Key Insights

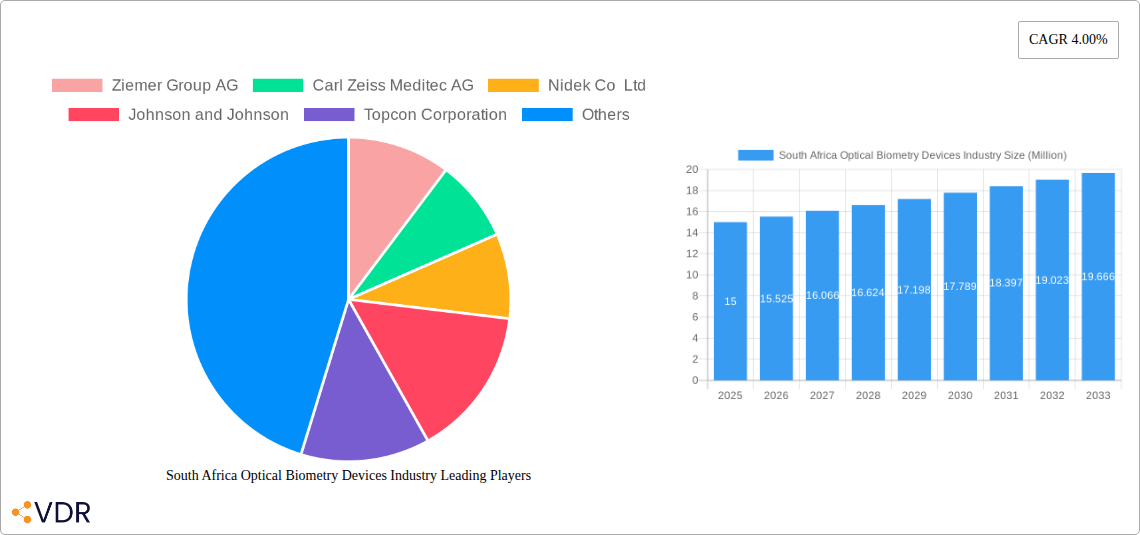

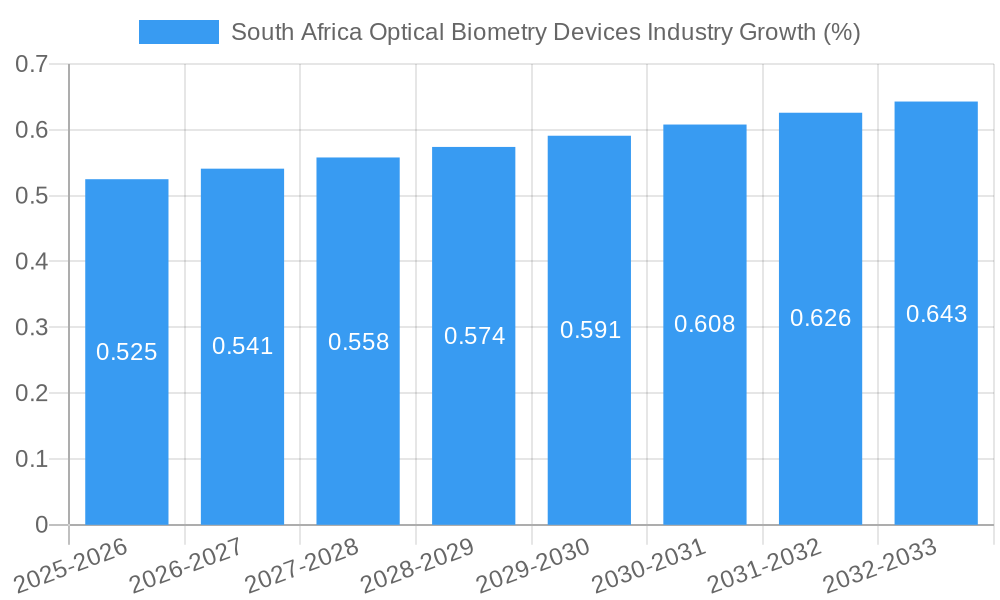

The South African optical biometry devices market, while a segment of a larger global industry experiencing a 4% CAGR, presents unique growth opportunities. The market's size in 2025 is estimated at $15 million, considering the regional context and the relatively lower healthcare spending compared to developed nations. Key drivers include the rising prevalence of age-related eye diseases like cataracts and glaucoma, increasing demand for precise refractive surgery, and a growing awareness of advanced diagnostic technologies among ophthalmologists. Technological advancements in optical biometry, leading to more accurate and efficient measurements, further fuel market growth. However, constraints exist, primarily related to healthcare infrastructure limitations and affordability challenges in certain segments of the population. The market is segmented into surgical devices (including those used in cataract surgery, the largest segment) and diagnostic and monitoring devices. Leading players such as Johnson & Johnson, Alcon Inc., and potentially local distributors, compete in the market. The forecast period (2025-2033) is expected to see a steady expansion driven by increasing disposable incomes, improved healthcare access in urban areas and public-private partnerships focusing on eye care.

Growth projections for the South African market will likely be moderated by factors including economic fluctuations and healthcare budget limitations. While the global CAGR suggests a positive outlook, realistic growth for South Africa might be slightly lower, perhaps around 3.5% annually, considering the specific economic and healthcare landscape. The segment of diagnostic and monitoring devices is poised for faster growth compared to surgical devices, fueled by the increasing adoption of preventative eye care measures and early diagnosis techniques. Successful market entry will require strategic partnerships with local healthcare providers and a focus on affordability to penetrate a broader patient base. Continued investment in research and development to adapt devices to the specific needs of the South African population will be crucial for long-term success.

South Africa Optical Biometry Devices Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the South Africa optical biometry devices market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report covers both parent market (Medical Devices) and child market (Optical Biometry Devices) segments for a holistic understanding. Market values are presented in million units.

South Africa Optical Biometry Devices Industry Market Dynamics & Structure

The South Africa optical biometry devices market is characterized by moderate concentration, with key players like Ziemer Group AG, Carl Zeiss Meditec AG, Nidek Co Ltd, Johnson and Johnson, Topcon Corporation, Alcon Inc, Bausch Health Companies Inc, and Hoya Corporation holding significant market share. The market is driven by technological advancements in device miniaturization, improved accuracy, and integration with AI for enhanced diagnostics. Regulatory frameworks, while largely aligned with international standards, pose some challenges to market entry and expansion. Competitive pressures stem from both established players and emerging companies offering innovative solutions. The M&A activity in the sector remains moderate, with xx deals recorded in the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on miniaturization, improved accuracy, AI integration.

- Regulatory Framework: Largely aligned with international standards, but with potential hurdles for new entrants.

- Competitive Substitutes: Limited direct substitutes; competition primarily based on features, accuracy, and pricing.

- End-User Demographics: Primarily ophthalmologists and eye clinics; growing demand from private and public healthcare sectors.

- M&A Trends: Moderate activity, with xx deals recorded between 2019-2024.

South Africa Optical Biometry Devices Industry Growth Trends & Insights

The South Africa optical biometry devices market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. Market penetration remains relatively low compared to developed nations, creating significant growth potential. The increasing prevalence of age-related eye diseases, coupled with rising healthcare expenditure and improved access to healthcare services, fuels market growth. Technological advancements, particularly the adoption of AI-powered diagnostic tools, are accelerating adoption rates and improving clinical outcomes. Consumer behavior is shifting towards greater preference for minimally invasive procedures and improved patient experience, creating demand for advanced devices. The forecast period (2025-2033) projects a CAGR of xx%, with the market expected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in South Africa Optical Biometry Devices Industry

The Gauteng province leads the South Africa optical biometry devices market, driven by the concentration of major hospitals, ophthalmology clinics, and healthcare infrastructure. Within the product segments, Surgical Devices hold the largest market share (xx%), followed by Other Surgical Devices (Diagnostic and Monitoring Devices) at xx%. This dominance stems from the increasing demand for advanced surgical interventions and the rising prevalence of eye diseases requiring precise diagnosis and monitoring. Furthermore, the increasing adoption of advanced surgical techniques and improved reimbursement policies have contributed to this segment's growth.

- Key Drivers (Gauteng): High concentration of hospitals, specialized clinics, well-developed healthcare infrastructure, strong economic activity.

- Key Drivers (Surgical Devices): Growing demand for cataract surgery, refractive surgery; improved reimbursement policies.

- Key Drivers (Diagnostic & Monitoring Devices): Rising prevalence of diabetic retinopathy, glaucoma; increasing demand for early detection and monitoring technologies.

South Africa Optical Biometry Devices Industry Product Landscape

The South African market showcases a diverse range of optical biometry devices, encompassing advanced optical coherence tomography (OCT) systems, ultrasound biometry devices, and newer technologies integrated with AI. These devices offer improved accuracy, speed, and reduced invasiveness compared to earlier generations. Unique selling propositions often center around superior image quality, ease of use, and the integration of advanced software for data analysis and reporting. Continuous technological advancements focus on enhancing precision, streamlining workflows, and improving patient comfort.

Key Drivers, Barriers & Challenges in South Africa Optical Biometry Devices Industry

Key Drivers: The rising prevalence of age-related eye diseases like cataracts and glaucoma, increasing healthcare expenditure, and government initiatives to improve healthcare access are significant drivers. Technological advancements leading to improved device accuracy and minimally invasive procedures also contribute to market growth.

Key Challenges: High cost of advanced devices, limited healthcare infrastructure in certain regions, and a shortage of trained ophthalmologists can hinder market penetration. Regulatory hurdles and supply chain complexities pose further challenges. The competitive landscape, with both international and local players, presents additional pressures.

Emerging Opportunities in South Africa Optical Biometry Devices Industry

Untapped market potential exists in rural and underserved areas, requiring strategic partnerships and affordable device solutions. The increasing adoption of telemedicine and remote patient monitoring offers opportunities for integrating optical biometry devices into virtual care models. Furthermore, there's a need for devices tailored to address the specific epidemiological trends in South Africa, such as the high prevalence of certain eye diseases.

Growth Accelerators in the South Africa Optical Biometry Devices Industry

Strategic partnerships between device manufacturers, healthcare providers, and government agencies can accelerate market growth. Technological advancements, specifically the integration of AI and machine learning for improved diagnostics and treatment planning, will propel market expansion. Focus on affordable and accessible devices suitable for diverse healthcare settings is also crucial for long-term growth.

Key Players Shaping the South Africa Optical Biometry Devices Market

- Ziemer Group AG

- Carl Zeiss Meditec AG

- Nidek Co Ltd

- Johnson and Johnson

- Topcon Corporation

- Alcon Inc

- Bausch Health Companies Inc

- Hoya Corporation

Notable Milestones in South Africa Optical Biometry Devices Industry Sector

- April 2022: Liqid Medical launches OptiShunt, a novel ocular implant for glaucoma treatment, potentially disrupting the market with its innovative approach.

- December 2021: Eyenuk launches nationwide diabetic retinopathy screening benefit using AI-powered EyeArt System, improving early detection rates and impacting the diagnostic device segment.

In-Depth South Africa Optical Biometry Devices Industry Market Outlook

The South Africa optical biometry devices market is poised for significant growth, driven by technological advancements, increasing healthcare expenditure, and a growing awareness of eye health. Strategic focus on affordable solutions, expansion into underserved markets, and leveraging telemedicine platforms will be crucial for realizing the market's full potential. The integration of AI and machine learning offers promising avenues for enhancing diagnostic accuracy and improving clinical outcomes, further bolstering market growth in the coming years.

South Africa Optical Biometry Devices Industry Segmentation

-

1. Devices

-

1.1. Surgical Devices

- 1.1.1. Glaucoma Devices

- 1.1.2. Intraocular Lenses

- 1.1.3. Lasers

- 1.1.4. Other Surgical Devices

-

1.2. Diagnostic and Monitoring Devices

- 1.2.1. Autorefractors and Keratometers

- 1.2.2. Ophthalmic Ultrasound Imaging Systems

- 1.2.3. Ophthalmoscopes

- 1.2.4. Optical Coherence Tomography Scanners

- 1.2.5. Other Diagnostic and Monitoring Devices

-

1.1. Surgical Devices

South Africa Optical Biometry Devices Industry Segmentation By Geography

- 1. South Africa

South Africa Optical Biometry Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Eye Disorders; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Ophthalmic Procedures

- 3.4. Market Trends

- 3.4.1. Intraocular Lenses Segment Expects to Register a High CAGR in the South Africa Ophthalmic Devices Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 5.1.1. Surgical Devices

- 5.1.1.1. Glaucoma Devices

- 5.1.1.2. Intraocular Lenses

- 5.1.1.3. Lasers

- 5.1.1.4. Other Surgical Devices

- 5.1.2. Diagnostic and Monitoring Devices

- 5.1.2.1. Autorefractors and Keratometers

- 5.1.2.2. Ophthalmic Ultrasound Imaging Systems

- 5.1.2.3. Ophthalmoscopes

- 5.1.2.4. Optical Coherence Tomography Scanners

- 5.1.2.5. Other Diagnostic and Monitoring Devices

- 5.1.1. Surgical Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Devices

- 6. South Africa South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Optical Biometry Devices Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Ziemer Group AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Carl Zeiss Meditec AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Nidek Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Johnson and Johnson

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Topcon Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alcon Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Bausch Health Companies Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hoya Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Ziemer Group AG

List of Figures

- Figure 1: South Africa Optical Biometry Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Optical Biometry Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Optical Biometry Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Optical Biometry Devices Industry Revenue Million Forecast, by Devices 2019 & 2032

- Table 4: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Devices 2019 & 2032

- Table 5: South Africa Optical Biometry Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: South Africa Optical Biometry Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: South Africa South Africa Optical Biometry Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa South Africa Optical Biometry Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Sudan South Africa Optical Biometry Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sudan South Africa Optical Biometry Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Uganda South Africa Optical Biometry Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Uganda South Africa Optical Biometry Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Tanzania South Africa Optical Biometry Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Tanzania South Africa Optical Biometry Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Kenya South Africa Optical Biometry Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya South Africa Optical Biometry Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of Africa South Africa Optical Biometry Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Africa South Africa Optical Biometry Devices Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: South Africa Optical Biometry Devices Industry Revenue Million Forecast, by Devices 2019 & 2032

- Table 22: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Devices 2019 & 2032

- Table 23: South Africa Optical Biometry Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South Africa Optical Biometry Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Optical Biometry Devices Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the South Africa Optical Biometry Devices Industry?

Key companies in the market include Ziemer Group AG, Carl Zeiss Meditec AG, Nidek Co Ltd, Johnson and Johnson, Topcon Corporation, Alcon Inc, Bausch Health Companies Inc, Hoya Corporation.

3. What are the main segments of the South Africa Optical Biometry Devices Industry?

The market segments include Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Eye Disorders; Technological Advancements.

6. What are the notable trends driving market growth?

Intraocular Lenses Segment Expects to Register a High CAGR in the South Africa Ophthalmic Devices Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Risk Associated with Ophthalmic Procedures.

8. Can you provide examples of recent developments in the market?

In April 2022, Liqid Medical designed a novel ocular implant, the OptiShunt, that uses a simple concept to revolutionize the treatment of glaucoma.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Optical Biometry Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Optical Biometry Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Optical Biometry Devices Industry?

To stay informed about further developments, trends, and reports in the South Africa Optical Biometry Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence