Key Insights

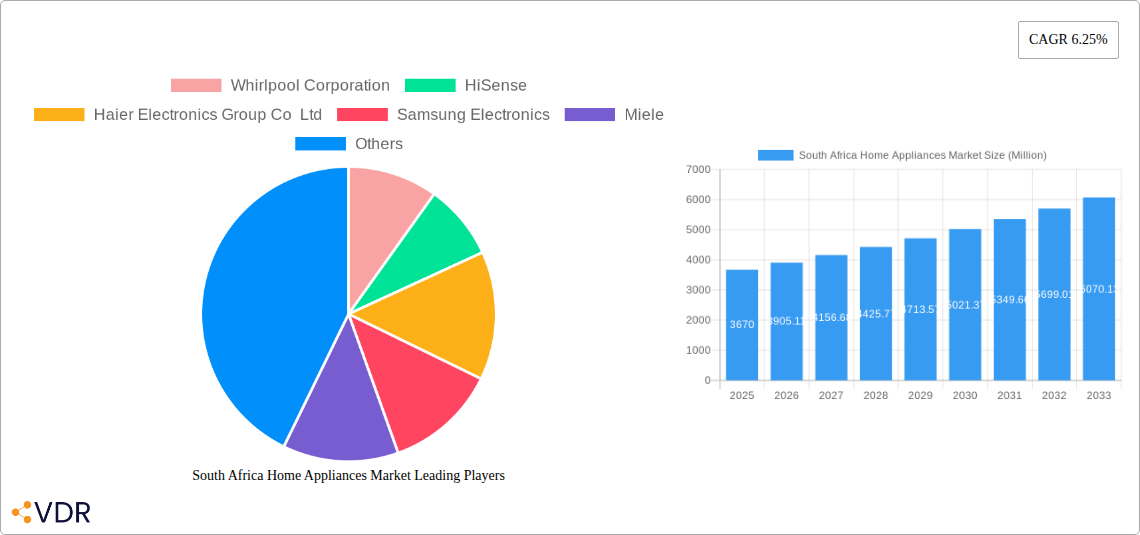

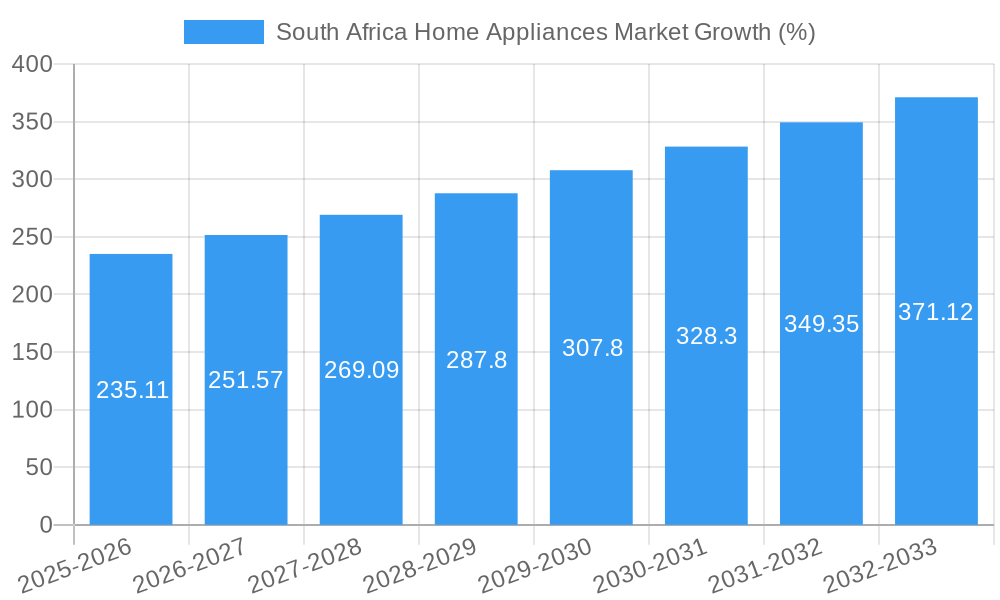

The South African home appliances market, valued at $3.67 billion in 2025, is projected to experience robust growth, driven by rising urbanization, increasing disposable incomes, and a shift towards modern lifestyles. This expanding middle class is increasingly demanding convenient and technologically advanced home appliances, fueling demand across segments such as major appliances (refrigerators, washing machines, etc.), cookers and ovens, and smaller kitchen appliances like blenders and microwaves. The market's growth is further amplified by the penetration of e-commerce, offering consumers greater access to a wider variety of products and brands. While the market faces challenges like economic volatility and potential power shortages, the overall trend points towards sustained expansion. Growth is anticipated to be particularly strong in segments like small appliances, reflecting a growing focus on convenience and individual needs. The distribution channels are diverse, with multi-brand stores holding a significant share, complemented by exclusive brand stores and the rapidly growing online segment. Leading brands like Whirlpool, Hisense, Haier, Samsung, and LG are actively competing to capture market share through product innovation, competitive pricing, and effective marketing strategies. The forecast period (2025-2033) suggests a promising outlook for investors and industry players, driven by sustained economic growth and evolving consumer preferences.

The strong CAGR of 6.25% indicates a healthy growth trajectory for the South African home appliances market. However, regional variations exist within the country, with urban areas experiencing faster growth than rural regions. This disparity presents opportunities for targeted marketing and distribution strategies. Furthermore, the market's resilience hinges on the ability of manufacturers to address challenges such as the rising cost of raw materials and potential supply chain disruptions. A successful strategy requires a balance between affordability, quality, and energy efficiency to cater to the diverse needs of South African consumers. The emphasis on after-sales service and robust warranties will also play a significant role in building brand loyalty and securing market leadership.

This in-depth report provides a comprehensive analysis of the South Africa home appliances market, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategists seeking to understand market dynamics, growth trends, and future opportunities within this dynamic sector. The report segments the market by product (major appliances, cookers & ovens, small appliances), distribution channel (multi-brand stores, exclusive stores, online, other), and key players, delivering a granular view of the South African landscape. Market sizes are presented in million units.

South Africa Home Appliances Market Dynamics & Structure

The South African home appliances market is characterized by a moderately concentrated landscape with key players such as Whirlpool Corporation, HiSense, Haier Electronics Group Co Ltd, Samsung Electronics, Miele, Electrolux AB, Defy Appliances (Pty) Ltd, Arcelik A S, Panasonic Corporation, and LG Electronics competing for market share. Technological innovation, particularly in energy efficiency and smart home integration, is a major driver. Regulatory frameworks focusing on energy consumption and safety standards significantly influence product design and market entry. The market also faces competition from substitute products, including used appliances and informal sector offerings. End-user demographics, especially the rising middle class and urbanization trends, are key growth factors. M&A activity remains relatively moderate, with xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on energy efficiency, smart home connectivity, and improved durability.

- Regulatory Framework: Stringent safety and energy efficiency standards impacting product development.

- Competitive Substitutes: Used appliances and informal market present competitive pressure.

- End-User Demographics: Growing middle class and urbanization drive demand for modern appliances.

- M&A Activity: xx M&A deals recorded between 2019 and 2024, indicating moderate consolidation.

South Africa Home Appliances Market Growth Trends & Insights

The South African home appliances market experienced a xx% CAGR during the historical period (2019-2024), reaching xx million units in 2024. This growth is attributed to factors such as rising disposable incomes, increasing urbanization, and a shift towards modern lifestyles. Technological disruptions, particularly the rise of smart appliances and connected devices, are significantly influencing consumer adoption rates. Consumer behavior is evolving towards premium products with enhanced features and energy efficiency, impacting product demand. The forecast period (2025-2033) projects a CAGR of xx%, driven by continuous economic growth and the increasing adoption of smart home technologies. Market penetration for key appliance categories, such as refrigerators and washing machines, is expected to further increase. However, economic volatility and inflationary pressures remain potential constraints on market growth.

Dominant Regions, Countries, or Segments in South Africa Home Appliances Market

Growth in the South Africa home appliances market is predominantly driven by urban areas, particularly in Gauteng and Western Cape provinces, due to higher disposable incomes and better infrastructure. Within the product segments, major appliances (refrigerators, washing machines, and freezers) represent the largest share, driven by increasing household formation and replacement demand. The multi-brand store distribution channel maintains the largest market share, while online sales are witnessing a substantial increase.

- Leading Region: Gauteng and Western Cape provinces, driven by higher disposable incomes and infrastructure.

- Dominant Product Segment: Major appliances (refrigerators, washing machines, freezers) account for xx million units in 2024.

- Leading Distribution Channel: Multi-brand stores hold the largest market share, with online channels rapidly growing.

- Key Growth Drivers: Rising disposable incomes, increasing urbanization, and improved infrastructure.

South Africa Home Appliances Market Product Landscape

The South African home appliances market showcases a diverse range of products, from basic models to sophisticated smart appliances with advanced features. Key innovations include energy-efficient technologies, smart connectivity features, and improved user interfaces. These advancements cater to diverse consumer preferences and budgets, enhancing product functionality and user experience. The emphasis on features such as increased capacity, improved durability, and enhanced convenience drives product differentiation and competitiveness.

Key Drivers, Barriers & Challenges in South Africa Home Appliances Market

Key Drivers:

- Increasing urbanization and rising disposable incomes.

- Technological advancements and innovation in smart home appliances.

- Growing demand for energy-efficient appliances.

Challenges & Restraints:

- Economic volatility and fluctuating exchange rates impacting affordability.

- Competition from informal sector and imported products.

- Supply chain disruptions and logistical challenges.

- xx% increase in import tariffs in 2022 causing price hikes.

Emerging Opportunities in South Africa Home Appliances Market

- Growing demand for energy-efficient and eco-friendly appliances.

- Increasing adoption of smart home technology and connected appliances.

- Expansion into rural markets with tailored product offerings.

- Growing demand for built-in appliances in new housing developments.

Growth Accelerators in the South Africa Home Appliances Market Industry

Long-term growth will be driven by investments in smart home technology, strategic partnerships with retailers and service providers, and the expansion into underserved markets. Technological advancements, such as AI-powered appliances and improved connectivity, will create new growth opportunities and reshape the competitive landscape.

Key Players Shaping the South Africa Home Appliances Market Market

- Whirlpool Corporation

- HiSense

- Haier Electronics Group Co Ltd

- Samsung Electronics

- Miele

- Electrolux AB

- Defy Appliances (Pty) Ltd

- Arcelik A S

- Panasonic Corporation

- LG Electronics

Notable Milestones in South Africa Home Appliances Market Sector

- May 2023: Samsung launched its latest line of semi-automatic washing machines with features like a Soft Closing Toughened Glass Lid and Dual Magic Filter.

- March 2023: Haier launched its anti-scaling top-load washing machines featuring anti-scaling technology, bionic magic filter, and 3D rolling wash.

- January 2023: Samsung launched a premium side-by-side refrigerator range, manufactured in India with India-specific features.

In-Depth South Africa Home Appliances Market Market Outlook

The South Africa home appliances market is poised for continued growth, driven by favorable demographic trends, increasing urbanization, and ongoing technological innovation. Strategic partnerships, expansion into untapped markets, and a focus on providing energy-efficient and smart home-integrated solutions will be key to capturing future market potential. The market presents significant opportunities for both established players and new entrants seeking to leverage the growing demand for modern, convenient, and technologically advanced home appliances.

South Africa Home Appliances Market Segmentation

-

1. Product

-

1.1. By Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Cookers & Ovens

-

1.2. By Small Appliances

- 1.2.1. Vacuum Cleaners

- 1.2.2. Small Kitchen Appliances

- 1.2.3. Hair Clippers

- 1.2.4. Irons

- 1.2.5. Toasters

- 1.2.6. Grills & Roasters

- 1.2.7. Hair Dryers

-

1.1. By Major Appliances

-

2. Distribution Channel

- 2.1. Multi-brand Stores

- 2.2. Exclusive Stores

- 2.3. Online

- 2.4. Other Distribution Channels

South Africa Home Appliances Market Segmentation By Geography

- 1. South Africa

South Africa Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Demand for Premium

- 3.2.2 Smart

- 3.2.3 and Innovative Appliances is Driven by Rising Incomes and Disposable Income; Major Appliances Segment is Dominating the Appliances Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Smart Appliances; Lack of Interoperability Between Devices and Platforms

- 3.4. Market Trends

- 3.4.1. Growth of the Online Distribution Channel in the South African Home Appliances Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Cookers & Ovens

- 5.1.2. By Small Appliances

- 5.1.2.1. Vacuum Cleaners

- 5.1.2.2. Small Kitchen Appliances

- 5.1.2.3. Hair Clippers

- 5.1.2.4. Irons

- 5.1.2.5. Toasters

- 5.1.2.6. Grills & Roasters

- 5.1.2.7. Hair Dryers

- 5.1.1. By Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-brand Stores

- 5.2.2. Exclusive Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. South Africa South Africa Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Whirlpool Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 HiSense

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Haier Electronics Group Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Samsung Electronics

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Miele

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Electrolux AB

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Defy Appliances (Pty) Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Arcelik A S

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Panasonic Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 LG Electronics

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Whirlpool Corporation

List of Figures

- Figure 1: South Africa Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: South Africa Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: South Africa Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South Africa Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: South Africa Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: South Africa Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South Africa Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: South Africa South Africa Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa South Africa Home Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Sudan South Africa Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan South Africa Home Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Uganda South Africa Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda South Africa Home Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Tanzania South Africa Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania South Africa Home Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Kenya South Africa Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya South Africa Home Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa South Africa Home Appliances Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa South Africa Home Appliances Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: South Africa Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 24: South Africa Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 25: South Africa Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 26: South Africa Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 27: South Africa Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Home Appliances Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the South Africa Home Appliances Market?

Key companies in the market include Whirlpool Corporation, HiSense, Haier Electronics Group Co Ltd, Samsung Electronics, Miele, Electrolux AB, Defy Appliances (Pty) Ltd, Arcelik A S, Panasonic Corporation, LG Electronics.

3. What are the main segments of the South Africa Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Premium. Smart. and Innovative Appliances is Driven by Rising Incomes and Disposable Income; Major Appliances Segment is Dominating the Appliances Market.

6. What are the notable trends driving market growth?

Growth of the Online Distribution Channel in the South African Home Appliances Market.

7. Are there any restraints impacting market growth?

High Cost of Installing Smart Appliances; Lack of Interoperability Between Devices and Platforms.

8. Can you provide examples of recent developments in the market?

In May 2023, Samsung introduced its latest line of semi-automatic washing machines, introducing notable upgrades like the Soft Closing Toughened Glass Lid and Dual Magic Filter. These additions elevate user experience and prioritize convenience and efficiency. This product range underscores Samsung's dedication to pioneering technology, positioning it as a top contender for consumers searching for a sophisticated, hassle-free laundry solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Home Appliances Market?

To stay informed about further developments, trends, and reports in the South Africa Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence