Key Insights

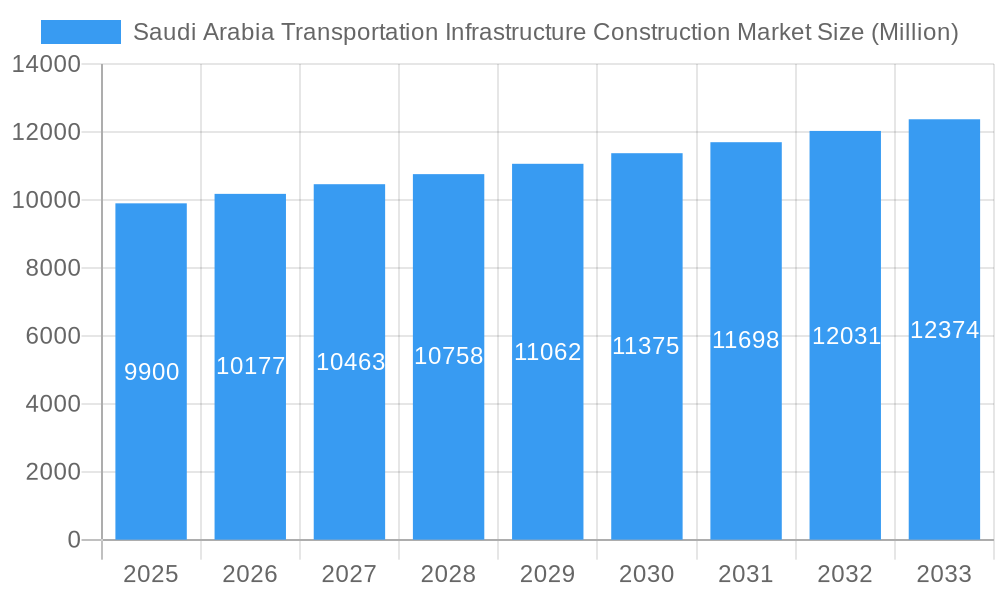

The Saudi Arabia Transportation Infrastructure Construction Market is poised for significant expansion, with an estimated market size of 9.90 Million for the year 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 2.77% projected over the forecast period of 2025-2033. The market's trajectory is primarily driven by ambitious government initiatives and substantial investments aimed at modernizing and expanding the nation's transportation network as part of Vision 2030. These initiatives include the development of new high-speed rail lines, the expansion and upgrading of existing road networks to improve connectivity, and significant investments in airport infrastructure to boost tourism and trade. Furthermore, the growing emphasis on diversifying the economy and reducing reliance on oil revenues naturally funnels capital into large-scale infrastructure projects, including those within the transportation sector. The increasing volume of trade and the need for efficient logistics to support growing industries also act as significant catalysts for this market.

Saudi Arabia Transportation Infrastructure Construction Market Market Size (In Billion)

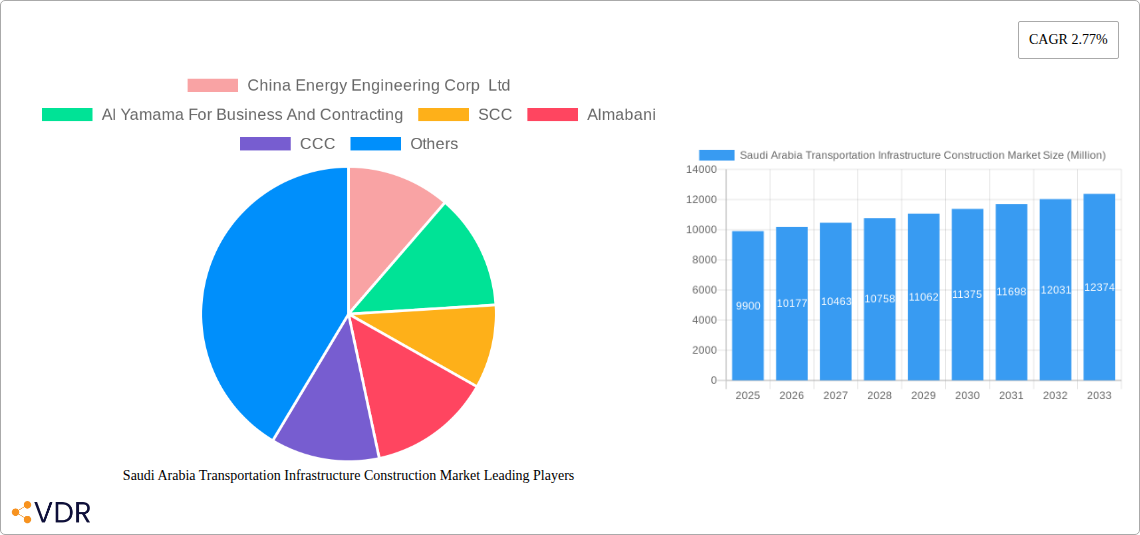

The competitive landscape features a mix of prominent global players and established local construction firms, all vying for a share in the lucrative Saudi Arabian market. Key segments within this sector include road construction, which remains a dominant force due to ongoing urban development and inter-city connectivity projects, followed by railways, airports, and waterways, each experiencing tailored growth based on specific development plans. While the market demonstrates strong growth potential, certain restraints such as the availability of skilled labor, environmental impact concerns, and the cyclical nature of large-scale construction projects can pose challenges. Nevertheless, the overarching drive towards a more connected and efficient Saudi Arabia, coupled with substantial financial backing for infrastructure development, paints a highly optimistic picture for the transportation infrastructure construction market in the coming years.

Saudi Arabia Transportation Infrastructure Construction Market Company Market Share

Saudi Arabia Transportation Infrastructure Construction Market Report Description

Unlock the vast potential of Saudi Arabia's burgeoning transportation infrastructure construction market with our comprehensive, SEO-optimized report. This in-depth analysis provides critical insights into market dynamics, growth trends, and investment opportunities, making it an indispensable resource for industry professionals, investors, and policymakers. We cover the entire spectrum, from parent markets like overall infrastructure development to child markets such as specific transportation modes, offering a granular view of this rapidly evolving sector.

Keywords: Saudi Arabia Transportation Infrastructure, Saudi Arabia Construction Market, Saudi Arabia Roads Construction, Saudi Arabia Railways Construction, Saudi Arabia Airports Construction, Saudi Arabia Waterways Construction, Saudi Arabia Infrastructure Development, Middle East Construction, GCC Infrastructure, Vision 2030 Construction, Transportation Projects Saudi Arabia, Infrastructure Investment Saudi Arabia, Road Networks Saudi Arabia, High-Speed Rail Saudi Arabia, Airport Expansion Saudi Arabia, Port Development Saudi Arabia, Mobility Solutions Saudi Arabia.

Saudi Arabia Transportation Infrastructure Construction Market Market Dynamics & Structure

The Saudi Arabian transportation infrastructure construction market is characterized by a moderate to high concentration, driven by significant government investment and large-scale project procurements. Key players are vying for substantial contracts, leading to strategic partnerships and occasional consolidations. Technological innovation is a crucial driver, with increasing adoption of Building Information Modeling (BIM), sustainable construction materials, and smart mobility solutions to enhance efficiency and environmental performance. Regulatory frameworks, largely guided by Saudi Vision 2030, are continuously evolving to attract foreign investment and streamline project approvals. Competitive product substitutes are less prevalent in terms of entire infrastructure projects, but advancements in construction techniques and materials offer performance-based alternatives. End-user demographics are diverse, encompassing a growing resident population, a surge in tourism, and significant industrial and logistical needs. Mergers & Acquisitions (M&A) trends are observed as companies seek to expand their capabilities, market reach, and secure their position in major projects.

- Market Concentration: Dominated by a mix of large international firms and established local contractors.

- Technological Innovation: Focus on digitalization, smart infrastructure, and sustainable building practices.

- Regulatory Frameworks: Aligned with Vision 2030 objectives for infrastructure modernization and economic diversification.

- End-User Demographics: Influenced by population growth, tourism initiatives, and industrial expansion.

- M&A Trends: Strategic acquisitions to enhance market share and technological capabilities.

Saudi Arabia Transportation Infrastructure Construction Market Growth Trends & Insights

The Saudi Arabian transportation infrastructure construction market is poised for robust growth, propelled by ambitious national development plans and a strong economic outlook. The market size is projected to witness a significant upward trajectory, driven by substantial investments in both new builds and upgrades across all modes of transportation. Adoption rates of advanced construction technologies are escalating, enabling faster project execution and higher quality standards. Technological disruptions, such as the integration of AI in project management and the use of pre-fabricated components, are becoming more prevalent, reshaping project delivery methods. Consumer behavior shifts are also influencing the market, with an increasing demand for efficient, sustainable, and integrated transportation networks that enhance connectivity and quality of life. The CAGR for the forecast period is estimated to be robust, reflecting the dynamic nature of the market. Market penetration of innovative solutions is expanding as the Kingdom prioritizes modernization.

Dominant Regions, Countries, or Segments in Saudi Arabia Transportation Infrastructure Construction Market

The Roads segment is currently the dominant force driving growth within the Saudi Arabian transportation infrastructure construction market. This dominance is underpinned by extensive government initiatives focused on expanding and modernizing the nation's road networks, crucial for facilitating internal trade, connecting urban centers, and supporting economic diversification goals outlined in Vision 2030. These initiatives include the construction of new highways, the upgrade of existing arterial roads, and the development of urban road infrastructure to ease congestion and improve traffic flow.

- Key Drivers for Roads Dominance:

- Vision 2030 Alignment: Direct correlation with national strategies for economic diversification and improved connectivity.

- High Investment Allocation: Significant budgetary provisions for road network expansion and upgrades.

- Economic Necessity: Roads are fundamental for logistics, trade, and accessibility across the vast Kingdom.

- Population Growth and Urbanization: Increasing demand for better urban mobility and intercity connectivity.

- Tourism Development: Essential for providing access to new tourist destinations and enhancing visitor experience.

The growth potential within the roads segment remains exceptionally high due to ongoing mega-projects and the continuous need for maintenance and enhancement. While other segments like railways and airports are experiencing substantial investment and growth, the sheer volume and ongoing nature of road construction projects currently position it as the leading segment in terms of market share and immediate impact. The development of smart roads, incorporating intelligent traffic systems and integrated digital infrastructure, further amplifies the segment's importance and innovation potential.

Saudi Arabia Transportation Infrastructure Construction Market Product Landscape

The Saudi Arabian transportation infrastructure construction market is witnessing a surge in product innovation focused on sustainability, efficiency, and smart technology integration. This includes advanced asphalt mixes for enhanced durability and reduced emissions, innovative concrete formulations for faster curing and higher strength, and smart materials for integrated sensor networks within road and rail infrastructure. Applications range from high-performance pavements capable of withstanding extreme weather conditions to noise-reducing barriers and energy-harvesting road elements. Performance metrics are increasingly emphasizing lifecycle cost, environmental impact, and resilience. Unique selling propositions revolve around reduced maintenance needs, improved safety features, and seamless integration with digital traffic management systems. Technological advancements are driving the development of modular construction components and pre-fabricated elements to accelerate project timelines.

Key Drivers, Barriers & Challenges in Saudi Arabia Transportation Infrastructure Construction Market

Key Drivers:

- Vision 2030: The overarching national strategy driving massive investments in infrastructure to diversify the economy and enhance connectivity.

- Government Spending: Significant allocation of public funds towards transportation projects, including roads, railways, and airports.

- Economic Diversification: A concerted effort to reduce oil dependency, requiring robust logistical and transportation networks.

- Population Growth & Urbanization: Increasing demand for efficient mobility solutions and expanded infrastructure.

- Technological Advancements: Adoption of innovative construction techniques and smart technologies to improve efficiency and sustainability.

Barriers & Challenges:

- Skilled Labor Shortages: Demand for specialized construction expertise often outstrips supply, leading to potential delays and cost overruns.

- Supply Chain Volatility: Global and local disruptions can impact the availability and cost of construction materials and equipment.

- Regulatory Complexities: Navigating evolving regulations and obtaining necessary permits can be time-consuming.

- Environmental Concerns: Increasing scrutiny on the environmental impact of large-scale infrastructure projects, requiring sustainable solutions.

- Financing and Funding Mechanisms: While government-backed, securing private sector investment for certain sub-segments can present challenges.

Emerging Opportunities in Saudi Arabia Transportation Infrastructure Construction Market

Emerging opportunities lie in the development of integrated smart mobility solutions that connect various transportation modes through a unified digital platform, enhancing passenger experience and operational efficiency. The growth of logistics and freight infrastructure, including advanced warehousing and intermodal hubs, presents a significant untapped market as the Kingdom aims to become a global logistics powerhouse. Further opportunities exist in the green infrastructure space, with a growing demand for sustainable construction materials, renewable energy integration in transportation assets, and environmentally friendly infrastructure solutions that minimize ecological footprints. The expansion of regional connectivity projects, linking Saudi Arabia with neighboring countries via high-speed rail and enhanced road networks, also represents a substantial growth area.

Growth Accelerators in the Saudi Arabia Transportation Infrastructure Construction Market Industry

Several catalysts are accelerating the growth of the Saudi Arabian transportation infrastructure construction industry. The relentless drive of Vision 2030 remains the primary accelerator, mandating significant investment in projects that enhance connectivity and economic diversification. The increasing focus on public-private partnerships (PPPs) is unlocking new avenues for private sector participation and funding, bringing in international expertise and innovation. Furthermore, the global shift towards sustainable development is pushing for the adoption of green building technologies and eco-friendly infrastructure, creating a market for specialized solutions and materials. The advancement and adoption of digital technologies, such as AI, IoT, and advanced analytics, are streamlining project management, improving operational efficiency, and enabling the development of "smart" transportation networks, further fueling market expansion.

Key Players Shaping the Saudi Arabia Transportation Infrastructure Construction Market Market

- China Energy Engineering Corp Ltd

- Al Yamama For Business And Contracting

- SCC

- Almabani

- CCC

- Al-Rashid Trading & Contracting Company

- Jacobs

- Binyah

- Gilbane Building Co

- Mohammed Al Mojil Group Co

- CB&I LLC

- Afras For Trading And Contracting Company

- Fluor Corp

- Al Latifa Trading and Contracting

- Bechtel

- Tekfen Construction and Installation Co Inc

- Al-Ayuni

- Al-Jabreen Contracting Co

- China Railway Construction Corp Ltd

- AL JazirAH Engineers & Consultants

Notable Milestones in Saudi Arabia Transportation Infrastructure Construction Market Sector

- January 2023: RATP Dev announced the signing of a contract with the Royal Commission for '360 Mobility' services for Al Ula. This collaboration aims to develop comprehensive plans, policies, governance, and infrastructure for AlUla's cutting-edge mobility network, impacting the development of resident and visitor transportation assets.

- October 2022: Alstom, a global leader in green and smart mobility, was expected to open a new regional office in Riyadh. This strategic move signifies a reinforced commitment to railway development in Saudi Arabia and the broader Gulf region, positioning the office as a hub for expanded operations, including marketing, financial services, and railway maintenance.

In-Depth Saudi Arabia Transportation Infrastructure Construction Market Market Outlook

The future market outlook for Saudi Arabia's transportation infrastructure construction is exceptionally promising, fueled by ongoing mega-projects and strategic national development goals. Vision 2030 continues to be the primary growth engine, with substantial investments allocated to enhance connectivity and support economic diversification. The increasing adoption of digital technologies and sustainable construction practices will not only optimize project delivery but also create demand for innovative solutions and materials. The market is set to benefit from robust growth in the roads and railways segments, with significant opportunities also emerging in airports and potentially waterways as the Kingdom expands its logistical capabilities and tourism offerings. Strategic partnerships and continued government support will be crucial in realizing the full potential of this dynamic and expanding market.

Saudi Arabia Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roads

- 1.2. Railways

- 1.3. Airports

- 1.4. Waterways

Saudi Arabia Transportation Infrastructure Construction Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of Saudi Arabia Transportation Infrastructure Construction Market

Saudi Arabia Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Increased investment in air infrastructure driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Energy Engineering Corp Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Yamama For Business And Contracting

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SCC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Almabani

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CCC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Rashid Trading & Contracting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jacobs

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Binyah

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gilbane Building Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mohammed Al Mojil Group Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CB&I LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Afras For Trading And Contracting Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fluor Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Al Latifa Trading and Contracting

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bechtel

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Tekfen Construction and Installation Co Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Al-Ayuni

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Al-Jabreen Contracting Co**List Not Exhaustive

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 China Railway Construction Corp Ltd

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 AL Jazirah Engineers & Consultants

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 China Energy Engineering Corp Ltd

List of Figures

- Figure 1: Saudi Arabia Transportation Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: Saudi Arabia Transportation Infrastructure Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Transportation Infrastructure Construction Market?

The projected CAGR is approximately 2.77%.

2. Which companies are prominent players in the Saudi Arabia Transportation Infrastructure Construction Market?

Key companies in the market include China Energy Engineering Corp Ltd, Al Yamama For Business And Contracting, SCC, Almabani, CCC, Al-Rashid Trading & Contracting Company, Jacobs, Binyah, Gilbane Building Co, Mohammed Al Mojil Group Co, CB&I LLC, Afras For Trading And Contracting Company, Fluor Corp, Al Latifa Trading and Contracting, Bechtel, Tekfen Construction and Installation Co Inc, Al-Ayuni, Al-Jabreen Contracting Co**List Not Exhaustive, China Railway Construction Corp Ltd, AL Jazirah Engineers & Consultants.

3. What are the main segments of the Saudi Arabia Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Increased investment in air infrastructure driving the market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

January 2023- RATP Dev announced that it has signed a contract with the Royal Commission for '360 Mobility' services for Al Ula. Under this contract, RATP Dev will assist RCU in developing the plans, policies, governance, and infrastructure, as well as the transportation assets, of AlUla's cutting-edge mobility network for residents and visitors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence