Key Insights

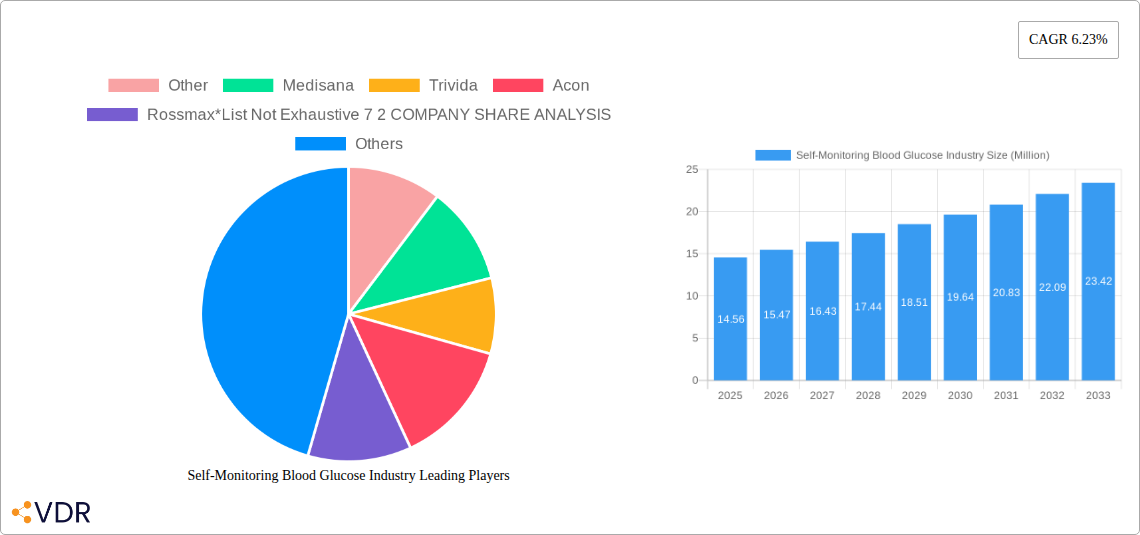

The Self-Monitoring Blood Glucose (SMBG) market is demonstrating robust growth, projected to reach an estimated $14.56 million in 2025. This expansion is driven by a confluence of factors, including the escalating prevalence of diabetes globally, increasing awareness among individuals regarding proactive health management, and the continuous technological advancements in SMBG devices. The market is characterized by a CAGR of 6.23%, signaling a sustained and healthy upward trajectory throughout the forecast period of 2025-2033. Key market segments include essential components like glucometer devices, test strips, and lancets, with the end-user landscape dominated by hospitals/clinics and the rapidly growing personal/home care segment. This latter segment's expansion is fueled by the demand for user-friendly, portable, and accurate home testing solutions, empowering individuals to manage their diabetes more effectively from the comfort of their homes.

Self-Monitoring Blood Glucose Industry Market Size (In Million)

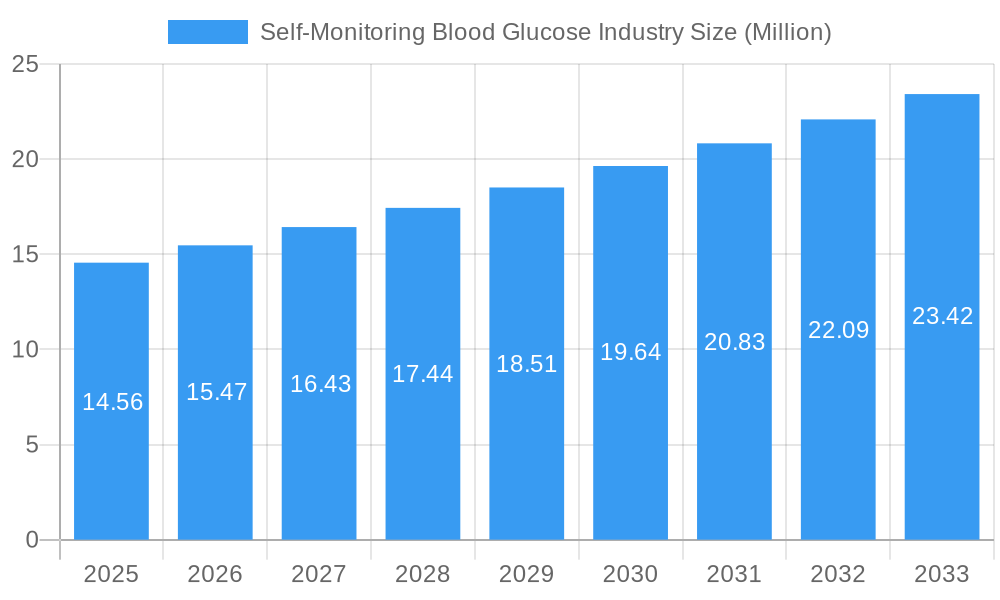

The competitive landscape features a mix of established global players and emerging companies vying for market share. Prominent companies such as F Hoffmann-La Roche AG, Abbott, and LifeScan are expected to maintain significant positions, while players like Agamatrix Inc., Bionime Corporation, and Arkray are also making substantial contributions. The market is experiencing dynamic growth across various regions, with North America and Europe currently holding substantial market shares due to advanced healthcare infrastructure and high diabetes rates. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, rising disposable incomes, and a growing patient population. Emerging trends include the integration of smart technologies, such as Bluetooth connectivity for data syncing with mobile apps, continuous glucose monitoring (CGM) system advancements that are beginning to overlap with traditional SMBG, and a focus on developing less invasive and more pain-free testing methods. These innovations are critical in addressing market restraints like the high cost of some advanced devices and the need for user education and adherence.

Self-Monitoring Blood Glucose Industry Company Market Share

Comprehensive Self-Monitoring Blood Glucose Industry Report: Market Dynamics, Growth, and Key Players (2019-2033)

This in-depth report provides a holistic analysis of the global Self-Monitoring Blood Glucose (SMBG) industry, exploring market dynamics, growth trends, regional dominance, product landscapes, and the strategic initiatives of key players. Covering the historical period of 2019-2024, base and estimated year of 2025, and a forecast period extending to 2033, this research offers critical insights for stakeholders seeking to capitalize on the evolving diabetes management market. We analyze parent and child market segments to deliver a nuanced understanding of market drivers and opportunities in units of Million.

Self-Monitoring Blood Glucose Industry Market Dynamics & Structure

The Self-Monitoring Blood Glucose (SMBG) industry is characterized by moderate market concentration, with a few leading players holding significant market shares, particularly in the glucometer devices and test strips segments. Technological innovation remains a primary driver, fueled by the increasing prevalence of diabetes globally and the growing demand for user-friendly, connected devices. Regulatory frameworks, such as FDA approvals and CE markings, play a crucial role in market entry and product acceptance, impacting product development cycles and market access. Competitive product substitutes, including Continuous Glucose Monitoring (CGM) systems, are increasingly influencing market dynamics, especially for certain patient demographics. End-user demographics are shifting towards home-based monitoring, driven by convenience and cost-effectiveness. Mergers and acquisitions (M&A) are a consistent trend, as larger companies seek to consolidate their market position and acquire innovative technologies. For instance, the historical period saw an estimated 8 M&A deals, reflecting ongoing consolidation. Barriers to innovation include stringent regulatory approval processes and the high cost of research and development for advanced features.

- Market Concentration: Dominated by key players with an estimated 70% market share collectively.

- Technological Innovation: Driven by miniaturization, connectivity (Bluetooth, Wi-Fi), and data analytics for improved glycemic control.

- Regulatory Frameworks: FDA, CE marking, and other regional health authority approvals are critical for market access.

- Competitive Substitutes: Rise of Continuous Glucose Monitoring (CGM) systems presents a competitive challenge.

- End-User Demographics: Growing preference for personal/home use and digital health integration.

- M&A Trends: Ongoing consolidation to acquire advanced technologies and expand market reach. Estimated M&A Deal Volume: 8 (Historical Period).

- Innovation Barriers: Lengthy regulatory pathways and substantial R&D investments.

Self-Monitoring Blood Glucose Industry Growth Trends & Insights

The global Self-Monitoring Blood Glucose (SMBG) market is poised for robust growth, driven by a confluence of factors including the escalating global diabetes epidemic, an aging population, and a growing emphasis on proactive health management. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market value of USD 9,500 Million by 2033. Adoption rates for SMBG devices are steadily increasing, particularly in developing economies where access to healthcare infrastructure is improving. Technological disruptions, such as the integration of AI-powered insights and smartphone connectivity, are enhancing the utility and appeal of SMBG devices. Consumer behavior shifts towards personalized healthcare and remote patient monitoring further bolster market expansion. The increasing disposable income in emerging markets, coupled with greater health awareness, contributes significantly to the penetration of SMBG devices. Furthermore, government initiatives and insurance coverage for diabetes management products are acting as significant growth accelerators. The market is witnessing a gradual shift from traditional lancing devices towards less painful and more convenient alternatives.

The evolving landscape of diabetes management, marked by a growing emphasis on patient empowerment and preventative care, is significantly influencing the SMBG market. The increasing prevalence of type 2 diabetes, often linked to lifestyle factors, necessitates regular blood glucose monitoring for effective management. This rising patient population directly translates to an increased demand for SMBG devices and consumables like test strips and lancets.

Technological advancements are not merely about incremental improvements; they represent a paradigm shift in how diabetes is managed. The integration of Bluetooth and other wireless technologies allows SMBG devices to seamlessly connect with smartphones and cloud-based platforms. This connectivity facilitates real-time data logging, analysis, and sharing with healthcare providers, enabling more informed treatment decisions and personalized care plans. The development of smart algorithms that can identify trends, predict potential hypoglycemic or hyperglycemic events, and offer personalized recommendations is a key area of innovation.

Consumer behavior is also undergoing a transformation. Patients are becoming more educated about their conditions and are actively seeking tools that empower them to take control of their health. The convenience of performing blood glucose tests at home, without the need for frequent clinic visits, is a major draw. The rise of the "quantified self" movement further fuels this trend, with individuals increasingly using technology to track and manage various health metrics. This has led to a greater demand for user-friendly interfaces, accurate readings, and integrated digital solutions that offer comprehensive insights. The pandemic further accelerated the adoption of telehealth and remote patient monitoring, reinforcing the importance of reliable SMBG devices for ongoing care.

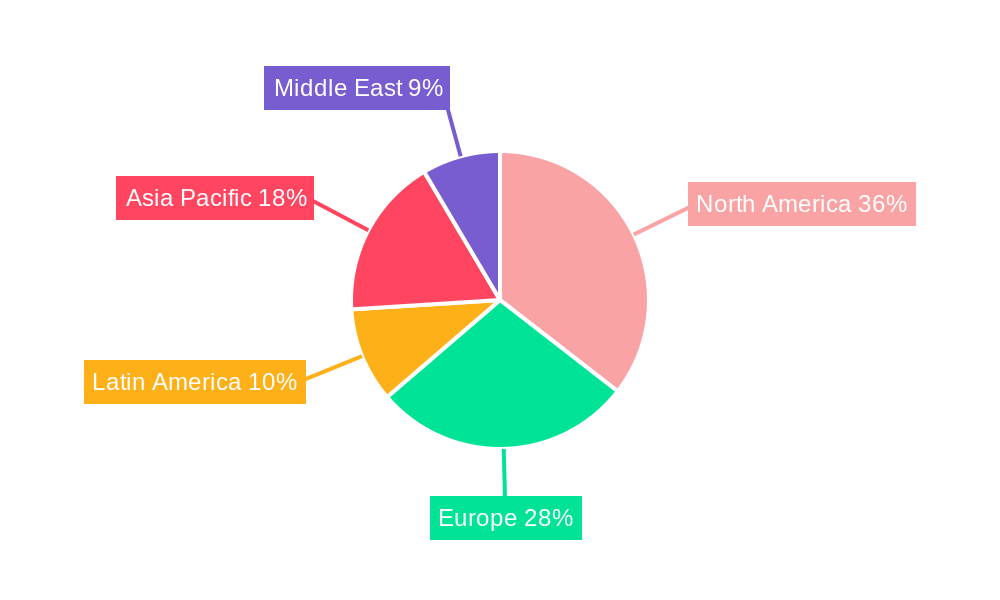

Dominant Regions, Countries, or Segments in Self-Monitoring Blood Glucose Industry

North America currently dominates the Self-Monitoring Blood Glucose (SMBG) industry, primarily driven by the high prevalence of diabetes, advanced healthcare infrastructure, and strong government initiatives promoting chronic disease management. The United States, in particular, boasts a significant market share due to a well-established reimbursement system and a large patient population actively engaged in self-care. The Test Strips segment within the Component category is a significant contributor to this regional dominance, accounting for an estimated 45% of the overall market value. The widespread availability of advanced diagnostic tools and a robust research and development ecosystem further solidify North America's leading position.

Asia Pacific is emerging as the fastest-growing region, fueled by a rapidly increasing diabetic population, improving healthcare access, and growing disposable incomes. Countries like China and India are witnessing substantial market expansion due to heightened awareness about diabetes management and the increasing adoption of home-based monitoring solutions. The Personal/Home end-user segment in this region is experiencing exponential growth, with an estimated CAGR of 8.9% over the forecast period.

Europe also holds a substantial share in the global SMBG market, supported by a strong healthcare system and a proactive approach to public health. Stringent quality standards and a focus on technological innovation contribute to the region's market strength. Within Europe, Germany and the UK are key markets, benefiting from well-developed healthcare policies and a high level of patient education.

Latin America and the Middle East & Africa are emerging markets with significant untapped potential. Factors such as increasing diabetes rates, improving economic conditions, and a growing emphasis on preventive healthcare are driving market growth in these regions. The Glucometer Devices segment is expected to witness considerable growth across these emerging markets as awareness and affordability increase.

- Leading Region: North America, driven by high diabetes prevalence and advanced healthcare.

- Key Component Segment: Test Strips (Estimated 45% market share in North America).

- Fastest-Growing Region: Asia Pacific, due to rising diabetes rates and improving healthcare access.

- Key End-User Segment in Asia Pacific: Personal/Home (Estimated CAGR of 8.9%).

- Dominant End-User Segment Globally: Personal/Home, accounting for an estimated 60% of the global market.

- European Market Strength: Supported by robust healthcare policies and technological innovation.

- Emerging Markets: Latin America and Middle East & Africa show significant growth potential.

Self-Monitoring Blood Glucose Industry Product Landscape

The Self-Monitoring Blood Glucose (SMBG) industry's product landscape is characterized by continuous innovation aimed at enhancing accuracy, user-friendliness, and data connectivity. Advancements in biosensor technology have led to the development of highly accurate and reliable glucometer devices that require minimal blood samples. Test strips are evolving with features like no-coding technology, faster reaction times, and improved stability. Lancets are becoming finer and more ergonomic, minimizing pain and discomfort. A significant trend is the integration of Bluetooth and other wireless technologies into glucometers, enabling seamless data transfer to smartphones and cloud platforms for comprehensive diabetes management. These connected devices offer unique selling propositions by providing patients and healthcare providers with real-time insights into glycemic trends, facilitating personalized treatment adjustments. The performance metrics of these devices are rigorously tested for accuracy, precision, and ease of use, adhering to international standards.

Key Drivers, Barriers & Challenges in Self-Monitoring Blood Glucose Industry

Key Drivers:

- Rising Global Diabetes Prevalence: The escalating number of individuals diagnosed with diabetes worldwide is the primary catalyst for SMBG market growth.

- Technological Advancements: Innovations in biosensor technology, connectivity, and data analytics are making SMBG devices more accurate, convenient, and insightful.

- Growing Health Awareness & Self-Care: Increased patient awareness about diabetes management and a preference for home-based monitoring are driving adoption.

- Government Initiatives & Reimbursement Policies: Supportive policies and insurance coverage for diabetes management products significantly boost market access and affordability.

Key Barriers & Challenges:

- Competition from Continuous Glucose Monitoring (CGM): The emergence of CGM systems, offering continuous data streams, poses a competitive challenge to traditional SMBG.

- Regulatory Hurdles: Stringent and evolving regulatory approval processes for new devices and software updates can lead to delays and increased development costs.

- Cost of Test Strips: The recurring cost of test strips can be a barrier for some patients, particularly in price-sensitive markets. Estimated annual cost of test strips for a regular user is USD 300.

- Data Security and Privacy Concerns: With increased connectivity, ensuring the security and privacy of sensitive patient data is paramount and can pose technical and regulatory challenges.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished goods, affecting production and distribution.

Emerging Opportunities in Self-Monitoring Blood Glucose Industry

Emerging opportunities in the Self-Monitoring Blood Glucose (SMBG) industry lie in the development of integrated digital health platforms that seamlessly connect SMBG devices with other health trackers and electronic health records (EHRs). The untapped potential in emerging economies, driven by increasing diabetes prevalence and improving healthcare infrastructure, presents significant market expansion avenues. Innovative applications, such as AI-powered predictive analytics for glycemic excursions and personalized lifestyle recommendations, are gaining traction. Furthermore, the evolving consumer preference for user-friendly, aesthetically pleasing, and discreet devices is creating opportunities for novel product designs and form factors.

Growth Accelerators in the Self-Monitoring Blood Glucose Industry Industry

Technological breakthroughs in miniaturization and biosensor accuracy are acting as significant growth accelerators for the SMBG industry. Strategic partnerships between device manufacturers, software developers, and healthcare providers are fostering the development of comprehensive diabetes management ecosystems. Market expansion strategies focused on increasing accessibility in underserved regions and developing cost-effective solutions for diverse patient populations are also pivotal in driving long-term growth. The increasing focus on preventative healthcare and the proactive management of chronic diseases by both individuals and healthcare systems further amplifies the market's growth trajectory.

Key Players Shaping the Self-Monitoring Blood Glucose Industry Market

- Agamatrix Inc

- F Hoffmann-La Roche AG

- Abbott

- Bionime Corporation

- Arkray

- LifeScan

- Ascensia

- Other

- Medisana

- Trivida

- Acon

- Rossmax

Notable Milestones in Self-Monitoring Blood Glucose Industry Sector

- June 2022: LifeScan announced the publication of Real World Evidence in Diabetes Technology and Therapeutics (DTT), demonstrating improved glycemic control in individuals using a Bluetooth-connected OneTouch Verio Reflect meter with the OneTouch Reveal mobile app, highlighting the impact of connected devices on patient outcomes.

- January 2022: Roche launched its new point-of-care blood glucose monitor, Cobas pulse, designed for hospital professionals. This device features a touchscreen companion and an automated test strip reader, catering to diverse patient needs from neonates to those in intensive care, signaling advancements in hospital-grade monitoring solutions.

In-Depth Self-Monitoring Blood Glucose Industry Market Outlook

The future outlook for the Self-Monitoring Blood Glucose industry is exceptionally promising, driven by the continuous demand for effective diabetes management solutions. Growth accelerators such as advancements in AI for predictive analytics and the expanding reach of telehealth will empower individuals with more personalized and proactive health insights. Strategic opportunities lie in catering to emerging markets with tailored product offerings and fostering collaborations to build integrated digital health platforms. The increasing emphasis on preventative healthcare and patient empowerment will continue to fuel innovation and market expansion, ensuring the SMBG industry remains a vital component of global healthcare.

Self-Monitoring Blood Glucose Industry Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

-

2. End User

- 2.1. Hospital/Clinics

- 2.2. Personal/Home

Self-Monitoring Blood Glucose Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Italy

- 2.4. Spain

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Latin America

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Rest of Latin America

-

4. Asia Pacific

- 4.1. Japan

- 4.2. South Korea

- 4.3. China

- 4.4. India

- 4.5. Australia

- 4.6. Vietnam

- 4.7. Malaysia

- 4.8. Indonesia

- 4.9. Philippines

- 4.10. Thailand

- 4.11. Rest of Asia Pacific

- 5. Middle East

-

6. Saudi Arabia

- 6.1. Iran

- 6.2. Egypt

- 6.3. Oman

- 6.4. South Africa

- 6.5. Rest of Middle East

Self-Monitoring Blood Glucose Industry Regional Market Share

Geographic Coverage of Self-Monitoring Blood Glucose Industry

Self-Monitoring Blood Glucose Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. The Glucometer Devices Segment is Expected to Witness the Highest CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinics

- 5.2.2. Personal/Home

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Latin America

- 5.3.4. Asia Pacific

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinics

- 6.2.2. Personal/Home

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinics

- 7.2.2. Personal/Home

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Latin America Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinics

- 8.2.2. Personal/Home

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Asia Pacific Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Glucometer Devices

- 9.1.2. Test Strips

- 9.1.3. Lancets

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospital/Clinics

- 9.2.2. Personal/Home

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Glucometer Devices

- 10.1.2. Test Strips

- 10.1.3. Lancets

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospital/Clinics

- 10.2.2. Personal/Home

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Saudi Arabia Self-Monitoring Blood Glucose Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Glucometer Devices

- 11.1.2. Test Strips

- 11.1.3. Lancets

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Hospital/Clinics

- 11.2.2. Personal/Home

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Other

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Medisana

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Trivida

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Acon

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rossmax*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Agamatrix Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 F Hoffmann-La Roche AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Abbott

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bionime Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Arkray

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 LifeScan

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Ascensia

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Other

List of Figures

- Figure 1: Global Self-Monitoring Blood Glucose Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 9: Europe Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 15: Latin America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Latin America Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Latin America Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Latin America Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Latin America Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 21: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 27: Middle East Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Middle East Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue (Million), by Component 2025 & 2033

- Figure 33: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue Share (%), by Component 2025 & 2033

- Figure 34: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue (Million), by End User 2025 & 2033

- Figure 35: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Saudi Arabia Self-Monitoring Blood Glucose Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: France Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 21: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Mexico Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Brazil Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Latin America Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Japan Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: China Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: India Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Australia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Malaysia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Indonesia Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Philippines Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Thailand Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 41: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 44: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global Self-Monitoring Blood Glucose Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Iran Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Egypt Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Oman Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Africa Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East Self-Monitoring Blood Glucose Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Monitoring Blood Glucose Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Self-Monitoring Blood Glucose Industry?

Key companies in the market include Other, Medisana, Trivida, Acon, Rossmax*List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS, Agamatrix Inc, F Hoffmann-La Roche AG, Abbott, Bionime Corporation, Arkray, LifeScan, Ascensia.

3. What are the main segments of the Self-Monitoring Blood Glucose Industry?

The market segments include Component, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

The Glucometer Devices Segment is Expected to Witness the Highest CAGR.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) published Real World Evidence of Improved Glycemic Control in People with Diabetes using a Bluetooth-connected Blood Glucose Meter with Mobile Diabetes Management Application using the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter which can be synced via the Bluetooth wireless technology. It could support improved glycemic control for people with diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Monitoring Blood Glucose Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Monitoring Blood Glucose Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Monitoring Blood Glucose Industry?

To stay informed about further developments, trends, and reports in the Self-Monitoring Blood Glucose Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence