Key Insights

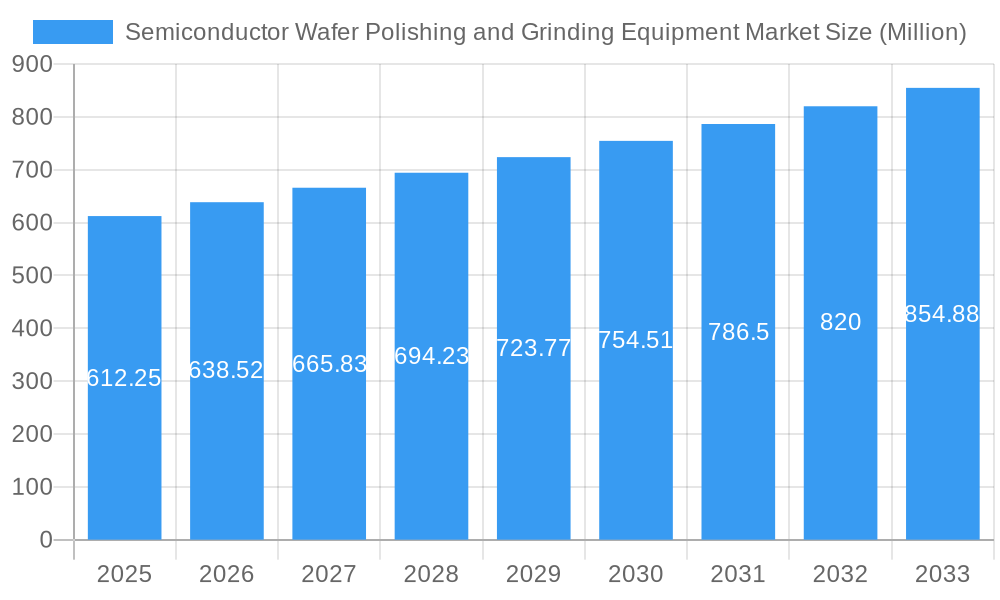

The global Semiconductor Wafer Polishing and Grinding Equipment Market is poised for robust expansion, estimated at a market size of $612.25 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.31% through 2033. This growth is primarily propelled by the insatiable demand for advanced semiconductor devices across a multitude of sectors, including consumer electronics, automotive, and telecommunications, all of which rely on increasingly sophisticated wafer processing capabilities. The relentless pursuit of miniaturization, enhanced performance, and power efficiency in microchips necessitates highly precise and advanced polishing and grinding techniques to achieve defect-free surfaces and optimal wafer integrity. Key drivers include the burgeoning adoption of 5G technology, the explosive growth of the Internet of Things (IoT) ecosystem, and the continuous innovation in artificial intelligence and machine learning, all of which are heavily dependent on cutting-edge semiconductor manufacturing. Furthermore, the increasing complexity of chip architectures and the drive towards smaller process nodes further amplify the need for state-of-the-art polishing and grinding equipment capable of meeting stringent quality and throughput requirements.

Semiconductor Wafer Polishing and Grinding Equipment Market Market Size (In Million)

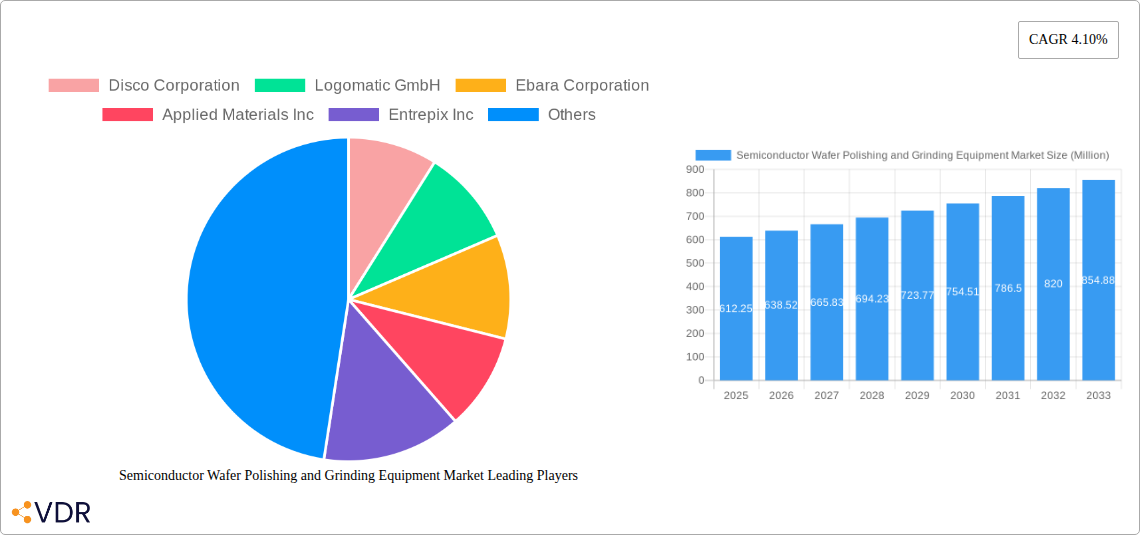

The market segmentation reveals a dynamic landscape, with polishing machines leading the charge, followed closely by grinding machines. Other equipment also plays a crucial role in supporting the end-to-end wafer fabrication process. In terms of applications, semiconductor wafers remain the dominant force, underscoring the core reliance of this equipment on the semiconductor industry. Solar cells represent a significant and growing application area, driven by the global push towards renewable energy solutions and the associated demand for efficient photovoltaic components. The market is characterized by intense competition among established players such as Disco Corporation, Applied Materials Inc., and Ebara Corporation, who are continuously investing in research and development to offer innovative solutions. Emerging trends include the development of advanced CMP (Chemical Mechanical Planarization) slurries and pads, automation and AI integration for process optimization, and the increasing adoption of specialized equipment for next-generation semiconductor materials. Geographically, Asia Pacific, led by China and Japan, is expected to maintain its position as the largest and fastest-growing regional market, owing to its dominant role in semiconductor manufacturing.

Semiconductor Wafer Polishing and Grinding Equipment Market Company Market Share

Here is a comprehensive and SEO-optimized report description for the Semiconductor Wafer Polishing and Grinding Equipment Market, integrating high-traffic keywords and structured as requested:

This in-depth market research report delivers a critical analysis of the global Semiconductor Wafer Polishing and Grinding Equipment Market, providing comprehensive insights into its dynamics, growth trajectory, and future outlook. With a meticulous study period spanning from 2019 to 2033, including a base year and estimated year of 2025, and a robust forecast period from 2025 to 2033, this report is an essential resource for stakeholders seeking to navigate the evolving landscape of advanced semiconductor manufacturing. We meticulously examine parent and child market segments, employing a data-driven approach to quantify market size, penetration, and CAGR. The report is enriched with high-traffic keywords such as wafer polishing machines, wafer grinding machines, semiconductor manufacturing equipment, CMP equipment, wafer processing, and silicon wafer polishing. All quantitative values are presented in million units for clear and actionable understanding.

Semiconductor Wafer Polishing and Grinding Equipment Market Dynamics & Structure

The Semiconductor Wafer Polishing and Grinding Equipment Market is characterized by a moderately consolidated structure, with leading players like Disco Corporation, Ebara Corporation, and Applied Materials Inc. holding significant market share. Technological innovation remains the primary driver, fueled by the relentless demand for smaller, more powerful, and energy-efficient semiconductor devices. Advances in chemical mechanical planarization (CMP) technologies and ultra-precision grinding are paramount. Regulatory frameworks, particularly those aimed at environmental sustainability and manufacturing safety, are increasingly influencing equipment design and adoption. Competitive product substitutes are minimal due to the specialized nature of wafer polishing and grinding, but advancements in alternative wafering technologies could pose a long-term threat. End-user demographics are dominated by semiconductor foundries and integrated device manufacturers (IDMs) focused on cutting-edge logic and memory chips. Mergers and acquisition (M&A) trends are sporadic but strategic, aimed at expanding technological portfolios and market reach. For instance, recent M&A activities in the broader semiconductor equipment sector suggest a consolidation around key technological competencies.

- Market Concentration: Moderately consolidated, with top players dominating the market.

- Technological Innovation Drivers: Miniaturization of nodes, advanced packaging, AI/ML chip demands, and 3D NAND architectures.

- Regulatory Frameworks: Environmental compliance (e.g., waste management, chemical usage) and safety standards shaping operational requirements.

- Competitive Product Substitutes: Limited in the short-to-medium term, but ongoing research into novel material processing could introduce alternatives.

- End-User Demographics: Predominantly semiconductor foundries, IDMs, and specialized MEMS manufacturers.

- M&A Trends: Strategic acquisitions focused on bolstering R&D capabilities and expanding product offerings, with an estimated xx M&A deals in the historical period.

Semiconductor Wafer Polishing and Grinding Equipment Market Growth Trends & Insights

The Semiconductor Wafer Polishing and Grinding Equipment Market is poised for robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This expansion is fundamentally driven by the insatiable global demand for semiconductors across a multitude of applications, including consumer electronics, automotive, telecommunications, and data centers. The increasing complexity of semiconductor fabrication processes, necessitating higher precision and efficiency in wafer preparation, further propels market growth. Technological disruptions, such as the advancement of multi-spindle grinders and advanced CMP slurries, are enhancing throughput and wafer quality, leading to wider adoption rates. Consumer behavior shifts, characterized by a rising preference for feature-rich and interconnected devices, directly translate into increased semiconductor production, thus stimulating demand for cutting-edge wafer polishing and grinding equipment. The market penetration of advanced wafer processing techniques is expected to reach xx% by 2033, a testament to the critical role these machines play in modern semiconductor manufacturing. Furthermore, the development of specialized equipment for emerging wafer materials like GaN and SiC is opening new avenues for market expansion. The evolution of the polishing machines segment, driven by innovations in slurry chemistry and pad technology, is crucial for achieving sub-nanometer surface roughness. Similarly, the grinding machines segment is witnessing advancements in double-side grinding for improved efficiency and wafer thinning capabilities. The "Other equipment" segment, encompassing metrology and cleaning solutions post-polishing and grinding, is also expected to see steady growth due to the stringent quality control requirements in advanced semiconductor manufacturing.

Dominant Regions, Countries, or Segments in Semiconductor Wafer Polishing and Grinding Equipment Market

The Semiconductor Wafer Polishing and Grinding Equipment Market is witnessing substantial growth, with Semiconductor wafers as the dominant application segment, accounting for an estimated xx% of the market share in 2025. This dominance is primarily driven by the ever-increasing global demand for advanced microchips that form the backbone of modern technology. Within the product type segmentation, Polishing machines emerge as the leading segment, capturing an estimated xx% of the market in 2025, closely followed by Grinding machines at xx%, and Other equipment at xx%. The growth of the polishing machines segment is directly linked to the critical need for Chemical Mechanical Planarization (CMP) in achieving ultra-flat wafer surfaces essential for multi-layer interconnects and complex chip architectures. Grinding machines are vital for wafer thinning and initial surface preparation, especially for high-power applications and advanced packaging.

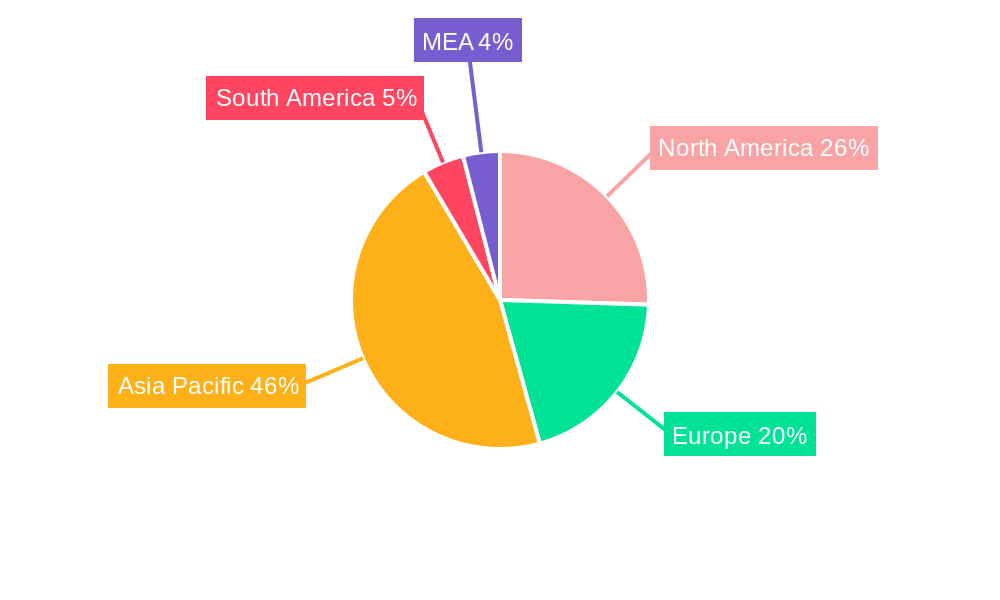

Geographically, Asia Pacific stands out as the dominant region, projected to command an estimated xx% of the global market in 2025. This supremacy is attributed to the concentration of major semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan. Favorable government policies promoting domestic semiconductor production, substantial investments in R&D, and the presence of leading foundries and IDMs are key drivers of this regional dominance. China, in particular, is experiencing rapid growth due to its ambitious plans to achieve semiconductor self-sufficiency, leading to significant capital expenditure on wafer fabrication facilities and, consequently, on polishing and grinding equipment. South Korea and Taiwan continue to lead in advanced node manufacturing, driving the demand for the most sophisticated wafer processing solutions. The North American region, while smaller in market share at xx%, exhibits strong growth due to its advanced research capabilities and a growing number of fabless semiconductor companies. Europe, with xx% market share, is also witnessing increased investment in its semiconductor ecosystem, particularly in areas like power semiconductors and automotive electronics.

- Dominant Application: Semiconductor wafers (estimated xx% market share in 2025).

- Leading Product Type: Polishing machines (estimated xx% market share in 2025).

- Dominant Region: Asia Pacific (estimated xx% market share in 2025).

- Key Countries (Asia Pacific): Taiwan, South Korea, China, Japan.

- Growth Drivers in Asia Pacific: Government incentives, established manufacturing base, increasing foundry capacity.

- North America: Strong R&D, fabless company growth, growing domestic manufacturing initiatives.

- Europe: Focus on power semiconductors, automotive electronics, and efforts to bolster regional supply chains.

Semiconductor Wafer Polishing and Grinding Equipment Market Product Landscape

The Semiconductor Wafer Polishing and Grinding Equipment Market is characterized by continuous product innovation focused on enhancing precision, throughput, and defect reduction. Leading manufacturers are introducing advanced polishing machines capable of achieving sub-nanometer surface roughness and planarity, critical for next-generation integrated circuits. Innovations in grinding machines include multi-spindle configurations and advanced control systems for precise wafer thinning and backside grinding, enabling thinner and more robust wafers for advanced packaging. Equipment for other applications encompasses metrology tools for real-time process monitoring and advanced cleaning systems to ensure particulate-free wafers. These advancements are driven by the industry's relentless pursuit of higher yields and superior device performance. The unique selling propositions of modern equipment lie in their ability to handle increasingly complex wafer architectures and materials, such as GaN and SiC, with unparalleled accuracy.

Key Drivers, Barriers & Challenges in Semiconductor Wafer Polishing and Grinding Equipment Market

Key Drivers: The Semiconductor Wafer Polishing and Grinding Equipment Market is propelled by several critical drivers. The relentless miniaturization of semiconductor nodes, demanding extreme precision in wafer preparation, is a primary catalyst. The burgeoning demand for AI-powered devices, 5G technology, and the Internet of Things (IoT) fuels the need for more advanced and higher-volume semiconductor manufacturing. Government initiatives worldwide to bolster domestic semiconductor production and supply chain resilience further stimulate investment in wafer processing equipment. Technological advancements in CMP slurries and polishing pads are also crucial enablers, improving surface quality and reducing defects.

Key Barriers & Challenges: Despite robust growth, the market faces significant barriers and challenges. The high capital expenditure required for advanced wafer polishing and grinding equipment can be a substantial hurdle for smaller players. Supply chain disruptions, particularly for critical raw materials and components, pose a persistent threat to production timelines and costs. Stringent quality control requirements and the increasing complexity of defect detection add to operational challenges. Furthermore, the market is subject to intense competitive pressure, necessitating continuous innovation to maintain market share. The long lead times for equipment development and qualification can also slow down the adoption of new technologies. The fluctuating global economic conditions and geopolitical uncertainties can impact capital investment decisions by semiconductor manufacturers.

Emerging Opportunities in Semiconductor Wafer Polishing and Grinding Equipment Market

Emerging opportunities within the Semiconductor Wafer Polishing and Grinding Equipment Market are significant. The growing adoption of advanced packaging technologies, such as 3D stacking and fan-out wafer-level packaging, creates a demand for specialized polishing and grinding solutions. The expansion of the Solar cells application, particularly for high-efficiency photovoltaic technologies, presents a new growth avenue. Furthermore, the development of novel wafer materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) for power electronics and high-frequency applications requires dedicated and highly precise wafer processing equipment. Untapped markets in emerging economies looking to establish or expand their semiconductor manufacturing capabilities also offer substantial potential. The increasing focus on sustainability is driving demand for eco-friendly polishing and grinding processes and equipment.

Growth Accelerators in the Semiconductor Wafer Polishing and Grinding Equipment Market Industry

Several catalysts are accelerating the long-term growth of the Semiconductor Wafer Polishing and Grinding Equipment Market. Technological breakthroughs in areas like atomic-level polishing and sub-micron grinding are continuously pushing the boundaries of wafer quality. Strategic partnerships between equipment manufacturers, material suppliers, and semiconductor fabs foster collaborative innovation and expedite the adoption of new technologies. The ongoing trend of semiconductor industry reshoring and diversification of supply chains in various regions is leading to significant capital investments in new fabrication facilities, thereby boosting demand for processing equipment. Market expansion strategies, including focusing on emerging applications and regional growth opportunities, are also key accelerators.

Key Players Shaping the Semiconductor Wafer Polishing and Grinding Equipment Market Market

- Disco Corporation

- Logomatic GmbH

- Ebara Corporation

- Applied Materials Inc.

- Entrepix Inc.

- Tokyo Seimitsu Co Ltd (Accretech Create Corp)

- Logitech Ltd.

- Okamoto Corporation

- Revasum Inc.

- Lapmaster Wolters GmbH

- Komatsu NTC Ltd.

Notable Milestones in Semiconductor Wafer Polishing and Grinding Equipment Market Sector

- December 2022: JTEKT demonstrated a new double-disc horizontal grinder, DXSG320, capable of simultaneously grinding both sides of silicon wafers to a tolerance of +/- 1 micron from the as-sliced condition. This innovation represents a significant leap in accuracy and productivity compared to traditional single-spindle vertical grinders used in the chip industry.

- March 2022: DISCO Corporation announced the opening of its Haneda R&D Center in Higashikojiya, Ota-ku, Tokyo. This strategic expansion aims to strengthen the company's research and development capabilities and support the anticipated high demand in the semiconductor and electronic components markets in the future.

In-Depth Semiconductor Wafer Polishing and Grinding Equipment Market Market Outlook

The Semiconductor Wafer Polishing and Grinding Equipment Market is set for a trajectory of sustained expansion, underpinned by a confluence of technological advancements and market demands. Growth accelerators such as the relentless pursuit of advanced node technologies, the burgeoning demand for specialized semiconductors in AI and 5G, and strategic governmental investments in semiconductor manufacturing infrastructure will continue to fuel market growth. The increasing adoption of advanced packaging techniques and the diversification into new wafer materials like SiC and GaN present significant opportunities for innovation and market penetration. Strategic partnerships and the ongoing trend of supply chain diversification will further bolster market resilience and growth prospects. The market's future outlook is exceptionally positive, promising robust opportunities for stakeholders to capitalize on the evolving needs of the global semiconductor industry.

Semiconductor Wafer Polishing and Grinding Equipment Market Segmentation

-

1. Product type

-

1.1. Polishing machines

-

1.1.1. Grinding machines

- 1.1.1.1. Other equipment

-

1.1.1. Grinding machines

-

1.1. Polishing machines

-

2. Application

-

2.1. Semiconductor wafers

-

2.1.1. Solar cells

- 2.1.1.1. Other applications

-

2.1.1. Solar cells

-

2.1. Semiconductor wafers

Semiconductor Wafer Polishing and Grinding Equipment Market Segmentation By Geography

- 1. North America: United States Canada Mexico

- 2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 3. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 4. South America : Brazil, Argentina, Rest of South America

- 5. MEA: Middle East, Africa

Semiconductor Wafer Polishing and Grinding Equipment Market Regional Market Share

Geographic Coverage of Semiconductor Wafer Polishing and Grinding Equipment Market

Semiconductor Wafer Polishing and Grinding Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Consumer Electronics; Increasing Need for Miniaturization of Semiconductors

- 3.3. Market Restrains

- 3.3.1. ; Complexity Regarding Manufacturing

- 3.4. Market Trends

- 3.4.1. Growing Consumption of Consumer Electronics is Expected to Positively Impact the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Wafer Polishing and Grinding Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Polishing machines

- 5.1.1.1. Grinding machines

- 5.1.1.1.1. Other equipment

- 5.1.1.1. Grinding machines

- 5.1.1. Polishing machines

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Semiconductor wafers

- 5.2.1.1. Solar cells

- 5.2.1.1.1. Other applications

- 5.2.1.1. Solar cells

- 5.2.1. Semiconductor wafers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America: United States Canada Mexico

- 5.3.2. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe

- 5.3.3. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific

- 5.3.4. South America : Brazil, Argentina, Rest of South America

- 5.3.5. MEA: Middle East, Africa

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Polishing machines

- 6.1.1.1. Grinding machines

- 6.1.1.1.1. Other equipment

- 6.1.1.1. Grinding machines

- 6.1.1. Polishing machines

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Semiconductor wafers

- 6.2.1.1. Solar cells

- 6.2.1.1.1. Other applications

- 6.2.1.1. Solar cells

- 6.2.1. Semiconductor wafers

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Polishing machines

- 7.1.1.1. Grinding machines

- 7.1.1.1.1. Other equipment

- 7.1.1.1. Grinding machines

- 7.1.1. Polishing machines

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Semiconductor wafers

- 7.2.1.1. Solar cells

- 7.2.1.1.1. Other applications

- 7.2.1.1. Solar cells

- 7.2.1. Semiconductor wafers

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Polishing machines

- 8.1.1.1. Grinding machines

- 8.1.1.1.1. Other equipment

- 8.1.1.1. Grinding machines

- 8.1.1. Polishing machines

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Semiconductor wafers

- 8.2.1.1. Solar cells

- 8.2.1.1.1. Other applications

- 8.2.1.1. Solar cells

- 8.2.1. Semiconductor wafers

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Polishing machines

- 9.1.1.1. Grinding machines

- 9.1.1.1.1. Other equipment

- 9.1.1.1. Grinding machines

- 9.1.1. Polishing machines

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Semiconductor wafers

- 9.2.1.1. Solar cells

- 9.2.1.1.1. Other applications

- 9.2.1.1. Solar cells

- 9.2.1. Semiconductor wafers

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 10.1.1. Polishing machines

- 10.1.1.1. Grinding machines

- 10.1.1.1.1. Other equipment

- 10.1.1.1. Grinding machines

- 10.1.1. Polishing machines

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Semiconductor wafers

- 10.2.1.1. Solar cells

- 10.2.1.1.1. Other applications

- 10.2.1.1. Solar cells

- 10.2.1. Semiconductor wafers

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Disco Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Logomatic GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ebara Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Applied Materials Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Entrepix Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tokyo Seimitsu Co Ltd (Accretech Create Corp )

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Logitech Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Okamoto Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Revasum Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lapmaster Wolters GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Komatsu NTC Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Disco Corporation

List of Figures

- Figure 1: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Product type 2025 & 2033

- Figure 4: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Product type 2025 & 2033

- Figure 5: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Product type 2025 & 2033

- Figure 6: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Product type 2025 & 2033

- Figure 7: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Application 2025 & 2033

- Figure 8: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America: United States Canada Mexico Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Product type 2025 & 2033

- Figure 16: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Product type 2025 & 2033

- Figure 17: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Product type 2025 & 2033

- Figure 18: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Product type 2025 & 2033

- Figure 19: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Application 2025 & 2033

- Figure 20: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe: Germany: France: Italy: United Kingdom Netherlands Rest of Europe Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Product type 2025 & 2033

- Figure 28: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Product type 2025 & 2033

- Figure 29: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Product type 2025 & 2033

- Figure 30: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Product type 2025 & 2033

- Figure 31: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Application 2025 & 2033

- Figure 32: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Application 2025 & 2033

- Figure 33: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific: China, Japan, India, South Korea, Taiwan, Australia, Rest of Asia-Pacific Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Product type 2025 & 2033

- Figure 40: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Product type 2025 & 2033

- Figure 41: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Product type 2025 & 2033

- Figure 42: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Product type 2025 & 2033

- Figure 43: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Application 2025 & 2033

- Figure 44: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America : Brazil, Argentina, Rest of South America Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Product type 2025 & 2033

- Figure 52: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Product type 2025 & 2033

- Figure 53: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Product type 2025 & 2033

- Figure 54: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Product type 2025 & 2033

- Figure 55: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Application 2025 & 2033

- Figure 56: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Application 2025 & 2033

- Figure 57: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Application 2025 & 2033

- Figure 59: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 60: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: MEA: Middle East, Africa Semiconductor Wafer Polishing and Grinding Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 2: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Product type 2020 & 2033

- Table 3: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 8: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Product type 2020 & 2033

- Table 9: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 14: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Product type 2020 & 2033

- Table 15: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 20: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Product type 2020 & 2033

- Table 21: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 26: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Product type 2020 & 2033

- Table 27: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Product type 2020 & 2033

- Table 32: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Product type 2020 & 2033

- Table 33: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Global Semiconductor Wafer Polishing and Grinding Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Semiconductor Wafer Polishing and Grinding Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Wafer Polishing and Grinding Equipment Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Semiconductor Wafer Polishing and Grinding Equipment Market?

Key companies in the market include Disco Corporation, Logomatic GmbH, Ebara Corporation, Applied Materials Inc, Entrepix Inc, Tokyo Seimitsu Co Ltd (Accretech Create Corp ), Logitech Ltd, Okamoto Corporatio, Revasum Inc, Lapmaster Wolters GmbH, Komatsu NTC Ltd.

3. What are the main segments of the Semiconductor Wafer Polishing and Grinding Equipment Market?

The market segments include Product type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Consumer Electronics; Increasing Need for Miniaturization of Semiconductors.

6. What are the notable trends driving market growth?

Growing Consumption of Consumer Electronics is Expected to Positively Impact the Market.

7. Are there any restraints impacting market growth?

; Complexity Regarding Manufacturing.

8. Can you provide examples of recent developments in the market?

December 2022 - JTEKT demonstrated a new double-disc horizontal grinder, DXSG320, that can simultaneously grind both sides of silicon wafers to +/- 1 micron from as-sliced condition. The performance of the new grinder represents a significant improvement in accuracy and productivity over the single-spindle vertical grinders common in the chip industry today.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Wafer Polishing and Grinding Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Wafer Polishing and Grinding Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Wafer Polishing and Grinding Equipment Market?

To stay informed about further developments, trends, and reports in the Semiconductor Wafer Polishing and Grinding Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence