Key Insights

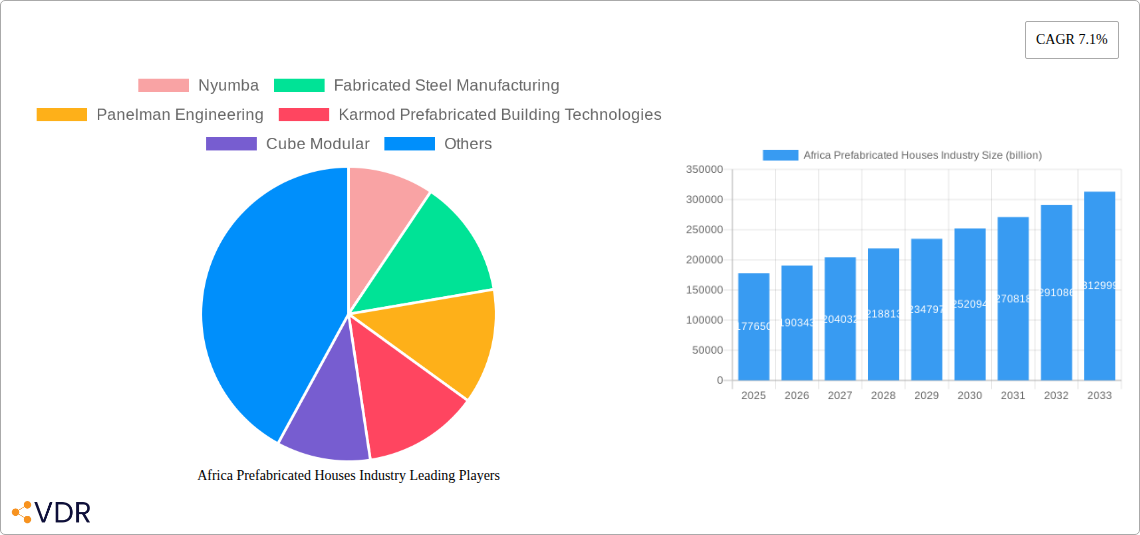

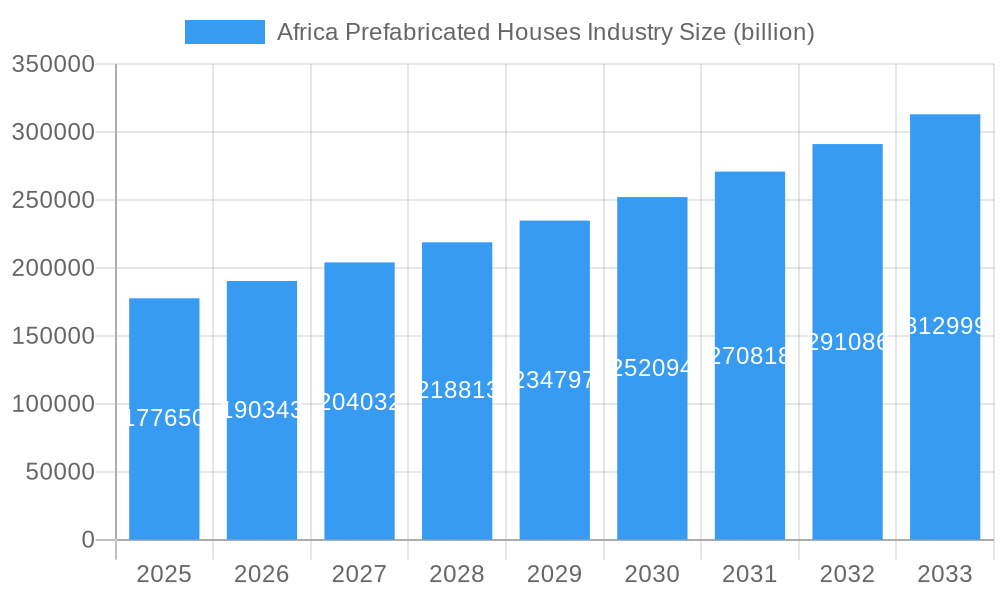

The African Prefabricated Houses Industry is poised for significant expansion, projected to reach an estimated $177.65 billion in 2025. This robust growth is driven by a confluence of factors including increasing urbanization, a growing demand for affordable and sustainable housing solutions, and government initiatives promoting infrastructure development across the continent. The sector is expected to witness a healthy Compound Annual Growth Rate (CAGR) of 7.1% throughout the forecast period of 2025-2033, underscoring its strong upward trajectory. The primary demand for prefabricated housing stems from the Single Family segment, reflecting the burgeoning middle class and individual homeownership aspirations, closely followed by the Multi-Family segment, catering to the rising need for dense urban housing solutions. Key players like Nyumba, Fabricated Steel Manufacturing, and Panelman Engineering are actively shaping the market with innovative solutions and expanded production capacities.

Africa Prefabricated Houses Industry Market Size (In Billion)

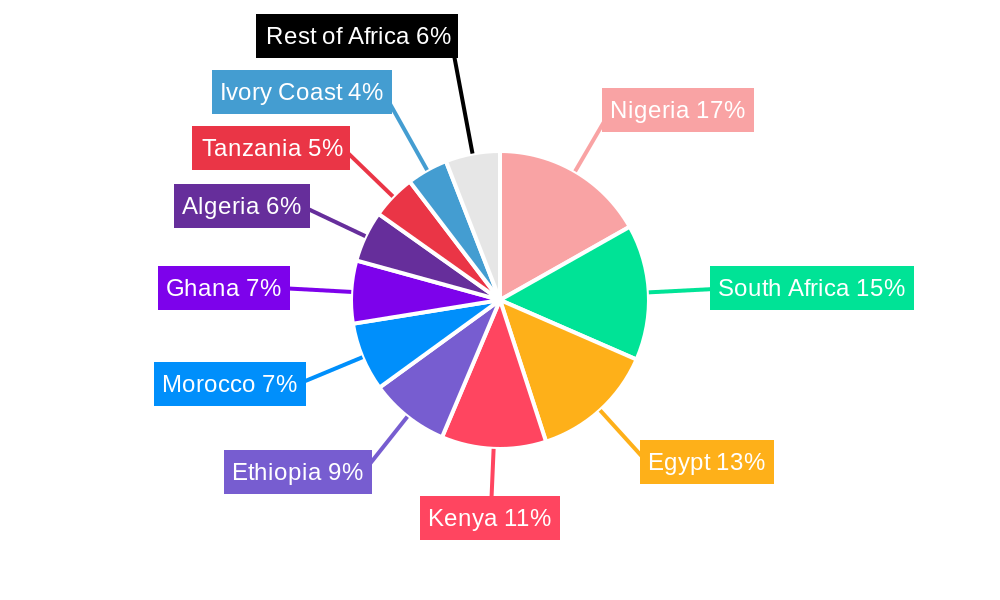

The growth trajectory of the African prefabricated housing market is further bolstered by emerging trends such as the adoption of advanced building materials, a focus on eco-friendly construction practices, and the integration of smart home technologies into prefabricated units. These advancements are not only enhancing the appeal and functionality of prefabricated homes but also addressing environmental concerns. However, the market faces certain restraints, including logistical challenges in transporting prefabricated modules to remote areas, the need for skilled labor in installation and finishing, and prevailing perceptions regarding the durability and aesthetic appeal of prefabricated structures compared to traditional construction. Despite these hurdles, continued investment in infrastructure, supportive government policies, and a growing awareness of the cost and time efficiencies offered by prefabricated construction are expected to propel the market forward. The African market, with a strong focus on key regions like Nigeria, South Africa, and Egypt, is well-positioned to capitalize on this burgeoning demand for modern, efficient, and accessible housing.

Africa Prefabricated Houses Industry Company Market Share

Africa Prefabricated Houses Industry: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a detailed analysis of the burgeoning Africa Prefabricated Houses Industry, offering a 15-year outlook from 2019 to 2033. The study encompasses market size, growth trends, key drivers, challenges, and a comprehensive competitive landscape. It delves into both parent and child market dynamics, leveraging high-traffic keywords to maximize search engine visibility and engage industry professionals, developers, investors, and policymakers. The report quantifies market evolution, adoption rates, and technological disruptions, delivering actionable insights for strategic decision-making.

Africa Prefabricated Houses Industry Market Dynamics & Structure

The Africa Prefabricated Houses Industry is characterized by a moderately concentrated market, with a growing number of innovative players entering the space. Technological innovation is a primary driver, fueled by advancements in materials science, digital design, and on-site assembly techniques. Regulatory frameworks are evolving, with governments increasingly recognizing the potential of prefab construction to address housing deficits and promote sustainable development. Competitive product substitutes include traditional construction methods, but the cost-effectiveness and speed of prefab are gaining traction. End-user demographics are diverse, ranging from individuals seeking affordable housing solutions to large-scale developers and government agencies. Mergers and acquisitions (M&A) trends are on the rise as established companies seek to expand their capabilities and market reach.

- Market Concentration: Moderate, with increasing fragmentation due to new entrants.

- Technological Innovation: Driven by material science (e.g., advanced composites), modular design software, and automation in manufacturing.

- Regulatory Frameworks: Developing, with a focus on building codes, standardization, and incentives for green construction.

- Competitive Product Substitutes: Traditional brick-and-mortar construction, container homes, and other modular building systems.

- End-User Demographics: First-time homebuyers, real estate developers, government housing initiatives, disaster relief organizations, and educational institutions.

- M&A Trends: Increasing, focused on acquiring innovative technologies and expanding regional presence.

Africa Prefabricated Houses Industry Growth Trends & Insights

The Africa Prefabricated Houses Industry is poised for significant expansion, driven by an escalating demand for affordable and rapid housing solutions across the continent. The market size is projected to witness robust growth, with adoption rates accelerating as awareness and acceptance of prefabricated construction increase. Technological disruptions, such as the integration of AI in design and advanced manufacturing processes, are further enhancing efficiency and cost-effectiveness. Consumer behavior is shifting towards embracing modern, sustainable, and quicker housing alternatives. This evolving landscape is underscored by a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period. The penetration of prefabricated housing solutions is expected to rise from xx% in the base year to xx% by the end of the forecast period, reflecting a substantial market shift. The increasing urbanization across African cities is a critical factor, amplifying the need for scalable and efficient housing delivery. Furthermore, government initiatives aimed at reducing housing backlogs and promoting industrialization are providing a significant impetus for the prefab sector. The development of sustainable and eco-friendly prefab designs is also resonating with a growing segment of environmentally conscious consumers and developers.

Dominant Regions, Countries, or Segments in Africa Prefabricated Houses Industry

The Single Family segment is currently the dominant force driving growth within the Africa Prefabricated Houses Industry. This dominance is attributed to a confluence of factors, including increasing disposable incomes, a rising young population, and a growing desire for homeownership among individuals and families. The inherent affordability and quicker construction timelines associated with single-family prefabricated homes make them an attractive option for a broad spectrum of the population, especially in rapidly urbanizing areas.

Key drivers behind the growth of the Single Family segment include:

- Economic Policies: Government incentives for homeownership, mortgage subsidies, and tax breaks for first-time buyers are directly benefiting the demand for affordable single-family units.

- Infrastructure Development: Investments in urban and peri-urban infrastructure, such as roads and utilities, are making previously inaccessible land viable for residential development, further boosting demand for prefab single-family homes.

- Growing Middle Class: The expansion of the middle class across various African nations translates to increased purchasing power and a greater ability to invest in personal housing.

- Affordability and Speed: Prefabricated single-family homes offer a significant cost advantage and a dramatically reduced construction period compared to traditional methods, appealing to consumers who value both budget-friendliness and swift occupancy.

- Customization and Design Flexibility: While mass-produced, many prefab manufacturers offer a degree of customization, allowing homeowners to personalize their living spaces, which is a significant draw.

The growth potential for this segment remains exceptionally high, as the continent's demographic trajectory and ongoing urbanization continue to fuel a sustained demand for individual dwelling units. While the Multi-Family segment is also gaining traction, particularly for urban housing projects and student accommodations, the sheer volume of individual housing needs currently places the Single Family segment at the forefront of market expansion.

Africa Prefabricated Houses Industry Product Landscape

The Africa Prefabricated Houses Industry is witnessing a surge in product innovation, focusing on enhanced durability, energy efficiency, and aesthetic appeal. Key product innovations include advanced insulation materials, integrated smart home technologies, and modular designs that allow for seamless expansion. Applications are diversifying beyond residential housing to include schools, healthcare facilities, and temporary shelters. Performance metrics are improving, with prefab homes now offering comparable or superior structural integrity and thermal performance to traditional builds, often at a lower cost per square foot. Unique selling propositions revolve around speed of construction, sustainability certifications, and adaptability to diverse environmental conditions. Technological advancements in 3D printing and robotic assembly are also beginning to influence the manufacturing process, promising further improvements in precision and efficiency.

Key Drivers, Barriers & Challenges in Africa Prefabricated Houses Industry

Key Drivers:

- Rapid Urbanization: Growing city populations necessitate faster housing solutions.

- Housing Deficit: Significant unmet demand for affordable housing across the continent.

- Cost-Effectiveness: Prefabricated units often offer lower per-unit construction costs.

- Government Support: Increasing policy initiatives and incentives for affordable housing.

- Technological Advancements: Improved manufacturing processes and materials enhance quality and speed.

Barriers & Challenges:

- Supply Chain Volatility: Reliance on imported materials and logistics complexities can lead to delays and increased costs, potentially impacting xx% of project timelines.

- Regulatory Hurdles: Inconsistent building codes and slow approval processes in some regions can impede market penetration.

- Perception and Awareness: A lingering perception of prefab as temporary or low-quality housing in some markets.

- Skilled Labor Shortage: A need for trained personnel in both manufacturing and on-site assembly can constrain scalability, potentially affecting xx% of production capacity.

- Financing Accessibility: Limited access to affordable financing for both manufacturers and end-users can hinder widespread adoption.

Emerging Opportunities in Africa Prefabricated Houses Industry

Emerging opportunities in the Africa Prefabricated Houses Industry lie in catering to the burgeoning middle class seeking quality and affordability, and in addressing the critical need for affordable housing in densely populated urban centers. The development of sustainable and eco-friendly prefab solutions, incorporating renewable energy sources and advanced water management systems, presents a significant untapped market. Furthermore, the application of prefabricated modules for disaster relief housing and semi-permanent structures in remote or underdeveloped regions offers substantial growth potential. There is also a growing demand for flexible, modular office spaces and retail units, driven by the continent's entrepreneurial spirit. Innovative financing models tailored to low-income households are also crucial for unlocking broader market access.

Growth Accelerators in the Africa Prefabricated Houses Industry Industry

Long-term growth in the Africa Prefabricated Houses Industry will be significantly accelerated by breakthroughs in sustainable materials science, leading to greener and more cost-effective building solutions. Strategic partnerships between local manufacturers and international technology providers will foster knowledge transfer and enhance production capabilities, potentially boosting output by xx%. Market expansion strategies focused on underserved rural areas and the development of community housing projects will open new avenues for growth. The increasing adoption of digital technologies, including BIM (Building Information Modeling) and AI-driven design, will streamline the entire construction lifecycle, from planning to execution, and reduce project completion times by an estimated xx%. Furthermore, the establishment of regional manufacturing hubs will improve supply chain efficiency and reduce transportation costs, acting as a major catalyst for sustained expansion.

Key Players Shaping the Africa Prefabricated Houses Industry Market

- Nyumba

- Fabricated Steel Manufacturing

- Panelman Engineering

- Karmod Prefabricated Building Technologies

- Cube Modular

- Concretex

- Kwikspace Modular Buildings Ltd

- M Projects

- House-it Building

- Global Africa Prefabricated Building Solutions Ltd

Notable Milestones in Africa Prefabricated Houses Industry Sector

- May 2023: Amsterdam-based architecture firm NLE developed a new prefab housing structure and installed a model in Cape Verde to test the viability of floating houses, aiming to significantly reduce costs associated with land prices.

- January 2022: In response to housing challenges in Addis Ababa, Ethiopia, the City Administration initiated the construction of 5,000 prefabricated houses in Akaki Kaliti and announced plans for an additional 2 million houses over the next ten years.

In-Depth Africa Prefabricated Houses Industry Market Outlook

The Africa Prefabricated Houses Industry is set for a period of accelerated growth, driven by a confluence of demographic, economic, and technological factors. The increasing demand for affordable and rapidly deployable housing solutions, coupled with evolving consumer preferences for sustainable and modern living spaces, presents a substantial market opportunity. Investments in advanced manufacturing technologies and the development of resilient, eco-friendly materials will further enhance the industry's competitive edge. Strategic collaborations and government support for housing initiatives are expected to fuel market expansion, particularly in emerging economies. The focus on innovation in design and construction processes will not only address the continent's housing deficit but also contribute to sustainable urban development and improved living standards for millions.

Africa Prefabricated Houses Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Africa Prefabricated Houses Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Prefabricated Houses Industry Regional Market Share

Geographic Coverage of Africa Prefabricated Houses Industry

Africa Prefabricated Houses Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Shift Towards Prefab Housing due to High Pricing in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nyumba

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fabricated Steel Manufacturing

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panelman Engineering

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Karmod Prefabricated Building Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cube Modular

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Concretex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kwikspace Modular Buildings Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 M Projects**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 House-it Building

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Global Africa Prefabricated Building Solutions Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nyumba

List of Figures

- Figure 1: Africa Prefabricated Houses Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Prefabricated Houses Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Prefabricated Houses Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Africa Prefabricated Houses Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Africa Prefabricated Houses Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Africa Prefabricated Houses Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Nigeria Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: South Africa Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Egypt Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Kenya Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Ethiopia Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Morocco Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Ghana Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Algeria Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Tanzania Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ivory Coast Africa Prefabricated Houses Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Prefabricated Houses Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Africa Prefabricated Houses Industry?

Key companies in the market include Nyumba, Fabricated Steel Manufacturing, Panelman Engineering, Karmod Prefabricated Building Technologies, Cube Modular, Concretex, Kwikspace Modular Buildings Ltd, M Projects**List Not Exhaustive, House-it Building, Global Africa Prefabricated Building Solutions Ltd.

3. What are the main segments of the Africa Prefabricated Houses Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 177.65 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Shift Towards Prefab Housing due to High Pricing in Egypt.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

May 2023: A new prefab housing structure is under development by Amsterdam-based architecture firm NLE. They installed a model in Africa's Cape Verde to understand its viability's various aspects as floating houses. The idea is to reduce the overall cost emanating from land prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Prefabricated Houses Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Prefabricated Houses Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Prefabricated Houses Industry?

To stay informed about further developments, trends, and reports in the Africa Prefabricated Houses Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence