Key Insights

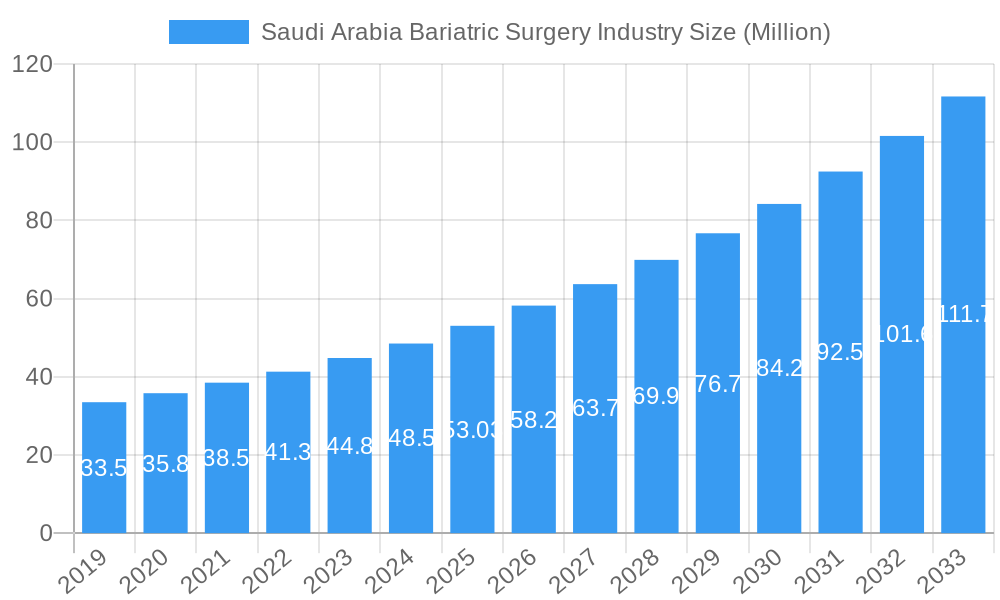

The Saudi Arabia Bariatric Surgery Industry is poised for substantial growth, driven by increasing prevalence of obesity and related comorbidities, alongside a growing awareness of bariatric surgery as an effective weight management solution. The market is estimated to have reached USD 53.03 million in 2024, with a projected Compound Annual Growth Rate (CAGR) of 10.3% over the forecast period of 2025-2033. This robust expansion is fueled by government initiatives promoting healthier lifestyles, significant investments in healthcare infrastructure, and the adoption of advanced surgical technologies. Key growth drivers include the rising incidence of type 2 diabetes, cardiovascular diseases, and sleep apnea, all strongly linked to obesity, which are compelling individuals to seek surgical interventions. Furthermore, a growing acceptance and demand for less invasive procedures, such as laparoscopic bariatric surgeries, are significantly contributing to market expansion.

Saudi Arabia Bariatric Surgery Industry Market Size (In Million)

The market is segmented into Assisting Devices, Implantable Devices, and Other Devices, with Assisting Devices, including suturing devices, closure devices, and stapling devices, expected to hold a dominant share due to their critical role in minimally invasive bariatric procedures. Leading global players like Medtronic PLC, Johnson and Johnson, and Intuitive Surgical Inc. are actively participating in the Saudi Arabian market, introducing innovative products and contributing to the overall development of bariatric surgery services. The focus on improving patient outcomes, reducing recovery times, and enhancing the precision of surgical procedures through technological advancements will continue to shape market dynamics. As the region prioritizes public health and well-being, the bariatric surgery market in Saudi Arabia is set to witness sustained and significant upward momentum, reflecting a commitment to tackling the obesity epidemic.

Saudi Arabia Bariatric Surgery Industry Company Market Share

Saudi Arabia Bariatric Surgery Industry Report: Market Dynamics, Trends, and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia bariatric surgery industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. It offers critical insights for stakeholders, including medical device manufacturers, healthcare providers, investors, and policymakers, to navigate this rapidly evolving market. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033.

Saudi Arabia Bariatric Surgery Industry Market Dynamics & Structure

The Saudi Arabia bariatric surgery market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and changing end-user demographics. Market concentration is moderately fragmented, with key players investing heavily in research and development to introduce advanced surgical techniques and devices. Technological innovation is primarily driven by advancements in minimally invasive surgery, robotics, and artificial intelligence, aiming to improve patient outcomes and reduce recovery times. The regulatory landscape is supportive, with government initiatives focused on improving healthcare access and quality. Competitive product substitutes include non-surgical weight loss programs and pharmacological interventions, though their long-term efficacy is often debated compared to surgical solutions. End-user demographics are shifting, with a growing prevalence of obesity-related comorbidities driving demand for bariatric procedures. Mergers and acquisitions (M&A) trends are nascent but indicate a growing interest from larger healthcare conglomerates seeking to expand their presence in this lucrative sector.

- Market Concentration: Moderately fragmented with key players focusing on innovation and market penetration.

- Technological Innovation Drivers: Minimally invasive surgery, robotic assistance, AI-powered diagnostics, advanced imaging technologies.

- Regulatory Frameworks: Supportive government policies promoting healthcare access and quality, with a growing emphasis on patient safety and reimbursement.

- Competitive Product Substitutes: Non-surgical weight management programs, diet plans, exercise regimes, and pharmacotherapy.

- End-User Demographics: Increasing prevalence of obesity and related chronic diseases (diabetes, hypertension), a younger demographic experiencing these issues, and a growing awareness of bariatric surgery as a viable solution.

- M&A Trends: Emerging trend, with strategic acquisitions to gain market share and access advanced technologies. For example, the sale of a 51% equity stake in New You Medical Center, a prominent bariatric surgery center, highlights investor interest.

Saudi Arabia Bariatric Surgery Industry Growth Trends & Insights

The Saudi Arabia bariatric surgery industry is poised for significant expansion, driven by a confluence of factors including rising obesity rates, increased healthcare expenditure, and favorable government initiatives. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12-15% over the forecast period (2025-2033), reaching an estimated market value of $XXX million in 2033 from $XXX million in 2025. Adoption rates of bariatric procedures are steadily increasing, fueled by greater public awareness and improved accessibility. Technological disruptions, such as the widespread adoption of laparoscopic and robotic-assisted surgeries, are transforming the surgical landscape, offering less invasive options with shorter recovery periods. Consumer behavior shifts are evident, with a growing preference for evidence-based, long-term weight management solutions, positioning bariatric surgery as a preferred choice for many. The increasing demand for advanced implantable devices and assisting devices, such as staplers and suturing devices, further contributes to market growth. The integration of bariatric surgery coverage within national health insurance schemes, as announced in October 2022, is a pivotal development expected to accelerate market penetration, particularly among the wider population. The investment in specialized medical centers and the focus on patient education are also crucial elements driving the market forward.

Dominant Regions, Countries, or Segments in Saudi Arabia Bariatric Surgery Industry

The Device Segment, specifically Assisting Devices, is anticipated to be the dominant force driving growth within the Saudi Arabia bariatric surgery industry. Within this segment, Stapling Devices and Suturing Devices are expected to hold the largest market share due to their crucial role in various bariatric procedures, including gastric bypass and sleeve gastrectomy. The Implantable Devices segment, encompassing gastric balloons and adjustable gastric bands, will also exhibit significant growth as minimally invasive options gain traction. The dominance of the Assisting Devices segment is attributed to several key drivers. Firstly, the increasing number of bariatric surgeries being performed necessitates a consistent and growing demand for these essential surgical instruments. Secondly, continuous technological advancements in these devices, leading to improved precision, safety, and ease of use, are further bolstering their adoption. For instance, the development of advanced stapling systems with enhanced safety features and real-time feedback mechanisms is highly attractive to surgeons.

- Assisting Devices: Expected to be the largest and fastest-growing segment, driven by the high volume of bariatric procedures.

- Stapling Devices: Integral to creating stomach pouches and rejoining digestive tracts, crucial for procedures like gastric bypass and sleeve gastrectomy.

- Suturing Devices: Essential for precise tissue closure and anastomosis, improving surgical outcomes.

- Closure Devices: Used for sealing surgical incisions, contributing to faster healing and reduced infection risk.

- Other Assisting Devices: Includes instruments like graspers, dissectors, and energy devices that aid in surgical execution.

- Implantable Devices: Growing demand for less invasive solutions like gastric balloons and adjustable gastric bands, offering reversible weight loss options.

- Other Devices: Encompasses a range of specialized equipment and consumables used in bariatric surgery.

Saudi Arabia Bariatric Surgery Industry Product Landscape

The product landscape in the Saudi Arabia bariatric surgery industry is characterized by a continuous stream of innovations aimed at enhancing procedural efficiency and patient safety. Key product developments include advanced laparoscopic staplers with improved articulation and firing mechanisms, intelligent suturing devices offering greater precision and knot security, and biocompatible closure devices that promote faster wound healing. Furthermore, there is a growing focus on single-use devices to minimize the risk of cross-contamination and improve workflow in operating rooms. The application of these products spans a wide range of bariatric procedures, from sleeve gastrectomy and gastric bypass to duodenal switch. Performance metrics are increasingly scrutinized, with manufacturers emphasizing reduced complication rates, shorter operative times, and improved patient comfort as key selling propositions. The integration of digital technologies into surgical devices, such as smart instruments with integrated sensors, is also an emerging trend.

Key Drivers, Barriers & Challenges in Saudi Arabia Bariatric Surgery Industry

Key Drivers:

- Rising Obesity Prevalence: The alarming increase in obesity rates across Saudi Arabia is the primary driver, creating a substantial patient pool seeking effective weight loss solutions.

- Increased Healthcare Spending: The Saudi government's commitment to improving healthcare infrastructure and services fuels investment in advanced medical technologies and procedures, including bariatric surgery.

- Technological Advancements: Innovations in minimally invasive surgical techniques, robotic surgery, and advanced device technology are making procedures safer, more effective, and less burdensome for patients.

- Government Initiatives & Insurance Coverage: The inclusion of bariatric surgery under health insurance, effective October 2022, significantly enhances accessibility and affordability for a broader segment of the population.

- Growing Awareness and Acceptance: Increased patient education and successful case studies are leading to greater public awareness and acceptance of bariatric surgery as a viable and life-changing treatment option.

Barriers & Challenges:

- High Cost of Procedures: Despite insurance coverage, the overall cost of bariatric surgery and associated devices can still be a barrier for some individuals.

- Limited Skilled Surgeons: A shortage of highly specialized and experienced bariatric surgeons can lead to longer waiting times and geographical disparities in access.

- Post-Operative Complications and Management: Although improving, the risk of complications and the need for long-term lifestyle changes and medical follow-up can deter some patients.

- Reimbursement Policies and Gaps: While expanding, nuances in reimbursement policies and potential gaps in coverage for specific procedures or devices can still pose challenges for providers and patients.

- Patient Adherence to Lifestyle Changes: Long-term success hinges on patient adherence to diet, exercise, and follow-up care, which can be challenging for some individuals, leading to suboptimal outcomes.

Emerging Opportunities in Saudi Arabia Bariatric Surgery Industry

Emerging opportunities in the Saudi Arabia bariatric surgery industry lie in the development of more personalized and less invasive surgical approaches, catering to the growing demand for patient-specific treatments. The untapped potential in rural and underserved areas presents a significant opportunity for expanding access through mobile surgical units or telemedicine-assisted consultations. Furthermore, the integration of digital health solutions, such as AI-powered patient monitoring platforms and virtual reality-based pre-operative training, offers a pathway for improved patient engagement and outcomes. The increasing focus on preventative care and early intervention for obesity also opens avenues for innovative bariatric solutions targeting younger demographics. Collaborations between medical device manufacturers and healthcare providers to develop integrated care pathways, encompassing pre-operative assessment, surgical intervention, and long-term follow-up, represent another lucrative opportunity.

Growth Accelerators in the Saudi Arabia Bariatric Surgery Industry Industry

Several catalysts are accelerating the growth of the Saudi Arabia bariatric surgery industry. Technological breakthroughs, particularly in robotics and AI, are making surgeries safer and more precise, driving adoption. Strategic partnerships between medical device companies, hospitals, and research institutions are fostering innovation and facilitating the rapid introduction of new products and techniques. Market expansion strategies, including increased investment in specialized bariatric centers and robust patient education campaigns, are broadening the reach of these services. The proactive stance of the Saudi government in promoting advanced healthcare solutions and integrating them into the national healthcare system, along with favorable reimbursement policies, acts as a significant growth accelerator. The increasing disposable income and a growing health-conscious population further contribute to sustained market expansion.

Key Players Shaping the Saudi Arabia Bariatric Surgery Industry Market

- Medtronic PLC

- Johnson and Johnson

- Apollo Endosurgery Inc

- Coopersurgical Inc

- Intuitive Surgical Inc

- Conmed Corporation

- B Braun SE

- Olympus Corporation

Notable Milestones in Saudi Arabia Bariatric Surgery Industry Sector

- October 2022: Saudi health insurance began including bariatric surgery coverage, following an announcement by the Council of Health Insurance and the Executive Director for Empowerment and Oversight. This marked a significant step towards improving accessibility and affordability of bariatric procedures.

- March 2022: Baker McKenzie provided advisory services to Tibbiyah Healthcare Holding Company regarding the sale of a 51% equity stake in New You Medical Center. This transaction highlighted the growing investor interest and consolidation within the Saudi bariatric surgery market, recognizing the potential of specialized healthcare facilities.

In-Depth Saudi Arabia Bariatric Surgery Industry Market Outlook

The future outlook for the Saudi Arabia bariatric surgery industry is exceptionally promising, propelled by sustained growth accelerators. The increasing integration of advanced robotic-assisted surgical systems will continue to enhance procedural precision and patient recovery. Strategic collaborations between domestic and international medical device manufacturers are expected to drive localized innovation and manufacturing capabilities. The market is poised for significant expansion as healthcare providers focus on creating comprehensive, multidisciplinary bariatric care programs, offering end-to-end solutions from diagnosis to long-term post-operative management. The ongoing shift towards preventive healthcare and personalized medicine will further fuel demand for tailored bariatric interventions. With a strong commitment from the government and a growing patient demand, the Saudi Arabia bariatric surgery market is set for robust and sustained growth in the coming years.

Saudi Arabia Bariatric Surgery Industry Segmentation

-

1. Device

-

1.1. Assisting Devices

- 1.1.1. Suturing Device

- 1.1.2. Closure Device

- 1.1.3. Stapling Device

- 1.1.4. Other Assisting Devices

- 1.2. Implantable Devices

- 1.3. Other Devices

-

1.1. Assisting Devices

Saudi Arabia Bariatric Surgery Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Bariatric Surgery Industry Regional Market Share

Geographic Coverage of Saudi Arabia Bariatric Surgery Industry

Saudi Arabia Bariatric Surgery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Obesity; Increasing Prevalence Rate of Type 2 Diabetes and Heart Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of Surgery and Lack of Knowledge and Awareness

- 3.4. Market Trends

- 3.4.1. Implantable Devices is Expected to Record a Significant CAGR in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Assisting Devices

- 5.1.1.1. Suturing Device

- 5.1.1.2. Closure Device

- 5.1.1.3. Stapling Device

- 5.1.1.4. Other Assisting Devices

- 5.1.2. Implantable Devices

- 5.1.3. Other Devices

- 5.1.1. Assisting Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Medtronic PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson and Johnson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Apollo Endosurgery Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Coopersurgical Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Intuitive Surgical Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Conmed Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 B Braun SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Olympus Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Medtronic PLC

List of Figures

- Figure 1: Saudi Arabia Bariatric Surgery Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Bariatric Surgery Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Bariatric Surgery Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 2: Saudi Arabia Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 3: Saudi Arabia Bariatric Surgery Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Bariatric Surgery Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Bariatric Surgery Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 6: Saudi Arabia Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 7: Saudi Arabia Bariatric Surgery Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Bariatric Surgery Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Bariatric Surgery Industry?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the Saudi Arabia Bariatric Surgery Industry?

Key companies in the market include Medtronic PLC, Johnson and Johnson, Apollo Endosurgery Inc, Coopersurgical Inc , Intuitive Surgical Inc, Conmed Corporation, B Braun SE, Olympus Corporation.

3. What are the main segments of the Saudi Arabia Bariatric Surgery Industry?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Obesity; Increasing Prevalence Rate of Type 2 Diabetes and Heart Diseases.

6. What are the notable trends driving market growth?

Implantable Devices is Expected to Record a Significant CAGR in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Surgery and Lack of Knowledge and Awareness.

8. Can you provide examples of recent developments in the market?

September 2022: The Council of Health Insurance and the Executive Director for Empowerment and Oversight announced that Saudi health insurance would include bariatric surgery coverage starting from October 1, 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Bariatric Surgery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Bariatric Surgery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Bariatric Surgery Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Bariatric Surgery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence