Key Insights

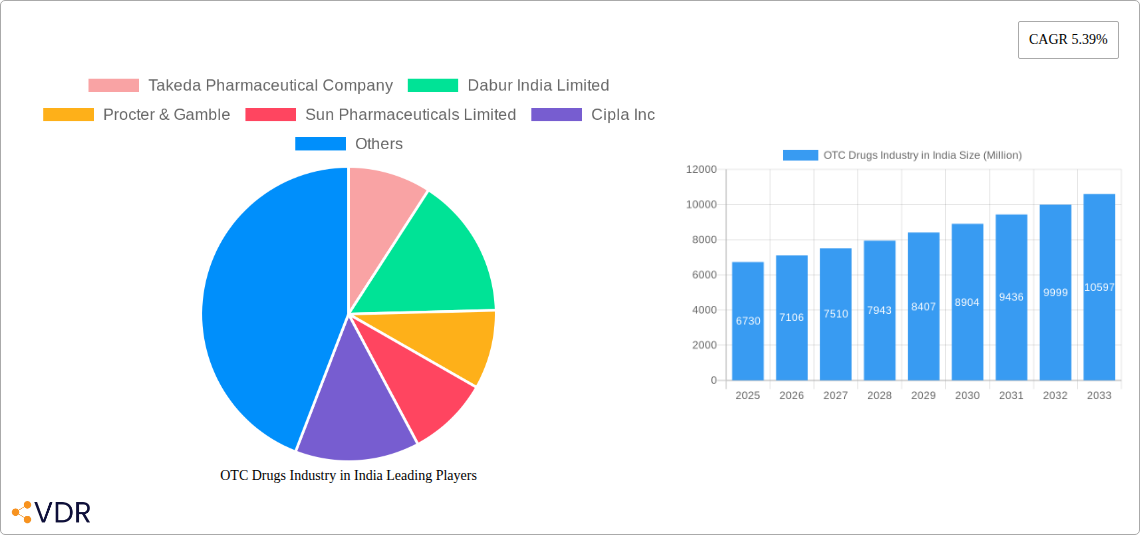

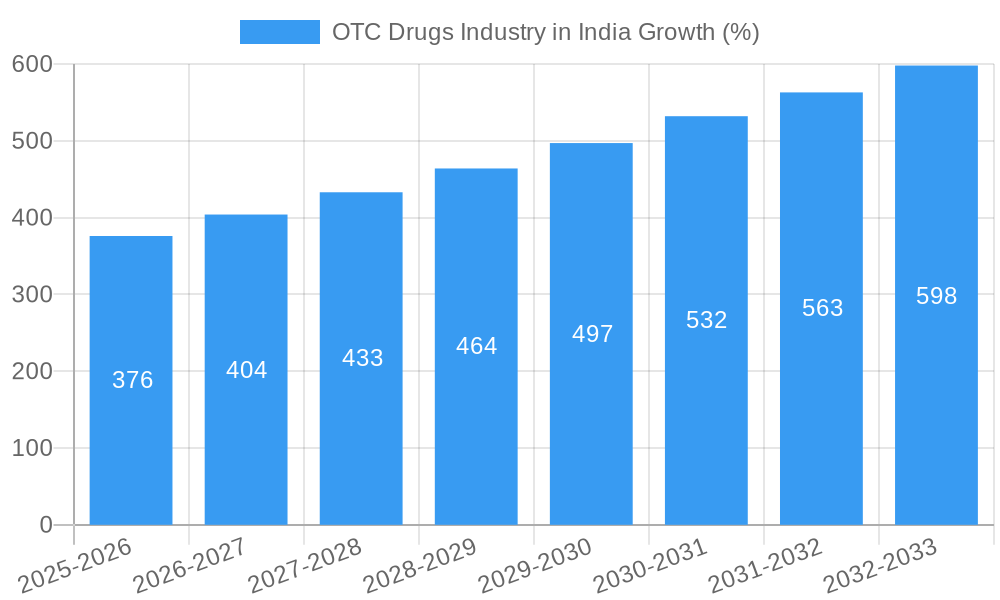

The Indian Over-the-Counter (OTC) drug market, valued at approximately $6.73 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.39% from 2025 to 2033. This growth is driven by several factors. Rising healthcare awareness and increasing disposable incomes empower consumers to self-medicate for minor ailments, boosting demand for OTC products. A burgeoning middle class and expanding access to healthcare infrastructure, especially in rural areas, further fuel market expansion. The increasing prevalence of chronic diseases like diabetes and cardiovascular conditions also contributes, as individuals actively manage their health through preventative measures and readily available OTC medications. The market segmentation reveals a significant contribution from Cough, Cold, and Flu products, Analgesics, and Dermatology products, which are consistently high-demand categories. Retail pharmacies serve as the primary distribution channel, reflecting the preference for convenient access to OTC medications. Leading players like Takeda, Dabur, Procter & Gamble, and Sun Pharmaceuticals are key competitors, leveraging their established brand presence and extensive distribution networks to capture significant market share. However, stringent regulatory norms and the potential for counterfeit products pose challenges to the market's consistent growth trajectory.

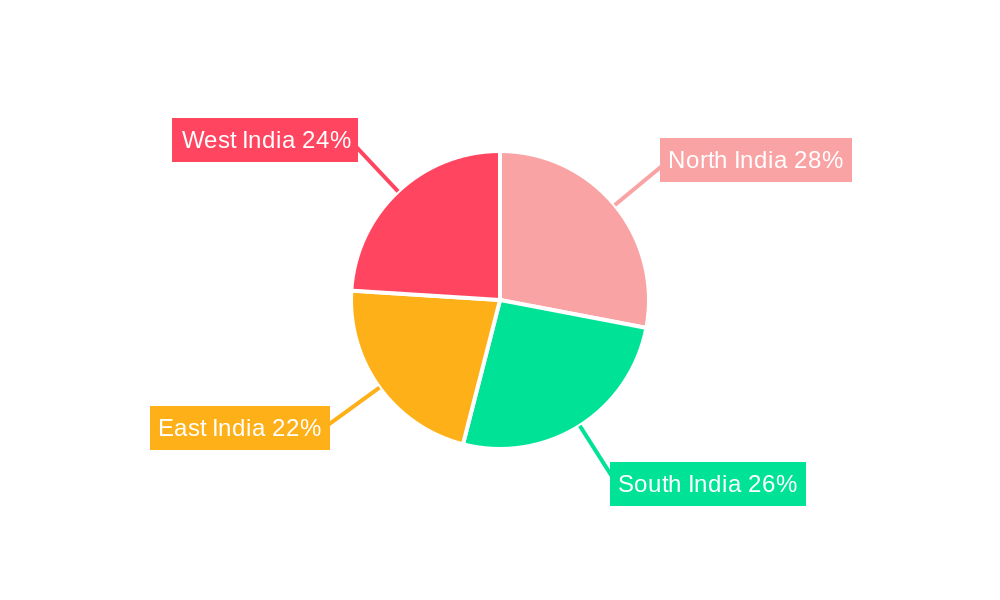

Geographical variations exist within India, with regional differences in healthcare infrastructure and consumer preferences influencing sales. North, South, East, and West India each contribute significantly to the overall market, with variations in product preferences and purchasing behavior depending on cultural factors and disease prevalence within each region. Future growth will likely be influenced by the development of innovative OTC formulations, targeted marketing strategies catering to specific demographics, and enhanced consumer education initiatives aimed at responsible self-medication. The market’s future success hinges on balancing convenient access with robust regulatory oversight, ensuring consumer safety and ethical marketing practices. Companies are focusing on digital marketing to promote brand awareness and drive product adoption.

OTC Drugs Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Over-The-Counter (OTC) drugs market in India, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It offers valuable insights for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic market. The report segments the market by product type (Cough, Cold & Flu, Analgesics, Dermatology, Gastrointestinal, VMS, Other) and distribution channel (Hospital Pharmacies, Retail Pharmacies, Other). Market values are presented in million units.

OTC Drugs Industry in India Market Dynamics & Structure

The Indian OTC drug market is characterized by a moderately fragmented landscape, with both large multinational corporations and domestic players competing for market share. Technological innovation, particularly in formulation and delivery systems, is a key driver, though regulatory hurdles and varying consumer preferences across regions present significant challenges. The market is significantly influenced by government regulations concerning pricing, advertising, and product approvals. Competition from Ayurvedic and homeopathic remedies also plays a considerable role. Mergers and acquisitions (M&A) activity has been relatively steady, with larger players consolidating their positions and acquiring smaller companies to expand their product portfolios.

- Market Concentration: Moderately Fragmented, Top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on targeted drug delivery, herbal formulations, and digital health integration.

- Regulatory Framework: Stringent regulations impacting pricing, advertising, and product approvals.

- Competitive Substitutes: Ayurvedic and homeopathic medicines, traditional remedies.

- End-User Demographics: Growing middle class, increasing health awareness driving demand.

- M&A Trends: Steady consolidation, with xx major M&A deals recorded between 2019-2024.

OTC Drugs Industry in India Growth Trends & Insights

The Indian OTC drugs market has witnessed significant growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing healthcare awareness, and a growing preference for self-medication. The market is projected to continue its expansion at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. This growth is being fueled by technological advancements, the increasing availability of online pharmacies, and evolving consumer preferences toward convenience and efficacy. Market penetration of OTC drugs is expected to increase from xx% in 2024 to xx% by 2033. Factors like rising urbanization and an aging population further contribute to this expansion. Technological disruptions such as telehealth and AI-powered diagnostic tools are expected to reshape the market landscape in the coming years. Shifting consumer behaviors towards preventive healthcare and personalized medicine also present significant opportunities.

Dominant Regions, Countries, or Segments in OTC Drugs Industry in India

The retail pharmacy distribution channel dominates the Indian OTC market, accounting for xx% of total sales in 2024. Within product segments, Analgesics and Cough, Cold, and Flu products are the largest contributors, collectively holding more than xx% of the market share. Urban areas demonstrate higher consumption rates compared to rural areas due to factors like increased awareness, accessibility, and higher disposable incomes.

- Key Drivers: Rising disposable incomes, increasing healthcare awareness, expanding retail pharmacy network.

- Dominance Factors: High prevalence of common ailments, self-medication practices, and widespread retail availability.

- Growth Potential: Significant untapped potential in rural areas, growing demand for specialized OTC products.

OTC Drugs Industry in India Product Landscape

The Indian OTC drug market showcases a diverse range of products, spanning analgesics, cough and cold remedies, dermatological preparations, and gastrointestinal medications. Recent innovations include extended-release formulations, improved palatability, and natural or herbal ingredients catering to health-conscious consumers. These products often incorporate advanced delivery systems for enhanced efficacy and convenience. Companies are focusing on improving product packaging and marketing to enhance consumer appeal and brand loyalty.

Key Drivers, Barriers & Challenges in OTC Drugs Industry in India

Key Drivers: Rising disposable incomes, increasing healthcare awareness, government initiatives promoting self-medication, expansion of retail pharmacy networks.

Key Challenges: Stringent regulatory requirements for product approvals and advertising, competition from traditional medicines, counterfeit products, and supply chain inefficiencies affecting accessibility in rural areas. These challenges may lead to a xx% reduction in overall market growth if not effectively addressed.

Emerging Opportunities in OTC Drugs Industry in India

Emerging opportunities lie in expanding into untapped rural markets through effective distribution strategies, developing customized products addressing specific regional health needs, and leveraging digital platforms to improve product accessibility and consumer engagement. The growing demand for natural and herbal-based remedies presents a further avenue for growth.

Growth Accelerators in the OTC Drugs Industry in India Industry

Strategic partnerships between pharmaceutical companies and digital health platforms to reach a broader consumer base, technological advancements such as telemedicine and AI, and aggressive marketing strategies targeting health-conscious consumers will accelerate market growth. Expansion into niche areas, such as specialized skincare and nutraceuticals, also presents a significant growth catalyst.

Key Players Shaping the OTC Drugs Industry in India Market

- Takeda Pharmaceutical Company

- Dabur India Limited

- Procter & Gamble

- Sun Pharmaceuticals Limited

- Cipla Inc

- Emami Limited

- Abbott Laboratories

- Johnson & Johnson

- Reckitt Benckiser

- GlaxoSmithKline PLC

Notable Milestones in OTC Drugs Industry in India Sector

- April 2024: Nestle India and Dr Reddy’s Laboratories Ltd. formed a joint venture for nutraceutical brands, expanding the OTC market into the nutrition segment.

- March 2024: Emcure Pharmaceuticals launched Galact, a new OTC product, marking a new entrant into the market.

In-Depth OTC Drugs Industry in India Market Outlook

The Indian OTC drug market is poised for sustained growth driven by rising healthcare spending, increased consumer awareness, and the entry of new players with innovative products. Strategic partnerships, technological advancements, and expansion into untapped markets will continue to shape market dynamics. The potential for significant growth remains high, especially in the areas of specialized OTC products and digital health integration.

OTC Drugs Industry in India Segmentation

-

1. Product

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Vitamins, Minerals, and Supplements (VMS)

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Hospital Pharmacies

- 2.2. Retail Pharmacies

- 2.3. Other Distribution Channels

OTC Drugs Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

OTC Drugs Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift Toward Self Medication by Consumers; Product Innovations; Inclination of Pharmaceutical Companies Toward OTC Drugs from RX Drugs

- 3.3. Market Restrains

- 3.3.1. Price Cuts for Various Ingredients and Restrictions for Advertising; Lack of Specific Regulations for OTC Drugs

- 3.4. Market Trends

- 3.4.1. The Analgesics Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Vitamins, Minerals, and Supplements (VMS)

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital Pharmacies

- 5.2.2. Retail Pharmacies

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Cough, Cold, and Flu Products

- 6.1.2. Analgesics

- 6.1.3. Dermatology Products

- 6.1.4. Gastrointestinal Products

- 6.1.5. Vitamins, Minerals, and Supplements (VMS)

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hospital Pharmacies

- 6.2.2. Retail Pharmacies

- 6.2.3. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Cough, Cold, and Flu Products

- 7.1.2. Analgesics

- 7.1.3. Dermatology Products

- 7.1.4. Gastrointestinal Products

- 7.1.5. Vitamins, Minerals, and Supplements (VMS)

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hospital Pharmacies

- 7.2.2. Retail Pharmacies

- 7.2.3. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Cough, Cold, and Flu Products

- 8.1.2. Analgesics

- 8.1.3. Dermatology Products

- 8.1.4. Gastrointestinal Products

- 8.1.5. Vitamins, Minerals, and Supplements (VMS)

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hospital Pharmacies

- 8.2.2. Retail Pharmacies

- 8.2.3. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Cough, Cold, and Flu Products

- 9.1.2. Analgesics

- 9.1.3. Dermatology Products

- 9.1.4. Gastrointestinal Products

- 9.1.5. Vitamins, Minerals, and Supplements (VMS)

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hospital Pharmacies

- 9.2.2. Retail Pharmacies

- 9.2.3. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Cough, Cold, and Flu Products

- 10.1.2. Analgesics

- 10.1.3. Dermatology Products

- 10.1.4. Gastrointestinal Products

- 10.1.5. Vitamins, Minerals, and Supplements (VMS)

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hospital Pharmacies

- 10.2.2. Retail Pharmacies

- 10.2.3. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North India OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 12. South India OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 13. East India OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 14. West India OTC Drugs Industry in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Takeda Pharmaceutical Company

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Dabur India Limited

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Procter & Gamble

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Sun Pharmaceuticals Limited

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Cipla Inc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Emami Limited

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Abbott Laboratories

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Johnson & Johnson*List Not Exhaustive

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Reckitt Benckiser

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 GlaxoSmithKline PLC

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Takeda Pharmaceutical Company

List of Figures

- Figure 1: Global OTC Drugs Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India OTC Drugs Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India OTC Drugs Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America OTC Drugs Industry in India Revenue (Million), by Product 2024 & 2032

- Figure 5: North America OTC Drugs Industry in India Revenue Share (%), by Product 2024 & 2032

- Figure 6: North America OTC Drugs Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America OTC Drugs Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America OTC Drugs Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 9: North America OTC Drugs Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America OTC Drugs Industry in India Revenue (Million), by Product 2024 & 2032

- Figure 11: South America OTC Drugs Industry in India Revenue Share (%), by Product 2024 & 2032

- Figure 12: South America OTC Drugs Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America OTC Drugs Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America OTC Drugs Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 15: South America OTC Drugs Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe OTC Drugs Industry in India Revenue (Million), by Product 2024 & 2032

- Figure 17: Europe OTC Drugs Industry in India Revenue Share (%), by Product 2024 & 2032

- Figure 18: Europe OTC Drugs Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe OTC Drugs Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe OTC Drugs Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe OTC Drugs Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa OTC Drugs Industry in India Revenue (Million), by Product 2024 & 2032

- Figure 23: Middle East & Africa OTC Drugs Industry in India Revenue Share (%), by Product 2024 & 2032

- Figure 24: Middle East & Africa OTC Drugs Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa OTC Drugs Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa OTC Drugs Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa OTC Drugs Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific OTC Drugs Industry in India Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific OTC Drugs Industry in India Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific OTC Drugs Industry in India Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific OTC Drugs Industry in India Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific OTC Drugs Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific OTC Drugs Industry in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global OTC Drugs Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global OTC Drugs Industry in India Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global OTC Drugs Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global OTC Drugs Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global OTC Drugs Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global OTC Drugs Industry in India Revenue Million Forecast, by Product 2019 & 2032

- Table 11: Global OTC Drugs Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Global OTC Drugs Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global OTC Drugs Industry in India Revenue Million Forecast, by Product 2019 & 2032

- Table 17: Global OTC Drugs Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Global OTC Drugs Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global OTC Drugs Industry in India Revenue Million Forecast, by Product 2019 & 2032

- Table 23: Global OTC Drugs Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Global OTC Drugs Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global OTC Drugs Industry in India Revenue Million Forecast, by Product 2019 & 2032

- Table 35: Global OTC Drugs Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Global OTC Drugs Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global OTC Drugs Industry in India Revenue Million Forecast, by Product 2019 & 2032

- Table 44: Global OTC Drugs Industry in India Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 45: Global OTC Drugs Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific OTC Drugs Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the OTC Drugs Industry in India?

The projected CAGR is approximately 5.39%.

2. Which companies are prominent players in the OTC Drugs Industry in India?

Key companies in the market include Takeda Pharmaceutical Company, Dabur India Limited, Procter & Gamble, Sun Pharmaceuticals Limited, Cipla Inc, Emami Limited, Abbott Laboratories, Johnson & Johnson*List Not Exhaustive, Reckitt Benckiser, GlaxoSmithKline PLC.

3. What are the main segments of the OTC Drugs Industry in India?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Shift Toward Self Medication by Consumers; Product Innovations; Inclination of Pharmaceutical Companies Toward OTC Drugs from RX Drugs.

6. What are the notable trends driving market growth?

The Analgesics Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Price Cuts for Various Ingredients and Restrictions for Advertising; Lack of Specific Regulations for OTC Drugs.

8. Can you provide examples of recent developments in the market?

April 2024: Nestle India and Dr Reddy’s Laboratories Ltd entered a definitive agreement to form a joint venture to bring innovative nutraceutical brands to consumers in India and other agreed territories. Dr Reddy’s has licensed brands such as Rebalanz, Celevida, Antoxid, Kidrich-D3, and Becozinc in the nutrition and OTC (over-the-counter) segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "OTC Drugs Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the OTC Drugs Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the OTC Drugs Industry in India?

To stay informed about further developments, trends, and reports in the OTC Drugs Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence