Key Insights

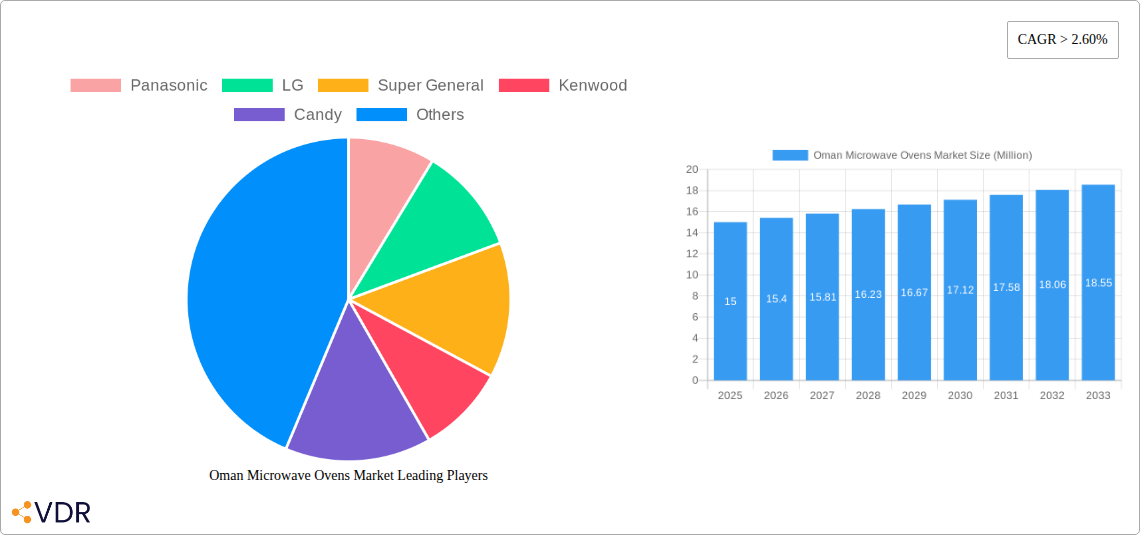

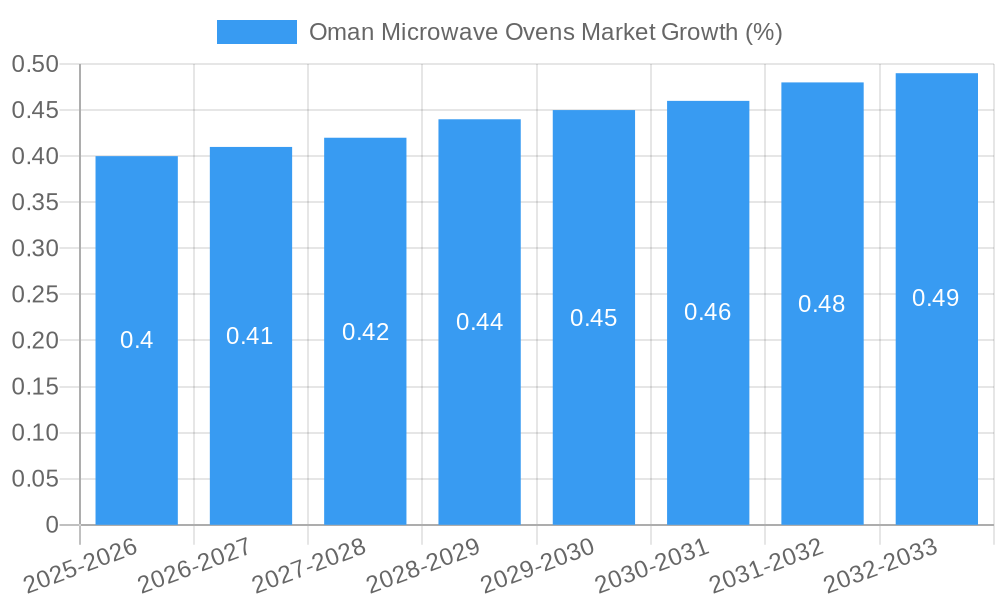

The Oman microwave oven market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 2.60% from 2025 to 2033. This growth is driven by several factors. Rising disposable incomes and increasing urbanization are leading to higher demand for convenience appliances like microwave ovens in both residential and commercial settings. The market is witnessing a shift towards technologically advanced models with features like convection and grill functionalities, catering to evolving consumer preferences for versatile cooking options. Furthermore, the expanding online retail sector provides convenient access to a wider range of microwave ovens, boosting market penetration. Leading brands like Panasonic, LG, Samsung, and others are actively engaged in product innovation and strategic distribution partnerships to capitalize on the market's growth potential. Competition is intense, with brands focusing on differentiating their offerings through features, pricing, and brand reputation. While a lack of widespread awareness about advanced microwave oven features in certain segments could present a restraint, overall, the market demonstrates significant promise.

The market segmentation reveals considerable diversity. Convection microwave ovens, offering greater cooking versatility, are gaining traction among consumers willing to invest in premium features. Multibrand stores constitute a significant distribution channel, but online sales are also growing rapidly, indicating a shift in consumer purchasing habits. Residential applications account for the largest share of the market, though commercial applications in hotels, restaurants, and offices are also witnessing steady growth, fueled by the increasing adoption of fast-paced food services and the need for efficient kitchen appliances. The presence of established international brands alongside local players contributes to a dynamic and competitive marketplace, ensuring continuous improvement in product offerings and accessibility. Future growth is expected to be largely driven by continuous innovation and improving accessibility of advanced features to a wider range of consumers.

Oman Microwave Ovens Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Oman microwave ovens market, offering valuable insights for industry professionals, investors, and stakeholders. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period extending to 2033. The report segments the market by product type (Grill, Solo, Convection), distribution channel (Multibrand Stores, Exclusive stores, Online, Other Distribution Channels), and application (Residential, Commercial), providing a granular understanding of market dynamics. Key players analyzed include Panasonic, LG, Super General, Kenwood, Candy, Nikai, Ikon, Bosch, and Samsung (list not exhaustive). The report's value lies in its detailed analysis of market size (in million units), growth trends, competitive landscape, and future opportunities.

Oman Microwave Ovens Market Market Dynamics & Structure

The Oman microwave oven market exhibits a moderately concentrated structure, with a few major players holding significant market share. Technological innovation, driven by advancements in energy efficiency, cooking technology (e.g., inverter technology), and smart features, is a key driver. Regulatory frameworks concerning energy consumption and safety standards influence market dynamics. Competitive substitutes include conventional ovens and other cooking appliances. The end-user demographic is predominantly residential, with a growing commercial segment. Mergers and acquisitions (M&A) activity in the Oman microwave oven market has been relatively limited in recent years, with approximately xx M&A deals recorded between 2019 and 2024. This translates to an average of xx deals annually.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on energy efficiency, smart features (Wi-Fi connectivity), and improved cooking performance.

- Regulatory Framework: Compliance with safety and energy efficiency standards is crucial.

- Competitive Substitutes: Conventional ovens, air fryers, and other cooking appliances pose competition.

- End-User Demographics: Primarily residential, with increasing demand from the commercial sector.

- M&A Trends: Low M&A activity observed in recent years (xx deals between 2019-2024), indicating a stable market structure.

Oman Microwave Ovens Market Growth Trends & Insights

The Oman microwave ovens market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to increasing urbanization, rising disposable incomes, and changing consumer lifestyles. The adoption rate of microwave ovens is expected to further increase in the forecast period (2025-2033), driven by factors such as convenience, time-saving features, and the growing popularity of ready-to-eat meals. Technological advancements, including the introduction of smart microwave ovens with integrated features, are further propelling market expansion. Consumer behavior shifts towards preference for energy-efficient and technologically advanced appliances also contribute to the market’s growth trajectory. Market penetration is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Oman Microwave Ovens Market

The residential segment dominates the Oman microwave ovens market, accounting for xx% of total market value in 2024. Within the product type segment, Solo microwave ovens hold the largest market share, followed by Convection and Grill microwave ovens. Multibrand stores are the leading distribution channel, owing to their widespread presence and accessibility. Growth is driven by factors such as rising disposable incomes, increasing urbanization, and a preference for convenient cooking solutions within the residential sector.

- Key Drivers: Rising disposable incomes, increasing urbanization, preference for convenience.

- Dominant Segment: Residential applications (xx% market share in 2024).

- Dominant Product Type: Solo microwave ovens.

- Dominant Distribution Channel: Multibrand stores.

- Growth Potential: Strong potential for growth in the commercial sector, particularly in the food service industry.

Oman Microwave Ovens Market Product Landscape

The Oman microwave oven market features a diverse range of products, from basic solo models to advanced convection and grill microwave ovens. Recent innovations focus on improved energy efficiency, smart features like Wi-Fi connectivity and pre-programmed cooking settings, and enhanced cooking performance. Unique selling propositions include features like sensor cooking, auto defrost, and child lock mechanisms. Technological advancements in inverter technology provide more precise temperature control and energy savings.

Key Drivers, Barriers & Challenges in Oman Microwave Ovens Market

Key Drivers: Rising disposable incomes, increasing urbanization, changing lifestyles favoring convenience, technological advancements such as smart features and energy efficiency improvements.

Challenges: Intense competition from established and emerging brands, fluctuating raw material prices impacting manufacturing costs, concerns over potential health effects of microwave radiation, and the potential disruption from alternative cooking appliances. Supply chain disruptions due to global events have had a quantifiable impact, resulting in xx% increase in prices in 2022.

Emerging Opportunities in Oman Microwave Ovens Market

Emerging opportunities include growth in the commercial sector (hotels, restaurants), the introduction of innovative features such as steam cooking and air frying capabilities, and increased demand for energy-efficient and eco-friendly models. The untapped potential within rural areas also presents an opportunity for market expansion. Targeting health-conscious consumers with features promoting healthy cooking methods will create new opportunities.

Growth Accelerators in the Oman Microwave Ovens Market Industry

Technological breakthroughs in areas such as sensor technology and energy efficiency are major growth catalysts. Strategic partnerships between manufacturers and retailers can enhance distribution networks and brand reach. Targeted marketing campaigns focusing on convenience and health benefits can accelerate market growth.

Key Players Shaping the Oman Microwave Ovens Market Market

- Panasonic

- LG

- Super General

- Kenwood

- Candy

- Nikai

- Ikon

- Bosch

- Samsung

Notable Milestones in Oman Microwave Ovens Market Sector

- May 10, 2022: Samsung's launch of AI-enabled washing machines reflects a broader trend towards technologically advanced appliances, influencing consumer expectations in other categories, including microwave ovens.

- April 20, 2022: Panasonic's investment in Conductive Ventures III, focused on AI and other technologies, indicates a future emphasis on smart appliances, potentially influencing innovation in the microwave oven market.

In-Depth Oman Microwave Ovens Market Market Outlook

The Oman microwave ovens market exhibits robust growth potential, driven by sustained economic growth, increasing urbanization, and technological advancements. Strategic opportunities lie in expanding into untapped market segments (e.g., rural areas), focusing on niche products (e.g., steam ovens), and strengthening distribution channels. A strong emphasis on energy efficiency and smart features will be critical for success in the long term.

Oman Microwave Ovens Market Segmentation

-

1. Product Type

- 1.1. Grill

- 1.2. Solo

- 1.3. Convection

-

2. Distribution Channel

- 2.1. Multibrand Stores

- 2.2. Exclusive stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. Application

- 3.1. Residential

- 3.2. Commercial

Oman Microwave Ovens Market Segmentation By Geography

- 1. Oman

Oman Microwave Ovens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional Flour

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. COVID-19 has Increased the Demand for Residential Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Microwave Ovens Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Grill

- 5.1.2. Solo

- 5.1.3. Convection

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multibrand Stores

- 5.2.2. Exclusive stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Super General

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Candy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nikai

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ikon**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Oman Microwave Ovens Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Microwave Ovens Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Microwave Ovens Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Oman Microwave Ovens Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Oman Microwave Ovens Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Oman Microwave Ovens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Oman Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Oman Microwave Ovens Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Oman Microwave Ovens Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 9: Oman Microwave Ovens Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Oman Microwave Ovens Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Microwave Ovens Market?

The projected CAGR is approximately > 2.60%.

2. Which companies are prominent players in the Oman Microwave Ovens Market?

Key companies in the market include Panasonic, LG, Super General, Kenwood, Candy, Nikai, Ikon**List Not Exhaustive, Bosch, Samsung.

3. What are the main segments of the Oman Microwave Ovens Market?

The market segments include Product Type, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional Flour.

6. What are the notable trends driving market growth?

COVID-19 has Increased the Demand for Residential Application.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

On 10th May 2022, Samsung announced the launch of its 2022 range of artificial intelligence enabled bi-lingual AI EcoBubble™ fully automatic front load washing machines. The new line-up comes with all new AI Wash feature for an effortless laundry experience and larger capacity models going up to 12 kg, as consumers shift their preference to bigger washing machines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Microwave Ovens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Microwave Ovens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Microwave Ovens Market?

To stay informed about further developments, trends, and reports in the Oman Microwave Ovens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence