Key Insights

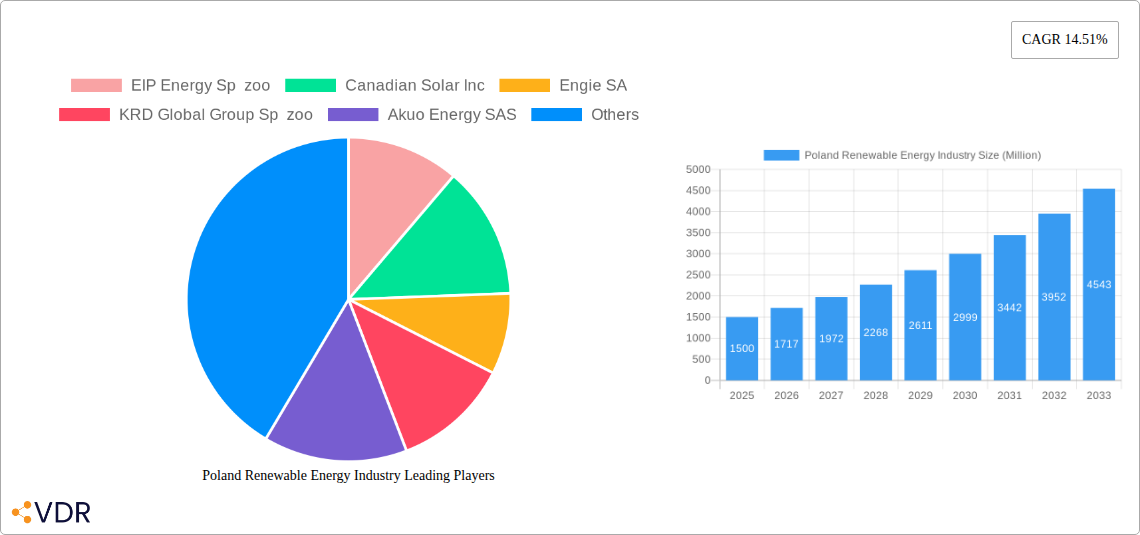

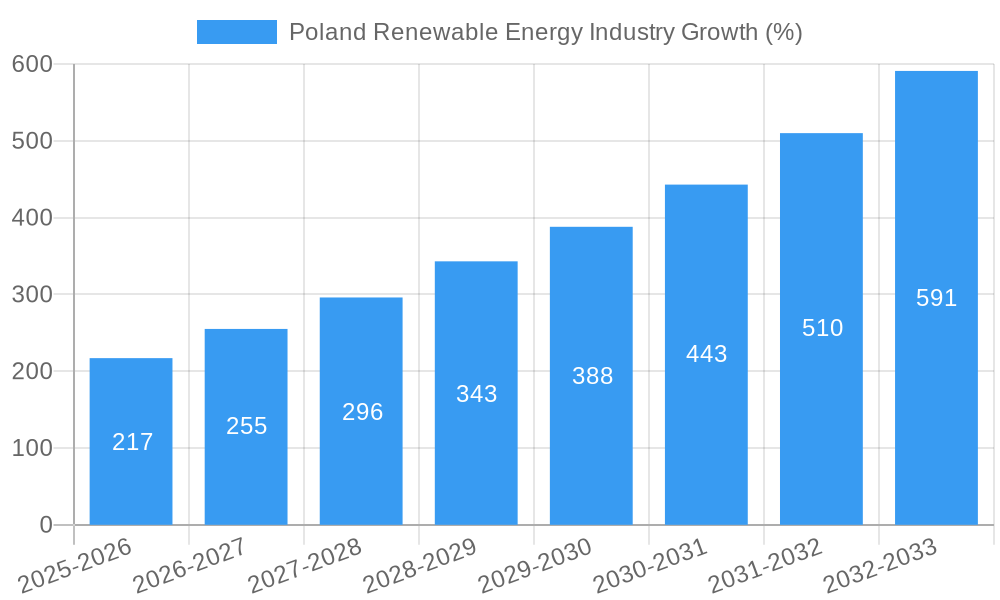

The Polish renewable energy market is experiencing robust growth, driven by the country's commitment to reducing carbon emissions and increasing energy independence. With a Compound Annual Growth Rate (CAGR) of 14.51% from 2019-2033, the market is projected to reach significant value by 2033. Key drivers include supportive government policies promoting renewable energy adoption, increasing investment in renewable energy infrastructure, and a growing awareness among consumers regarding environmental sustainability. The market is segmented by power source, with wind, hydroelectric, and solar energy dominating. While wind power currently holds a significant share, solar energy is anticipated to experience the fastest growth, fueled by decreasing technology costs and readily available land. The presence of established players like EIP Energy Sp zoo, Canadian Solar Inc., and Engie SA, alongside emerging domestic companies, indicates a healthy and competitive landscape. However, challenges remain, such as grid integration issues, permitting complexities, and occasional fluctuations in government support. Despite these restraints, the long-term outlook for Poland's renewable energy market remains positive, driven by sustained investment and a focus on achieving ambitious climate targets.

The dominance of specific power sources within the Polish renewable energy market will likely shift over the forecast period. While hydroelectric and wind power currently contribute substantially to the overall market value, we anticipate a greater contribution from solar power in the coming years given the aforementioned drivers. This implies significant investment opportunities within the solar energy sector, including photovoltaic panel manufacturing, installation, and maintenance. Further, Poland's strategic location within Europe could position it as a key player in cross-border renewable energy projects, creating further opportunities for growth and international collaboration. The success of the Polish renewable energy market will depend on continued government support, investment in infrastructure, and technological advancements addressing the existing challenges. Monitoring these factors closely will be vital for understanding future market trajectory.

Poland Renewable Energy Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Poland renewable energy market, covering the period 2019-2033. It examines market dynamics, growth trends, key players, and emerging opportunities within the wind, hydro, solar, and other renewable energy sectors. The report is essential for investors, industry professionals, and policymakers seeking to understand and capitalize on the evolving landscape of Poland's green energy transition.

Poland Renewable Energy Industry Market Dynamics & Structure

The Polish renewable energy market exhibits a dynamic interplay of factors shaping its structure and growth. Market concentration is moderate, with several large players alongside smaller, specialized firms. Technological innovation is driven by EU directives and national targets, pushing for greater efficiency and cost reduction across all renewable energy sources. Regulatory frameworks, while evolving, are generally supportive, incentivizing renewable energy development through subsidies and feed-in tariffs. Competitive product substitutes remain limited, with fossil fuels facing increasing pressure from stricter environmental regulations and declining renewable energy costs. End-user demographics are shifting towards increased energy awareness and a demand for sustainable power solutions. M&A activity is relatively frequent, reflecting consolidation and expansion within the industry.

- Market Concentration: Moderate, with a few dominant players and numerous smaller companies. Market share data will be detailed within the full report.

- Technological Innovation: Driven by EU targets and government incentives focusing on cost-effectiveness and efficiency enhancements.

- Regulatory Framework: Supportive, characterized by evolving subsidies and feed-in tariffs.

- Competitive Substitutes: Primarily fossil fuels, facing increasing pressure due to environmental concerns and decreasing renewable energy prices.

- M&A Activity: Moderate to high, driven by consolidation and strategic expansion. The report will include a detailed analysis of the number and value of M&A deals (xx Million) in the historical period.

- End-user Demographics: Growing awareness of sustainability is driving demand for renewable energy.

Poland Renewable Energy Industry Growth Trends & Insights

The Polish renewable energy market exhibits robust growth, driven by a confluence of factors detailed in this report. Market size evolution demonstrates a significant increase in capacity additions from xx Million in 2019 to an estimated xx Million in 2025, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing adoption rates across all segments, particularly in the solar and wind sectors. Technological disruptions, such as advancements in solar panel efficiency and wind turbine designs, further enhance market expansion. Consumer behavior shifts towards environmentally conscious choices and a preference for renewable energy sources are actively contributing to this trend.

Dominant Regions, Countries, or Segments in Poland Renewable Energy Industry

Within the Polish renewable energy market, the wind power segment currently holds the largest market share (xx%), followed by solar (xx%) and hydro (xx%). This dominance is primarily attributable to favorable wind resources and extensive land availability for wind farms. Government support schemes have also significantly contributed to the growth of the wind power sector. The solar power segment is experiencing rapid growth, driven by decreasing technology costs and increasing investor interest, particularly in large-scale solar photovoltaic projects, such as the Zwartowo plant.

- Wind Power: Dominant due to favorable wind resources and supportive government policies.

- Solar Power: Rapidly expanding due to decreasing technology costs and large-scale project developments (e.g., Zwartowo).

- Hydroelectric Power: Relatively stable, with limited potential for significant expansion due to geographical constraints.

Poland Renewable Energy Industry Product Landscape

The Polish renewable energy product landscape is characterized by increasing sophistication and efficiency. Advancements in wind turbine technology, including larger rotor diameters and higher tower heights, have led to greater energy generation capacity. Similarly, solar panel technology has witnessed improvements in efficiency and durability, resulting in higher power output and longer lifespans. These improvements, coupled with innovative energy storage solutions, enhance the reliability and cost-effectiveness of renewable energy systems.

Key Drivers, Barriers & Challenges in Poland Renewable Energy Industry

Key Drivers:

- Favorable government policies and incentives.

- Declining technology costs.

- Growing environmental awareness and consumer demand.

- EU's renewable energy targets.

Key Barriers & Challenges:

- Grid infrastructure limitations in certain regions.

- Land acquisition and permitting processes.

- Intermittency of renewable energy sources.

- Competition from established fossil fuel industries. The projected negative impact on fossil fuel revenues is estimated at xx Million annually.

Emerging Opportunities in Poland Renewable Energy Industry

Emerging opportunities within the Polish renewable energy industry encompass the integration of smart grid technologies for improved energy management, the expansion of off-shore wind energy projects, and increased investment in energy storage solutions to address intermittency issues. Furthermore, opportunities exist in the development of green hydrogen production using renewable energy sources, aligning with Poland's emerging green hydrogen strategy.

Growth Accelerators in the Poland Renewable Energy Industry

Long-term growth in the Polish renewable energy sector is expected to be fueled by substantial investments in renewable energy infrastructure, technological advancements that further reduce the levelized cost of energy (LCOE), and the ongoing implementation of supportive government policies that encourage greater renewable energy penetration. Increased collaboration between international and domestic companies will also accelerate growth and knowledge transfer.

Key Players Shaping the Poland Renewable Energy Industry Market

- EIP Energy Sp zoo

- Canadian Solar Inc

- Engie SA

- KRD Global Group Sp zoo

- Akuo Energy SAS

- SGS SA

- Dalkia Polska

- PGE Polska Grupa Energetyczna SA

- General Electric Company

Notable Milestones in Poland Renewable Energy Industry Sector

- October 2022: Equinor completed the 58 MW Stępień solar plant.

- May 2022: RWE commenced operation of the 16.8 MW Rozdraew wind farm.

- April 2022: EBRD provided PLN 212 million (USD 50.17 million) for the 285.6 MWp Zwartowo solar plant.

In-Depth Poland Renewable Energy Industry Market Outlook

The Polish renewable energy market is poised for substantial growth over the next decade, driven by continued policy support, technological advancements, and increasing investor confidence. Strategic opportunities exist for companies focused on large-scale renewable energy projects, energy storage solutions, and smart grid technologies. The projected market size in 2033 is expected to reach xx Million, representing a significant contribution to Poland's energy security and its commitment to achieving climate neutrality.

Poland Renewable Energy Industry Segmentation

-

1. Power Source

- 1.1. Wind

- 1.2. Hydroelectric

- 1.3. Solar

- 1.4. Other Power Sources

Poland Renewable Energy Industry Segmentation By Geography

- 1. Poland

Poland Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Solar Energy Expected to be the Fastest-growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Renewable Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Source

- 5.1.1. Wind

- 5.1.2. Hydroelectric

- 5.1.3. Solar

- 5.1.4. Other Power Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Power Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 EIP Energy Sp zoo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Canadian Solar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Engie SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KRD Global Group Sp zoo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Akuo Energy SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SGS SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dalkia Polska

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PGE Polska Grupa Energetyczna SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Electric Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 EIP Energy Sp zoo

List of Figures

- Figure 1: Poland Renewable Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Renewable Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Poland Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Poland Renewable Energy Industry Revenue Million Forecast, by Power Source 2019 & 2032

- Table 4: Poland Renewable Energy Industry Volume gigawatt Forecast, by Power Source 2019 & 2032

- Table 5: Poland Renewable Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Poland Renewable Energy Industry Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Poland Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Poland Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Poland Renewable Energy Industry Revenue Million Forecast, by Power Source 2019 & 2032

- Table 10: Poland Renewable Energy Industry Volume gigawatt Forecast, by Power Source 2019 & 2032

- Table 11: Poland Renewable Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Poland Renewable Energy Industry Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Renewable Energy Industry?

The projected CAGR is approximately 14.51%.

2. Which companies are prominent players in the Poland Renewable Energy Industry?

Key companies in the market include EIP Energy Sp zoo, Canadian Solar Inc, Engie SA, KRD Global Group Sp zoo, Akuo Energy SAS, SGS SA, Dalkia Polska, PGE Polska Grupa Energetyczna SA, General Electric Company.

3. What are the main segments of the Poland Renewable Energy Industry?

The market segments include Power Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Solar Energy Expected to be the Fastest-growing Segment.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

Oct 2022: Equinor completed the construction of the 58 MW Stępień solar plant in Poland, which is ready for operation. Stępień was developed and operated by Wento, Equinor's 100% subsidiary.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the Poland Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence