiratory is set to showcase its new integrated 'smart' peak flow meter, which allows patients to conveniently manage their asthma, at Arab Health 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Respiratory Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Respiratory Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Respiratory Devices Market?

To stay informed about further developments, trends, and reports in the UAE Respiratory Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence