Key Insights

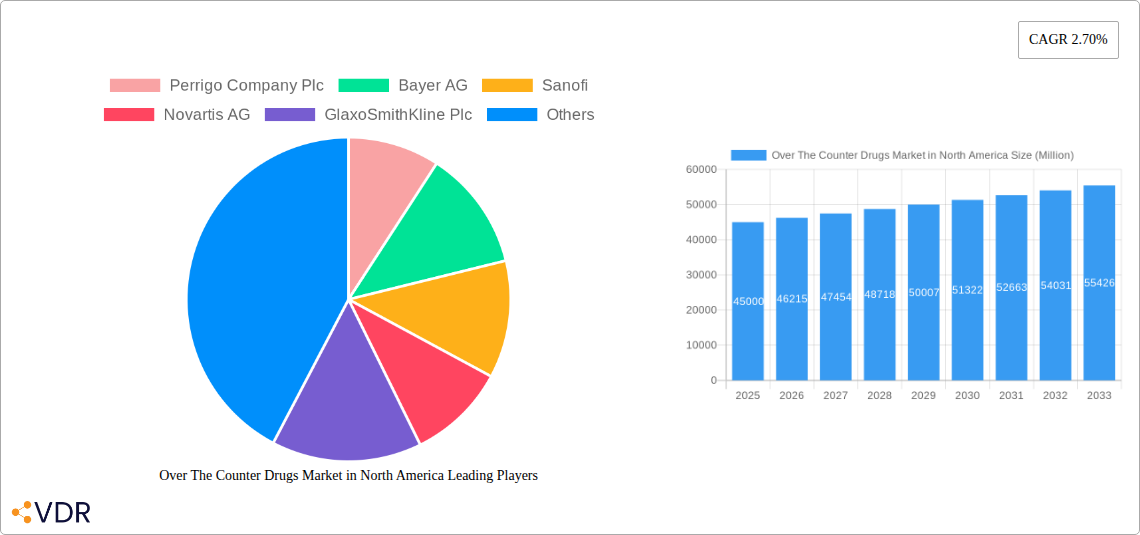

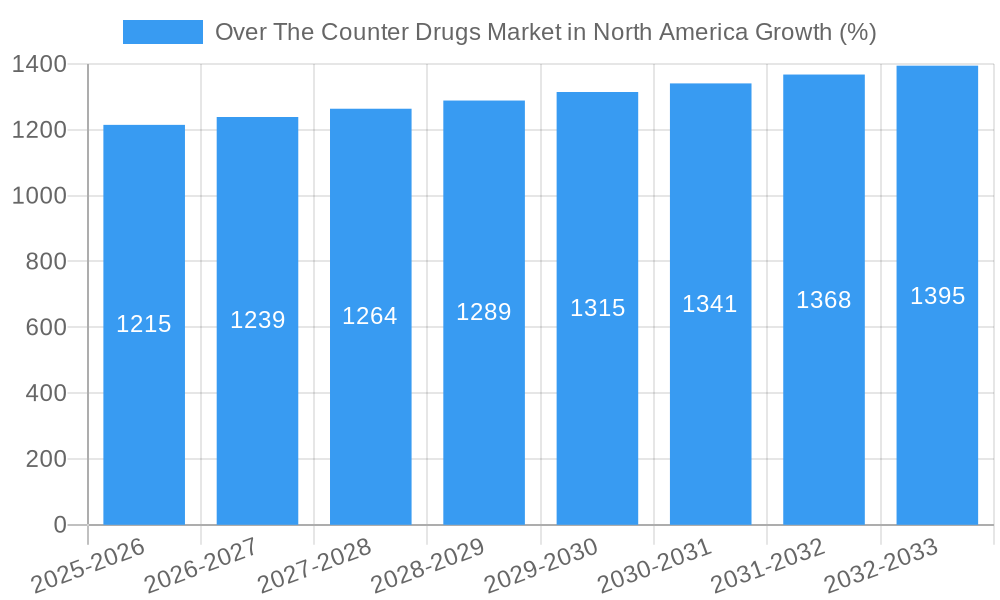

The North American over-the-counter (OTC) drug market, valued at approximately $45 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 2.70% from 2025 to 2033. This growth is fueled by several key drivers. The aging population, with its increased susceptibility to chronic conditions requiring regular OTC medication, significantly contributes to market expansion. Furthermore, rising healthcare costs are pushing consumers towards more affordable self-care options, boosting OTC drug sales. Convenience factors, such as readily available products in retail pharmacies and the burgeoning online pharmacy sector, also contribute to market growth. While increasing consumer awareness of potential side effects and the rise of herbal and natural remedies present some constraints, the overall market outlook remains positive. Segment-wise, analgesics and cold, cough, and flu products are likely to continue dominating the market, owing to their high demand. The growing prevalence of chronic diseases is expected to boost demand for products across segments like vitamins, minerals, and supplements. Specific growth in online distribution channels reflects evolving consumer preferences for convenience and ease of access. Leading players like Perrigo, Bayer, Sanofi, Novartis, GSK, Johnson & Johnson, Takeda, and Pfizer leverage their strong brand recognition and established distribution networks to maintain their market share. However, increased competition from smaller players and private label brands will need to be addressed.

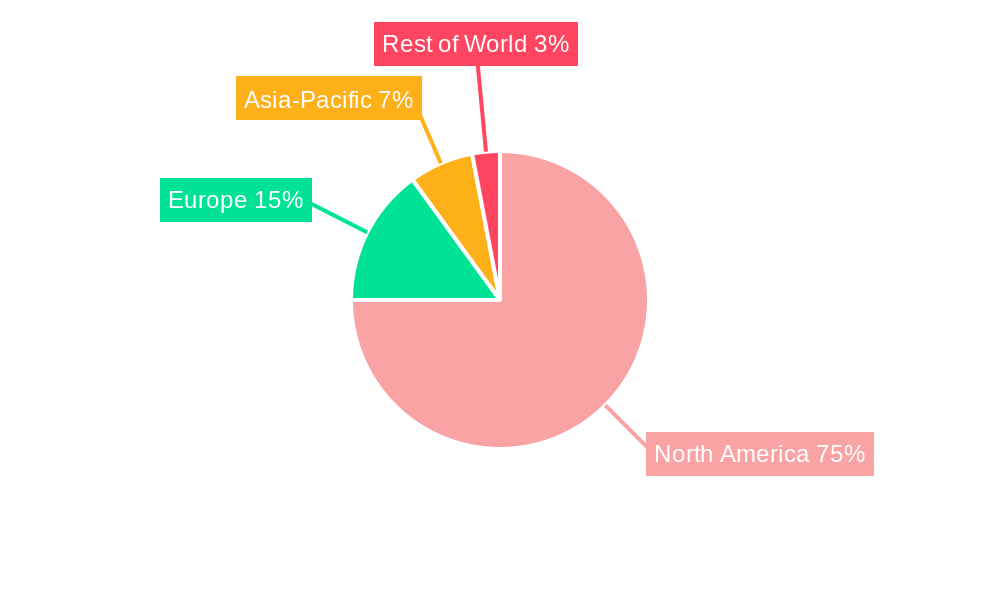

The North American market's geographic distribution shows the United States as the largest consumer of OTC drugs, followed by Canada and Mexico. The continued emphasis on preventative healthcare and self-medication is expected to sustain market growth. While regulatory hurdles and evolving consumer preferences for natural remedies pose challenges, the overall market trajectory is projected to be positive, supported by sustained demand and an increasing focus on convenient access through multiple distribution channels. Future market performance will be influenced by factors like technological advancements, shifting consumer healthcare choices, and new product innovations within the OTC pharmaceutical sector. The market's steady growth reflects the ongoing importance of accessible and affordable healthcare solutions.

Over The Counter Drugs Market in North America: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American Over-The-Counter (OTC) drugs market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by product type (Cough, Cold, and Flu Products; Analgesics; Dermatology Products; Gastrointestinal Products; Vitamins, Mineral, and Supplements (VMS); Weight-loss/Dietary Products; Ophthalmic Products; Sleeping Aids; Other Product Types) and distribution channel (Hospital Pharmacies; Retail Pharmacies; Online Pharmacy; Other Distribution Channels). The market is valued in Million units.

Over The Counter Drugs Market in North America Market Dynamics & Structure

The North American OTC drug market is characterized by a moderately concentrated landscape, with several multinational pharmaceutical giants holding significant market share. Market concentration is further analyzed through the Herfindahl-Hirschman Index (HHI) calculated at xx. Technological innovation, particularly in drug delivery systems and personalized medicine, is a key driver, although regulatory hurdles and high R&D costs present significant barriers. The market is also influenced by evolving consumer preferences towards natural and herbal remedies, impacting the growth of specific segments like VMS. The regulatory framework, including FDA guidelines, plays a crucial role in product approvals and market access. Furthermore, mergers and acquisitions (M&A) activity has been significant, with xx deals valued at xx million units recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on targeted drug delivery, digital health integration, and personalized formulations.

- Regulatory Framework: Stringent FDA regulations impacting product development and launch timelines.

- Competitive Substitutes: Rise of herbal remedies and alternative therapies posing competitive pressure.

- M&A Activity: Consolidation continues, with xx major acquisitions predicted for the forecast period.

- Innovation Barriers: High R&D costs, stringent regulatory approvals, and intense competition.

Over The Counter Drugs Market in North America Growth Trends & Insights

The North American OTC drug market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is driven by factors such as rising healthcare expenditure, increasing prevalence of chronic diseases, and growing self-medication trends. However, the market faced challenges due to generic competition and economic downturns impacting consumer spending. The adoption rate of new OTC drugs is moderate, influenced by consumer awareness and physician recommendations. Technological disruptions, such as telehealth and online pharmacies, are reshaping distribution channels, increasing convenience for consumers. Shifts in consumer behavior, including a preference for natural ingredients and convenient formats, are impacting product development and marketing strategies. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033.

Dominant Regions, Countries, or Segments in Over The Counter Drugs Market in North America

The United States dominates the North American OTC drug market, accounting for xx% of the total market value in 2024. Within the product type segment, Analgesics and VMS exhibit the highest market share due to widespread usage. The retail pharmacy channel is the dominant distribution channel, driven by accessibility and consumer familiarity.

- United States: Highest market share driven by high healthcare spending and prevalence of chronic diseases.

- Canada: Slower growth compared to the US, influenced by healthcare system structure and regulatory environment.

- Dominant Product Type: Analgesics and VMS due to high prevalence of related health conditions and self-medication practices.

- Dominant Distribution Channel: Retail Pharmacies offering accessibility and convenience.

- Key Growth Drivers: Rising prevalence of chronic diseases, aging population, increasing self-medication trends, and growing online pharmacy adoption.

Over The Counter Drugs Market in North America Product Landscape

Innovation in the OTC drug market focuses on improving product efficacy, safety, and convenience. This includes the development of extended-release formulations, targeted drug delivery systems, and the incorporation of natural ingredients. Products are increasingly tailored to meet specific consumer needs and preferences, such as convenient packaging, targeted formulations, and digital health integration. Key performance metrics include sales volume, market share, and consumer satisfaction ratings. Unique selling propositions often center on improved efficacy, faster relief, and minimal side effects.

Key Drivers, Barriers & Challenges in Over The Counter Drugs Market in North America

Key Drivers: Rising prevalence of chronic diseases, aging population, increasing healthcare expenditure, growing self-medication trends, and technological advancements in drug delivery.

Challenges and Restraints: Stringent regulatory approvals (xx% of new drug applications are rejected), generic competition resulting in price erosion (estimated xx% price decrease in 2024 compared to 2019), supply chain disruptions causing shortages (xx% of critical raw materials faced supply chain issues in 2022), and counterfeiting impacting consumer trust (xx% of OTC drugs sold online are estimated to be counterfeit).

Emerging Opportunities in Over The Counter Drugs Market in North America

Emerging opportunities include the growth of personalized medicine, leveraging digital health platforms for product promotion and patient engagement, tapping into the increasing demand for natural and herbal remedies, expanding into underserved markets, and developing innovative drug delivery systems for enhanced patient compliance.

Growth Accelerators in the Over The Counter Drugs Market in North America Industry

Strategic partnerships between pharmaceutical companies and telehealth providers will fuel market growth. Technological advancements like AI-powered diagnostics and personalized medicine will create significant opportunities. Expanding into emerging markets and offering customized product lines catering to specific demographic needs will also drive accelerated growth.

Key Players Shaping the Over The Counter Drugs Market in North America Market

- Perrigo Company Plc

- Bayer AG

- Sanofi

- Novartis AG

- GlaxoSmithKline Plc

- Johnson and Johnson

- Takeda Pharmaceutical Company Ltd

- Pfizer Inc

Notable Milestones in Over The Counter Drugs Market in North America Sector

- 2020: FDA approves a new formulation of a leading analgesic with improved efficacy.

- 2021: Major merger between two leading OTC drug companies, consolidating market share.

- 2022: Launch of several innovative OTC digital health platforms.

- 2023: Increased regulatory scrutiny on herbal remedies, impacting product approvals.

In-Depth Over The Counter Drugs Market in North America Market Outlook

The North American OTC drug market presents significant long-term growth potential driven by several factors, including technological advancements, changing consumer preferences, and the increasing prevalence of chronic diseases. Strategic opportunities lie in developing personalized medicine solutions, expanding into digital health, and focusing on innovative product development to meet evolving consumer demands. The market is poised for continued expansion, with significant opportunities for established players and new entrants alike.

Over The Counter Drugs Market in North America Segmentation

-

1. Product Type

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Vitamins, Mineral, and Supplements (VMS)

- 1.6. Weight-loss/Dietary Products

- 1.7. Ophthalmic Products

- 1.8. Sleeping Aids

- 1.9. Other Product Types

-

2. Distribution Channel

- 2.1. Hospital Pharmacies

- 2.2. Retail Pharmacies

- 2.3. Online Pharmacy

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

-

3.1. North America

Over The Counter Drugs Market in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

Over The Counter Drugs Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Product Innovations; Inclination of Pharmaceutical Companies Toward OTC Drugs from RX Drugs

- 3.3. Market Restrains

- 3.3.1. ; Probability of Substance Abuse

- 3.4. Market Trends

- 3.4.1. Weight-loss and Dietary Products Segment is Expected to Grow with a High CAGR Over the Forecast Period in the North America Over the Counter Drugs Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Over The Counter Drugs Market in North America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Vitamins, Mineral, and Supplements (VMS)

- 5.1.6. Weight-loss/Dietary Products

- 5.1.7. Ophthalmic Products

- 5.1.8. Sleeping Aids

- 5.1.9. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital Pharmacies

- 5.2.2. Retail Pharmacies

- 5.2.3. Online Pharmacy

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States Over The Counter Drugs Market in North America Analysis, Insights and Forecast, 2019-2031

- 7. Canada Over The Counter Drugs Market in North America Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Over The Counter Drugs Market in North America Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America Over The Counter Drugs Market in North America Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Perrigo Company Plc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bayer AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sanofi

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Novartis AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GlaxoSmithKline Plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Johnson and Johnson

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Takeda Pharmaceutical Company Ltd*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Pfizer Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Perrigo Company Plc

List of Figures

- Figure 1: Over The Counter Drugs Market in North America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Over The Counter Drugs Market in North America Share (%) by Company 2024

List of Tables

- Table 1: Over The Counter Drugs Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Over The Counter Drugs Market in North America Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Over The Counter Drugs Market in North America Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Over The Counter Drugs Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Over The Counter Drugs Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Over The Counter Drugs Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Over The Counter Drugs Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Over The Counter Drugs Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Over The Counter Drugs Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Over The Counter Drugs Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Over The Counter Drugs Market in North America Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Over The Counter Drugs Market in North America Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Over The Counter Drugs Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Over The Counter Drugs Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Over The Counter Drugs Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Over The Counter Drugs Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Over The Counter Drugs Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Over The Counter Drugs Market in North America?

The projected CAGR is approximately 2.70%.

2. Which companies are prominent players in the Over The Counter Drugs Market in North America?

Key companies in the market include Perrigo Company Plc, Bayer AG, Sanofi, Novartis AG, GlaxoSmithKline Plc, Johnson and Johnson, Takeda Pharmaceutical Company Ltd*List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the Over The Counter Drugs Market in North America?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Product Innovations; Inclination of Pharmaceutical Companies Toward OTC Drugs from RX Drugs.

6. What are the notable trends driving market growth?

Weight-loss and Dietary Products Segment is Expected to Grow with a High CAGR Over the Forecast Period in the North America Over the Counter Drugs Market.

7. Are there any restraints impacting market growth?

; Probability of Substance Abuse.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Over The Counter Drugs Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Over The Counter Drugs Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Over The Counter Drugs Market in North America?

To stay informed about further developments, trends, and reports in the Over The Counter Drugs Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence