Key Insights

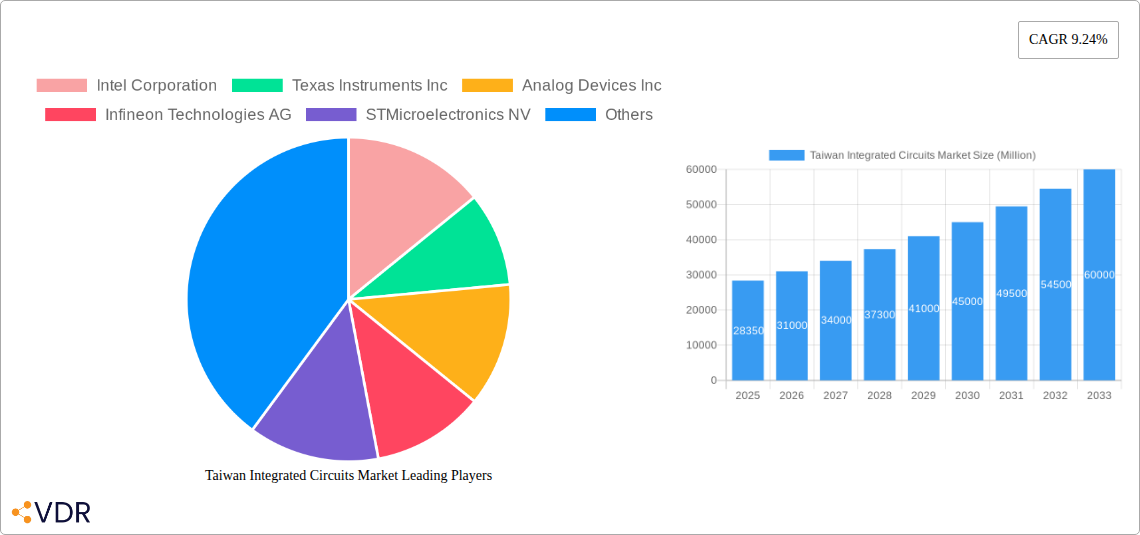

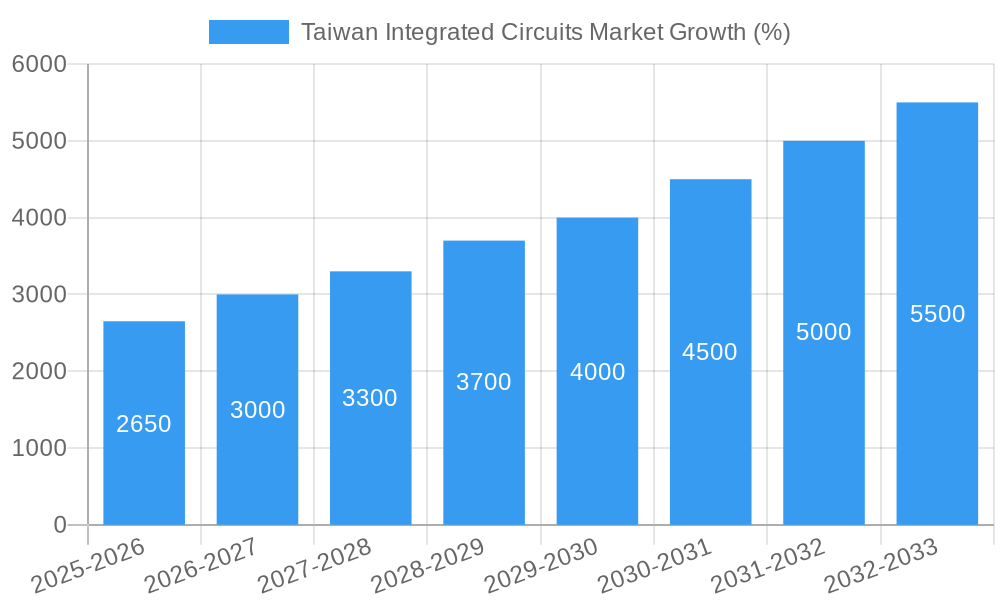

The Taiwan Integrated Circuits (IC) market, valued at $28.35 billion in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.24% from 2025 to 2033. This significant expansion is driven by several key factors. The burgeoning demand for high-performance computing, particularly in sectors like artificial intelligence (AI) and 5G telecommunications, fuels the need for advanced ICs. Furthermore, the increasing adoption of IoT devices across various industries, including automotive, consumer electronics, and healthcare, creates substantial growth opportunities. Government initiatives promoting technological advancements and investments in R&D further bolster the market's trajectory. However, the market also faces challenges including potential supply chain disruptions, geopolitical uncertainties, and the cyclical nature of the semiconductor industry. Competition among major players like Intel, Texas Instruments, and others is fierce, demanding continuous innovation and cost optimization strategies. The market's segmentation (while not specified in the prompt) likely reflects the diverse applications of ICs, including memory chips, logic chips, and analog ICs, each experiencing its own growth trajectory depending on specific market demands. The regional focus within Taiwan necessitates analysis of its specific strengths in manufacturing capabilities, access to skilled labor, and proximity to key Asian markets. Overall, the Taiwanese IC market presents a compelling investment opportunity despite inherent market risks. The forecast period, 2025-2033, promises significant expansion fueled by both technological progress and increasing global demand for semiconductors.

The dominance of key players such as Intel Corporation, Texas Instruments Inc., and others highlights the competitive landscape, emphasizing the need for constant innovation and strategic partnerships to thrive. The historical period (2019-2024) likely saw fluctuating growth depending on global economic conditions and technological shifts. Analyzing this historical data alongside future projections provides a holistic view of the market's cyclical patterns and long-term potential. The study period encompassing both historical and forecast data (2019-2033) offers a comprehensive understanding of market evolution and future growth prospects. Precise regional data, while unavailable in the prompt, is crucial for assessing market penetration and identifying growth opportunities within specific geographic areas in Taiwan.

Taiwan Integrated Circuits Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Taiwan Integrated Circuits (IC) market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking a thorough understanding of this dynamic sector. The report delves into parent markets like the global semiconductor industry and child markets such as automotive ICs and consumer electronics ICs, offering granular insights into market segmentation and growth potential.

Taiwan Integrated Circuits Market Dynamics & Structure

The Taiwan IC market is characterized by a high degree of concentration, with a few major players holding significant market share. Technological innovation is a key driver, particularly in areas like AI, 5G, and automotive electronics. Stringent regulatory frameworks influence market behavior, while the presence of competitive product substitutes necessitates continuous improvement and innovation. End-user demographics, including consumer electronics, automotive, and industrial sectors, significantly impact market demand. Mergers and acquisitions (M&A) activity has played a role in shaping the market landscape. The market size in 2025 is estimated at xx Million units.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Significant investments in R&D drive advancements in process technology and chip design.

- Regulatory Framework: Government policies and regulations regarding intellectual property and trade impact market operations.

- Competitive Substitutes: The emergence of alternative technologies and materials presents a competitive challenge.

- M&A Activity: xx M&A deals were recorded in the historical period (2019-2024), shaping market consolidation.

- Innovation Barriers: High capital expenditure requirements and talent acquisition difficulties hinder innovation.

Taiwan Integrated Circuits Market Growth Trends & Insights

The Taiwan IC market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is projected to continue during the forecast period (2025-2033), driven by increasing demand from various end-user segments, technological advancements, and supportive government policies. The market penetration rate for advanced IC technologies is expected to reach xx% by 2033. Adoption rates of newer IC technologies vary based on the end-user segment, with automotive and industrial segments showing strong adoption. Consumer behavior shifts towards smart devices and IoT applications further fuels market expansion. The market is expected to reach xx Million units by 2033.

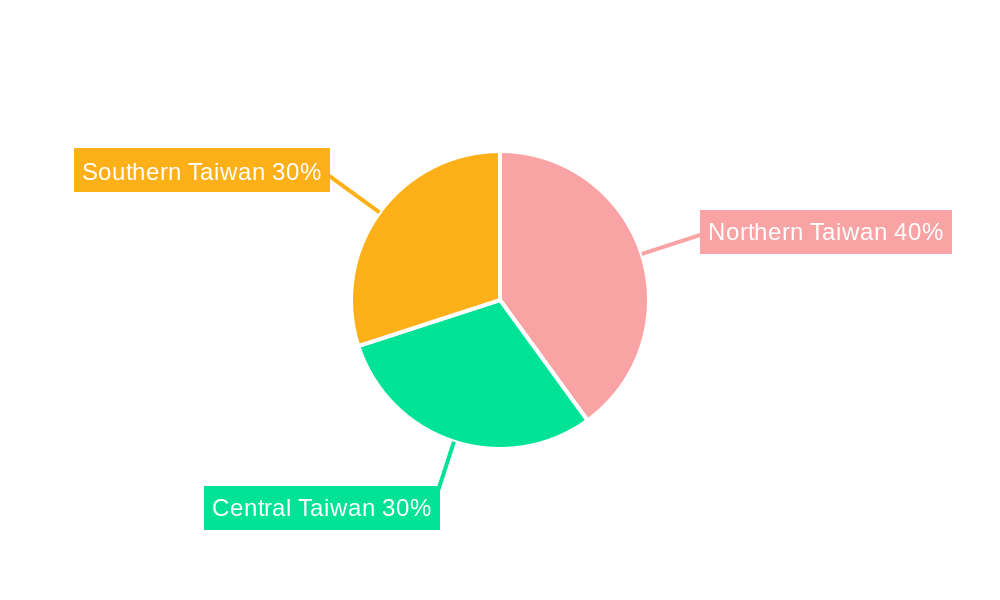

Dominant Regions, Countries, or Segments in Taiwan Integrated Circuits Market

The dominant region within the Taiwan IC market is the Hsinchu Science Park, driven by its robust infrastructure, skilled workforce, and concentration of leading IC manufacturers. This region accounts for xx% of the market share in 2025. Government initiatives aimed at fostering technological advancement and attracting foreign investment have significantly contributed to this dominance. The strong government support and thriving ecosystem creates a highly favorable environment for growth.

- Key Drivers:

- Government subsidies and tax incentives for R&D.

- Well-established infrastructure and skilled workforce.

- Favorable business environment.

- Dominance Factors:

- High concentration of leading IC manufacturers.

- Extensive R&D capabilities.

- Strong government support.

Taiwan Integrated Circuits Market Product Landscape

The Taiwan IC market encompasses a wide range of products, including microcontrollers, memory chips, logic ICs, analog ICs, and others. Recent product innovations have focused on enhancing performance, reducing power consumption, and integrating advanced functionalities. Key applications include consumer electronics, automotive, industrial automation, and telecommunications. The market is witnessing the emergence of specialized ICs for AI, 5G, and other emerging technologies. These advancements are marked by improved processing speed, smaller form factors, and higher energy efficiency.

Key Drivers, Barriers & Challenges in Taiwan Integrated Circuits Market

Key Drivers:

- Increasing demand for high-performance computing.

- Expansion of the automotive electronics market.

- Growth of the Internet of Things (IoT) industry.

- Government support for semiconductor manufacturing.

Key Challenges:

- Geopolitical uncertainties and trade tensions.

- Intense competition from global players.

- Talent shortage in the semiconductor industry.

- Supply chain disruptions. The impact of these disruptions resulted in a xx% decrease in production in Q2 2024.

Emerging Opportunities in Taiwan Integrated Circuits Market

Emerging opportunities lie in the expanding adoption of AI, 5G, and IoT technologies. The market is poised for growth in specialized ICs for these applications, along with increasing demand for high-bandwidth memory and advanced packaging technologies. Furthermore, the development of sustainable and energy-efficient ICs presents significant potential.

Growth Accelerators in the Taiwan Integrated Circuits Market Industry

The long-term growth of the Taiwan IC market will be driven by continuous technological advancements, strategic partnerships between IC manufacturers and end-user companies, and government investments in infrastructure and talent development. Increased focus on R&D and the expansion of manufacturing capacity are critical factors in realizing long-term growth.

Key Players Shaping the Taiwan Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Microchip Technology Inc

- Renesas Electronics Corporation

- Samsung Electronics Co Ltd

- SK Hynix Inc

Notable Milestones in Taiwan Integrated Circuits Market Sector

- December 2023: Asahi Kasei Microdevices Corporation launched its AK7018 and AK7017 audio DSPs, enhancing in-car audio and voice experiences. Collaboration with DSP Concepts, Inc. further expands application possibilities.

- December 2023: Infineon unveiled its PSoCEdge series microcontrollers, featuring dual-core architecture for advanced AI operations. This launch strengthens Infineon's position in the high-performance computing market.

In-Depth Taiwan Integrated Circuits Market Market Outlook

The Taiwan IC market is poised for continued growth, driven by technological innovation, increasing demand from diverse sectors, and ongoing government support. Strategic partnerships and investments in advanced manufacturing capabilities will further accelerate market expansion. The long-term outlook remains positive, with significant opportunities for market players to capitalize on emerging trends and technological breakthroughs.

Taiwan Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

Taiwan Integrated Circuits Market Segmentation By Geography

- 1. Taiwan

Taiwan Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. The Logic Segment is Anticipated to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Electronics Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SK Hynix Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: Taiwan Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Taiwan Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: Taiwan Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Taiwan Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Taiwan Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Taiwan Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Taiwan Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Taiwan Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Taiwan Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Taiwan Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Taiwan Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Taiwan Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Taiwan Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Taiwan Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Taiwan Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Taiwan Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Integrated Circuits Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Taiwan Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, Samsung Electronics Co Ltd, SK Hynix Inc.

3. What are the main segments of the Taiwan Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

The Logic Segment is Anticipated to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

December 2023 - Asahi Kasei Microdevices Corporation unveiled its AK7018 and AK7017 audio DSPs with dual and single HiFi 4 CPUs, respectively, both pin-compatible. These new additions to the AK701x series aim to elevate the in-car audio and voice experience. In a strategic move, AKM collaborated with DSP Concepts, Inc., enabling the AK701x lineup to leverage the Audio Weaver platform. This collaboration fosters a versatile and expandable audio and voice application development environment and taps into the diverse array of 3rd party audio algorithms already available on Audio Weaver.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Taiwan Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence