Key Insights

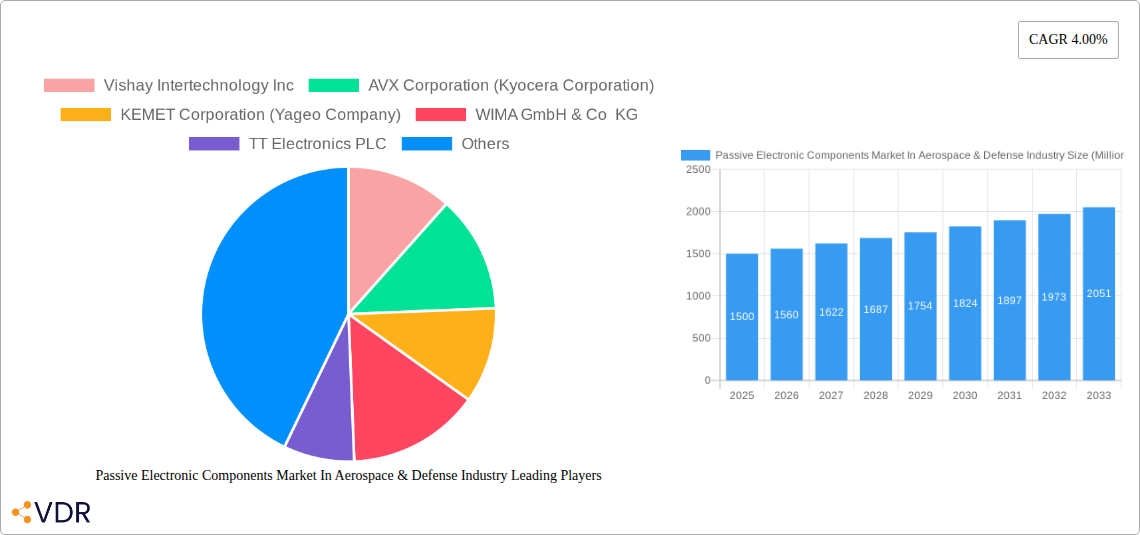

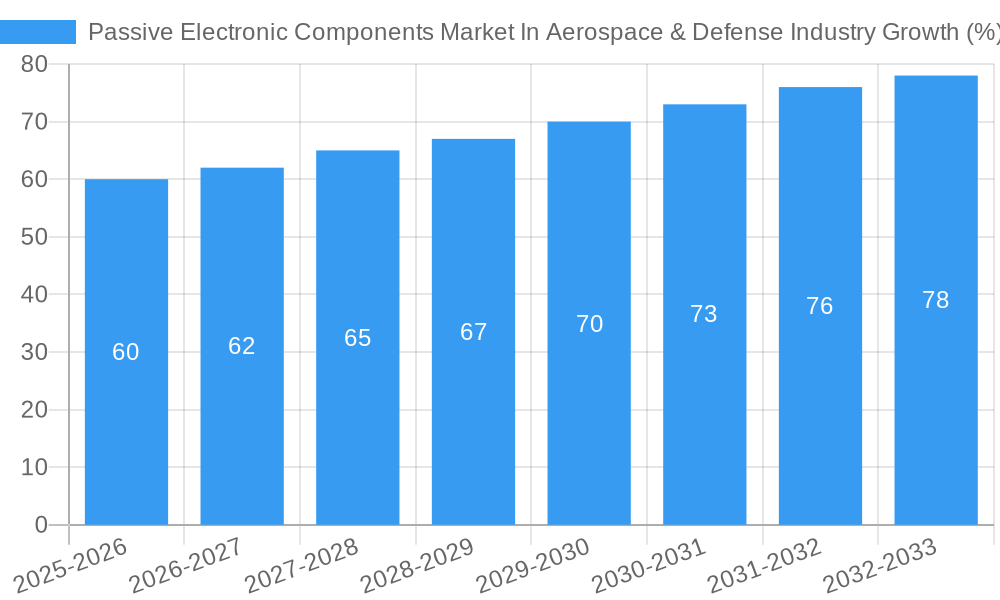

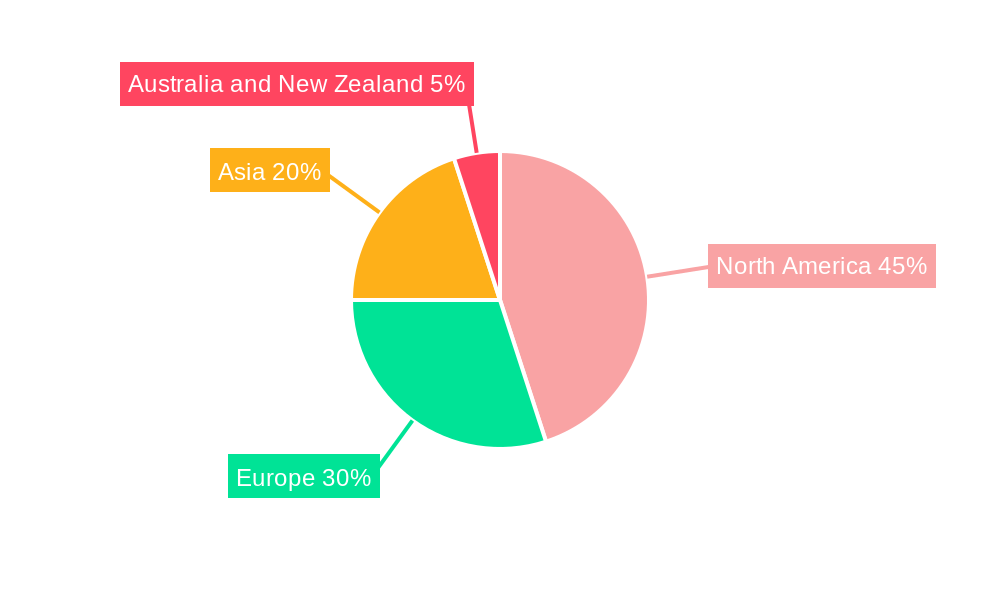

The Passive Electronic Components market within the Aerospace & Defense industry is experiencing steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for sophisticated and reliable electronic systems in military aircraft, spacecraft, and defense systems is a primary factor. Technological advancements leading to miniaturization, higher performance, and improved reliability of passive components are also contributing to market growth. Furthermore, the growing adoption of advanced technologies such as AI, IoT, and autonomous systems in defense applications is further boosting demand. While the market faces restraints such as stringent regulatory compliance and high initial investment costs for advanced components, the long-term growth prospects remain positive, particularly driven by government investments in defense modernization programs and increasing global geopolitical instability. Market segmentation reveals capacitors, inductors, and resistors as the key component types, with capacitors likely holding the largest market share due to their widespread use in various applications. Major players like Vishay Intertechnology, AVX Corporation, and TDK Corporation are actively shaping the market landscape through innovation and strategic partnerships. The North American region, owing to significant defense spending and technological advancements, is anticipated to command a substantial share of the market, followed by Europe and Asia-Pacific regions.

The market's geographical distribution shows a concentration in regions with significant defense budgets and technological prowess. North America, driven by substantial government spending on defense modernization and technological leadership, is likely the largest regional market. Europe follows, with strong aerospace and defense industries. Asia-Pacific's growth is anticipated to be significant, albeit at a potentially slightly slower pace than North America and Europe, primarily due to increasing defense expenditure in several countries. The competitive landscape is characterized by established industry giants and specialized niche players. The competitive intensity stems from technological innovation, cost optimization, and the stringent quality requirements of the aerospace and defense sector. Future growth will depend upon continued innovation in material science, miniaturization techniques, and the development of components capable of withstanding extreme environmental conditions.

Passive Electronic Components Market in Aerospace & Defense Industry: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Passive Electronic Components market within the Aerospace & Defense industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by type (Capacitors, Inductors, Resistors) and analyzed across key regions. Expected market size in Million units is analyzed throughout.

Passive Electronic Components Market In Aerospace & Defense Industry Market Dynamics & Structure

The Aerospace & Defense Passive Electronic Components market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, particularly in miniaturization, increased reliability, and improved performance, is a major growth driver. Stringent regulatory frameworks and quality standards, such as those from DO-160, govern component selection and qualification. Competitive pressures arise from substitutes like advanced semiconductor technologies in certain applications. The end-user demographic is largely driven by government defense spending and commercial aerospace manufacturing. M&A activity has been relatively consistent, with consolidation aiming to expand product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2024 (estimated).

- Technological Innovation: Focus on miniaturization, high-reliability components for harsh environments, and improved thermal management.

- Regulatory Framework: Strict adherence to industry standards (e.g., DO-160) impacting component selection and lifecycle management.

- Competitive Substitutes: Emerging technologies like MEMS and advanced semiconductors pose some competitive threat in specific niche applications.

- End-User Demographics: Primarily driven by government defense programs and commercial aircraft manufacturers.

- M&A Trends: Steady M&A activity aimed at expanding product portfolios and achieving economies of scale. Approximately xx M&A deals were recorded in the historical period.

Passive Electronic Components Market In Aerospace & Defense Industry Growth Trends & Insights

The Aerospace & Defense Passive Electronic Components market is experiencing steady growth, driven by increasing demand for advanced electronics in aerospace and defense systems. The market size is estimated at xx Million units in 2025, with a projected CAGR of xx% during the forecast period. This growth is fueled by increasing adoption of advanced technologies in modern aircraft and defense platforms and the rising demand for miniaturized, high-reliability components. Technological disruptions, such as the integration of AI and IoT technologies, are shaping new application requirements and driving market innovation. Consumer behavior shifts towards increased reliance on advanced aerial and defense systems further propel market expansion.

Dominant Regions, Countries, or Segments in Passive Electronic Components Market In Aerospace & Defense Industry

North America currently dominates the Aerospace & Defense Passive Electronic Components market, driven by strong defense spending and a robust commercial aerospace sector. Within the segment breakdown by type, Capacitors holds the largest market share due to their extensive use in various applications, followed by Resistors and Inductors. Europe and Asia-Pacific are also showing significant growth potential.

- North America: Strong defense spending, robust aerospace industry, and established supply chains contribute to its market dominance. Market share estimated at xx% in 2024.

- Europe: Significant aerospace manufacturing and a growing focus on defense modernization drive market growth. Market share estimated at xx% in 2024.

- Asia-Pacific: Rapid economic growth and increasing investments in defense capabilities fuel market expansion. Market share estimated at xx% in 2024.

- Segment Dominance: Capacitors hold the largest segment share (xx%), followed by Resistors (xx%) and Inductors (xx%).

Passive Electronic Components Market In Aerospace & Defense Industry Product Landscape

The market showcases a wide range of passive components, including high-reliability capacitors, inductors, and resistors designed for harsh environments and extreme temperature fluctuations. Key features include miniaturization, improved temperature stability, high Q-factors, and low outgassing properties crucial for aerospace applications. These components meet stringent quality and performance standards for aviation and defense systems. Recent innovations include advanced materials and manufacturing techniques allowing for smaller footprints, increased power handling capabilities, and enhanced reliability.

Key Drivers, Barriers & Challenges in Passive Electronic Components Market In Aerospace & Defense Industry

Key Drivers:

- Increasing demand for advanced electronics in next-generation aircraft and defense systems.

- Growing investments in research and development of high-reliability components.

- Stringent regulatory compliance driving the adoption of advanced technologies.

Challenges & Restraints:

- High manufacturing costs and stringent quality control requirements for aerospace-grade components.

- Supply chain vulnerabilities and potential disruptions impacting component availability.

- Intense competition from established players and the emergence of new entrants. This has resulted in a price pressure of approximately xx% in the past year.

Emerging Opportunities in Passive Electronic Components Market In Aerospace & Defense Industry

- Development of high-frequency, high-power components for advanced radar and communication systems.

- Growing adoption of electric and hybrid-electric aircraft creating opportunities for advanced power management components.

- Integration of miniaturized components into unmanned aerial vehicles (UAVs) and other autonomous systems.

Growth Accelerators in the Passive Electronic Components Market In Aerospace & Defense Industry Industry

Technological advancements in materials science and manufacturing processes are significant catalysts for market growth. Strategic partnerships between component manufacturers and aerospace companies are streamlining product development and enhancing supply chain efficiency. Furthermore, market expansion into emerging defense markets and the increasing adoption of commercial off-the-shelf (COTS) components present significant opportunities.

Key Players Shaping the Passive Electronic Components Market In Aerospace & Defense Industry Market

- Vishay Intertechnology Inc

- AVX Corporation (Kyocera Corporation)

- KEMET Corporation (Yageo Company)

- WIMA GmbH & Co KG

- TT Electronics PLC

- TE Connectivity

- Cornell Dubilier Electronics Inc

- API Delevan (Fortive Corporation)

- Taiyo Yuden Co Ltd

- Bourns Inc

- TDK Corporation

- Ohmite Manufacturing Company

- Panasonic Corporation

- Honeywell International Inc

- Eaton Corporation

List Not Exhaustive

Notable Milestones in Passive Electronic Components Market In Aerospace & Defense Industry Sector

- April 2023: Cornell Dubilier Electronics Inc. launched the DSM series of standard supercapacitor modules, addressing the need for higher voltage supercapacitor storage.

- March 2023: API Delevan released the S0603 and S0402 high-reliability space SMD inductors designed for harsh environments, including aerospace applications.

In-Depth Passive Electronic Components Market In Aerospace & Defense Industry Market Outlook

The Aerospace & Defense Passive Electronic Components market is poised for continued growth, fueled by technological advancements and increasing demand for sophisticated electronics in both commercial and military applications. Strategic investments in R&D, focusing on miniaturization, improved reliability, and enhanced performance, will further shape the market landscape. Opportunities lie in exploring niche applications and catering to the specific requirements of emerging defense technologies. This presents significant potential for market players to expand their product portfolios and strengthen their market positions.

Passive Electronic Components Market In Aerospace & Defense Industry Segmentation

-

1. Type

- 1.1. Capacitors

- 1.2. Inductors

- 1.3. Resistors

Passive Electronic Components Market In Aerospace & Defense Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

Passive Electronic Components Market In Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Advanced Electronic Devices in Aerospace & Defense Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Price of Critical Metals Used in Manufacturing of Passive Electronic Components

- 3.4. Market Trends

- 3.4.1. Increase in Defense Spending is Expected to Propel the Industry's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Capacitors

- 5.1.2. Inductors

- 5.1.3. Resistors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Capacitors

- 6.1.2. Inductors

- 6.1.3. Resistors

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Capacitors

- 7.1.2. Inductors

- 7.1.3. Resistors

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Capacitors

- 8.1.2. Inductors

- 8.1.3. Resistors

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Capacitors

- 9.1.2. Inductors

- 9.1.3. Resistors

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Vishay Intertechnology Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 AVX Corporation (Kyocera Corporation)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 KEMET Corporation (Yageo Company)

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 WIMA GmbH & Co KG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 TT Electronics PLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 TE Connectivity

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Cornell Dubilier Electronics Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 API Delevan ( Fortive Corporation)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Taiyo Yuden Co Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Bourns Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 TDK Corporation

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Ohmite Manufacturing Company

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Panasonic Corporation

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Honeywell International Inc *List Not Exhaustive

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Eaton Corporation

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Australia and New Zealand Passive Electronic Components Market In Aerospace & Defense Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Passive Electronic Components Market In Aerospace & Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Passive Electronic Components Market In Aerospace & Defense Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passive Electronic Components Market In Aerospace & Defense Industry?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Passive Electronic Components Market In Aerospace & Defense Industry?

Key companies in the market include Vishay Intertechnology Inc, AVX Corporation (Kyocera Corporation), KEMET Corporation (Yageo Company), WIMA GmbH & Co KG, TT Electronics PLC, TE Connectivity, Cornell Dubilier Electronics Inc, API Delevan ( Fortive Corporation), Taiyo Yuden Co Ltd, Bourns Inc, TDK Corporation, Ohmite Manufacturing Company, Panasonic Corporation, Honeywell International Inc *List Not Exhaustive, Eaton Corporation.

3. What are the main segments of the Passive Electronic Components Market In Aerospace & Defense Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Advanced Electronic Devices in Aerospace & Defense Industry.

6. What are the notable trends driving market growth?

Increase in Defense Spending is Expected to Propel the Industry's Growth.

7. Are there any restraints impacting market growth?

Increasing Price of Critical Metals Used in Manufacturing of Passive Electronic Components.

8. Can you provide examples of recent developments in the market?

April 2023: Cornell Dubilier Electronics Inc. announced a new line of standard supercapacitor modules. The DSM series addresses the need for supercapacitor storage capability at higher voltages than individual devices can provide. The new modules come in packs of 6, 3, or 10 cells in series for 18V, 9V, and 30V outputs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passive Electronic Components Market In Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passive Electronic Components Market In Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passive Electronic Components Market In Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Passive Electronic Components Market In Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence