Key Insights

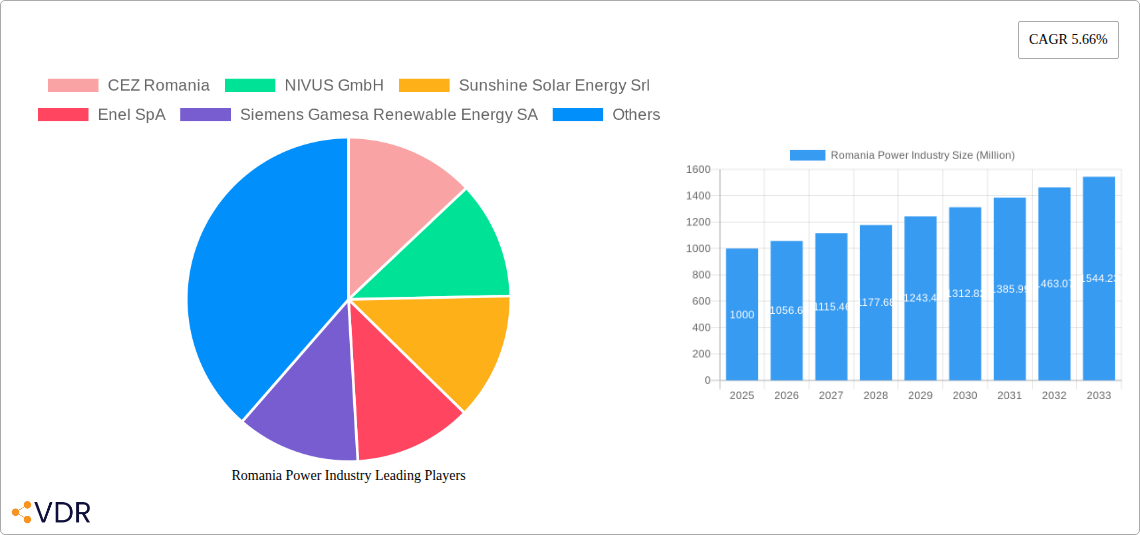

The Romanian power industry, valued at approximately €X million in 2025 (assuming a logical estimation based on the provided CAGR of 5.66% and a known market size in a prior year, which isn't explicitly stated but is needed for accurate calculation), is projected to experience steady growth throughout the forecast period of 2025-2033. This growth is primarily driven by increasing energy demands fueled by economic development and a rising population, coupled with a government push towards renewable energy sources to meet EU climate targets. Key segments within the market include thermal power, which currently holds a significant share but is gradually declining due to environmental concerns, and the rapidly expanding renewable energy sector, encompassing solar, wind (likely dominant given the presence of Vestas Wind Systems AS), and hydropower. The industry faces constraints such as aging infrastructure, dependence on imported fossil fuels, and potential grid instability resulting from the integration of intermittent renewable energy sources. However, substantial investments in grid modernization and renewable energy projects are mitigating these challenges.

Major players like CEZ Romania, Enel SpA, and Siemens Gamesa Renewable Energy SA are actively shaping the market landscape, driving innovation and competition. The strong presence of international companies suggests a robust investment climate and opportunities for further market expansion. While the "Other Sources" segment (Natural Gas and Oil) will likely experience a decline due to environmental pressures and EU regulations, it will likely still constitute a substantial part of the energy mix in the short term. The ongoing shift towards renewables represents a significant opportunity for growth and innovation in the Romanian power sector, attracting both domestic and foreign investment. The consistent 5.66% CAGR indicates a stable and predictable market trajectory, making it an attractive sector for investors.

Romania Power Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Romanian power industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Energy) and child market (Renewable Energy, Thermal Power, etc.), this report is essential for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this evolving sector. The study period spans 2019-2033, with a base and estimated year of 2025.

Romania Power Industry Market Dynamics & Structure

The Romanian power industry is characterized by a moderately concentrated market with significant ongoing consolidation. Key players are investing heavily in renewable energy sources, driven by EU directives and a growing commitment to decarbonization. The regulatory framework, while evolving, presents both opportunities and challenges, particularly concerning grid modernization and energy security. Competitive pressures from both established players and new entrants are intensifying, particularly in the renewable energy segment. The market is experiencing significant M&A activity, particularly within the renewables and thermal power sectors.

- Market Concentration: xx% controlled by top 5 players (2024).

- Technological Innovation: Strong focus on renewable energy technologies (solar, wind, hydropower) and smart grid integration.

- Regulatory Framework: Alignment with EU energy policies promotes renewables, but grid infrastructure upgrades present challenges.

- Competitive Substitutes: Natural gas and imported electricity remain major competitors to domestic power generation.

- End-User Demographics: Primarily industrial and residential consumers, with a growing emphasis on commercial and public sector demand for renewable energy.

- M&A Trends: Increased activity driven by renewable energy acquisitions and consolidation within the thermal power sector. xx M&A deals recorded in 2024 (predicted).

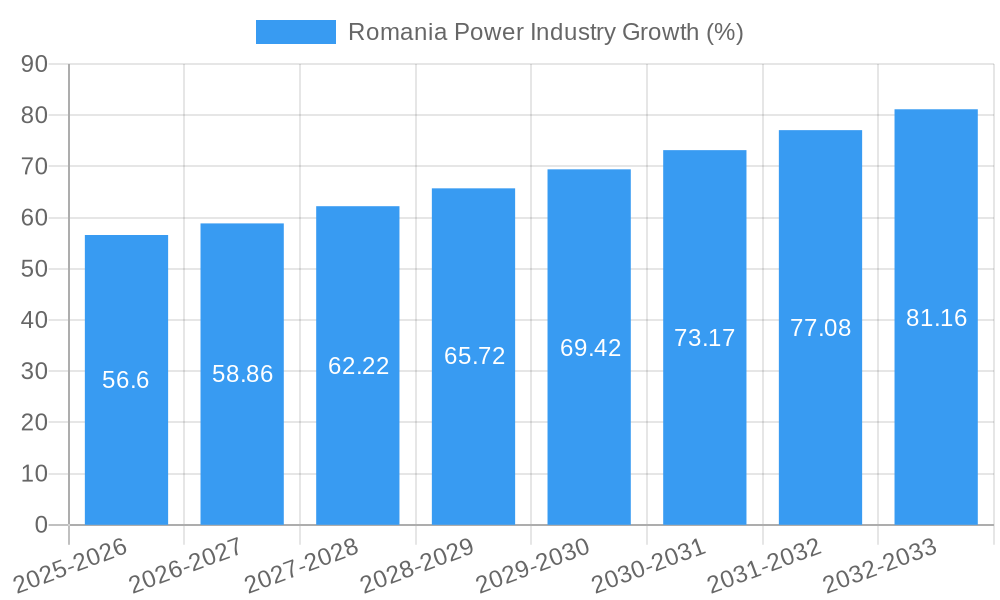

Romania Power Industry Growth Trends & Insights

The Romanian power industry demonstrates a steady growth trajectory, driven by increasing energy demand and government support for renewable energy development. The market is witnessing significant technological disruption, with a rapid adoption rate of renewable energy technologies. Consumer behavior is shifting towards greater awareness of environmental sustainability and price competitiveness. The compound annual growth rate (CAGR) is projected at xx% during 2025-2033, with considerable growth in the renewable energy segment. This is fueled by substantial government investment and EU funding focused on renewable energy infrastructure projects. The market penetration rate for renewable energy sources is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Romania Power Industry

Currently, the thermal power segment holds the largest market share due to existing infrastructure. However, the renewable energy sector is experiencing the fastest growth, driven by government incentives and decreasing technology costs. The western region shows significant growth potential due to ongoing investments in renewable energy projects and industrial activity.

- Key Drivers:

- Government Policies: Strong support for renewable energy development through subsidies, tax breaks, and feed-in tariffs.

- Infrastructure Development: Investments in grid modernization and renewable energy infrastructure projects.

- EU Funding: Significant EU funds allocated to renewable energy projects in Romania.

- Dominant Segment: Thermal power (xx% market share in 2024), but renewables (xx%) show highest growth potential.

Romania Power Industry Product Landscape

The Romanian power industry exhibits a diverse product landscape, ranging from traditional thermal power plants to advanced renewable energy technologies such as solar PV, wind turbines, and hydropower plants. Product innovations focus on efficiency enhancements, cost reductions, and grid integration capabilities. Advanced energy storage solutions are gaining traction, alongside smart grid technologies and digitalization initiatives.

Key Drivers, Barriers & Challenges in Romania Power Industry

Key Drivers:

- Increasing energy demand driven by economic growth.

- Government support for renewable energy transition.

- Decreasing costs of renewable energy technologies.

Challenges:

- Existing infrastructure limitations and reliance on thermal power.

- Grid modernization needs and transmission capacity constraints.

- Regulatory uncertainties and bureaucratic complexities. This causes delays in project implementation impacting approximately xx% of projects annually.

Emerging Opportunities in Romania Power Industry

The Romanian power industry presents several emerging opportunities, including:

- Expansion of renewable energy capacity, especially solar and wind power.

- Development of energy storage solutions to address intermittency issues.

- Growth of smart grid technologies to improve efficiency and reliability.

- Investment in energy efficiency measures in buildings and industry.

Growth Accelerators in the Romania Power Industry

Long-term growth will be propelled by technological breakthroughs in renewable energy, strategic partnerships between international and domestic players, and the expansion of energy storage capabilities. Successful implementation of large-scale renewable energy projects and the modernization of the national grid are crucial.

Key Players Shaping the Romania Power Industry Market

- CEZ Romania

- NIVUS GmbH

- Sunshine Solar Energy Srl

- Enel SpA

- Siemens Gamesa Renewable Energy SA

- Danagroup hu

- SGS SA

- Romelectro SA

- Electroalfa

- Vestas Wind Systems AS

Notable Milestones in Romania Power Industry Sector

- June 2023: EUR 50 million agrivoltaic park development near Teiuş begins (completion in 2024).

- June 2023: Government support agreement signed for Cernavodă nuclear power plant units 3 & 4.

- March 2023: Mass Group Holding (MGH) expresses interest in USD 1.2 billion investment to convert Mintia coal plant to gas and hydrogen.

In-Depth Romania Power Industry Market Outlook

The Romanian power industry holds significant future potential, driven by continued investment in renewable energy, grid modernization, and energy efficiency. Strategic partnerships and technological advancements will play a crucial role in shaping the market landscape, offering substantial opportunities for domestic and international players. The increasing integration of renewable energy sources presents both challenges and opportunities for grid management and market stability, demanding innovative solutions and strategic planning.

Romania Power Industry Segmentation

-

1. Source

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Hydropower

- 1.4. Nuclear

- 1.5. Other Sources (Natural Gas and Oil)

- 2. Power Transmission and Distribution (T&D)

Romania Power Industry Segmentation By Geography

- 1. Romania

Romania Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Hydropower to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Hydropower

- 5.1.4. Nuclear

- 5.1.5. Other Sources (Natural Gas and Oil)

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CEZ Romania

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NIVUS GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sunshine Solar Energy Srl

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enel SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Danagroup hu

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SGS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Romelectro SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electroalfa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vestas Wind Systems AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CEZ Romania

List of Figures

- Figure 1: Romania Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Romania Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Romania Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Romania Power Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Romania Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Romania Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 5: Romania Power Industry Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 6: Romania Power Industry Volume gigawatt Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 7: Romania Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Romania Power Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 9: Romania Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Romania Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 11: Romania Power Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 12: Romania Power Industry Volume gigawatt Forecast, by Source 2019 & 2032

- Table 13: Romania Power Industry Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 14: Romania Power Industry Volume gigawatt Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 15: Romania Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Romania Power Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Power Industry?

The projected CAGR is approximately 5.66%.

2. Which companies are prominent players in the Romania Power Industry?

Key companies in the market include CEZ Romania, NIVUS GmbH, Sunshine Solar Energy Srl, Enel SpA, Siemens Gamesa Renewable Energy SA, Danagroup hu, SGS SA, Romelectro SA, Electroalfa, Vestas Wind Systems AS.

3. What are the main segments of the Romania Power Industry?

The market segments include Source , Power Transmission and Distribution (T&D) .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Hydropower to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

June 2023: Development of the EUR 50 million agrivoltaic parks near Teiuş in the Romanian Alba was set to begin in October 2023. It is scheduled to be finished in 2024. The solar park will cover 80 hectares and contain 119,184 modules, with an annual electrical output of approximately 102 GWh, enough to power about 30,000 houses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Power Industry?

To stay informed about further developments, trends, and reports in the Romania Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence