Key Insights

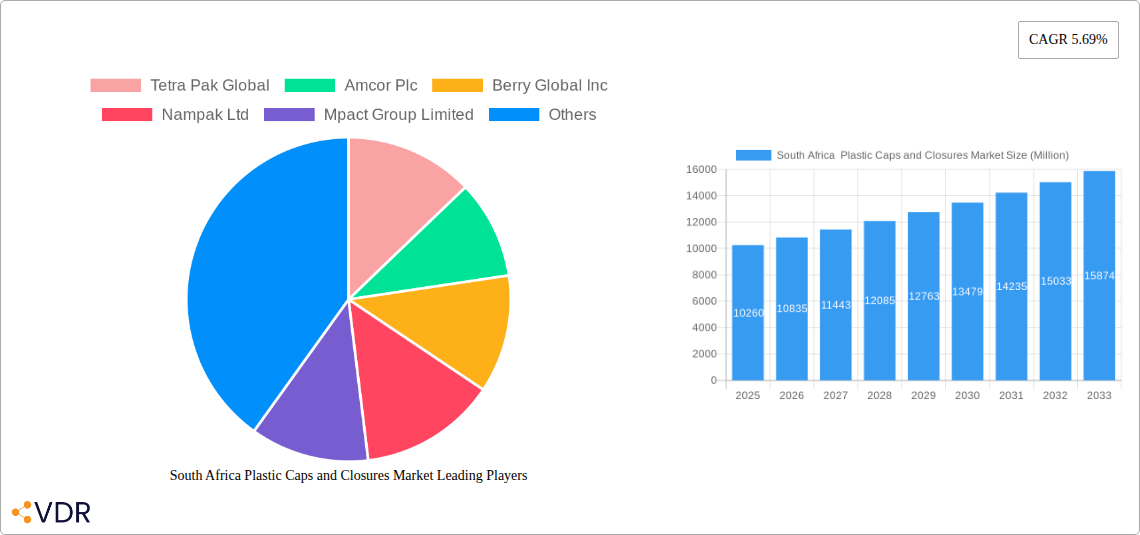

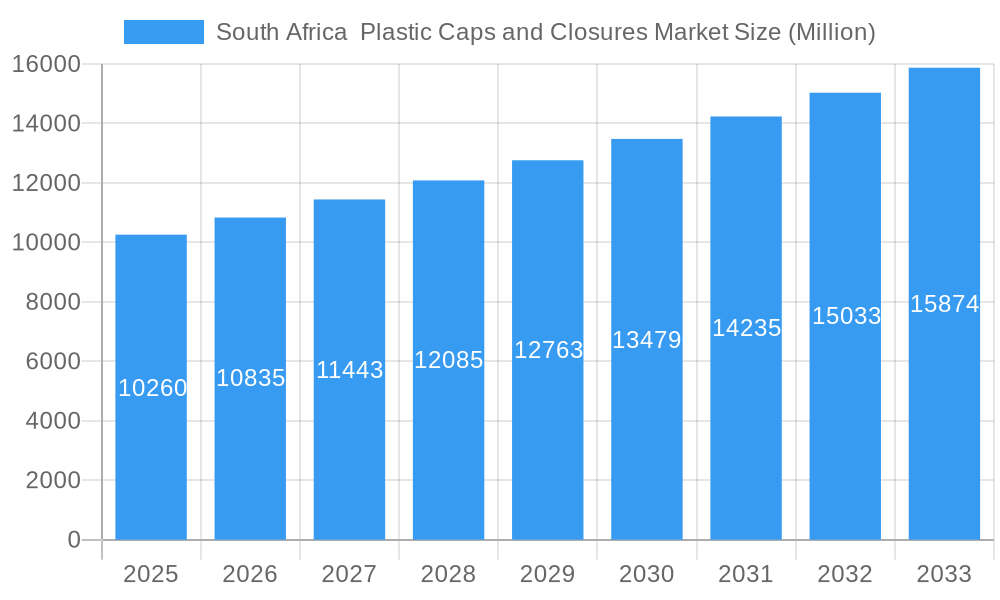

The South African plastic caps and closures market is poised for robust expansion, with an estimated market size of approximately ZAR 10.26 billion in 2025, growing at a Compound Annual Growth Rate (CAGR) of 5.69% through 2033. This projected growth, translating to a market value of roughly ZAR 16.08 billion by 2033, is fueled by the increasing demand for packaged goods across vital sectors such as food, beverages, and personal care. The growing middle class and evolving consumer lifestyles in South Africa are driving higher consumption of bottled water, juices, carbonated soft drinks, and convenience food products, all of which rely heavily on secure and functional plastic caps and closures. Furthermore, the rising adoption of advanced packaging solutions, including child-resistant and dispensing closures that enhance product safety and user convenience, are significant growth catalysts. The market's dynamism is further underscored by the versatility of key resin types like Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP), which cater to a diverse range of product applications and performance requirements.

South Africa Plastic Caps and Closures Market Market Size (In Billion)

Key trends shaping the South African plastic caps and closures landscape include a strong emphasis on sustainability and recyclability. Manufacturers are increasingly investing in the development of eco-friendly materials and designs to meet regulatory pressures and growing consumer preferences for environmentally conscious packaging. Innovations in lightweighting and material optimization are also paramount, aiming to reduce production costs and environmental impact. While the market demonstrates significant growth potential, certain restraints may influence its trajectory. These could include fluctuations in raw material prices, particularly for virgin plastics, and the ongoing development of alternative packaging materials. However, the inherent advantages of plastic closures in terms of cost-effectiveness, durability, and sealing performance are expected to maintain their dominance. The market is segmented by product type, with threaded and dispensing closures holding substantial shares, and by end-user industry, where food and beverages are the primary consumers, followed closely by personal care & cosmetics and household chemicals. Major players like Tetra Pak Global, Amcor Plc, and Berry Global Inc. are actively shaping the market through strategic investments, product innovation, and expanding distribution networks within South Africa.

South Africa Plastic Caps and Closures Market Company Market Share

This in-depth report provides a detailed examination of the South Africa plastic caps and closures market, analyzing its current state, historical trends, and future projections. With a comprehensive study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report offers crucial insights for industry stakeholders. The analysis delves into market dynamics, growth drivers, key players, and emerging opportunities, making it an indispensable resource for businesses seeking to navigate this evolving landscape. Discover market segmentation by resin type (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Other Plastics), product type (Threaded, Dispensing, Unthreaded, Child-resistant), and end-user industry (Food, Beverage (Bottled Water, Carbonated Soft Drinks, Alcoholic Beverages, Juices & Energy Drinks, Other Beverages), Personal Care & Cosmetics, Household Chemicals, Other End-use Industries).

South Africa Plastic Caps and Closures Market Market Dynamics & Structure

The South African plastic caps and closures market is characterized by a moderately concentrated structure, with key players like Tetra Pak Global, Amcor Plc, and Berry Global Inc. holding significant market shares. Technological innovation is a primary driver, fueled by advancements in material science and manufacturing processes that enhance product functionality, safety, and sustainability. The regulatory framework, particularly concerning food safety and environmental impact, plays a crucial role in shaping product development and adoption. Competitive product substitutes, such as metal closures and alternative packaging materials, exert some pressure, but the cost-effectiveness and versatility of plastic closures maintain their dominance. End-user demographics, driven by a growing middle class and increasing urbanization, are influencing demand for convenience and premium packaging solutions. Mergers and acquisitions (M&A) trends, though not as aggressive as in global markets, are observed as companies seek to expand their product portfolios and market reach. For instance, strategic alliances and minor acquisitions are prevalent to integrate supply chains and enhance production capabilities. The market is estimated to have reached approximately 15,500 Million units in 2024 and is projected to grow.

- Market Concentration: Moderately concentrated with leading global and local manufacturers.

- Technological Innovation: Driven by lightweighting, improved sealing mechanisms, and smart packaging solutions.

- Regulatory Framework: Stringent regulations on food contact materials and increasing pressure for recycled content.

- Competitive Product Substitutes: Metal caps and alternative non-plastic closure solutions.

- End-User Demographics: Growing demand from expanding beverage, food, and personal care sectors.

- M&A Trends: Strategic partnerships and smaller acquisitions for market consolidation and capability expansion.

South Africa Plastic Caps and Closures Market Growth Trends & Insights

The South Africa plastic caps and closures market is poised for robust growth, driven by an expanding consumer base and increasing demand across various end-user industries. The market size is projected to evolve significantly, with an estimated Compound Annual Growth Rate (CAGR) of approximately 4.8% during the forecast period of 2025-2033. Adoption rates of innovative closure technologies, such as tamper-evident seals and child-resistant mechanisms, are steadily increasing, particularly in the beverage and pharmaceutical sectors. Technological disruptions, including advancements in injection molding and sustainable material solutions, are reshaping the market. Consumer behavior shifts towards convenience, safety, and sustainability are compelling manufacturers to develop and adopt eco-friendly and user-friendly caps and closures. The market penetration of specialized closures, like dispensing caps for personal care products and high-barrier closures for food preservation, is expected to rise. The growing emphasis on product differentiation and brand appeal further fuels the demand for customized and aesthetically pleasing plastic closures. The overall market volume is anticipated to reach approximately 22,000 Million units by 2033.

Dominant Regions, Countries, or Segments in South Africa Plastic Caps and Closures Market

Within the South Africa plastic caps and closures market, the Beverage end-user industry emerges as the dominant segment, consistently driving significant market share and growth. This dominance is attributed to the sheer volume of packaged beverages consumed across the nation, encompassing bottled water, carbonated soft drinks, juices, and alcoholic beverages. The specific sub-segment of Bottled Water is a particularly strong contributor due to consistent demand and increasing health consciousness among consumers.

- Beverage Industry Dominance:

- Market Share: Consistently holds over 45% of the total market share.

- Growth Potential: Driven by a growing population and rising disposable incomes.

- Sub-Segments: Bottled water, carbonated soft drinks, and juices are key growth areas.

- Resin Type Dominance: Polyethylene (PE) and Polypropylene (PP)

- PE: Widely used for its flexibility, chemical resistance, and cost-effectiveness, particularly for beverage closures. Estimated to account for over 35% of the resin market.

- PP: Valued for its rigidity, heat resistance, and good sealing properties, making it suitable for a variety of applications. Holds an estimated 30% of the resin market.

- Product Type Dominance: Threaded Closures

- Ubiquity: The most common and widely used product type due to its simplicity and secure sealing capabilities.

- Applications: Dominates across food, beverage, and household chemical sectors.

- Market Penetration: Exceeds 60% of the total product type market.

- Key Drivers of Dominance:

- Economic Policies: Favorable trade agreements and manufacturing incentives support the growth of the beverage and FMCG sectors.

- Infrastructure Development: Robust logistics and distribution networks ensure efficient supply of packaged goods.

- Consumer Preferences: Growing demand for ready-to-drink products and single-serving formats.

- Technological Advancements: Innovations in closure designs for enhanced safety and convenience in the beverage sector.

South Africa Plastic Caps and Closures Market Product Landscape

The South Africa plastic caps and closures market is witnessing a surge in product innovations focused on enhanced functionality and sustainability. Key developments include the introduction of lightweight designs that reduce material usage and transportation costs, alongside advanced tamper-evident features that bolster consumer confidence. Dispensing closures are gaining traction for their convenience in personal care and household chemical applications. Furthermore, the market is seeing a rise in child-resistant closures, driven by safety regulations in the pharmaceutical and household chemical sectors. The increasing integration of recycled content in plastic caps and closures, exemplified by Safripol's new rPET product, highlights a commitment to environmental stewardship. These innovations are crucial for meeting evolving consumer demands and regulatory expectations, ensuring competitive advantage for manufacturers.

Key Drivers, Barriers & Challenges in South Africa Plastic Caps and Closures Market

Key Drivers:

- Growing Beverage and Food Consumption: An expanding population and increasing demand for packaged goods, particularly beverages, directly fuel the need for plastic caps and closures.

- Technological Advancements: Innovations in manufacturing processes and material science lead to more efficient, safer, and sustainable closure solutions.

- Demand for Convenience and Safety: Consumers increasingly seek easy-to-open, tamper-evident, and child-resistant closures across various product categories.

- Economic Growth and Urbanization: Rising disposable incomes and a growing urban population contribute to higher consumption of packaged goods.

Barriers & Challenges:

- Environmental Concerns and Regulations: Growing pressure to reduce plastic waste and increase the use of recycled materials poses challenges for traditional manufacturing. Stringent environmental regulations can increase compliance costs.

- Raw Material Price Volatility: Fluctuations in the prices of key resins like PE, PET, and PP can impact manufacturing costs and profit margins.

- Competition from Alternative Materials: While plastic closures are dominant, competition from metal, glass, and other sustainable materials exists.

- Supply Chain Disruptions: Global and local supply chain issues can affect the availability and cost of raw materials and finished products.

Emerging Opportunities in South Africa Plastic Caps and Closures Market

Emerging opportunities in the South Africa plastic caps and closures market lie in the development and adoption of sustainable packaging solutions. This includes a greater focus on circular economy principles, such as designing for recyclability and increasing the use of post-consumer recycled (PCR) content. The demand for innovative dispensing closures with improved functionality and user experience in sectors like personal care and pharmaceuticals presents significant growth potential. Furthermore, the untapped market for smart closures, incorporating features like QR codes for traceability or authentication, could offer a competitive edge. The increasing preference for smaller, single-serving packaging formats, particularly in the beverage and food sectors, also creates opportunities for specialized closure designs.

Growth Accelerators in the South Africa Plastic Caps and Closures Market Industry

Several catalysts are accelerating long-term growth within the South Africa plastic caps and closures industry. Technological breakthroughs in injection molding and material science are enabling the production of lighter, stronger, and more sustainable closures. Strategic partnerships between resin manufacturers, closure producers, and brand owners are fostering innovation and market penetration of new products. Market expansion strategies, including increased penetration into underserved segments and the development of export markets, will further drive growth. The continuous drive towards premiumization in consumer goods also necessitates sophisticated and aesthetically pleasing closures, acting as a significant growth accelerator.

Key Players Shaping the South Africa Plastic Caps and Closures Market Market

- Tetra Pak Global

- Amcor Plc

- Berry Global Inc.

- Nampak Ltd

- Mpact Group Limited

- Polyoak Packaging

- Nioro Plastics (Pty) Ltd

- Cherry & Co

Notable Milestones in South Africa Plastic Caps and Closures Market Sector

- December 2023: Switch Energy Drink launched G-Force, a limited-edition energy drink in partnership with Biogen South Africa, showcasing innovative product integration and marketing.

- October 2023: Safripol introduced a new rPET product with 15% to 25% post-consumer recycled plastic resin, offering a 'one bag' solution that meets and surpasses national and global recycled waste content regulations.

In-Depth South Africa Plastic Caps and Closures Market Market Outlook

The future outlook for the South Africa plastic caps and closures market is exceptionally promising, driven by a confluence of factors. The continuous evolution towards sustainable packaging will remain a primary growth accelerator, with increasing demand for recycled and recyclable materials shaping product development. Technological advancements in smart packaging and functional closures will unlock new market segments and enhance product differentiation for brand owners. Strategic collaborations across the value chain, from raw material suppliers to end-users, will foster innovation and streamline market entry for novel solutions. The expanding consumer base and evolving lifestyle trends will continue to propel demand across the food, beverage, and personal care sectors, ensuring a robust and dynamic market landscape for plastic caps and closures in South Africa.

South Africa Plastic Caps and Closures Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Pl

-

2. Product Type

- 2.1. Threaded

- 2.2. Dispensing

- 2.3. Unthreaded

- 2.4. Child-resistant

-

3. End-User Industry

- 3.1. Food

-

3.2. Beverage

- 3.2.1. Bottled Water

- 3.2.2. Carbonated Soft Drinks

- 3.2.3. Alcoholic Beverages

- 3.2.4. Juices & Energy Drinks

- 3.2.5. Other Bevrages

- 3.3. Personal Care & Cosmetics

- 3.4. Household Chemicals

- 3.5. Other End-use Industries

South Africa Plastic Caps and Closures Market Segmentation By Geography

- 1. South Africa

South Africa Plastic Caps and Closures Market Regional Market Share

Geographic Coverage of South Africa Plastic Caps and Closures Market

South Africa Plastic Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth

- 3.3. Market Restrains

- 3.3.1. Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Plastic Caps and Closures Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Pl

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Threaded

- 5.2.2. Dispensing

- 5.2.3. Unthreaded

- 5.2.4. Child-resistant

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.2.1. Bottled Water

- 5.3.2.2. Carbonated Soft Drinks

- 5.3.2.3. Alcoholic Beverages

- 5.3.2.4. Juices & Energy Drinks

- 5.3.2.5. Other Bevrages

- 5.3.3. Personal Care & Cosmetics

- 5.3.4. Household Chemicals

- 5.3.5. Other End-use Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tetra Pak Global

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nampak Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mpact Group Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Polyoak Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nioro Plastics (Pty) Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cherry & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Tetra Pak Global

List of Figures

- Figure 1: South Africa Plastic Caps and Closures Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Plastic Caps and Closures Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 3: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 10: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 11: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Plastic Caps and Closures Market?

The projected CAGR is approximately 5.69%.

2. Which companies are prominent players in the South Africa Plastic Caps and Closures Market?

Key companies in the market include Tetra Pak Global, Amcor Plc, Berry Global Inc, Nampak Ltd, Mpact Group Limited, Polyoak Packaging, Nioro Plastics (Pty) Ltd, Cherry & Co.

3. What are the main segments of the South Africa Plastic Caps and Closures Market?

The market segments include Resin, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth.

8. Can you provide examples of recent developments in the market?

December 2023: Switch Energy Drink, a player in the energy beverage sector, unveiled G-Force, a limited-edition energy drink from a pioneering partnership with Biogen South Africa, a distinguished wellness brand known for its top-tier vitamin and supplement offerings. G-Force epitomizes the fusion of cutting-edge energy tech and Biogen South Africa's wellness ethos. This joint effort promises a potent energy kick but guarantees a revitalizing drinking experience, showcasing both brands' dedication.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Plastic Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Plastic Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Plastic Caps and Closures Market?

To stay informed about further developments, trends, and reports in the South Africa Plastic Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence